The accelerator effect in economics is a positive effect on private fixed investment of the growth of the market economy (measured e.g. by a change in Gross Domestic Product). It suggests that a small change in national output (GDP) can trigger a larger change in aggregate investment. It states that investment levels are related to the rate of change of GDP. Rising GDP implies that businesses, in general, see rising profits, increased sales and cash flow, and greater use of existing capacity. Thus an increase in the rate of economic growth will cause a correspondingly larger increase in the level of investment. This usually implies that profit expectations and business confidence rise, encouraging businesses to build more factories and other buildings and to install more machinery. When income and therefore consumption of the people increases, more goods will have to be produced. This may lead to further growth of the economy through the stimulation of consumer incomes and purchases, i.e., via the multiplier effect.

The accelerator effect also goes the other way: falling GDP (a recession) hurts business profits, sales, cash flow, use of capacity, and expectations. Investment is a function of changes in National Income, especially consumption. Investment is a key component of aggregate demand. This in turn discourages fixed investment, worsening a recession by the multiplier effect.

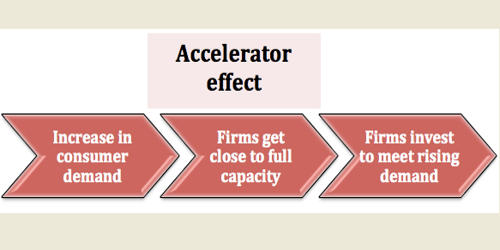

The occurrence of Accelerator Effect – It happens when an increase in national income (GDP) results in a proportionately larger rise in capital investment spending. It is used to explain the level of investment in an economy.

- If firms see a rise in demand and expect this demand to be maintained, then they will soon start to reach full capacity.

- Because of economies of scale in investment, it is more efficient to make a significant investment – rather than small annual increases in the investment of 2%.

- Therefore, firms will wait for promising economic conditions, before embarking on investment decisions.

The accelerator effect fits the behavior of an economy best when either the economy is moving away from full employment or when it is already below that level of production. It refers to a positive effect on private fixed investment in the growth of the market economy. This is because high levels of aggregate demand hit against the limits set by the existing labor force, the existing stock of capital goods, the availability of natural resources, and the technical ability of an economy to convert inputs into products. Underlying the accelerator effect is that real investment depends on business expectations, and on the divisibility of capital.