Banglalink Digital Communications Ltd. is the second largest telecom service provider in Bangladesh. Since its inception in 2005, the company is successfully catering the market niches with unique and economic products offering. It started business under the brand name ‘Banglalink’ in 2005 and now the Russian telecom giant VimpelCom is the parent company of Banglalink. It is growing everyday from the day it started its business in Bangladesh. Now, it has over 29 million subscribers all over the world and the company provides services like 3G, Value added services, Mobile financial services and so on. Currently it has market share of 26% among all the telecom companies. The vision of Banglalink is ‘To understand people’s needs best and develop appropriate communication services to improve people’s lives and make it simple’. To achieve this vision there are certain missions that Banglalink pursues. The missions of Banglalink are segmented approach in terms of products and services, delivering superior benefits in every phase of the customers’ experience (before, during and after sales) and

creating optimum shareholder value. This report is prepared on the treasury functions and the financial performance of Banglalink. Excluding the introductory part this report is divided into five parts.

The first part will provide an overall idea about Banglalink. The second one will describe the internship experience in the treasury unit of Banglalink. The third part will give an idea regarding major treasury functions those are conducted in Banglalink. The next part of the report shows an analysis on the financial performance of Banglalink over the past years and there was a comparison made between Banglalink and its counterpart Grameenphone based on the financial performance of the company. Lastly, there are some recommendations provided those can help the company to improve its effectiveness.

OBJECTIVE OF THE STUDY

GENERAL OBJECTIVE

The major objective of this report is to assess the treasury functions, different aspects of treasury functions, overall analysis of financial performance of the organization in comparison with a similar organization and to recommend the changes those can enhance the performance of the organization.

SPECIFIC OBJECTIVE

The specific objectives of this study are:

- To know about the organization and its parent in details and the ownership structures of both the entities.

- To have an understanding on the products and services offered by Banglalink Digital Communications Ltd.

- To understand the core treasury functions of Banglalink Digital Communications Ltd.

- To comprehend the corporate treasury activities of Banglalink Digital Communications Ltd.

- To assess the tasks of trade finance of Banglalink Digital Communications Ltd.

- To analyze the cash management process of Banglalink Digital Communications Ltd.

- To conduct a thorough trend and cross-sectional financial analysis on Banglalink Digital Communications Ltd. and Grameenphone Ltd.

Overview of The Telecom Industry in Bangladesh

Among the south Asian countries Bangladesh adopted cellular technology first back in 1993 by introducing Advanced Mobile Phone System (AMPS).The first mobile license was issued in 1989 but it failed to cater the market with good products and services in a lower cost. The subscription price was way too high to attract the mass people and the tariff was highest in the history, yet the network coverage and the quality of network was unbelievably poor. In 1996,

the government awarded three GSM licenses aimed at breaking the monopoly and making the cellular technology affordable to the general masses. Since then, the telecom industry played significant role in improving the quality of life of people through providing information technology and a new era of communication started. This telecom sector has brought largest foreign direct investment the country has ever experienced, paid substantial amount of tax in every year, created new opportunities by generating employment and most importantly because of the availability of this particular service the socio-economic development of the country has boosted up drastically. It has brought changes in the country by providing valueadded services and creating employment from direct/indirect firms in the telecommunications sector, increasing productivity in businesses, increasing the involvement and engagement of its

population with news and current affairs. The inflow of foreign direct investment (FDI) grew by 26 per cent with telecommunication sector making highest growth in the 2008-09 fiscal years over that of the previous fiscal. A total of around US $ 430 million was invested in the country’s telecommunication sector, particularly by fast-growing mobile phone companies in FY 09,” a recent study of Bangladesh Bank reveals. Investment from this industry as of December 2008 stands around BDT 3,000 (Three Thousand) billion. It has generated direct and indirect

employment of 675,000 (six hundred seventy five thousand) people till 2006-07 FY which has increased further in recent years. In the year 2011 Bangladesh faced a new version of financial service which is mobile banking. The easiest way of money transfer and lot more. In this service mobile customers can use their mobile phone numbers to hold or open an account and with the account they can transfer money to one another without going to the bank. The main purpose of launching this service is to reach the unbanked population with appropriate financial services using cellphone technology. The telecom sector has also made possible the availability of data enabling services across Bangladesh. Mobile internet has helped, and will likely continue, to bridge the digital divide between people with access to information and services, and those without paving the way for materializing the dream of “Digital Bangladesh”.

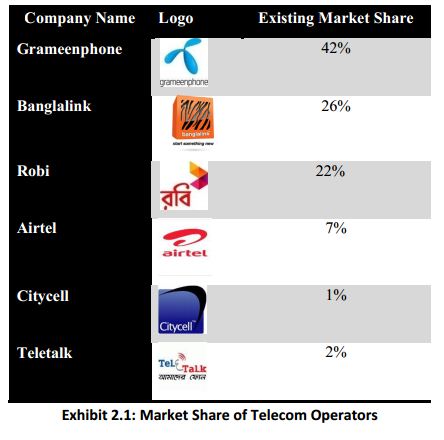

This is especially also given the greater mobile coverage reaching 97% of the population which extends into areas beyond the fixed-lines network. It was estimated that there were over 5 million mobile internet users. Geographic location as a result will become less of a barrier to social and economic inclusion, especially amongst those within the rural areas, helping support local development, avoiding unnecessary migration and improving socio-geographic structure. In the year 2013, to accelerate the internet data usage the government of Bangladesh has issued 3g license to four telecom operators of Bangladesh. Bangladesh has 5 privately owned mobile operators along with 1 state owned operator. The private operators are popular as Grameenphone, Banglalink, Robi, Airtel and Citycell. The only

one state owned organization is known as Teletalk. The market shares of the operators are as follows:

All the private companies are financed and led by multinational telecom companies. Therefore, the foreign direct investment (FDI) is comparatively higher in this sector than any other sector in Bangladesh. Although the market is regulated by very few players, the fierce competition among the operators is notable. The price war is always on among the operators and there is a good chance that the small companies will not be able to cope with their limited factor endowments and eventually they will either go out of the market or in order to sustain they will merge. One of the major characteristics of the telecom industry of Bangladesh is the change of ownership of telecom companies. Now the telecom companies are more concentrated with making 3g services available to mass people and in order to do so they are coming up with more capital deployment to develop their infrastructure. As the industry is evolving

continuously, using voice or short messaging service will be replaced by data services very soon and people will feel more comfortable to use data services since using data service is economic.

Banglalink Digital Communications Ltd.

“Banglalink Digital Communications Limited” is the second largest company in the telecom sector of Bangladesh after Grameenphone. This operator has brought massive change in the telecom industry of Bangladesh. Before Banglaink’s emergence, the telecom industry was monopolized by Grameenphone and Grameenphone took the chance of being the only player in the market by skimming the market although Grameenphone was successful to provide good quality of service and yet the subscription price and the call & sms tariff was unjustifiably high.

Although Banglalink started its operation back in 1989 which was formerly known as Sheba Telecom (Pvt.) Ltd., failed to compete with Grameenphone. It was a joint venture company of Bangladesh-Malaysia and was granted license to operate in the rural areas of 199 upazilas. Upon obtaining GSM (Global System for Mobile) license in 1996 it expands its business to cellular mobile and radio telephone services. The scenario of the telecom industry changed all on a sudden when the Egypt based telecom giant Orascom Telecom Ltd. purchased the shares of TRI(Technology Resources Industry) in Sheba for US$25 million in July 2004. The Bangladeshi partner ISL(Integrated Services Ltd) did not know that TRI had sold their shares to Orascom. However, there was an agreement between TRI & ISL regarding the sale of shares and it was “if any party wants to sell their shares, the other party will get the chance to buy those first”. This is a very common law of finance and this kind of contract is done to avoid the dilution of the

shareholders’ value. Therefore, when the deal between TRI and Orascom was revealed, ISL purchased the stocks back from Orascom as per the agreement. However, ISL did not see any hope in Sheba Telecom and failed to operate the business effectively and in September, 2004 they sold their 100% ownership to Orascom Telecom Holdings with 59,000 user base for $50 million. That’s how in the year 2005 Banglalink was born and it purchased a GSM license to operate cellular business in the country for 15 years. The beginning years were not easy for Banglalink. Grameenphone started their operation in 1997 and Banglalink made its entrance in the market after seven years of Grameenphone.

Therefore, very logically Grameenphone was a well-established company when Banglalink started to build its cellular infra-structure in the country. By the time Banglalink entered, Grameenphone had taken the maximum advantage of the market. However, it did not take too much time for Banglalink to capture considerable market share of Grameenphone as it started its operation with a vision to make the telephony available to the mass at a lower price. Before Banglalink’s operation in the country, using a cellphone was luxury. Afterwards, it became a necessity and Banglalink’s vision to penetrate the market using lower cost worked in favor of them. Banglalink came up with innovative and low cost product & service offerings and the sales increased like wildfire and it became the

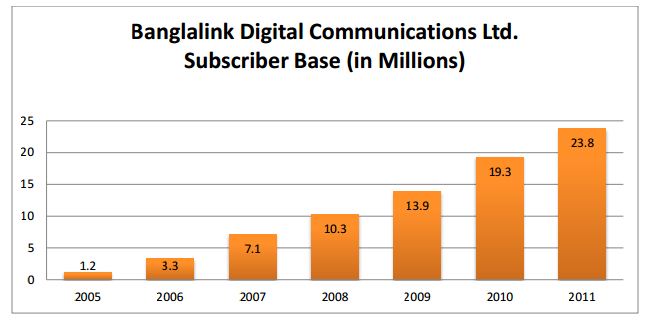

fastest growing mobile operator of the country with a growth rate of 257%. This milestone was achieved with innovative and attractive products and services targeting the different market segments; aggressive improvement of network quality and dedicated customer care and effective communication that emotionally connected customers with Banglalink. Banglalink started with 59,000 customers when they purchased Sheba in February, 2005 and in December 2005 the customer base count showed 1.2 million. The customer base is growing exponentially

every day and in March, 2014 the company has reported the current customer base is more than 29 million. The telecom industry is fully saturated with different mobile operators. To keep hold of the market position and match with changing wave strategically, Banglalink has changed its slogan to “notun kichu koro” or “start something new” in October, 2013. The slogan was backed by the launch of 3G (third generation) mobile network.

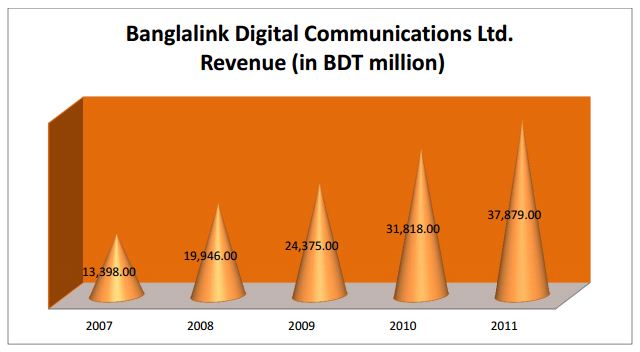

After Orascom’s takeover the revenue of the company has grown significantly every year. The organization has achieved milestones in terms of revenue every year, although maximum portion of revenue was re-invested in order to finance its network deployment project. In the year 2007 the revenue of the company was BDT 13,398 million and in the year 2011 the revenue was BDT 37,879 million. The revenue for each year from 2007 to 2011 is shown in a

chart below:

Although Banglalink has experienced stable growth in the revenue every year, the average revenue per user (ARPU) has seen a declining trend. In the year 2009, the ARPU was $2.5 and the declined ARPU in the year 2010 & 2011 was $2.3 & $1.9 respectively. This is happening because of the high rivalry among the operators and also because of low switching cost. This must be alarming for Banglalink as while the customer base is increasing significantly, the ARPU

is declining; which implies the existing customers are switching to other operators and to stop this Banglalink needs to focus more on retaining existing customer more than creating new customers.

Banglalink has built four core values from the very beginning of their journey. The organizational culture has developed based on the core values. The employees of Banglalink demonstrate these four core values which create the difference. The employees of Banglalink are innovative, straight forward, passionate and reliable.

Ownership Structure

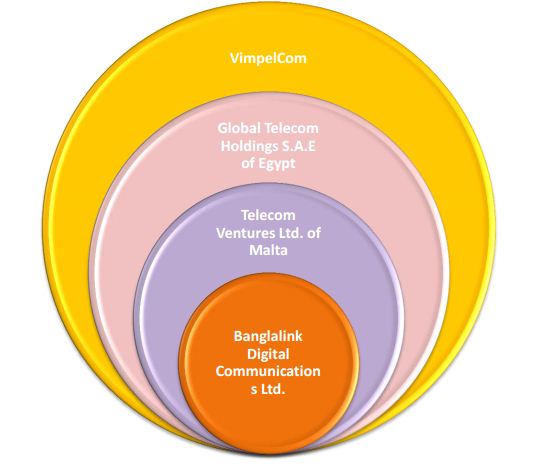

Telecom ventures Ltd. is currently operating its business in Bangladesh under the brand name Banglalink Digital Communications Ltd. Telecom Ventures Ltd. It is a Malta-based telecommunication company which was formerly known as Orascom Telecom Ventures Ltd. and now it is a fully owned subsidiary of Global Telecom Holding S.A.E. (former Orascom Telecom Holding S.A.E.). A business combination between VimpelCom of Russia and Wind

Telecommunication of Italy took place in April 2011 and after this combination world’s sixth largest telecom operator VimpelCom now owns 51.92% voting shares of Global Telecom Holding S.A.E and therefore, VimpelCom is the ultimate parent company of Banglalink Digital Communications Ltd. Although VimpelCom is the ultimate owner of Banglalink, The structure of shareholders is shown below using an exhibit:

The ownership structure of VimpelCom is also very interesting. The parent company of Banglalink’s main competitor in Bangladesh is Telenor and very surprisingly Telenor has good amount of stake in VimpelCom. Altimo of Alpha Group has 56.2% economic rights and 47.9% voting rights in VimpelCom. Altimo is one of the Russia’s largest investment firms and it has its stake in oil and gas, commercial and investment banking, asset management, insurance, retail trade, telecommunications, water utilities and special situation investments. Their business

portfolio includes many large corporations and they are successful in investing on diversified sectors to reduce business risk which is also popular as unsystematic risk. The other shareholder of VimpelCom is Telenor group of Norway. This Norwegian giant holds 33% economic rights and 43% voting rights in VimpelCom. This group has its fame in operating large telecom companies in 29 countries around the world. Therefore, in Bangladesh whether

someone uses Grameenphone or Banglalink Telenor is being benefitted substantially.

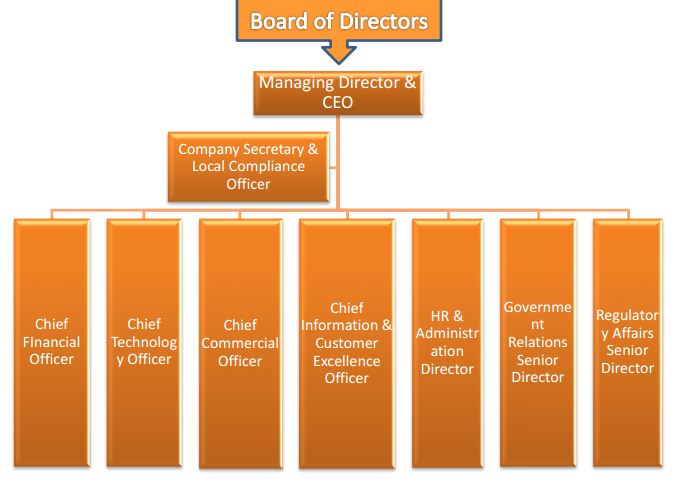

Organizational Structure

The present management team of Banglalink is led by nine highly qualified people. They are the power house of decision making and strategy forming. This management team is headed by Ziad Shatara who is the current CEO and Managing Director of Banglalink. He was appointed by Board of Directors as the CEO of Banglalink in January 2013. The Chief Financial Officer(CFO), Chief Technology Officer(CTO), Chief Commercial Officer(CCO), Chief Information & Customer Excellence Officer(CICEO), Human Resources & Administration Director, Government Relations Senior Director, Regulatory Affairs Senior Director and Company Secretary & Local Compliance Officer are the members of the management team.

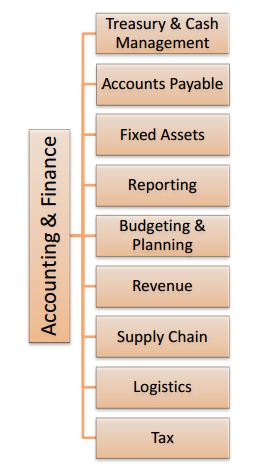

Accounting & Finance Department of Banglalink – at a glance

Accounting & Finance Department is probably the biggest functional department of Banglalink. Chief Financial Officer (CFO) is the head of the department. The people working in this department are highly experienced and they process the financial data and look after the financial matters of the company and based on the data provided by them the top management takes strategic decisions to run the organization. To ensure the effectiveness and

efficiency of this department, it has been broken down to several functional units. Few major functional units of accounting & finance department are shown below:

I was assigned to work with the treasury and cash management unit and this specific unit is the most important unit of accounting & finance as it deals with the core financing activities of the company. The major responsibility of the treasury functions unit is to bring, utilize, monitor and repay the money from different financing sources, to figure out an optimum capital structure and to minimize the financing cost while maintaining a good relationship with financial stakeholders. In words, the treasury & cash management unit takes care of the money of the organization. The treasury functions & cash management unit uses the most-diversified financing activities in Bangladesh. Treasury and cash management has its own subunits to ensure the proper functionality of the unit and those subunits are:

Activities Performed in Core Treasury

Core treasury unit of Banglalink keeps the track of fund through effective fund management process, remits money outside the country for different purposes, works for reporting required by government institutions like Bangladesh Bank, Board of Investments and most importantly monitor the short term loans and prepares the journal entries associated with working capital.

My activities were:

Downloading and sorting the bank statements: Preparing the fund positioning and fund movement report is very sensitive as well as important activity that core treasury performs every day. Everyday the fund positioning and fund

movement report has to be circulated to the top management and across the treasury functions unit within the shortest possible time so that the decisions regarding fund can be undertaken effectively. Bank statements are the most important prerequisite of this process. Banglalink has its accounts in more than 20 banks and in every bank there are multiple accounts. Different banks account statements come in different form and the data in the bank statements is useless to input in the process until it is properly filtered and sorted. I used to download bank statements of Banglalink and sort and filter the data in the proper way to facilitate the fund positioning process.

Forecasting the interest expense: Interest expense forecasting is another major activity of the core treasury functions team so that the company is prepared to pay the interest against short term loans properly and to keep adequate fund available in the bank accounts to pay off the interest expense. The interest on short-term loans is paid either on maturity of the loan or at the quarter end. One of my prime responsibilities was to prepare a forecast of interest expense at the month-end for every week of the next three months. I used to prepare this report based on the past-trend of interest expense.

Preparing the bank instructions: The movements of or payment from the available fund is made by writing an instruction for the banks. A bank instruction is like an application addressed to designated personnel of a bank and all the details of the transaction is written in the body part. The bottom of the instruction is signed by the signatories of the organization. In most of the cases, it is required to get the bank instruction signed and stamped by two signatories upon receiving which the receiving bank clears the transaction. One of my responsibilities was to prepare the instruction for the payment to a roaming partner. A roaming partner is a foreign telecom operator the network of which has been used by a customer of Banglalink via IGW (international Gateway) as the customer wants to use the Banglalink connection in abroad. Therefore, in every month payment has to be made to the roaming partners in different countries and I used to prepare the bank instructions to remit money outside the country and the payment was made from the dollar account of the company since the roaming partners sends the invoice in a foreign currency.

Keeping track of FDR tax deduction certificates: Whenever treasury spots funds are staying idol for a period of time and there is a scope to earn interest income from the unutilized fund, upon receiving prior approval treasury invests the money and create a FDR. The moment interest is realized on the FDR, banks deducts 10% tax on the earned interest and sends a tax deduction certificate. My task was to get the tax certificates from the banks, review the certificates, documentation of those certificates and keeping a track of the certificates. Updating Bloomberg Rate: The exchange rate of US dollar, Euro & British pound against taka is updated everyday from the website of Bloomberg and the rate is used to declare the corporate rate at the end of every month.

Activities Performed in Corporate Treasury

The main responsibility of corporate treasury unit of Banglalink is to allocate the funds for business activities and sourcing the funds from different financial institutions at a lower cost and maintaining a good liaison with financial institutions so that fund can be procured anytime at a lower cost. My basic responsibilities in this unit were:

Keeping track of Bangladesh Bank cheques: The treasury functions allocates the money to other departments and facilitates the vendor and non-vendor payment. There are times when payment has been made from an account which does not have sufficient money to meet the required payment amount; money is transferred from an account of another bank that has surplus balance through Bangladesh Bank cheque in the same day. In the clearing house of Bangladesh Bank this type of cheques are cleared twice a day. The transaction cost of BB cheque is Tk. 230. My task was to keep the track of this type of fund transfer and to check the bank statements whether the transfer has been executed or not.

Keeping track of internal fund transfer: Funds are also transferred from one account to another account of the same bank for the similar reason Bangladesh Bank cheque is issued. As it is stated before, Banglalink has multiple bank accounts in the same bank and money is transferred from one to another whenever it is necessary. I used to keep the track of internal fund transfer as well.

Cross unit acitivities: At the end of each month the trackers of Bangladesh Bank cheques and internal fund transfer has to be provided to the cash management unit along with the bank instructions made to transfer funds. This was done to facilitate the month end bank reconciliation.

Activities Performed in Cash Management

The cash management team monitors the cash collection process and different bank accounts, prepares bank reconciliation statements at month end and monitors the cash collection process from e-commerce projects with PDB, WASA, Qubee and etc. My tasks in this department include:

Updating the point of POS system: The distributors sends their sales report to the cash management unit of Banglalink and the sales report is updated in the POS system everyday to get the cash collection from different sources like prepaid sales, postpaid sales, airtime revenue(I’top up) and many more headings. My task was to update the POS system from the collection report to get the accumulated cash collection.

Updating the collection report of international roaming: Just like Banglalink’s payment to its roaming partner, Banglalink also receives revenue from its roaming partners for using its network and a tracker of the collection from the roaming partners is maintained. I used to update the tracker of the collection from the roaming partner.

Updating the bank balance in centralized system: There is a centralized system of group treasury of VimpelCom which is also known as treasury management system and the closing balance of each bank account is updated in this system. I updated the closing bank balances of few accounts in that system.

Activities Performed in Trade Finance

The trade finance team plays a crucial part in procuring the capital goods of the company. Trade finance facilitates the financing activities of capital goods their main responsibility include preparing LC & LCA upon the request of Procurement unit and the dissolving LC & LCAs and the payments related with LC. The only cross-unit activity that I had with this unit was: Sorting the necessary LC and LCA documents: One of my basic responsibilities was to arrange and compile necessary documents required by regulatory institutions of government and it has been described previously. For the reporting purpose the LC and LCA documents as well as the other documents of

trade finance were necessary and I had to sort out the relevant documents. Moreover, I have learned the LC process from the mentors in trade finance unit during my internship period.

Banglalink Treasury Functions

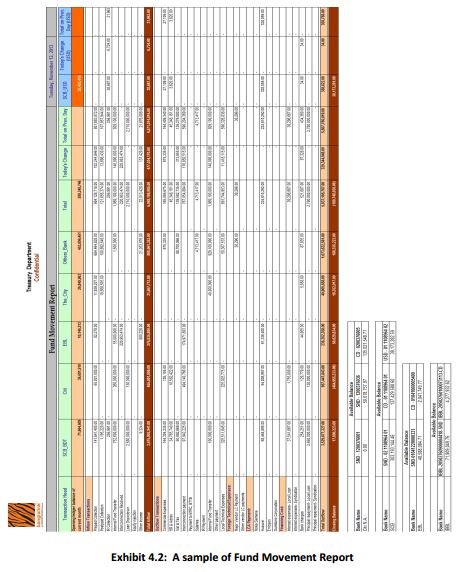

In this part of the report, few major functions of the treasury unit will be discussed briefly; the working process of the units will be shown using steps and sample output of the prepared repots.

Core Treasury Functions

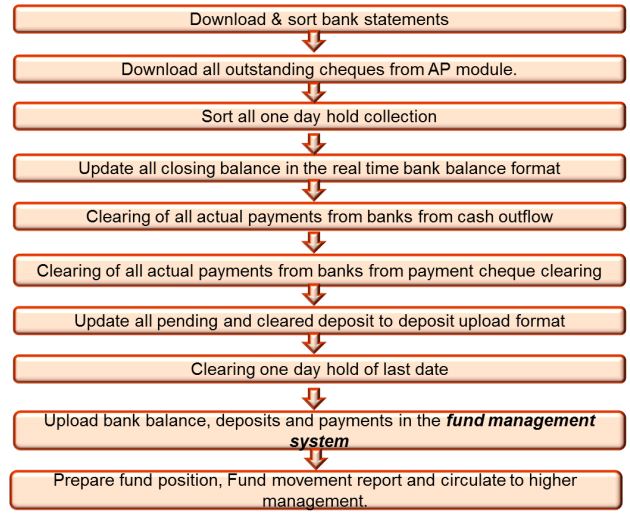

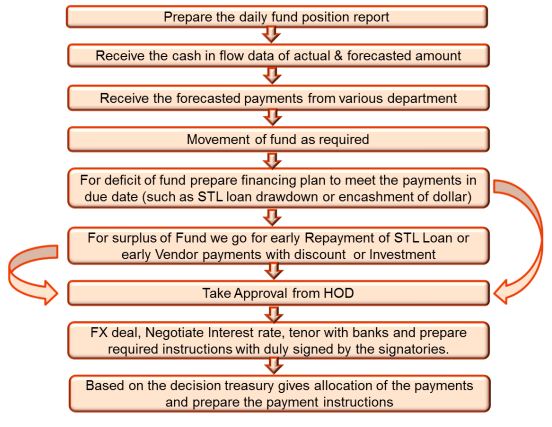

Prepare Daily Fund Position and Fund Movement Report: The core treasury functions starts with by preparing fund position and fund movement report. This is a systematic approach to know the status of fund and the steps followed to prepare fund position and fund movement report are shown below:

The process starts with downloading and sorting the bank statements and after following all the steps shown in the above exhibit a fund movement and a fund status report is extracted.

Fund Allocation and Investment Decision: After fund position and fund movement report is prepared treasury gets to know the status of fund available to execute the operational activities of Banglalink. Treasury supplies the money to all other departments from available fund and after the fund is allocated; if there is a surplus of fund treasury goes for investment and if there is a deficit of fund treasury functions looks for available financing options. The steps followed in fund management are:

Preparing various types of payment Instruction: Everyday the treasury unit has to prepare high volume of payment instructions for different financial institutions to make sure the operational activities of the company is going on in full swing.

Cash Flow forecast- Weekly, Monthly & Yearly (Budget): Treasury prepares a weekly, monthly and yearly forecast on the probable cash outflow and inflow based on the past experience and the expertise of treasury personnel so that treasury can have an idea of outflow or inflow before it is happening actually. Treasury functions always keeps track of inflow

and outflow so that the treasury people know in which particular period of a time a good amount of money is coming in or going out.

Different types of Foreign and Local payments-IR, Training, Loans, and Membership: The payments of Banglalink sent to other countries for various purposes are processed by the treasury unit. The treasury unit made this payment from the dollar account maintained with standard chartered bank. Money is remitted for the settlement of

liabilities and interest charged on those liabilities, international roaming partner payment, membership and subscription payment, training payment, consultancy fee, audit fee and many other reasons. 15% Tax and 15% VAT has to be paid to the government while executing the payment for all types of remittance other than the principal and interest payment on the liabilities.

Tracking & Processing – Interest Income and Expenses: All the liabilities and the financial expenses on the liabilities are journalized in the general ledger of Banglalink by treasury functions unit. The earning from FDR and other financial instruments is also booked in the ledger.

Corporate Treasury Functions

Banking Facility Arrangement, Renewal, Interest Rate negotiation: The corporate treasury functions unit of Banglalink arranges banking facility if there is a deficit of fund. A facility with a bank is an agreement with the bank. After conducting the creditworthiness evaluation of Banglalink, a bank prepares an agreement for Banglalink and the funded and non-funded facility limit, interest rate on the bank loan, tenure of the bank loan and other terms are there in the agreement. The funded facility limit is the amount of money that will be provided to Banglalink and the non-funded facility limit is the amount of money that will be borne by the bank for LCs(Letter of Credit) of Banglalink. The corporate treasury arranges this facility files; renews the facility files after it is expired; negotiates the corporate rate if the interest rate is higher than the market average rate and gets the bank facility signed by CEO.

Financing Plan (Loan drawdown, repayment – STL, LTL, WCS, Foreign Borrowings and FDR): The core treasury prepares the fund position and fund status report and whenever there is a shortage core treasury goes for financing, especially for short term bank loans. Corporate treasury facilitates the financing option in this manner and takes

the decision from whom to procure the fund after examining the facility files of different banks. Besides that, it also arranges the long-term loan and other financing options which have been described in this report in another section.

Maintaining relationship with the bankers and other financial institutions: Nowadays, business activities are conducted based on mutual trust and relationship with the stakeholders. The major unsaid responsibility of the corporate treasury functions unit is to maintain a cooperative relationship with banks and other financial institutions in a way

which benefits both the parties. A business cannot run without the help of financial institutions and financial institutions cannot run without the help of corporations. Both the parties complement each other. For this reason, the corporate treasury functions works as the relationship agent between the company and the financial institutions and serve the interest of the company.

Lease financing: The corporate treasury also takes lease financing decision; if leasing something benefits the company more than owning that. The lease terms are set in coordination with the lessor and the lease payments are made by the corporate treasury.

Foreign exchange deal and foreign loan repayment: As it has been discussed before, for a foreign deal valued more than USD 10,000; Banglalink gets the right to negotiate the FX rate with the banks. Corporate treasury negotiates the FX rate for Banglalink. Corporate treasury functions also makes the payment of foreign loan while the other foreign payments are processed by core treasury.

Cash Management Functions

The major functions of cash of management are:

Collection Reporting: The cash management team keeps track of prepaid collection, postpaid collection, IR collection, Icon sales collection, Interconnection collection and etc. It also reports collection from M-commerce project with BPDB, CWASA, Jibon Bima, Qubee, Desco, Bkash and other sources.

Payment Processing: The cash management team of Banglalink also facilitates all sorts of payment using online and manual payment method. The payments are requested by the accounts payable team of Banglalink to the treasury unit. The treasury unit then allocates the fund to accounts payable and the cash management unit processes the payments. These payments basically include vendor payment, payment for utility and BTS towers. Bank Reconcilation Statements: At the end of each month bank reconciliation statements are prepared to see what entries the bank did not book and what entries cash management did not book in the general ledger.

Trade Finance Functions

The trade finance team of Banglalink plays a crucial role in opening and dissolving LCs and LCAs. To import goods for Banglalink, the procurement team asks trade finance to undertake necessary financial initiatives. The trade finance team then selects a bank with which Banglalink has non-funded facility to open a LC. An IRC (Input Registration Certificate) is necessary to import goods. IRC is of two types: Industrial IRC and Commercial IRC. Banglalink is only allowed to import industrial equipment and don’t have the permission to import commercial

equipment. The following documents are required for Banglalink to import goods:

I. Input Registration Certificate (IRC)

II. Copy of Trade License

III. Copy of VAT & TIN certificate

IV. Membership Certificate of AMTOB (Association of Mobile Telecom Operators of Bangladesh)

After examining the pro forma invoice the LC issuing bank will issue a SWIFT Message to the beneficiary’s bank which will receive the payment for beneficiary. A SWIFT message is a document where all the terms and conditions of LC are written in a short form and it is a deed of LC between the importer and beneficiary. The following information is found in almost every SWIFT Message:

- Importer’s & Beneficiary’s Name & Address

- LC Issuing Date

- LC Expiry Date

- Last Date of Shipment

- LC Value

Then goods are consigned and the beneficiary issues a challan or commercial invoice for the importer. The challan or commercial invoice has to be shown to the customs officer when the consigned goods are available to release. To release the consignment from the customs the following documents are needed:

- Copy of Commercial Invoice or Challan

- Packing List

- LC SWIFT Copy

- BTRC NOC

- Trade License

- IRC

- VAT & TIN Certificate

- Insurance Coverage

After going through the long process the goods are received. A LC is dissolved with the full payment of LC. The payment can be done in two ways. One is upon receiving the goods and which is known as sight LC and for the one payment has to be made within 360 days. This is known as deferred LC. However, combination of the both payment methods is also possible. For example, if the term of a LC says 15% sight, 85% deferred; it means 15% payment has to be made when the importer receives the consignment and the rest 85% has to be paid within next 360 days. This is the very basic LC process that trade finance uses.

Financing options used by Banglalink

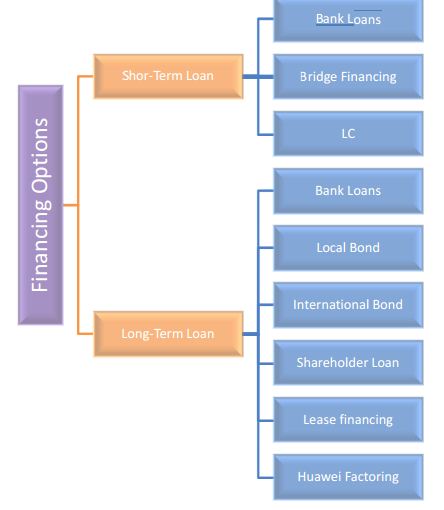

Banglalink is a fast growing telecom company which needs substantial amount of money for CAPEX (Capital Expenditure). The money has to be sourced for capital expenditure like payment for LC of network equipments, maintenance of network equipments and many more. The fact is Banglalink do not have enough current assets to finance its CAPEX and it does not have enough capacity to pay for the capital expenditure. For this reason, different financing options have to be sought to pay for capital expenditure. The treasury unit works consistently to finance so that the company can have its pace towards growth. Usually, there are two types of financing methods available for treasury when it faces cash deficiency. The company finances the projects either through short term liability or through long term liability.

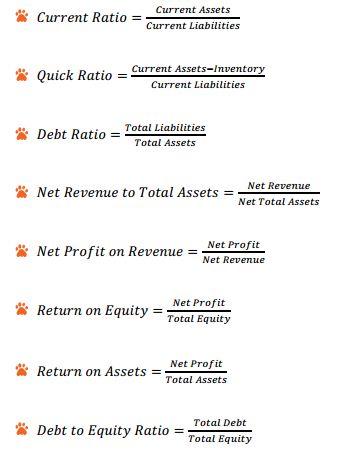

Ratios Used for Analysis

By conducting ratio analysis the financial performance of an organization can be realized. Two types of ratio analysis are conducted in this report. One is trend analysis and the other one is cross-sectional analysis. Trend analysis is done to compare the company’s performance over the past years and cross-sectional analysis is done to compare the performance of a company with a similar company in the same organization. To perform an analysis, liquidity ratios,

leverage ratios, asset management, debt management and profitability ratios have been assessed. The ratios used in the report are listed below:

Financial Ratios of Banglalink & Grameenphone

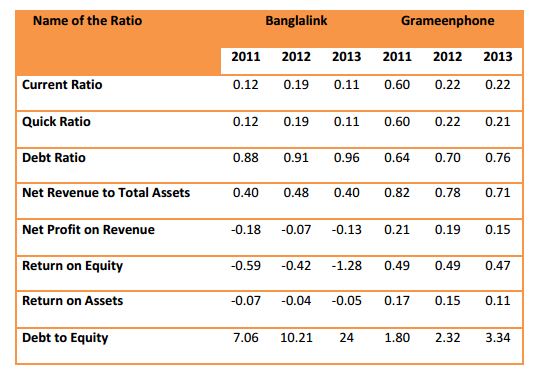

Banglalink is not yet a listed company and therefore the financial data of Banglalink is not revealed to other people because of the company confidentiality. For analysis purpose, the final outcome of the ratios have been used in this report and as the company keeps the financial data with high confidentiality, the calculation of the ratios could not been shown in this report. On the other hand, Grameenphone’s data is available since it’s a listed company. The ratios of Grameenphone & Banglalink for the year 2011, 2012 & 2013are listed in the table drawn below:

Trend & Cross-sectional Analysis of the Ratios

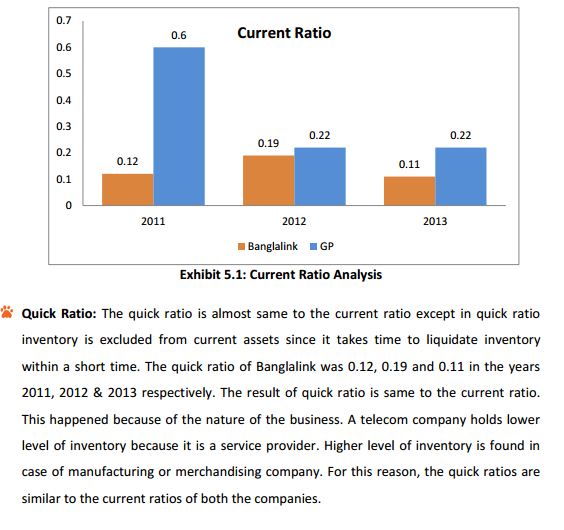

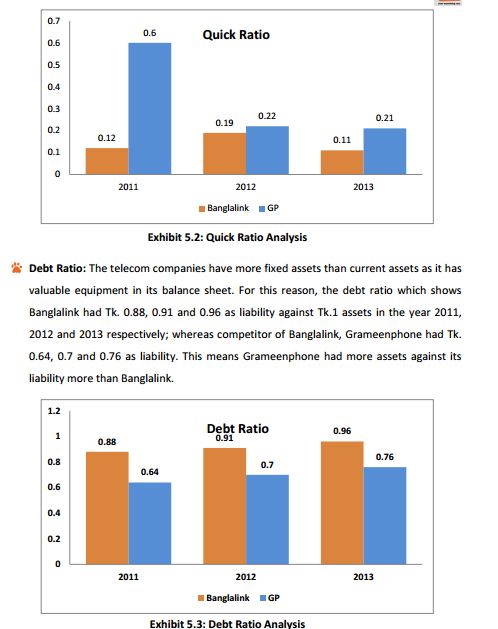

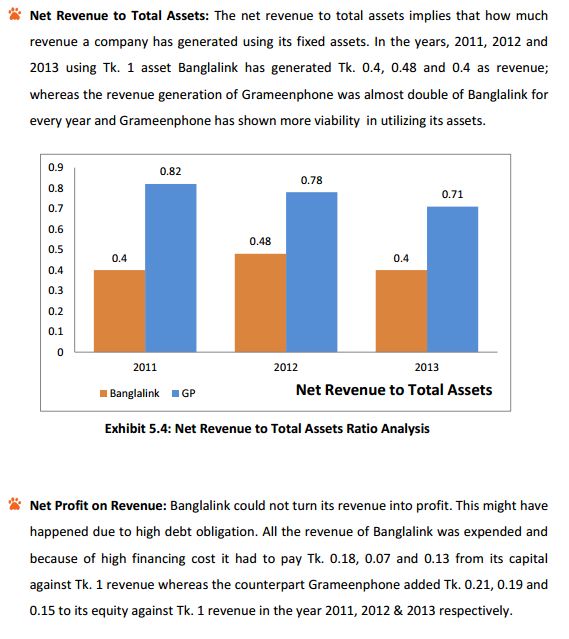

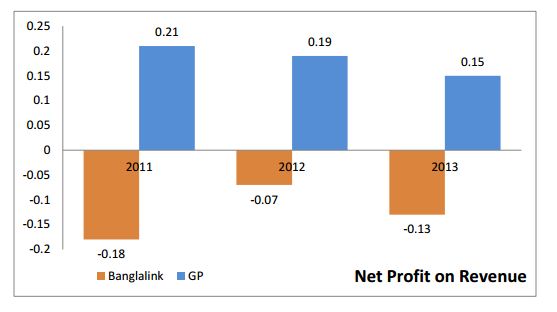

Current Ratio: Current ratios are used to test a firm’s ability to pay off the current liabilities using its current assets. Banglalink had TK. 0.12, 0.19 and 0.11 as current assets in the year 2011, 2012 and 2013 respectively against TK. 1 current liability. The current ratio of a company should be more than 1 as it indicates the company has more current assets than current liability. If compared to its counterpart Grameenphone, it had relatively lower current ratio in the last two years, but in 2011 Grameenphone had comparatively higher current ratio than Banglalink.

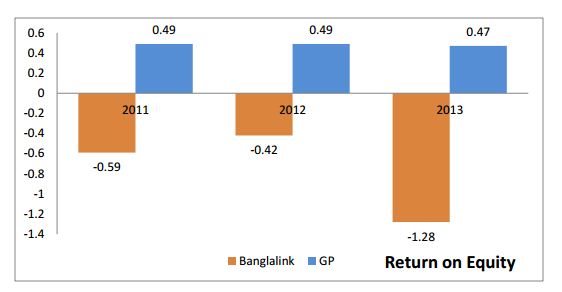

Return on Equity: Other than Grameenphone any other telecom operators have failed to declare profit so far. Since, the companies are not declaring profit the value of shareholders is declining. From Tk. 1 equity Banglalink lost Tk. 0.59, 0.42 and 1.28 in the year 2011, 2012 and 2013 respectively. On the other hand, Grameenphone sustained and added Tk. 0.49, 0.49 and 0.47 against Tk. 1 equity in the years 2011-2013.

Recommendation

It is really difficult to draw recommendation based on four months’ work experience and it would be audacious of me to give suggestions to the people who have better understanding and expertise than me. However, there are few areas in which I think the organization can improve:

Number signatories are needed to be increased. There are only two signatories outside the finance department. Being high designated officers of Banglalink they are really busy. There are times when urgent documents have to be signed, but none of the signatories are available. Therefore, two or three more signatories can be added to

ensure the efficiency of work.

Banglalink has changed its previous logo and adopted a new logo which is a 3D version of the previous logo. The company needs to evolve its outlook totally just like its counterparts. Coming in a totally new form helps the company to grow faster than before.

The finance department can have more control over the expenses and other than allocating budgets, it should monitor the expenses of other departments and make the proper justification of expenses. Although Banglalink negotiates the interest rate with banks, to avoid interest rate risk, the dealings with the financial institutions can be done using floating interest rate.

FX loss can be downsized by using currency forward contract or currency future contract. Being a technology based organization; Banglalink should create a benchmark in using latest softwares that others will follow. It needs to transform its ERP system to SAP from Oracle.

It is good that company is expanding its operation everyday and bringing new people under its customer bucket but the ultimate goal of a business is to make profit. Banglalink is operating for nine years and it is high time the company should turn itself into a profitable company. Doing business with other people’s money is good, but not

putting a business into a risky position. The financial performance indicates the company has considerable debt obligation. To minimize business risk the organization needs to reduce the usage of debt in its capital structure.

Conclusion

Banglalink Digital Communications Ltd. is one of the leading multinational telecom companies in Bangladesh. I had the opportunity to work for this company during my internship program. This internship program has helped me to explore new horizons of business environment. This report has provided insights on the treasury functions activities within the limited scope. The treasury functions are so vast and complex that one report is not enough to write everything about it. However, the fullest measure was taken to make this report fruitful and informative. Although the financial analysis does not provide an outstanding image of the organization, the company has very good potential because it has got highly skilled people and they know better than anyone how to take this organization in a better position. I believe this company will keep on growing whatever the situation is.

Finally, I would say that this internship at Banglalink Digital Communications Ltd. has made my practical knowledge of Business Administration better and made my BBA education more complete and applied.