Remittance of Funds

Remittance of funds is ancillary services of SIBL. It aids to remit fund from one place to another place on behalf of its customers as well as non-customers of bank .SIBL has its branches in the major cities of the country and therefore, it serves as one of the best mediums for remittance of funds from one place to another.

The main instruments used by SIBL, Local Office Branch for remittance of funds.

I. Pay Order/ Banker’s check.

II. Demand Draft.

III. Telegraphic Transfer.

Pay Order/ Banker’s check

The pay order is an instrument issued by bank, instructing itself a certain amount of money mentioned in the instrument taking amount of money and commission when it is presented in bank. Only the branch of the bank that has issued it will make the payment of pay order. The banker’s cheque must come the branch for payment wherever it is presented.

Issuing of Pay Order:

The procedures for issuing a Pay Order are as follows:

- Deposit money by the customer along with application form.

- Give necessary entry in the bills payable (Pay Order) register where payee’s name, date, Po no, etc is mentioned.

- Prepared the instrument.

- After scrutinizing and approval of the instrument by the authority, it is delivered to customer. Signature of customer is taken on the counterpart.

Cancellation of a Pay Order:

If a buyer wants to cancel it, he should submit a letter of instrument in this regard and also return the instrument.

Bank Draft:

The person intending to remit the money through a pay order has to deposit the money to be remitted with the commission which the banker charges for its services. The amount of commission depends on the amount to be remitted. On issue of the pay order, the remitter does not remain a party to the instrument

1) Drawer branch

2) Drawer branch

3) Payee.

This is treated as the current liability of the bank as the banker on the presentation of the instrument should pay the money. The banker event on receiving instructions from the remitter cannot stop the payment of the instrument. Stop payment can be done in the following cases:

a) Loss of draft before endorsement in this case, “Draft reported to be lost payee’s endorsement requires verification” is marked.

b) Loss of draft after endorsement: In this case, the branch first satisfies itself about the claimant and the endorsement in his favor.

Charges:

A commission of 0.15% is taken on the draft value & Tk.50 is taken as postal charge.

Closing of an Account

For two reasons, one can be closed. One is by banker and other is by the customer.

- By banker: If any customer doesn’t maintain any transaction within six years and the A/C balance becomes lower than the minimum balance, banker has the right to close an a/C.

- By customer: If the customer wants to close his A/C, he writes an application to the manager urging him to close his close his A/C.

Different procedures are followed in cash of different types of A/C to close. Fixed deposit A/C is closed after the termination of the period.

Closing process for current & saving A/C:

- After receiving customer’s application the officer verifies the balance of the A/C.

- He then calculates interest and other charges accumulated on the A/C.

- If it bears a credit balance, the officer writes advice voucher. He gives necessary accounting entries post to accounts section.

- The balance is returned to the customer. And lastly the A/C is closed.

But in practice, normally the customers don’t close A/C willingly. At times, customers don’t maintain any transaction for long time. Is this situation at first, the A/C becomes dormant and ultimately it is closed by the bank.

Organgram of SIBL

Marketing Mix:

Product: Product means customer solution. SIBL introduces some products for their respective customers

Price: Price means customer cost for the products. SIBL’s pricing system is also satisfactory.

Place: Place means convenience. Its channels, coverage’s is also satisfactory.

Promotion: Promotion refers to communication. There is a lacking for the advertisement activities.

SIBL SWOT Analysis:

Strength:

Strength means the positive internal factor that a company can use to accomplish it mission, goals, & objectives. They might include:

- Customer satisfaction

- Service quality

- Pricing effectiveness

- Special skill & knowledge

- Positive public image.

Weakness:

Weakness means the negative internal factors that inhibit or restrict the accomplishment of company’s mission goal & objectives. They might include:

- Market share

- Shortage of skill work force.

- SIBL has lack of ATM booth.

Opportunity:

Opportunities are the external option that a firm can exploit to accomplish its mission. They might include:

- Sales force effectiveness

- Customer retention

- Innovation effectiveness

Threat:

Threats are negative external forces that restrict a company’s ability to achieve its mission, goal, & objectives. Threat to the business can take variety type of forms such as:

- Promotion effectiveness

- Competitors entering the market.

- Economic recession

- Technological advantages

Customer Satisfaction:

Customer satisfaction is the extent to which a product or service’s perceived performance matches a buyer’s expectations. If the product or service’s performance falls short of expectations, the buyer is dissatisfied. If performance matches or exceeds expectations, the buyer is satisfied or delighted.

Expectations are based on customers past buying experiences, the opinion of friends and associates, and marketer and competitor information and promises. Marketer must be careful to set the right level of expectations. If they set expectations too low, they may satisfy those who buy but fail to attract enough buyers. In contrast, if they raise expectations too high buyers are likely to be disappointed. Dissatisfaction can arise either from a decrease in product and service quality or from an increase in customer expectations. In either case, it presents an opportunity for companies that can deliver superior customer value and satisfaction.

Today’s most successful companies are rising expectations—and delivering quality product. Such companies track their customers’ expectations, perceived company performance, and customer satisfaction. Highly satisfied customers produce several benefits for the company. Satisfied customers are fewer prices sensitive, remain customers for a longer period, and talk favorably to others about the company and its products & services.

Marketing Mix:

Marketing Mix:

Product: Product means customer solution. SIBL introduces some products for their respective customers

Price: Price means customer cost for the products. SIBL’s pricing system is also satisfactory.

Place: Place means convenience. Its channels, coverage’s is also satisfactory.

Promotion: Promotion refers to communication. There is a lacking for the advertisement activities.

Target Customers:

The bank has a clear idea about the customers it wants to serve. Without fulfill their needs the bank has no functions. So to collect the target customers banks can run properly.

- Market Segmentation- the process of dividing a market into distinct groups of buyers with different needs, characteristics or behavior.

- Target Marketing- the process of evaluating each market segments, attractiveness and selecting one or more segments to enter.

- Market Positioning- Occupying a clear, distinctive and desirable place relative to competing products in the minds of target customers

7 p’s of Service Marketing:

Product: Any goods or services which can be offered to a market for attention, use or consumption that might satisfy a want is known as a product.

Price: The amount of money customers have to pay to obtain the product.

Place: The place is where the product or services are offered to the customers.

Promotion: Activities that communicate the merits of the product & persuade target customers to buy it.

People: People are those who create demand for a products or services & someone who fulfill his or her demand.

Physical Evidence: It is the environment in which the service is delivered & where the firm & customer interact & tangible components that facilitate performance or communication of the service.

Process: It is the actual procedures and flow of activities by which the service is delivered the service delivery & operating system.

Survey outcomes about SIBL product

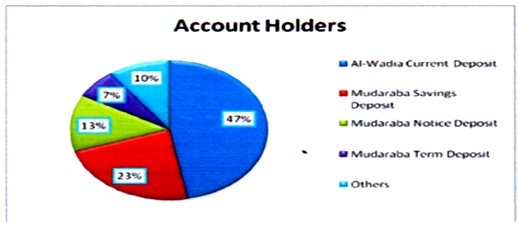

Nature of customers:

Figure 1: Accounts preference of the SIIBL customers

Interpretation: 40% customers have Mudaraba Savings Deposit, 30% customers have Al-Wadia Current Deposit, 13% customers have Mudaraba Notice Deposit, and 7% customers have Mudaraba Term Deposit and 10% customers have others. Here I have seen that most of the customers prefer savings and current deposits than other accounts.

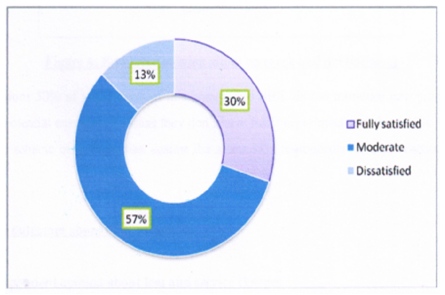

2. Customer Opinion about brand name “Social Islami Bank Limited”:

Figure 2: Customer opinion about Brand name

Interpretation: SIBL should create the likeability towards the customers not only to the existing but also towards the potentials.9 respondents (30%) preferred brand name and fully satisfied while another 4 (13%) are dissatisfied with this. Furthermore 57%

respondents have shown moderate Opinion about the brand name. This actually appraises the bank.

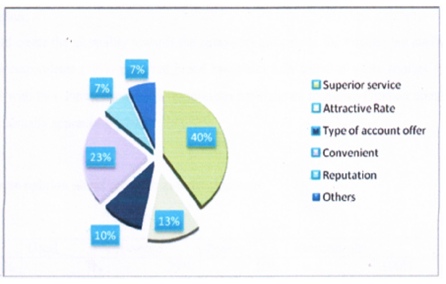

3. Reason for opening an account:

Figure 3: Reason for choice the SIIBL

Interpretation: around7% with (2) respondents said that they have chosen the bank because it is has a good reputation in the community such as “Shariah-based Islami Bank”. 40% (12) respondents have said that it is a reliable bank and provide better service and 23% said they prefer for convenient place. 13% and 1 0% respondents choose the bank because of attractive rate and types of accounts offered respectively.

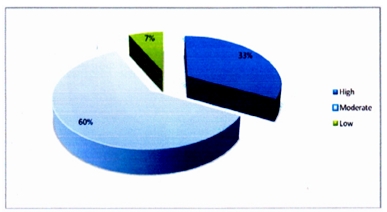

4. Respondent opinion about fees and service charges:

Figure 4: Customer opinion about fees and service charges

Interpretation: Product and service charge is a sensitive issue in banking sector. 60% respondents said this bank charge moderate value toward the customers. Moreover 33% respondents were against the arguments because they felt that bank charge little bit higher. Majority was medium value which they are able to pay to get the product or service and rest of 7% respondents experienced that SIBL demand lower charges.

More parts of this post–

A Report On Social Islami Bank Limited.(Part-1)

A Report On Social Islami Bank Limited.(Part-2)