Units-of-production method determines the useful life of an asset based on the units of production. Each period, the units of production determine the depreciation expense.

To illustrate this situation, assume that the computer use varies from one year to another. We will take hours of computer use as the basis for our computations of depreciation expense. During 20X7 the computer was in use for 8,000 hours, in 20X8 – for 12,000 hours, in 20X9 – for 4,000 hours, and in 20X0 – for 16,000 hours (totaling 40,000 hours). The first step in determining depreciation expense under the units-of-production method is to calculate the cost per unit of production (usage, in our example). This cost can be calculated by dividing the total depreciable cost (historical cost – salvage value) by the number of hours the computer is expected to be in use over its useful life. The cost per hour is $0.5 ($20,000 / 40,000 hours). Then the depreciation expense for every year is determined by multiplying the cost per hour by the number of hours the computer was in use. The table below shows the computation results:

Illustration : Schedule of units-of-production depreciation for Mr. Serfy’s computer

Year | Cost Per | x | Hours Computer | = | Depreciation |

20X7 | 0.5 | x | 8,000 | = | $4,000 |

20X8 | 0.5 | x | 12,000 | = | $6,000 |

20X9 | 0.5 | x | 4,000 | = | $2,000 |

20X0 | 0.5 | x | 16,000 | = | $8,000 |

40,000 | $20,000 |

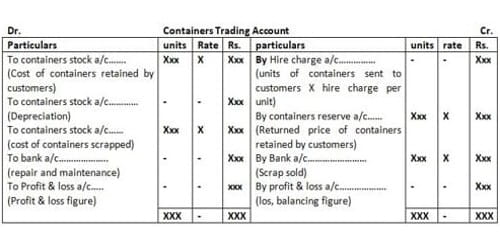

Let us assume that the revenues during the four accounting periods were as follows: for 20X7 – $8,000, for 20X8 – $10,000, for 20X9 – $6,000, and for 20X0 – $12,000. Look at the financial statements under the units-of-production depreciation method presented below:

Illustration 8-12: Financial statements under the units-of-production depreciation method

Financial Statements under Units-of-production Depreciation Method | ||||

| Income Statement | ||||

20X7 | 20X8 | 20X9 | 20X0 | |

| Revenue | $8,000 | $10,000 | $6,000 | $12,000 |

| Depreciation Expense | (4,000) | (6,000) | (2,000) | (8,000) |

| Operating Income | $4,000 | $4,000 | $4,000 | $4,000 |

| Gain | 0 | 0 | 0 | 1,000 |

| Net Income | $4,000 | $4,000 | $4,000 | $5,000 |

| Balance Sheet | ||||

| Assets | ||||

| Cash | $10,000 | $20,000 | $26,000 | $42,000 |

| Computer | $23,000 | $23,000 | $23,000 | 0 |

| Accumulated Depreciation | (4,000) | (10,000) | (12,000) | 0 |

| Total Assets | $29,000 | $33,000 | $37,000 | $42,000 |

| Equity | ||||

| Contributed Capital | $25,000 | $25,000 | $25,000 | $25,000 |

| Retained Earnings | 4,000 | 8,000 | 12,000 | 17,000 |

| Total Equity | $29,000 | $33,000 | $37,000 | $42,000 |

| Statement of Cash Flows | ||||

| Operating Activities | ||||

| Inflow from Clients | $8,000 | $10,000 | $6,000 | $12,000 |

| Investing Activities | ||||

| Outflow to Purchase Computer | (23,000) | $ 0 | $ 0 | $ 0 |

| Inflow from Sale of Computer | 0 | 0 | 0 | 4,000 |

| Financing Activities | ||||

| Inflow from Capital Acquisition | $25,000 | 0 | 0 | 0 |

| Net Change in Cash | $10,000 | $10,000 | $6,000 | $20,000 |

| Beginning Cash Balance | $ 0 | $10,000 | $20,000 | $26,000 |

| Ending Balance | $10,000 | $20,000 | $26,000 | $42,000 |