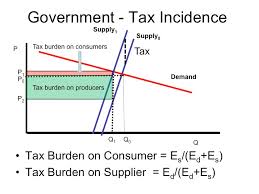

Tax incidence is an economic term for the division of some sort of tax burden concerning buyers and suppliers. Tax incidence is related to the price firmness of supply as well as demand. When provide is more flexible than demand, the tax burden falls around the buyers. If need is more flexible than supply, producers will bear the expense of the tax. Within economics, tax incidence is the analysis of the effect of a particular tax around the distribution of fiscal welfare.

Tax Incidence