EXECUTIVE SUMMERY:

This research report is a partial requirement of the Thesis phase of BBA program, Stamford University Bangladesh. The topic of this research project “On SME Banking Bangladesh and Credit Risk Grading System of Bangladesh Private Commercial Bank Limited”.

The intent of this chapter is to present an overview of general banking and also to represent the performance analysis of BCBL.This has been done using the manuals, reports and documentary evidences of the bank under study. General Banking department performs the core functions of the bank. They take deposit from the customers and meet their demand for cash honoring their cheque.They pass entry of every transaction within the day. The bank opens new accounts; remit funds, issues bank drafts and pay order etc. Since the bank has got to provide these services everyday, general banking in known as “Retail Banking”.

During the two months of my Thesis period I was placed in the different departments of general banking and also for few days in advance. I heavily enjoyed the work of those departments. The work experience gave me a good idea of the general banking of BCBL and d a little idea about advance. In preparing the report, both primary and secondary data were collected for the purpose of the report. The population for the purpose of the study comprises customers and personnel/officers of BCBL only. In regard to secondary data, related literature like books, internet, journals, annual reports and financial statements were reviewed. In analyzing the performance of BCBL the calculation of the ration was done from the balance sheet and profit and loss a/c of 9 months ended 30 September 2003.

List of Abbreviation & Acronyms:

- Bangladesh Private Commercial Bank

- BL- Bad loss

- BMRE- Balancing Modernizing Reconstruction Expansion

- CAM- Credit Administration and Mentoring

- CIB-Credit Information Bureau

- CRM-Credit Risk Management

- CRGS-Credit Risk Grading System

- CU-Credit Unit

- CCU- Credit & Collections Unit

- DF- Doubt Full

- EC- Executive Committee

- EMI-Equal Monthly Installment

- FSRP- Financial Sector Reform Project

- FSV-Force Sale Value

- GOB- Government Of Bangladesh

- PAD-Payment Against Deposit

- UBME- Union Bank of Middle East

- SAVP-Senior Assistant Vice President

- SMA- Special Mention Account

- SME- Small & Medium Enterprise

- RRDH-Repair & Reconstruction of Dwelling Houses

- RFCL-Request for Credit Limit

- RM-Relationship Manager

- KYC- Know Your Customer

- RFA-Request For Action

- RU-Recovery Unit

- PG-Program Guideline.

- PPG- Product Program Guidelines

INTRODUCTION:

Origin and Background of the Report:

In recent days the Small and Medium Enterprise (SME) Financing has become an important area for Commercial Banks in Bangladesh. To align its corporate policy with the regulation of Central Bank, banks have become more concerned about SME and opened windows to conduct business in this particular area. This study has been conducted to fulfill the requirements of sixth term MBM program and gain an insight about the present condition of small and medium enterprise in the economy of Bangladesh and their financing scenario in light of Bangladesh Bank regulation.

This report is being assigned as a part of the Degree BBA 499A, (Thesis)To prepare this report under the state of University’s requirement, I accommodate my Dissertation program in Bangladesh Private Commercial Bank Ltd. For the completion of the course, as an essential part I had prepared Dissertation Report. This report is being formed on the “A Study on SME Banking & Credit Risk Grading system of Bangladesh Private Commercial Bank Limited. From the very beginning of my I have worked on General banking. After few weeks later I was shift on Credit department. And I worked on SME Banking .For that reason I made my Report on SME Banking & Credit Risk Grading system of Bangladesh Private Commercial Bank Limited.

Objective of the Study:

After Liberation of Bangladesh, intensive efforts were undertaken to accelerate the rate of industrialization in the country. At the beginning, import substitution and subsequently export-led economic growth strategy was pursued for industrialization. In order to attain this objective, large amount of industrial credit was funneled to the industrial sector. But the whole exercise of industrialization came to a halt with the massive diversion of resources to other non priority sectors. Policy makers, of late, have come to recognize the contribution of SME sector towards economic development in the country. Small and medium enterprises have been recognized as one of the most important means for providing better economic opportunities for the people of least developing countries like Bangladesh. A developing economy like that of ours suffers from many peculiar problems such as disproportionate pressure of population on agriculture due to lack of rural industrialization, unemployment and underemployment of human and materials resources, unbalanced regional development etc. The contribution of small and medium enterprises in the solution of these problems is beyond doubt, provided they are organized and run on scientific basis.

Small and medium enterprises are particularly suitable for densely populated countries like Bangladesh where SME sector can provide employment with much lower investment per job provided. Out of 11% employment of the civilian labor force provided by the manufacturing sector, about two thirds are estimated to be provided by the small and cottage industries sector. Again, development of small industries facilitates the effective mobilization of capital and labor resources. They also help in raising standards of living of people in rural areas. Contribution of SME sector to GDP remained above 4% during the period from 1985-86 to 1999-00. Moreover, the present contribution of SME sector to GDP is approximately 5% and SME sector employs 25% of the total labor forces, thus this sector is the present available sector for creation of jobs (Saha, Sujit R. 2007).

Research papers developed by Bakht, Zaid (1998) and Ahmad, Salahuddin et al. (1998) described that the policy environment within which SMEs in Bangladesh operate accompanies legal, regulatory and administrative constraints to employment creation by SMEs. The robustness of SME contributions to employment generation is a common phenomenon in most developing countries in that the magnitude varies between 70% to 95% in Africa and 40% to 70% in the countries of the Asia-Pacific region (Ahmed, M.U. 1999).

Liberalization of industrial and trade regimes along with globalization are likely to have

significant effects on Bangladesh’s SMEs (Ahmed, 2002; Bhattacharya et. al., 2000).

Various recent studies (Ahmed, M.U. 2001, ADB 2001, USAID 2001) show that SMEs have undergone significant structural changes in terms of product composition, degree of capitalization and market penetration in order to adjust to changes in technology, market demand and market access brought by globalization and market liberalization. The official data show that the share of private investment in Bangladesh’s GDP in the late 1990s, which may be considered as the post-reform era, has remained more of less constant at around 15% (Bhattacharya, 2002). This may be interpreted as an evidence of stagnant private sector activities in the country.

The recent private sector survey estimates the contribution of the micro, small, and medium enterprises (MSMEs) is 20-25% of GDP (Daniels, 2003). While SMEs are characteristically highly diverse and heterogeneous, their traditional dominance is in a few industrial sub-sectors such as food, textiles and light engineering and wood, cane and bamboo products. According to SEDF sources quoted from ADB (2003), food and textile units including garments account for over 60% of the registered SMEs.

Despite these contributions in the economy of the country, Banking sectors are not interested in financing the small and medium enterprises; rather there is a decline in the amount of advances by the Banking sector.

There are approximately 52 Banks operating

In our country and all are serving large enterprises rather than SMEs though only the

Small enterprise’s contribution is 5% in GDP of Bangladesh in 2007. But why? What are the causes for which Banks are not interested in financing this sector? From recent statistical data of Sonali Bank of Bangladesh, we see that the credit recovery rate is 51.44% in this sector. Why this recovery rate is not large enough? Why the SMEs are failing to payback their credit to the lenders? We have tried to find out the answer of these questions in this research paper.

The objective of my study can be divided into two segments.

These are given below:

Primary Objective:

The primary objective of this report is to meet the requirements of the course, BBA 499A, Internship.

Secondary Objective:

The secondary objectives are:

To know the concept of SME and its impact in overall economy of Bangladesh

Entrepreneurship development situation through SME banking

Importance of SME banking in context of Bangladesh

To be familiar with SME loan procedures

To understand the terms and conditions of SME loan

To value the disbursement and recovery procedures of SME lo

To understand the credit risk grading system of Bangladesh Private Commercial Bank Limited

To suggest some recommendations for development of SME loan products

Scope of the study:

The study was limited to the SME banking o Bangladesh Private Commercial Bank Ltd. The report covers the SME functions performed by the Credit Division, rules and regulations related to SME Credit, procedure of Sanctioning SME Credit, credit grading system of BPCBL, Monitoring, and various analyses related to this particular arena etc.

Data collection:

(I) Primary data- Discussion with the reactive organizations officials

(ii) Secondary data-

For the completion of the present study, secondary data has been collected.

The main sources of secondary data are:

Annual report of Bangladesh Private Commercial Bank Ltd.(2008)

Data from published reports of Bangladesh Bank

Different Books, journals, Periodicals, News papers etc.

Methodology of the study:

In spite of the scarcity of published data, I have been tried to make the report informative and handy. The data used in the report have been complied through different complicated ways- direct questionnaire to executives, Bangladesh Bank publication, working with the organization for a meager period of three month is the main aspect of acquiring data and information to evaluate the culture, working environment and similar sort of affairs of the organization. For gathering concept of SME loan, the Product Program Guideline (PPG) thoroughly analyzed. Beside this observation, I discussed with the employees of the Credit department and Credit administration and mentoring (CAM) department. The study was conducted mainly based on secondary information although some information relating to entrepreneurs have been collected primarily. The sources of data include Office Records, BIBM – Library, Different Research Paper regarding SMEs, Different Publications on SMEs of different banks and some websites.

Sample banks of DNCBs, PCBs, and FCBs from the sample frame, was selected purposively considering the amount of loan size, interest rate, loan processing fees, period of loans, mode of finance and management.

Policies relating to SME financing such as fiscal policy, monetary policy and internal policies of commercial banks was examined thoroughly with a view to find out the influence of existing policies on SME financing. Trend and pattern of bank financing to SME was analyzed by classifying the financing in terms of areas, rate of interest, types, category, and banks.

Limitation of the study:

To make a report various aspects and experience are needed. But I have faced some barriers for making a complete and perfect report. These barriers or limitations, which hinder my word, are as follows:

Non-availability of some preceding and latest data.

Some information was withheld to retain the confidentiality of the bank.

I was placed to this Bank for only 12 weeks of time & working like a regular employee hindered the opportunity to put the effort for the study.

Major limitation to make this report is not availing the Annual report of 2009, which is not yet published. Therefore, it was very difficulty to carry out the whole analyses.

Frame work of the study:

For the internship program, I was taking part my internship at of BPCB Bank. My objective was to get a clear idea about the activities of the Bank. I was assigned by my organization supervisor to study different division and mainly focus on to work on credit division. In particular I was mainly work on SME banking of credit division. I had to analyze the different aspects of the loan proposals viz. Company & Management aspect, marketing aspect, Liability with BPCBL, Liability with other banks, and liability as per CIB.

Job rotation in ABBL:

| Name of the Department | To (Date) | From (Date) | Total Days |

| Accounts Opening | 02-09-2009 | 20-10-2009 | 18 |

| Local Remittance | 21-09-2000 | 01-10-2000 | 12 |

| Financial Control Department | 02-102009 | 17-10-2009 | 16 |

| Clearing | 18-10-2009 | 01-11-2009 | 14 |

| Foreign Remittance | 02-11-2009 | 07-11-2009 | 05 |

| Credit | 08-11-2009 | 31-11-2009 | 22 |

SME Definition:

SME stands for Small to Medium Enterprise.

However, what exactly an SME or Small to Medium Enterprise is depends on who’s doing the defining. Industry Canada uses the term SME to refer to businesses with fewer than 500 employees, while classifying firms with 500 or more employees as “large” businesses.

Breaking down the SME definition, Industry Canada defines a small business as one that has fewer than 100 employees (if the business is a goods-producing business) or fewer than 50 employees (if the business is a service-based business). A firm that has more employees than these cut-offs but fewer than 500 employees is classified as a medium-sized business.In its ongoing research program that collects data on SMEs in Canada, Statistics Canada defines an SME as any business establishment with 0 to 499 employees and less than $50 million in gross revenues.

Different countries define SMEs differently.

In the EU, a similar system is used to define Small to Medium Enterprises. A business with a headcount of fewer than 250 is classified as medium-sized; a business with a headcount of fewer than 50 is classified as small, and a business with a headcount of fewer than 10 is considered a micro business. The European system also takes into account a business’s turnover rate and its balance sheet.

There does not seem to be any standard definition of SME in the U.S.

In recent days the Small and Medium Enterprise (SME) Financing has become an important area for Commercial Banks in Bangladesh. To align its corporate policy with the regulation of Central Bank, banks have become more concerned about SME and opened windows to conduct business in this particular area. This study has been conducted to fulfill the requirements of sixth term MBM program and gain an insight about the present condition of small and medium enterprise in the economy of Bangladesh and their financing scenario in light of Bangladesh Bank regulation.

Collections & Remedial Management

A banks loan portfolio should be subject to a continuous process of monitoring. This will be achieved by regular generation of over limit and overdue reports, showing where facilities are being exceeded and where payments of interest and repayment of principle are late. There should be formal procedures and a system in place to identify potential credit losses and remedial actions has to be. Taken to prevent the losses. Besides that the systems should be in place to report the following exceptions to relevant executives in Credit / sales and branch marketing staff: Past due principal or interest payments; Timely corrective action is taken to address findings of any internal, external or Regulator inspection/audit. All loan facilities are reviewed annually.

Collection Objectives

The collector’s responsibility will commence from the time an account becomes delinquent until it is regularized by means of payment or closed with full payment amount collected. The goal of the collection process is to obtain payments promptly while minimizing Collection expense and write-off costs as well as maintaining the customer’s goodwill by Monitoring.Computer systems should be able to produce the reports for central / head office as well as branch review.

Recovery

The collection process for SE loans will start when the borrower has failed to meet one ormore contractual payment (Installment). It therefore, becomes the duty of the Collection Department to minimize the outstanding delinquent receivable and credit losses. This procedure has been designed to enable the collection staff to systematically recover the dues and identify / prevent potential losses, while maintaining a high standard of service and retaining good relations with the customers. It is therefore essential and critical, that collection people are familiar with the computerized system (where applicable), procedures and maintain effective liaison with other departments within the bank.

Risk Management

Credit Risk

The credit risk is managed by the Credit & Collections unit (CCU), which is completely segregated from business/sales. The following elements contribute to the management of

credit risks:

The credit risk associated with the products is managed by the following:

Loans will be given only after proper verification of customer’s static data and after proper assessment & confirmation of income related documents, which will objectively ascertain customer’s repayment capacity.

Proposals will be assessed by independent Credit division (CCU) that is completely separated from business/sales. Every loan will be secured by hypothecation over the asset financed, and Customer’s authority taken for re-possession of the asset in case of loan loss.

The Credit & Collection activities will be managed centrally and loan approval authorities will be controlled centrally where the branch managers or sales people will have no involvement.

Contact Point Verification:

Contact Point Verification should be done wherever possible for all applicants. The external CPV includes residence, office and telephone verifications. All verifications are done to seek/verify/confirm the declared/undeclared information of the applicant.

Third Party Risk

Political and economical environment of a country play a big role behind the success of business. Banks should always keep a close watch in these areas so that it is able to position itself in the backdrop of any changes in country’s political and economical scenario.

Operational Risk

For consumer loans, the activities of front line sales and behind-the-scene maintenance

And support is clearly segregated. Credit & Collections Unit (CCU) will be formed.

CCU will manage the following aspects of the product: a) inputs, approvals, customer file maintenance, monitoring & collections; b) the Operation jobs like disbursal in the system including raising debit standing orders and the lodgment and maintenance of securities. Type ‘a’ jobs and type ‘b’ jobs will be handled by separate teams within CCU; therefore the risk of compromise with loan / security documentation will be minimal.

It will ensure uncompromising checks, quick service delivery, uncompromising

Management of credit risks and effective collections & recovery activities.

Maintenance of Documents & Securities CCU or Operations Unit will hold the applications and other documents related to SE loans in safe custody. All this documents will go under single credit file per customer developed before launch of the product. The physical securities and the security documents will be held elsewhere inside fireproof cabinets under CCU’s or Operation’s custody. The dual-key system for security placement and retrieval will have to be implemented.

Internal Audit

All Banks should have a segregated internal audit department who will be responsible with performing audits of all departments. Audits should be carried out on a regular or periodically as agreed by the Management to assess various risks and possible weaknesses and to ensure compliance with regulatory guidelines, internal procedures, and Lending Guidelines and Bangladesh Bank requirements.

In case of third party deposits/security instruments, banks should verify third party’s signature against the specimen attached to the original instrument and bank will also send the instrument to the issuing office for their verification and written confirmation on lien marking and encashment of the instrument. Therefore, any inherent risk emanating from accepting third party deposits/security instruments is minimal.

Fraud Risk

There is an inherent fraud risk in any lending business. The most common fraud risks are:

Application Fraud

The applicant’s signature may not be verified for authenticity. However, the applicant’s identity should be confirmed by way of scrutiny of identification and other documentation. A Contact Point Verification (CPV) agency should be in place to verify applicant’s residence, office and contact phone numbers etc.

There always remains the possibility of application fraud by way of producing forged documents. Considering the current market practices and operational constraints, it may not always be feasible to validate the authenticity of all documentation. However, banks/ NBFIs should be aware of this threat and may consider validating the bank statement (the most important and commonly provided income document) through CPV agent.

Credit Administration

After approval, Credit Team will send / forward the approved application along with the security and other documents to the Credit Administration Department under Operations Unit for processing. The Credit Administration function is critical in ensuring that proper documentation and approvals are in place prior to the disbursement of loan facilities. Under Credit Administration there may be two-sub unit, Documentation & QC and Loan Administration Dept who will process the document and disburse the loan.

Credit Documentation

Credit Documentation dept is responsible:

To ensure that all security documentation complies with the terms of approval. To control loan disbursements only after all terms and conditions of approval have been met, and all security documentation as per the checklist of approved PPG is in place. To maintain control over all security documentation. To monitor borrower’s compliance with agreed terms and conditions, and general monitoring of account conduct/performance. Upon performing the above, Documentation dept will forward the Limit Insertion Instruction to the Loan Administration unit for limit and other information to input into the bank’s main system.

Disbursement

Loan Administration dept will disburse the loan amounts under loan facilities only when

all security documentation is in place. CIB report is obtained, as appropriate, and clean.

Custodial Duties

Loan disbursements and the preparation and storage of security documents should be centralized in the regional credit centers. Security documentation is held under strict dual control, in locked fireproof storage.

Compliance Requirements

All required Bangladesh Bank returns are submitted in the correct format in a

Timely manner. Bangladesh Bank circulars/regulations are maintained centrally, and advised to all relevant departments to ensure compliance. All third party service providers (valuers, lawyers, insurers, CPAs etc.) are approved and performance reviewed on an annual basisraining and experience in financial statement, cash flow and risk analysis. A good working knowledge of Accounting. A good understanding of the local market. A monthly summary of all new facilities approved, renewed, enhanced, and a list of proposals declined stating reasons thereof should be reported by Credit Team to the Business Head. Duplication of Check All approved applications must be checked against bank’s database to identify whether the applicant is enjoying any other loan in other account apart from the declared loans.

Maintenance of Negative Files

Two negative files – one listing the individuals and the other listing the employers – are to be maintained to ensure that individual with bad history and dubious integrity and employers with high delinquency rate do not get loan from banks.

Historical Background of Bangladesh Private Commercial Bank Limited:

Bangladesh Private Commercial Bank is known as one of leading bank of the country since its commencement 27 years ago.

The products and services offered by the company include retail banking, corporate banking, SME banking, project finance, NRB banking, money transfer, Islami banking and more investment banking and cards. In the corporate banking segment, the products offered include working capital finance, trade finance, cash management, syndicated finance, equity finance and corporate advisory services. The bank also has drawing arrangements with 14 exchange/money transfer.

Historical Background of Bangladesh Private Commercial Bank Limited:

Bangladesh Private Commercial Bank is known as one of leading bank of the country since its commencement 27 years ago.

During the last 27 years, Bangladesh Private Commercial Bank Limited has opened 74 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World. It is listed on Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd. Bangladesh Private Commercial Bank has a branch network of 74 branches in Bangladesh. The overseas operations of the bank are conducted through its Mumbai branch in India and its subsidiary company, the Bangladesh Private Commercial international Finance Ltd.

The products and services offered by the company include retail Banking, corporate banking, SME banking, project finance, NRB banking, money transfer, Islami banking, investment banking and cards. In the corporate banking segment, the products offered include working capital finance, trade finance, cash management, syndicated finance, equity finance and corporate advisory services. The bank also has drawing arrangements with 14 exchange/money transfer remittance houses all over the globe to facilitate fast, reliable and hassle – free inward remittance.

Organization structure of Bangladesh Private Commercial Bank Ltd.

The guidelines, rules and regulations given for scheduled commercial banks operating in Bangladesh. Investment in Bangladesh. As per provisions of the bank Articles of Associations, with the approval of Bangladesh Bank and the controller of Capital issue Government of Bangladesh, the shares (60%) held by the Union Bank of Middle East (UBME), were purchase by the Bangladeshi Sponsored Directors, raising total shares of holding to 80% of total share capital. However, as desired by the government of Bangladesh the sponsors. Directors, who acquired the 60% shareholdings of Union Bank of Middle East (UBME), unclosed 50% of share purchased by them from UBME to the general public of Bangladesh raising the public share holdings to the 45% of total share capital of the bank. The Objective of the bank is to undertake all kinds of banking and foreign exchange business in Bangladesh as well as abroad through its brandies/correspondents.

. Capital structure of Bangladesh Private Commercial Bank Ltd. (BPCBL) was incorporated on 31st December 1981, under the company’s act-1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 12th April 1982 with the approval of Bangladesh Bank

Bank Limited:

The authorized capital of B. Bangladesh Private Commercial Bank Ltd. (BPCBL) was incorporated on 31st December 1981, under the company’s act-1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 12th April 1982 with the approval of Bangladesh Bank Ltd. is taka 400.00 core divided into 4.00 core ordinary shares of taka 100 each, from the existing Tk. 200.00 core on 05 march, 2008. The total paid up capital rose to taka 743.00 million at the end of 2008. At present the composition of the existing shareholders of the bank is as under:

Bangladesh Private Commercial Bank Ltd. (BPCBL) was incorporated on 31st December 1981, under the company’s act-1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 12th April 1982 with the approval of Bangladesh Bank Bank Limited in a Global View:

B. Bangladesh Private Commercial Bank Ltd. (BPCBL) was incorporated on 31st December 1981, under the company’s act-1913 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 12th April 1982 with the approval of Bangladesh Bank has total 71 branches with in the country as on 29th July 2008

Global presence of BPCBL

Bangladesh Private Commercial Mumbai branch’s main focus continued to be meeting the needs of Indian exporters to Bangladesh promoting Indo-Bangla trade. Particular attention was given to fee-based business.

Change of Name & Logo of BPCBL:

Bangladesh Private Commercial Bangladesh Bank Ltd. was incorporated on 31st December 1981, under the company’s act-1913. The bank started functioning from 12th April 1982.It is the first private bank in Bangladesh. Motijheel Branch is the corporate branch of this bank. The branch has enjoyed its 27th anniversary during this year.

Bangladesh Private Commercial Bank Ltd. Changed its name to Bangladesh Private Commercial Bank Limited (BPCBL) with effect from 14 November 2007 vides Bangladesh Bank BRPD Circular Letter No-10 dated 22 November 2007. Prior to that Shareholder of the Bank approved the change of name in the Extra-Ordinary General Meeting held on 4 September 2007. Effective 1 January 2008, BPCBL changed its Logo as well.

Objective:

“To exceed customer expectations through innovative financial products & services and establish a strong presence to recognize shareholders’ expectations and optimize their rewards through dedicated workforce.”

2.5.2. Mission Statement:

“To be the best performing bank in the country”

Vision Statement: “To be the trendsetter for innovative banking with excellence & perfection”

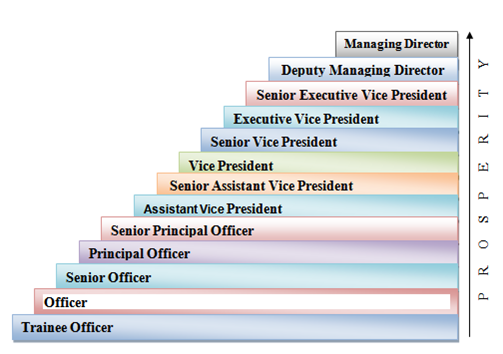

Management hierarchy of

Bank Ltd:

In Bangladesh Private Commercial Bank Ltd. (BPCBL) an incumbent has to start his carrier as a provisionary officer. For this, candidate has to seat for a competitive examination. It is under full authority of the Board of Directors. The following figure shows the hierarchy of carrier ladder in BPCBL:

Fig: : Management hierarchy of AB Bank Ltd

| 2.7.0. Bank Performance Analysis Bangladesh Private Commercial Bank Limited: (Million taka) Particulars | 2008 | % Change | 2007 | 2006 | 2005 | 2004 |

| Operating Profit (PBP & T) | 4298.39 | 29.26 | 3325.29 | 710.69 | 755.03 | 360.07 |

| Net Operating Profit (PBT) | 3600.62 | 27.77 | 2817.99 | 532.19 | 407.45 | 190.07 |

| Profit After Tax (PAT) | 2300.62 | 20.86 | 1903.49 | 532.19 | 162.45 | 90.07 |

| Authorized Capital | 3000.00 | 50.00 | 2000.00 | 2000.00 | 800.00 | 800.00 |

| Paid-up capital | 2229.79 | 200.00 | 743.26 | 571.74 | 519.76 | 495.01 |

| Reserves | 2702.95 | 30.42 | 2072.54 | 1456.47 | 826.33 | 623.99 |

| Shareholders Equity | 6722.51 | 49.01 | 4511.59 | 2582.76 | 1526.88 | 1243.58 |

| Deposits | 68560.47 | 28.25 | 53375.35 | 42077.00 | 27361.44 | 28299.23 |

| Loans & Advances | 56708.77 | 38.60 | 40915.35 | 31289.25 | 21384.63 | 17008.50 |

| Investments | 11408.54 | 28.41 | 8884.60 | 6271.37 | 4060.95 | 6738.15 |

| Fixed Assets | 2444.65 | 2.67 | 2381.00 | 1148.46 | 370.06 | 276.67 |

| Total Assets | 84053.61 | 32.26 | 63549.86 | 47989.34 | 33065.40 | 32508.63 |

| Import Business | 70041.35 | 44.59 | 48441.35 | 42860.24 | 23150.85 | 19266.00 |

| Export Business | 28937.24 | 39.95 | 20676.61 | 17876.15 | 12595.20 | 10100.00 |

| Guarantee | 6578.17 | 95.16 | 3370.58 | 3496.38 | 2507.91 | 2353.00 |

| No. of Branches | 72 | 1.41 | 71 | 68 | 67 | 70 |

| No. of Employees | 1804 | 4.58 | 1725 | 1590 | 1726 | 1726 |

Table: 2: Performance Analysis Bangladesh Private Commercial Limited

Evaluation of recent performance of Bangladesh Private Commercial Bank Limited:

The overall performance of BPCBL is increasing gradually. The total authorized capital in 2008 was increase almost 50 % to compare with 2007 and paid-up capital has increased to Tk1486.53 million in the year 2008. Statutory and other reserves have increasing trend. The total asset of the bank increased to Tk. 20503.75 million in 2008 against Tk. 63549.86 million in the year of 2007. The total deposits stood at Tk. 68560.47 million in 2008 against Tk53375.35million in 2007 However, the net profit after taxes during the year increased significantly.

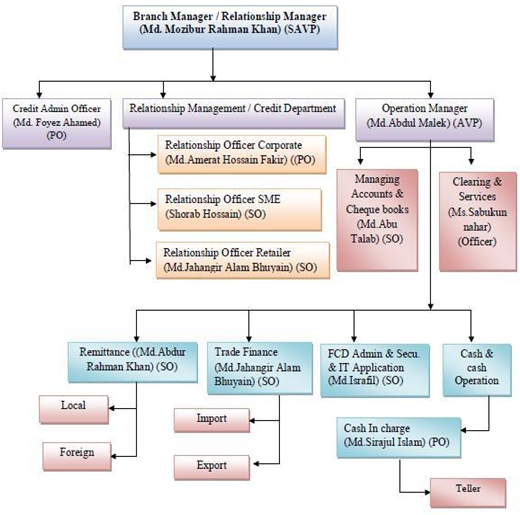

Includes 1 SAVP, 1 AVP, 06 principal officers, 1 management trainee, 5 senior officers, 3 officers, 1 internees and others are messengers, tellers, typist, security guards and drivers. The details information of this Branch is given below:

The figures, which are presenting below are as on Actual 2008:

- Time Deposit :1595(Lac)

- Saving Deposit :151(Lac)

- Demand Deposit : 977(Lac)

- Loans & Advance :4460(Lac)

- Total asset & Liabilities :4588 (Lac)

- Total Import Business :1429(in Lac)

- Total Guarantee :100 (in Lac)

- Total Profit :114 (in Lac)

The Organogram of Bangladesh Private Commercial Bank Ltd.

My Jobs & Responsibilities as an Intern at Bangladesh Private Commercial Bank Limited.

I have been attached as an intern of Bangladesh Private Commercial Bank Limited. In Bangladesh Private Commercial Bank.There was no intern before me, so I am the first and only intern in this branch during my internship program. From the first day of my attachment I have been working in different departments including Credit, Remittance, Foreign exchange, Clearing, and General Banking. But during this time period I spent most of the time in Credit Division.

During this internship period I learned various aspects of general banking, foreign remittance, and cash transaction reporting and cash management facilities.Moreover,I also learnt about various aspects of compilation of data, preparation and submission of various returns to Bangladesh Bank in prescribed forms and as per guidelines of Bangladesh Bank.

However, in my internship program last one month I was shifted to the credit department in particular SME section of Credit Department. Where my prime responsibility was to assist the officers of Credit Department in their regular works i.e. a brief description of my job duties are given below:

Loan documentation for SME Banking

Preparation of Credit Risk Grading

Preparation of Charge documents

Forwarding customer requests e.g. address changes, statements, certificates, etc.

Answer customer’s queries regarding account balance, receipt of remittance etc.

SME Banking of Bangladesh Private Commercial Bank limited

Definition of SME:

The Small and Medium Enterprises worldwide are recognized as engines of economic growth. In recent days the Small and Medium Enterprise (SME) Financing has become an important area for Commercial Banks in Bangladesh. To align its corporate policy with the regulation of Central Bank, banks have become more concerned about SME and opened windows to conduct business in this particular area. According to the latest circular of Bangladesh Bank (Date – 26/05/2008), the definition of Small and Medium Enterprise sector is given below:

Small Enterprises:

Small enterprises refer to those enterprises which are not any Public Limited Companies and which fulfill the following criteria-

Service Concern:

-Having an investment of Tk. 50,000 to Tk. 50, 00,000 excluding land & building and / or employing up to 25 workers.

Business Concern:

– Having an investment of Tk. 50,000 to Tk. 50, 00,000 excluding land & building and / or employing up to 25 workers.

Manufacturing Concern:

– Having an investment of Tk. 50,000 to Tk. 1, 50, 00,000 excluding land & building and / or employing up to 50 workers.

Medium Enterprises:

– Medium enterprises refer to those enterprises which are not any Public Limited Companies and which fulfill the following criteria:

Service Concern:

– Having an investment of Tk. 50, 00,000 to Tk. 10, 00, 00,000 excluding land & building and / or employing up to 50 workers.

Business Concern:

– Having an investment of Tk. 50, 00,000 to Tk. 10, 00, 00,000 excluding land & building and / or employing up to 50 workers.

Manufacturing Concern:

– Having an investment of Tk. 1, 50, 00,000 to Tk. 20, 00, 00,000 excluding land & building and / or employing up to 150 workers.

Definition by Ministry of Industries (MOI):

SMEs in Bangladesh are also defined for purposes of industrial policies by Ministry of Industries (MOI). Historically, this definition has been in terms of fixed investment brackets, and a dual mode definition is in place, separate for manufacturing establishments, and service establishments. According to the Industrial policy 2005, Small and medium enterprises shall be categorized using the following definitions:

(A.) Manufacturing enterprise:

Small enterprise

– An enterprise should be treated as small if, in current market prices, the replacement cost of plant, machinery and other parts / components, fixtures, support utility, and associated technical services by way of capitalized costs (of turn key consultancy services, for example), etc, excluding land and building, were to be up to tk. 15 million;

Medium enterprise –

-An enterprise would be treated as medium if, in current market prices, the replacement cost of plant, machinery and other parts / components, fixtures, support utility, and associated

Technical services by way of capitalized costs (such as turn key consultancy services), etc, excluding land and building, were to be up to tk. 100 million;

(B.)Non-manufacturing enterprise:

Small enterprise

– An enterprise should be treated as small if it has less than 25 workers, in full time equivalents;

Medium enterprise –

-An enterprise would be treated as medium if it has between 25 and 100 employees

Contribution of SMEs in the Economy:

There is a great interest in small and medium enterprises (SME) as a major plank of poverty reduction in Bangladesh In view of present economic development effort in Bangladesh the SME sector plays an important role.

These are reflected in the following performance /activities of this sector:

During the Fourth Five year plan, a total of 0.35 million jobs were created against the target of 0.4 million.

SME sector employs 25% of the total labour force. As a result, this sector is the present available sector for creation jobs.

SME sector help alleviate poverty, increase income level of rural people and promote agro-industrial linkage in Bangladesh.

SME sector requires lower energy supply, lower infrastructure facilities and this sector imposes less environmental risk.

They contribute towards better utilization of local resources and skills that might otherwise remain unutilized.

Small industries being labor oriented are capable of generating more employment.

They are necessary to maintain and retain traditional skills and handicrafts.

They are the only medium for diversification of rural economy and for peaceful and concurrent socio-economic development of all classes of people.

From the above discussion, we can say that SMEs are playing an important role in our economy in various ways.

SME Financing by Banks in Bangladesh:

The National Commercial Banks (NCBs) are disbursing significant amount of credit under various programs like Small Enterprise Development Project, Self-help Credit Program, and Projects for Small Entrepreneurs, Special Investment Program and Agro-based Supervisory Industrial Credit etc. for the promotion and development of SMEs. The investment of private sector banks in financing SMEs remains insignificant in Bangladesh. Of all the private sector banks, BRAC Bank, Bangladesh Private Commercial Bank Limited.(BPCBL) Eastern Bank Ltd. (EBL), Prime Bank Ltd, Dhaka Bank Ltd, Mercantile Bank Ltd, Dutch-Bangla Bank Ltd, Islami Bank Bangladesh Ltd, IFIC Bank Ltd. have the leading role in SME financing. Bank of Small Industries and Commerce Bangladesh Ltd. (BASIC) are entrusted with the responsibility of providing medium and long-term loans for promotion and development of small-scale industries. The memorandum and Articles of Association of the bank stipulates that 50% of loan able funds shall be used for financing small scale and cottage industries.

SME Financing by Bangladesh Private Commercial Bank Limited:

Considering the volume, role and contribution of the SMEs, in the last two decades AB Bank has been patronizing this sector by extending credit facilities of different types and tenor. As of now 54% of the bank’s total loan portfolio is segmented to the SMEs which deserve all out attention in its plans, projections and forecasting. As such the AB Bank has emphasized on the following issues:

To provide the best services to the SME sector

To increase the SME portfolio of BPCBL significantly

To improve the quality of BPCBL’s portfolio

Definition of SME at Bangladesh Private Commercial Bank Limited:

The SME definition which was approved by management committee in 13th meeting held on 12th May, 2008 and notified to the Board of Directors 414th meeting, was circulated all Branches though BBD circular No.02/2008. Meanwhile, Bangladesh Bank has revised the SME definition though it’s ACSPD Circular No.08, dated 26th May, 2008.In context to this revision, the Board of Directors of Bangladesh Private Commercial Bank Ltd. has changed the Banks SME definition in its 435th Meeting held on Sunday, March 22, 2009, which is as follow:

| For small Enterprise: Turnover | Total Fixed Assets * | No. Of Employee | Loan Size | ||||

| Service / other concern | Up to 500 Lac | 0.5 to 50 Lac | Less than 25 | Up to 50 Lac | |||

| Trading Concern | Up to 500 Lac | 0.5 to 50 Lac | Less than 25 | Up to 50 Lac | |||

| Manufacturing Concern | Up to 500 Lac | 0.5 to 150 Lac | Less than 50 | Up to 50 Lac | |||

| For Medium Enterprise: Turnover | Total Fixed Assets * | No. Of Employee | Loan Size | ||||

| Service / other concern | Up to 1500 Lac | 50 to 1000 Lac | Less than 50 | Up to 50 Lac | |||

| Trading Concern | Up to 500 Lac | 50 to 1000 Lac | Less than 50 | Up to 50 Lac | |||

| Manufacturing Concern | Up to 500 Lac | 150 to 2000 Lac | Less than 150 | Up to 50 Lac | |||

Table: 4: Definition of Medium Enterprise by BPCBL

Participation of SME Sector by Bangladesh Private Commercial Bank Limited:

Small and medium enterprises (SME) has emerged as the cornerstone of economic development of Bangladesh in terms of job creation, income generation, development of forward and backward industrial linkage and meting local links.SME provide over 87%of total industrial employment and contribute 90% export earning. Thus, SME occupy a unique position in Bangladesh. However, SME Sectors in which Bangladesh Private Commercial Bank has participated so far are Agro machinery, Poultry, Animal Feed, Dairy Product, Fruit Preservation ,Hotel & Restaurants, Garments Accessories ,Leather products, Plastic product Furniture : Wooden & Metal ,Ink ,Paint ,Printing & Packaging ,Wire & Cable ,Aluminum Cement and Lime Plaster ,Clinics and Hospitals Engineering & Scientific Instruments.

A Loan facility for meeting regular as well as additional requirements of businesses; i e. it will be part of working capital of the business.

Maximum Loan Amount: Maximum TK. 500 Lac

Limit will be determined by the stock and/or Volume of sales.

Maximum 80% of the stock value to be financed.

Interest Rate: 13.00% p, a.to 15.00% p.a.

Service Charge: 1.00%

Tenor: Maximum 3 (three) Years.

Repayment: Through EMI/ Lump sum (No moratorium).

Security and/or Collateral:

Hypothecation of stock and/or receivables

Registered Mortgage of Land & buildings and/or tripartite

Agreement for shop and/or Business premises and/or any

Other collateral

Proshar:

It is long term finance for infrastructure development / capacity building etc: i. e.term loan for

Expansion. Balancing modernizing Reconstruction Expansion (BMRE)

Maximum Loan Amount: Maximum TK. 500.00 lac

Loan amount will be maximum 80% of the proposed additional Investment/ expenditure

Interest Rate: 13.00% p, a.to 15.00% p.a.

Service Charge: 1.00%

Tenor: Maximum 5(Five) Years.

Repayment: Through EMI/ (Moderating Period: Maximum 6 months)

Security and/or Collateral:

Hypothecation of stock and/or receivables

Registered Mortgage of Land & buildings and/or tripartite agreement for shop and/or Business premises and/or any other collateral.

Digun:

Double amount of loan against value of the savings Instrument (BPCBL FDR, DDS etc,) to meet any type of business requirement.

Maximum Loan Amount: TK, 10.00 lac to TK. 100.00 lac

Interest Rate: 8.00% above the instrument interest rate p.a subject to minimum

Loan interest rate of 13.00% p.a.to 15% P.a.

Service Charge: 1.00%

Tenor: Maximum 5 (Five) Years.

Repayment: Through EMI/ Lump sum (No moratorium).

Security and/or Collateral:

Hypothecation of stock and/or receivables

Lien of savings instrument (BPCBL FDR, DDS) Covering minimum

50% of loan size.

PG of the spouse of the borrower.

1 (one) 3rd party guarantee

Condition: Deposit instrument will not be released before adjustment of the loan.

Sathi:

Term loan for CNG Refueling conversion/ Light Engineering/ project finance (package Deal Including Non- founded)

Maximum Loan Amount: Maximum TK.500.00 lac

Interest Rate: 13.00% p. a. to 15.00% p. a.

Service Charge: 1.00%

Tenor: Maximum 5 (Five) Years.

Moratorium Period: Maximum 6 month

Repayment: Through Equal Monthly Installment (EMI)

Security and/or Collateral:

Hypothecation of Machineries and / or stock and/or receivables

Registered mortgage of project land and buildings; additional land

(If require)

PG of the spouse of the proprietor / PG of the Director.

Chhoto Puji:

Mortgage free Term Loan for working Capital/ fixed investment requirement.

Maximum Loan Amount: TK, 10.00 lac

Interest Rate: 13.00% p. a. to 15.00% p. a.

Service Charge: 2.00%

Tenor: Maximum 3 (three) Years.

Repayment: Through Equal Monthly Installment (EMI)/ Lump sum .

Security and/or Collateral:

Hypothecation of stock and/or receivables

Lien of savings instrument (ABBL FDR, DDS) Covering minimum 50% loan size.

PG of the spouse of the borrower.

1 (one) 3rd party guarantee

Condition: Deposit instrument will not be released before adjustment of the loan.

Loan for New entrepreneur/ business. (For working Capital as well as fixed capitalinvestment.)

Maximum Loan Amount: Tk. 50.00 Lac

Interest Rate: 13.00% p.a to 15.00% p. a

Service Charge: 2.00%

Tenor: Maximum 3 (three) Years.

Repayment: Through EMI

Security and/or Collateral:

Hypothecation of stock and/or receivables

Registered Mortgage of land and building and/ or any other Collateral.

PG of the spouse of the borrower and / or able family members.

Awparajita:

A loan facility for meeting working capital requirement as well as fixed investment in businesses for women entrepreneurs.

Maximum Loan Amount: Tk. 50.00lac

Interest Rate: 14.00% p.a to 16.00% p. a

Service Charge: 1.00%

Tenor: Maximum 3 (three) Years.

Repayment: Through EMI

Security and/or Collateral:

Hypothecation of stock and/or receivables

Registered Mortgage of land and building and/ or any other Collateral.

PG of the spouse of the borrower and / or able family members.

Special Condition for all the Above Products:

Deposit Condition:

The client will build a deposit from cash flow (the amount and nature will be decided by the Relationship Manager (RM) or Relationship Executive (RE) after discussion with the client) of the business.

Early Settlement:

Winding Up fee of 1.00% to be realized on the outstanding Term Loan

(Incase of EMI based amount in case of settlement of the same earlier than maturity Loan)

Special Note For all above products:

Existing Client:

Clients/ Guarantor having mortgage of properties under existing Credit Facilities may suffice on case to case basis. SME banking & Credit Risk Grading System of Bangladesh Private Commercial Bank Limited.

Loan for Ltd. Company:

For Credit facility favoring a Limited Companies, Personal Guarantee.

Procedure for giving SME loans

Initial Steps:

The prospective borrower has to apply to BPCBL for loan by filling up of a specific Application for. The application form (Request for credit Limit) contains following

Particulars,

Name of the Borrower

A/C no.

Business address (with telephone no.) [Residential addresses and permanent address] –

Introducer’s name, A/C no. & address-

Date of establishment/ Incorporation-

Trade license number, issue date, expiry date (Photocopy of trade license enclosed)

GIR/TR no. & amount of income tax paid last year

Constitution/ Status (Mention whether sole proprietorship/ partnership/ Public Ltd. company/ Private Ltd. company)-

Particulars of Individual/ Proprietor/ Partners/ Directors (Name & Designation, Father’s/ husband’s name, present & permanent address with telephone no., % of shares held)-

Experience and background of Individual/ proprietors/ partners/ directors.

Full particulars of assets in the particular name of Individual/ proprietors/ partners/ directors with valuation.

A name of subsidiaries/ affiliates percentage of share holding and nature of business.

Nature and details of business/ products (for which credit facility is applied for), markets (present market price per unit, factory price), estimated sales for next one year.

Credit facilities required (type, amount, period, purpose, and made of adjustment).

Details of securities offered with estimated value (primary security, collateral security, market value of the security.).

Balance sheet, Income statement or statement of accounts of the following year attached (preferably last 3 years).

Other relevant information.

Proposed debt/ equity ratio.

Signature of the applicant.

Second Steps:

After receiving the loan application form, BPCBL sends a letter to Bangladesh Bank for obtaining a report form there. This is called CIB (credit information bureau) report. The report is essential if the loan is exceeds Tk. 50 Lac. But BPCBL usually collects this report if the loan amount exceeds Tk 10 lac. The purpose of this report is being informed that whether the borrower has taken loan form any other bank.

Third Steps:

After receiving CIB report if the Bank thinks that the prospective borrower will be a good borrower, than the bank will scrutinize the documents. In this stage, the Bank will check whether the documents are properly filled up & signed.

Forth Steps:

Then comes the processing stage, the bank will prepare a proposal. A proposal contains following relevant information-

a) Name of the borrower

b) Nature of limit

c) Purpose of limit

d) Extent of limit

e) Security

f) Margin

g) Rate of interest

h) Repayment

i) Validity

Branch incumbent has the discretionary to sanction loan (SOD) against financial obligations by informing Head Office. But in that case4, the branch Manager has to give attention to the following matters-

The interest rate of the loan must not be less than 14.5% &

The borrower must maintain 10% margin

Except this case, the branch has to send the proposal to the Head Office. Head Office will prepare a minute and submit before the Executive Committee (EC). The minute has to be passed by EC.

After passing the minute, it will be sent to Bangladesh Bank for approval in case of followings:-

If the proposal limit exceeds 15% of Bank’s equity

If the proposed limit against cash collateral securities exceeds 25% of Bank’s equity.

After getting the approval of Bangladesh, it will again come to the Head Office.

Fifth Steps:

After the sanction advice, Bank will collect necessary documents. For withdrawing the loan amount, the customer creates a CD account and the loan is transferred to the CD A/c. Afterwards, The customer can withdraw the money.

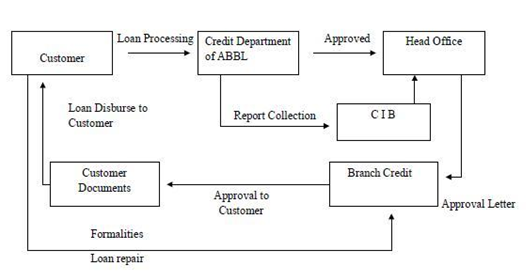

General Procedure for Loans and Advance of BPCBL:

Credit Risk Grading System of Bangladesh Private Commercial Bank Limited

Credit risk is the primary financial risk in the banking system. Identifying and assessing credit risk is essentially a first step in managing it effectively. In 1993, Bangladesh Bank as suggested by Financial Sector Reform Project (FSRP) first introduced and directed to use Credit Risk Grading system in the Banking Sector of Bangladesh under the caption “Lending Risk Analysis (LRA)”. The Banking sector since then has changed a lot as credit culture has been shifting towards a more professional and standardized Credit Risk Management approach.

Keeping the above objective in mind, the Lending Risk Analysis Manual (under FSRP) of Bangladesh Bank has been amended, developed and re-produced in the name of “Credit Risk Grading Manual”.

Definition of Credit Risk Grading:

The Credit Risk Grading (CRG) is a collective definition based on the pre-specified scale and reflects the underlying credit-risk for a given exposure.

A Credit Risk Grading deploys a number/ alphabet/ symbol as a primary summary indicator of risks associated with a credit exposure.

Credit Risk Grading is the basic module for developing a Credit Risk Management system.

Function of Credit Risk Grading:

Well-managed credit risk grading systems promote bank safety and soundness by facilitating informed decision-making. Grading systems measure credit risk and differentiate individual credits and groups of credits by the risk they pose. This allows bank management and examiners to monitor changes and trends in risk levels. The process also allows bank management to manage risk to optimize returns.

Use of Credit Risk Grading:

The Credit Risk Grading matrix allows application of uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio of a unit, line of business, the branch or the Bank as a whole.

As evident, the CRG outputs would be relevant for individual credit selection, wherein either a borrower or a particular exposure/facility is rated. The other decisions would be related to pricing (credit-spread) and specific features of the credit facility. These would largely constitute obligor level analysis.

Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a Bank. It is also relevant for portfolio level analysis.

