The sticky wage theory is an economic concept that describes how wages react slowly to shifts in the labor market. Sticky wages is an idea to depict how in reality, wages might be delayed to change and stall out over the harmony since laborers oppose ostensible compensation cuts. When unemployment rises, the salaries of those who remain employed tend to keep the same or grow at a slower rate, rather than falling in tandem with the decline in labor demand, according to the theory.

Wages can be “sticky” for a variety of reasons, including the influence of trade unions, employment contracts, aversion to nominal wage reduction, and “efficiency wage” theories. In particular, wages are regularly supposed to be tacky down, implying that they can climb effectively yet drop down just with trouble. Wages can stay tacky for an assortment of reasons, for example, work associations or business contracts. Sticky wages during economic downturns, such as a recession, can lead to unemployment, labor market disequilibrium, and slowed economic recovery attempts.

The theory is credited to economist John Maynard Keynes, who coined the term “nominal rigidity” to describe the phenomena. Sticky wages can lead to real wage unemployment and labor market disequilibrium. Since wages will in general be “sticky down,” genuine wages are rather disintegrated through the impacts of expansion. A critical piece of Keynesian monetary hypothesis, “stickiness” has been seen in different territories also, for example, in specific costs and tax assessment levels.

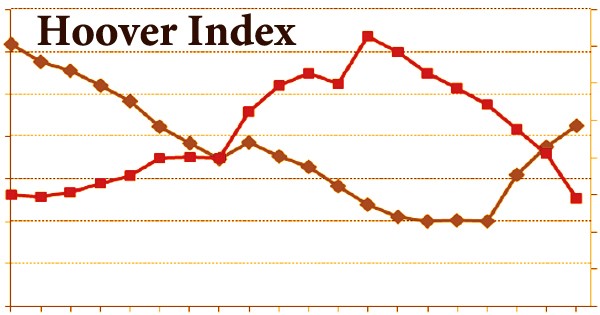

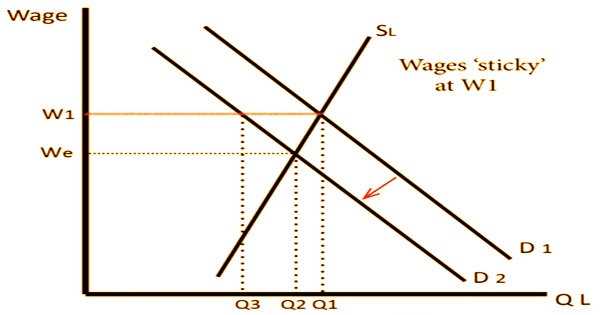

In the actual world, however, there may be a number of variables that keep salaries from plummeting. If wages remain at W1 and demand decreases to W2, the demand for labor falls.

Stickiness is a hypothetical economic situation wherein some ostensible value opposes change. While it regularly applies to compensation, tenacity may likewise frequently be utilized concerning costs inside a market, which is additionally regularly called price stickiness. The dynamics of supply and demand determine the prices of commodities in a typical marketplace. When demand rises, prices rise as well. The market is in balance when supply and demand are equal.

The total value level, or normal degree of costs inside a market, can get tacky because of an imbalance between the unbending nature and adaptability in estimating. This imbalance frequently implies that costs will react to factors that permit them to go up, yet will oppose those powers acting to push them down. Most things are subject to supply and demand, but sticky wages are an exception. Labor is the “good,” and wages are the “price” in the labor market. We would expect changes in supply or demand to result in pay changes in a completely competitive labor market.

Sticky wages and ostensible compensation inflexibility was a significant idea in J.M. Keynes The General Theory of Employment, Interest and Money. Specifically, Keynes contended in a downturn, with falling costs, compensation didn’t tumble to reestablish balance. This prompted genuine pay joblessness. Aversion to nominal wage reduction, for example, was cited by Keynes as a reason. Wages are supposed to act in a similar way: individuals are delighted to earn an increase, but will struggle against a pay cut.

For example, if labor demand falls, wages are expected to fall as well. Wages would continue to fall until the market reached equilibrium, at which point every worker would be hired based on the wage they are prepared to take. In fact, however, this is not the case.

Wage stickiness is a well-known hypothesis acknowledged by numerous financial analysts, albeit some idealist neoclassical financial specialists question its strength. Advocates of the hypothesis have represented various reasons regarding why wages are sticky. During a downturn in the economy, demand for labor tends to diminish, while salaries remain constant. Wages tend to stay stagnant rather than reaching equilibrium. Companies are afraid to slash pay because wages are sticky. Instead, many businesses will choose to lay off workers, resulting in joblessness.

These incorporate the possibility that laborers are substantially more able to acknowledge salary increases than cuts, that a few specialists are patrons with long haul agreements or aggregate dealing power, and that an organization might not have any desire to open itself to the terrible press or negative picture related with wage cuts. Sticky wages are important because they break the relationship between microeconomics and macroeconomics. It means that inflation and deflation can significantly affect economic growth and inflation.

The dynamics of supply and demand should effect salaries in a completely competitive labor market. Wage cutbacks, on the other hand, are often resisted by both businesses and employees. The reason for this might be attributed to a number of factors:

Unions: Because they have collective negotiating strength, employees in unions can fight salary decreases. Despite the fact that some unemployed workers are willing to accept lower salaries, employed union members can reject planned wage cutbacks.

Efficiency Wage Theory: According to the theory, increased compensation can boost employee morale and commitment to the organization. Workers are more willing to work harder and produce more as a result of this incentive. Workers may experience a psychological drop in morale as a result of wage cuts, resulting in decreased production.

- Minimum Wage Laws: Employers are unable to reduce pay below the minimum wage due to minimum wage legislation.

- Employment Contracts: Wages are frequently computed annually and are thus fixed in the short term. The provisions of the employment contract are usually followed by employers.

Costs Associated with Labor: In contrast to different products, labor includes costs related with the recruiting and terminating of laborers. On the off chance that a worker has effectively been prepared, cutting wages may bring about the representative stopping, which would bring about costs related with the preparation of new representatives.

Sticky wages are viewed with suspicion by classical and monetarist economics. They are more optimistic that labor markets would stabilize and wages will fall to equilibirum levels. Without stickiness, wages would consistently change in pretty much ongoing with the market and achieve moderately steady monetary harmony. With a disturbance in the market would come proportionate compensation decreases absent a lot of occupation misfortune. An expected clarification for expanding joblessness is the sticky pay hypothesis.

Wages are slow to react to changing market conditions, resulting in labor market disequilibrium. In a period of unemployment, however, they may point to barriers to free markets, such as minimum wages and trade union power. All things being equal, because of tenacity, in case of a disturbance, compensation are bound to remain where they are and, all things considered, firms are bound to manage business. This propensity of tenacity may clarify why markets are delayed to arrive at balance, if at any time.

As a result, removing these barriers to open markets would allow salaries to become less sticky and reach equilibrium. The demand for goods falls during a recession, lowering the need for manufacturing and labor. Since organizations and workers are impervious to wage cuts, companies may choose to lay off representatives all things considered, expanding joblessness. A few financial analysts have likewise estimated that tenacity can, essentially, be infectious, spilling from an influenced space of the market into other unaffected territories.

Economists have warned, however, that such stickiness is merely a mirage, as real income will lose purchasing power over time as a result of inflation. The labor market eventually returns to equilibrium, even with sticky wages. It occurs as a result of inflation gradually reducing nominal wages, allowing businesses to reduce salaries without taking any action. Due to rivalry for jobs and firms’ efforts to maintain salaries competitive, the entry of wage-stickiness into one area or industry sector sometimes leads to wage-stickiness in other sectors.

Employment rates are thought to be affected by the distortions in the job market produced by sticky wages. However, in instances of very low inflation, the gradual decrease in real wages may not be enough to bring the market back to equilibrium. Therefore, when wages are sticky in a low inflation environment, economic recovery tends to be slower. On the other hand, according to the theory, wages themselves will often remain sticky-down and employees who made it through may see raises in pay.

Information Sources: