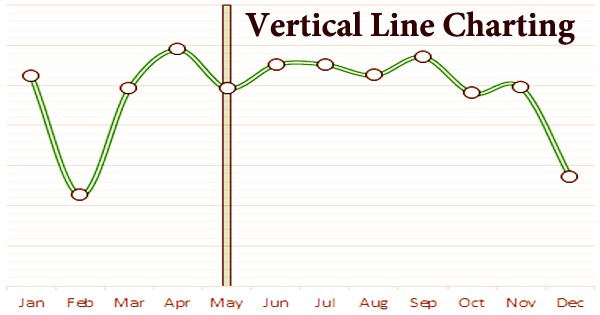

Vertical line charting is a graphical representation of a given asset’s different price points over time, which can range from 15 minutes to five years. It’s a method used by technical traders and market technicians to monitor a security’s price movements. In vertical line charting, the value activity over a predefined period is summed up by a vertical bar. A constant line is utilized to interface a progression of information focuses, and the subsequent line mirrors the general patterns in value development.

The top and bottom of the line represent the security’s high and low prices for the time, while short horizontal bars to the left and right of the vertical bar represent the security’s opening and closing prices. A vertical line chart is a very simple form of a financial chart that shows the closing prices of a security. Vertical line graphs are all the more ordinarily called bar diagrams. A-line outline can be utilized for any time span, yet ordinarily, specialized brokers and market experts record everyday value changes and graph them. A security’s price patterns are therefore monitored and used to predict potential price movements.

Vertical line charts may contain any number of data points, such as the time period’s open, high, low, and close prices. A bar map, also known as an OHLC chart, is created when all of these data points are included (open, high, low, close). Vertical outlines pass on a lot of data in easy-to-plot and simple-to-understand diagrams and subsequently give clear visual data about the market. Its high and low points, as well as narrow horizontal lines to the left and right of the line, provide detail. A bar chart is what you get when all of these prices are shown for each day.

Vertical line graphs are additionally called “close-only charts;” it is on the grounds that lone the end costs of protections are plotted with dabs. A merchant could likewise select to just see the high and low, or just the open or close, or any blend of the four information focuses. The security’s every day value activity is summed up with a vertical bar. The top and bottom of the vertical line reflect the security’s highest and lowest prices during the trading day. If the vertical bar is long, it indicates that there has been a lot of movement. There was a huge contrast between the high and low. In the event that the nearby (line on right) and open (line on left) were comparable, the purchasers and dealers were in balance or are hesitant.

If there is a significant difference between the open and close, it indicates that one of the buyers or sellers has a significant advantage over the other. If the close is significantly lower than the open, the time span was dominated by sellers. If the close is significantly higher than the open, the time was dominated by buyers. In the event that the cost moved just a modest quantity during the time frame, it is conceivable that there was little interest in the security, or that purchasers and venders were equitably coordinated however not forceful in their exchanges.

Advantages of Vertical Line Charting:

- Since they provide straightforward visual details about the market, vertical line charts are extremely simple to plot and interpret.

- Swing charts and Kagi charts are examples of more complicated technological evaluations that use them as a foundation or starting point. As a result, vertical line charting is a medium for “initial assessment.”

- They provide experienced market practitioners with a lot of detail. Trend lines, dominant support and resistance levels, and chart patterns can all be seen on vertical line charts. The examples are bouncing lines that address the value development of security, which gives significant understanding to dealers.

- They’re crucial because price forecasting, also known as volatility assessment, is an integral part of risk analysis. Any prospective investor should examine the vertical line charts of a security to determine the level of risk involved in investing in that security.

Outlining stages regularly permit brokers to shading code the vertical line contingent upon whether the value rose or declined over the time frame. Further developed types of dissecting value diagrams including searching for help and opposition levels, and featuring outline designs which may introduce exchanging openings. Vertical line charts depict the movement of an asset over time. Before attempting to predict future movements based on historical market movements, all interpretations of the map should be carefully checked for validity.

Since the highs and lows in markets are not accounted for, vertical line charts do not provide a full picture of trading prices. Notwithstanding, shutting costs are as yet viewed as the main pointers of the strength of an exchanging period. Exchanging just dependent on the cost is graph is called value activity exchanging. Many traders still use technical metrics and fundamental analysis to help them make decisions.

Information Sources: