SME Activities of BRAC Bank Limited

BRAC Bank Limited is a scheduled Commercial Bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as Private Limited Company on May 20, 1999 under the Companies Act, 1994. Its operation started on July 4, 2001 with a vision to be the market leader through to providing all sorts of support to people in terms of promoting corporate and small entrepreneurs and individuals all over the Bangladesh. At present the Bank operating its business by 69 Branches. BRAC Bank is the first local commercial banks that proving online banking service to its customers from the very beginning of its starts. BRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country. The Bank has already established its network in different area of the country with assistance of BRAC.

BRAC Bank is trying to develop economic condition of the country. So the bank provides loan facility 3 to 30 lacs taka to that small and medium enterprise that has no easy access to banks/financial institutes. The bank already established 91 Zonal offices and 429 unit offices all over the country and 1309 Customer Relation Officers (CRO) providing door-to-door service to clients. Till April 2009, the bank provides loan facilities to 265,000 clients which amount is Tk. 10,000 crore. The success of SME will largely depends on the selection of a business and man behind the business. BRAC Bank provides this facility to those whose business operation is minimum one year and environment friendly business. It provides no loan facility to tobacco business. The business should be legally registered and must have valid trade license. The entrepreneur should be physically able, preferably between the ages 25 to 50. Entrepreneur must have the necessary technical skills to run the business and acceptable social standing in the community i.e. people should speak highly of him/her. BRAC Bank gives equally important to the guarantor to getting the SME facility. The guarantor must have the ability to repay the entire loan and is economically solvent. The guarantor should know the entrepreneur reasonable well and should preferable live in the same community.

SME loan can be repaid in two ways,

1) In equal monthly loan installment with monthly interest payment.

2) By one single payment at maturity, with interest repayable a quarter ends residual on maturity. Customer relation officers search new potential customer by providing door-to-door service. They talk with clients and monitor their manners, activities of their business and provide the loan to the potential customers. The customer relation officers also monitor the borrower’s activities after the loan disbursement.

Monitoring also facilitates the buildup of an information base for future reference. Bank has to prepare the periodic reconciliation statements to identify any mismatch. Reconciliation is the process of systematically comparing the balance of bank statement with the balance as per the company’s ledger and explaining any differences and taking necessary measures to correct the wrong entries. It is an important internal control mechanism of the bank.

The responsibilities of reconciliation of BRAC Bank are centralized and given to Central Operations. There is a separate devoted team under the Central Operations for identifying the unmatched items, analyzing the same and guide to the initiating departments to do the rectification. Reconciliation section of Central Operations prepares and submits a status report on monthly basis and the same to all concerned departments and Operational Risk Management Departments for their information and monitoring. Also submits a status report to MD & CEO and DMD, CIO and Head of Operations for their information. The core competence of the BRAC Bank is to provide the fastest loans to the clients in this country. To retain this competitive advantage BRAC Bank would provide computer and palmtop facilities whether they can give fastest services to clients than other banks. Also to convey the customer focus, BRAC Bank is trying to reduce collateral securities than other banks. It provides more collateral free secured loans to capture the market.

Regarding the services by the CRO, almost all clients are satisfied by get these quick facilities from them. In the survey it is found that most of the clients give a suggestion to decrease the interest rate so I think BBL management look after this things from the view point of customer. They also look after the remuneration packages of CRO and entry level employees and promotional activities regarding SME because it is low and incompetent compare to other contemporary bank. Though it is pioneer division of this bank, I tried to give an in-depth analysis for every factor, which relates the SME division from the perspective of customer satisfaction and dissatisfaction.

Objective

The broad objective of this project:

- How BRAC BANK Ltd operates SME banking operation around the country though its extensive network

- Why Market concentration and product diversification are considered the main strategies for expanding the SME business.

Specific Objective

To support the broad objectives better we have developed some specific objectives. These are:

How BRAC BANK Ltd operates SME banking operation around the country though its extensive network

- What is the Structure of SME division of BBL

- History of BRAC Bank SME

- SME Product Details

- Operation Process of SME Loan Disbursement of BBL

Why Market concentration and product diversification are considered the main strategies for expanding the SME business.

- Market segmentation

- Bases for segmenting consumer market

- Target consumer

- Target market

- Differentiated marketing

- Developing marketing mix

- SWOT Analysis

Methodology

The study was totally based on primary data and secondary data. As the report has three parts, the organization part and job part data was collected from secondary sources books, brochures, leaflets, files, published reports and official web site of BRAC Bank Limited. For SME related information I took short interview of the SME Department employees. Moreover I had a four days attachment in the chawkbazar SME sales and service centre. Apart from this, Annual reports of BRAC Bank and different SME related journals used as a secondary data.

Overview of the BRAC Bank Limited

BRAC Bank Ltd, a full service commercial bank with Local and International Institutional shareholding, is primarily drive by creating opportunities and pursuing market niches not traditionally met by conventional banks. BRAC Bank has been striving to provide “best-in the class” services to its diverse range of customers spread across the country under an on-line banking platform.

Today, BRAC BANK Limited, one of the latest generation of commercial banks which started its journey on the 4th of July 2001 with a vision to be the absolute market leader through providing the entire range of banking services suitable to the needs of modern and dynamic banking business as well as to promote broad based participation in the Bangladesh economy through the provision of high quality banking services. The unique strength of BRAC Bank lies in the fact that BRAC one of the world’s largest private development organization is its key shareholder and the bank’s vision are thus aligned with those of BRAC.

The reason BRAC Bank is in business is to build a profitable and socially responsible financial institution focused on markets and businesses with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”.

BRAC Bank fulfills the purpose by reaching for high standards in doing everything for their customers, shareholders, associates and communities upon, which the future prosperity of their company rests.

BRAC Banks envisages providing mass financing by increasing access to economic opportunities for all individuals and business in Bangladesh with a special focus on currently under-served enterprises across the rural-urban spectrum

BRAC Bank is surviving in the large banking arena through its unique and competitive products and it is the only local bank providing 100% integrated on-line banking services. BRAC Bank Limited consists of four major business divisions namely Corporate Banking Division, Retail Banking Division, Small and Medium Enterprise (SME) and Foreign Trade & Treasury. Corporate Division provides full range of commercial banking products and services to any potential corporate clients including multinationals, large or medium local corporate, NGOs, institutional bodies.

Retail Division offers a wide array of lucrative and competitive banking products to the individual customers of the bank. Currently there are six lending products and a number of other attractive new products will be launched shortly. It also offers different types of term deposit scheme and attractive STD & Savings deposit schemes giving interest on daily balance.

As part of the total banking solution it has introduced an innovative and one of its kinds Remittance Service under the style and name “Secured & Easy Remittance Service” (SERS). The aim of the program is to introduce easy and secured remittance service whereby people will be comfortable and secured in remitting funds without hassle and delay. Using the countrywide network of BRAC comprising more than 1100 field offices the SRS will ensure secured and only 24 hour lead time delivery of remittance anywhere in Bangladesh.

BRAC Bank Limited, hereinafter called BBL, is a first growing third generation-scheduled commercial bank incorporated on 20th May 1999 as a public limited company under Companies Act, 1994 with multinational collaboration including IFC of The World Bank Group & Shore Cap. BBL started its operation on 4th July 2001. The main sponsor of the bank is the BRAC. The Bank is pioneer and focused on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped. BBL believes, this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. BBL caters the banking services to its rapidly growing customers through 69 branches and 429 SME Unit Offices.

Introduction

The SME, Probashi and Cash management business of Brac Bank Limited is mostly dependent on corresponding banking relationship. BRAC Bank has to open accounts with the other banks in the remote areas where banks representation not available. The corresponding bank accounts are used for SME disbursement, realization, remittance and cash management purpose. Every month we have found a huge number of entries un-reconciled between the bank and the corresponding banks book.

Bank has to prepare the periodic reconciliation statements to identify any mismatch. Reconciliation is the process of systematically comparing the balance of bank statement with the balance as per the company’s ledger and explaining any differences and taking necessary measures to correct the wrong entries. It is an important internal control mechanism of the bank.

The responsibilities of reconciliation of BRAC Bank are centralized and given to Central Operations. There is a separate devoted team under the Central Operations for identifying the unmatched items, analyzing the same and guide to the initiating departments to do the rectification. Reconciliation section of Central Operations prepares and submits a status report on monthly basis and the same to all concerned departments and Operational Risk Management Departments for their information and monitoring. Also submits a status report to MD & CEO and DMD, CIO and Hoed of Operations for their information.

Definition of SME

An SME is defined as, “A firm managed in a personalized way by its owners or partners, which has only a small share of its market and is not sufficiently large to have access to the stock exchange for raising capital”. SMEs ordinarily have few accesses to formal channels of finance and depend primarily upon savings of their owners, their families & friends. Consequently, most SMEs are sole proprietorships & partnerships. As with all definitions, this one is not perfect.

Depending on context therefore definition of an SME will vary.

Despite the common features globally, countries do not use the same definition for classifying their SME sector. Also, a universal definition does not appear feasible or desirable. SMEs have been defined against various criteria. The three parameters that are generally applied by the

Governments to define SMEs are:

- Capital investment in plant and machinery

- Number of workers employed

- Volume of production or turnover of business

Other definitions are based on whether the owner of the enterprise works alongside the workers, the degree of sophistication in management, and whether or not an enterprise lies in the “formal” sector. The definitions in use depend on the purposes these are required to serve according to the policies of the respective countries/Governments.

A quantitative definition in each national context is, however, advantageous, as it makes it easier to target macro-level policies for a specific group of enterprises. The countries with such definitions have recorded a higher growth rate in the SME sector. This indicates that the more precise the definition, the more effective the transaction of policies intended to benefit the sector with actual results. In countries where no definition exists, the enterprises are in a disadvantageous position.

SME History of BRAC Bank

He wants to see poverty banished forever. This has been his single-minded pursuit in life. Ever since a devastating cycle wreaked havoc on the lives of the people and property in the coastal regions of pre-independence Bangladesh 1970, everything changed for a young chartered accountant. The young man was so moved by the death and destruction that he, along with some friends, dedicated to set up HELP to carry out relief and rehabilitation efforts. Later after the independence of Bangladesh the young man sold his flat in London and decided to set up a relief and rehabilitation center in the war ravaged Bangladesh. He never looked back.

He is Sir Fazle Hasan Abed, the founder and chairperson of BRAC, the world’s largest NGO, arguably in terms of size and operation. BRAC has been working relentlessly to realize the hidden potential of mankind, especially the ones who are most deprived of opportunities.

It is this same vision that motivated him to come up with a bank that could realize the untapped potentials of this country. Traditionally banking in Bangladesh has mainly addressed the mid to large sized businesses or the professionals. When Sir Fazle Hasan Abed established BRAC Bank he did it with the goal to serve the highly motivated group of entrepreneurs who wanted to break out of the vicious cycle of poverty and take control of their own future. We call them the “Missing Middle”. His long cherished dream of availing quality finance services to these small to medium businesses finally come to reality. BRAC Bank proud to be the pioneering and largest SME bank in Bangladesh, discharging over 10,000 crore taka in SME loan and helping fulfillment of more than 256,000 dreams that change hundrerds and thousands of lives everyday.

SME banking division of BRAC Bank Limited has successfully made a mark in creating platform for small and medium entrepreneurs in “Access to Finance”, the key to the prime obstacle towards growth of SMEs. Since inception BRAC Bank upholds the motto to finance the “Missing Middle” the underserved market segment of SMEs. Years of market knowledge and understanding, committed resources, countrywide coverage and well aligned strategies have made the bank an expert in SME financing and the bank has successfully developed an examined and successfully model in SME financing in Bangladesh.

SME Activities of BRAC Bank Limited

The bank has incorporated double bottom line approach in its operation –

1) Making profit by mobilizing fund from urban to rural areas.

2) Performing social responsibility by creating an entrepreneurial class.

Along with Small & Medium Enterprise financing, SME banking division is also actively working in creating awareness and imparting knowledge to SMEs about financial record keeping, dealing with modern banks and industry best practices in SME operation. In an attempt to ensure customer awareness and to strengthen the relationship with customers, SME banking division arranged informative campaigns and road shows for SMEs located across the country.

Obstacles and Challenges faced BRAC Bank Limited in SME

At the beginning phrase of the SME, BRAC Bank Limited faced lots of obstacles and challenge. There was a shortage of capital, absence of high technology, high employee turnover, lack of Skills entrepreneur, no trade license of businessman etc. These problems are describe in brief in below –

Financial Constraint

At the very beginning of the SME, BRAC Bank have financial constraints. BRAC Bank does not have enough liquid money so that they failed to satisfy every customers need.

Absence of High Technology

Absence of high technology was another constraint for the BRAC Bank limited. At that time they do not have strong inter-banking software so that they failed to contact with different SME service centre.

High Employee Turnover

In 2001 employee turnover rate was pretty high. BRAC Bank does not have any legal bindings to their employees. Employees quit their job according to their wish. So it also hampers the SME Service.

Lack of Skills Entrepreneur

At that time entrepreneurs were not educated enough. They do not have sufficient skills about the different types of paper requirement. It hampers the loan processing time.

Trade License

Trade license was another major problem for BRAC Bank. Most of the business man does not have their business trade license. Without proper documents it was quite hard to sanction the loan.

SME Activities of BRAC Bank Limited

Poor Physical Infrastructure

Inadequate supply of necessary utilities like electricity, water, roads and highways hinder the growth of SME sector.

Employee Skills

At that time employees do not have sufficient knowledge about SME. It was costly to train all the employees. So lack of proper training to employees was another obstacle for SME growth.

Lack of Information

At that time SME just got a new shape in our country. So no one has clear idea about it. So vague and wrong information were passed among the people.

Steps Taken to Overcome the Obstacles

In order to overcome the above mentioned obstacles BRAC Bank started follow some steps, these steps were –

BRAC Bank started to expand their SME network

In 2001 BRAC Bank Limited their SME loan business with 4 SME sales and service center. Gradually they have started to expand their network. Now they have 429 SME sales and service center.

Training Session for employees

At the very beginning of SME operation employees do not have sufficient knowledge to handle the customer. Besides at that time there were lack of educate employees to join this sector. So BRAC Bank started to train up employees those who have started to join in SME division.

Orientation Session for Borrowers

Besides training with the employees BBL also started to train the borrowers also. Most of the borrowers are not educate at all. Even they don’t pass the S.S.C or H.S.C. So BBL started to organize orientation session for a group of borrowers.

Tried to Overcome Financial Constraint

At the very beginning BBL investment was low in the SME loan. Gradually they have started to invest huge in the SME. As they have a strong background of shareholders.

Educate the Entrepreneurs

At that time most of the entrepreneurs just passed the S.S.C or H.S.C level. So they have a very poor knowledge about the banking transaction. They come for the loan but they don’t have any trade license. So educate the entrepreneurs were other steps to overcome the obstacles.

Employee Commitment

As employee turnover was quite high so BBL started to give handsome remuneration to their employees. They started to provide some extra facilities to their employees. Besides they also started to take contract sign for 2 or 3 years from the employees.

Advancement of Technology

BRAC Bank Limited also started to develop their technology. In consequent of this they have transfer their software from MBS to Finacle. Now the respective department can easily find out whether the particular borrower paid his installment or not.

Selection of Potential Enterprise for SME

Enterprise selection Criteria

The success of SME will largely depend on the selection of a business and man behind it. In terms of the business (Enterprise), the following attributes should be sought:

- The business must be in operation for at least one year

- The business should be environment friendly, no narcotics or tobacco business

- The business should be legally registered, i.e., valid trade license, income tax or VAT registration, wherever applicable.

- The business should be in legal trade, i.e.; smuggling will not be allowed or socially unacceptable business will not be entertained.

- The business must have a defined market with a clear potential growth

- The business must be located ideally close to the market and the source of its raw materials/suppliers. It should have access to all the utilities, skilled manpower’s that are required.

- Any risk assessed by the management in turn will become a credit risk for the bank. So effort should make to understand the risk faced by the business.

Entrepreneur Selection Criteria

In order to understand the capability of the management behind the business, the following should be assessed:

- The entrepreneur should be physically able and in good health, preferably between the age of 25-50. If he/she is an elderly person closer to 50, it should be seen what the succession process will be and whether it is clearly defined or not.

- The entrepreneur must have the necessary technical skill to run the business, i.e. academic background or vocational training, relevant work experience in another institution or years of experience in this line of business.

- The entrepreneur must have and acceptable social standing in the community (People should speak highly of him), he should possess a high level of integrity (doesn’t cheat anyone, generally helps people), and morally sound (Participates in community building)

- The entrepreneur must possess a high level of enthusiasm and should demonstrate that he is in control of his business (Confidently replies to all queries) and has the ability to take up new and fresh challenges to take the business forward.

- Suppliers or creditors should corroborate that he pays on time and is general in nature

- Clear-cut indication of source of income and reasonable ability to save.

Guarantor Selection Criteria

Equally important is the selection of a guarantor. The same attribute applicable for an entrepreneur is applicable to a guarantor. In addition he should posses the followings:

- The guarantor must have the ability to repay the entire loan and is economically solvent (check his net worth)

- The guarantor should be aware about all the aspect of SEDF loan and his responsibility

- Govt. and semi-govt. officials can be selected as a Guarantor such as schoolteacher, college teacher, doctor etc.

- Police, BDR and Army persons, political leaders and workers, and religious leader cannot be selected as a guarantor.

- The guarantor should know the entrepreneur reasonable well and should preferably live in the same community.

Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a CRO to know the borrowers activities after the loan disbursement. This also facilitates the buildup of an information base for future reference.

Importance of Monitoring

Through monitoring a CRO can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc, This information will help the CRO/BRAC Bank to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans. Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Area of Monitoring

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

(i) Business Condition: The most important task of the CRO to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once month if all things are in order.

(ii) Production: The CRO will monitor the production activities of the business and if there is any problem in the production process, the CRO will try to help the entrepreneur to solve the problem. On the other hand the CRO can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

(iii) Sales: Monitoring sales proceed is another important task of the CRO it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as well as to take necessary steps for future loans.

(iv) Investment: It is very important to ensure that the entire loan has been invested in the manner invented. If the money is utilized in other areas, then it may not be possible to recover the loan.

(v) Management of raw materials: In case of a manufacturing enterprise, management of raw materials is another important area for monitoring. If more money is blocked in raw materials then necessary, then the enterprise may face a fund crisis. On the other hand the production will suffer if there are not enough raw materials.

Monitoring System

The CRO can consider the following thing for monitoring:

(i) The CRO will monitor each business at least once a month. He/she will make a monitoring plan/ schedule at the beginning of the month. During monitoring the CRO must use the prescribed monitoring from and preserve in the client file and forward a copy of the report to SME head office immediately.

(ii) A SME branch will maintain the following files: The file will contain Purchase Receipt, Delivery Memo’s, and Quotations. In addition, all other papers related to furniture and fixture procurement

(iii) Other fixed assets and refurbishment: All fixed assets and refurbishment related papers such as purchase receipt, delivery memo’s, quotation, guarantee and warrantee papers, servicing related papers and any other paper related to fixed assets are refurbishment will be in this file.

(iv) Lease agreement file: This file will contain all papers related to lease agreement between the SESDS office and owners of the leased premises.

(v) Individual client file: Individual files are to be maintained for each borrower and that will hold loan application, Loan Proposal, Copies of Loan Sanction Letter, Disbursement Memo, Monitoring Report, CIB application and Report, Credit report from other bank and all other correspondents including bank receipt.

(vi) Statement file: All types of statement sent to SME head office will be kept in this file chronologically

(vii) Office instruction file: All kind of office instruction regarding administration should be kept in this file.

(viii) Operating instruction and guideline files: All kind of office instruction and guidelines related to operating should be kept in this file

(ix) New forms introduction file: All minutes of meeting, whenever held, should be kept in this file.

(x) Security documents and legal aspect file: One set of security documents and lawyer’s opinions and suggestions regarding issue will be kept in this file. The original should be send to SME head office on a weekly basis

(xi) Survey form file: After conducting survey, all survey will be kept in this file chronological.

SME Relates With Modern Marketing Concept

The goal of modern marketing concept is the customer satisfaction and this satisfaction comes through integrated marketing efforts. In terms of SME the goal is to economic development of our country through meeting and exceeding customer needs better than competition. In terms of customer orientation, SME provides the best facilities to customers regarding their needs. SME provides unsecured loans up to 8 lacs which none of other banks provide. In spite of integrated effort, SME is a team-based organization. CRO go to the door-to-door business and by depending on them, BBL gives loan to clients. By this BBL gets the direct feedback from the customers about their needs and wants. BBL analyzes the customers’ wants and tries to give them the product that the customer wants.

Marketing Processes Relate to SME

Basically strategic plans define the organizations overall mission and objective. Within each business unit, marketing plays a role in helping to accomplish the overall strategic objectives.

Market Segmentation

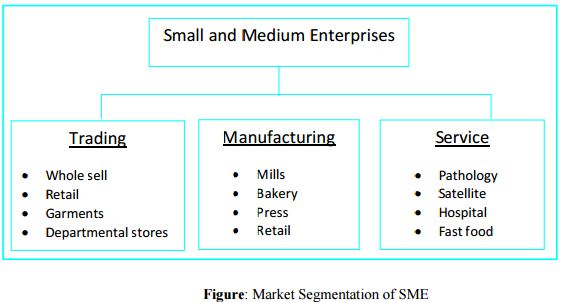

The market consists of many types of customers, products and needs and the marketer has to determine which segments offer the best opportunity for achieving company objectives. SME segments the market into three categories: Trading, Manufacturing, and Service. In trading business, there are different kinds like retailer, wholesaler, food business, general stores etc. in manufacturing, there are mills, bakery, press business, etc and also except purchasing manufacturer organization also take loans to meet the working capital requirements. In service business, there are pathology, hospitals and satellite business. Though in our country there is not much manufacturing organization, so most of the demands go for trading business. However it is a small and medium enterprise, therefore it focuses on small loan clients that are small types of business like trading, manufacturing, and service. Basically manufacturing clients take medium or low amount of loan during short period of time.

Bases for Segmenting Consumer Markets

There is no single way to segment a market. A market has to try different segmentation variables, alone and in combination, to find the best way to view the market structure.

Geographic segmentation: Dividing a market in to different geographic units such as nations, states, region, countries, cities, or neighborhood. In terms of SME, it targets every region around the country in terms of small business. Now the SME has almost 429 unit offices to provide credit facilities to the clients around the country. Each of the SME unit offices mainly setup the district levels around the city but not in the rural or undeveloped areas. However, where the potential enterprises/businesses are more, SME try to develop unit office at that particular region/area to capture the entire market.

Demographic Segmentation: Dividing the market in to groups based on demographic variables such as age, sex, family, income, education, religion, and nationality. In terms of SME, in some cases it is very strict. If one who has Hindu religion and live close to the border, SME would have very careful to provide loans to those clients. SME provide loans 20-60 aged peoples. SME is restricted to provide loans more than age of 65.

Behavioral Segmentation: Behavioral segmentation divides buyers in to groups based on their knowledge, attitude, uses or responses to a product. Many marketers believe that behavior variables are the best starting point for building market segments. In terms of SME, few clients would be found those who had done Masters and most of clients are secondary or higher secondary pass. But basically SME segments clients at least whether the clients can understand his/her own business. SME gives very importance on attitude. At the first sight if any client behaves rough then CRO never go to that particular client.

Target Consumer

To succeed in today’s competitive marketplace, organization must be customer centered and keeping them by delivering greater value. But before it can satisfy customers, organization must first understand their needs and wants. There are too many different kinds of consumers with too many different kinds of needs and some organizations in a better position to serve certain segments of the market. In terms of SME of BRAC bank, their target customers are small and medium enterprises. BRAC bank SME target customers those who have minimum income of 40- 70 thousand Tk. per month. Mostly entrepreneur’s in our country is illiterate. Some of them are higher secondary and BSC graduate. So SME mainly targeted those clients who actually understand his own business. There are three sectors of target customers which SME follows: Trading, Service and Manufacturing. Basically according to the clients demand, SME support them financially to enhance their business.

Target Market

It is the process of evaluation of each market segment and after then selecting one or more segments to enter into the target market. In terms of SME, the scope is specified in which the target market is small and medium enterprise. However, SME is restricted for leather, jewelry, and alcohol business.

Differentiated marketing: Using a differentiating marketing strategy, an organization decides to target several markets or niches and designs separate offers for each. Basically it provides the loan within 25 days and gives the highest months to repay the loan than other banks. In terms of trading business, if the business is not too big then SME is not allow to give more than 20 months to repay the loan. On the other hand, in case of manufacturing business, if the business is too big then SME gives the client gross period and more than 30 months to repay the loan. SME also categorizes the dealings with the customers in A, B & C groups. A-Categories officers are dealing with the educated clients, like masters or above or highly social client.

B-Categories officers are dealing with the undergraduate or normal standard clients.

C- Categories officers are dealing with the non-educated or illiterate normal clients.

Market Positioning

Market positioning means to occupy a clear, distinctive and desirable place relative to accomplish products in the minds of target consumers. To meet the customer demands, SME already establish different offices across the country. Before taking the loan CRO clearly defines to the clients regarding SME policies and repayment schedules. To positioning in the market, SME not only provide loan but also they give some valuable ideas to enhance the clients business and for economic development.

Once a company decides in which segments of the market it will enter, it must decide what positions it wants to occupy in those segments. A products positioning in the way the product is defined consumers mind relative to competing product.

Main head office of SME is in Dhaka city and rest of its unit offices are spread out surrounding the country. Each unit office consist of 2 or 3 CRO who provides door to door services, they even work at night. Many banks have field officers but could not carry out the unit office facilities. So BRAC bank can reach to the potential clients at anywhere in the country. The CRO of SME never say to the customer at the first impression that interest rate is 24%. They try to make understand to the clients mind that 2% per month or equal monthly payment as well as many benefits.

Unique Selling Propositions Facilities- the main facility of SME is to provide quick service to the clients, which might take 15 to 20 days. Hypothecation loans are collateral security free which other banks take securities. If any clients got serious problem in business after taking SME loans then it gives reschedule to repay the clients loan. While taking repeat loan SME provide various facilities to the clients.

Different features- IFC and Shore banks are going to carry out equity participation with BRAC bank. It will deposit more funds to provide more loans to the clients, which cover around the whole country

5.4.4 Different services- to get the loan, client do not have to go in bank directly. All sorts of work are done by the CRO for clients to have the loan quickly. In terms of necessities CRO go to clients home and bring repayments of the loan. In favor of clients, CRO also work in holidays.

Marketing Strategies for Competitive Advantages

To be successful the company must do a better job than its competitors for satisfying target consumers. Thus marketing strategies must be geared to the needs of consumers and also to the strategies of competitors. The core competency of SME is that it already set up the business around the country and marketing officers go to the door to door to the clients. On the other hand, it provides the highest amount for unsecured loans than other banks. In addition, it provides extremely quick services to clients by getting the loan.

Developing Marketing Mix

The set of controllable tactical marketing tools- product, price, place and promotion that the organization blends to produce it wants in the target market. The many possibilities can be controlled into four groups of variables known as the four P’s: Product, Price, Promotion and Place.

Product

Means the goods and services combination the company offers to the target market. In view of SME, they have short term and medium term loans whether CRO provide quick and quality services to clients. Customer service is another element of product strategy. A company designs its products and support services to profitability meet the needs of target customers. Short terms products means 3/6/9/12 months loan and midterm product means 15/18/24/30/36 months loan. For example- in Eid occasion most cloth merchants want short-term loan to carry out a profitable business.

Short Term Products

Easy repay- these categories of products are easy repaid for the clients. When the pick season comes like Christmas/Eid/Puja then these short-term products could be required for the clients. If the clients can exercise these types of loan at the pick season then clients business carry out like hot cakes and easily can repay the loan to BRAC bank.

Short-term fund requirement- without pick season, many clients could have required short funds to hold the tender or dealership. BRAC bank would be a good hand for the clients to have that dealership.

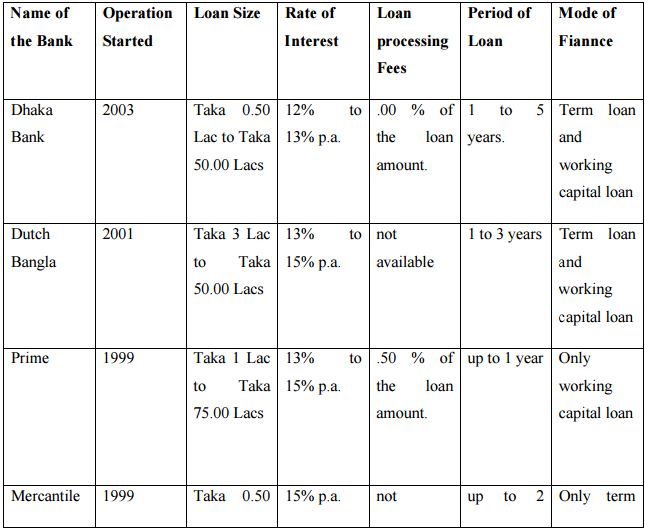

Comparative analysis of SME Credit Scheme of Six Different Banks currently Available in Bangladesh

About the Sample Banks

Dhaka Bank Ltd.

The Bank started branch operations at Belkuchi Sirajgonj in April 2003. Prior to the Bank’s intervention, the weaving community did not have the financial strength to stock their products till “Eid ul Fitr” when the annual sale takes place. Traders were taking advantage to the situation by buying up entire productions at low prices and liquidating stocks just before “Eid”. With financial services from Dhaka Bank Limited, the weavers have converted to power looms, significantly increased profitability and reduced the involvement of middlemen. Already they have identified several clusters and are working on improving access to finance within these clusters.

Dutch-Bangla Bank Ltd.

Dutch-Bangla Bank Limited (the Bank) is a scheduled commercial bank. The Bank was established under the Bank Companies Act 1991 and incorporated as a public limited company under the Companies Act 1994 in Bangladesh with the primary objective to carry on all kinds of banking business in Bangladesh. The Bank is listed with Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited. DBBL a Bangladesh European private joint venture scheduled commercial bank commenced formal operation from June 3, 1996. The Bank commenced its banking business with one branch on 4 July 1996. The bank opened SME windows in 2001.

Prime Bank Ltd.

As per decision of the Board of Directors of Prime Bank Ltd. in its 78th meeting held on 17.11.1999, “Small & Medium Enterprise (SME) Cell” has already been established at Head Office under the Credit Division. Now the bank can replicate quality anywhere in the world. So, the competitive differentiation comes from swiftness to market and innovation. And in this regard, small companies’ right down to the individual can beat big bureaucratic companies ten out of ten times.

Mercantile Bank Ltd

Mercantile bank is a third generation commercial bank. It has opened SME windows in 1999 to encourage the small business activities.

Small and Medium Enterprises (SME) in Bangladesh contributed 25% of gross domestic product (GDP) and 80% of the industrial jobs of the country in 2004. According to ADB, the country’s estimated 6 million SMEs and micro enterprises firms of less than 100 employees have a significant role in generating growth and jobs. This is a sector that has its own distinct needs and requires specialized focus. Eastern Bank Ltd. (EBL) has launched SME Banking in early 2005 with this view in mind. Eastern Bank Ltd. Services in SME:

- Provide SMEs with easy access to financing.

- Deliver products that ensure superior returns to our customers.

- Orient customers with industry trends, regulatory issues etc, for their success.

- Value long-term relationship banking BRAC Bank Ltd.

The BRAC Bank ltd started its operation in 2001. The SME portfolio includes

- Prothoma Rin Exclusively designed for women

- Anonno Rin This is a small-scale loan

- Apurbo Rin In order to help our SME

- Supplier Finance

Criterion for Sample Selection:

The banks for comparative analysis have been chosen in the basis of the following criterion:

Loan size

- Prime Bank Ltd – Taka 1 Lac to Taka 75.00 Lacs

- Dhaka Bank Ltd – Taka 0.50 Lac to Taka 50.00 Lacs

- Eastern Bank Ltd- Taka 1 Lac to Taka 300.00 Lacs

- Mercantile Bank Ltd- Taka 0.50 Lac to Taka 2.00 Lacs

- Dutch-Bangla Bank Ltd- Taka 3 Lac to Taka 50.00 Lacs

- BRAC Bank Ltd- Taka 3 Lacs to Taka 30.00 Lacs

Among the banks EBL offers the highest loan amount to the customers where as the BRAC bank offers the lowest loan to its customers.

Rate of interest

- Prime Bank Ltd – 13% to 15% p.a.

- Dhaka Bank Ltd – 12% to 13% p.a.

- Eastern Bank Ltd- 14% to 15% p.a.

- Mercantile Bank Ltd- 15% p.a.

- Dutch-Bangla Bank Ltd- 13% to 15% p.a.

- BRAC Bank Ltd- 18% to 24% p.a.

In terms of interest rate the Dhaka Bank Ltd offers the lowest rate of interest to its customers. The highest rate is charged by BRAC Bank Ltd. The Mercantile Bank Ltd. have the only bank that offers fixed rate for any loan customers.

Loan processing fees

- Prime Bank Ltd – .50 % of the loan amount.

- Dhaka Bank Ltd – .00 % of the loan amount.

- Eastern Bank Ltd- not available

- Mercantile Bank Ltd- not available

- Dutch-Bangla Bank Ltd- not available

- BRAC Bank Ltd- .50 % of the loan amount

All the banks do not provide data about loan processing fees to their customers. The prime bank and BRAC bank limited only charges .50% as loan processing fess

Period of loan

- Prime Bank Ltd – 1 to 5 years.

- Dhaka Bank Ltd – 1 to 3 years.

- Eastern Bank Ltd- up to 1 year.

- Mercantile Bank Ltd- up to 2 years.

- Dutch-Bangla Bank Ltd- 1.5 to 5 years.

- BRAC Bank Ltd- 1 to 3 years.

Among the banks the highest loan maturity date is offered by DBBL and Mercantile Bank Limited offers the lowest maturity period

Mode of Finance

- Prime Bank Ltd – Term loan and working capital loan

- Dhaka Bank Ltd – Term loan and working capital loan

- Eastern Bank Ltd- Only working capital loan

- Mercantile Bank Ltd- Only term loan

- Dutch-Bangla Bank Ltd- Only term loan

- BRAC Bank Ltd- Only term loan

All the Banks providing SME financing facilities do not provide long-term loan to its customers. Among the banks Prime and Dhaka Bank limited both provides term loan and working capital loan to their customers. Other bank either provides term loan or working capital loan to its customers.

Comparative Analysis of SME Credit Scheme of Six Different Banks

Findings

BRAC bank plays a vital role in the SME sector of Bangladesh. Up to April 2010, BBL provides loans for 265,000 clients and in total 10,000 crore TK. BBL is the pioneer in the SME loan sector. They have taken different strategies for the development of this sector, because it is the main profitable product of BBL. In the recent years they launched different types of SME loan product for mitigate the different target customers needs. Throughout the survey analysis and 3 months internship period this reports found some shortfalls of SME sector of BBL. The findings of this report are given below:

- Most of the customers want to reduce the interest rate and increase tenure.

- Some customers are not satisfied with the attitude/behavior of CROs.

- Huge number of documents in the helpdesk causes delay in the disbursement process

- Zonal office can approve up to 5 lacs, but at present the percentage of repeat customer’s increase rapidly and most of the cases they apply for more than 5 lacs.

- Lack of marketing activities in the urban area, whereas other competitors are giving more ad at different spot.

- The remuneration package for the entry and the mid level management is considerably low. The compensation package for BBL entry-level position even lower than the contemporary banks.

- Some of the borrowers do not install a signboard in a visible place of business or manufacturing unit mentioned that financed by “BRAC Bank Limited”.

Recommendation

For better improvement of SME, BBL can consider the following recommendation:

- Reduce the interest rate because most of their competitors are providing loans at a lower rate for example most of the competitors banks providing loan at 12-15% interest rate

- Increase marketing activities in the urban area because other competing industries are given huge ad in urban area which helps them to increase their customer base.

- Give proper training to the CROs with some real life problem because they are all in all for SME loan. Sometimes they made a mistake which results in customer harassment, increase processing time and charges.

- Look after CROs activities by the ZOs because sometimes they are hiding information and make mistakes to prepare financial statements and other documents.

- Increase amount of SME loan approval by the Zonal officer, at present they can approve up to 5 lacs.

- Increase amount up to 10 lacs without collateral security for providing loans

- Recruit fresh ZOs from outside to control CRO grievances (since present ZOs are mostly promoted CROs who have joined the Bank all most at same time).

- Frequently check clients are perform all the terms and condition of SME loan.

- Provide loans to the leather and jewelers industry, because leather is the 3rd exporting product so it is better to encourage them for the economic development of Bangladesh

- Increase the remuneration and compensation package for the entry and mid level management otherwise BBL can’t retain the efficient and experienced employees.