Valuation of Unsold Stock in Accounting for Consignment of Goods

Where all the goods have not been sold, it becomes necessary to value the unsold goods. The stock lying in the hands of consignee at the end of accounting year is valued at cost or market price whichever is less. If all the goods are not sold by the Consignee within the accounting period, then the unsold stock is brought into account by the Consignor. The cost of unsold stock or closing stock should be valued at cost to the consignor plus proportionate non-recurring expenses incurred by the consignor and consignee. As usual, the unsold stock in the hands of the consignee should be valued on cost price or market price whichever is less. The consignment stock account is an asset and will be shown in the balance sheet.

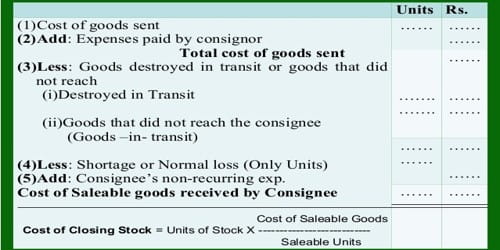

Calculation of Value of Unsold Stock: It is calculated as follows:

(a) The proportionate Cost Price and

(b) Proportionate direct expenses i.e. the expenses incurred by the Consignor and Consignee till the goods reached the godown of the Consignee.

The following method should be carefully considered while valuing unsold stock:

Cost Price Of Goods Consigned……………………………XXX

Add: Expenses incurred by consignor:

- Freight……………………………………………………………….XXX

- Carriage……………………………………………………………..XXX

- Insurance on goods dispatch………………………………..XXX

- Docks dues…………………………………………………………..XXX

- Export/Import duties…………………………………………….XXX

- Loading and unloading charges……………………………..XXX

Add: Consignee’s expenses:

- Unloading charges……………………………………………..XXX

- Landing charges………………………………………………..XXX

- Import duty……………………………………………………….XXX

- Octroi……………………………………………………………….XXX

- Godown rent etc………………………………………………..XXX

- Total Cost…………………………………………………………XXX

Cost of unsold stock = (Total Cost/Total Quantity) X Unsold Quantity

Alternative Method, The cost of stock implies the value at which goods are consigned by the consignor to the consignee.

Cost Of Unsold Stock = (Cost of goods sold+Proportionate of all expenses/Total Quantity) X unsold stock.

The value of stock includes all the expenses incurred before bringing it into usable condition.

Value of unsold stock = Cost Price of Closing Stock + Proportionate non-Recurring Expenses.