Number and Short Name of Grades used in the CRG:

The proposed CRG scale consists of eight categories with Short names and Numbers are

provided as follows:

| Grading | Short Name | Number |

| Superior | SUP | 1 |

| Good | GD | 2 |

| Acceptable | ACCPT | 3 |

| Marginal/Watchlist | MG/WL | 4 |

| Special Mention | SM | 5 |

| Sub standard | SS | 6 |

| Doubtful | DF | 7 |

| Bad & Loss | BL | 8 |

Credit Risk Grading Definitions:

A clear definition of the different categories of Credit Risk Grading is given as follows:

Superior – (SUP) – 1:

Credit facilities, which are fully secured i.e. fully cash covered.

Credit facilities fully covered by government guarantee.

Credit facilities fully covered by the guarantee of a top tier international Bank.

Good – (GD) – 2:

Strong repayment capacity of the borrower

The borrower has excellent liquidity and low leverage.

The company demonstrates consistently strong earnings and cash flow.

Borrower has well established, strong market share.

Very good management skill & expertise.

All security documentation should be in place.

Credit facilities fully covered by the guarantee of a top tier local Bank.

Aggregate Score of 85 or greater based on the Risk Grade Score Sheet

Acceptable – (ACCPT) – 3:

These borrowers are not as strong as GOOD Grade borrowers, but still demonstrate consistent earnings, cash flow and have a good track record.

Borrowers have adequate liquidity, cash flow and earnings.

Credit in this grade would normally be secured by acceptable collateral (1st charge over inventory / receivables / equipment / property).

Acceptable management

Acceptable parent/sister company guarantee

Aggregate Score of 75-84 based on the Risk Grade Score Sheet

Marginal/Watch list – (MG/WL) – 4:

This grade warrants greater attention due to conditions affecting the borrower, the industry or the economic environment.

These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/or inconsistent earnings.

Weaker business credit & early warning signals of emerging business credit detected.

The borrower incurs a loss

Loan repayments routinely fall past due

Account conduct is poor, or other untoward factors are present.

Credit requires attention

Aggregate Score of 65-74 based on the Risk Grade Score Sheet

Special Mention – (SM) – 5:

This grade has potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower.

Severe management problems exist.

Facilities should be downgraded to this grade if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage),

An Aggregate Score of 55-64 based on the Risk Grade Score Sheet.

Substandard – (SS) – 6:

Financial condition is weak and capacity or inclination to repay is in doubt.

These weaknesses jeopardize the full settlement of loans.

Bangladesh Bank criteria for sub-standard credit shall apply.

An Aggregate Score of 45-54 based on the Risk Grade Score Sheet.

Doubtful – (DF) – 7:

Full repayment of principal and interest is unlikely and the possibility of loss is extremely high.

However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad & Loss.

Bangladesh Bank criteria for doubtful credit shall apply.

An Aggregate Score of 35-44 based on the Risk Grade Score Sheet.

Bad & Loss – (BL) – 8:

Credit of this grade has long outstanding with no progress in obtaining repayment or on the verge of wind up/liquidation.

Prospect of recovery is poor and legal options have been pursued.

Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for.

This classification reflects that it is not practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. Legal procedures/suit initiated.

Bangladesh Bank criteria for bad & loss credit shall apply.

An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

An Aggregate Score of 45-54 based on the Risk Grade Score Sheet.

Doubtful – (DF) – 7:

Full repayment of principal and interest is unlikely and the possibility of loss is extremely high.

However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad & Loss.

Bangladesh Bank criteria for doubtful credit shall apply.

An Aggregate Score of 35-44 based on the Risk Grade Score Sheet.

Bad & Loss – (BL) – 8:

Credit of this grade has long outstanding with no progress in obtaining repayment or on the verge of wind up/liquidation.

Prospect of recovery is poor and legal options have been pursued.

Proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for.

This classification reflects that it is not practical or desirable to defer writing off this basically valueless asset even though partial recovery may be affected in the future. Bangladesh Bank guidelines for timely write off of bad loans must be adhered to. Legal procedures/suit initiated.

Bangladesh Bank criteria for bad & loss credit shall apply.

An Aggregate Score of less than 35 based on the Risk Grade Score Sheet.

Computation Credit Risk Grading Of Bangladesh Private Commercial Bank Limited:

The following step-wise activities outline the detail process for arriving at credit risk grading.

Credit risk for counterparty arises from an aggregation of the following:

Step 1 Identify all the Principal risk component:

Financial Risk

Business/Industry Risk

Management Risk

Security Risk

Relationship Risk

Step 2 Allocate weight ages to Principal Risk Components:

Each of the above mentioned key risk areas require be evaluating and aggregating to arrive at an overall risk grading measure.

According to the importance of risk profile, the following weight ages are proposed for corresponding principal risks.

Principal Risk Components: Weight:

Financial Risk 45%

Business/Industry Risk 18%

Management Risk 10%

Security Risk 15%

‘ Relationship Risk 12%

Step 3 Establish the Key Parameters:

| Principal Risk Components | Key Parameters |

| Financial Risk | Leverage, Liquidity, Profitability ,Coverage ratio,Stock Turnover days, receivable Turnover |

| Business/Industry Risk | Size of Business, Age of Business, Business Outlook, IndustryGrowth, Market Competition, Entry /Exist Barriers. |

| Management Risk | Experience, Second line / Succession & Team Work. |

| Security Risk | Security Coverage, Ownership of Collateral, Location ofCollateral, collateral coverage and Support. |

| Relationship Risk | Account Conduct ,Utilization of Limit, Compliance ofcovenants/conditions & Personal Deposit |

Step 4 Assign weight ages to each of the key parameters:

| Principal Risk Components | Key Parameters | Weight | |

| Financial Risk | 45% | ||

| LeverageLiquidity Profitability Coverage ratio Stock Turnover days, | 12%12% 11% 5% 3% | ||

| Account conductUtilization of limit Compliance of covenants Personal deposit | 5%4% 2% 1% |

After the risk identification & weight age assignment process, the next steps will be to input actual parameter in the score sheet to arrive at the scores corresponding to the actual parameters.

| The following is the proposed Credit Risk Grade matrix based on the total score obtained by an obligor. Number | Risk Grading | Short Name | Score |

| 1 | Superior | SUP | 100% cash covered Government guarantee International Bank guarantees

|

| 2 | Good | GD | 85+ |

| 3 | Acceptable | ACCPT | 75-84 |

| 4 | Marginal/Watchlist | MG/WL | 65-74 |

| 5 | Special Mention | SM | 55-64 |

| 6 | Sub-standard | SS | 45-54 |

| 7 | Doubtful | DF | 35-44 |

| 8 | Bad & Loss | BL | <35 |

Findings:

Major Findings of my Observation in Bangladesh Private Commercial Bank Limited:

Bangladesh Private Commercial Bank Limited provides the SME loans and advances to the borrower through their different branches in all over the country. Though every branch is not best in all respective area of the program but in a particular area a bank can be best. The major point that I have identified in credit policy in procedure of giving SME loan & advances Bangladesh Private Commercial of Bank Limited is given below:

as of now 54% of the Bangladesh Private Commercial bank’s total loan portfolio is segmented to the SMEs.

There are many competitions in the banking sector of our country considering our Economic condition. The SME Products provided by the banks are almost same in case of interest rate.

Lending is one of the main functions of a bank. But lending is a risky procedure, in order to make it less risky Bangladesh Private Commercial Bank have different variations such as credit grading and risk grading system.

Practical procedure is different from the policy that is prescribed by head office.

Some times situation is a big factor at the time of giving SME loan. Such as-if there is a occurrence in the branch then head office will restricted the % of giving loan. At that time Branch will not sanction more loans.

The full process of loan sanction is done by the branch official, but the final decision is taken by the head office.

The procedure of giving SME loan is very complex. That sometimes discourages client from taking loan.

BPCBL’s loans and advances are dominated by financing on short-term credit programmers mainly to the trade commerce & processing units rather in any manufacturing unit.

Recommendation:

Recommendation for Bangladesh Private Commercial Bank Limited:

I propose some recommendations for Bangladesh Private Commercial Bank Ltd. These are given below:

Rearrange the process of SME loan. This can help to cover large number of people in remote areas.

Bangladesh Private Commercial Bank should use more advertising camping to introduce SME product of them to their prospective customer. All type of media should be encouraged in.

Bangladesh Private Commercial Bank should increase the amount of loan and advance in micro credit sector as the loan recovery rate from micro credit sector is much higher.

Implement continuous monitoring system in the whole SME loan recovery process.

Improve the criteria for receiving SME loan.

Improve the Credit risk management department for avoid possible defaulter.

To ensure that the borrowers can utilize the loan on the right purpose.

There are many competitors in banking sector. ATM, online banking, credit card service etc are common in banking sector. They should introduce new features in existing services.

Bangladesh Private Commercial Bank should examine its borrower’s Cash flow Statement, Audited Balance Sheet, and Income Statement and other financial statement to make sure that its borrower has the ability to repay the loan.

1. Seed Money, Leasing, Venture Capital and Investment Funding:

There is a need for improving different aspects of financial services of SMEs, such as seed money, leasing, venture capital and investment funding. There is a lack of long-term loans; interest rates are high, Guarantee/Security issues, exchange risks etc. All these limit the development of SMEs. Finance, both short and long term, should be provided at market cost of capital. Fund should be made available through encouragement for setting up ‘Venture Capital’ organization in Bangladesh. The concept of venture capital (VC) has successfully operating in the USA, EU countries, and Canada.

2. Establishment of Small Business Investment and Lending

Corporation (SBILC):

We should start with ‘something effective’ for industrial development in general and the SMEs sector in particular. Such a step, for example, could be the establishment of a separate corporate body. That means a separate financing institution could be developed, with joint ownership of the public and private sector. To make the proposed initiative effective in achieving its goals, government may set up a Small Business Investment and Lending Corporation (SBILC). The SBILC can be formed under Small Business

Investment and Lending Act passed through the Parliament. Under SBILC there may have external and Internal Financing policies. Taken from the different countries experiences the different types of financing policies and programmed that can be introduced through SBILC, is enumerated below:

Low Doc Loan Programmed, which may allows small business to use a simple

One-page application for loans up to Tk.50, 000; loans between Tk.50, 000 and Tk.1, 00,000 may require the one-page application plus personal tax returns for three years and a personal financial statement from entrepreneur.

Direct loans, this type of loan may be provided directly to the small business with

public funds and no participation. The interest rate charged on direct loans depends on the cost of money to the government and it changes as general interest rates fluctuate. It can be limited to a fixed ceiling.

Immediate participation loan can be made from a pool of public funds and

private loans.

Guaranteed loan. When private lenders extend loans to small businesses, SBILC

in those cases can provide guarantee for repayment in case the borrower defaults on the loan, which may be given for a defined amount of loan and up to certain percentage e.g., 80% or 75% of loans.

Seasonal line of credit programmed, may be offered for short-term capital to growing companies needing to finance seasonal buildups of inventory or accounts receivable. The maturity period cannot be exceeding 12 months and the company must repay it form cash flow. Accounts receivables and inventory can be collateral for the loan. Contract loan programmed, is another short-term loan guarantee, but it is designed to finance the cost of labor and materials needed to perform a contract. Maturity times are up to 18 months. Export working capital programmed. Under this programmed the SBILC may give guarantee 90 percent of bank credit line up to a certain limit. In such case Loan proceeds must be used to finance\e small business exports.

Disaster Loans. As their name implies, disaster loans can be provided to small businesses devastated by some king of financial or physical losses (such as tremendous flood, earthquakes). Disaster loan may carry below-market interest rates.

Green line revolving line of credit programmed. Green line programmed can be

designed to increase small companies’ access to working capital by providing them with revolving lines of credit. It can be different than traditional loans, which may require fixed monthly payments; the Greenline programme may employ highly flexible revolving loans, in which cash-hungry small businesses able to draw on a credit line only when they need the money. This loan prgramme can be designed to provide short-term credit to allow small businesses to finance the sale of their products and services until they can collect payment for them.

3. Periodical Professional Training Courses for SMEs & for

Entrepreneurship Development:

Periodical professional training courses should be arranged for technical staff of SMEs.

Moreover training in management of small enterprises and efficient marketing can also provided. Islamic Chamber regularly organizes training workshops on management, marketing, procurement of technologies, quality control system and financing of SMEs, for the benefit of representatives of private enterprises and staff of member chambers in different regions of the Islamic World. Training programme / workshop should be organized for the development of SMEs capabilities to acquire enhanced knowledge and skills about how to choose, use and improve technology. At present, no such institution exists except a project of the BSCIC called ‘SCITI (Small and Cottage Industries Training Institute). Training on different aspects of SMEs activities for entrepreneurs is crucial for the development of an entrepreneurial.

4. Establishment of R&D Institute for Enterprise and Entrepreneurship

Development, Training and Research Institute:

In a country like Bangladesh, where entrepreneurial initiative is rare and shy, a separate institute for enterprise and entrepreneurship development, training and research should be developed. To make it a ‘centre of excellence’ in SMEs development, it should be designed, involving educational institutions, business associations, relevant government bodies, private research agencies, and individual consultants having experience in SMEs development.

5. Establishment of a separate bank for women entrepreneurs:

Establishment of a separate bank for women entrepreneurs will accelerate the development of women SME through their increased access to formal financial institutions.

6. Minimum quota for women entrepreneurs:

Maintaining a minimum quota for loan disbursement to women entrepreneurs and

proactively seek out female clients.

7. Training program for women entrepreneurs:

Increase the capacity of women entrepreneurs through training and awareness raising activities on financial management, business procedures and other regulatory process such as trade license, tax and VAT, etc. At the same time, initiatives should be undertaken to sensitize the people working with respective regulatory institutions so that women SME can easily arrange necessary documents for loan application and other procedures.

8. Implementation and Monitoring of Policy Measures for SMEs:

Only policy prescription is not the end, if it is not implemented through different measures timely and properly. How far policy measures are implemented, along with, what effect – desired or not – such policy measures has had on the development of SMEs should also be monitored from time to time. This monitoring will provide feedback for taking corrective actions, if necessary, to ensure desired effect of the policy adopted.

Conclusion:

The banking sector of Bangladesh is passing through a tremendous reform under the economic deregulation and opening up the economy. Currently this sector is becoming extremely competitive with the arrival of multinational banks as well as emerging and technological infrastructure, effective credit management, higher performance level utmost customer satisfaction and the transactions of foreign exchange. As we all know in the business world things move on the will of impression. In spite of all limitations Bangladesh Private Commercial bank still doing better and holding a good percentage of market shares in banking sector, only because of its best impression, performance and trust of its clients.

During the three months internship program at BPCBL, almost all the desks have been observed more or less. This internship program, in first, has been arranged for gaining knowledge of practical banking and to compare this practical knowledge with theoretical knowledge. During the internship, it is found that the branch provides all the conventional banking services as well as some specialized financing activities to the economy. SME credit is very important for any financial institution as it generates profit and gear up economic activities of the country. In other words, SME credit is business and it is input in the production process of the country. Since credit is inherent risk. So proper utilization of use of the loans is very much essential to meet up the requirements of the borrower wants. The loan applied for by the borrower must not be employed for unproductive purpose. So, a purpose-oriented loan must be followed up regularly by the Bank So that the borrower properly uses the fund. Bangladesh Private Commercial Bank Ltd airways trying to improve their credit policy for minimizing loss and maximizing profit and various measures are undertaken to develop the credit management system. Recently Bangladesh Private Commercial Bank Ltd is going to adopt pure automation system in credit division for proper handling of disbursement and better monitoring reviewing of regular and irregular loan. In addition they are exploring new ideas, implementing new technology to serve the better service to clients.

Reference:

I. Annual Report of Bangladesh Private Commercial Bank Limited (2008)

II. Anthony Saundres & Marcia Millon- “Financial Institution Management”.

III. Brochures on Consumer Credit Scheme of Bangladesh Private Commercial Bank Limited.

IV. Credit Manual of BPCBL, by Training Institute.

V. Moral M.L.H. “Problems of lending risk analysis implementation”, Volt – 43

VI. Credit Investigation of Bangladesh Private Commercial Bank Limited.

VII. Credit Policy manual of Bangladesh Private Commercial Bank Limited.

VIII. www.abbank.org.bd.com

IX. www.bangladesh-bank.org