Executive Summery

World is becoming very complex but fast. To achieve any objective now, people have to be fast and managed themselves very quickly within the limited resources. Specially, throughout the business one has to accomplish unique outcomes with limited resources under critical time constraints. Beside this, we have to remember that Bangladesh is an under developed country. People here face too many constraints. The business people here also face too many barriers to lead their organization with the consistent of country’s economical, political, and other situations. So, to carry on the business companies have to undertake competitive business strategy. Among them ‘pricing strategy’ is most influential strategy for any business. We can mention ‘pricing strategy’ is the heart of overall business strategy of DANO milk powder.

On the other hand, at the very beginning of job, I was working actually with the marketing strategy (pricing policy, Distribution & Logistics policy) of DANO milk Powder. So, in this report I have prefaced all possible factors related with marketing, financing, economy, production (Packaging) etc. As Arla Foods Ingredients, Bangladesh can get actual picture of milk powder market and also can get real orientation about pricing policy as well as other policy.

So far, I have tried to give a target from product market to reach it to final buyers. In the report, I have put up a proposal about DANO milk powder, product design, marketing of DANO milk powder, financial analysis, competitive current marketing strategy, Ad. & trade promotional opportunities, market segmentation, pricing strategy with the compare of competitors, opinions & suggestions from field survey, and other related factors. So, I think Arla Foods Ingredients, Bangladesh will get a thorough scenario of milk powder market of Bangladesh and will get the effective way to penetrate in the milk powder market as Arla Foods can able to obtain its desired market position.

INTRODUCTION

Bangladesh is a densely populated country. For decades, Bangladesh has a large domestic market for milk products which was largely met through importation of subsidized milk and milk and milk products form developed countries. During 1989-90, Bangladesh imported milk and milk products worth 400 million Taka to meet a short fall of 40 percent of domestic demand. Bangladesh milk sector is failed to provide sufficient supply for liquid milk. To minimize this shortage government has taken some steps such as urgent meet up through imported powder milk and try to develop dairy farms to the private entrepreneurs’ levels. Only local dairy farm could not provide sufficient supply of liquid milk according to consumers demand. To fill up this gap there are a lot of companies launch in Bangladesh to sell milk powder product. One of them is DANO which is a familiar word for each household in rural and urban area in Bangladesh.

It is on of the widely used milk powder as Baby foods and other purposes in Bangladesh for last 30 years after liberation due to strong marketing strategy of the company .Now, it has been sold in Bangladesh with a current market share 20%, milk powder range is among the market leader. Due to expanded market, company has to adopt frequently changing marketing techniques. Last few years, marketing is playing an important role in enterprise development. This milk powder is a product of Arla foods of Denmark and it is packed and marketed by Mutual milk Products ltd of Bangladesh through license agreements .After liberation, industries of milk sectors are expanded due to ever increasing population, life style, cultures and other purposes.

During the last few decades after liberation a number of trading companies which is about eight in numbers entered into the milk market of Bangladesh. As a result, a strong competition has occurred among concern companies. So, consumers of rural and urban areas has access to a number of brands milk powder in Bangladesh milk market .Each of them has individual market strategy. So, marketing strategy of all individual company is completely different. Due to advancement of technology, knowledge, people Awareness Company has to change its strategy time to time. In a research paper it is found that the ever –expanding city of Dhaka used to get near about 115000 liters of milk Vita liquid milk per day.

Origin of the Report

This report is orientated as the course requirement of the Masters of Business Administration Program . Bangladesh. As the practical orientation is an integral part of the Masters of Business Administration degree requirement, I was sent to Arla Foods Ingredients, Bangladesh (DANO Milk Powder) to take the real life exposure of the activities of consumer products institution from May 12, 2009 to September 28, 2009.

Background of the Study

There are four semesters in MBA Program and final semester is the Dissertation program in any business organization. The program is an integral part of MBA degree requirement, students are sent to different organizations after completed of 12 coursed in the different institute & area of studies to expose them to earned real life management situation in the private organizations. The theoretical knowledge that we acquire from class lectures, books, journals, case study, seminar, project, workshop etc. is replenished in the practical setting. Here I also placed in Arla Foods Ingredients, Bangladesh program office for ‘Marketing problem and prospects of Dano milk powder in Bangladesh.’

Purpose of the Study

The report is prepared as partial requirement of the Masters of Business Administration Program of final term.

Objective of the Study

Broad Objective:

The broad objective of the study is to analyze the Marketing problem and prospects of Dano milk powder in Bangladesh.

Specific Objective:

i. To complete the required academic need.

ii. To find out the marketing planning procedures of Dano Milk Powder.

iii. To know the marketing control of Dano Milk Powder in Bangladesh.

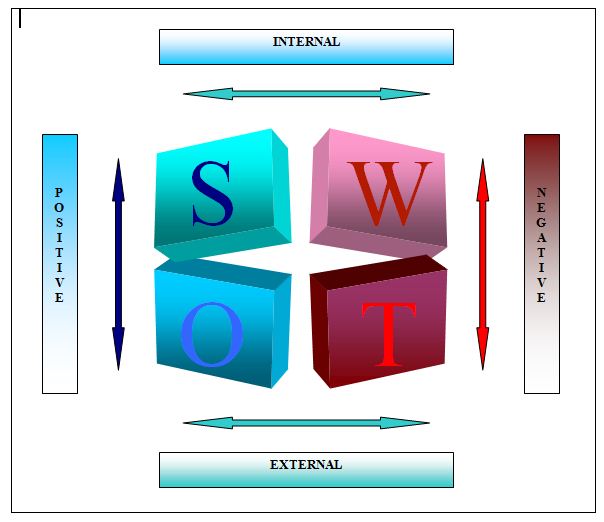

iv. To find out the strength and weakness of the marketing activities of Dano.

The objectives of the orientation are study various desk works of the Arla Foods Ingredients, Bangladesh and Mutual Milk Products Ltd.

Sources of Data Collection

The report is based on both primary and secondary sources of information. Interviewing the managers and officers of the Arla Foods Ingredients, Bangladesh, and Mutual Milk Products Ltd and employees of its competitors & customers has provided the primary sources of information. Further more the secondary sources of information are the different annual reports kept in the different journal.

Scope of the study

Dano Milk Powder is one of the leading products in Bangladesh. The scope of the study is limited to the Arla Foods Ingredients, Bangladesh and Mutual Milk Products Ltd. The report covers the organizational structure, background, functions and the performance of the organization.

Methodology of the Study

For the procedure of different department operations, I had observed the operations and worked with the Officers at the same time. I had interviewed the Arla Foods Ingredients, Bangladesh and Mutual Milk Products Ltd Officials for getting more information.

For the analysis part, data have been collected from different statements and the annual reports of the organization.

Limitation of the Study

The following limitations are apparent in the report—

a. Time is the first limitation as the duration of the program was of three months only.

b. Another limitation of this report is Arla Foods Ingredients, Bangladesh and Mutual Milk Products Ltd policy of not disclosing some data and information for obvious reason, which could be very much useful.

Chapter 2

AN OVERVIEW OF DANO

An overview of Dano milk powder history in Bangladesh

Dano Milk powder is the leading milk powder product in the Bangladesh. Dano was introduced in the market in1962 by MD Foods all over the world. MD Foods is a Danish company and operation business in European market Some of Bangladeshi (Former East Pakistan) businessmen were imported Dano milk powder from Denmark in 1962. Basically their market was whole sales point like Moulovi Bazar base. They distribute Dano milk powder all over East Pakistan. They continue their import Dano as scattered from Denmark till 1970. MD Foods was recognized one Bangladeshi person as intender in 1973. Bangladesh indenter was collected & identifies importer demand and authorized indent of importer letter of credit from Bangladesh to Denmark till 1994.

In 1989, MD Foods was setup liaison office in Bangladesh. MD foods basically monitor the market by various activities like sales promotion (Both for consumer & Traders) and advertisement in print and electronic media.

In 1995, Mutual Trading Ltd was got import license of Dano milk powder from Denmark as an exclusive importer in Bangladesh. Mutual Treading Ltd. is only one Bangladesh Company, who can import Dano milk powder from Denmark.

In 1995, Arla foods take over MD foods and merger new company name as Arla Foods Ingredient. Arla Foods Ingredients owned Dano milk powder all over the world.

In 1998, Mutual Trading ltd was setup new factory in Bangladesh for packing of Dano milk powder product as per Arla Foods recommendation and Mutual Trading Ltd changed company name as Mutual Milk Products Ltd.

History of Arla Foods Ingredients, Bangladesh

The two companies behind Arla Foods, the Danish MD Foods and the Swedish Arla, are both rooted in the co-operative movement.

MD Foods (Denmark)

The first Danish cooperative began in Hjedding in Jutland, in 1882. in the following decades, the number of cooperative dairies rose dramatically so that by 1945, there were 1650 cooperative dairies throughout the country.

1963: The concept of a nationwide dairy was aired for the first time.

1970: Mejeriselskabet Denmark (MD) was established on October 1 by four dairy groups and three individual dairies. Initially, MD had a milk volume of 384 million kg.

1978 and 1979: Total milk received exceeded 1 billion kg for the first time.

1970 and 1980: Dairies and dairy companies across Denmark joined MD Foods through mergers or acquisitions.

1988: the company changed name to MD Foods.

1989: MD Foods International A/S was formed for the purpose of acquiring dairies abroad.

1990: MD Foods International made its first acquisition: Associated Fresh Foods- The UK’s fifth largest dairy company.

1992: MD Foods and Denmark’s second largest dairy company Kløver Mælk signed a financially binding cooperation agreement. MD Foods International made further acquisitions in the UK.

1999: MD Foods merged with Kløver Mælk to gain 90% of the Danish milk production.

Arla (Sweden)

In Sweden, the Arla name dates back to 1881 when the first cooperative was formed at stora Arla Farm in Västmanland under the name Arla Mejeriförening.

1915: The Company’s history began when Landtmännens Mjölkförsäljningsförening was formed. The name was later changed to Mjölkcentralen. Subsequent years saw a substantial number of larger and smaller dairies merging with Mjölkcentralen.

1970: In connection with a number of mergers in the early 1970s, it was proposed that the company should have a new common name.

1974: The name Mjölkcentralen Arla was registered, it was changed to Arla the following year.

1992: Arla took a stake in the Copenhagen-based dairy, Enigheden, owned by Kløver Mælk of Denmark.

1992: Arla took a stake in the Copenhagen-based dairy, Enigheden, owned by Kløver Mælk of Denmark.

Arla Foods

1995: MD Foods and Arla began to cooperate.

1999: MD Foods and Arla announced merger plans.

2000: Arla Foods amba was formed on April 17.

Vision of Arla Foods

“Our vision is to be the leading dairy company in the world through considerable value creation and active market leadership to obtain the highest possible milk price.”

Our aim is to maximize the price paid for our owners’ raw material – the milk. To achieve this objective, we are committed to creating added value and demonstrating proactive market leadership. Being market leader means a strong negotiating position. We wish to be the most attractive dairy company for our owners and employees and for our customers and suppliers.

First and foremost, added value is about generating added value for our farmers in the form of a high milk price and creating confidence in the company. Added value, however, is also vital for meeting consumers’ and customers’ requirements for inspiring, safe and healthy dairy products. Active market leadership embraces competitiveness through competitive prices, products and service. However, we must also be pro-active in terms of our ethical guidelines and demonstrate our respect for the surrounding world. This is part of our responsibilities as market leader.

Mission of Arla Foods

“Our mission is to provide modern consumers with natural milk-based products that create inspiration, confidence and well-being.”

Our task is to meet your wishes and requirements. By doing so, we create the greatest possible value in the market and maximize the price paid to our owners for their milk.

“Our Mission” signals that our owners and the company share a common mission. The work to create value for modern consumers begins at the farm where we source our raw material. One of our strengths is that we provide food products under conditions where we control the entire value chain from cow to consumer. We believe that modern consumers are looking for variation, innovation and inspiration as well as naturalness and safety. All are key concepts for Arla Foods – and all represent the values that we strive to deliver each time you purchase one of our products.

“Milk-based food products” signals that milk is the most important raw material in our products. Other raw materials are also part of our products, of course, but milk is, and will continue to be, the basis of all our products. To create inspiration and enjoyment at every meal time is crucial for Arla Foods. To meet your requirements for accessible and open information about the nutritional content and health value of our products to ensure that you benefit from a well-balanced diet is important to us, too. We wish to create a sense of security and well-being by offering you dairy products of the highest quality where food safety is second to none and where our products are produced in an ethically sound and sustainable way.

Foods Safety& Environment of Dano Milk Powder

Holistic Approach

Arla have set meticulous standards for food safety throughout the food chain, which means that Arla engage everyone, from our milk suppliers to consumers, in our food safety commitments.

Knowledge

Arla keep ourselves abreast of food safety developments and ensure that we have the information and knowledge required to take preventive action.

Product Quality

Arla deliver products and ingredients, which comply with the necessary standards and specifications.

HACCP (Hazard Analysis and Critical Control Point)

Arla maintain control over hazards in the manufacturing process by using a well functioning Hazard Analysis and Critical Control Point system and by empowering skilled employees.

Foreign Substances

Arla prevent and protect our consumers from being injured by foreign items and substances in our products.

Hygiene

Arla offer safe products by using hygienic processes and facilities and by following clear routines for personal hygiene.

Production Facilities

Arla meet or exceed relevant standards when maintaining and cleaning buildings and equipment to ensure food safety throughout the supply chain.

Pest Control

Arla keep our premises free from pests by means of a proactive program.

Traceability

Arla have systems for tracing raw materials, ingredients and end products.

Product Recall

If Arla detect a problem with our products we protect consumers by recalling products that are judged to be hazardous to health.

Allergies

To enable consumers to make an active choice we declare the ingredients of all of our products. Arla maintain up-to-date knowledge of allergies and have robust purchasing and production procedures that prevent contamination.

Environment

Products

Arla strives to continually reduce the environmental impact of our products.

Plant

Arla design new facilities and procure equipment to meet or exceed relevant environmental standards.

Resources

Arla saves energy and reduce material consumption by continually monitoring and optimizing our operations.

Recycling

Arla reduce waste from our operations by maximizing the reuse, recycling and recovery of materials from our waste streams.

Suppliers

Arla challenge and encourage our suppliers to develop and deliver products and services that exceed their environmental standards.

Stakeholders

Arla meet the aspiration of our stakeholders and regulatory authorities by embracing our environmental responsibilities.

Climate Change

Arla contribute towards a reduction in global warming by striving to continually reduce their greenhouse gas emissions.

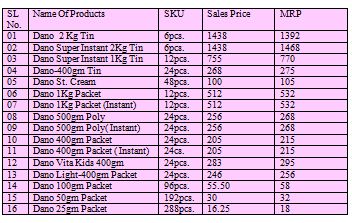

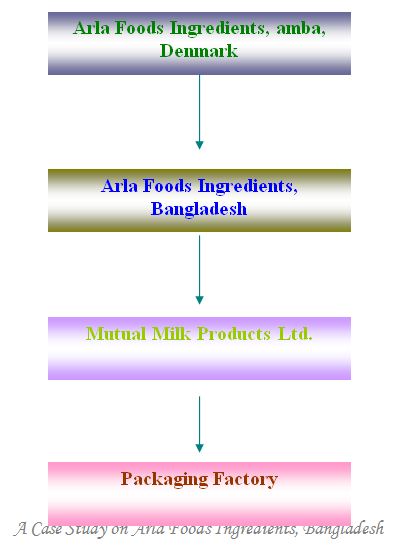

Operational System in Bangladesh

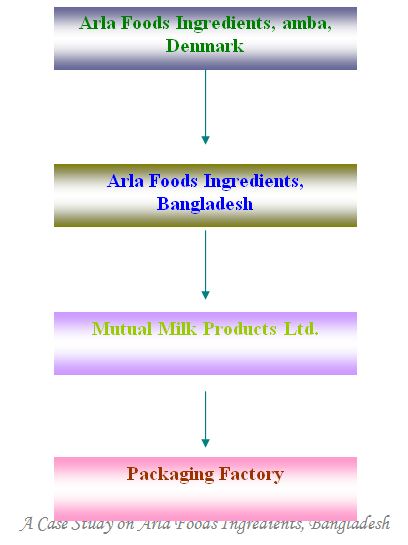

Basically Arla foods Ingredients amba monitor Bangladeshi market by their liaison office of Arla Foods Ingredients, Bangladesh have to take over all marketing functional activities for occupying their product and share in market. On other hand, Arla foods set up packing factory finance by Mutual Milk products ltd. They can packet only for 1 Kg, 500gm. 400gm, 100gm, 50gm and 25gm packet milk Arla have a separate product supervisor, who can monitor packing system and product quality.

Operational System in Bangladesh

Basically Arla foods Ingredients amba monitor Bangladeshi market by their liaison office of Arla Foods Ingredients, Bangladesh have to take over all marketing functional activities for occupying their product and share in market. On other hand, Arla foods set up packing factory finance by Mutual Milk products ltd. They can packet only for 1 Kg, 500gm. 400gm, 100gm, 50gm and 25gm packet milk Arla have a separate product supervisor, who can monitor packing system and product quality.

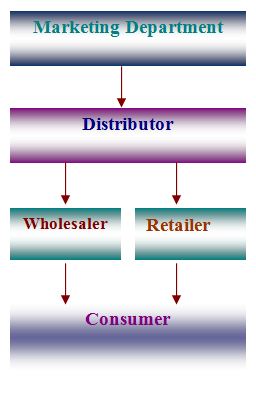

In this flow chart show, Arla foods have given an annual sales target to Mutual Milk Products Ltd and product directly import by L/C from Denmark according to the Arla Foods, Bangladesh instruction. Mutual Milk products ltd. is to operating packing factory after received product from Denmark

Arla foods ingredient Bangladesh deals all the marketing functions activities including pricing, packing design, advertisement, market development and finally monitor over all sales in Bangladesh. Mutual Milk Products ltd. is to recruitment distributors for sales Dano products all over the country. Here Arla and Mutual is to jointly market monitor by their staff. All theses staff are monitor distribution sales activities and reported submit to the regional executive about the distributors’ performance.

Marketing Activities Flow Chart in Bangladesh

Major Competitor Brand & Company profile.

Sl.no. | Brand Name | Country of Origin | Marketing by |

01 | Dano | Denmark | Arla Foods & MMPL

|

02 | Nido | New Zealand | Nestle Bangladesh |

03 | Red Cow | Australia | New Zealand Dairy Products Ltd. |

04 | Anchor | New Zealand | New Zealand Dairy Products Ltd. |

05 | Diploma | Australia | New Zealand Dairy Products Ltd. |

06 | Farmland | New Zealand | New Zealand Dairy Products Ltd. |

07 | Kwality | Australia | Sanowara Corporation |

08 | Marks | Australia | Abul Kair Bhuiyan |

09 | Starship | China | Abul Kair Bhuiyan |

10 | Fresh | China | Tanvir Foods ( Megna Group) |

11 | Milk Vita | Bangladesh | Bangladesh |

Introduction

Dano milk powder products are marketed all over the country through established strong marketing network to ensure sufficient supply the product to the distributors warehouses by pick-up van, contact private transport agencies. After receiving the product, distributors provide this product to wholesalers and retailers outlets as per company’s legislation. It is mention here that distributors pay their money through demand deposit (DD) at Head Office after they get products as per demand deposit (DD). All distributors should sale company product according to company’s targeted plan and should achieve this target.

To operate smooth business the company has divided its entire market into eight regions these are- Dhaka-A, Dhaka-B, Dhaka-C, Chittagong, Camilla, Sylhet, Khulna, Barisal and Rajshahi. All logistic support and Sales Representative (SR) are recruited and paid salary by the respective distributor except Dhaka-Metro and Chittagong-Metro that is fully operate by the company. Marketing activities are monitored by the company’s personnel of which Territory Officer to handle the distributor and monitor SR of the distributor in which Territory Officer is reportable to Regional Executive and Regional executives are importable to senior Marketing Manager. Sales Representatives arc trained up by the organizational training. In this regard all financial support provided by the organization. All SR are liable to the company and follow company rules & regulations.

According to company policy wholesalers, should keep large quantity of product than that of retailers where distributor supply the product with same price and it is strictly controlled by the company personnel through close monitoring. Retailer may collect these product from wholesaler while he faces shortage his product or crisis period because it is the running product of the market and close monitoring is a part of strong marketing channel which is continuous follow-up by higher authority of the company. In this connection those who are perform better they will get rewards and on the other hand who do not perform satisfactory company take necessary action in this regard.

Market Share

Aria Foods Ingredients’ milk powder products for retail sale are much more than milk powder alone. Consumer produce team is dedicated to meeting the nutritional needs of all age groups and ensuring that regional taste preferences are satisfied.

To achieve this goat, regular surveys to find out exactly what the consumers on specific markets want from milk powder, how they use it and how much they consume. The information obtained forms the basis for current consumer range and Future developments.

Mutual Milk Products ltd has divided its entire geographic market into 9 Regions; these are Dhaka-A, Dhaka- B, Dhaka-C, Chittagong, Comilla, Sylhet, Khulna, Barisal and Rajshahi. Product sells and market share are increasing with satisfactory level by the company targeted plan. Talented workforces are engaged in marketing activities to promote their brand and to increase sell lo the consumers.

DANO has been packed at an independent packing plant in Bangladesh since 1996 The success of this packing venture and prospects for further sales growth mean the time has come to invest in a packing plant built lo improve production flow and quality control processes and to give greater production flexibility and capacity. In this regard Mutual, AFI’s local distributor and packer, invested in the plant following j request from AFI which has seen sales of the market leading brand, Dano, quadruple in Bangladesh over the past four years. Focusing on one site offers greater quality, flexibility and efficiency and allows them to rapidly adjust their procedures to the market1 s requirements.

Market Share of Major Brand (2004-2008)

SL No | Brand Name | Yearly Market Share of % | ||||

2004 | 2005 | 2006 | 2007 | 2008 | ||

1 | Dano | 23 | 26 | 28 | 26 | 22 |

2 | Diploma | 14 | 15 | 18 | 17 | 14 |

3 | Nido | 9 | 10 | 11 | 12 | 8 |

4 | Red Cow | 7 | 7 | 8 | 9 | 7 |

5 | Anchor | 5 | 5 | 6 | 7 | 9 |

6 | Marks | 11 | 12 | 11 | 9 | 17 |

7 | Kwality | 6 | 4 | 7 | 6 | 8 |

8 | others | 25 | 21 | 11 | 14 | 15 |

Total | 100 | 100 | 100 | 100 | 100 | |

Sources: AC nelson Bangladesh yearly Report (2004-2008)

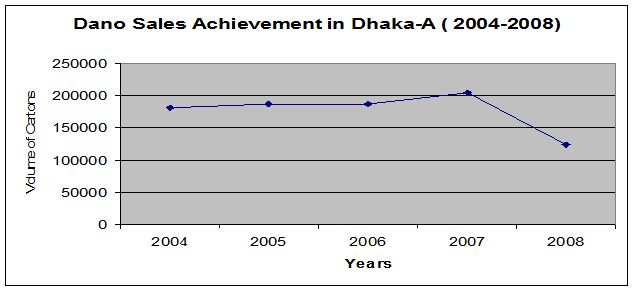

Dano Sales Volume & Market Share in Dhaka-A region since 2004-

Years | Cartons | Ton | % of Mkt Share in Dano |

2004 | 180957 | 1809.57 | 31 |

2005 | 187688 | 1876.88 | 33 |

2006 | 186734 | 1867.34 | 32 |

2007 | 204822 | 2048.22 | 38 |

2008 | 124378 | 1243.78 | 36 |

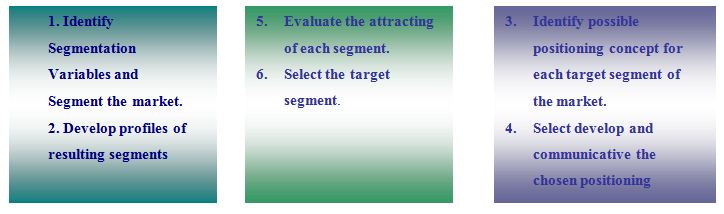

Market Segmentation and Positioning Strategy

To better meet the needs of specific groups of consumers, most marketers adopted a policy of market segmentation, which called for the division of their total potential markets into smaller, homogeneous segments for which they could design specific products and / or promotional campaigns. They also used promotional techniques lo vary the image of their products needs of certain target segments. In selecting the target segment, organizations usually follow any one of the following strategies:

* Single segment concentration

* Selective specialization

* Product specialization

* Market specialization

* Full market coverage

Based on analysis of marketing practice? Of Arla Foods’ it seems they are currently follows a “Product Specialization Strategy”. Aral Foods’ concentrates on making a certain product that it sells to several segments through the strategy of organization build up a strong reputation in a specific product area,

Steps in market segmentation, targeting and positioning

Factors needed

to

Segment the consumer markets of milk powder

1. Psychographics factors:

In psychographics segmentation, buyers are divided into different groups on the basis of social class. In respect of social class the customer can sub-divided into three groups these are- lower, middle, and upper,

2. Behavioral factors:

In behavioral segmentation, buyers arc divided into groups on the basis of their knowledge, altitude. Use or response to -a product in case of milk powder business, we will segment the customer market on the basis of business, benefit and loyalty status. Customers can be sub-divided into three groups according to their loyalty status.

• Hardcore Loyal: Consumer who buy? One brand Jill the time.

• Shifting Loyal : Consumer who shift tram favoring one brand to another.

• Switchers : Consumer who show no loyally to any brand.

Each market consists of different numbers of three types of buyers. A brand loyal market is one with a high percentage of hard-core brands.

3. Demographic factors:

Demographic segmentation consists of dividing the market into groups on the basis of demographic variables such as age, income, occupation etc,

• Age

Customer’s needs, wants and exceptions differ according to their age Although Aria Foods’ milk powder product team is dedicated to meeting the nutritional needs of all age groups and ensuring that regional taste preferences are satisfied. In case of assigning the range from below 14; 15-24; 25-34; 35-44; 45-54 and above 54.

• Income

Income segmentation Is another long-standing practice in such consumer product as milk powder. Income does not always predict the best consumers for a given product. It is found from market survey that major milk powder users are in this income level these are: 6000-9999; 10000-15999; 16000-20999; 21000-25999 and above 26000.

* Occupation

Present study found that the major occupation of powder milk users of Bangladesh are-Student, Service, Business and Housewife.

4. Geographic factors:

Geographic segmentation calls for dividing the market into different geographic units. At present Mutual Milk Products ltd. Local distributor of Arla Foods’ has divided its entire geographic market into eight major marketing regions.

Major marketing regions of Dano milk powder in Bangladesh.

| SL No | Region | Area/Location |

| 1 | Dhaka-A | Dhaka Metro & Tongi |

| 2 | Dhaka-B | Narayangong, Munshigong, Keanigong, Norsindi, Sreenagor, BhirabNawabgong, Kishorgong. |

| 3 | Dhaka-C | Savar, Gazipur, Manikgong, Tangail, Jamalpur, Goforgaon, Netrokona Mymensing. |

| 4 | Chittagong | Chittagong Metro,Swandip,Sitakundu,Nazirhat,Potia, Rangamati,Rangamati,Lohagora,Cox’s bazar. |

| 5 | Comilla | Comilla,Laksham,Chandpur, B.Baria,Chowmuhani, Feni, Laximpur. |

| 6 | Sylhet | Sylhet,Moulovibazar,Srimogal,Inathgong,madhabpur,Hobogonj. |

| 7 | Khulna | Khulna,Jessore,Jhenaidah,Kaligonj,Narail,Kustia,Chuadanga,Magura,Rajbari,Faridpur,Bhanga. |

| 8 | Barisal | Barisal,Bhola,Torkey,Madaripur,Takerhat,Shibchar,Gopalgonj,Shariatpur,patuakhali,Borguna,Pirojpur, Jhalokathi. |

| 9 | Rajshahi | Rajshahi,Nator,Pabna,Sirajgong,Bogra,Naogaon,Gaibanda,Rangpur,Dinajpur,Thakurgaon,Sayedpur,Lalmonirhat. |

Segmentation and Target Consumer Market of Dano

Types of Variable factors | Empirical factors | Target Areas |

Geographic factors | Region | Dhaka-A, Dhaka-B, Dhaka-C, Chittagong, Comilla, Sylhet, Khulna, Barisal, Rajshahi |

Demographic Factors | Age | Below 14;15-24,;25-34;35-44;45-54; and above 54 |

Income | 8000-10000; 10000-16000; 16000-20999, 21000-25999; above 26000. | |

Occupation | Student, Service, Business and Housewife. | |

Psychographics factors | Social | Lower, middle and upper, |

Behavioral factors | Benefit, Loyalty Status | *Hard Core loyal *Shifting loyal *Switchers |

Positioning Strategy of Dano Milk Powder

The purpose of planning is to design the country’s offer so that it occupies a distinct and valued place is the target customer’s minds. Positioning is one of the integral parts in the act of differentiation. Its purpose is to differentiate the company’s offer from that of the competitors. For Arla Foods’, the positioning & differentiation of its product is even more important to continue the previous good quality of the product of the company to reemphasizes their distinct marketing approaches features and practices. Furthermore the company continues to enjoy existing brand loyalty among its customer. Over the year, company has built on image of itself as a high quality performer. So, Arla Foods’ should pursue as positioning strategy, where to achieve the right of positioning, Arla Food’s should differentiate its ‘offer’ in the following fronts.

1. Product differentiation

2. Image differentiation

3. Service differentiation

1. Product differentiation

Features arc a competitive tool for differentiating the company’s product. Some features are as follows’

* Arla Foods nutritional experts working close co-operation with food manufactures to incorporate particular dietary advantages in their products, often the specific needs of defined customer groups: infant formula for babies. Drinks for the highly active, clinical nutrition for those suffering or recovering from illness and fortified foods for people with special nutritional needs. All ingredients are subject lo extensive clinical tests which confirm their nutritional value.

The high quality and excellent flavor of Dane milk powder products are the result of a closely supervised production process that starts even before the cows are milked. The criteria for measuring the quality of Dano milk powder is the good taste and smelt, no residue, and easy to digest.

* Production plants have Kosher and Halal certificates that means products are approved for Kosher or Halal use.

* Instant milk powder is more rapidly soluble. The difference between instant and regular milk powder is mainly the larger milk powder grain size which is obtained by various Spray drying system.

* The benefit of B12 in Dano is essential for normal blood formation and neurological functions.

* Dano milk powder is 100% free of artificial additives and preservatives.

* Guarantees the health of Danish cows and the safety of Dano milk powder are performed strict and regular veterinary control.

2. Image Differentiation

Aria Foods’ promotes its image as a quality performer. The singular message must be expressed in symbols, written and audio / visual media, atmosphere and events. Here we review [heir major media for linage communication.

• Symbols:

A strong image consists of one or more symbols that trigger company or brand recognition. The company and brand logos should design for instant recognition. Aria Foods’ should promote their symbols in such a way that it will be synonymous with the Quality performance of the company.

• Written and audio / visual media:

The chosen symbols must be worked into advertisements that convey the personality of the company or brand. The acts will attempt in establish a story line, a mode, a performance level something distinctive. The message should be replicated in other publications, brochures, and catalogs. The company’s stationary and business cards should reflect the same image tone the company wants to convey.

• Atmosphere:

The physical spaces, in which the organization produces or delivers its products, become another powerful image generator. Accordingly the interior designs of other and atmosphere of the building should pose image of high technology and quality performer. A customer visiting company office should watch a hassle free working environment.

• Events:

A company can create an image through the type of events it sponsors as well as social events which would help to define the image, status and quality of Aria Foods;.

3. Service Differentiation

Aria Foods’ can find many other ways to add value through differentiate its services to give their customers. The service they provide needs to be as specific to individual customer as possible. To this end, they have divided their activities among four units, committed to maintaining the most up-to-date knowledge and skills relevant to their market segment.

a) Ingredient sales

b) Industrial Ingredient

c) Consumer product

d) Contract manufacturing

a) Ingredient sales:

Nor all customers need the technical service that goes along with their tailor-made solutions. Arla Foods’ international network of local representatives ensures easy contact lo customers round the world. And, because they understand exactly how important it is for supplies to arrive punctually and in superb condition, they1 have developed a sophisticated logistics system – guaranteeing reliable, on-time deliveries of ingredients that are fully in accordance with local legislation.

h) Industrial Ingredients;

To provide the customers with the best possible service, they have divided this sector of their business into three business units-each one accommodating the specialist expertise and facilities relevant to their application area.

c) Consumer products:

Arla Foods Ingredients* milk powder products for retail sale are much more than milk powder alone. Consumer product team is dedicated to meeting the nutritional needs of all age groups and ensuring that regional taste preferences are satisfied. To achieve this goal, they conduct regular surveys to find out exactly what the consumers on specific markets want from milk powder, how they use it and how much they consume. The information obtained forms the basis for current consumer range and future developments.

Target Market and Potential

Aria Foods’ milk powder products are marketed under the brand names of Dano. Dano milk powder provides a series of functional and nutritional properties, making it widely used both as an ingredient in food and dietetic products and in its own right as a consumer product, Company want to hold their existing market and increase sales through Company strategy. To achieve this goal product breadth should be increased through satisfied consumers need. In this connection company’s ranges of milk powder products and its functions arc as follows:

ì) Full cream milk powder – the family’s choice

Give your family the essential energy and nutrition they need with Dano full cream milk powder. Available in Regular and Instant versions, this highly nutritious product has an identical composition to liquid cow’s milk – not to mention an authentic creamy taste. Dano full cream milk powder is also rich in vitamins A and D3 and contains a high level of calcium, essential for development, growth and the maintenance of bones and teeth.

ii) Kinder – for a good start in life

Children love the delicious creamy taste of kinder products. Specially formulated for children need between 1 and 5, this Instant milk powder is a balanced source of nutrients vital to physical and mental development. In addition to the nutrients naturally present in . Kinder 1-5 contains iron and extra vitamins.

iii) Hi & Low – the taste of healthy living

Instant Hi & Low has been specifically developed for consumers of all ages who priorities a healthy lifestyle and require a nutritious low-fat milk powder with the rich, creamy flavor of milk. Products meet all those requirements with an extra supplement of natural milk calcium and vitamins A and D3 thrown in. Just two glasses a day are sufficient to obtain the recommended daily intake.

iv) Sterilized canned cream

In addition to powder products. Company supply sterilized cream with all the natural, rich flavor of fresh cream,

Contract manufacturing teams are dedicated to seeing each alignment through all phases of development to production, packaging and dispatch. Give the label design and coordinate the production of tailor-made tins, boxes, bags and cartons based on the most

They employ the latest business systems, ensuring efficient project co-ordination and optimum prices for customers. Company develops products that meet the nutritional needs of all consumer groups – children, adults and the elderly alike. Some of their products have also been developed for hospital nutrition.

The company represented by an eye-catching stand, providing a prime opportunity to inform consumers about the nutritional brand and the new growing-up milk powder DAVO & Vita Kids. Core business in sight of Aria Foods Ingredients identifies functional milk proteins, nutritional products and bakery concepts as main growth areas. An ambitious growth plan is reshaping Aria Foods Ingredients’ strategy and placing renewed focus on the milk proteins market. Within functional milk proteins, the ice cream and dairy sector remain important growth sectors, A range of pre-packed milk powder products that meet the nutritional needs of all age groups, DANO is distributed to retail outlets throughout the country.

Application area of Dano milk powder nutrition is the prime basic supply for pregnancy, childhood, old age illness and recovery or sheer active living – these are times when need to pay more attention for diet. Arla Foods Ingredients special milk proteins fractions and minerals are designed to make that simple highly soluble, stable and with good dispersion properties, they promote the inclusion of dietetic benefits in a broad assortment of food products – targeting the consumers who need them most.

Company inspirational concepts are developed by company own initiative, but they also often work on development projects in close co-operation with a customer. In developing new nutritional ingredients and solutions, company specifically address the needs of the consumers who can gain from them.

Company target market focus on four main areas

i) Mother and child

ii. Active living

iii. Healthy recovery

iv. Conscious consumer

i) Mother and Child:

The right nutrition of the right quality is paramount throughout life, In infancy it is more important than ever. Far the new-born child, proteins are important building blocks for healthy growth. But sometimes the best source of this nutrition – maternal breast milk – is nut available.

As children move away from pure milt to an alt-round diet, they still need a well-balanced intake of nutrients. Milk proteins and minerals are of paramount importance in ensuring the healthy growth and development of muscles and bone mass. Nutritional ingredients serve as perfect supplement in a wide range of appealing food products – providing children with essential nourishment throughout the growing years.

In pregnancy, the body undergoes more changes than at any other time and, naturally, j nutrition-rich diet is crucial calcium and casein phosphor peptide, the latter promoting calcium uptake; provide an ideal means of enriching a basic diet during pregnancy and the breast-feeding that follows.

ii) Active living:

Professional sports people who push their physical performance to the extremes deplete their energy reserves and degrade their muscular balance, creating a need for an extra supplement of energy and protein. Before, during and after sporting activity, it is essential for the body to receive the right fuel to keep on going and the optimal nutrients to minimize bodily wear and tear.

iii) Healthy Recovery:

The nutrient requirements of” the human body change in extreme situations. Illness, physical or psychological trauma and major bums can deplete the body’s nutrient stores and, when combined with a loss of appetite, result in a life-threatening condition.

As we grow older, our general slate of physical well being becomes even more dependent on (he lifestyle and eating habit we choose to adopt. A die! that adapts to these changing physical requirements is an important means of maintaining good health in the third age and warding off illness and diseases, a number of which are lifestyle and die I related.

iv) Conscious Consumer:

Busy people need energy and strength so they can give their best at work and play, Mental challenges and everyday stress put the body and mind to the test – and that calls for an additional helping hand in the form of well-balanced nutrition.

But with many active people consuming at least one meal a day on the move, maintaining a healthy diet today is no easy task. A growing focus on health issues, dietary supplements, meal substitutes and functional foods means consumers increasingly demand convenient foods that meet all their nutritional requirements.

From the above all segments consideration milk powder market is expanding with time through change of consumers taste of fashion, out looking, purchasing behavior, attitude, diversification use and necessity product of daily life,

Promotional Strategy

Of the marketing mix (product, price distribution and promotion) promotion certainly occupies a very important position. Promotion is vital to any firm because it is used to inform, persuade and remind the market of the product’s availability, like the marketing mix there is also n promotional mix made up of personal selling, -advertisement, sales promotion, publicity and public relation are used sparingly. The reliance on advertisement is understandable. From the market perspective, DANO milk powder is widely dispersed, and its range of customers is greatly varied. According to these reasons it is more meaningful to use advertisements and sales promotion rather than personal selling or other promotional mix.

DANO milk powder promotion is aimed at two pinups of people.

DANO milk powder promotion is aimed at two pinups of people.

i) Consumer promotion:

Consumer promotion plays a vital role on product selling because consumers are main users. To keep their attention and to grow intention to purchase this product through lucrative prizes through scratch card while a consumer may get a Refrigerator, TV, Radio, etc. and another promotional strategy is used for produce are used within the product package.

ii) Trade promotion:

Trade promotion is undertaken to stimulate the middlemen’s (market Sales go up in Bangladesh as retailers aim for big DANO prizes. Shop owners cleared their shelves, stacked them high with DANO milk powder and decorated their entire premises with DANO posters and festive lights for a DANO display competition. Participation alone was rewarded with a DANO t-shirt and dock, but bigger prizes were also at stake, including a trip to abroad (India) an incentive that inspired a strong competitive spirit among local retailers.

Part of a high profile campaign in Bangladesh, the competition was backed by a series of television commercials which have brought DANO to the attention of consumers across the nation, It involved a lot of hard legwork by company sales team in the country but, in the end, the local people had never seen anything like it. Prizes were awarded at a special reception to the retailers with the most eye-catching displays and best DANO sales figures. Newspaper coverage of the event was another feather for the prize-winners.

Whether you’re the kind that sticks to the traditional or the kind that prefers the newest variation, the DANO milk powder range has something for you. Such was the message to consumers in Bangladesh during Aria Foods Ingredients’ latest DANO promotion.

The display contest run in Bangladesh at [he same time as the Television campaign increased the focus on DANO, both among consumers and retailers. Shop owners, who received free DANO gifts just for participating, stood to win a series of attractive prizes if their DANO display was judged to be among the most creative, varied and prominent and resulted in high sales.

Distribution Channel and System

Marketing creates utility of time, place and possession. Possession utility is created when the title in the products that is the ownership of the products are transferred to buyer. Distribution is that marketing activity which creates these utilities. But it is not end in end in itself. Distribution does not mean only the transfer of ownership but is also indicating physical transportation of goods to the place where they are needed; Distribution also includes the inflow of raw materials. In a word without distribution activity marketing is meaningless.

Channel of Distribution:

Channel of distribution is the set people and the firms that facilitate the flow of finish goods from (he producer to the ultimate consumers. That channel consists of producers, middlemen, and customers.

The Marketing Department and the Production Department activities are highly created. According to the needs of the Marketing Department, Production Department carries out the DAMO milk powder manufacturing.

The Marketing Department forecasts the sales volume of the DANO milk powder for the coming business year and based on this prepare a marketing plan known as the Sales Operational Plan (SOP). According to the plan, Marketing Department communicates the sales target for each month to the Production Department. Based on the Sales Operational Plan ISOP), Production Department sets its production schedule. The inventories of milk powder are also evaluated at this stage to find out the actual output to be produced. Mutual Milk Ltd. has a well-defined mission for the marketing and distribution of products, which is to reach the target consumer in the most efficient manner by becoming the supplier to the trade within the strategic channels in every market where the company operates.

A well-organized trade marketing team is working continuously to make this mission successful; furthermore the whole country has been divided into eight regions to perform the marketing activities efficiently. Moreover the regions are further spitted in 77 areas. Right now there are 8 Regional Executives, 31 territory officers working under the Marketing Manager, at present there are 77 distributors who arc responsible to make the DANO milk powder product of the company available through out country.

The company sells their product to the distributors; in turn the distributors sell to the wholesalers & retailers. Wholesalers are needed because at limes the retailers may not have the adequate funds to buy the required quantity.

Distribution Channel of DANO milk powder in Bangladesh

Regional Godown:

There are 5 Regional Godown through out the country to fill every regional demand just at the time of need, and to overcome various uncertainties related to physical distribution of products, every regional Godown is directly controlled by Logistic Department of Headquarter to face the regional physical distribution challenge.

Distribution Warehouse:

All distributors have their own warehouse, where DANO milk powder product tin be kept safely while degrading its product quality. Distributors buy the product from The Company. Company takes all the responsibility before receiving the product by the distributors to their warehouse and all responsibilities of the products go under the distributors.

Internal Carrying Agent:

There are two types of carrying agent’s name Pick & Drop and Five Star transports are used to provide the product from central godown to distributor’s warehouse. Pick & Drop transport is engaged lo provide the product to distributor’s warehouse almost of the country. On the other hand Five Star transport is engaged to provide the product almost 5-6 distributors warehouse of the country.

Delivery Van:

AH the delivery van arc owned by the dealers to assure the supply of DANO milk powder on the door of wholesalers & retailers just according to their demand. According lo product capacity ^. there are two types of delivery vans are used in the Dhaka City where the capacity of vans are 80 cartoons (768 kg) and 120 cartoons (1152 kg). There are also two types of delivery vans are used out of Dhaka dry one is Rickshaw Van and another is three wheeler / Scooter Van.

Wholesalers:

Wholesalers are the ends of physical distribution system of DANO milk powder selling the product directly to the consumer. Sometimes sell the product lo the retailers to cover the shortage of the product.

Transport:

There are two private transport are used in the distribution system for long distances and ensure the product to the distributor’s warehouse according to their need The company provides all expenses before receiving the product by the distributors to their warehouse. Transport agencies are settled by the contractual agreement between the Agency and the Company. This agreement renews every year through fulfilling smooth delivery of [he product to distributor’s warehouse. After loaded the products from company’s warehouse till liabilities such as damage or broken of the products should be taken by the transport Agencies before receiving the product to distributor’s warehouse.

Distributors:

To make a company distributor at first Territory Officer to collect necessary information and provide these information to his Regional Executive. In this regard Regional Executive physically checkup/ inventory ail documents of a proposed distributor. The financial standing of the distributors, their reputation in the local region and prior related business experience are some of the key criteria examined when a distributor is primary selected. The Regional Executive of marketing prior to making a decision to check [he evaluation forms and field recommendations. After a distributor is selected, they are issued a “letter of intent” that specifies certain requirements of the company. After these requirements are satisfactorily fulfilled, a formal “letter of appointment” is issued. Distributors buy fixed volumes of Dano milk powder from the company at a set price and resell to the wholesalers & retailers. The company closely monitors their activities and performance and ensuring them to operate in the market at the highest standard. Distributors follow a routine work set by the company plan.

Retail outlet classification

Arla Foods’ distributor of Dano milk powder in Bangladesh Mutual Milk Products ltd. has classified all the retail outlets into four categories, these are – Category ‘A’; Category ‘B’– Category ‘C’; Category ‘D’ and Category ‘E’ This category based on the purchasing power of the product by the retailer for stock sale.

Category ‘A’:

In this category those who are able to purchase all pack sizes of Dano milk powder including all products, canon range would be minimum 5 carton and above which Value range of Tk. 15000,00 and above on weekly basis by cash in hand. Outlets are in this category such as Departmental Store, Supermarket, etc.

Category ‘B’:

In this category those who are able to purchase all pack sizes of Dano milk ponder including all products, carton range would be minimum 3 cartons to 5 cartons which value range of Tk. 8000.00-15000.00 on weekly basis by cash in hand. Outlets are in this category such as Grocery shop. Semi wholesale shop, etc.

Category ‘C’:

In this category those who ere unable to purchase ail pack sizes of Dano milk powder but they only purchase on need basis which value range of Tk, 2000 00-8000 00 on weekly basis by cash in hand. Outlets are in this category such as Grocery shop, Perfect Retailer, etc,

Category ‘D’:

In this category those who are unable to purchase all pack sizes of Dano milk powder but they only purchase on demand basis, which value range of Tk. 1000.00-2000.00 on weekly basis by cash in hand. Outlets are in this category such as Grocery shop. Perfect Retailer, etc

Category ‘E’:

In this category those who are unable to purchase all pack sizes of Dano milk powder bur they only purchase on demand basis which value range below Tk 1000.00 on weekly basis by cash in hand. Outlets are in this category such as Grocery shop, Perfect Retailer, etc.

SWOT ANALYSIS

Strength

Wide Recognition:

Aria Foods Ingredients is an independent, company within Aria Foods, Europe’s largest dairy group. It gives !he strength and solidity of a large organization and, al the same time, the flexibility of a much smaller business, enabling us to react promptly and efficiently to customer needs.

Company production capacity is extensive, as is the pool of professional experience and expertise on which it depends. At present, company have .seven plants in Denmark, four in Sweden and a new functional milk proteins plant in Argentina, which began serving the South American food industry in June 2002.

International Brand Image:

hi many parts of the world, DANO milk powder brand ii, household name. The market leader in Yemen and well established in Bangladesh, DANO is widespread in many Middle Eastern countries.

Talented Workforce:

Aria Foods Ingredients employs more than 1,700 people worldwide, selling more than 301,000 tones of powder milk products a year to some 100 countries. Mutual milk Products ltd. distributor of Aria Foods Ingredients established a packing plant in Bangladesh on December 2004. The packing plant employs 40 talented workforces with another 10 to come. Talented workforces are engaged in marketing activities to promote their brand and increase sell to the consumer,

Superior Technology:

Ongoing research continues to reveal new ingredients and new opportunities to use them. Within company research and development department, company project managers, technicians and laboratory assistants are dedicated to anticipating the future needs of the market and optimizing the products and production processes of Market and optimizing the products and production processes of customers. Company modem laboratory facilities in R&D are complemented by the advanced facilities with their application centers. Here, formulations and processes are thoroughly tested at every stage of production ironing out any potential problem before commercial production begins. Just the guarantee their customers need when launching a product on the highly competitive foot and beverage market.

Better Product Quality Relative to the Rivals;

As mentioned earlier Aria foods’ maintains its consistent high quality and excellent flavor of Dano milk powder in production process through superior technology, thus Dano milk powder is always in an advantages position compare lo its competitors Presently new packing plant establish in Bangladesh lo meet up demand of consumers of their competitors do not have the packing plant.

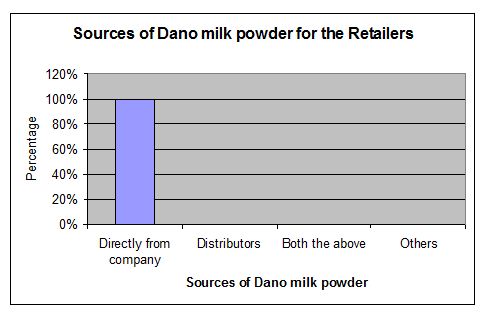

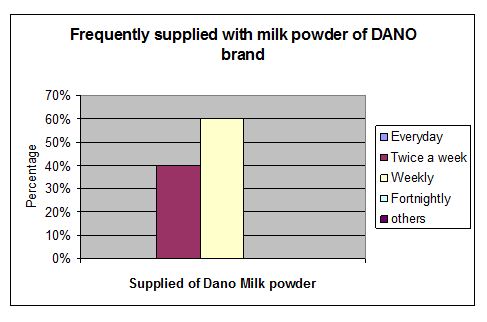

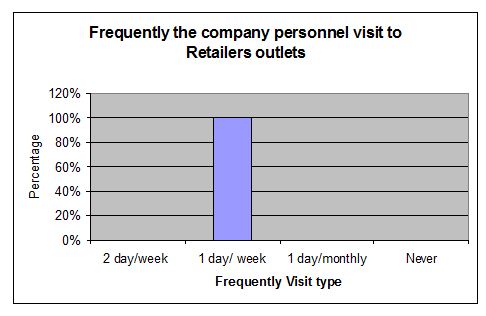

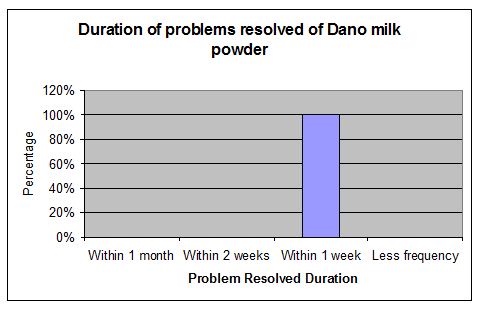

Distribution System:

Distribution system of Dano milk powder to the retailer’s outlet throughout the country is maintained proper channel and frequently company personnel visit to retailer’s outlets one day per week. A market survey report found that retailer’s positive attitude about satisfaction with current procedure of distribution system of the company.

Team Work:

Marketing is a networking system of which ream work is essential part to achieve the organizational goals. Team works of the company is another strategy to operate smooth business by the organizational plan and it is continuous monitored by the higher authority of the company.

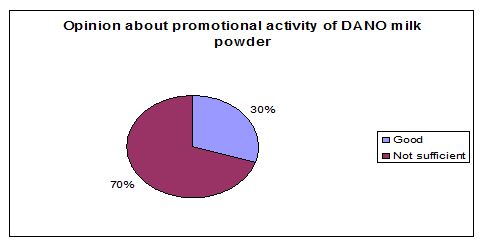

Promotional Activity:

It is found that majority retailers express their opinion about sales promotion and advertisements of DANO milk powder are not sufficient to compare with competitors in Bangladesh.

Opportunities:

Growing Marketing Demand:

Now a day’s milk is essential part for every man but we could not get sufficient supply of liquid milk. In this regard consumers are becoming habited with powder milk instead of liquid milk. The use of powder milk is becoming diversified such as Hotel, Restaurant, Coffee House, Fermented products. Bakery products. Mother and Child, Active living, Healthy recovery, conscious consumer etc. So, milk powder market of Bangladesh is expanding with time and buying behavior of consumers is changing due to changing of life style & attitude.

Increase Trade Barriers:

After the Chernobyl disaster in 1987 the Bangladesh Government temporarily suspended import of milk and milk products from me European countries. This, along with the trend of increasing the price of milk and milk products in the global market, has led to a fresh initiative towards self-sufficiency in milk production. Since 1986h milk production in Bangladesh has increased by 26.35 thousand metric tons and imports have decreased by 16.8 thousand metric tons annually. Of the total national consumption of IS million tons of liquid milk a year, 15 million tons is produced indigenously.

Legislation:

I he World Health Assembly endorsed an International Code of Marketing of Breast milk Substitutes in May 1981. The International Baby Fond Action Network (1BFANJ, a coalition of more than 140 breastfeeding promotion groups, monitor.1; the implementation of the Code worldwide. 24 countries have parsed legislation including all or almost all provisions of the International Code. Governments of 31 countries implemented many but not all provisions as Jaw. Other 74 countries have taken some measures to implement the international code. In South Asia, only India and Nepal have a law with almost all provisions of the Code; Bangladesh and Pakistan has only some provisions, and others arc lagging even further behind. It is found that code violation in Bangladesh relatively low, perhaps because of national legislation and because breastfeeding campaign groups are very active.

METHODOLOGY

Research Design for the Study

The research is descriptive in nature. For the purpose of the study both secondary and primary data have been used.

Descriptive Research:

This research design applicable for this study is descriptive research design causes are outlined below:

• Descriptive research studies are those studies which concerned with describing the characteristic of li particular individual or a group,

• This study concerned with specific predictions with narration’s of facts and characteristics concerning individual group of situation.

* Descriptive research minimization of bias and maximization of reliability of evidence; collected.

* This study makes specific predictions.

” This study provides valuable facts.

So this is a descriptive type of research study in the sense that this study aimed at describing the existing fact, the features of the current channel networks of Dano powder milk.

This study is conducted mainly on the Questionnaire method. The questionnaires comprise with:

* Questionnaire for the Consumers

• Questionnaire for the Retailers

The necessary facts and figure will be coming out for the study through the analysis and observation of the answers of the questions from the above two groups.

Sources of Data

Data is gathered from information which is the foundation of research. The .search for answers to research questions call for collection of data. The data collection begins after a research problem has been identified and research / plan chalked our white deciding about the method of data collection to be used for The study. Data are fact, figures and other relevant materials pas! and present serving as bases for study and analysis. Two types of data should be kept in mind in cases of collection. They are as follows:

a. Primary Data

b. Secondary Data

Primary Data:

Primary data’s are generated when a particular problem at hand is investigated by the researchers employing mail questionnaires, telephone surveys, personal interviews, observations and experiment.

Secondary Data:

Secondary data’s are those which are already prepared or collected for some purpose other than the current investigations.

Process of Collecting Data

For this research project, I have used personal interview method for collecting primary data and as the research instrument I have used questionnaire.

The main reasons of using questionnaire are:

1. Less expensive even when the universe is large and widely spread geographically.

2. It is free from bias of the interview answers are in respondents own words.

3. Respondents have adequate time to give well thought out answers,

4. Respondents who are not easily approachable can also be reached conveniently,

5. Large sample can be made use of and the results can be made more dependable and reliable.

6. Time saving.

I have carefully developed distinguished questionnaire as research instrument for this project. The form of questionnaire is combination of dichotomous, reasoning and multiple choice. The method has been selected as personal interview.

Methodological Assumptions

The methodology followed in this research for the preparation of this project is questionnaire method. This method is more suitable. Comparatively this approach enables the determination of the cause and effect and relationship more precisely and clearly. Because this study is primarily and mainly dependent on primary data.

Sampling Procedures

Most of marketing studies involve a sample or subgroup of the total population relevant to the problem, rather than a census of the entire group. The population is generally specified as a part of the problem definition process. In this phase of this study, the researcher starts by identifying the appropriate population which includes all the people who can provide the required information. To define the populations the researcher need to know not only who or what to study but also where and when. When a researcher thinks about the sampling procedure it must have clear idea about the following terms:

• Population:

Determination of who (or what objects) can provide the required information.

• Sample Frame:

Developing a list of population members.

• Sampling Unit:

Determination of the basis for drawing the sample (individuals, household, city blocks, etc.)

• Sampling Method:

Determination of haw sample will be selected (probability and non probability)

• Sample Size:

Determination of how many population members are to be included in the sample.

* Sampling Plan:

Developing a method for selecting and contracting the sample members.

• Execution:

Carry out the sample plan.

From the above terminology the following will be concluded for this study: Name and location out of about 10000 retail shops that sell Dano milk powder product is existing in the marketing department. But there is no up to dale data available as. to determine the exact number of consumers that consume Dano milk powder product.

Sample Unit for this Study

Sample /Unit Place

Customer (Consumer) Dhaka City

Retailer Dhaka City

Determination of Sample Size

Since the distribution of shops those sell Dano milk powder product arc not homogeneous, stratified probability sampling was undertaken. On the basis of shops number in different Zones following strata were identified. The percentages of each stratum along with respective sample size are shown below. Assumption is 10% error is a] lowed to calculate sample size.

Sampling Plan

Total 10000 (approx.) retail shops of Dhaka City are divided into 10 zones.

l. Mirpur Zone

2. Mohammadpur Zone

3. Dhanmondi Zone

4. Gulshan Zone

5. Tejgaon Zone

6. Uttra Zone

7. Shahjahanpur Zone

S. Azimpur Zone

9. Motijheel Zone

10. Zattrabari Zone

Selection of Sample Size for the Retailer

It is decided for this study to select 50 Retail shops from the above zones. For this purposes 05 Retailer shops are selected by random sampling from the list of the retailers shop from every zones. The necessary data was collected by interview through structures questionnaires.

Selection of Sample Size for the Consumer

Fr-m the above zone it is decided to select 10 numbers of consumers from each zone for the purpose of the study. So sample size for [he consumer will be 100 from the iii i number of zones as listed.

Research Instruments

The research instruments based on which data were collected for this study were questionnaire method. Personal interview with retailers were conducted using this questionnaire. The method of data collection was through structured questionnaire. I questionnaire consists of both open and close-ended questions. Which include multiple choices as means of collecting data. For the research purpose some questionnaires were used to interview the retailers and consumers.

Analytical Procedure

Collected data edited on the basis of different statistical figures Statistical Methods were used along qualitative analysis procedure to implement the study in line with the determined objectives. Tabulation, frequency distribution, weighted average and percentage and charts were used.

Recommendation

On the basis of the findings some recommendations have made which will be helpful in applying different new marketing strategies and rectifying the previous strategy.

Preparation of Report

At the time of preparing the report at first a draft report has been prepared which sets the topic of final report. Then the final report is prepared. Final report is detailed findings &. analysis of collected data.

Limitation of the Study

The researcher faced a number of impediments in the way of data collection, the following limitation of this research work as given below.

Financial Limitation:

The completion of this report is researcher own cost, so researcher finance is limitation Financial limitation is vital point of researcher point of view.

Lack of Cooperation:

To conduct tin is survey many retailers and consumers are non-cooperative and reluctant in providing necessity information.

Non-availability of Retailers:

When researcher approached to retailers there has non-availability. So, non- availability of retailers was the limitation of the researcher study.

Limitation of Data:

Some information is not available to organizational employees or retailers. Due to this reason they could not provide the necessary information which would be helpful to prepare a report. Moreover secondary data were not available as a result, of which the present situation could not be compared with the previous situation. For this reasons the whole research have been done on the basis of primary data available at the time.

Limitation of Communication:

When researcher approached to collect data from retailers and consumers on that time most of the retailers and consumers were involved in inventory but it had been ultimately managed at cost time &. courtesy. So the fruitful communication was the limitation to conduct this survey.

Limitation for the Sample Size:

The sample size has been selected because of time and cost factor, Ii is not possible to draw appropriate picture from this most sample size because Jack of appropriate responds arid co-operation from the retailers and consumers.

Limitation of Time:

Time limitation was a factor in this survey which was really insufficient time to conduct a study on vast subject. DANO milk powder produces are markets all over, the Bangladesh. So, it is difficult to survey all the districts of Bangladesh, within a short period of lime due to this reason only Dhaka city has been selected to conduct this research survey.

FINDINGS

Analysis of the Answer of the Questionnaires for the Consumer

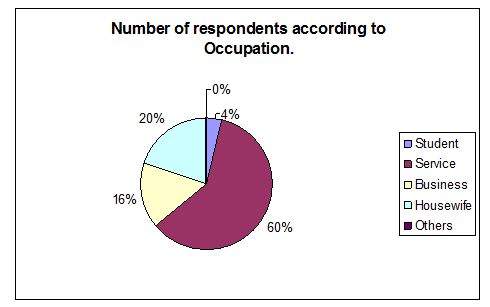

Analysis on Q. 01: Number of respondents according to Occupation.

Table 01: Number of respondents according to occupation:

| Sl No | Occupation | Respondents | Percentage | Majority |

1 | Student | 4 | 4% |

|

2 | Service | 60 | 60% | Service |

3 | Business | 16 | 16% |

|

4 | Housewife | 20 | 20% |

|

5 | Others | 0 | 0% |

|

In the occupation category of respondents, the percentages of occupation are: Service-60%; Housewife-20%; Business-16%; and Student-4%. The graph is as presented below:

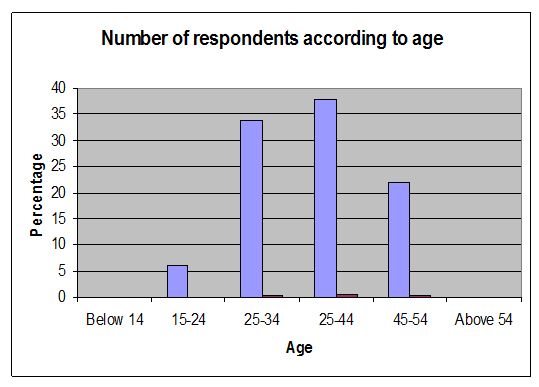

Analysis on Q.02: Number of respondents according to Age.

It is found that the number of respondents according to age in the class interval are below 14=0%, 15-24 =6%, 25-34=34%, 35-44=38%, 45-54=22%, and above 54=0%. The graphical presentation is depicted below:

Table 02: Number of respondents according to age

Sl No | Age | Frequency | Percentage | Majority |

1 | Below 14 | 0 | 0% |

|

2 | 15-24 | 6 | 6% |

|

3 | 25-34 | 34 | 34% |

|

4 | 25-44 | 38 | 38% | 35-44 years of age |

5 | 45-54 | 22 | 22% |

|

6 | Above 54 | 0 | 0% |

|

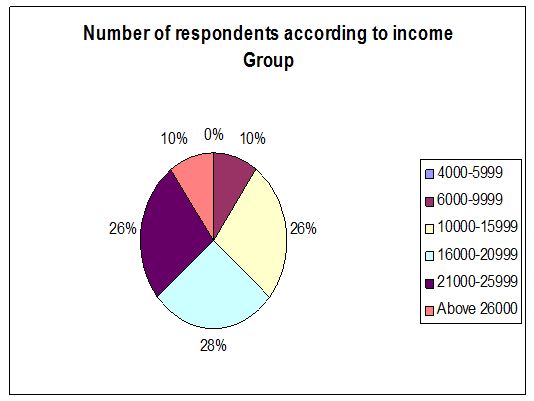

Analysis on Q.03: Number of respondents according to Income Group.

Table 03: Number of respondents according to Income Group

SL No | Income Group | Frequency | Percentage | Majority |

1 | 4000-5999 | 0 | 0% |

|

2 | 6000-9999 | 10 | 10% |

|

3 | 10000-15999 | 26 | 26% |

|

4 | 16000-20999 | 28 | 28% | 16000-20999 income Group |

5 | 21000-25999 | 26 | 26% |

|

6 | Above 26000 | 10 | 10% |

|

It is observed that the numbers of respondents according to income group in the class interval are: 4000-5999=0%, 6000-9999= 10%, 1000-15999=26%, 16000-20999=28%, 21000-25999=26%, and above 26000=10%. The graphical presentation is depicted below.

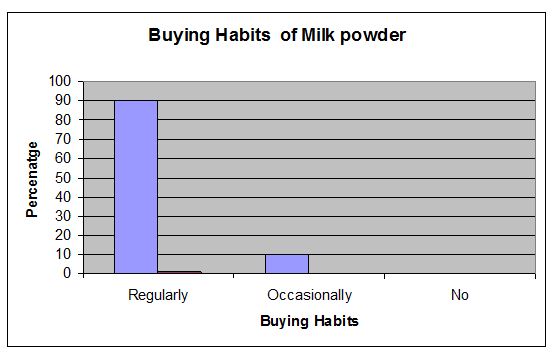

Analysis on Q. 04: Buying habits of milk powder.

Table 04: Buying habits of milk powder

SL No | Buying Habits | Respondents | Percentage | Majority |

1 | Regularly | 90 | 90% | Regularly |

2 | Occasionally | 10 | 10% |

|

3 | No | 0 | 0% |

|

Buying habits of consumers for milk powder are found that 90% consumers are buying milk powder on regularly and 10% are buying mile powder on occasionally. Majority of the consumer are used milk powder on regularly basis for their daily purposes. The graphical presentation is depicted below.

Analysis on Q.05: Brands preferences of milk powder according to choice

Table 05: Brand Preferences of milk powder according to choice

SL No | Brand Name | Rank Frequency | |||||

1 | 2 | 3 | 4 | 5 | 6 | ||

1 | Nido | 36 | 38 | 20 | 6 | 0 | 0 |

2 | Diploma | 14 | 10 | 42 | 20 | 10 | 4 |

3 | Kwality | 6 | 6 | 10 | 34 | 30 | 14 |

4 | Dano | 44 | 32 | 14 | 8 | 2 | 0 |

5 | Fresh | 0 | 14 | 10 | 20 | 40 | 16 |

6 | Marks | 0 | 0 | 4 | 12 | 18 | 66 |

The present study revealed that brand preferences of milk powder according to consumer’s choice followed by highest preference to lowest preference are-

Dano>Nido>Diploma>Marks>Fresh>Marks.

Analysis on Q.06: Intention to purchase high priced brand of milk powder.

Table 06: Intention to purchase high price brand of milk powder.

SL No | Condition | Respondents | Percentage | Majority |

1 | Yes | 80 | 80% | Yes |

2 | No | 6 | 6% |

|

3 | Others | 14 | 14% |

|

It is found that most of the 80% respondents answer yes about intention of purchase high priced brand of milk powder where comparatively low prices products are available and 6% respondents don’t purchase high priced brand. Rest of the 14% respondent’s opinion about product quality should be maintained and price will be the less than that of high price brand. The graphical presentation is depicted below.

Analysis on Q.07: The Favorite type of milk powder pack.

Table 07: The Favorite type of milk powder pack

SL NO | Type of Pack | Respondents | Percentage | Majority |

1 | Tin Pack | 22 | 22% |

|

2 | Soft Pack | 78 | 78% | Soft Pack |

The data and information received by the research it is observed that 78% of the respondents are mentioned their favorite type of milk powder pack is the soft pack (pouch) and rest of the 38% respondents are mentioned Tin pack. The graphical presentation is as follows.

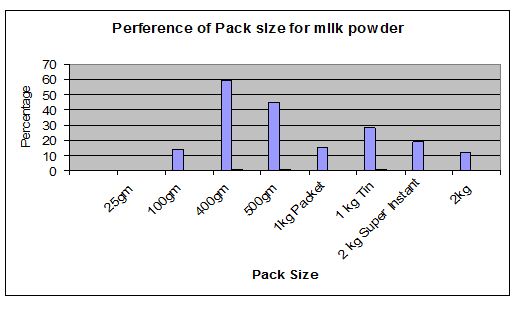

Analysis on Q. 08: Preference of pack size for milk powder.

Table 08: Preference of Pack size for milk powder

SL No | Size of the Pack | Respondents | Percentage | Majority |

1 | 25gm | 0 | 0% |

|

2 | 100gm | 14 | 14% |

|

3 | 400gm | 59 | 59% | 400gm Packet |

4 | 500gm | 45 | 45% |

|

5 | 1kg Packet | 15 | 15% |

|

6 | 1 kg Tin | 28 | 28% |

|

7 | 2 kg Super Instant | 19 | 19% |

|

8 | 2kg | 12 | 12% |

|

It is observed from the analysis of the following data the preference of pack size for milk powder accordingly followed by highest preference to lowest preference are-400gm (59%.), 500gm (45%.), 1kg Tin (28%), 2Kg Super Instant (19%), 1kg pack (15%), 100gm (14%), 2 Kg Tin (12%) and 25gm (0%). The graphical presentation is depicted below.

Analysis on Q. 09: Purchasing place of milk powder.

Table 09: Purchasing place of milk powder.

SL No | Purchasing Place | Respondents | Percentage | Majority |

1 | Nearest Convenience Shop | 84 | 84% | Nearest Convenience Shop |

2 | Shop where other items were purchase | 16 | 16% |

|

Among the respondents 84% of the consumers prefer to purchase milk powder at the nearest convenience shop and only 16% said that they are purchasing their milk powder from the shop where the other items are normally purchases. In this analysis it is understood that the majority of the consumers like to prefer their nearest convenience shop. The graphical presentation is depicted below:

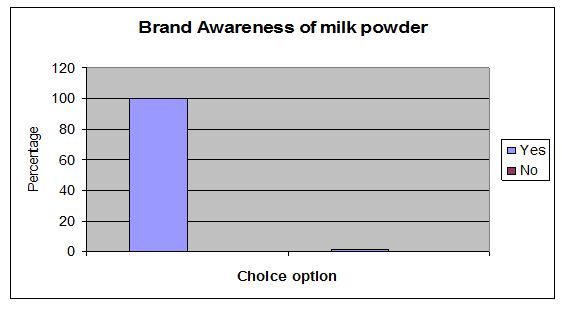

Analysis on Q. 10: Brand awareness of milk powder

Table 10: Brand awareness of milk powder

SL No | Brand awareness | Respondents | Percentage | Majority |

1 | Yes | 100 | 100% | Yes |

2 | No | 0 | 0% |

|

It is observed from analysis of the following data that 100% of the consumers have the awareness of the brand while they purchase milk powder for daily purpose. The graphical presentation is depicted below:

Analysis on Q. 11: Immediate previous brand for milk powder.

Table 11: Immediate previous brand for milk powder.

SL No | Previous Brand | Respondents | Percentage | Majority |

1 | Nido | 22 | 22% |

|

2 | Diploma | 16 | 16% |

|

3 | Dano | 45 | 45% | Dano |

4 | Marks | 10 | 10% |

|

5 | Fresh | 7 | 7% |

|

From the data it is observed that the immediate previous brand for milk powder are. Dano-45%; Nido-22%; Diploma-16%, Marks-10%; and Fresh 7%. Majority of the consumers mentioned their immediate previous brand for milk powder is Dano and the second highest immediate previous brand for milk powder is Nido. The graphical presentation is depicted below.

Analysis on Q. 12: Buying conditions of milk powder.

Table 12: Buying Conditions of milk powder.

SL No | Conditions | Respondents | Percentage | Majority |

1 | When earlier stock almost finished | 88 | 88% | When earlier stock almost finished |

2 | When home stock is finished | 8 | 8% |

|

3 | On date of your daily shopping | 0 | 0% |

|

4 | On date of weekly shopping | 0 | 0% |

|

5 | Others | 4 | 4% |

|

The data and information received by the research it is found that different consumers have different in nature of buying milk powder product. In this connection the majority of the 88% consumers are buying their milk powder when earlier stock is almost finished and 8% of the consumers are like to buy milk powder when home stock is finished, it means that consumers are not interested to pile up the stock of milk powder. All other conditions are tabulated as well as graphical presentation is depicted below.

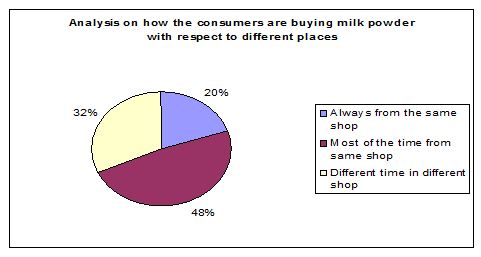

Table 13: Analysis on how the consumers are buying milk powder with respect to different places.

SL No | Condition | Respondents | Percentage | Majority |

1 | Always from the same shop | 20 | 20% |

|

2 | Most of the time from same shop | 48 | 48% | Most of the time from same shop |

3 | Different time in different shop | 32 | 32% |

|

The majority of the consumers’ i.e. 48% said that they are buying milk powder most of the time at same shop and 32% mentioned that they are buying milk powder of different time in different shop and on the other hand only 20% said that they are buying milk powder always from the same shop. The graphical presentation is as follows.

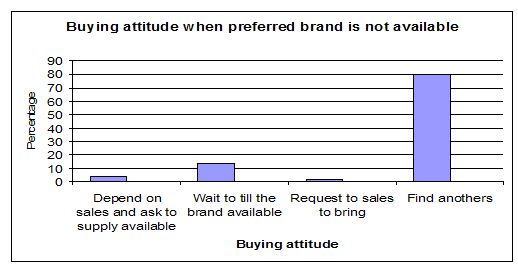

Analysis on Q. 14: Buying attitude when preferred brand is not available.

Table 14: Buying attitude when preferred brand is not available

SL No | Condition | Respondents | Percentage | Majority |

1 | Depend on sales and ask to supply available | 4 | 4% |

|

2 | Wait to till the brand available | 14 | 14% |

|

3 | Request to sales to bring | 2 | 2% |

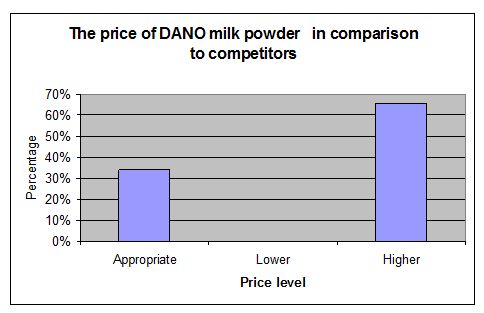

|