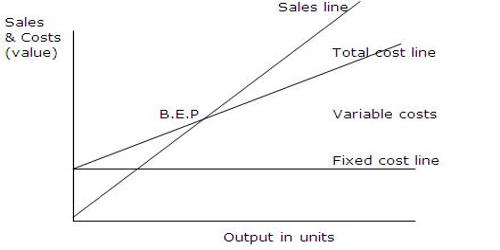

A fully depreciated asset is an asset or fixed asset of a plant where the book value of the asset is equal to the approximate salvage value. Whenever an asset is capitalized, the expense is depreciated according to a depreciation schedule for several years. Theoretically, this gives a more detailed calculation of the true costs of running the activities of the company every year. In two ways, an asset may be completely depreciated:

- The asset expires its useful life

- An impairment charge is equal to or greater than the remaining value of the asset

If the fully depreciated asset continues to be used without spending on improvement, no further depreciation costs can be incurred. When its useful life expires, an asset may achieve maximum depreciation or if an impairment charge is incurred against the original cost, but this is less usual. If the asset’s accumulated depreciation is equal to the asset’s original cost, then it is labeled as completely depreciated. If an impairment charge equal to the asset’s fee is incurred, then the asset is right away fully depreciated.

(Fully Depreciated Asset)

When a corporation takes a full impairment charge against the asset, the asset is automatically entirely depreciated, leaving only its rescue value (also referred to as the terminal or residual value). The cost of the asset and its accrued depreciation before the asset is disposed of will continue to be listed on the balance sheet. The method of depreciation can take the form of straight-line or accelerated (double-declining-balance or sum-of-year), and the asset is now completely depreciated on the company’s books when collected depreciation equals the genuine expense.

There are different methods to estimate the depreciation expense:

- It is common to enforce a more aggressive depreciation plan and consider expenditures sooner by using more traditional accounting practices.

- Sometimes, a fully depreciated asset can still provide value to a company.

- In such a scenario, a company’s operating income will grow because no depreciation costs will be remembered.

In fact, the useful life of an asset is difficult to predict, so depreciation costs reflect only a rough approximation of the true amount of an asset used up each year. The asset is withdrawn from the company’s balance sheet if the asset is no longer used by a company or is sold. Conservative accounting standards require that using a quicker depreciation schedule is more prudent when in question so that expenditures are recorded sooner. Since property, plant, and equipment (PP&E) and accrued depreciation are balance sheet products, the balance sheet of the business will be impacted by the full depreciation of an asset. At the same time, since that is where the depreciation cost is reported, the revenue statement is affected. The accrued depreciation account is debited and the asset account is paid at the rate of its original expense when the completely depreciated asset is finally disposed of.

Information Sources: