The aim of a customs union is to make free trade with each other easier for member countries. The union eliminates the administrative and financial strain of barrier trade and fosters international economic cooperation. It is a step towards a single market but it does not provide freedom of movement for citizens and products in a customs union. A customs union is often examined from the perspective of trade creation and trade diversion.

Member States do not have the right to form their own trade agreements, however. The customs union countries usually restructure their domestic economy and economic policies to maximize their benefit from membership in the union. The European Union is the world’s biggest customs union, in terms of its members’ economic production.

The advantages of a customs union:

Customs union eliminates the requirement for a few regulations and customs checks at the border. Looking on the manufacturer, between 20% to 50% of the worth of the provision chain is imported from the EU.

A free trade agreement has the principal effect of the trade between member countries. It helps to increase the distribution of scarce resources that meet customers’ needs and desires and boosts foreign direct investment (FDI). Customs unions lead to improved economic integration and political cooperation among nations, and the development of a common market, monetary union, and fiscal union.

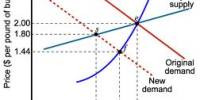

The effect of a union is often explained in terms of trade creation and trade diversion. With trade creation, more efficient members can now sell more to less efficient (domestic) members. With trade diversion, however, more effective non-members are now able to sell less goods to members, providing an incentive for less efficient members to benefit by selling more in the Union.

One of the most reasons a union is favored over a trade agreement is because the previous solve the matter of trade deflection. This happens when a non-member country sells its goods to a low-tariff FTA (free trade agreement) country and then resells to a high-tariff FTA country resulting in distortions of trade. The existence of a similar external tariff in customs unions helps prevent problems resulting from differentials in tariffs.

Trade deflection occurs when a rustic ‘cherry-pick’ the country with an all-time low tariff in a free trade area then moves the great within the free trade area. That is prevented by a customs union with a common external tariff. There are regulations in free trade agreements such as NAFTA to ensure that you are not selling to one and going into the free trade area but this has administrative costs.

Establishing a customs union could pave the way for closer economic integration and political cooperation, including the development of a single internal market, monetary union (common economy), and fiscal union. Naturally, this is something that can create as many new problems as it solves old ones.

The disadvantages of a customs union:

Members of a customs union are required to barter with non-member countries and organizations like the WTO. This can be necessary to take care of a customs union; however, it also implies that individual member countries don’t seem to be absolved to negotiate their own deals. If a country wishes to liberalize its trade outside the Union, the standard external tariff prohibits it from doing so. It also makes no sense for a particular member to place a tariff on the import of a good which is not manufactured in that country at all.

A nation cannot sign different agreements, since a similar external tariff exists. This decreases autonomy at both the economic and national levels. EU critics say it meant the UK had higher food prices and decreased the health of low-income households facing higher prices.

There is also a possible disadvantage to one member in how the tariff revenue is allocated. Members that trade comparatively more with non-union countries like the UK do not get their ‘equal share’ of tariff revenue. In addition, the income retained by members receiving the initial income in Europe between 20 and 25 percent was projected to surpass the real collection costs of that tax.

A common problem faced by customs unions are that the complexity of setting the applicable tariff rate. The method is incredibly costly and time-consuming. Member States also find it difficult to forgo the trade in those products or services because it is created more effectively by another nation in the Union. Developing countries generally face the problem, and it is a major issue that the UK is dealing with during Brexit.

A further problem related to customs unions is that negotiations regarding the setting of common tariff levels will be very complex and expensive, both in terms of time and also the use of resources. This issue is usually associated with developing-country customs unions, but it has become applicable to possibly Brexit negotiations. Exemptions for particular goods or countries which reintroduce the trade deflection problem which a customs union is intended to eliminate.

A common external tariff can result in trade diversion. As an example, when the UK joined the EEC, it had to lift tariffs on imports from the Commonwealth. This means higher Butter and Lamb import rates. The development of customs unions is of long-term benefit to economies. It allows small economies to draw on industries that may not have been accessible only through domestic trade. Via transport and infrastructure, they will achieve broad external economies of scale within the Union.

According to one government source (Times), the United Kingdom could face increased “transaction costs by an estimated 2% to 24% of the worth of traded goods if it left the union. The domestic markets would be more likely to increase productivity in the face of competition from other economies. Customs unions help stimulate prosperity and stabilize markets with policies of free exchange.

Information Sources: