Foreign Remittance

“Foreign Remittance” means purchase and sale of freely convertible foreign currencies as admissible “Foreign Exchange Regulations Act-1947” and “Guidelines for foreign Exchange Transaction –VOL. 172 of the country. Purchase of foreign currencies constitutes inward foreign remittance and sale of foreign currencies out ward foreign remittance.

In broad sense, foreign remittance includes all sale and purchase of foreign currencies on account of import, export, travel and other purposes. However, specifically foreign remittance means sale & purchase of foreign currencies for the purpose other than export and import. As such, this chapter will not cover purchase & sale of foreign currencies on account of import & export of goods.

Remittance procedure of foreign currency

Foreign remittance takes place in two ways-

1. Inward remittance

2. Outward remittance

Inward Remittance

Remittance comes from foreign countries to our country is called inward remittance. To the bankers or Ads inward remittance means purchase of foreign currency by authorized dealers. Generally, inward remittances are received by draft, mail transfer, TT, purchase of foreign bills & travelers Cheque, export bills. Basically, these are the formal channels of receiving inward remittance. A local bank also receives indenting commission of local firm also comes under purview of inward remittance.

Outward Remittance

Remittance from our country to foreign countries is called outward foreign remittance. On the other word, sales of foreign currency by the authorized dealer or formal channels may be addressed as outward remittance. The authorized dealers must utmost caution to ensure that foreign currencies remitted or released by them are used only for the purpose for which they are released. Outward remittance may be made by appropriate method to the country to which remittance is authorized. Most outward remittance is approved by the authorized dealer on behalf of Bangladesh Bank.

Outward remittance may be made for following purpose-

- Travel

- Medical treatment

- Education purpose

- Attending seminar etc.

- Balance amount of F.C account

- Profit of foreign companies.

- Technical assistance

- New exporters up to USD 6,000/- for business promotion

- F.C. remittance can be made for fare, exhibition from export retention quota.

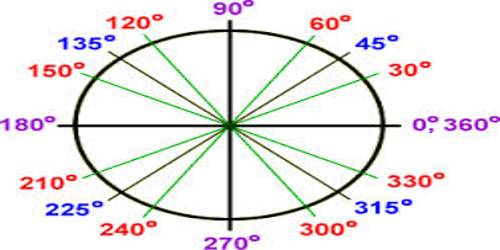

Outward remittance in favor of beneficiaries outside Bangladesh may be made in any of the following manners-

Foreign Remittance Process

Fund transfer from one country to another country goes through a process which is known as remitting process. Suppose a local bank has 200 domestic branches. The bank hag corresponding relationship with a foreign bank say –“X”, and maintaining “Nostro Account” in US $ wit the bank. Bangladeshi expatriates are sending foreign remittances to their local beneficiary, through that account. Now, when the Bangladeshi expatriates through other banks of different countries remit the fund to their “Nostro Account” with “X”, then the local bank’s Head Office international division will receive telex message and the remittance section will record the advice and generate the advice letter to the respective branch of the bank. The branch will first decode the test, verify signature and check the account number and name of the beneficiary. After full satisfaction, the branch transfers the amount to the account of the beneficiary and intimates the beneficiary accordingly. But some times the complexity arises, if the respective local bank has no branch where the beneficiary maintains his account. Then the local bank has to take help of a third bank who has branch there.

Formal Channel

Fund transfer from one country to another country through official channels, i.e. banking channel, post office, and other private service channels, such as- Western money order, Neno money order etc.

The legitimate purposes for moving money abroad through formal channel are

- To invest

- To lend

- To meet trading/ Personal obligation

- To safeguard assets against theft or seizure by repressive regimes.

Informal Channel

Fund transfer from one country to another country through hand or over telephone in an unofficial channel like as “Hundy”. Haque (1992) comments, that remittance collected by informal “Hundy” rings operating in Middle East counties and UK are also used to finance illegal trade and transactions.

Islam (2000) observes that as informal channel is needed for illegal trade of goods, as well as gold and drug into Bangladesh, and therefore, helping the ever-present problem of capital flight out of Bangladesh.

Criminals use informal channel for moving money abroad because of-

- Dealing in arms & ammunition

- Drug trafficking

- Financial terrorist activities

- Evasion of exchange regulations/ control

- Evasion of taxation

- Disguise or remove proceeds of threat/ fraud/ bribe

- Making blackmail payments

- Paying ransom for kidnappers.