The allocation of factory overhead to products based on the volume of production resources consumed is known as traditional costing. This strategy applies cause-and-effect techniques to a business’s direct and indirect costs and expenses. This method works by computing and applying specified overhead rates to a given statistic.

The conventional method involved assigning manufacturing overhead costs based on the number of units produced, direct worker hours, or production machine hours. The problem with traditional costing is that factory overhead might be substantially greater than the basis of allocation, resulting in a huge variation in the amount of overhead applied when the volume of resources consumed changes.

For a specific cost driver, traditional costing approaches use anticipated overhead rates. A cost driver is a component of the production process that has the potential to cost money, such as:

- Managerial expenses

- Packaging

- Machine hours

- Machine setups

- Quantity of materials required

- Cleaning and maintenance

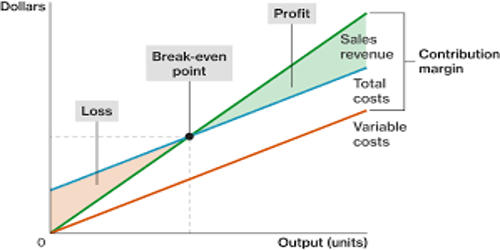

Companies frequently lose money because the entire cost of manufacturing a product turns out to be significantly more than anticipated. When a company’s total cost rises suddenly, the amount of profit it obtains decreases. Traditional costing is especially problematic in highly automated manufacturing systems when factory overhead is considerable and direct labor is scarce.

Assume a manufacturer’s manufacturing overhead expenditures total $2,000,000, which include depreciation, electricity, insurance, supervisory, production engineering, material handling, and equipment maintenance, among other things. The firm has 40,000 hours on the production line. The corporation will allocate or assign $50 of overhead to each machine utilized to make the output using the usual technique of cost accounting. Applying $50 per machine hour to each product will disperse overhead costs, but it will ignore the variety of activities and efforts that occur with various products.

Follow these steps to calculate costs using the traditional costing method:

Identify overhead costs: Overhead costs are manufacturing costs that do not have a direct impact on the product. Manufacturing and non-manufacturing expenses are both possible.

Take, for example, Fresh for Fido, a tiny business that offers organic dog food. The business operates out of a small factory. The company’s overhead expenditures include factory utilities, supply cleaning, and maintenance personnel compensation.

Estimate the overhead costs for a specific time period: These costs could be estimated for a month, quarter, or year. Fresh for Fido’s proprietors, for example, estimate their annual overhead costs to be $30,000.

Choose a cost driver to use in your calculations: For highly automated production, the cost driver should be strongly related to production, such as machine hours. Given that Fresh for Fido produces and mixes its dog food by hand, labor hours are the company’s primary cost driver.

Estimate the figure for the cost driver: The time period you specify for the overhead costs estimate should match the time period you choose for the cost driver.

To return to the previous example, Fresh for Fido employs eight people who work 40 hours per week for 40 weeks per year. This equates to 12,800 hours of labor per year.

Calculate the predetermined overhead rate: Your estimates are used to calculate the specified overhead rate. Divide the projected overhead expenses by the estimated cost driver amount or quantity to get the rate.

Fresh for Fido, for example, determine the specified overhead rate using the formula below:

Predetermined overhead rate = estimated overhead cost/cost driver amount

Predetermined overhead rate = $30,000 / 12,800 labor hours = 2.34

Apply the overhead rate to your product: To calculate the projected overhead costs for the product, multiply your chosen measure by the predetermined overhead rate.

Fresh for Fido may calculate its projected overhead costs using the 2.34 predefined overhead rates. We can estimate total overhead expenses for each pound of dog food if, for example, each pound of dog food involves two hours of labor.

Overhead costs per pound of dog food = 2 hours of labor per pound of dog food x $2.34 per hour = $4.68

For the specified time period, this statistic indicates an average overhead expense of $4.68 per pound of dog food.

Traditional costing is still effective for financial statement reporting when the goal is to apply overhead to the number of produced units in order to value ending inventory. Traditional costing calculates expected overhead costs using a predetermined overhead rate and a single cost driver.