INTRODUCTION-The service sector has been growing rapidly after the World War II, as many nations shift from a manufacturing based economy to service economy. Telecommunication industry is playing an important role in the communication system that has become an obvious for this modern world. ‘Orascom Telecom Holdings’ which was established in 1998 is one of those dynamic telecom companies of the world. Till date, this Egyptian Telecom company is facilitating cellular phone service to the people of 9 countries. Banglalink is the new member of the esteemed GSM family of Orascom Telecom Holdings. The scenario of the telecom industry has totally changed as Banglalink entered in the industry with the aim of serving mobile phone services to the mass population of the country so that the entire communication system of Bangladesh develop dramatically.

If we compare the present situation of ‘Banglalink ’ with Sheba Telecom Company, we find the emerging growth and cordial consumer acceptance of ‘Banglalink ’ which was never been seen and even thought during the operational period of Sheba Telecom Company. Brand preference and consumer acceptance of Banglalink has created this immense growth rate.

OBJECTIVE OF THE STUDY

General objective:

The objective of this research work was to examine and explain: the existing corporate clients’ attitude toward BanglalinkTM and at the same time, imply some strategy that would help the corporate sales department to improve its performance which would help the organization to maintain a high customer retention ratio.

Project Objective:

To analyze the existing corporate client’s attitude, I examined the following issues in this research work:

Ä Quality of the network.

Ä Network Coverage.

Ä Corporate Customer Service Maintenance.

Ä Value added services facilities.

Ä Competitive pricing policy and tariff plan.

HYPOTHESIS

In this research study, the null and alternative hypotheses are –

H0: Existing corporate client’s attitude toward BanglalinkTM is negative.

Ha: Existing corporate client’s attitude toward BanglalinkTM is positive or neutral.

METHODOLOGY

Research Design:

For this research I have adopted the primary research design. The information about the research components are as follows –

- Kind of information – For this research I found out individual respondents’ information.

- Method of administering the questionnaire – I used a survey questionnaire for collecting information for the research.

- Nature of questionnaire – For the research work, both open ended and close ended questions were asked. The average interviewing time was approximately 10 – 15 minutes.

- Sample size –for this research work the sample size was 120.

Data Collection:

I obtained necessary data for this project by surveying 120 corporate cell phone subscribers. I went to the different corporate offices and asked them to fill up the questionnaire if they are using corporate cellular phone.

Data Analysis:

For the analysis of the collected data I used SPSS software. Some cross-tabulations were conducted to show the difference in the service quality, brand image, and customers’ attitude toward the mobile phone services providers in Bangladesh. For the hypothesis testing I used chi-square test. In some analysis I found out frequency, and percentage. A

regression analysis was also used for this research work. The analyzed date is presented both in graphical and tabulated format. Depending on the result of the analyzed data I made some recommendations which I believe would be helpful for the decision making strategy for the corporate sales department of BanglalinkTM.

Report format:

This research paper format is formal in nature. For the formatting I used APA format.

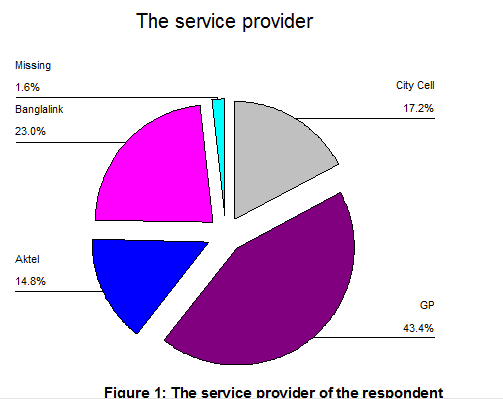

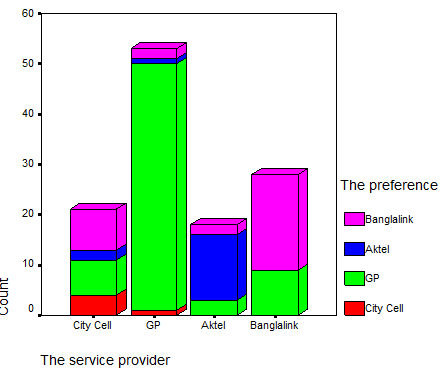

THE SERVICE PROVIDER OF THE RESPONDENT

The mode for the responses of this question is 2, that is the majority respondents are using GP Corporate connections. The frequency table shows that among 120 respondents, 43.4% respondents are using GP connection, while 23% respondents are using banglalink, 17.2% using CityCell, and remaining 14.2% respondents are using AKTEL corporate connection.

Comparing the above sample result it can said that majority of the corporate clients are using GP connection while banglalink got the second position in case of subscriber base of the selected sample.

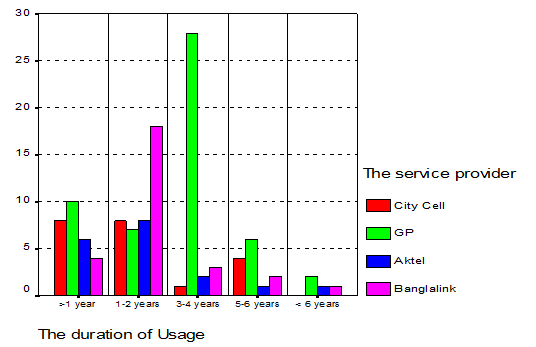

DURATION OF USAGE OF CORPORATE CELL PHONE SERVICE

The mode for the responses of this question is 2, which is majority (33.6%) of the respondents using corporate cell phone for 1-2 years. 27.9 % respondents using corporate connection for 3-4 years. The frequency table also shows that the percentage of 5-6 years and more than 6years users is very low comparing with the user of 1-2years and 3-4 years.

Above statistics regarding the time bend of usage prove that the trend of providing corporate cell phone in our country has grown up in recent years. 4 years ago, it was very poor.

The cross tabulation (table: 2.2) shows the duration of usage of corporate connections of different cell phone service provider in the country:

From the above analysis it is evident that majority of the corporate subscribers are using the GP connection for long duration which is 3-4 years. Banglalink, AKTEL and CityCell are very close to each other considering this specific issue.

To ruin the first place in the industry, banglalink has to ensure best quality service through the implementation of increasing customer retention strategy.

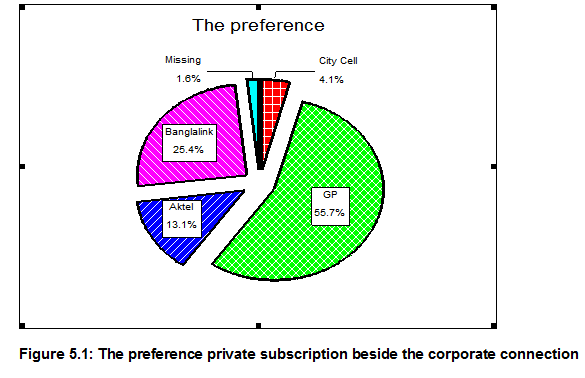

From the above analysis it can be said that there is no general agreement on this issue as the newest player is retaining a significant preference in comparison with GP. This may depend on the image of particular brand. So, to evaluate this I have decided to conduct a chi-square test to measure correlation between preferences for private subscription and corporate subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: There is no association.

Alternative hypothesis H1: They are associated.

The mode for the responses of this question is 2, that is majority of the respondents are privately subscribe to GP connection and the percentage of the user is 55.7%. Banglalink which is providing the cheapest tariff rate in the industry is placed in the second position by retaining 25.4% preference for private subscription. Aktel has got the 3rd position by gaining 13.1% response while CityCell-the oldest cell phone service provider of the industry has got only 4.1% preference.

Though banglalink is the youngest cell phone service provider of the telecom industry of Bangladesh, they got noticeable preference for private subscription beside the corporate connection.

From the above analysis it can be said that there is no general agreement on this issue as the newest player is retaining a significant preference in comparison with GP. This may depend on the image of particular brand. So, to evaluate this I have decided to conduct a

chi-square test to measure correlation between preferences for private subscription and corporate subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: There is no association.

Alternative hypothesis H1: They are associated.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 123.632(a) | 9 | .000 |

| Likelihood Ratio | 104.082 | 9 | .000 |

| Linear-by-Linear Association | 20.271 | 1 | .000 |

| N of Valid Cases | 120 |

a 8 cells (50.0%) have expected count less than 5. The minimum expected count is .75.

At 5% significance level (2-sided) and 9 degrees of freedom,

χ2 (.025, 9) –cal is = 123.632

The χ2-cr for 9 df is 19.023

So, χ2 (.025, 9) cal > χ2 (.025, 9) cr

So, null hypothesis rejected.

That is there is association among the variables. The preference for private subscription from a particular cell phone service provider – have association with corporate subscription from a particular cell phone service provider.

The association among the variable will be clear from the analysis of the following cross tabulation:

Figure 5.2: Crosstabulation: The corporate service provider * The preference for private subscription

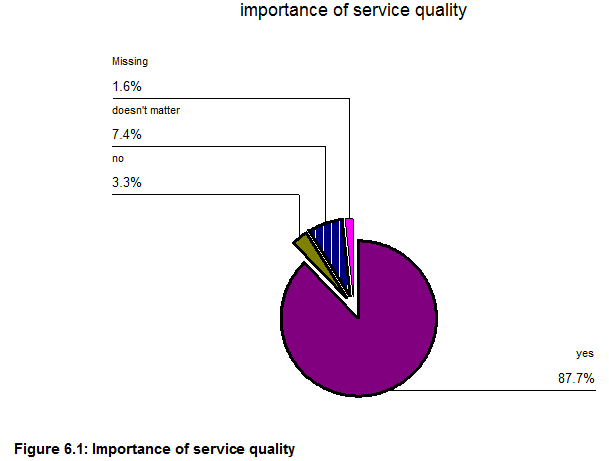

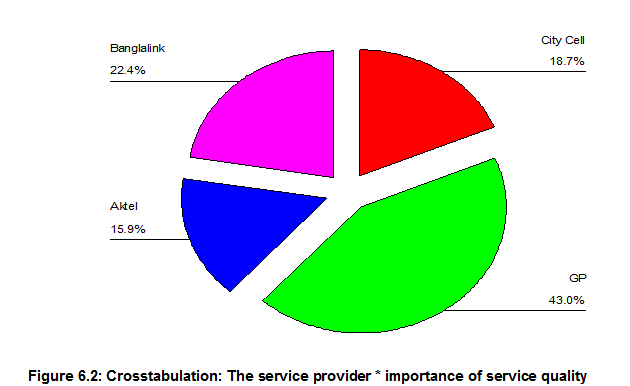

IMPORTANCE OF SERVICE QUALITY FOR CELL PHONE SUBSCRIPTION

The mode for the responses of this question is 1, that is majority (87.7%) of the respondents agreed that service quality is important for cell phone subscription. Only 7.4% respondents think that it is not an important matter.

From the above analysis it can be said that there is no general agreement on the importance service quality for cell phone subscription. This may depend on the image of particular brand. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency between the service provider and the perception about the importance of service quality for cell phone subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about the importance of service quality does not depend on the service provider.

Alternative hypothesis H1: Perception about the importance of service quality depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 3.426(a) | 6 | .754 |

| Likelihood Ratio | 5.393 | 6 | .494 |

| Linear-by-Linear Association | .280 | 1 | .597 |

| N of Valid Cases | 120 |

a 8 cells (66.7%) have expected count less than 5. The minimum expected count is .60.

At 5% significance level (2-sided) and 6 degrees of freedom,

χ2 (.025, 6) –cal is = 3.426

The χ2-cr for 6 df is 14.449

So, χ2 (.025, 6) cal < χ2 (.025, 6) cr

So, null hypothesis accepted.

That is there is no dependency among the variables that is perception about the importance of service quality does not depend on the service provider.

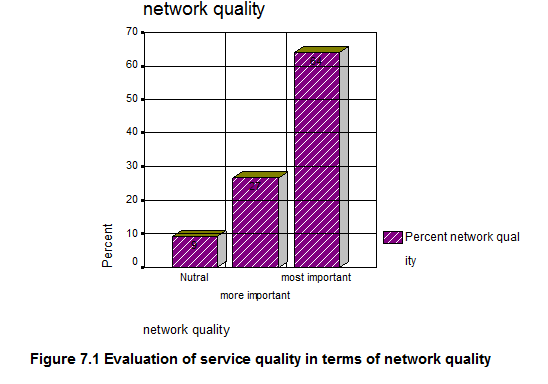

EVALUATION OF SERVICE QUALITY IN TERMS OF NETWORK QUALITY

From the statistics of table 7.1 we see that mode is 5 that mean 63.1% of the total respondents think that network quality is very important to the subscriber of cellular phone. Only 26.2% respondent agreed that this fact is more important than other factors.

As banglalink network quality is quite behind the competition and network quality is an important tool to evaluate the service quality so, banglalink has to be more conscious about building a superb network for its valued customers.

From the above analysis it can be said that there is no general agreement on the importance network quality for cell phone subscription. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency between the service provider and the perception about the importance of network quality for cell phone subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about the importance of network quality does not depend on the service provider.

Alternative hypothesis H1: Perception about the importance of network quality depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 4.706(a) | 6 | .582 |

| Likelihood Ratio | 5.029 | 6 | .540 |

| Linear-by-Linear Association | .311 | 1 | .577 |

| N of Valid Cases | 120 |

a 5 cells (41.7%) have expected count less than 5. The minimum expected count is 1.65

Figure 7.2: Cross tabulation: The service provider * network quality

At 5% significance level (2-sided) and 6 degrees of freedom,

χ2 (.025, 6) –cal is = 4.706

The χ2-cr for 6 df is 14.449

So, χ2 (.025, 6) cal < χ2 (.025, 6) cr

So, null hypothesis accepted.

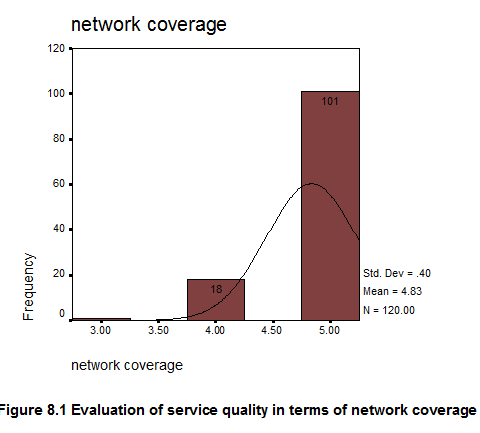

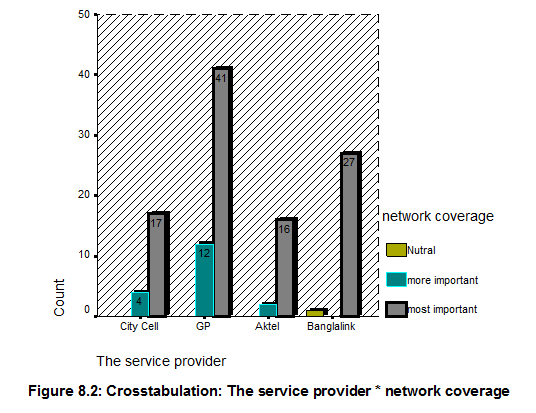

EVALUATION OF SERVICE QUALITY IN TERMS OF NETWORK COVERAGE

From the statistics of table 8.1 we see that mode is 5 that mean 82.8% of the total respondents think that network coverage is very important to the subscriber of cellular phone. Only 14.8% respondents agreed that this fact is more important than other factors and remaining .8% respondents were neutral when they were asked this question.

Banglalink is quite ahead in the competition regarding the network coverage.

So, to retain the firs position in the industry with the network coverage, banglalink should ensure the best coverage for complete mobility solution.(in relation with findings of q8b.)

From the above analysis it can be said that there is no general agreement on the importance network coverage for cell phone subscription. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency between the service provider and the perception about the importance of network coverage for cell phone subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about the importance of network coverage does not depend on the service provider.

Alternative hypothesis H1: Perception about the importance of network coverage depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 10.825(a) | 6 | .094 |

| Likelihood Ratio | 14.353 | 6 | .026 |

| Linear-by-Linear Association | 2.333 | 1 | .127 |

| N of Valid Cases | 120 |

a 7 cells (58.3%) have expected count less than 5. The minimum expected count is .15.

At 5% significance level (2-sided) and 6 degrees of freedom,

χ2 (.025, 6) –cal is = 10.825

The χ2-cr for 6 df is 14.449

So, χ2 (.025, 6) cal < χ2 (.025, 6) cr

So, null hypothesis accepted.

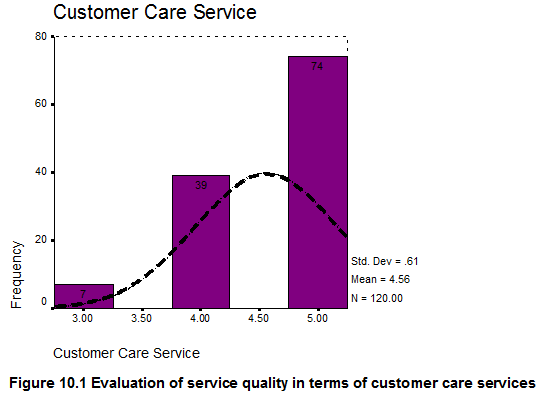

EVALUATION OF SERVICE QUALITY IN TERMS OF CUSTOMER CARE SERVICES

From the statistics of table 10.1 we see that mode is 5 that mean 60.7% of the total respondents think that customer care service is very important to the subscriber of cellular phone. Only 32% respondents agreed that this fact is more important than other factors and 7% respondents were neutral when they were asked this question.

Banglalink should focus more on customer care services though banglalink customer care service quality is the benchmark for the industry.

From the above analysis it can be said that there is no general agreement on the importance customer care service for cell phone subscription. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency between the service provider and the perception about the importance of customer care service for cell phone subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about the importance of customer care service does not depend on the service provider.

Alternative hypothesis H1: Perception about the importance of customer care service depends on the service provider. Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 12.126 (a) | 6 | .059 |

| Likelihood Ratio | 12.794 | 6 | .046 |

| Linear-by-Linear Association | .124 | 1 | .725 |

| N of Valid Cases | 120 |

a 4 cells (33.3%) have expected count less than 5. The minimum expected count is 1.05.

At 5% significance level (2-sided) and 6 degrees of freedom,

χ2 (.025, 6) –cal is = 12.126

The χ2-cr for 6 df is 14.449

So, χ2 (.025, 6) cal < χ2 (.025, 6) cr

So, null hypothesis accepted.

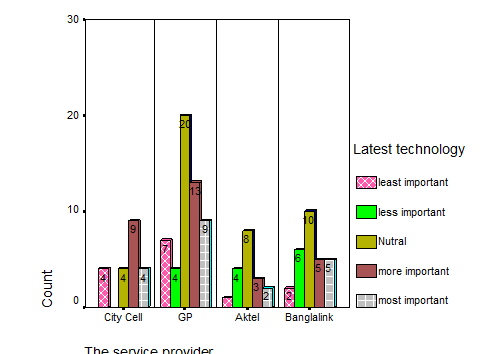

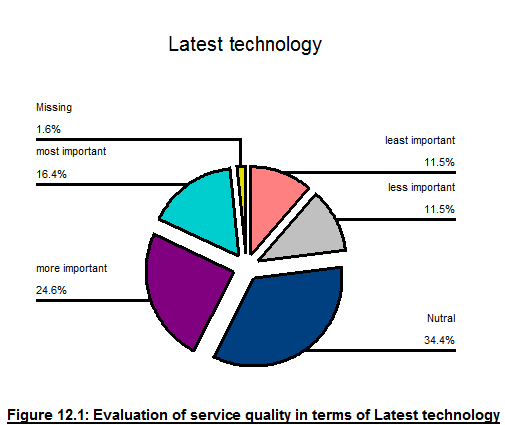

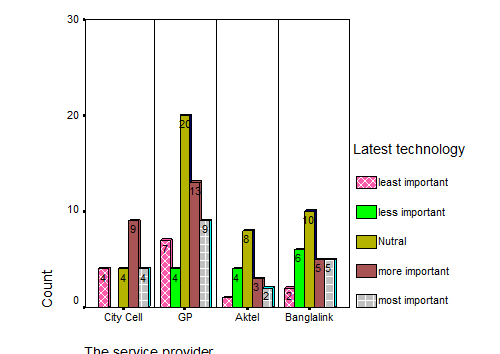

EVALUATION OF SERVICE QUALITY IN TERMS OF LATEST TECNOLOGICAL SERVICES

From table 12.1 we see that mode is 3 that show 34.4% of the total respondents showed their neutral response while they were asked the question regarding latest technological services. 24.6% respondent think that it is more important and 16.4% respondent think that latest technological service like e-mail, internet browsing is most important for the subscriber.

So, banglalink should consider this issue if they want to reach more subscriber in the industry.

From the above analysis it can be said that there is no general agreement on the importance latest technological services for cell phone subscription. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency among the service provider and the perception about the

importance of latest technological services for cell phone subscription. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about the importance of latest technological services does not depend on the service provider.

Alternative hypothesis H1: Perception about the importance of latest technological services depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 15.672(a) | 12 | .207 |

| Likelihood Ratio | 17.430 | 12 | .134 |

| Linear-by-Linear Association | .578 | 1 | .447 |

| N of Valid Cases | 120 |

a 10 cells (50.0%) have expected count less than 5. The minimum expected count is 2.10.

Figure 12.2: Crosstabulation The service provider * Latest technology

At 5% significance level (2-sided) and 12 degrees of freedom,

χ2 (.025, 12) –cal is = 15.672

The χ2-cr for 12 df is 23.337

So, χ2 (.025, 12) cal < χ2 (.025, 12) cr

So, null hypothesis accepted.

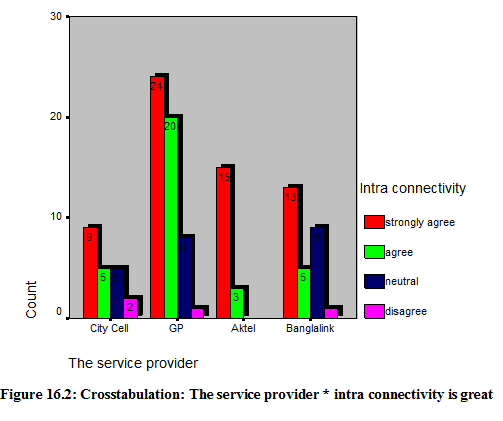

SUBSCRIBERS’ BELIEF ABOUT INTRA CONNECTIVITY

From the table 16.1 it is clear that majority (40.9%) of the total banglalink respondents showed their neutral response regarding the intra connectivity where as majority (60.6%) of the total GP respondents agreed that intra connectivity of GP network is great. So considering response it can be said that banglalink is quite behind GP regarding customer satisfaction about the intra connectivity. Statistics also shows that majority of the AKTEL respondents strongly agreed that intra connectivity of AKTEL is great where 21.3%banglalink respondents strongly agreed about the statement.

So, banglalink is way behind the competition regarding the intra connectivity.

From the above analysis it can be said that there is no general agreement on the belief that intra connectivity of cell phone service provider is great. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency among the service provider and the belief of the subscriber about intra connectivity of cell phone service provider. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about intra connectivity does not depend on the service provider.

Alternative hypothesis H1: Perception about intra connectivity depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 18.480(a) | 9 | .030 |

| Likelihood Ratio | 20.553 | 9 | .015 |

| Linear-by-Linear Association | .289 | 1 | .591 |

| N of Valid Cases | 120 |

a 7 cells (43.8%) have expected count less than 5. The minimum expected count is .60.

At 5% significance level (2-sided) and 9 degrees of freedom,

χ2 (.025, 9) –cal is = 18.480

The χ2-cr for 9 df is 19.023

So, χ2 (.025, 9) cal < χ2 (.025, 9) cr

So, null hypothesis accepted.

SUBSCRIBERS’ BELIEF ABOUT CUSTOMER CARE SERVICES

From the percentage table 18.1 it is clear that 56.6%of the total GP respondents strongly agree that customer care service of GP is great where 67.9% of the total banglalink respondents strongly agreed that banglalink customer care service is great. So considering response it can be said that banglalink is quite ahead to GP regarding customer care services.

Statistics also shows that 42.9% of the total CityCell respondents agreed and 44.4% of AKTEL subscribers strongly agreed that their customer care service is great. So banglalink is the benchmark for the industry regarding customer care services.

From the above analysis it can be said that there is no general agreement on the belief that customer care services of cell phone service provider is great. This may vary among the cell phone operator. So, to evaluate this I have decided to conduct a chi-square test to measure the dependency among the service provider and the belief of the subscriber about customer care services of cell phone service provider. The null and alternative hypotheses in this case are –

Null hypothesis H0: Perception about customer care services does not depend on the service provider.

Alternative hypothesis H1: Perception about customer care services depends on the service provider.

Chi-Square Test

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 16.238(a) | 9 | .062 |

| Likelihood Ratio | 16.605 | 9 | .055 |

| Linear-by-Linear Association | 1.867 | 1 | .172 |

| N of Valid Cases | 120 |

a 8 cells (50.0%) have expected count less than 5. The minimum expected count is .90.

At 5% significance level (2-sided) and 9 degrees of freedom,

χ2 (.025, 9) –cal is = 16.238

The χ2-cr for 9 df is 19.023

So, χ2 (.025, 9) cal < χ2 (.025, 9) cr

So, null hypothesis accepted.

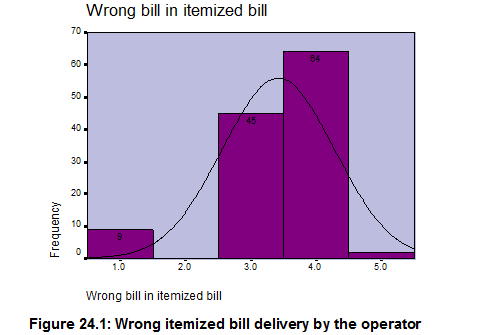

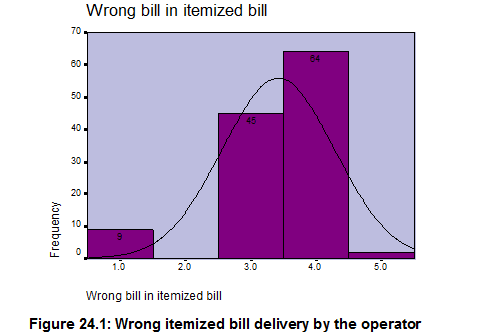

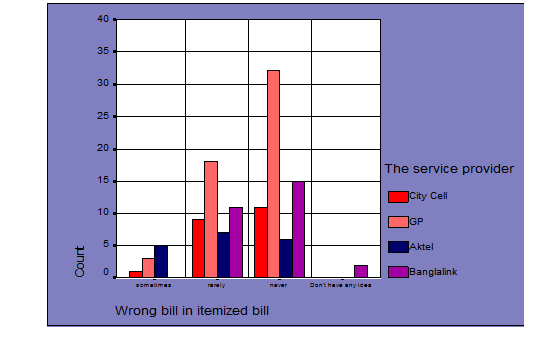

WRONG ITEMIZED BILL DELIVERY BY THE OPERATOR

The mode of response for this question is 4, that is majority (52.5%) of the respondent agreed that their service provider never sends wrong itemized bill. 36.9% respondents agreed that rarely they get wrong itemized bill.

As this particular statistical analysis do not say anything about the specific operator so I have decided to do a chi-square test to see the dependency among the service provider and this specific issue.

Null and alternative hypotheses in this case are –

Null hypothesis H0: receiving wrong itemized bill does not depend on the service provider.

Alternative hypothesis H1: receiving wrong itemized bill depends on the service provider.

Chi-Square Tests

Value | df | Asymp. Sig. (2-sided) | |

| Pearson Chi-Square | 21.207(a) | 9 | .012 |

| Likelihood Ratio | 18.723 | 9 | .028 |

| Linear-by-Linear Association | .091 | 1 | .763 |

| N of Valid Cases | 120 |

a 8 cells (50.0%) have expected count less than 5. The minimum expected count is .30.

Figure 24.2: Crosstabulation: wrong bill in itemized bill * the service provider

At 5% significance level (2-sided) and 9 degrees of freedom,

χ2 (.025, 9) –cal is = 21.207

The χ2-cr for 9 df is 19.023

So, χ2 (.025, 9) cal > χ2 (.025, 9) cr

So, null hypothesis rejected.

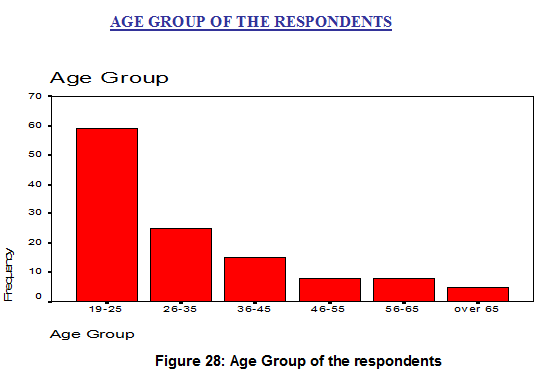

In the above statistics mode is 1, which means that most of the respondent fall under the age group of 19 – 25. 48% of the total respondent were between age group of 19-25, 20.5% respondent fall under the age group 26-35, and only 12.3% respondent were of 36-45 age group.

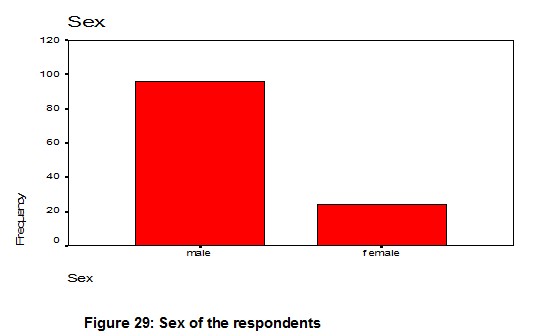

SEX OF THE RESPONDENTS

In the above statistics mode is 1, which shows that 78.7% of the total respondents were male whereas remaining were female respondent.

TYPES OF ORGANIZATION THE SUBSCRIBERS ARE WORKING WITH

The statistics of table 30 shows that mode is 6 which means majority of the respondents work in textile industry who are using corporate cellular phone and their percentage is 22.1. Only 13.9% respondent work in food industry, 13.1% respondent work in engineering field, only 9% respondent are working in media sector, 8.2% respondents were of financial organization.

PREFERENCE OF SERVICE PROVIDER FOR PRIVATE SUBSCRIPTION IN RELATION WITH CURRENT CORPORATE SERVICE PROVIDER & AGE GROUP OF THE RESPONDENT

Table 31: Crosstabulation: the service provider * favorable cell phone service provider * age group.

Age Group | favorable cell phone service provider | Total | ||||||||

City Cell | GP | Aktel | Banglalink | Teletalk | ||||||

Count | 19-25 | The service provider | City Cell | 1 | 4 | 3 | 1 | 0 | 9 | |

GP | 0 | 21 | 2 | 0 | 1 | 24 | ||||

Aktel | 1 | 5 | 2 | 5 | 0 | 13 | ||||

Banglalink | 0 | 11 | 1 | 1 | 0 | 13 | ||||

Total | 2 | 41 | 8 | 7 | 1 | 59 | ||||

26-35 | The service provider | City Cell | 0 | 2 | 1 | 0 | 3 | |||

GP | 0 | 10 | 0 | 0 | 10 | |||||

Aktel | 0 | 3 | 0 | 0 | 3 | |||||

Banglalink | 1 | 5 | 2 | 1 | 9 | |||||

Total | 1 | 20 | 3 | 1 | 25 | |||||

36-45 | The service provider | City Cell | 1 | 1 | 0 | 0 | 2 | |||

GP | 5 | 1 | 1 | 0 | 7 | |||||

Aktel | 1 | 0 | 0 | 1 | 2 | |||||

Banglalink | 2 | 0 | 2 | 0 | 4 | |||||

Total | 9 | 2 | 3 | 1 | 15 | |||||

46-55 | The service provider | City Cell | 2 | 0 | 0 | 0 | 2 | |||

GP | 0 | 1 | 2 | 1 | 4 | |||||

Banglalink | 2 | 0 | 0 | 0 | 2 | |||||

Total | 4 | 1 | 2 | 1 | 8 | |||||

56-65 | The service provider | City Cell | 3 | 0 | 0 | 3 | ||||

GP | 2 | 2 | 1 | 5 | ||||||

Total | 5 | 2 | 1 | 8 | ||||||

over 65 | The service provider | City Cell | 1 | 1 | 0 | 2 | ||||

GP | 2 | 0 | 1 | 3 | ||||||

Total | 3 | 1 | 1 | 5 | ||||||

Analysis for age group19-25:

Among 120 participants of the survey, majority (total 59) of the respondents fall under the age group of 19 – 25. where total 9 respondents were CityCell corporate line user, 24 respondents were GP corporate line user, 13 respondents of banglalink & remaining 13

respondents from AKTEL corporate line user. Among these 59 respondents, 41 participants believe GP, 8 participants believe AKTEL, and 7 respondents believe banglalink and only 1 respondent think teletalk as their favorable corporate cell phone service provider.

Analysis for age group 26 – 35:

Among 120 participants of the survey, 25 respondents fall under the age group of 26 – 35. Where total 3 respondents were CityCell corporate line user, 10 respondents were GP corporate line user, 9 respondents of banglalink & remaining 3 respondents from AKTEL corporate line user. Among these 25 respondents, 20 respondent believe GP, 3 participant believe AKTEL, 1 respondent believe banglalink and remaining 1 respondent think CityCell as their favorable corporate cell phone service provider.

Analysis for age group 36 – 45:

Among 120 participants of the survey, 15 respondents fall under the age group of 36 – 25 where total 2 responded were CityCell corporate line user, 7 of them were GP corporate line user, 4 respondents of banglalink, 2 respondents from AKTEL corporate clients. Among these 15 respondents, 9 participants believe GP, 2 participants believe AKTEL, 3 respondents believe banglalink and only 1 respondent believes teletalk and none believes CityCell as their favorable corporate cell phone service provider.

A REGRESSION MODEL FOR MONTHLY BILL OF THE SUBSCRIBERS

I have used a multiple regression model to provide estimates of the effect of each variable in combination with other variables in this model the dependent variable Y is the monthly bill of the corporate subscribers. Independent variables include monthly household income, x1, sex x2, and age group x3. These variables were identified as the predictors of monthly bill of the corporate subscribers. The resulting model is

Y = β0 + β1 x1 + β2x2 + β3x3

Y = monthly bill of corporate subscriber.

β0 = constant

β1 = coefficient of monthly house hold income

β2 = coefficient of sex

β1 = coefficient of age group

x1 = monthly house hold income of corporate subscriber

x2 = sex of the corporate subscriber.

x3 = age group of the corporate subscriber

Coefficients (a)

| Model | Unstandardized Coefficients | Standardized Coefficients | t | Sig. | ||

| B | Std. Error | Beta | ||||

| 1 | ||||||

| (Constant) | 1260.728 | 550.714 | 2.289 | .024 | ||

| Age Group | 207.797 | 68.361 | .264 | 3.040 | .003 | |

| Sex | -407.067 | 245.712 | -.142 | -1.657 | .100 | |

| Monthly household income | .038 | .017 | .197 | 2.270 | .025 | |

a. Dependent Variable: Avg. monthly bill of your cell phone

From the above table the resulting model is

Y = 1260.728 + 0.038 x1 – 407.067x2 + 207.797 x3

From the p – value of the model it is evident that –

- Monthly house hold income of corporate subscriber, x1 is significant for the model. (As p- value .025 < 0.05)

- Sex of the corporate subscriber, x2 is not significant for the model. (As p- value 0.100 > 0.05

- Age group of the corporate subscriber, x3 is significant for the model. (As p- value .0003 < 0.05).

An AVOVA test is conducted to test whether the model is adequate or not.

Null hypothesis H0: the model is not adequate

Alternative hypothesis H1: the model is adequate.

Variables Entered/Removed(b)

| Model | Variables Entered | Variables Removed | Method |

| 1 | Monthly household income , Sex, Age Group(a) | . | Enter |

a All requested variables entered.

b Dependent Variable: Avg. monthly bill of your cell phone

ANOVA

| Model | Sum of Squares | df | Mean Square | F | Sig. | |

| 1 | Regression | 25804595.751 | 3 | 8601531.917 | 7.550 | .000(a) |

| Residual | 132162070.916 | 116 | 1139328.198 | |||

| Total | 157966666.667 | 119 |

a Predictors: (Constant), Monthly household income , Sex, Age Group

b Dependent Variable: Avg. monthly bill of your cell phone

Model Summary(b

| Model | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | |||||

| 1 | .404(a) | .163 | .142 | 1067.39318 | .163 | 7.550 | 3 | 116 | .000 |

a Predictors: (Constant), Monthly household income , Sex, Age Group

b Dependent Variable: Avg. monthly bill of your cell phone

Residuals Statistics(a)

Minimum | Maximum | Mean | Std. Deviation | N | |

| Predicted Value | 1123.4305 | 3319.9470 | 2183.3333 | 465.66656 | 120 |

| Residual | -1988.7585 | 2969.5024 | .0000 | 1053.85276 | 120 |

| Std. Predicted Value | -2.276 | 2.441 | .000 | 1.000 | 120 |

| Std. Residual | -1.863 | 2.782 | .000 | .987 | 120 |

a Dependent Variable: Avg. monthly bill of your cell phone

Here, p-value is 0.000 which less than 0.05

So, we reject the null hypothesis. That is the model is adequate.

So it can be said that monthly bill of the corporate subscriber (Y) depends on monthly household income (x1) and age (x3) of the corporate subscriber.

FINDINGS

Finally, after conducting an exclusive and effective research I came to the following conclusion:

- The trend of providing corporate cell phone in our country has grown up in recent years. 4 years ago, it was very poor.

- Cell phone service providers have huge chunk of postpaid user in different corporate offices while the number of pre-paid corporate user is not that much attuned with the post-paid corporate user.

- Majority of the corporate subscribers are using the GP connection for long duration which is 3-4 years. Banglalink, AKTEL and CityCell are very close to each other considering this specific issue.

- Though banglalink is the youngest cell phone service provider of the telecom industry of Bangladesh, they got noticeable preference for private subscription beside the corporate connection. It is evident that –

- High preference for private subscription from the same operator.

- Preference for private subscription from banglalink by CityCell corporate subscriber is noticeable (38.9%) and by AKTEL it is 11.11% – which shows a high trend of future mobility from CityCell / AKTEL toward banglalink is perceptible.

- banglalink network quality is quite behind the competition and network quality is an important tool to evaluate the service quality

- banglalink is quite ahead in the competition regarding the network coverage and network coverage is an important tool to evaluate the service quality

- banglalink should focus more on customer care services though banglalink customer care service quality is the benchmark for the industry.

- Majority (58.2%) of the subscribers of all cell phone operators believe that call rate is the most important factor to evaluate the service quality of the cell phone operator.

- Majority (35.2%) of the subscribers of all cell phone operator believe that value added services is the most important factor to evaluate the service quality of the cell phone operator.

- banglalink is quite behind the competition regarding the belief of the corporate subscribers about the network quality.

- banglalink is quite ahead in the competition regarding the belief of the corporate subscribers about the network coverage. GP is in the first position regarding the perception of their corporate subscribers’ satisfaction about the network coverage. banglalink has got the second position regarding the perception of their corporate subscribers’ satisfaction about the network coverage. AKTEL is positioned in the 3rd place and with poor network coverage CityCell is in the last place in the industry.

- banglalink is way behind the competition regarding the intra connectivity.

- banglalink is quite behind the competition regarding the perception of the corporate subscribers about inter connectivity where AKTEL is the benchmark for the industry regarding inter connectivity.

- banglalink is in the lowest condition regarding special care for the corporate users.

- banglalink is quite ahead the competition regarding the issue of providing customized tariff plan for their corporate users.

- On an average banglalink is trying to provide the cheap tariff rate for the corporate users.

- banglalink is way behind the competition in the sense of providing adequate value added services to its subscribers.

- Majority of the subscribers believe that the service providers are technologically updated. GP is in the first place regarding this issue where banglalink-the newest player of the industry is in the 2nd position in terms of technological advancement.

- banglalink is far away behind Grameen Phone and AKTEL regarding preference as the favorite cell phone provider.

- Majority the service providers are maintaining a standard regarding cautiousness about sending correct itemized bill to their corporate subscribers but banglalink is away behind the industry average regarding this specific issue.

- Existing banglalink corporate users who fall under the age group of 26-35 are not satisfied at all with the current service quality as majority preferred the competitors.

- According to the perception of corporate users who fall under the age group of 36-45, banglalink has a satisfactory level of preference among the other competitors of the cell phone industry as its existing clients are either satisfied or preferred GP but none of them prefer AKTEL, CityCell or Teletalk.

- Majority of sample of corporate cell phone subscribers get monthly bill close to 2500TK.

- Average monthly household income of the corporate subscriber is 25,791 TK.

- Monthly bill of the corporate subscriber depends on monthly household income and age of the corporate subscriber.

RECOMMENDATION

In a country where the mobile telephony penetration is below 9%, the best strategic move for any operator would be to concentrate on expanding the subscriber base. To expand the subscriber base and to build a brand image among the existing & potential subscribers, banglalink must concentrate on different issues with which the subscribers are not satisfied at the present condition. To survive in the competitive market and to grab majority of the corporate subscriber base, banglalink must concentrate on the following issues:

Improve network quality:

Network quality is a very important tool to evaluate the service quality of cell phone. As the existing subscribers of banglalink are not satisfied with the current network condition, so, the top level management of the company should concentrate on this issue so that they can improve the quality of the network. Banglalink technical department has to be more conscious to ensure best quality network in the country. High quality BTS (Base Transverse Station) and powerful equipments set up can increase the quality of network.

Improve coverage:

Banglalink has already created a positive perception among the subscribers with its fastest growing network coverage. Within a short span of 1 year operation, banglalink has covered 61 districts and 88% population base under its network coverage. Though the existing subscribers are satisfied with the network coverage, banglalink is still way behind the competitors like Grameen Phone, and AKTEL. So to ruin the position of GP

Introduce separate corporate care line:

Since the existing corporate subscribers of banglalink are not satisfied with the customer care service, so the company should introduce a separate unit in the customer care department to serve the corporate customers so that the corporate subscribers get prompt one stop solution of any sort of problem.

Add more value added services:

Banglalink must add more value added services to its line-up, such as WAP, Data & Fax, etc. recently GP and AKTEL introduced GPRS facility for its subscribers and this service is still not available with banglalink. To compete in the market, and to satisfy the customers, banglalink has to be up to date regarding the innovation and introduction of more value added services.

Overall improvement of service quality:

To ensure complete mobility solution with mobile phone service banglalink has to improve its overall service quality. Banglalink has to invest more in all sectors of development to ensure better quality service for its subscribers. By hiring more skilled people, and providing training to its existing employees, banglalink can ensure a superb employee base who will be eligible to provide best service to its valued subscribers.

CONCLUSION

Technological developments have opened up a new dimension in the deployment of creative and efficient services and customer satisfaction. Telecommunication industry is playing an important role in the communication system that has become an obvious for this modern world and the scenario is indifferent for Bangladesh telecom industry. If we look at the scenario of telecom industry of country we see that people has paid approximately 7.00 TK/minute charge for the use of their cellular phone. The scenario of the telecom industry has totally changed as BanglalinkTM entered in the industry with the aim of serving mobile phone services to the mass population of the country so that the entire communication system of Bangladesh develop dramatically. The intense competition in telecom industry is facilitating the people with reduced tariff rate. Cell phone is no more a fashion in the country rather it became a necessity. People now have more than one scheme card of different subscribers. So, considering the competitive scenario, banglalink must come up with new product and service idea that will satisfy not only the existing subscribers but also attract the potential subscribers and this is the only way how the company can sustain in the intense competitive market in the long run.