INTRODUCTION

A firm has to decide how it wants its brand perceived relative to other brands in the marketplace. This involves creating a distinct image for the brand relative to other brands. For instance, suppose you introduce a new kind of granola bar. You can position it as a good-tasting candy bar, a relatively healthy bar or, possibly, a low-fat bar. Similarly, a new brand of cookie could be positioned using health, diet, or good taste. When a college refers to itself as the “poor man’s Harvard” it is also positioning itself.

A product or service may be positioned on the basis of an attitude or benefit, use or application, user, class, price, or level of quality. It targets a product for specific market segments and product needs at specific prices. The same product can be positioned in many different ways. The figure below is taken from Philip Kotler’s book, Marketing Management published by Prentice Hall. This two-dimensional perception map shows how Kotler analyses the positioning of an instant breakfast drink relative to variables of the price of the product and the speed of preparation.

There is a process of five steps to determine the perceived position of a product in a set of product offerings. The steps are:

- Identification of relevant set of competitive products:

- Identification of a set of determinant product attributes:

- Collecting information from a sample of customers about their perception on:

- Analysis of intensity of the product’s current position in customers’ mind;

- Determination of products’ current position in the product space.

However. the task in connection with this study is to ascertain consumers’ perception regarding the product Biscuit. Biscuit are one of the favorites products in Bangladesh. Biscuit industry has evolved in Bangladesh from late 1980. During its introductory phase the industry had suffered from a poor quality of the products, which included lack of taste, flavor, packaging etc. But with the increase of demand in the market, various marketers tried to invade the market by adding different features with the product. From the viewpoint of Product Life Cycle (PLC), this product has already shifted from introduction stage to its growth stage as new products are coming to the industry. There is a fair bit of competition going on among different brands. One interesting thing about the market is that the target market for this particular product is basically people. And it is difficult for the marketers to identify the underlying causes of their choice and purchase decision. Though most of the consumers don’t have the purchasing power but certainly they are the influencers of the decision-making. After conducting pilot survey it is understood that the young do have much more information regarding the product. However, sometimes adults do look for the nutritional value of these products before buying the same for their siblings. Considering this fact some marketers are trying to give more product related information and segmenting the market to hold a position. Competition among brands has been increasing at a faster rate. Competitors are interested to formulate various market strategies to increase their own market share. But ascertaining consumers’ perception of the product is the prerequisite of formulating appropriate market strategies. Systematic studies are lacking in this area of Biscuit market. The present study on Biscuit industry is a modest attempt to fill this gap. This study may help the Biscuit manufacturers by providing information regarding their products’ positions in the market.

The Power of a Name

A brand’s name is perhaps the most important factor affecting perceptions of it. In the past, before there was a wide range of brands available, a company could name a product just about anything. These days, however, it is necessary to have a memorable name that conjures up images that help to position the product.

Background of the Study

This Research paper is based on a Partial Requirement of BBA in Faculty of Business Studies,Northern college Bangladesh . The aim of arranging this program is to gather knowledge for its B.B.A students after the completion of theoretical courses of Batchelor of Business Administration (B.B.A) program. Each Study must carry out a Research which is assigned by the research supervisor. I select Biscuits for my research and since then I have started my research work in local biscuits. I have prepared my research paper on the “A Study of Biscuit Industry in DhakaCity” as I found this issue is very important in this present complex market.

Statement of the Problem

Effective Product Positioning is contingent upon identifying and communicating a product’s uniqueness, differentiation and verifiable value. It is important to note that “me too” product positioning contradicts the notion of differentiation and should be avoided at all costs. This type of copycat product positioning only works if the business offers its solutions at a significant discount over the other competitor(s).

Generally, the product positioning process involves:

- Identifying the business’s direct competition (could include tertiary players that offer your product/service amongst a larger portfolio of solutions)

- Understanding how each competitor is positioning their business today (e.g. claiming to be the fastest, cheapest, largest, the #1 provider, etc.)

- Documenting the provider’s own positioning as it exists today (may not exist if startup business)

- Comparing the company’s positioning to its competitors’ to identify viable areas for differentiation

- Developing a distinctive, differentiating and value-based brand positioning statement, key messages and customer value propositions.

Rationale of the Study

This study gives overall concepts on Product Positioning and the compliance status of product positioning drawing from the study on many kind of biscuits industry. This study shows that the position of a product in this competitive product market.

Objectives of the Study

Against the introduction given above following are the objectives of the study:

1) To analysis of intensity of the product’s current position in customers mind.

2) To collecting information from a sample of customers about their perception.

3) To give suggestions for formulating market strategy.

4) To understand product positioning approaches.

5) To identification of a set of determinant product attributes.

6) To judge the existing brands with their important attributes.

7) To determination of products current position in the product space.

8) To develop perceptual map on the basis of consumers’ perceptions.

LIMITATION OF THE STUDY

The study is based on data collected from Dhaka city area only. Respondents, above 7 years of age have been interviewed. Some of the respondents are poorly, conscious about the attributes of the product. Only a limited number of attributes have been presented to the respondents to know their perceptions. The findings of the study are likely not to represent the overall situation of the market because the data belonging to a particular urban area.

BACKGROUND OF THE RESPONDENTS

The range of age of the respondents has been found to be 8 years to 22years. Most of the respondents are from middle class and upper middle class of the society. The respondents are considered to be more conscious as compared to the common people of Bangladesh. Literature Review

Positioning should be a formal exercise, no matter how large or small the organization. If you are discussing company positioning, it should involve all senior management. If it is product positioning, it should involve representative from sales, Field Engineering, and both product marketing and marketing communications.

The Objectives

It is easy to start broad and then narrow the focus through elimination.

Define the primary customer

It is good idea to start broad and then narrow it down. It is important to note that your primary customer may be the same or different person who is using the product.

Define secondary customers

Define secondary users and buyers of this product.

Define the problem

What is the problem you are solving? What is the area of pain for the primary customer listed above?

Define the secondary problem or other symptoms of the problem.

A significant problem will have an impact in multiple areas. List all the areas affected by the problem and how they are affected.

Emotions

List the emotions of the customer as they think about the problem. What is the primary emotion associated with the pain?

Market characteristics

Breakdown the characteristics of your primary customer. What do they buy? How do they buy it? Hot are there hot buttons? What do they worry about when they think of there competition? What keeps tem up at night?

Competitors

List competitors and there strengths and weakness in comparison to your offering.

Walk through the seven objectives above, in the order they are listed. Again broad and narrow the objective down by the process of elimination.

METHODOLOGY

The study followed a five-step procedure mentioned in the introduction, to determine the perceived position of the product by the customs. In order to complete the first two steps pilot survey was conducted. The other steps were completed through the conduction of sample survey. After conducting pilot survey it was understood that the target market for this particular product is young kid. And most of the young people of Dhaka city are students. Therefore students of Dhaka city area have been selected as population of the study. Non-students people have been ignored as they are from very poor family and do not have the experience of having Biscuits of different brands. Importance has been given on age in selecting sample respondents from population. Stage by stage sampling technique is used for sample collection. To collect samp1e respondents a list of 10 educational institutions comprising of 5 primary level, 3 secondary level and 2 higher secondary level and above was prepared first. Out of these 10 institutions 5 primary level institutions, 3 secondary level institutions and 2 higher secondary levels and above institutions were selected at random. So that 200 sample respondents were selected for the purpose of the study. Direct interview method was conducted to collect information on the basis of prepared questionnaire. Respondents were asked questions regarding their age, sex, workplace, occupation and order of preference of the brands. Perceptions regarding 6 attributes of the product of different brands were collected on 5-point scale. Moreover, 10 traders of 10 different shops were interviewed at random to cross check the information regarding the demand of the product. Thus collected information has been analyzed by using sophisticated statistical tools and techniques.

Sources of information:

This research is designed to collect information from secondary sources as indicated below:

Secondary data:

1. Articles

2. Websites

3. Annual reports

Data Collection Procedure

To make the study evidentially I have gone through collecting secondary sources (Articles, Annual Reports, and Related Websites) of data which I have collected from my term paper supervisor, teacher, Library, and related websites.

FINDINGS AND THEIR ANALYSIS

Existing Position of the Brands Available brands of the product

As per the opinion of the sample traders 8 brands are very much available in the market. It is being noted that all of the different brands under the name Mr. Cooky are considered as Haque brand. The available brands along with their price are shown in.

at 4 different prices brands are available in the market. Mr. Cooky is the brand of the highest price per packet. On the other hand Tip Biscuit and pran Glucose are the brands of the lowest price per packet. Nabisco Milk Biscuit and Mr. Cooky Biscuit are the brands of the second highest price Energy Biscuit, Grand Choice Biscuit and Pran Energy Biscuit is the brands of the second lowest price. It is noted that the ingredients of the brands are not same. Moreover, quantity per packet of the brand is not also equal.

Ranking of the brands by traders

After conducting pilot survey among the traders it was found that the most demanding brands in the market are Mr. Cooky,’ Energy Biscuit, Nabisco Milk Biscuit, Pran Biscuit, Grand Choice Biscuit, Tip Biscuit and. Accordingly sample traders were asked to rank these six brands by assigning 6 for the most demanding brand and I for the least demanding brand. The ranks of the brands along with their scores are shown in

Ranking of the brands by the consumers

Same brands were presented in front of consumers for ranking.

Sample consumers gave 6 for the most liking brand and I for the

least liking brand. Total scores of the brands along with their ranks are shown in

Rank correlation

In order to find out how far the rankings of brands by traders and consumers go together, rank correlation co-efficient is calculated by using the following formula:

The calculated value of R is .94. The value shows that there is high positive correlation between the rankings. Thus the rankings of the

brands by two groups of respondents agree very closely as far their opinion on demand of brand concerned.

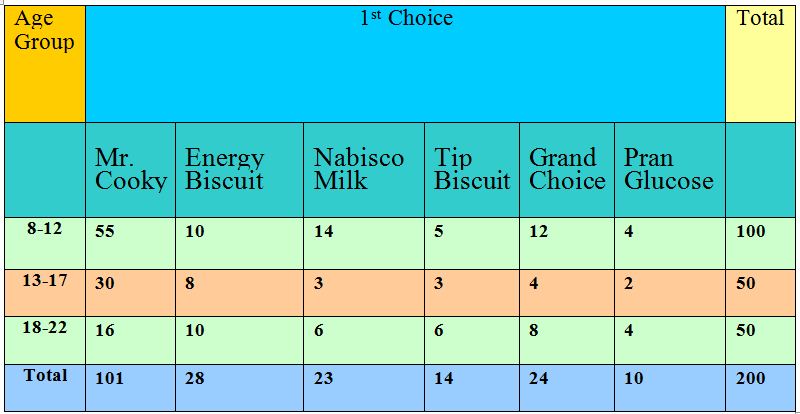

Influence of age in choosing the brand

In order to see the influence of age over choice of brand, sample consumers were asked to give their lst choice of 6 brands. On the basis of their lst choice the following contingency table is developed and a null hypothesis is drawn that there is no association between age and choice of brand.

CONTINOENCY TABLE BY CHOICE AND AGE GROUP

From the above table, X2 value is calculated which is 14.08. This calculated value is less that table value (1 8.3) at 3% level of significance and at 10 degrees of freedom. Thus the null hypothesis is accepted. Hence the age has no influence over the choice of brand.

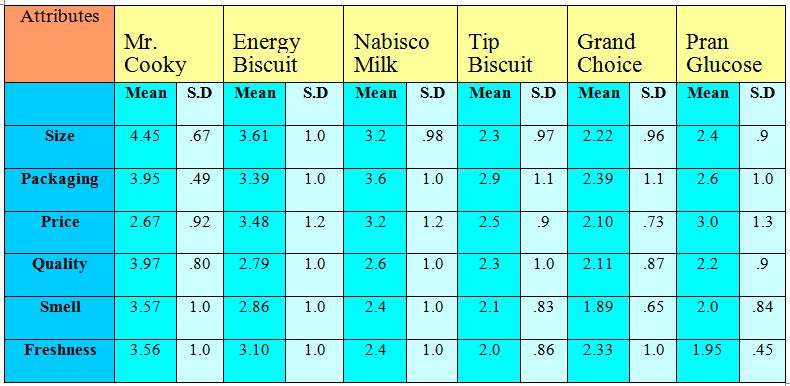

Analysis of brands with their important attributes

Six attributes were given to the sample respondents to know their opinion regarding the six brands. The attributes are taste, price, quality, freshness, smell and packaging. Opinion was collected at 5-point scale from the respondents. Five points mean scores of the selected attribute is shown in the Table 5.

POINT MEAN SCORES OF SELECTED ATTRIBUTES

The Table shows that Mr. Cooky scores the highest score in respect of Taste. Packaging, Quality, Smell and Freshness which are 4.45, 3.95, 3.97, 3.57, 3.56 respectively. Regarding the attribute price, Energy Biscuit possess the 1st position (3.45). which is followed by Nabisco Milk Biscuit (3.2), Pran Glucose Biscuit (3.0) Mr. Cooky (2.67), Grand Choice Biscuit (2.5) and Tip Biscuit (2.10). Tip Biscuit scores the lowest score (2.39) regarding the attribute Packaging. However the mean scores of other brands regarding packaging are 3.39, 3.6, 2.9 and 2.6 for Energy Biscuit. Nabisco Milk Biscuit. Grand Choice Biscuit and Tip Biscuit respectively. The mean score of Grand Choice Biscuit. Tip Biscuit and Pran Glucose Biscuit is below 3 regarding all the attributes except the Price of Pran Glucose Biscuit. Perceptual map on taste and quality:

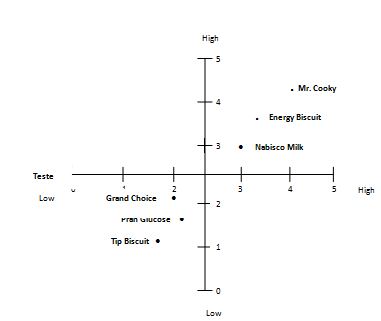

Perceptual Map on Taste and price

A map that shows where consumers locate various products in the category in terms of several important features (Advertising. wells, Bartlett, Moriarthy; 4th edition). By seeing tile perceptual map an organization can understand its position in the market on tile basis of buyers perception. Each and every organization has a positioning strategy in the market place to target their customers. The technique of perceptual mapping helps the marketers to determine just how their products and services appear to customers in relation to competitive brands on one or more relevant characteristics. It also enables them to see gaps in the positioning of all brands in the product or the service and to identify the areas in which consumer needs are not being adequately met. Through this perceptual map the marketers can understand whether their target customers perceive their product on title basis of the positioning that they want to create and identify the deviation if any. with the help of perceptual map it can also find tile segment, which is yet to be targeted by the companies of tile same industry. The perceptual map can be drawn on the basis of different variables, if two different variables are taken to draw the perceptual map then it is called a two-way perceptual map and if more than two variables are taken then it is called multivariate perceptual map: Present study tries to draw the perceptual map on the basis of two different variables. In the earlier section of the study the mean scores of the 6 attributes have been shown. On the basis of these mean scores perceptual maps are drawn in this section. By taking 2 attributes at a time out of 6 attributes the study can show 6c2 =15 perceptual maps. But only 6 perceptual maps are shown below considering the importance of the attributes.

The map shows 4 segments of consumer’s Perception. First quadrant is the segment of low price-high taste, second quadrant is the segment of low taste-low price, Third quadrant is the segment of low taste-high price and Fourth quadrant is the segment of high price-high taste. The above perceptual map shows that as far as taste is concerned Mr. Cooky is perceived as the tastiest among all the brands but its price is perceived to be a bit higher by the customers. Consumers perceive the price of Energy Biscuit to be favorable, but its perception regarding the taste of the brand is not that good. Nabisco Milk Biscuit can be called a very close competitor of Energy Biscuit, but it is maintaining slightly lower taste and more price than Energy Biscuit.

Mr. Cooky’s packaging is considered to be the best in the consumer mind as this shown in this perceptual map. Nabisco Milk and Energy Biscuit are closely following Mr. Cooky as far as packaging is concerned Perception about Tip Biscuit on the basis of price and packaging is the lowest in the consumer’ mind and the brand is perceived to be higher priced product with a lower packaging outlook. see again the low price and high packaging segment is dominated by different brands as 5 different brands arc competing within the Came segment. Both the segments of low price and low packaging and also high price and high packaging are yet to be targeted by any Bangladeshi brand and it is understood that the second segment is dominated by non brand Biscuit with low price and the 4th segment is dominated by the foreign Biscuit brands.

One interesting finding in this perceptual map is that Tip Biscuit, Grand Choice Biscuit and Pran Glucose Biscuit are very close competitor as far as taste end freshness concerns. All of them are perceived as low in taste and low in freshness. If they can address on these factors and try to rectify these products’ taste and freshness, hopefully they can increase the sales of these brands. Mr. Cooky once again is perceived to be the best in freshness and also maintaining a higher taste as it is shown in the perceptual map. Both the segments of low taste—high freshness and low freshness—high taste are completely ignored by competing brands. It may be due to positive correlation between freshness and

In this perceptual map 3 brands arc operating in the low freshness— high packaging segment: the second segment is ignored by different Bangladeshi brands up to now. working on their freshness can improve the buyers perception and hence can improve the sales of these brands. As far as packaging is concerned Tip Biscuit is perceived as the lowest in packaging among all the brands in the market. Surely one area they can work on.

In quality and smell Mr. Cooky is Perceived as a high quality product and with a better smell. Once again Grand Choice, Tip Biscuit and Pran Glucose are Close competitors as far as quality and smell are concerned Buyer’s perception regarding quality and smell of these three products is low. These brands should work on, their product’s quality and smell to increase their product’s sale in the market.

Nabisco Milk Biscuit and Energy Biscuit are the closest competitors in the high quality-high taste segment. Grand Choice, Tip and Pran Glucose Biscuit can improve their taste and quality to have a better market share in the marketplace.

Nabisco Milk Biscuit and Energy Biscuit are the closest competitors in the high quality-high taste segment. Grand Choice, Tip and Pran Glucose Biscuit can improve their taste and quality to have a better market share in the marketplace.

Positioning and Repositioning

Positioning:

Positioning is the act of designing the company’s offering and image to occupy a distinctive place in the target consumers mind (Kotler, 2000). Positioning involves determining how consumers’ perceive the marketer’s product and also developing and implementing marketing strategies to achieve the desired position in the market (Loudon and Bitta, 1993). The key objective of positioning strategy is to form a particular brand image in the consumers’ minds. The position of a product, service or even store is the image that comes to mind and the attributes consumers perceive as related to it (Belch and Belch 2001). The common approaches to have a clear, distinctive and favorable image in the minds of the consumers all the marketers try to have a clear positioning strategy in mind. This positioning helps the company to set its brand apart from its competitors. Companies try to target a particular segment as it is not possible for a company to satisfy all the consumers in a given product category. After selecting the target segment the company tries to differentiate its offering from its competing brands with different kinds of positioning strategies. For positioning to succeed, marketers must communicate with their target market, making the product available through channels that support the positioning strategy, and setting a price that matches the products position as well as the value placed on the product by the target market

Product positioning process

Generally, the product positioning process involves:

1. Defining the market in which the product or brand will compete (who the relevant buyers are)

2. Identifying the attributes (also called dimensions) that define the product ‘space’

3. Collecting information from a sample of customers about their perceptions of each product on the relevant attributes

4. Determine each product’s share of mind

5. Determine each product’s current location in the product space

6.Determine the target market’s preferred combination of attributes (referred to as an ideal victor)

7. Examine the fit between:

a. The position of your product

b. The position of the ideal victor

8. Interest and started a conversation, you’ll know you’re on the right track.

There are ninny ways how a company can position its product or service. Some of the approaches are illustrated below, on the basis of research observation. It should be noted that combinations of these approaches are also possible and the sample brands are following accordingly.

Position on product features/benefits: A common approach to positioning is setting the brand apart from competitors on the basis of the specific characteristics or benefits offered by the product or service. Tip Biscuit is trying to position its that’s why they included the word ‘No Sugar’ in their brand.

Positioning by price: Marketers often use price characteristics to position their brands. Though Pran Glucose Biscuit tried to position the brand on low price but from the perceptual map (6.2.1 Perceptual map on Taste and Price) it is found that consumers perceive Energy Biscuit to be the most price favorable brand. On the other hand Mr. Cooky charges the highest price. Hut consumers perception toward their pricing is not that much unfavorable.

Position on user: This approach associates the product with a user or class of users. More or less all these brands are trying to position on this strategy by targeting the people, as these people are their target customers. Particularly Mr. Cooky and Grand Choice Biscuit are providing free offer with the packet to attract the people.

- Positioning by quality: Marketers also use quality characteristics to position their brands. It is observed that Mr. Cooky is trying to position their brand on quality characteristics. The pricing and packaging of the brand indicates its endeavor on quality positioning.

Again all these approaches can be categorized into two categories, a. Head to head positioning and b. Differentiation positioning.

a. Head to head positioning: It involves competing directly with competitors on similar product attributes in the same target market. It has been observed from the perceptual maps that Mr. Cooky is engaged with Energy Biscuit and Grand Choice is engaged with Tip in head to head positioning.

b. Differential positioning: It involves seeking a less competitive smaller market niche in which to locate a brand. This is done when a company wants to explore a different market segment, which is ignored by the competing brands. Pran Glucose Biscuit is doing this sort of positioning with, Mr. Cooky and vice versa.

Repositioning

Re-positioning involves changing the identity of a product, relative to the identity of competing products, in the collective minds of the target market.

In volatile markets, it can be necessary – even urgent – to reposition an entire company, rather than just a product line or brand. When Goldman Sachs and Morgan Stanley suddenly shifted from investment to commercial banks, for example, the expectations of investors, employees, clients and regulators all needed to shift, and each company needed to influence how these perceptions changed. Doing so involves repositioning the entire firm.

This is especially true of small and medium-sized firms, many of which often lack strong brands for individual product lines. In a prolonged recession, business approaches that were effective during healthy economies often become ineffective and it becomes necessary to change a firm’s positioning. Upscale restaurants, for example, which previously flourished on expense account dinners and corporate events, may for the first time need to stress value as a sale tool.

Repositioning a company involves more than a marketing challenge. It involves making hard decisions about how a market is shifting and how a firm’s competitors will react. Often these decisions must be made without the benefit of sufficient information, simply because the definition of “volatility” is that change becomes cult or impossible to predict.

When a product s current positioning fails to achieve the desired goal into the minds of the consumers the marketer can take a different strategy to establish a clear image in the consumers’ mind, which is called repositioning. Repositioning a product usually occurs when because of declining or stagnant sales or because of anticipated opportunities in other market positions. Repositioning can also be done if there is intense competition in a particular segment to avoid serious competition. Repositioning is often difficult to accomplish because of entrenched percept ions about and attitudes toward the product or brand.

Perceptual map helps marketer to formulate positioning on jug and repositioning strategy for their brands. Following are the suggestions to the competing brands of the Biscuit industry of how they can take advantage of the positioning and repositioning on the basis of perceptual map.

Taste and price: In this particular perceptual map it is seen that Mr. Cooky, Nabisco Milk Biscuit and Energy Biscuit are competing within the same quadrant. SC) anyone of them can choose 4th quadrant, which is overlooked by oilier brands. in the 2nd quadrant Pran Glucose Biscuit and Martial are competing with each other. They can also think of targeting 4th quadrant to avoid head to head competition with the other brand.

Price and packaging: In this map it is seen that Mr. Cooky, Nabisco Milk Biscuit. Grand Choice, Energy Biscuit, Pran Glucose Biscuit all of them are perceived in the same quadrant by their consumer, so some of them can easily reposition & target 2nd or 4th quadrant to avoid head to head competition. Pran Glucose Biscuit may go for the 2nd quadrant and Grand Choice Biscuit may go for the 4th quadrant.

Taste and freshness: This particular perceptual map shows that all the brands are competing only in two quadrant; 1st quadrant and third quadrant. Second quadrant and 4th quadrant are yet to be targeted by any of the brands to avoid to head competition.

Packaging and freshness: Grand Choice, Twist and Pran Glucose Biscuit are competing in the 4th quadrant. The 3rd quadrant is dominated by Tip. So any of those brands can reposition themselves in the second and third quadrant to have a better market share in the industry.

Quality and smell: Currently Grand Choice, Tip Biscuit and Pran Glucose Biscuit are positioned in the third quadrant. They can reposition their product and go for second quadrant or 4th quadrant to have a better market share for their product.

Taste and quality: This map shows that 2nd and 4th quadrant arc not yet targeted by any brand Nabisco Milk Biscuit and Energy Biscuit can avoid head to head competition by repositioning their brands in these quadrants.

SUMMARY AND CONCLUSION

Ascertaining product position is the prior Step of formulating market strategy for the product. There is a process of live steps to determine this product position. According to the process the study first identified a set of 6 competitive brands viz, Energy Biscuit. Pran Glucose Biscuit, Nabisco Milk Biscuit, Grand Choice Biscuit, Tip and Mr. Cooky considering the demand of the brands. Ranking of die brands has been made on the basis of opinion of customers and traders. Moreover, influence of age in choosing the brand has been tested by developing a contingency table and using X2 test. In the next step the study selected 6 attributes viz, Taste, Packaging, Price, Quality, Smell and Freshness to collect customers’ perception of the brands. Then the study tried to ascertain the existing position of the brands oil the basis of perception in respect of selected attributes in the market. Findings of the study show that Mr. Cooky Buscuits occupies the best position in respect of all the attributes except the attribute ‘price’. Energy Biscuit and Nabisco Milk Biscuit are in 2nd and 3rd position in respect of most of the attributes. However to pinpoint the position of the brands in the market 6 perceptual maps were drawn. These perceptual maps show that some brands are in the position of head to head in respect of some particular attributes and some others are in the position of differentiation in respect of some either attributes. Finally the study formulated some repositioning strategies for the brands on the basis perceptual maps.

POINT MEAN SCORES OF SELECTED ATTRIBUTES

The Table shows that Mr. Cooky scores the highest score in respect of Taste. Packaging, Quality, Smell and Freshness which are 4.45, 3.95, 3.97, 3.57, 3.56 respectively. Regarding the attribute price, Energy Biscuit possess the 1st position (3.45). which is followed by Nabisco Milk Biscuit (3.2), Pran Glucose Biscuit (3.0) Mr. Cooky (2.67), Grand Choice Biscuit (2.5) and Tip Biscuit (2.10). Tip Biscuit scores the lowest score (2.39) regarding the attribute Packaging. However the mean scores of other brands regarding packaging are 3.39, 3.6, 2.9 and 2.6 for Energy Biscuit. Nabisco Milk Biscuit. Grand Choice Biscuit and Tip Biscuit respectively. The mean score of Grand Choice Biscuit. Tip Biscuit and Pran Glucose Biscuit is below 3 regarding all the attributes except the Price of Pran Glucose Biscuit. Perceptual map on taste and quality:

Perceptual Map on Taste and price

A map that shows where consumers locate various products in the category in terms of several important features (Advertising. wells, Bartlett, Moriarthy; 4th edition). By seeing tile perceptual map an organization can understand its position in the market on tile basis of buyers perception. Each and every organization has a positioning strategy in the market place to target their customers. The technique of perceptual mapping helps the marketers to determine just how their products and services appear to customers in relation to competitive brands on one or more relevant characteristics. It also enables them to see gaps in the positioning of all brands in the product or the service and to identify the areas in which consumer needs are not being adequately met. Through this perceptual map the marketers can understand whether their target customers perceive their product on tile basis of the positioning that they want to create and identify the deviation if any. with the help of perceptual map it can also find tile segment, which is yet to be targeted by the companies of tile same industry. The perceptual map can be drawn on the basis of different variables, if two different variables are taken to draw the perceptual map then it is called a two-way perceptual map and if more than two variables are taken then it is called multivariate perceptual map: Present study tries to draw the perceptual map on the basis of two different variables. In the earlier section of the study the mean scores of the 6 attributes have been shown. On the basis of these mean scores perceptual maps are drawn in this section. By taking 2 attributes at a time out of 6 attributes the study can show 6c2 =15 perceptual maps. But only 6 perceptual maps are shown below considering the importance of the attributes.

The map shows 4 segments of consumer’s Perception. First quadrant is the segment of low price-high taste, second quadrant is the segment of low taste-low price, Third quadrant is the segment of low taste-high price and Fourth quadrant is the segment of high price-high taste. The above perceptual map shows that as far as taste is concerned Mr. Cooky is perceived as the tastiest among all the brands but its price is perceived to be a bit higher by the customers. Consumers perceive the price of Energy Biscuit to be favorable, but its perception regarding the taste of the brand is not that good. Nabisco Milk Biscuit can be called a very close competitor of Energy Biscuit, but it is maintaining slightly lower taste and more price than Energy Biscuit.

Mr. Cooky’s packaging is considered to be the best in the consumer mind as this shown in this perceptual map. Nabisco Milk and Energy Biscuit are closely following Mr. Cooky as far as packaging is concerned Perception about Tip Biscuit on the basis of price and packaging is the lowest in the consumer’ mind and the brand is perceived to be higher priced product with a lower packaging outlook. see again the low price and high packaging segment is dominated by different brands as 5 different brands arc competing within the Came segment. Both the segments of low price and low packaging and also high price and high packaging are yet to be targeted by any Bangladeshi brand and it is understood that the second segment is dominated by non brand Biscuit with low price and the 4th segment is dominated by the foreign Biscuit brands.

One interesting finding in this perceptual map is that Tip Biscuit, Grand Choice Biscuit and Pran Glucose Biscuit are very close competitor as far as taste end freshness concerns. All of them are perceived as low in taste and low in freshness. If they can address on these factors and try to rectify these products’ taste and freshness, hopefully they can increase the sales of these brands. Mr. Cooky once again is perceived to be the best in freshness and also maintaining a higher taste as it is shown in the perceptual map. Both the segments of low taste—high freshness and low freshness—high taste are completely ignored by competing brands. It may be due to positive correlation between freshness and taste.

In this perceptual map 3 brands arc operating in the low freshness— high packaging segment: the second segment is ignored by different Bangladeshi brands up to now. working on their freshness can improve the buyers perception and hence can improve the sales of these brands. As far as packaging is concerned Tip Biscuit is perceived as the lowest in packaging among all the brands in the market. Surely one area they can work on.

In quality and smell Mr. Cooky is Perceived as a high quality product and with a better smell. Once again Grand Choice, Tip Biscuit and Pran Glucose are Close competitors as far as quality and smell are concerned Buyer’s perception regarding quality and smell of these three products is low. These brands should work on, their product’s quality and smell to increase their product’s sale in the market.

Nabisco Milk Biscuit and Energy Biscuit are the closest competitors in the high quality-high taste segment. Grand Choice, Tip and Pran Glucose Biscuit can improve their taste and quality to have a better market share in the marketplace.

Positioning and Re Positioning

Positioning:

Positioning is the act of designing the company’s offering and image to occupy a distinctive place in the target consumers mind (Kotler, 2000). Positioning involves determining how consumers’ perceive the marketer’s product and also developing and implementing marketing strategies to achieve the desired position in the market (Loudon and Bitta, 1993). The key objective of positioning strategy is to form a particular brand image in the consumers’ minds. The position of a product, service or even store is the image that comes to mind and the attributes consumers perceive as related to it (Belch and Belch 2001). The common approaches to have a clear, distinctive and favorable image in the minds of the consumers all the marketers try to have a clear positioning strategy in mind. This positioning helps the company to set its brand apart from its competitors. Companies try to target a particular segment as it is not possible for a company to satisfy all the consumers in a given product category. After selecting the target segment the company tries to differentiate its offering from its competing brands with different kinds of positioning strategies. For positioning to succeed, marketers must communicate with their target market, making the product available through channels that support the positioning strategy, and setting a price that matches the products position as well as the value placed on the product by the target market.

Product positioning process

Generally, the product positioning process involves:

1. Defining the market in which the product or brand will compete (who the relevant buyers are)

2. Identifying the attributes (also called dimensions) that define the product ‘space’

3. Collecting information from a sample of customers about their perceptions of each product on the relevant attributes

4. Determine each product’s share of mind

5. Determine each product’s current location in the product space

6.Determine the target market’s preferred combination of attributes (referred to as an ideal vector)

7. Examine the fit between:

a. The position of your product

b. The position of the ideal vector

8. Interest and started a conversation, you’ll know you’re on the right track.

There are ninny ways how a company can position its product or service. Some of the approaches are illustrated below, on the basis of research observation. It should be noted that combinations of these approaches are also possible and the sample brands are following accordingly.

Position on product features/benefits: A common approach to positioning is setting the brand apart from competitors on the basis of the specific characteristics or benefits offered by the product or service. Tip Biscuit is trying to position its that’s why they included the word ‘No Sugar’ in their brand.

Positioning rig by price: Marketers often use price characteristics to position their brands. Though Pran Glucose Biscuit tried to position the brand on low price but from the perceptual map (6.2.1 Perceptual map on Taste and Price) it is found that consumers perceive Energy Biscuit to be the most price favorable brand. On the other hand Mr. Cooky charges the highest price. Hut consumers perception toward their pricing is not that much unfavorable.

Position on user: This approach associates the product with a user or class of users. More or less all these brands are trying to position on this strategy by targeting the people, as these people are their target customers. Particularly Mr. Cooky and Grand Choice Biscuit are providing free offer with the packet to attract the people.

- Positioning by quality: Marketers also use quality characteristics to position their brands. It is observed that Mr. Cooky is trying to position their brand on quality characteristics. The pricing and packaging of the brand indicates its endeavor on quality positioning.

Again all these approaches can be categorized into two categories, a. Head to head positioning and b. Differentiation positioning.

a. Head to head positioning: It involves competing directly with competitors on similar product attributes in the same target market. It has been observed from the perceptual maps that Mr. Cooky is engaged with Energy Biscuit and Grand Choice is engaged with Tip in head to head positioning.

b. Differential positioning: It involves seeking a less competitive smaller market niche in which to locate a brand. This is done when a company wants to explore a different market segment, which is ignored by the competing brands. Pran Glucose Biscuit is doing this sort of positioning with, Mr. Cooky and vice versa.

Repositioning

Re-positioning involves changing the identity of a product, relative to the identity of competing products, in the collective minds of the target market.

In volatile markets, it can be necessary – even urgent – to reposition an entire company, rather than just a product line or brand. When Goldman Sachs and Morgan Stanley suddenly shifted from investment to commercial banks, for example, the expectations of investors, employees, clients and regulators all needed to shift, and each company needed to influence how these perceptions changed. Doing so involves repositioning the entire firm.

This is especially true of small and medium-sized firms, many of which often lack strong brands for individual product lines. In a prolonged recession, business approaches that were effective during healthy economies often become ineffective and it becomes necessary to change a firm’s positioning. Upscale restaurants, for example, which previously flourished on expense account dinners and corporate events, may for the first time need to stress value as a sale tool.

Repositioning a company involves more than a marketing challenge. It involves making hard decisions about how a market is shifting and how a firm’s competitors will react. Often these decisions must be made without the benefit of sufficient information, simply because the definition of “volatility” is that change becomes cult or impossible to predict.

When a product s current positioning fails to achieve the desired goal into the minds of the consumers the marketer can take a different strategy to establish a clear image in the consumers’ mind, which is called repositioning. Repositioning a product usually occurs when because of declining or stagnant sales or because of anticipated opportunities in other market positions. Repositioning can also be done if there is intense competition in a particular segment to avoid serious competition. Repositioning is often difficult to accomplish because of entrenched percept ions about and attitudes toward the product or brand.

Perceptual map helps marketer to formulate positioning on jug and repositioning strategy for their brands. Following are the suggestions to the competing brands of the Biscuit industry of how they can take advantage of the positioning and repositioning on the basis of perceptual map.

Taste and price: In this particular perceptual map it is seen that Mr. Cooky, Nabisco Milk Biscuit and Energy Biscuit are competing within the same quadrant. SC) anyone of them can choose 4th quadrant, which is overlooked by oilier brands. in the 2nd quadrant Pran Glucose Biscuit and Martial are competing with each other. They can also think of targeting 4th quadrant to avoid head to head competition with the other brand.

Price and packaging: In this map it is seen that Mr. Cooky, Nabisco Milk Biscuit. Grand Choice, Energy Biscuit, Pran Glucose Biscuit all of them are perceived in the same quadrant by their consumer, so some of them can easily reposition & target 2nd or 4th quadrant to avoid head to head competition. Pran Glucose Biscuit may go for the 2nd quadrant and Grand Choice Biscuit may go for the 4th quadrant.

Taste and freshness: This particular perceptual map shows that all the brands are competing only in two quadrant; 1st quadrant and third quadrant. Second quadrant and 4th quadrant are yet to be targeted by any of the brands to avoid to head competition.

Packaging and freshness: Grand Choice, Twist and Pran Glucose Biscuit are competing in the 4th quadrant. The 3rd quadrant is dominated by Tip. So any of those brands can reposition themselves in the second and third quadrant to have a better market share in the industry.

Quality and smell: Currently Grand Choice, Tip Biscuit and Pran Glucose Biscuit are positioned in the third quadrant. They can reposition their product and go for second quadrant or 4th quadrant to have a better market share for their product.

Taste and quality: This map shows that 2nd and 4th quadrant arc not yet targeted by any brand Nabisco Milk Biscuit and Energy Biscuit can avoid head to head competition by repositioning their brands in these quadrants.

SUMMARY AND CONCLUSION

Ascertaining product position is the prior Step of formulating market strategy for the product. There is a process of live steps to determine this product position. According to the process the study first identified a set of 6 competitive brands viz, Energy Biscuit. Pran Glucose Biscuit, Nabisco Milk Biscuit, Grand Choice Biscuit, Tip and Mr. Cooky considering the demand of the brands. Ranking of die brands has been made on the basis of opinion of customers and traders. Moreover, influence of age in choosing the brand has been tested by developing a contingency table and using X2 test. In the next step the study selected 6 attributes viz, Taste, Packaging, Price, Quality, Smell and Freshness to collect customers’ perception of the brands. Then the study tried to ascertain the existing position of the brands oil the basis of perception in respect of selected attributes in the market. Findings of the study show that Mr. Cooky Buscuits occupies the best position in respect of all the attributes except the attribute ‘price’. Energy Biscuit and Nabisco Milk Biscuit are in 2nd and 3rd position in respect of most of the attributes. However to pinpoint the position of the brands in the market 6 perceptual maps were drawn. These perceptual maps show that some brands are in the position of head to head in respect of some particular attributes and some others are in the position of differentiation in respect of some ether attributes. Finally the study formulated some re-positioning strategies for the brands on the basis perceptual maps.