A priori probability, often known as classical probability, is derived through formal reasoning. The principle of indifference is one technique to derive a priori probabilities. It states that if there are N mutually exclusive and collectively exhaustive occurrences that are equally likely, then the likelihood of a given event occurring is 1/N. In other words, a priori probability is calculated by studying an occurrence rationally.

The previous result has no bearing on the events in a priori probability. To put it another way, any previous results will not provide you with an advantage in forecasting future outcomes. In the same way, the probability of one of a set of K events is K / N. One inconvenience of characterizing probabilities in the above manner is that it applies just to limited assortments of occasions. Deduced likelihood doesn’t differ from one individual to another (as would an abstract likelihood) and is an objective probability.

To explain a priori probability, a coin flip is typically employed. Each coin toss has a 50% chance of finishing in heads or tails, regardless of whether you have a streak of heads or tails. The phrase “a priori” comes from the Latin terms “presumptive” and “deductive.” Thus, as the name proposes, it is more deductive and isn’t at all affected by what has occurred before. The biggest downside to this strategy for characterizing probabilities is that it must be applied to a limited arrangement of occasions as most certifiable occasions we care about are dependent upon restrictive likelihood to in some measure some degree.

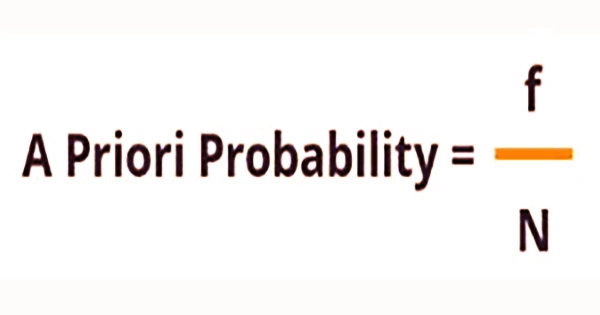

Formula for A Priori Probability –

Where:

f refers to the number of desirable outcomes.

N refers to the total number of outcomes.

It’s worth noting that the method above can only be used to occurrences in which all possible outcomes have equal chances of occurring and are mutually exclusive. A priori probability is primarily a theoretical framework for probabilities with a small number of possible outcomes. Like the differentiation in way of thinking between deduced and deduced, in Bayesian induction deduced signifies general information about the information dissemination prior to making a surmising, while deduced indicates information that joins the consequences of making a derivation.

Leaving aside the prospect of a coin landing on its edge and remaining there, the likelihood of a coin landing on heads is the same as the probability of a coin landing on tails. As a result, the likelihood of a coin toss landing on heads is equal to the probability of a coin toss falling on tails, which is 50%. The deduced likelihood has a significant application in factual mechanics. The old-style form is characterized as the proportion of the quantity of rudimentary occasions (for example the occasions a bite the dust is tossed) to the complete number of occasions and these are considered absolutely deductively, for example with next to no testing.

A priori probability has limited applicability in finance. Apart from preventing individuals from putting their financial future in the hands of the lottery, most financial outcomes do not have a finite number of possible possibilities. A classical probability is often computed by rationally examining the pre-existing knowledge or condition linked with an event. As previously stated, each event is independent in such a probability assessment, and their past occurrences have no bearing on their occurrence.

The probability can likewise apply to an organization’s income where regardless of whether the firm will create a gain, a misfortune, or earn back the original investment at some random year, the likelihood of every one of the occasions happening is equivalent. The notion of a priori probability is simple to grasp; it is a straightforward concept that may be applied to a variety of real-world scenarios. Aside from a priori probabilities, there are two more forms of probabilities to consider:

- Empirical Probability: A probability based on historical data is known as empirical probability. If three coin tosses resulted in a head, the empirical chance of receiving a head in a coin toss is 100%.

- Subjective Probability: Subjective probability is a probability that is dependent on personal opinion or experience. For example, if an analyst feels that “the S&P 500 will attain all-time highs in the following month with an 80% likelihood,” he is utilizing subjective probability.

Note that in Priori probability, specialists reach an inference about the result of an occasion prior to taking a gander at any insights. This means the Priori likelihood is utilized to gauge the event of an occasion before the occasion really occurs. As can be shown, a priori probability is a crucial statistical approach that applies to a variety of topics. It does, however, have its own set of restrictions that must be considered when drawing statistical conclusions.

Information Sources: