Chapter-1

Introduction and Background

1.0 Scope of the study:

The internship is a part of the Bachelor Business Administration (BBA) degree that provides the job experience to students. I was placed at National Bank Limited, Mymensingh Branch as an internee for three months duration. This internship program provides me a lot of experience and knowledge in several areas of Banking Sector. During the first few week of my internship period, I was able to get accustomed to the working environment of National Bank Limited. As the internship continued, I not only learned about the activities but also gathered some knowledge about the basic business activities of banking in first on month of my internship period.

The internship report covers all the trade related products handled by “National Bank Limited” such as cash department, dispatch, account opening, cheque clearing, Local remittance, Advance loan division, Credit card division, foreign exchange division, Western money union etc. These have been prepared through extensive discussion with bank employees.

Generally by the word “Bank” we can easily understand that the financial institution that deal with money. But there are different types of bank such as Central Bank, Commercial Bank, Investment Bank etc. but we are use the term “Bank” without any prefix, or qualification, it refers to the “commercial bank”. Commercial banks are the primary contribution to the economy of the country. Therefore we can say commercial banks are the profit making institution. As bank are profits making concern; they collect deposit at the lowest possible cost and provide loans and advance at higher interest rate.

A company can increase efficiency through a number of steps. These include exploiting economics of scale and learning effects, adopting flexible manufacturing technologies, reducing customer defection rate, getting R&D function to design products that are easily to manufacture, upgrading the skills of employee through training, introducing self managing team, linking pay to performance building a companywide to efficiency through strong leadership, and designing structures that facilitate cooperation among different functions in pursuit the efficiency goal.

Efficiency of customers related with progression of operation. We can identify the efficiency of customers’ service by studying the progress of “National Bank Limited” from starting to at present. The progress of “National Bank Limited” is very rapid with concern of its profits making and growth of its operation within the country towards the country’s economy.

National Bank Limited pursues decentralized management policies and gives adequate work freedom to the employees. This result in less pressure for the employee and acts as a motivational too, for them, which gives them, increased encouragement and inspiration to move up the leader of success. Overall I have experienced a very friendly and supporting environment at National Bank Limited which gave me the pleasure and satisfaction to be a part of them for a while

1.1 Objectives of the report:

The main objectives of the internship program is to familiarize business students with the real business situation, to compare them with the business theories and at last stage make a report on assign task. The main objectives of the report are to investigate the general banking activities of National Bank Limited (Mymensingh Branch).

1.2 Methodology:

Most of the information of this report have been collected from secondary sources such as various books related with the subject, web sites of NBL, files and folders of NBL. Some qualitative information has also been collected from informal interviews and discussions with customers and employees of the branch. Unstructured guidelines have been used as tools for information collection. Collected information has been analyzed qualitatively. Besides, observations of office activities, employee behavior and attitude, various events during the internship period have also been used as information.

1.3 Rationale of the study:

The internship program gives a great scope to gather experience and knowledge in several areas of banking by which I can evaluate myself. As I was working at the National Bank Limited in Mymensingh Branch I got the opportunity to learn different division of Banking. This internship report has been designed to have a partial experience through the theoretical understanding. This report focuses on the practice of the overall branch activities.

1.4 Limitation:

- The main constraint of the study is inadequate access to information, which has hampered the scope of the analysis required for the study

- Three months is in sufficient to know all activities.

- Necessary publications, prospectus etc that are related to my topic of the report are not enough available at the Branch.

- Banking policy about the secrecy of the information.

- Officer of Mymensingh Branch are too much busy they don’t have enough time to share information.

Chapter-2

Organizational Profile & Structure of the Organization

2.1 Background of National Bank Limited:

National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of National Bank Limited to play a vital role in the national economy. We are determined to bring back the long forgotten taste of banking services and flavors. We want to serve each one promptly and with a sense of dedication and dignity.

The then President of the People’s Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj Chittagong. In February 24, 1987 NBL launch their Mymensingh branch at Mymensingh district.

At present, NBL has been carrying on business through its 106 branches spread all over the country. Besides, the Bank has drawing arrangement with 415 correspondents in 75 countries of the world as well as with 37 overseas Exchange Companies located in 13 countries. NBL was the first domestic bank to establish agency arrangement with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. NBL was also the first among domestic banks to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS. NBL has been continuing its small credit programmed for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for 2,737.

National Bank Limited (Mymensingh Branch) has its prosperous past, glorious present, prospective future and under processing projects and activities. At present NBL have over twelve thousand customers at Mymensingh district and their market share is over 35% at Mymensingh district. But at the very beginning it started its banking activities with 1200 customers. But at present NBL plays an important role on every business sector at Mymensingh district. To keep peace with time and in harmony with national and international economic activities and for rendering all modern services, NBL, as a financial institution automated all its branches with computer network in accordance with the competitive commercial demand of time. Moreover, considering its forth-coming future the infrastructure of the Bank has been rearranging. Now the bank is smoothly conducting its foreign transaction through its four hundred fifteen correspondents in seventy five countries. It is serving the expatriate worker by arranging to remit their hard-earned money to their near and dear ones at the shortest possible time through the world famous Western Union Financial Service International. In order to provide high technology based modern and quick service to the people, NBL have been broad under a computer network. Now the NBL (Mymensingh Branch) has been able to create a special image at Mymensingh district by introducing different banking products.

NBL of (Mymensingh Branch) has established different types of business organization at Mymensingh district such as Sema Spinning Mill, Albyes Poultry Firm, and Rashid Brick Fields etc. NBL of Mymensingh Branch is actively involved in sports and games as well as in various Socio-Cultural activities. They also provide relief to the flood victim areas at Mymensingh district.

2.2 Mission:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

2.3 Vision:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

2.4 Objectives of the Bank:

- To build a harmonious customer relationship.

- To make best use of hard earned investment of our

valued shareholders. Simultaneously, play our due part in developing a vibrant capital market by ensuring more effective participation of the Bank in the share market.

- To cover all brunch under On-Line service.

- To respond to the need of the time by participating in syndicate large loans financing, there by expanding the area of investment of the Bank.

- To make best use of latest technologies for giving the clients a taste of modern banking so as to encourage them to continue and feel proud of banking with NBL.

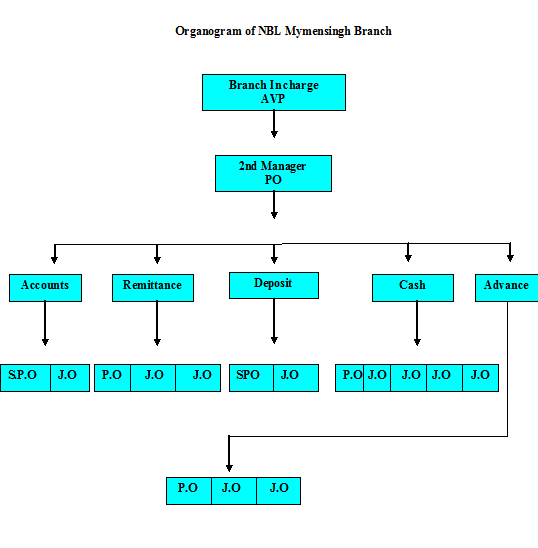

2.5 Branch Organogram:

Here – AVP –Assistant Vice President.

P.O- Principle Officer.

S.P.O- Senior Principle Officer.

J.O- Junior Officer.

Chapter-3

Functions of the Organization

3.0 Functions of the National Bank Limited:

The main functions of the National Bank Limited are divided into seven parts. These are following as:

v Accounts.

v Remittance.

v Clearing.

v Dispatch.

v Deposit.

v Advance.

v Cash

Now I would like to mention major activities of each division.

3.1 Accounts division:

Account opening is the first step that’s build a relationship between Bank & Customer. Opening of account binds the banker and customer into contractual relationship. A bank has to maintain different types of accounts for different purpose. National bank provide various types of account these are following as:

- Current Account.

- Saving Account.

- NMS ( National Bank Monthly Saving Scheme)

- MSS (Monthly Saving Scheme).

- NFCD (Non resident foreign currency deposit).

- RFCD (Resident foreign currency deposit).

- Short term deposit Account.

- Fixed deposit Account.

There are other types of account such as CCS, CC, and SOD (FO). Those accounts are maintained by Advance division.

In accounts division the other major activities are following as:

- Posting all Credit, Transfer & Remittance transaction.

- Posting all Clearing transaction.

- Check the balance of Cash & Deposit transaction.

- Check all types of voucher.

- Prepare daily affairs etc.

3.2 Remittance division:

Remittance is another important side of the bank. It makes our transaction easy. It plays a very vital role of bank customer service section. The main activities in remittance sector are following as:

- Pay Order.

- Pay Slip.

- TT (Telegraphic Transfer).

- DD (Demand Draft).

- Western money union transaction.

- Maintain Samba, Xpress money, Instant cash service.

3.3 Clearing and Bills Department:

This department is one of the income sources of bank take a fees for clearing transaction from the customers. This department has two main activities these are following as:

- Inward cheque clearing.

- Outward cheque clearing.

3.4 Dispatch division:

In this sector all types of official letter, proposal, sending pay order those activities are maintain. Dispatch plays and important role on Banking sector because all official letter are receive and send through this department. This department has also two major activities these are given below

- In ward mail.

- Out ward mail.

3.5 Deposit division:

This is an important sector on the bank. Deposit division maintains all types of accounting activities. The major tasks of deposit sector are following as:

- Prepare daily statement.

- Giving posting of different types of voucher and cheque.

- Closing different types of account.

- Transfer different types of account.

- Perform on-line transaction.

- Cancel the cheque.

- Provide customer’s accounts statement etc.

3.6 Cash division:

Cash plays another important role of the bank. Because all types of transaction are stared from cash. The whole transaction are divided into three parts Cash, Transfer and Clearing. The major functions of cash division are

- Maintaining Surplus money Record.

- Put entry on Cash Book.

- Put entry on On-line transaction book.

- Check the remittance transaction.

3.7 Advance division:

Advance sector is the major earning points of Bank. The advance sector provide different types of loan such as:

- CCS ( Consumer Credit Scheme )

- CC ( Cash Credit )

- Car Loan

- HouseBuilding Loan

- Lease Financing

- SOD ( FO)

- SME (Small Business Loan) etc.

- Foreign LC and Local L.C.

There are another activity that is done by the advance sector such as issuing credit card, NBL power card, international master and visa card

Chapter-4

Internship Position and Duties

4.0Internship Position and Duties:

I did my Internship at NBL, Mymensingh Branch from March 23 to June 23, 2009. I got the opportunity to work as an Internee in the bank by the Head of Human Resources, NBL Bank Limited. I have worked all division of NBL. My supervisor of NBL advised me to work on every department for fifteen days.

4.1 The daily routine:

During internship period I work from 9.00 am to 10.00 pm. The NBL Mymensingh Branch is one of the busiest Branches at Mymensingh district. So every officer has to work very hard. During office time officer of different division were share their work with me. After 5.30 pm I did other official activities such as voucher posting take backup of daily transaction. As a result I got a practical knowledge about over all Branch activities.

4.2 Job description:

It was clearly mentioned in my joining letter that I was supposed to give regular attendance at the place where I would be deputed to work on my project. As an Internee I work on several divisions on NBL Mymensingh Branch.

First fifteen days I was worked on accounts division. During this time I was dealing with the customers for some formalities of the bank. Such as provide application on the prescribed form, provide different types of features or facilities for opening an account check the signature, input the accounts number etc. I also maintain and deliver checkbook to the customers. I also did different types of activities in account’s division. These are following as:

- Voucher maintenance

- Give posting

- Prepare supplementary

- Prepare daily resource position.

After complete my first fifteen days on accounts division I was transferred on remittance division. In remittance division I help customers to fill up western money union form, provide pay order transaction, checking customer ID and information, checking TT voucher, put customer details on TT voucher, download incoming TT, and send TT to the different branches of NBL. I also did western money union, Xpress Money, Samba transaction through computer.

Second month I was working for clearing division. In clearing division I did different types of activities such as taking clearing check, put entry on clearing form, provide voucher to the deposit and accounts division, and put entry the IBC and OBC check to the register khata. I also place clearing cheque to the Sonali Bank etc.

In deposit division at first five days I just observe their activities and procedure of posting. After five days I posted different types of voucher such as NMS, MSS, and cheque posting etc. during this period I also did different types of activities such as

- Close account.

- Checking signature and picture for on-line transaction by using computer.

- Provide statement etc.

Last month I worked for cash and advance division. In cash division I do not performed a lot. I just put the entry for all types of transaction on cash maintenance khata. I also provide surplus money transaction statement to the Head Office.

Last fifteen days I worked for advance division. In advance division I got the opportunity to provide SOD (FO) loan to the customers. I. I also perform different types of activities such as:

- Provide the requirements to the customers for taking different types of loan.

- Survey different party’s firm for loan purpose.

- Provide commission voucher to the deposit sector.

- Provide statement etc.

4.3 Technical features in internship program:

In my internship I did some technical work as an internee. The technical functions, which I did, are listed below

• Cheque & Voucher posting using the A2Z software.

• Send & receive TT by using IBTA software.

• Provide transaction slip by using Western money union software.

4.4 Use of office machinery:

In NBL Bank, Mymensingh Branch as an internee I was not authorized to use all the machineries of the office although I did used some of them to complete my duties. The things, which I used, are listed below

• Computer for data entry

• Photocopy machine for copying documents

• Money counters for counting money

Chapter-5

Major Findings and Learning Points

5.1 Learning Points:

During three month internship period I was worked in each division for 15 (Fifteen days) and I had to work as an employee from 9.00am to 10.00pm. In this chapter I would like to explain those things that were did by me.

5.1.1 Accounts Division:

National Bank Ltd, Mymensingh branch has huge number of customers than other bank in Mymensingh district. Every day I have to open more than fifty accounts. There customer growth rate are given below

First fifteen days I was worked in Accounts Division. In accounts division there are two employees. One employee maintained account opening and cheque book issuing. Other one posting all credit, transfer, pay order, pay slip, clearing transaction through computer by using A2Z software. During this period I learn how to open different types of accounts, how to issue cheque book, how to posting all credit, transfer, pay order, pay slip, how to check different types of voucher etc.

5.1.1.1 The requirements & the procedure to open an account:

For opening a Savings Account (SB) the requirements are following as:

- One introducer

- National ID card (Photocopy)

- Two copy passport size photographs

- One Nominee photograph

There are others important element that is attached by bank with the savings application form these are Signature Verifying Card, Transaction Profile, KYC (Know your customer) Profile. These things are important for bank because signature card is important when customer want withdraw his/her money then deposit in charge check the customer photo and signature. Transaction profile indicates his/her transaction volume and KYC profile contain his/her details activities such as address, occupation, source of money etc.

Current Account is not available for all types of customer. National Bank provides Current Account for business man or business organization. For opening a Current Account the requirements are following as:

- One introducer.

- National ID card (Photocopy).

- Two copy passport size photographs.

- One Nominee photograph.

- TIN Certificate.

- Trade License.

The other procedure are as like as Savings Account.

For opening NMS (National Bank Monthly Saving Scheme) and MSS (Monthly Saving Scheme) and FDR (Fixed Deposit) the requirements are following as:

- National ID card (Photocopy)

- Two copy passport size photographs

- One Nominee photograph

For opening a FDR Account customer must put his/her signature on signature verifying card. This an important element for bank and as well as customer .because when customer want to withdraw his/her money or take is interest against FDR account then he must sign on Pay slip cheque or FDR Cheque. To withdraw FDR money and interest the customer need to sign on stamp which is attested on FDR cheque and Pay slip cheque.

Otherwise this cheque does not contain any value. To open an FDR account the requirements are following as:

- National ID card (Photocopy)

- Two copy passport size photographs

- One Nominee photograph

RFCD Account is available for businessman. For opening RFCD (Resident foreign currency deposit) account the requirements are following as:

- National ID card (Photocopy)

- Two copy passport size photographs

- One Nominee photograph

- Passport Photocopy.

- Photocopy of visa.

- TIN Certificate

- Trade License

NFCD Account is available for foreign customer. For opening NFCD (Non Resident foreign currency deposit) account the requirements are following as:

- Two copy passport size photographs

- One Nominee photograph

- Passport Photocopy.

- Photocopy of visa.

- National ID card (Foreign Country)

These are the procedure and rules regulation that is maintained by the bank to open an account.

5.1.1.2 Cheque Book Issue:

There are three types of cheque books provide by the National Bank Ltd those are

- Ten Leaves– This cheque book provide for Saving Account holder.

- Twenty Leaves– This cheque book provide for Current Account holder.

- Fifty Leaves– This cheque book provide for loyal customer or that person whose need to place check daily.

For issuing cheque book bank follow two procedures a requisition slip that is available for new account holder and for old customer a requisition slip already attached with the cheque book. A cheque requisition slip contains date, account number, customer’s name & address, customer’s signature cheque serial number and authorized signature. The bank’s employee has to complete the cheque requisition form & take signature of customer then he transfer this form to deposit sector to entry the cheque serial number & verify the customer signature. After verifying the signature the deposit in charge put his sign on requisition form and sends this to the accounts division. Then accounts division’s employee put the cheque serial number, date, accounts holder name and the signature of the account holder on cheque book maintaining khata. For issuing a new cheque book bank’s employee must maintain the cheque serial number of previous cheque book that is already deliver. If the serial number is not match then he need to inform his senior or authorized officer.

If any account holder lost his cheque than he need to make a GD on polish station and place this GD form and application on authorized officer.

5.1.1.3 Others Activity:

I also learn how to posted different types of voucher. Bank transaction are divided into three parts Cash, Transfer and Clearing. For posting different types of voucher the bank’s employee maintain two boxes. One is un posted and the another is posted box. All un posted voucher are put into un posted box and when employee posted the voucher then he put these voucher into the posted box. During internship period I posted different types of voucher these are following as:

- Pay order

- Pay Slip

- TT

- Clearing voucher

- Income commission voucher

- Sundry deposit voucher etc.

For posting different types of transaction NBL use A2Z software. During posting the employee need to know the voucher. At first officer has to identify which transaction is cash which transaction is transfer and which transaction clearing. Cash transaction voucher contain cash receive seal, authorized officer’s signature and deposit in charge signature. If officer see all things are properly done then officer can posted on computer through A2Z software. For posting TT transaction at first officer has to enter on TT transaction then officer has to put branch ID number in which branch officer want to send. Different branch has different ID. Such as Rajshahi (05), Dilkusha (01), KawranBazar (48) etc. Then officer has to put the transaction code Cash (01), Transfer (02) and Clearing (03). Then put the transaction amount, beneficiary name. And finally save.

For posting pay order and pay slip transaction at first officer has to enter the pay order code (NPO) and pay slip code (NPS), pay order/pay slip cheque number, beneficiary name and finally the amount. Clearing transaction is also posted by the same procedure in this case officer has to use clearing code (03) to post in the computer. For posting other voucher officer has to know different types of code and officer need know which voucher is debit and which voucher is credit.

5.1.2 Remittance Division:

Remittance means transfer of money from one place to another. It is one of the safest ways to transfer money. National Bank has 106 brunches as a result they have strong network through whole country. For transferring money National Bank Ltd offer different instrument such as-

1) Telegraphic Transfer (TT).

2) Demand Draft (DD).

3) Pay Order

4) Pay Slip.

5.1.2.1 Telegraphic Transfer (TT):

Telegraphic transfer is the quickest and safe way to transfer money. This transaction is done by IBTA software through internet. If the internet problem occurs then transaction is done by the telephone. Requirements for sending TT are following as:

- Client should have account in National Bank (Mymensingh Branch).

- Client should paid commission, vat and telex charge.

When clients wants to send their money to another NBL branch then he/she has follow the following procedure

- At first he/she need to collect TT form from remittance.

- Deposit money with vat, commission and telex charge.

- Then client collect a cost memo from remittance authorize officer with TT number.

After receiving the TT form officer has to check the signature of the cash officer and deposit officer. Then officer has to enter the branch name, beneficiary name, account number and the amount in IBTA software. Then put a test number on TT form and IBTA software. Test number is given by the authorized officer because it is very confidential. Finally he sends the TT through internet.

For receiving TT officer need to use test number one test number send by the sender brunch and one test number is enter by the receiving brunch if the code is correct then officer can download and posted the TT from internet by using IBTA software. After download officer need to prepare a debit and a credit voucher for each TT and put signature on voucher and send this voucher to deposit division. Vouchers are automatically made by the software. Party collects their money from deposit. If the internet doesn’t work properly then officer send and receive TT by using telephone.

5.1.2.2 Demand Draft (DD):

Demand draft is another way to send money from one brunch to another brunch. It is very confidential because to receive and send DD officer need to learn test code. For this reason DD transaction done by the authorize officer.

5.1.2.3 Western Money Union:

It is the most safe and quick transfer process of sending money from one country to another country. Basically NBL just receive money that is send from different country. A large numbers of Bangali Peoples work on different types of country. They send their money through different types of money exchange organization; western money is one of them. To collect money through Western Money Union at first customer submit their Voter ID card photocopy and then fill the Western Money Union From. When customers submit their form and Voter ID card then officer need put all data on Western Money Union Software. If the all data & password is correct then officer can print the transaction details. Finally officer need to take the signature of customers on print copy after taking the signature officer need to take signature of remittance officer. After signature the officer send this print form to the cash division and customer collect their money from cash.

5.1.2.4 Xpress Money & Samba:

For transaction of Xpress Money officer need download all information from the website of the Xpress Money exchange. To enter their web site officer need to type their ID and password. This transaction is made by the authorize officer. To collect money of Xpress money customers submit their Voter ID, and password that is given by the sender. If the password and others information is correct then customer can withdraw their money. For Samba transaction customer just said their password to the officer. Officer put their password on Samba’s website. If the password is correct then officer can print the transaction details from Samba website. Finally officer needs to take the signature of customers on print copy after taking the signature officer put his signature on print copy. After signature the officer send this print form to the cash division and customer collect their money from cash. There are other money exchanges such as Speed cash, Balka etc. Balka payment is done by Pay Order.

5.1.2.5 Pay Order:

Pay Order is an order by an issuing brunch upon client for made payment of the amount mentioned there in that named pay on according to client order. Pay order issued only for local payment.

5.1.2.6 Pay Slip:

Pay slip is used only for bank’s internal payment such as different types of bill payment, payment of FDR interest rate etc.

5.1.3 Dispatch:

The main function of dispatch division is dispatching different types of official letter, different advice, and advance loan proposal. The officer in dispatch maintain two types of mail which are

1) Inward Mail.

2) Outward mail.

5.1.3.1 Inward mail:

Inward mails are those mails that have come from outside of the organization. When officer receive any letters or official documents from outside of the brunch then he maintain some procedure. These procedures are following as:

1) First put receive seal on that letter or document.

2) Put a serial number on inward register book with date.

5.1.3.2 Outward mail:

Outward mails are those mails that are sending from other organization. For outward mail they maintain an outward book for record the letter number, sending address etc.

When official letter and other documents send out side of the branch then dispatch officer done the following things

1) Put serial number

2) Register on outward mail register book with date.

Out ward dispatch is done by three ways these are following as:

1) By courier service

2) DHL/ Fed Ex

3) Register post.

5.1.4 Deposit:

Deposit division is one of the important sectors in a bank because all money transaction is regulated from this division. In deposit sector I did different types of activities these are following as:

- Cheque Posting.

- NMS & MSS Posting.

- NMS closing.

- On-Line transaction

- Posting different types of account.

- Provide statement.

For cheque posting at first officer need to observe the following things

1) Barer or Payee name

2) Date

3) Amount

4) In ward Amount

5) Signature

6) Picture

These are the most important factor before posting a cheque. If any of this information is mismatch then deposit in charge will refuse the cheque. On the other hand if officer see any over writing on cheque then a signature of the customers must put on cheque, other wise bearer can’t withdraw money or that cheque do not contain any value. If all things are correct then officer can post the cheque on computer through A2Z software. For transfer money to another account at first office debit the account of the client through A2Z software and credit another account number. Here transferred account number must be put on computer.

For NMS and MSS posting at first officer check the NMS & MSS account holder name and number than he observe the deposit amount. If the amount is match with the computer then he posted it on computer.

For closing NMS account at first customer submit a application with signature. After getting the application officer check the signature of the customer. If the signature is match then he verify the signature and close the NMS account through A2Z software and print this transaction. Then he put a signature on print copy and put a seal where pay in cash instruction was given.

On-Line plays an important rule on transaction process. It makes our transaction process easy and safety. For On-Line transaction there are two officers. First procedure is done by the checker and the finally maker will send the money. For online transaction at first checker enter under any branch bank service then he enters the expected brunch code. After entering code than he can see the branch name. After see the brunch name then he enters the customer account number. After entering the number checker can see the accounts details expected the amount. For receiving money checker enter the amount if the amount is available then he can run the transaction. He can also see the picture & signature of the account holder. If all things are match then print the transaction details and puss this transaction voucher to the checker by using “Under Any Brunch Bank” seal and put his signature on voucher. After receiving the voucher of On-Line transaction Maker check the posted signature then he check the information if checker make any fault then he can reverse this process. After confirming then he posted it and print the transaction details. Then the maker put his signature on print copy and sends this voucher to cash officer and customer collect money from cash. For sending money checker just check the account holder name and branch name if all things are right then he posted it and prints the transaction details and maker also check the same things and send it through On-Line. In deposit division I also open different types of account through A2Z software in computer and also provide statement to the customers.

5.1.5 Advance Division:

Advance division is a heart of any bank. A big portion of income of the National Bank Limited (Mmensingh Branch) is comes from this advance division. This income comes from different types of loan that is serving by the advance division. The incomes from Advance division increase each year. The growth rate of advance division are given below

5.1.5.1Consideration factor for loan:

When national bank provide loan then they consider some factors these are

Safety:

Safety is the most important things for sanctioning loan. At the time of repayment borrower may be unable to pay the loan amount. For that reasons when bank sanctioning loan they takes collateral security from the borrowers.

Security:

Banker should aware in the selection of security for their loan. They should properly evaluated the value of security it should not less than or equal of loan amount. When bank take any land, building as a collateral security then banker should check the CS, SA and RS porcha.

Liquidity:

When banker sanctioning any loan then they should ensure the liquidity position of their branch.

From different types of loan I especially work for SOD (FO) loan. This loan is available for those customers who have NMS, MSS, FDR and NDS. For taking SOD (FO) loan customer has to submit an application to the bank’s manager. If the manger accept it then authorize officer prepare the following papers

1) Letter of authority.

2) Limit loading.

3) Sanction letter.

4) Promissory note.

5) Letter of lien.

6) Letter of continuity.

7) Letter of disbursement.

8) Letter of arrangement

Letter of authority contain SOD (FO) number, current amount of the financial obligation, loan amount, lien permission and customer details.

The loan expire date, loan amount and loan details information are written in Limit loading page.

In Sanction letter loan amount information, validity of the limit, mode of disbursement, customer details, nature of loan, interest rate details, purpose of the loan, securities details etc.

Promissory note contains interest rate, date of loan sanctioning, loan amount and stamp. The value of the stamp is five taka.

Letter of lien and letter of continuity contains the lien security’s number, name of the A/c holder, current amount, and two 50 Tk stamp and two 100 Tk stamp.

Letter of arrangement give the permission to prepare the loan papers and the loan amount transfer permission order details are written in letter of disbursement.

After prepare all of these documents authorize officer take the signature of customer on all papers and stamp. Then officer open the SOD (FO) account through A2Z software. Then he transfers this loan amount by using voucher. If the customers take loan against FDR account then he can take loan amount from SOD (FO) account directly by placing cheque. But NMS and MSS account holder cannot take his loan amount directly from SOD (FO) account his loan amount transfer to another account number as per customer instruction.

I also know the nature and requirements for several types of loan. Such as Cash credit (CC), SOD (BB), and SME. The requirements of these accounts are given below

5.1.5.2 Cash Credit:

Nature of the cash credit are given below

1) Its duration is one year.

2) Interest charged quarterly.

3) End of the duration loan holder must have to pay loan amount with interest rate.

4) Risk fund and service charge is not needed for cash credit.

5) Collateral security is essential for cash credit.

5.1.5.2.1 Cash credit (Hypothecation):

In the case of cash credit (H) the borrower sign a letter of hypothecation and physical possession of the goods are control by the borrower binding himself to the National Bank Ltd at Mymensingh branch. For CC (H) bank always prefer legal equitable mortgage of properties such as land, building as a collateral securities. For sanctioning a CC (H) loan the requirements are following as:

1) Party’s application & Declaration.

2) Trade license. (Photocopy).

3) TIN certificate.

4) Account statement.

5) Project profile.

6) Lease deed (New & Sabek).

7) Photocopy of Voter ID etc.

5.1.5.3 SOD (BB):

SOD Bid Bond is available for that borrower who wants to participate any bid for collect work. In SOD Bid Bond payment is making by the pay order. If a borrower gets the work then interest is charge of that amount.

If borrower does not get the work then he deposits that amount which he has issued by pay order. Charge document of SOD (Bid Bond)-

- Promissory note.

- Letter of arrangement.

- Letter of continuity.

- Letter of guarantee.

- Letter of disbursement.

(N.B-All this charge documents are describe at previous page)

Expect SOD (FO) loan NBL need much more time for sanction a loan because branch have no authority power. Every Saturday Head Office held a meeting for loan purpose. NBL have 106 branches and they send loan proposal everyday a result Head Office takes much more time. If NBL provide some authority to every branch then they can overcome these types of problem.

5.1.5.4 Other activities:

Advance division also maintains different types of card such as ATM card. Credit card, Local credit card, International master card etc

5.1.5.4.1 ATM card:

ATM means automated teller machine. NBL ATM card give opportunity to their customer that they can withdraw their money at any time, any days even holidays. By using ATN subscriber can give various utility bill such as telephone, gas, electricity bills etc. Actually ATM card is a debit card.

Charges for ATM card:

ATM card holders has to pay 1000 TK annually and in the case of card lost subscriber also pay additional 300 TK.

5.1.5.4.2 Credit card:

Credit card is very much popular in our country. In our country credit card was first introduced by the National Bank Ltd. Master Card is a name of popular credit card brand and it is world wide accepted credit card. Credit card is safe, instance and universal money National Bank Ltd issued to types of credit card which is as follows

Local Credit card:

Local credit card is two types, such as “Gold Card” and “Silver Card”. Gold Card limit is 45000 TK to100000 TK and Silver Card limit is 10000 TK to 50000 TK.

Requirement for local credit card

- FDR, STD account loan

- National ID

- Tax identification number

- Two copy passport size photo

International credit card:

It has also two types, such as Gold Card and Silver Card. For international purpose Gold card limit is 2000 US $ to 4000 US $. For international purpose Silver card limit is 1000 US $ to 2000 US $. It can very with the customer. If the customer show more security than the bank can increase the limit of card. Requirement for international credit card

- Two copy passport size photo.

- National ID.

- Passports photocopy (First five pages).

- TIN number.

- FDR, STD, SB account lien.

5.1.5.4.3 NBL Power card:

It is a prepaid card. No need of any account of NBL branch. Application form is available at any NBL branch and card center. Renewal fee and SMS fee TK 350. Card limit is 20000 TK minimum. Customers have to pay 1% of their deposit money.

Requirement for NBL Power card

- Two copy passport size photo.

- National ID.

5.1.6 Cash Division:

The major activities of cash department are to provide and receive money to the customer. In cash department sometime I receive the money of the customers. For receiving money the following procedure are. At first check the voucher amount and check the money carefully. Then put the cash seal on voucher and put the signature on deposit voucher. After that officer needs to put the transaction details such as account number and name, serial number, amount etc.

5.1.7 Clearing:

NBL, Mymensingh branch receive cheque, demand draft, pay order from their client for clearing. It has been seen that when the instrument of other bank has deposited in the NBL, Mymensingh branch, then the officer has to check the particulars of the credit voucher, he ensure that giving instrument and credit voucher account number, amount should be same. When officer receive any instrument he should ensure that instrument issuing date should not exceed six months. When every thing is ok then authorized officer put a receive seal on that instrument. This seal’s call cross seal.

5.1.7.1 Clearing Procedure:

After getting the cheque then officer do the following things-

- He put the cheque number and amount of the different banks on a Voucher where different bank name are organized.

- Then he sums the total amounts that are written on cheque.

- Then he place these check to the different banks officer in Sonali Bank.

- Different bank’s officer also placed check to the National Bank’s officer if they have any National Bank Ltd, Mymensingh branch’s cheque.

- Then officer put the cheque number and amount that re submit by others bank.

- Then he calculate the amount of cheque of NBL that are submit by others bank.

- If the cheque amount is higher then he credit the Sonali Bank’s accounts if the amount is lower then he debit the Sonali Bank’s account. Because every bank maintain an account in Sonali Bank. If there is no Central Bank Branch.

Clearing division has another two types of activities. These are following as:

1) Inward Bank Collection (IBC)

2) Outward Bank Collection (OBC)

By giving an example I can explain the IBC and OBC transaction. Suppose National Bank got a Standard Chartered Bank’s cheque from his client but there is no branch of that bank. Than National Bank Ltd send A OBC advice for Standard Chartered bank because in

Mymensingh there is no Standard Chartered bank’s branch for the reason this bank is out of clearing. When Standard Chartered bank got the OBC advice than this advice is IBC for

Standard Chartered bank. Then Standard Chartered bank sends a DD advice for NBL to collect the money. NBL take this money through clearing from Sonali Bank. The money is paid by that bank which bank has account on Standard Chartered bank. This process is done when a bank is out of clearing.

Reason for clearing cheque return:

- Insufficient fund.

- Payments stop by drawer.

- Cheque is out of date.

- Amount in word and figure is different etc.

5.2 Major findings:

After three months internship program on NBL Mymensingh branch I learn different activities of NBL Mymensingh branch. From the overall activities I find the following things such as Money laundering, their promotional activities, Sales target and achievement, competitive strategies, pricing approach, direct marketing activities and risk factors

5.2.1 Pricing approach:

Basically bank’s pricing strategy is defined by the Bangladesh Bank. Bangladesh Bank provides circular for interest rate range against different products of the banks. NBL Head offices provide the circular of the interest range circular to every branch. In this interest rate range branch can increase or decrease the rate of interest by the permission of the NBL head office. It is basically depends on the competitors. Sometimes new bank provide low interest rate for loan and high interest rate for Savings account and FDR to attract customer. But this interest is change fraction wise. This interest rate is more or less same for all banks. If the loan amount is high then a little fraction of interest rate creates an important rule. For this reason customer of NBL can switch to the other bank to take the facility. For these reason sometime they set a low price to attract the large number of buyers. From these strategy I can say that their pricing strategy more or less similar with the Market skimming pricing and Market penetration pricing. It is also similar with the competition based pricing.

5.2.2 Competitive strategies:

NBL work hard to achieve the lowest production and distribution costs. Their pricing strategy is lower than other competitors. Their target is to win the market share of Mymensingh district not only Mymensingh district but also whole district of Bangladesh. Here I mention the Mymensingh district for some reason because by using the surplus money of NBL branch they can overcome other NBL branch liquidity crises. From this point of view this strategy similar with the Overall cost leadership.

The market share of NBL, Mymensingh branch at Mymensingh district are following as:

National Bank Ltd (NBL)- 35%

Islami Bank Ltd (IBL)- 20%

Dutch Bangla Bank Ltd (DBL)-10%

Arab Bangladesh Bank (AB)-15%

Others Bank-20%

5.2.3 Direct Marketing and Promotional activities:

In every Saturday NBL Branch Manager arrange a meeting to provide their product facility to the customers. Manager will gives a speech for his employee and make a group. Each group contains two people. Then they go to the different side of the city and describe their product features to the customers. From these customers they have to identify the qualified potential customers, customer’s details etc. They also describe the customer benefit that are provides by NBL, Mymensingh branch. From this point of view we can say that it is similar with the personnel selling process. NBL, Mymensingh branch also provides their feature by using Local satellite channel. They use Bill board also.

5.2.4 Sales target and achievement:

NBL Head Office sometime through a target for its several branches. This target segmented by district wise. They provide different types of price for achieving the target. This target is distributed among the employee of several branches. In our branch target for each employee was TK 2500000 (Twenty five lac).

The sales target and achievement of NBL Mymensingh district branches are given below

DEPOSIT MOBILIZATION CAMPAIGN MAR- JUNE, 09

PERIOD: 01.03.09 – 31.05.09

(Figure in Lac)

Branch Name |

Mymensingh |

Tangail | Bhaluka |

Kishoregonj |

Jamalpur | Sherpur | Modhupur |

Target |

150.00 |

100.00 |

100.00 |

100.00 |

100.00 |

150.00 |

75.00 |

Achievement | 289.00 |

136.00 |

182.00 |

23.00 |

64.00 |

45.00 |

34.00 |

Number of A/C

| 209 | 160 | 325 | 118 | 133 | 63 | 111 |

5.2.5 Risk Analysis:

When NBL provide loan or invest to it’s they analyze risk factors such as Market risk, Interest risk, Liquidity risk, Credit risk etc. If all the risky factors show positive sign then they sanction the loan. For sanction a loan they maintain the following rules

5.2.5.1 Market risk:

Before sanction a loan they analyze the market risk because market’s fluctuation creates a huge change in banking sector. If the market’s economy is not stable or if inflation rate is increase then customer will not deposit their money on bank. On the other hand customers do not adjust their loan. As a result bank do not achieve their target.

5.2.5.2 Interest risk:

Interest risk plays an important rule on bank. Because bank’s capital is depends on interest rate. If the interest rate is increase then customer will deposit their surplus money on bank. On the other hand if the interest rate is fall down then bank will face liquidity crisis.

5.2.5.3 Liquidity risk:

Before sanction a loan bank checks the liquidity of the mortgage asset of the customers because if the properties of customer are not liquid then the bank will face lot of problem.

5.2.5.4 Credit risk:

Credit risk is an important factor for every bank. When a bank provides loan to its customer then bank must take takes some security to overcome the credit risk such as mortgage property, land or other financial obligation.

Bank also considers turnover factors for providing a loan because if the turnover ratios do not fulfill the required amount then they do not provide the loan to the customers.

5.2.6 Money Laundering:

Money laundering means the tendency to make the Black money into White money. Black money is that money which is earn by illegal ways. For this reason client of the Black money cannot show the money to the government. If the client shows his extra money then government wants to know the source of the money. For these reason Black money holder try to white their money through banking procedure. NBL takes different types of activities to prevent money laundering. For opening an account of the customer NBL attach a KYC (Know your customer) form and transaction profile. Where account’s opening officer writes detail of the customers. For sending money by using TT authorized officer put the sender detail address on the back side of the TT form. NBL Head Office provides different types of training to prevent money laundering. In every NBL branch they mentioned an officer who monitor the money transaction activities this officer called BAMELCO (Branch anti money laundering compliance officer).

5.2.7 SWOT analysis:

Strength:

- NBL provide its customers excellent and consistent quality in service.

- NBL is free from dependence from the ever destructive owner supply of our public sources.

- NBL has strong brand image. Ii is second position on brand image.

- NBL employees are well trained.

Weakness:

- NBL has very limited human resources compare to its financial activities. As a result many of the employees are burdened with extra workloads and works late hour without any overtime facilities.

- Account opening system is not well structured. Because account information are not put by on computer by accounts division.

- NBL Power card take extra money for deposit amount as result customers are dissatisfy.

- Take much time for sanctioning a proposal of advance division.

- On-Line facility is not good.

- ATM booth is not sufficient.

Opportunities:

- Bank can issue credit in diversified areas.

- NBL can increase its business in foreign country. Their target is to open ten branches in Malaysia.

- By adopting new technology at advance division bank can achieve more customer satisfaction.

Threats:

- Risk of repayment of loan from the clients on time.

- Entering new bank’s branches at Mymensingh district.

- Switching customers to other bank.

- New opportunity for the clients by the competitive banks.

Chapter 6

Conclusions and Recommendations

6.1 Conclusions:

It would not be appropriate to draw any definite conclusion right now. So the result of the study should be taken as indicate rather than conclusive.

During three month internship program in National Bank Limited, Mymensingh Branch, almost the entire all the desk has been observed more or less. In fact, it has been arranged for gaining knowledge of practical banking and to compare this practical knowledge with theoretical knowledge.

In internship it is found that the branch provides all the conventional banking service as well as some specialized financing activities to the economy. Within very short period of time, the branch will also introduce the On-Line banking.

General banking in engaged in cash receipt and payment, cheque clearing, local remittance etc. the amount of deposit In Mymensingh branch is very high because most of the loyal (Chamber of Commerce) customers take the maximum service of National Bank Limited, Mymensingh Branch.

Loan and advance division analysis the credit proposal and disburse credit if the proposal is sound. As specialized financing, it provides term finance to medium and small scale industries. The branch also provide hose building loan, car loan etc.

Thus by providing various services the Mymensingh branch of National Bank Limited is playing an important role in the banking system and the economic progress of the Mymensingh district.

From the learning and experience point of view I can say that I really enjoyed my internship at NBL from the first day. I am confident that this three months internship program at NBL will definitely help me to realize my further carrier in the job.

6.2 Recommendation:

It is also very difficult for me to give any recommendation with my little working experience but I have tried as my best to give recommendation above shortcomings (Its may be its not suitable for NBL)

- NBL should give more freedom to their branches for taking decisions and their Head Office should take decision more quickly for sanctioning loan.

- NBL Inter Bank Transaction is made by advice but it is unsecured for bank So NBL has to build net working system between branches and Head Office.

- NBL, Human Resource Department should train their employee with computer knowledge and their Human Resource Division arrange training program frequently.

- NBL management should take decision more quickly.

- NBL need to increase their ATM booth.

- NBL SME loan should be increased.

- NBL should use group intensives so that employee can share their experience, strength and can work smoothly.

- NBL should provide better On-Line service.

- NBL should increase their computer facility for all employees as a result employee can work swiftly.

- NBL need to communicate with their client regularly.

![Thesis Paper on Performance Analysis and Budgetary Control Activities of Trade Vision Limited [Part-1]](https://assignmentpoint.com/wp-content/uploads/2013/04/images-18-200x100.jpg)