EXECUTIVE SUMMARY

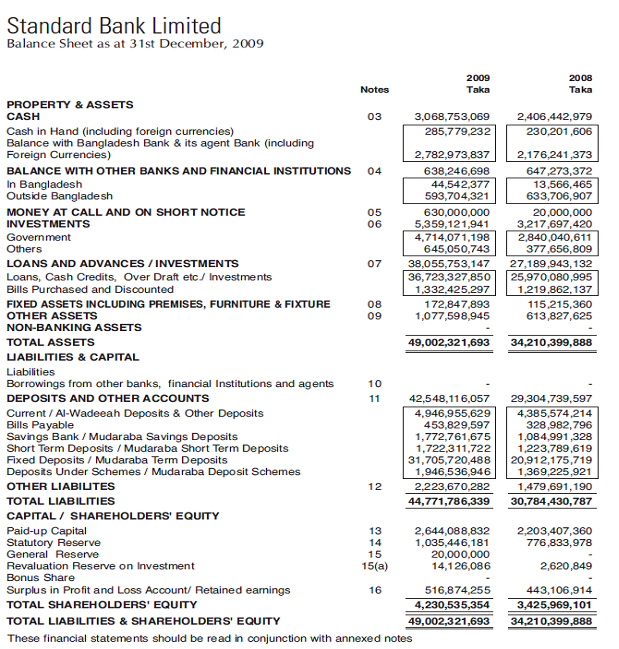

Despite global recession and economic slowdown we had a very successful year 2009. The Bank achieved record level of operating profit. This is an achievement in which we all take proud considering many difficulties and uncertainties in the financial world. The Bank marched ahead capitalizing the opportunities and overcoming the adversity and challenges. The strong performance and growth in all areas of business operation is a reflection of ban’s strength in core business and management. The financial statements for 2009 bear testimony of the bank’s excellent performance and sound health.

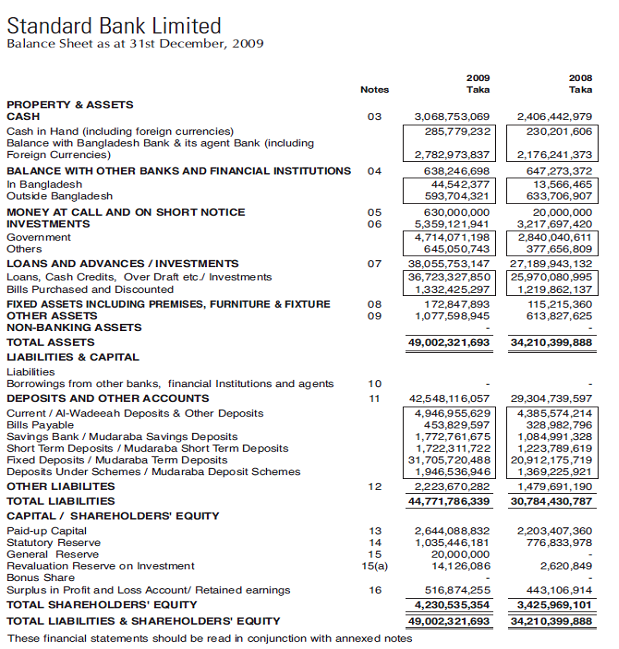

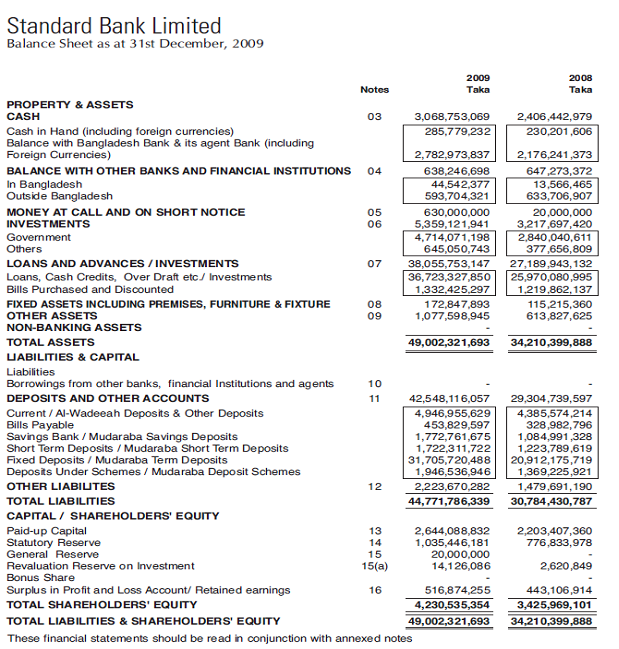

The Bank posted net profit of TK764 million for the year ended December 2009 registering a growth of 16% compared to the last year. The deposit and advances grew by 45% and 40% respectively while the market was very competitive. We have carefully progressed with our credit growth branch managing various risk profiles and strict monitoring system. The bank is now adequately capitalized and the ratio stands at 13.47% against risk weighted assets. With all provisions made, classification stands at 1.83%.

The year 2010 will no doubt be another challenging year for the Bank. SBL will make every endeavor to maintain the quality of assets, keep a close eye on our balance sheet and the portfolio of investment. SBL shall focus more on improving profitability by bringing growth in loans and advances and deposit base. SBL shall try to achieve improved productivity in our operations, maintain sound ratings and practices in corporate governance, compliance process and strong capital base. SBL shall also put emphasis on return on assets, return on equity and other key performance indicators.

SBL’s IT infrastructure has already extended its reach across all our branches. SBL own switching system is in place and we have already installed a few ATM booths. Our debit cards can be used not only in our own ATMs but also in other networks operating in Bangladesh. We have already taken associate membership from VISA International and we shall soon launch VISA credit card which can be used locally and internationally. Debit and credit card will add to our milestone of progress. In line with Bangladesh Bank’s guidelines we want to deepen our stake in agriculture and agro based projects. We have undertaken initiatives to offer agro loan to marginal farmers under cluster arrangement. We have already included two villages under our branches’ command area to enlist farmers and put them under bank’s finance for farming or any other productive activities. Such project will be done under pilot scheme of ‘ADARSHA GRAM’ and we believe this will definitely alleviate poverty among those who are at the marginal level and have least access to bank’s finance.

While doing all these, we have not lost sight of our commitment to the society we belong. We do share various state run activities by way of giving financial contribution and at times we undertake projects that are solely for disadvantage group in our society. We also offer scholarship and other financial assistance to meritorious students particularly in rural areas under corporate social responsibility.

1.Introduction

1.0 Introduction:

Banking sector is expanding its hand in different financial events every day. At the same time the banking process is becoming faster and easier. As the demand for the better service increases day by day, banks are coming up with different innovative ideas and products. In order to survive in the competitive field of the banking sector, all the banking organizations are looking for better service opportunities to provide their fellow clients. As a result, it has become essential for every person to have some idea on the bank and banking procedure.

The word bank has been derived from the Latin word Bancs or from Basque, which means a bench in English. The early bankers transacted their business at a bench in a market place. Bank is a financial institution which deals in money, receive deposit from customers, honor customers’ drawings against such deposits on demand, collect Cheques for customers and lend or invest deposits to individuals, companies or other organizations. So, bank is an intermediary institution that makes relationship between the owner of surplus savings and the investor of deficit capital. In this process, banks earn profit by receiving interest from the borrowers who want to take short-term or long-term loans and making relatively lower interest payment to the depositors for providing their funds for use by the bank.

1.1 Origin of the Report:

OCP is required for students who get Master degree in Business Administration (MBA) from ASA University Bangladesh. In this Program, I have studied with Standard Bank Limited as I assigned and my topics is “Products and Services Analysis ”.

1.2 Significance of the study:

This report has been prepared for the partial requirement of the MBA but I think it has a great significance for others also. This report deals with the foreign exchange system of Standard Bank Limited (SBL). The findings and analysis of this report will be the useful for me, the authority of the Bank and Customer also. I can acquaint with the different types of product and services and gain knowledge. The authority of the Bank’s can also be benefited. They can know the different types of problem that customer face and the remedy of the problem. They may take decision on the basis of this report and have some new ideas to be launched. The customer can express their opinion about the problem they face and can acquaint with different services what they don’t know.

1.3 Objective of the study:

This report has been prepared for the following objectives:

- To identify the documents used in foreign exchange system in SBL.

- To evaluate export, Import, & foreign remittance of the selected Bank.

- To identify problems regarding foreign exchange operation of the sample Bank.

- To suggest in order to improve the foreign exchange operation of the given Bank.

1.4 Methodology of the study:

Both primary and secondary data have been used in this study. Primary data have been collected with the help of a questionnaire method through field survey and ten bankers & thirty customers have been selected in this report

Primary Sources:

The primary data have been collected from the following sources:

- Face to face conversation with the employees and the customers.

- Questioners.

Secondary Sources:

The secondary data have been collected from the annual report of Standard Bank Limited & different manuals of sample Bank. The collected data has been analyzed by using different tables & graphs.

The secondary data have been collected from the following sources:

- Annual report of Standard Bank Ltd.

- Different manuals of Standard Bank Ltd

- Web site of Standard Bank

1.5 Limitations of the study:

Due to the code of the secrecy of the Bank, Bankers does not give the confidential data which are essential though they were cordial to me. Time constraints also a barrier for me. The customers were very busy and not willing to give me time to have necessary information as I desired from them.

2.Overview of Standard Bank limited

2.1. Development of Banking in Bangladesh:

Since early British rule, the history of banking in Bangladesh territory shows that the traditional trade-networks developed before the banks invaded rural areas. And the banking services have slowly flourished in Bangladesh territory. Even today, in many places, moneylenders provide credit services. Small shopkeepers and businessman use informal credit at high interest rate, traditional Mahajan’s money lending business gradually declined due to expansion of bank and the micro credit programs of NGOs, Cooperative banks and government agencies

Modern banking system plays a vital role for a nation’s economic development. Over the last few years the banking world has been undergoing a lot of changes due to deregulation, technological innovations, globalization etc. These changes in the banking system also brought revolutionary changes in a country’s economy. Present world is changing rapidly to face the challenge of competitive free market economy. It is well recognized that there is an urgent need for better, qualified management and better-trained staff in the dynamic global financial market. Bangladesh is no exceptions of this trend. Banking Sector in Bangladesh is facing challenges from different angles though its prospect is bright in the future.

Bangladesh is one of the developing countries in the world. The economy of the country has a lot left to be desired and there are lots of scopes for massive improvement. In an economy like this, banking sector can play a vital role to improve the overall social – economic condition of the country. The banks by playing the role of an intermediary can mobilize the excess fund of surplus sectors to provide necessary finance, to those sectors, which are needed to promote for the sound development of the country.

Commercial banks in Bangladesh economy are to face an increasing competition for their business in coming days, like any other emerging market economies. Their business is no longer remaining easy as they earlier. The real change in the banking business has started to come with the government’s decision to allow the business in the private sector in the middle of the Eighty’s.

2.2 Background of SBL:

Standard Bank Limited (SBL) was incorporated as a Public Limited Company on May 11, 1999 under the Companies Act, 1994 and the Bank achieved satisfactory progress from its commercial operations on June 03, 1999. SBL has introduced several new products on credit and deposit schemes. It also goes for Corporate and Retail Banking etc. The Bank also participated in fund Syndication with other Banks. Through all these myriad activities SBL has created a positive impact in the Market.

2.3 Features of SBL:

- Standard Bank builds up strong pillar of capital, promote trade, commerce and industry; discover strategies for achieving systematic growth.

- It is the pioneer in introducing and launching different customer friendly deposit Schemes to tap the savings of the people for channeling the same to the productive sectors of the economy.

- It has created congenial atmosphere so that the client becomes interested to deal with the Standard bank limited.

- For uplifting the standard of living of the limited income group of the population, the Bank has introduced Retail Credit Scheme by providing financial assistance in the form of loan to the consumers for procuring household durables.

- The Bank is committed to maintain continuous research and development to keep pace with modern banking.

- Recently the bank starts internet banking in order to provide prompt and efficient services to the customers.

- The bank has introduced customer relations management system to assess the needs of various customers and resolve any problem on the spot.

2.4 Objectives of Standard Bank Limited

To be a dynamic leader in the financial market in innovating new products as to the needs of the society.

To earn positive economic value addition (EVA) each year to come.

To top the list in respect of cost efficiency of all the commercial Banks.

To become one of the best financial institutions in Bangladesh economy participating in the most significant segments of business market that we serve.

2.5 Mission, Vision & Core Values of Standard Bank Limited

Vision of SBL:

To be a modern Bank having the object of building a sound national economy and to contribute significantly to the Public Exchequer.

Mission of SBL:

To be the best private commercial bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability.

Core Values of SBL:

Our Shareholders: By ensuring fair return on their investment through generating stable profit.

Our customer: To become most caring bank by providing the most courteous and efficient service in every area of our business.

Our employee: By promoting the well being of the members of the staff.

Community: Assuring our socially responsible corporate entity in a tangible manner through close adherence to national policies and objectives.

2.6 Management of Standard Bank Ltd:

As a fully licensed professional bank, Standard Bank Limited is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so the bank and its responsibilities itself changed in the market condition.

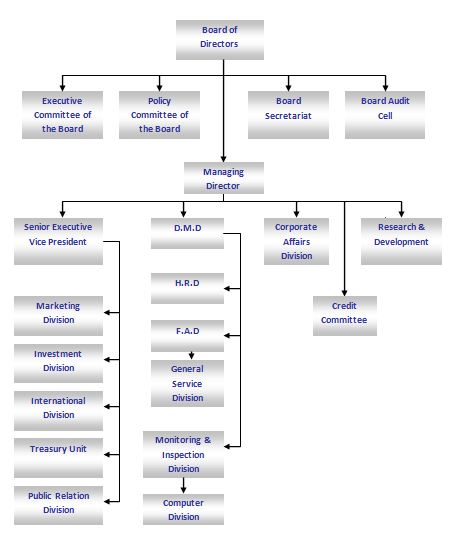

In the bank, board of directors has the sole authority too take decision about thee affairs of the business. Now there are 18 directors in the management of the bank. All the directors have the good academic background and have huge experience in business. The board of directors holds meetings on a regular basis. There are different committees in the bank for the efficient management of the bank. All these committees meet on a regular basis for discussing various issues and proposals submitted for decisions. The committees are:

- ⇒ Board of Directors

- ⇒ Executive Committee of the Board

- ⇒ Policy Committee of the Board

- ⇒ Credit Committee

Board of Directors:

SL No | Name | Designation |

1 | Mr. Kazi Akramuddin Ahamed | Chairman |

2 | Mr. Kamal Mostafa Chowdhury | Director |

3 | Mr. Mohammad Nurul Islam | Director |

4 | Mr. Ashok Kumar Saha | Director |

5 | Mr. Ferozur Rahman | Director |

6 | Mr. Md. Monzurul Alam | Director |

7 | Mr. S. A. M. Hossain | Director & Chairman of Executive Committee |

8 | Mr. Mohammed Abdul Aziz | Director & Chairman of Green Banking Committee |

9 | Al-Haj Mohammed Shamsul Alam | Director |

10 | Mr. Abdul Ahad | Director |

11 | Mr. Md. Zahedul Hoque | Director |

12 | Mr. Ferdous Ali Khan | Director |

13 | Al-Haj Md. Yousuf Chowdhury | Vice-Chairman |

14 | Mr. Moshfeque Mamun Rizvi | Director |

15 | Mr. Md. Fayekuzzaman | Director |

16 | Mr. Shaikh Mesba Uddin | Director |

17 | Mr. S. S. Nizamuddin Ahmed | Director & Chairman of Audit Committee |

18 | Mr. S. A. Farooqui | Managing Directo |

2.7 Organ gram of Standard Bank Limited:

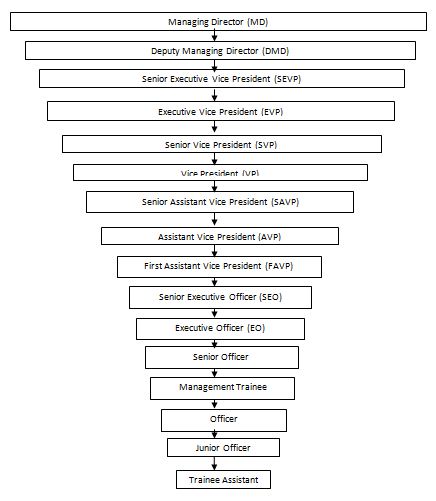

2.8 Organizational Hierarchy of SBL:

2.8 Organizational Hierarchy of SBL:

2.9 The Major Products & Service of SBL:

2.9.1 Products:

Opening of different types of Accounts

Issuing checkbook and delivering Deposit receipt book

There are several kinds of Account are held:

Savings Account:

When a person will open this A/C, the important things are necessary.

1. Introduction of Depositor / A/C’s holder

2. Photocopy of passport/ Chairman Certificate/ Attested of First Class Officer/

Voter ID Card.

3. Two copies of photographs.

4. KYC {Know Your Customer) form & TP (Transaction Profile)

SBL Regular Deposit Programme ( SRDP )

* If any monthly installment remains unpaid for 5 (five) consecutive months, the account will be closed automatically and the account will be settled as detailed below:-

Relationship/ Tenure | Applied Interest |

Less than 1(one) year | No interest |

More than 1 year but less 3 years | Savings Rate |

More than 3 years but less 5 years | Matured value of 3 years and rest as per prevailing interest rate on savings rate |

More than 5 years but less 10 years | Matured value of 5 years and rest as per prevailing interest rate on savings rate. |

If failure to pay monthly installment on due dates he/she will pay penalty of Tk. 20/-(Twenty) next subsequent installment.

Monthly Installment, Tenure and Maturity Value will be as per following Schedule:-

Installment / Years | 300 | 500 | 1000 | 2000 | 2500 | 5000 | 10000 |

3 Years | 13,000 | 21,700 | 43,400 | 86,800 | 1,08,600 | 2,17,200 | 4,34,400 |

5 Years | 24,700 | 41,400 | 82,800 | 1,65,600 | 2,07,000 | 4,14,000 | 8,28,000 |

7 Years | 39,900 | 65,600 | 1,31,200 | 2,62,400 | 3,28,000 | 6,56,000 | 13,12,000 |

10 Years | 69,100 | 1,15,100 | 2,30,200 | 4,60,400 | 5,75,500 | 11,51,000 | 23,02,000 |

Consumer Credit Scheme :

Lending rate has been shown in the following table where fixed rate (Bangladesh bank instructed rate) and mid-rate are given. Bank may re-fix ±1.50 over the mid rate considering the risk involvement. These rates are effective from January 01, 2010.

SL | Particulars | Fixed Rate | Mid Rate |

01 | Consumer Credit Scheme (Staff) | 12.00% | — |

02 | Consumer Credit Scheme (Commercial) | — | 14.00% |

1.00% additional interest rate will be charged for default in payment/ adjustment. All other charges, commissions and fees shall remain unchanged.

Current Individual Account:

1. Requirement same as savings Account

2. Proprietorship /Firm Account

3. Common Individual of S/A

4. Trade License with validity

5. Seal of the Firm.

Partnership Account:

1. Common Individual of S/A

2. Trade License with validity (more than two owners)

3. Partnership Deed with Registered

4. TK.l000 stamp

5. Partnership letter (Bank will gives)

6. Firm’s Seal

Private (LTD)

1. Common Individual of S/A

2. Trade license

3. Memorandum or articles of association

4. Certificate in Corporation

5. Regulation of full board with signature

6. List of Directors

7. Organizations seal

8. Certificate of commencement

9. STD (Short term Deposits)

10. Requirement same as individual A/C

11. STD (Public & Private)

12. Requirement same as Public and private A/C

Club/ Society

I. By Laws

2. Regulation

3. Common Individual

4. Seal of club/society

5. Registration number

Trustee

1. Common as club/society

2. Trustee Deed

NGO

1. Common as club/society

2. Registration of NGO Bureau

Local Remittance:

Transmission/transfer of money from one place to another, Local remittance represents remittance that takes place within the territory of a country.

Banks have a wide network of Branches all over the country and offer various types of remittance facilities to the public/customer/client etc.

Virtually there are main works of remittance department that are as under: —

1. Transfer of funds through Demand Draft (DD), Telegraphic Transfer (TT), and

Money Transfer (MT)

2. Issuance of Pay Order (P0), pay slips (PS), Security Deposit (SD), Bearing

Certificate Deposit (BCD) etc.

3. Local Bills for Collection (LBC), Outward Bills Collection (OBC)

4. Collections of cheques, Drafts and presenting them to clearing house

5. Maintenance of FDR

Foreign Remittance:

These activities are:

1. Activities related to L/C opening

2. Receiving documents from Exporters Bank

3. Perform all activities for retirement of document for collecting the importing

Goods.

The main functions of the Exports are:

I. Getting the L/C Documents from Foreign importers Bank

2. Gives this L/C to Exporter

3. Advising the L/C

4. Opening the Bank-to-Bank L/C

5. Collection and distribution of the payment of Bank to Bank

6. When after shipment of goods the exporter submits all documents as per as L/C,

This department scrutinizes those documents and sent to Importer Bank.

Foreign Exchange

1) Deals with inward foreign Remittance.

2) Dealing of Traveler Checks.

3) Transfer money and currency through Western Union.

4) Transfer fund through draft, Telegraphic Transfer, Mail Transfer etc.

5) Foreign Bills collection.

6) Foreign Bills purchase and discount.

WESTERN UNION

Standard Bank is the pioneer to launch Western Union in Bangladesh and now it is one of the most popular way to transfer money.

It is used for foreign dealings.

ID (To Receive Money through Western Union).

Passport (within the validity period)

Driving License

Ration Card

Voters ID

Pan Card

Refugee Card

Student JD (Nationalized University and college)

Bank Account

Credit Card

Army Card

Post office loyalty card, Govt., employee ID card, local (W/C) ID card. All ID are valid only if they have a photograph and the ID verifies the person’s signature

ADVANCE

Advance in the form of loans, overdraft (i.e. cash credit-CC, Secured overdraft-SOD) and discounts are sanctioned to the customers. If the amount of advance crosses the limit of authority of Branch in charge then it has to take approval from the Head Office Credit Division.

Advance facilities provided by the Bank are:

• General loan.

• Employee House Building Loan (EHBL), House Building Loan (i-IBL)

• Secured Overdrafts-SOD

• Cash Credit-CC

• LIM, Overdraft

• Consumer Credit Scheme-CCS

• Loan against work order, Govt. bond and checks and shares

• Loan against foreign bill of document etc.

2.9.2 Services Of SBL:

Exchange House

SBL Exchange Houses at various locations (USA, UK, etc) is enabling Non Resident Bangladeshis to send their remittances at home in a quickest and safest way.

Islamic Banking

Standard Bank has introduced Islamic banking to meet the growing needs of the customers for Shariah-based banking. It offers a wide range of financial services that covers the entire spectrum of banking operations. Islamic Banking Client can also access Net Banking through this site.

Visa Credit Card

Credit Cards facilitate your lifestyle in all facets like shopping, dining, accommodation, traveling, hospitalization, purchasing furniture & equipment for a interest free time, gift cards and so on that would be determined in needs of time.

ATM Service

Standard Bank Limited has modern banking facility. Withdraw cash 24 hours a day. 7 days a week. You can get a mini-statement of your account whatever required. For the safety reason our ATM

SME Banking

From the perspective of SME banking, there is no doubt that the world is getting flatter every day. Standard Bank launched SME banking to deliver the highest standard of service to its clientele.

Corporate Banking

Bangladesh economy is changing every day. Changes are more and more visible and sometimes it seems they are happening overnight. Now days the economical challenges require flexibility and adjustment capacity. To face the challenges and business opportunities Standard Bank delivers cash Management and Lending Solutions match for specific business and requests.

2.10 Company Environment Analysis:

Bank is a financial Institution, which deals with money.

In recent years there are dramatic changes in the national banking sector. Banks are being called upon to deliver prompt and efficient services through state-of-the art technology in a competitive and demanding market. At the same time, banks are expected to play an increased role to meet the national needs of economic growth and productive employment. By identifying and promoting schemes that will lead to greater employment and mobilization of resources, the banking sector will not only contribute to a more dynamic economy but also enhance the quality of the lives of the people of the country. International banking too has transformed itself in the last decade. Bands have had to operate in a global market place where trade barriers have been firstly disappearing.

A truly international bank must now finance foreign trade, handle foreign exchange in branch banking as well as involved in activities such as correspondent banking, cross border lending, money market investments, bond trading, project financing, leasing, issuing stand-by letter of credit, and offering international cash management services etc. The banking sector thus requires bank to be much more dynamic, global and sophisticated than ever before. Very few banks have taken up the challenge and attempted to modernize and offer a comprehensive package of services.

Considering the above situation and a demand for a bank fully equipped handle the national and international requirements of the private sector, Standard Bank Ltd. has emerged as the nation’s progressive bank which is innovative modern, and international in its outlook. It is committed to take care of all banking requirements through state.

2.11 Internal Environment Analysis:

The management of the Bank is vested with the Board of Directors comprising of 21 members including the managing director who are reputed professional business personalities and leading industrialists of the country. Commercial banking, with its great reliance on public confidence and influence on the nation’s economy needs high quality management and organization structure. The organization structure is shown below. The board of directors being at the highest level of organizational structure plays an important role in the policy formation. The board of directors is not directly concerned with the day-to-day operation of the bank. It has delegated authority to its management committee. The position of the chairman of the Board carries with it a great deal of dignity and respects in banking circles. The chairman keeps the Board of Directors informed of the progress of the bank and in turn implements the policies established. The Managing Director of is the Chief Executive of the Bank. He is responsible for administering the business affairs of the bank. He is also concerned with planning and its implementation. He represents the bank to the meeting and responds to the various inquiries of the members of the board.

The growth and progress of a band can be realized only through combined and coordinated efforts of its members who work there. Keeping these in mind, recruited very skilled and qualified people in the bank having banking expertise and experience has also been recruiting probationary officers having good academic background. As on December 31, 2007 the total number of employees of the bank stood at 2008.

2.12 Divisions of SBL:

The Managing Director is the head of the operational area of the bank and its chief executive. The Managing Director is appointed by the Board of Directors with prior permission of the Bangladesh bank. All policy formulation and subsequent executions are done in the head office.

2.12.1 Credit Administration Division:

Credit Administration Division is one of the important divisions of a financial institution.

This division is headed by Senior Vice President or Vice President.

All advance proposals from the prospective borrowers are sent by respective branches for an approval form the head office. This department initiates the advance proposals of the branch, it keeps track of credit portfolio by obtaining regular information form branch. It sets price for credits and ensure affecting it at branches. This department also monitors the various loan accounts of the branches and prepares various statements for Bangladesh Bank.

The broad functions of credit division are:

a) Follow-up/monitoring the implementation of Boards standing committee’s

comment or past due.

b) Reviewing the monthly past due accounts and monitoring the progress or each

case with the Branch.

c) Review the cases already transferred to the legal advisor for initiating legal action.

d) Review the internal/ external/ Bangladesh Bank audit reports (Credit Porting)

e) Prepare the statements, information, etc, required for the Board! Management

Bangladesh Bank.

f) Provide financing for foreign trade (Export and Import).

g) Project finance, real estate finance, small business professional and rural credit

and other credit scheme

h) Marketing support and intelligence.

2.12.2 Financial Institutions Division

This division is headed by a senior Vice President or a Vice President. Work of this department has become important due to the governments policy of making Taka a convertible currency.

This division is a very important functional division because of SBL’s huge involvement in export-import business. All foreign exchange is handled by this division. All the international business and transaction have to go through this division and after it improves the final decisions to go to the branches. This division performs a number of functions which are as follows:

1) Fund Management: This can be broken down as follows-

Spot and forward sale and purchase of foreign currency

Foreign currency transfer and placement

Foreign currency fund management i.e. managing the Nostro account

To maintain holding of foreign currency with correspondent Bank

2) Correspondent Banking, L/C confirmation etc.

It includes-

Arranging agency

Correspondence banking- which includes correspondence relationship, test key control,

Authorized signature control etc.

Distribution of foreign test keys.

Distribution of authorized and dealership license to the branch.

3) Reconciliation of different foreign accounts maintained by SBL against different banks is done here.

4) Preparing and forwarding overdue L/C statements on account of Bank to Back L/C to

Bangladesh, monitoring garments related affairs maintaining the Bangladesh Bank

returns and statistics concerning Bangladesh Bank.

SBL has international operation with about fifty countries through 125 correspondents.

2.12.3 Audit and Risk Management Division:

The main functions of this division is to provide legal assistance to the branches and implement recovery strategy for stuck-up loan and to ensure strict adherence of rules and policies by all concerned of the bank through routine and surprise inspection and audit. The functions of this division area as follows:

- Monitor the individual cases with respect to their securities, value of securities, and finally review the possibility of recovery of bank’s stuck-up dues. Implement rescheduling process of stuck-up classified loan to the branches for obtaining repayment schedule through strong persuasion and serve final notice etc., as the condition required.

- Time to time follow-up stuck-up advances of branches and keep the branches under constant pressure

- Appointment of branch lawyers from a panel of lawyer kept in the division.

- Personal contact is made at the head office level, especially with the big borrowers and arrangements are for recovery.

- Incase of failure of moral persuasion, concerned branches are advised to serve legal notice to the defaulters.

- Time to time follow up of the cases and keep the top management informed.

- Maintain statistics of recovery of classified advances.

- Inspect all branches operation audits at least once in a year.

- Carry out surprise audits as felt necessary.

- Investigate suspicious or irregular matters being directed by higher management.

- Also conduct such inquiry being requested by affected branch-in-charges.

- Receive non-performing advances classification recommendation form branches and approve disposal.

- Prepare classified advance report; recommend bank’s strategy to deal with that for management and Board of Directors.

2.12.4 Operation and Innovative Services Division:

The main functions of this division are to develop General Banking, maintain public relation, technology development and support, strategic planning procurement and supply all tangible goods to the branches. These are described as follows:

a) Make arrangements for branch opening such as making lease agreement, internal

decorations etc.

b) Print all securities paper and bank stationery.

c) Distribute this stationery to the branches.

d) Import necessary stationery items.

e) Purchase all sort of furniture’s & fixtures for the branches.

f) Issuance of power of Attorney to the officers for the branches etc.

g) Issuance of different circulars to the Bangladesh Bank.

h) General correspondence with Bangladesh Bank and other Banks.

i) Oversee the cash affairs of the branches etc.

j) Advertise in the different media about tender notice, general meetings and other

public interests.

k) Print and distribute greeting cards, calendar, diary etc.

1) Keep good relationship with the various news media.

m) Prepare speeches for Managing Director or Directors for any special occasion.

n) To develop or improve or introduce new technologies for speedy implementation

of polices.

o) Issue notice regarding board meeting and other meetings.

p) Holding meeting.

q) Obtain signature in the minutes from Chairman.

r) Inform different divisions of the department regarding decision of a particular memo.

s) Repair, maintain and contract Bank’s building.

2.12.5 Card Division:

They are now in this business for last 9 months the response to which has been found quite satisfactory. Master-Card International, is to allow cash drawings facility from its branches against Master-Card cards, whether issued by or any other bank/institutions in the world.

Initially such cash drawing arrangements can be made in 14 branches of the bank. For cash drawing, branches will have to take prior authorization from Head Office Credit Card division over phone and after and cash drawing, a debit advice along with the sales slip to be sent to HO Credit Card division.

The customer can draw from other bank (branches) if he has any account for that, in that case the Head Office will issue a Debit advice for that branch. Any individual, who is an account holder of for at least six months, is between 21 and 70 years of age. Has a regular gross monthly income of TL. 10,000 above after tax are eligible for a Credit Card. A person can use his/her Credit Card at over 500 retail and service outlets around the country. Just look for the “VISA/Master Card” sign —it the outlets and enjoy the benefits of being a Credit Cardholder.

With this service they have newly started the service of DEBIT CARD.

2.12.6 Treasury and Central Accounts Division:

The board functions of this department are:

- Maintain daily liquidity positions, Treasury bills call money, Investment / Debentures, placement of funds, etc

- Monthly accrued interest calculation of all interest bearing accounts. Inter-branch interest calculation for Head-Office, Amortization of all fixed and o there assets.

- Preparation of statement of Accounts and Profit & Loss account for the bank.

- Weekly deposit and advance analysis of the bank.

- Cost of fund analysis.

- Branches extract preparation.

- Providing information to the auditor for preparing balance sheet

- Maintenance of accounts, preparation of annual repot of the bank, maintenance of provident fund accounts, maintenance of Income & Expenditure posting, maintenance of salaries and wages of the employees etc.

All schedule commercial banks in Bangladesh has to perform under the rules and regulations of Central Bank. For this reason all banks have to furnish different types of information to Bangladesh Bank in prescribed forms. The following information is prepared by this department for this purpose.

Weekly position i.e. Thursday position.

S.B.S —1, monthly statement of asset and liabilities.

S.B.S- 2 classification of deposits — quarterly.

S.B.S- 3, classification of credit- quarterly.

S.B.S-4, statement of credit ceiling, credit report.

Form 09, statement of liquid assets-monthly.

Form 10, statement on asset and liabilities- monthly

Deposit held by sector corporations/ enterprises- monthly

Statement of small depositors-quarterly.

Cash in transit-monthly

Statement on credit by size —monthly.

Statement on loans and advances.

In the present world, computer has become the most essential and vital area in any organization. It is much more important for financial institutions to carry out its day to day operations with the help of computers. Introduced on-line computer system from its inception.

SBL has a good reputation in the market for its excellent services among domestic banks. SBL has always been forward looking to cater more effectively to its valued customers and computerization in the bank has been recognized as a priority all along.

Under the branch computerization program all branches have been computerized and starting from Cheque posting to back office accounting, all operations are handled by computers. This has given the bank an added advantage in increasing its productivity and brought qualitative change in customer service.

At the Head Office level all divisions are equipped with personal computer. Business functions under different divisions are being systematically taken its computerized environment. Budget control and monitoring, General Ledger, Income & Expenditure, classification of advances at Head Office are all computerized under Head Office computerization plan. A large network has been installed to include all divisions and departments so that most of the business functions and activities are integrated and made accessible to the users for management decisions.

2.12.7 Information System and Technology Division:

Information technology & flow of information is an important division of today’s world..SBL’s IT infrastructure has already extended its reach across all our branches. SBL’s own switching system is in place and we have already installed a few ATM booths. Our debit cards can be used not only in SBL’s own ATMs but also in other networks operating in Bangladesh. SBL have already taken associate membership from VISA International and SBL shall soon launch VISA credit card which can be used locally and internationally. Debit and credit card will add to our milestone of progress. In line with Bangladesh Bank’s guidelines SBL want to deepen our stake in agriculture and agro based projects.

SBL have undertaken initiatives to offer agro loan to marginal farmers under cluster arrangement. SBL have already included two villages under our branches’ command area to enlist farmers and put them under bank’s finance for farming or any other productive activities. Such project will be done under pilot scheme of ‘ADARSHA GRAM’ and we believe this will definitely alleviate poverty among those who are at the marginal level and have least access to bank’s finance.

2.12.8 Human Resources Division

The growth and progress of a Bank can be released only through the combined and coordinated efforts of its members who work there. Keeping these in mind, SBL recruited very skilled and qualified people in the bank having expertise and experience. SBL have also been recruiting probationary officers having good academic background. SBL have also decided to recruit probationary officers every year through competitive examination and create s strong management cadre for the future. The Bank has offered a new pay scale to the employees bringing significant improvement in salary structure. In line with salary raise SBL have also revised house building loan scheme for the employees with higher ceiling and SBL have allocated more fund. Leave Fare Assistance is being introduced in the Bank for the first time to inspire the Executives.

SBL consider promotion cases for the deserving and eligible employees every year and accordingly has promoted a total of 235 employees in different categories during the year.

Incentive Bonus equivalent to 15 days basic salary has been given to all eligible Executives, Officers and Staffs for the appreciable loan collection of 1996. SBL have also decided to bring the outstanding performance. Those who have achieved their budgeted targets in different areas of business operations were rewarded with cash prize in the form of prize bonds, crest and appreciation letter. It is to be hoped that all these measures will raise the spirit of the employees and they will feel encouraged to contribute more towards the growth of business for the Bank.

2.12.9 Investment Division

The major functions of this division are as follows:

a) Capital market operations.

b) Lease —financing.

c) Hire-purchase.

d) Merchant-Banking etc.

2.12.10 Foreign Exchange Division

It is an essential part of the Standard Bank. Most of the private bank has their separate branch which is known as Foreign Exchange Branch and they will only deal with foreign exchange related work. Although Standard Bank doesn’t have this option but they have given much priority to this division. This division performs several activities which are given below:

Provide L/C facilities.

Monitoring exchange rate of different currencies.

Facilitates the exchange rate to other branches.

Managing good relation with foreign correspondent.

Increase foreign correspondent.

Provide endorsement facilities.

Provide travelers Cheque facilities.

Buy and sell foreign exchange.

Provide transfer facilities.

2.12.11 Recent Development of SBL:

Retail Banking deals with the banking services to the individuals. It includes the following:

a) Deposits services.

b) Wage Earners Services: SBL. Offers a few innovative schemes to Bangladeshi

wage earners working overseas.

c) Personal banking private banking, customer, finance, investment management,

Finance for self-employed persons.

2.12.12 Problems of the Standard Bank Limited

Following various problems is including in the SBL:

Political disturbances:

It is not favorable for Bank Business in Bangladesh. It is the main problem of SBL. It is also a problem of all Banking system in Bangladesh

Competitive Banking Market:

Different kinds of commercial Bank are serving in our commercial Banking Market. Therefore, no single Bank is allowed or capable to establish personal interest especially due to heavy competitive market.

Company representative effect:

There are so many representatives working in the market to collect the sales price directly from the customer of each product daily. So merchant group, Businessman1 Traders, Agency, Wholesalers and high Depositor are not capable to Deposit the money in the Bank. Due to this Deposit system, they hamper it.

High rate of Government security:

Practically, the Government security likes Bond, Security, Debenture; Savings certificate etc. gives high rate of interest than commercial Bank. So, all the investors are invested to utilize their idle fund to purchase the Government security due to higher rate of interest.

Credit Sales:

Now a day, Businessperson is bound for credit sales to increase their sales in the competitive market. For this reason Business organization need less working capital and Banking companies are loosing their opportunities to invest in Business organization.

Lack of modem tools and techniques:

SBL performing activities by using backdated tools and techniques. It is fully far from information technology. Though SBL enough strength to play proactive role in every aspect, it play reactive role.

Lack of proper training:

SBL should be arranging adequate training. Though SBL has its own training center, it is not adequate for its employees. Because, it is not well furnished to with this modem world.

Lack of Marketing Activities:

SBL does not promote itself for catering its services to the public or the Business organization

Lack of favorable market image:

SBL has a higher book value per share but market value per share is very low corresponding to its book value.

2.12.13 Recommendations:

All the services offered by the bank are similar and prone to imitation by its competitors. Long established services may cease to satisfy fully the changing needs of the customers; such product may become increasingly uncompetitive, unprofitable and even unnecessary. When all the banking institutions are offering similar services, SBL can offer differentiated service. A significant part of the marketing effort must be devoted to the monitoring of existing services, and where such deterioration is found, a decision must be taken on how to remedy the situation. In essence there are two alternatives. Firstly, to add new features to services. The product may be updated and renovated so as to bring it bring in line with customer requirements. The following may be considered:

a) Payment of customer’s monthly bill

b) Bills collection agreement

c) Tele-Banking

d) Mobile Banking

e) On-line Banking

Secondly, to maintain existing services. Current services can be maintained despite its fault or unpredictability and without alteration, either because the service is continuing to make a profit, however slight, or because it is considered an important component of the company’s image, which cannot be dispended with. Such services may include Deposit Pension Scheme (DPS) Marriage Deposit Scheme (MDS), Daft coequal and so forth.

Customers of Standard Bank who come from largely middle class income-groups are likely to be very price sensitive. SBL can offer services, which have less/no service charge.

Service advertising should emphasize tangible cues that will help the customers. SBL may consider using advertising to promote principally the name of organization and keep it in the forefront of consumer’s consciousness. SBL may also pursue advertising strategy aimed at raising the general level of awareness of the range of services available without attempting to give details of any particular item. SBL can advertise its specific services either to promote and establish new products or to maintain the success of existing ones. SBL should put its advertising effort to arouse the need in respect of a particular service. SBL may also focus on one attribute of the product, which is not emphasized in the campaigns of competitors.

SBL must continually monitor its branch networks to ensure that they reflect demographic and economic changes. Areas develop and decline or change their nature, and SBL must ensure that its branches reflect these developments.

They are dealing with huge number of accounts customers of Standard bank are losing their confidence day-by-day. Because they are treating their customer with poor service, lack of profitable schemes, old banks environment and improper management. SBL is not keeping pace with the changes, which have taken place in the last few years in private banking sector. SBL’s import business has fallen in considerably. They have proper manpower but they are not utilizing it. Its advance policy is also faulty. Top management is very much reluctant to take corrective action in this regard.

Bank should go for modernization and they should increase their collaboration with foreign and domestic banks. Export and import facilities should be given due consideration. Renovation of the old branches is of top priority if SBL is to compete with the other private banks doing business in the market.

As the SBL realized a negative interest spread in 1999 and its average percentage of interest income from loan and advances had been low consistently over the year 1999 to 2001, more emphasis should be placed to increase the interest income from loans and advances. In doing so the SBL should utilize its funds properly.

Interest expenses on Deposits of SBL may be tried to keep low with due regard to balances Deposit mix.

. The SBL should introduce on-line facilities so that the SBL can know its present resources not past month or past week’s resources. By this way SBL can use its funds properly.

It should maintain a separate cost accounting cell at the head office of this Bank furnished by professional cost accounts for implementation of appropriate costing system.

. The research cell of this Bank should be strengthening with the efficient manpower by studying the feasibility of introduction of new products, analysis of manpower productivity and similar other research works.

In order to sustain and remain profitable, this Bank should identity and reinvests in productive sector and terminates unproductive operations/divisions.

SBL should establish investment priorities and develop corporate Budgets that steer resources into those internal activities critical to strategic success. It should be involved in channeling resources into areas where earning potentials are higher and away from areas where they are lower.

SBL should initiate responses to change under way in the industry, the economy at large, the regulatory and political arena and other relevant areas.

SBL should observe competitors closely to analyze any new action taken by them and react competitively to that action. It can be accomplished by the following

Ways:

SBL can get information about a certain competitor’s Business policies by recruiting that company’s employees.

It can get information from people who do Business with rivals.

It can get information about other Banks from published materials and published document.

SBL should reengineer its core Business process in order to eliminate duplicate

Work and reduce cost.

SBL should enhance its market exposure and create a favorable image because

Its market value per share is very low than its Book value.

At present people does not deprived of facilities of modern world due to its sum hindrance. Every better have its own negative aspects. Think about transportation facilities that makers the world so advanced. Nobody can think to stop it or avoid it. It is the part of our life. So everybody thinks to reduce its negative aspects rather than avoid or stop it.

Similarly now a day in our Banking sectors exports and imports facilities are necessary elements. In banking sectors people keeps their excess money for various kinds of necessary works. From it they will get interest/profit. Although for our socio-cultural environment, it has some problems government and other related sectors have to appreciate Banking sectors by providing favorable environments and take steps to prevent and protect this problem solving of our country. If proper steps are taken in this regard we think it will be a highly prospective edition of the Banking sectors of Bangladesh.

On the other hand customers are needed to their necessary goods to export or import that will be essential for Business sectors, then they comes Bank to transaction their goods from Bank to Bank (Other Countries). Bank suggests their customers to open L/C against their necessary documents that will be valid and that will be related with Business. As for any security will be taken Bank.

In our country, now it is the golden period of banking sectors. So, there is a greater suitable place to keep customer’s money and dealings their transactions for their necessary works. All new entrance and existing documents, Bank always keep in mind this thing because it will be a highly competitive area.

3. Conceptual Framework

3.1 Export:

Export is the shipment of goods and services from one country to other country. When one country sell its surplus or excess goods and service to other country then it is called Export. In modern days export is one of the most wrathful way by which a country can make proper utilization of its resources and get foreign currency.

3.2 Import:

Import also the shipment of goods and services from one country to other country. The brings of goods and services from other country for meeting the deficit amount of goods and services of that country.

3.3 Foreign Remittance:

Foreign remittance dealings are the conversion of home currency into foreign currency and the conversion of foreign currency into home currency. Only the authorized dealers can involve with this business. The transaction of the authorized dealer in foreign exchange involves either outward or inward remittances of foreign exchange from one country to another in cover of the remittance.

4 . Assessment of documents used in foreign exchange of SBL

4.1 Export:

It is an essential part of the Standard Bank. Most of the private bank has their separate branch which is known as Foreign Exchange Branch and they will only deal with foreign exchange related work. Although Standard Bank doesn’t have this option but they have given much priority to this division. This division performs several activities which are given below:

Provide L/C facilities.

Monitoring exchange rate of different currencies.

Facilitates the exchange rate to other branches.

Managing good relation with foreign correspondent.

Increase foreign correspondent.

Provide endorsement facilities.

Provide travelers Cheque facilities.

Buy and sell foreign exchange.

Provide transfer facilities.

Give the Master Card facilities.

4.1.1. Documentary Letter of Credit-Concepts & Types:

4.1.1.0. Definition of L/C:

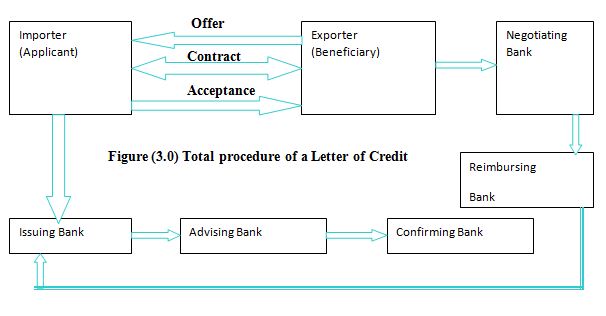

Documentary Letter of credit is a conditional Bank undertaking of payment. For more illustration, Letter of credit is a conditional undertaking given by a Bank (Issuing Bank) at the request of a customer (applicant) to pay a seller (Beneficiary) against stipulated documents provided all other terms and conditions of the credit is complied with.

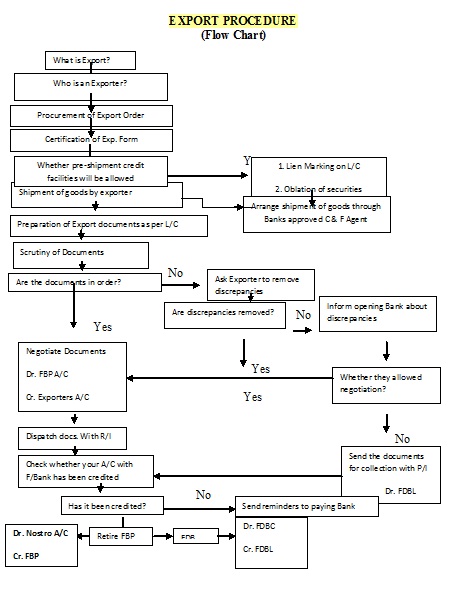

We can understand the total procedure of a Letter of Credit by the following Flow Chart:

4.1.1.1 Types of Documentary Letter of Credit:

There are various types of documentary Letter of Credit:

- Revolving L/C

- Irrevocable L/C

- Confirmed Irrevocable L/C

- Back to Back L/C

- Transferable L/C

- Red Clause L/C

- Green Clause L/C

- Stand by L/C

- Performance L/C

There are various types of documentary letter of credit.

1.Revocable Credit:

This type of credit can be revoked or cancel at any time without the consent of, or notice of the beneficiary. As per Article 8 (a) of UCPDC 500 “A revocable credit may be amended or cancelled by the Issuing Bank at any moment and without prior notice to the Beneficiary”.

2.Irrevocable Credit:

The Irrevocable Credit is a commonly used type of documentary credit. The Credit which cannot be revoked, varied or changed/amended without the consent of all parties – buyer (Applicant), seller (Beneficiary), Issuing Bank and Confirming Bank (in case of confirmed LC).

3.Confirmed Irrevocable Credit:

It is a credit of issuing Bank, which is opened at the request of buyer/importer upon a seller/exporter abroad through an advising Bank with a request to add confirmation. Advising Bank, the agent/correspondent of issuing Bank add their confirmation under credit line arrangement already existing between issuing Bank and advising Bank, i.e. in addition to the commitment of the issuing Bank the advising Bank makes its own, independent payment commitment when it add its confirmation. (Article 9 b, UCPDC 500).

4.Revolving Credit:

A Revolving Credit is one where, under the terms and conditions thereof, the amount of the Credit is renewed or reinstated without specific amendment to the Credit being needed. Revolving Credit may be revocable or irrevocable. It can revolve in relation to time or value. But credit that revolves in relation to value is not in common use.

5.Back to Back Credit:

One credit backs another. It may so happen that the beneficiary/seller of an L/C is unable to supply the goods direct as specified in the Credit as a result of which he needs to purchase the same and make payment to another supplier by opening a second Letter of Credit. In this case, the second Credit called a “Back to Back Credit”. These concepts involve opening of second Credit on the strength of first Credit i.e., mother L/C opened by foreign importers.

6.Transferable Credit:

A transferable Credit is one, which can be transferred by the original Beneficiary to one or more parties. In transferable Credit, the original beneficiary becomes the middleman and transferee becomes the actual supplier of the goods. It is normally used when the first beneficiary does not supply the merchandise himself, but is a middleman and thus wishes to transfer part, or all, of his rights and obligations to the actual supplier(s) as second beneficiary(s). This type of Credit can only be transferred once, i.e., the second beneficiary(s) cannot transfer to a third beneficiary. (Article 48, UCPDC 500).

7.Red Clause Credit:

A red clause Credit is a credit with a special clause incorporated into it that authorizes the advising Bank or confirming Bank to make advances to the beneficiary before presentation of documents. The clause is incorporated at the specific request of the applicant, and the wording is dependent upon his requirements. It is so called because the clause was originally written in red ink to draw attention to the unique nature of this credit. It specifies the amount of the advance that is authorized, in some instances it may be for the full amount of the credit.

8.Green Clause Credit:

A Green Clause Credit is a credit with a special clause incorporated into it that which not only authorizes the advising Bank to grant pre-shipment advances but also storage cost for storing the goods prior to shipment. It is useful in situations where shipping space is not ready available, i.e., some African countries. It is so called because the clause was originally written in green ink to draw attention to the unique nature of this Credit.

4.1.1.2 Different Banks of a Documentary Credit:

1. Issuing Bank:

The Bank, which issues the Letter of Credit, is known as Issuing Bank.

2. Advising Bank:

The L/C issuing Bank sends L/C to its correspondent Bank in the Beneficiary’s country with request to advise the same to the Beneficiary after authentication of the Credit.

3. Negotiating Bank:

The correspondent Bank which negotiates the documents and pay the document value to the Beneficiary provided that all credit terms are fully complied with.

4. Reimbursing Bank:

As per instruction of L/C issuing Bank, the correspondent Bank, which debits the Nostro account of L/C issuing Bank and make payment to negotiating Bank or any other Bank.

5. Confirming Bank:

The Correspondent Bank, which confirms the L/C of the issuing Bank and advises the same to beneficiary after adding its confirmation

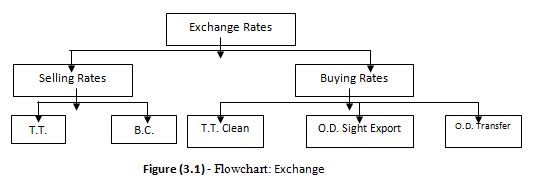

4.1.1.3 Operational Exchange Rate:

Exchange rate:

This is the rate at which two national currencies are exchanged. The twin forces of market demand and supply of foreign currency determine the exchange rate. The demand for foreign exchange arises primarily in the course of importing goods and services from abroad and making foreign investments and loans. The supply of foreign exchanges arises in the course of exporting goods and services and receiving foreign investments and loans.

- Selling and Buying Rates:

A foreign exchange transaction is either a sale or purchase transaction. That means a transaction could be either a sale transaction in which case conversion of domestic currency into foreign currency takes place, or purchase transaction in which case conversion of foreign currency into domestic currency takes place. The Bank would, therefore, quote two different rates of exchange:

Selling rate i.e., a rate of exchange at which it would put through a Sale transaction, and

Buying rate i.e., a rate of exchange at which it would put through a purchase transaction.

We can understand more conveniently the above factor with the following flowchart:

4.1.2. Import Procedures:

4.1.2.1 Documentary Requirements for Opening of L/C by the Importer:

The importer must submit the following papers along with L/C application before opening a Letter of Credit (L/C):

i) Valid Import Registration Certificate (IRC) (commercial/industrial)

ii) Taxpayers Identification Number (TIN)/ Membership Certificate

iii) VAT Registration Certificate

iv) Performa/Indent Invoice duly accepted by the importer.

iv) Insurance Cover Note with Money Receipt covering value of goods to be imported plus 10 (Ten) percent above.

v) IMP forms duly signed by the importer.

vi) LCA forms duly signed by the importer and incorporating New ITC number of at least 6 (six) digits under the Harmonized System as given in the Import Trade Control Schedule 1988.

vii) Credit report of the supplier / country of supplier.

viii) Poet import finance (required or not)

ix) Margin for opening L/C

x) Authority /sanction

xi) Other documents/ papers etc.

Bank will supply the following papers:

i) L/C application form (Printed format)

ii) LCA Form

iii) IMP Form

iv) Charge documents

4.1.2.4.2 Application for issuing of a L/C:

L/C application form represents an agreement between the importer and the Bank to be stamped under, Stamp Act.

The importer would apply on Bank’s standard form to his Bank for issuing a letter of credit. In addition to recording the full details of the proposed credit, the application also serves as an agreement between the Bank and the buyer. The credit application must be clear and precise and generally included the following items:

- Full name and address of the supplier, manufacturer or beneficiary (including his Bank).

- Opener’s name and address (including Import Registration Certificate No. etc.)

- The total amount of credit asked for and whether the credit is a specific credit or a revolving letter of credit and amount of the currency in which the documents are to be drawn.

- The type of credit to be opened, i.e. whether revocable or irrevocable, confirmed or unconfirmed, transferable etc.

- Tenor of draft (Sight/Usance)

- Brief description of goods including quantity, quality, unit price and H.S. Code.

- L/C value for US$, DM, GBP etc.

- The terms of sale, i.e. whether the contract is on CIF, CRF, FOB basis.

- Origin of goods, Place of shipment and destination.

- Mode of shipment (Sea, Air, Truck/Rail etc.)

- Last date of shipment, Negotiation/presentation period (not over 30 days)

- Insurance cover note number and name of the company (the risks to be covered under the policy and the amount of insurance).

- The details of the mode of shipment whether part shipment or transshipment will be allowable or not.

- Mode of advising (Mail/SWIFT/Courier Service)

- LCA number

- Pre-shipment inspection

- Other conditions (if any)

Vouching Procedure (at the time of opening a L/C):

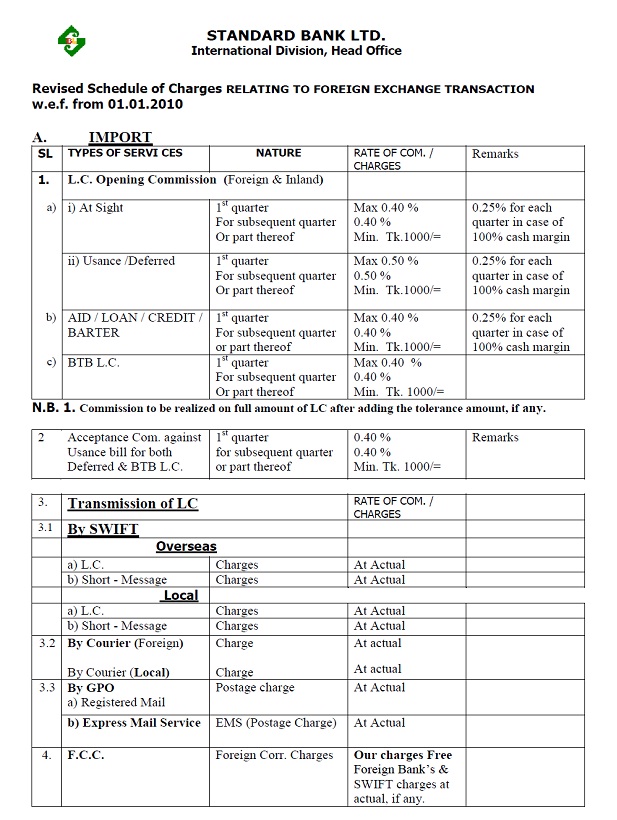

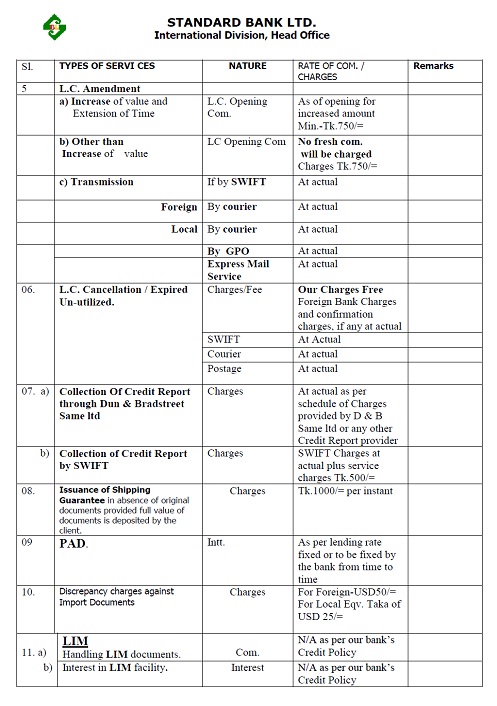

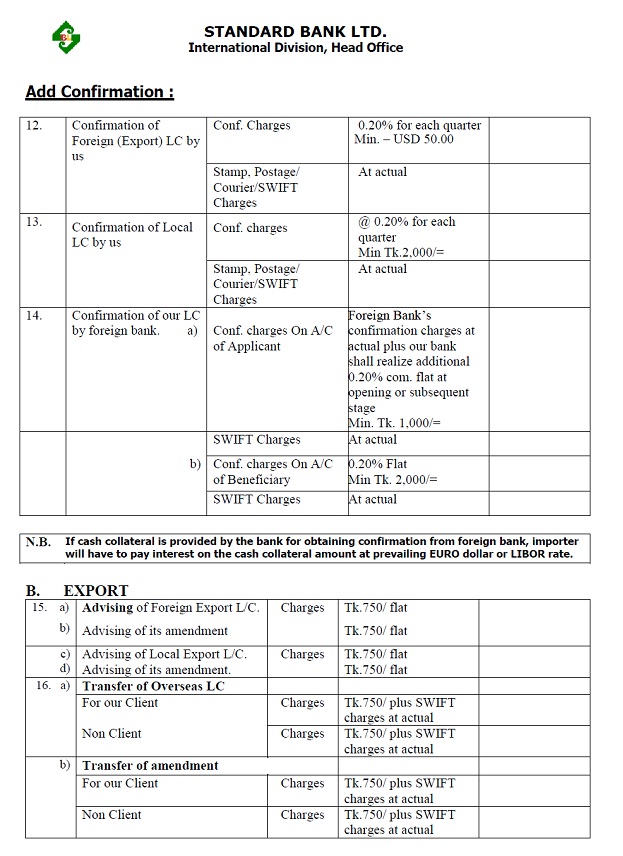

a) Margin/Commission & Charges:

Dr. Customers/ Importer’s A/c

Cr. Marginal Deposit A/c L/C Foreign (Cash)

Cr. Income A/c: Commission on L/C Foreign

Cr. VAT A/c

Cr. Income A/c (SWIFT)

Cr. Stationery A/c

Cr. Stamp in Hand A/c

Cr. Miscellaneous Income (PSI if any)

b) Creation of L/C liability:

Dr. Customers Liability under L/C (Foreign)

Cr. Acceptance Liability under L/C (Foreign)

(Amount to be rounded off to the nearest thousand Taka)

4.1.2.4.3 Amendment or Modification of a L/C:

Once a letter of credit is opened, there are situations and reasons, may be within or beyond the control of either parties, when original terms and conditions need to be amended. These amendments may be changing of description of goods or enhancement or reduction in the value of Letter of Credit or it may be the extension of time for shipment and negotiation etc. In normal business, the Banks do not discourage the amendment to the Letter of Credit provided the amendment is within the validity of the license and other regulations in force are not violated. Before doing any amendment, written request is necessary from the importer who generally makes this request after obtaining consent of the supplier. Such amendment will, of course, be effective if all the parties to L/C, namely L/C opening Bank, the advising Bank and the beneficiary, agree to it.

Article 9 (d) of the Uniform Customs and Practice for Documentary Credit (Publication 500) has very clearly advised that irrevocable credits:

“Can neither be amended or cancelled without the agreement of the Issuing Bank and Confirming Bank, if any, and the beneficiary”

These amendments must be advised by the opening Bank to the beneficiary through the advising or confirming Bank before the shipment is made.

The Branch may allow amendments to the L/Cs only upon requests of the L/C applicants that do not violate foreign exchange regulations and import control regulations. Necessary charges and/or margin (where L/C value in increased by subsequent amendments) are also to be realized/recovered from the customer before amending the L/Cs.

Vouching Procedure

Dr. Customer/ Party Account

Cr. Marginal Deposit A/c on L/C (Cash) (if the L/C value is increased)

Cr. Income A/c: Commission on L/C Foreign

Cr. Income A/c: SWIFT/Postal charge Recovered

4.1.2.4.4 Shipment Validity & Expiry:

All L/Cs must specify shipment validity as per terms of the P/Invoice or indent or L/C application. However, shipment validity under any circumstances shall not exceed 9 (nine) months from the date of issuance of LCAF or registration of LCAF with Bangladesh Bank, except capital machinery and spare parts, shipment of which shall be made within 17 (seventeen) months. All L/Cs must stipulate an expiry date and a place for presentation of documents for payment/ acceptance.

Vouching Procedure

Dr. Customer’s A/c

Cr. Income A/c: Commission on L/C (confirmed)

4.1.2.4.5 Stipulation of Reimbursement terms and issuance of Reimbursement Authorization:

The branch shall stipulate reimbursement term in the L/Cs mentioning name of the Reimbursing Bank and Nostro Account Number (preferably in the country of the currency denominated in the L/Cs so as to avoid possible loss due to conversion of differential currencies). The branch shall issue and send Reimbursement Authorization to the Reimbursing Bank immediately after opening of the L/Cs.

4.1.2.4.6 Cancellation of Letter of Credit:

An Irrecoverable L/C cannot cancel without the agreement of the beneficiary and the confirming Bank, if any. The branch, at the request of the importer, may approach the L/C advising Bank for cancellation of the L/C and such cancellation will only be effective upon consent of the beneficiary advised to the branch through the L/C advising Bank. However, the branch may cancel the L.C without the consent to the beneficiary, advising Bank and confirming Bank, if any, if the L/C expires and the branch receives no shipping documents within 15 days of expiry of the L/C. The branch should send a message to the concerned Bank advising such cancellation and closure of L/C file due to expiry of the same. The branch will then cancel the Reimbursement Authorization, which has been provided to the Reimbursing Bank while opening the L/C. The branch will reverse L/C contra liabilities, refund margin and recover charges from the L/C applicant as per schedule of charges.

Documents sent to PSI Company

Importer sends following documents along with application to PSI Company.

L/C copy

Photocopy of insurance cover note

Copy of indent/pro-forma invoice

PSI information and other relevant papers.

4.1.2.4.7 Shipment of Consignment and Lodgment of Documents:

There may be two types of exporter:

i) Merchant/Trade exporter

ii) Manufacturer Exporter

If the supplier is a merchant exporter, he will immediately start packing and shipping the goods. If he is a manufacturer exporter, he will start manufacturing the item. In either case, he will ship the goods when ready and obtain full set of bill of lading etc. from the carrier company and submit the same to the negotiating Bank along with other documents that is called for in the credit.

The shipping documents usually obtained are:

- Bill of Lading or Air Consignment Note or Post Parcel Receipt or Truck

- Receipt

- Bill of Exchange

- Commercial Invoice

- Certificate of origin

- Packing list

- Weight certificate

- Consular Invoice where necessary

- A copy of declaration of shipment made to the Insurance company (to be submitted with original shipping documents)

- Pre-shipment inspection certificate from internationally reputed surveyor.

- Analysis certificate where specification of commodity is given.

4.1.2.4.8 Discrepancies in Shipping Documents:

The discrepancies found in the shipping documents presented under L/C vary from document to document and from shipment to shipment.

The discrepancies usually found in shipping documents are listed below, but this is not an exhaustive or even complete list, as the discrepancies vary from document to document, though apparently discrepancies do look alike. Their impact may not be the same keeping in view the relationship and importance of each shipping document with other documents asked for by the L/C opening Bank.

The usual discrepancies found are:

L/C expired;

Late shipment;

Late presentation;

Amount drawn in excess of the letter of credit;

Bill of Exchange not properly drawn;

Description of goods differs;

Interest clause in missing in bill of exchange, where stipulated;

Bill of Lading or Airway Bill state;

Bill of Lading ”Clause” Full set (of B/L not submitted or B/L not properly signed

and submitted;

Bill of Lading is not manually signed by the master or an authorized agent of the

Shipping company.

Bill of Lading indicates that goods are carried on deck;

Bill of Lading as issued under a charter party;

Enough number of Bill of Lading not submitted as required by Letter of Credit;

Invoice amount differs from that mentioned in the bill of exchange.

Invoice is not certified as correct/signed by the exporter;

The marking in invoice differ from that appearing on the Bill of Lading;

Insurance cover not as per terms of L/C;

Insurance cover obtained after the Bill of Lading or Airway bill date;

Insurance risks covered do not agree with the requirements of the Credit;

Insurance policy is not in negotiable form or not endorsed in Bank;

Insurance does not cover the entire voyage;

Insurance policy is not properly stamped;

Negotiation under Letter of Credit restricted;

The documents tendered are not issued by the authority specified in the Letter of

Credit;

Packing list and Certificate of analysis are not as per the terms of L/C.

Documents not properly endorsed in favour of the Bank;

Full shipment not effected, and part-shipment prohibited;

Gross weight and net weight shown in different documents differ;

Some of the documents required by L/C not submitted;

Documents inadequately stamped;

Shipment made from and to ports other than those permitted in the relevant L/C.

No indication of ”Freight paid” or ” Freight payable at destination” and

Tenor of draft wrong;

4.1.2.4.9 Checking of Import Documents:

Import documents are checked thoroughly and some specific points receive crucial attention that delineated below:

- · The Letter of Transmittal

1. It must be addressed to L/C issuing Bank

2. It has ac current date.

3. It relates to current Documentary number credit of the Bank.

4. The documents enumerated are attached.

5. The value of documents and the value mentioned in the cover letter are same etc.

- The Documentary Credit

1. It is the correct referenced Documentary Credit

2. It is still valid that nit not expired or cancelled.

3. Available balance in tit is sufficient to cover value of drawing etc.

- Bill of Exchange

1. The draft bears the correct L/C number.

2. The name of the drawer corresponds with the name of the beneficiary

3. It is drawn on the correct drawer indicated in the L/C

4. Amount in words agrees with the amount in figures.

5. The beneficiary as duly signed the draft.

6. The tenor is as required by the credit.

7. The value of draft and the value of invoice are identical.

- Commercial Invoice.

1. Beneficiary as stated in documentary credit issues it.

2. The description of gods. Value and unit price matches that stated in

credit as regards to the amount and currency.

3. Value of invoice does not exceed the available balance of the credit

4. The invoice is signed as required in the credit.

5. The correct number of original copies is presented.

6. The terms of delivery match with the terms of credit.

7. In case of partial shipment, the invoice amount corresponds

proportionally to the dispatched quantity etc

- Marine Bill of Lading

The shipping company must issue it.

Full sets of originals issued and presented.

The consignee’s name and address are correct as mentioned in the credit.

The bill of lading bears issuing date, duly signed by the issuer and the name of ship papers.

The port of departure and port of destination are correct.

The bill of lading bears the “on board shipped” notation.

It is correctly marked Freight prepaid of Freight to collect.

The goods are consigned as stipulated in the credit

The bill of Lading must be properly endorsed etc.

- Airway Bill

- The consignee’s name and address and the airport of departure and destination are stated in the Airway bill are consistent and in agreement with the terms of credit.

- The documents indicated the name of the carrier.

- The issuer is the carrier or a named agent of the named carrier.

- The airway bill indicates the actual flight date and flight number

- The documents are signed by the courier.

- The consignee’s name and address and notify party’s name address are correct.

- It is correctly marked “Freight prepaid” of “Freight collect” etc.

- The consignor’s copy is being presented.

- · Certificate of Origin

- The country of origin of the goods as stated in the certificate agrees

with the terms of the credit.

- The certificate has been signed as required by the credit.

- The certificate has been authenticated by the stipulated authorities.

- It is unique a document and not combined with any other documents.

- The list contains all necessary information specially concerning the packing units.

- The data on it is consistent with that of the other documents

- Packing List

After scrutiny of import document if the above-mentioned points are found in order ad drawn as per credit terms, A/D branch shall make lodgment of documents.

- Pre-shipment inspection:

To ensure the qualities of imported goods and to become sure that imported goods are not radioactive pre-shipment inspection are performed by some government approved PSI Company. For different block different PSI Company works.

Block A: ITS-Interlake Testing Service.

Country includes China and Europe.

Block B : Inspectorate Griffith.

Country includes India, Spelunker, Bhutan, Nepal, Myanmar, Malaysia, Singapore, Thailand and south East Asia.

Block C : Bureau Varieties International

Country includes, Indonesia Japan, Korea, Taiwan, Indonesia, Pakistan, Australia, and New Zealand, UAS, Meddle East, Africa and others.

PSI not required for items such items include Dyes, Capital machinery, Poultry feed, Drug and medicine (They require manufacture and expiry date) Fruits, Computer accessories, Surgical equipment, Food items (They require Phytosanitery Certificate that is provided by chamber of commerce and industry of exported country).

4.1.2.4.10 Lodgment of Import Documents:

While lodgment of the import bills under Cash L/C, A/D branch shall reverse the liability vouchers passed at the time of opening L/Cs.

a) Lodgment Voucher to be passed

Debit : PAD Account (Payment against Document A/C)

Credit: PB General A/C HO/ID

Income Account (SWIFT)

Documents handling Charge

b) Reversal of the liability Vouchers

Debit # Acceptance Liability under Foreign L/C

Credit # Customer Liability under Foreign L/C

c) Adjustment of PAD A/C

i) Debit : Margin A/c

Credit : PAD A/C

ii) Debit : Customer’s A/C/ LIM/LATR

Credit : PAD A/C (with interest if applicable)

Transfer of Margin to PAD account

After passing the above lodgment voucher, L/C margin is also to be transferred to the PAD Account.

The following vouchers are to be passed

Debit : Marginal Deposit A/c L/C (Foreign)

Credit: PAD Account

4.1.2.4.11 Retirement of Import Documents:

A/D branch shall issue and intimation letter to the customer to retire the documents on payment of Bank’s dues in full. Receiving Bank’s dues the branch shall pass the following entry:

a) For application of up to date interest

Debit : PAD Account

Credit : Income A/C (Interest on PAD)

b) Retirement Voucher

Debit : Importer’s Current A/C

Credit : PAD A/C along with up to date interest

The documents will be delivered to the import of his authorized representative with due endorsement on the back of the bill of Exchange.

4.1.2.4.12 Clearance of Goods by the Bank:

Subject to prior arrangements, the Bank clears the goods from the port and stores the goods in Bank’s go down. Bank clears the goods by the Bank’s approved C&F agent and through C&F cell of the Bank. The branch must issue a very clear instruction as to the mode of transport for sending goods by road or road or mode through the nominated C&F agent for storage. After clearance of the goods, C&F agent shall arrange delivery of the goods to the branch authorized representative and branch stores the goods in the Bank’s go down as per sanction terms.

4.1.2.4.13 Taxes & Duties at Import Stages: