The statement of cash flows, commonly known as the cash flow statement, is a financial statement that demonstrates how changes in balance sheet accounts and revenue effect cash and cash equivalents, and divides the analysis into three categories: operating, investing, and financing. It’s one of the three basic financial statements that show how much money was made and spent over a period of time (e.g., a month, quarter, or year). The cash flow statement is primarily concerned with the inflow and outflow of cash in and out of the firm. The statement of cash flows is a valuable analytical tool for analyzing a company’s short-term sustainability, notably its capacity to pay bills.

Investors and analysts may see a picture of all the transactions that take place in a company’s financial records, and each transaction adds to its success. A smaller company might not produce a statement of cash flows for internal use, choosing instead to disclose an income statement and balance sheet. It is, nevertheless, a compulsory component of the audited financial statements provided to lenders, creditors, regulators, and investors.

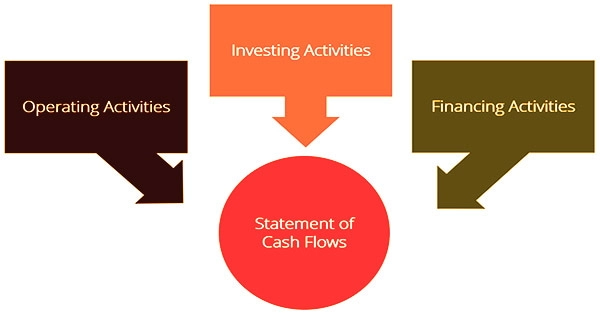

By demonstrating how the money went in and out of the firm, the statement of cash flows serves as a link between the income statement and the balance sheet. Because it tracks the cash generated by the firm in three primary ways: operations, investment, and financing, it is said to be the most intuitive of all the financial statements. The cash flow statement (formerly known as the flow of funds statement) depicts the sources of a company’s cash flow as well as how it was spent over a certain time period.

The statement of cash flows can be used to spot trends in business performance that aren’t visible in the other financial statements. It’s especially beneficial when the amount of profits reported and the quantity of net cash flow created by activities aren’t in sync. Because a corporation might declare a profit on its income statement while yet having inadequate capital to function, it is a crucial sign of its financial health. The cash flow statement displays a company’s profits quality as well as its ability to pay interest and dividends.

Three Sections of the Statement of Cash Flows:

- Operating Activities: Any cash flows from current assets and current liabilities; an organization’s main revenue-generating operations and other activities that are not investing or financing.

- Investing Activities: Any cash flows not included in cash equivalents from the acquisition and disposal of long-term assets and other investments.

- Financing Activities: Any cash flows resulting from changes in the amount and mix of the entity’s contributed equity capital or borrowings (i.e., bonds, stock, dividends).

The cash flow statement is an important document that gives all interested parties a window into all of a company’s activities. It varies from the balance sheet and income statement in that it does not include non-cash activities that accrual basis accounting requires, such as depreciation, deferred income taxes, bad debt write-offs, and sales on credit when receivables have not yet been collected.

Many investors believe the statement of cash flows is the most transparent of the financial statements (i.e., the most difficult to manipulate), hence they depend on it more than the other financial statements to determine a company’s genuine performance. They may utilize it to figure out where money comes from and where it goes. Accounting is divided into two branches: accrual and cash. Most public firms employ accrual accounting, which implies that the income statement differs from the cash position of the organization. The cash flow statement, on the other hand, is primarily concerned with cash accounting.

Prior to accrual accounting, cash basis financial statements were fairly frequent. In the past, “flow of funds” statements were simply cash flow statements. For the following reasons, there may be considerable variations between the income statement figures and the cash flows in this statement:

- There are discrepancies in when a transaction is recorded and when the associated cash is actually spent or received.

- It’s possible that management is adopting aggressive revenue recognition to record revenue for which cash transactions are still a long way off.

- The company may be asset-intensive, necessitating huge capital inputs that are not shown in the income statement except as depreciation.

Profitable businesses sometimes fail to manage cash flow properly, which is why the cash flow statement is such an important tool for businesses, analysts, and investors. The cash flow statement is divided into three parts: operations, investment, and financing. The direct method or the indirect technique can be used to illustrate the operational portion of the statement of cash flows. The investment and financing portions are the same in both methods; the only variation is in the operational section.

The direct technique of creating a cash flow statement yields a report that is easier to comprehend. The indirect technique, on the other hand, starts with net income and adjusts profit/loss for transaction impacts. In the end, whether using the direct or indirect technique, cash flows from the operational sector will provide the same outcome; however, the presentation will change. On the income statement, the firm makes a profit and pays income taxes on it, although the corporation may bring in more or less cash than the sales or income statistics indicate.

Information Sources: