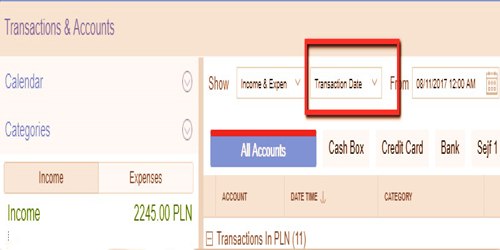

Transaction date is a term used to describe (successful or not) a certain day or time of the week when the transfer was completed. The date of the agreement reflects the time when the ownership is legally transferred. In the banking sector, the date on which a transaction occurs in the account is often referred to as the date of the transaction, even though it is not exactly the date on which the bank clears the transaction and deposits or withdraws funds. Customers will check for the date and get all the relevant information about a specific transaction as a result.

Standard way transactions have a settlement date of either one or two days after the date of contract depending on the type of asset. If the customer does not have the transaction ID, he/she can monitor the order or a transfer using the date. In the financial world, there are many alternative dates to remember as they play a unique role within the ownership process. The date at which a trade occurs is usually referred to as the transaction date. It’s the date at which ownership changes hands. In addition, this date appears in the background of the account to protect both the contract and financial instruments.

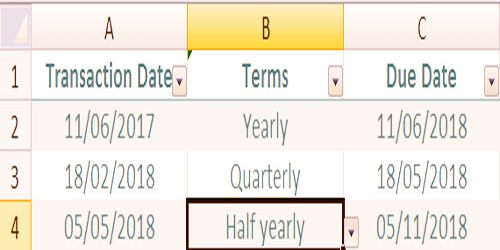

Example of Transaction Date

The transaction date is not, however, usually the date on which payment is obtained by the seller. The date is referred to as the date of settlement and usually happens a few days after the date of the transaction. The date of the deal cannot be edited by the customer or a bank worker since it is aligned with the cash outflow or inflow. So the date is truly a report about money flow.

The transaction date could be a date that’s prevalent in everyday examples. Such examples that incorporate a transaction date within the banking world include:

- Deposits or withdrawals (via automated teller machine or ATM) from a personal account

- The withdrawal of funds via a paper check

- Recording a purchase on a credit card or debit card

- Recording a point-of-sale (POS)

- Depositing, withdrawing, or transferring funds between online banking accounts

It should also be recalled that the date of the transaction does not always equate to the date of settlement. The investment world also contains a range of financial products and procedures with settlement dates. Since financial transactions have several stages, the process is marked by multiple dates. The transaction date isn’t necessarily the identical date because the settlement date, which may happen several days after the transaction occurs.

So, the transaction date may well be xx.00.xxxx while the settlement itself may well be on xx.00.xxxx. Because all the particulars of the contract have been finalized, and because the buyer is confident that what was provided was actually delivered, the seller is compensated upon settlement.

Our purchase on Sunday, for instance, was successful, which can be shown by the transaction date. Enter the account and check the date of the offer to find out the exact amount we’ve spent on that item.

Information Sources: