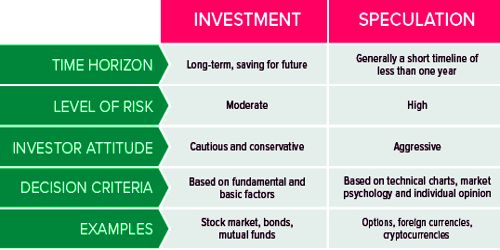

Speculation is the investment in stocks, property, etc. in the hope of gain but with the risk of loss. It is the buying and selling of shares, securities, stocks, and commodities in stock and produces exchange with the expectation of making a large profit in a short time by resale. It is the buying of an asset or financial instrument with the hope that the price of the asset or financial instrument will increase in the future.

Speculation is a method of short-term investing whereby traders essentially bet on the direction an asset’s price will move. With speculation, the risk of loss is more than offset by the possibility of a substantial gain or another recompense. Speculators are people who engage in speculative investments. Bill Gates and Steve Jobs were speculators; Warren Buffett is a speculator.

The speculation involves trading a financial instrument involving high risk, in expectation of significant returns. An investor who purchases a speculative investment is likely focused on price fluctuations. The motive is to take maximum advantage of fluctuations in the market. While the risk associated with the investment is high, the investor is typically more concerned about generating a profit based on market value changes for that investment than on long-term investing. Speculators are prevalent in the markets where price movements of securities are highly frequent and volatile. When speculative investing involves the purchase of foreign currency, it is known as currency speculation. They play very important roles in the markets by absorbing excess risk and providing much-needed liquidity in the market by buying and selling when other investors don’t participate. In this scenario, an investor buys currency in an effort to later sell that currency at an appreciated rate, as opposed to an investor who buys currency in order to pay for an import or to finance a foreign investment. So, it is an assumption of unusual business risk in hopes of obtaining commensurate gain.

Without the prospect of substantial gains, there would be little motivation to engage in speculation. Speculative investors tend to make decisions more often based on technical analysis of market price action rather than on fundamental analysis of an asset or security. It may sometimes be difficult to distinguish between speculation and simple investment, forcing the market player to consider whether speculation or investment depends on factors that measure the nature of the asset, expected duration of the holding period, and/or amount of leverage applied to the exposure. They also tend to be more active market traders – often seeking to profit from short-term price fluctuations – as opposed to being “buy and hold” investors.