Executive Summary

Jamuna Bank Limited is a third generation bank in the private sector banking of Bangladesh. JBL has already achieved tremendous progress within only 09 (nine) years. Now JBL is offering about to all modern Banking services with modern technologies.

This report focuses on credit risk management of Jamuna Bank Limited. In this report management of credit risk is critical component of a comprehensive approach to risk management and essential to long-term success of any banking organization.

This report has been divided into five parts and named as six chapters. Chapter one comprises of the background of the report, the problem statement, objectives and limitations of study.

Chapter two comprises of research methodology. In this chapter, the sources of data collection are discussed briefly. Based on data collection the area is cove-ed regarding the report. Then the sample size is fixed and various soil wares are used to analyze the collected data from different sources.

Chapter three is comprised of the profile of Jamuna Bank Limited. In this chapter the details of Jamuna Bank Limited are presented in an organized manner, thus one can understand the activities of Jamuna Bank Limited.

The fourth chapter comprises of credit risk management. Here the risks of credit arc discussed in a detail manner.

The fifth chapter is the analysis and finding of the report and sixth chapter comprises of conclusion in accordance with the analysis and further recommendations have been made to mitigate credit risk of Jamuna Bank Limited.

Introduction

Bangladesh is a new comer in the world of modernized banking sector. Public sector was the dominant player in the market after liberalization. All financial activities were occupied by the public sector, where insurance was the only privatized sector, Government allowed the private sector to enter the banking industry. The other segment of the financial sector is represented by about two dozen insurance companies, six none-banking financial institutions, few leasing companies & twenty newly permitted merchant banks. Jamuna Bank LTD. Is one of the few banks permitted by the Bangladesh bank in the late 1991.Some other bank permitted earlier. This bank known as third generation bank and fortunate to remain immune from the bad loan culture. However, the performance of this bank is not same. The Jamuna Bank LTD. Remained as one of the top performers among them.

Background of the Report:

The report is an attempt to provide an orientation to real life scenario wherein one can observe and evaluate the uses and applicability of theoretical concepts that were taught in BBA program. As a partial fulfillment of Bachelor of Business Administration (BBA) Program of Institute of Business Studies, of DarulIhsanUniversity, every student has to undergo an term paper program. The author of the study is the student of this University , a well reputed private sector commercial bank has been assigned to prepare a project paper on “Credit Risk Management of Jamuna Bank Limited Eventually a report with proper analysis and possible solutions of the organization -s hereby submitted to Shafia Mumtaj Rakhi Amin Course Coordinator & Assistant Professor of Institute of Business of Darul Ihsan University.

Objectives of the Study:

General Objective

To overview the overall credit risks management of Jamuna Bank Limited.

Specific Objective

P To examine credit operation system of Jamuna Bank Limited.

P To study the credit appraisal procedures of Jamuna Bank Limited.

P To analyze the asset quality of Jamuna Bank Limited.

P To identify the control mechanisms followed by JBL for lending and assessment of credit risk.

P To compare profitability and growth of Jamuna Bank Limited in different years.

P To recommend some suggestions for sustainable development of Jamuna Bank Limited

Methodology

Sources of data:

Both Primary and Secondary data have been used in preparing this report. The details of the sources of data are as follows:

Primary Sources:

• Practical work exposure with Jamuna Bank Limited

• Face to face conversation / Interview with the Bank Officials

• Observations

Secondary/ Sources:

• Annual Report of Jamuna Bank Limited

• Credit Operational Manual

• Training materials of the Bank

• Periodicals published by Bangladesh Bank

• Policy Guidelines and related circulars of Bangladesh Bank

• Various books, journals, articles etc,

• Web Sites.

Population, Sampling & Sampling Design:

The process of using a small number of items or parts of a large population to make conclusions about the whole population. In Jamuna Bank Limited total numbers of employees are 805. From that 50 employees are chosen for interview which has been considered as sample size. Samples have been collected from Top management, Executives and Officers of the Bank on randomly basis.

Software used

Software has been used for preparing this report is MS-power, MS-Excel, MS-Power Point etc.

NAME OF THE ORGANIZATION: Jamuna Bank Limited (JBL)

ADDRESS: Head Office: Chini Shilpa Bhaban, 03, Dilkusha C/ A, Dhaka-1000 Web: wwvw.jamunabankbd.com

History & Background of Jamuna Bank LTD:

Jamuna Bank Ltd. (JBL) is a Banking Company registered under the Bank Companies Act, 1991 and incorporated as Public Company limited by Shares under the Companies Act, 1994 inBangladesh. The Bank starred its operation from 3rd June 2001 as a scheduled Bank.

JBL came into being as a highly capitalized new generation Bank started its operations with an Authorized Capital and Paid-up Capital of Tk. l600.00 million and Tk.390,00 million respectively.

JBL, the only Bengali named private commercial bank was established by a group of wining local entrepreneurs conceiving an idea of creating a model banking institution with different outlook to offer the valued customers, a comprehensive range of financial services and innovative products for sustainable mutual growth and prosperity. The sponsors are reputed personalities in the filed of trade, commerce and industries.

The Bank is being managed and operated by a group of highly educated and professional team with diversified experiences in finance and banking. A team of highly qualified and experienced professionals headed by the Managing Director of the Bank who has vast banking experience operates bank and at the top there is an efficient Board, of .Directors for making policies. Earnest and prudent involvement of the best management team in all tires of the 3ank has brought the best out of the Bank. The Management of the bank constantly focuses on understanding and anticipating customer’s needs.

The scenario of banking business is changing, day by day, so the bank’s responsibility is to devise strategy and new products to cope with the changing environment. JBL has already achieved tremendous progress within only Seven years. The bank has already ranked at top of the quality service providers & is known for its reputation.

JBL is now trying to widen its periphery by targeting all the potential sectors. With an extensive range of financial products and services day by day tine bank is committed to provide high duality financial services/products to contribute to the growth of GDP of the country through stimulating trade & commerce, accelerating the pace of Industrialization, boosting up export, creating employment opportunity for the educated youth, poverty alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country.

To keep pace with time and in harmony with national and international economic activities and for rendering all modern services, JBL, as a financial institution automated all its branches with computer network in accordance will the competitive commercial demand of time. Moreover, considering is forthcoming future the infrastructure of the Bank has been rearranging.

Since its inception the Bank’s footprint has grown to 41(orty one) branches across the country and the customer base has expanded to 76,047 and 7,924 borrowers as on 30th April, 2009. The expectation of all class businessman, entrepreneurs and general public is much more to JBL Keeping the target in mind the bank has taken preparation to open new branches in coming months of 2009.

JBL undertakes all types of banking transactions to support the development of try de and commerce of the country. The JBL’s services also available for the entrepreneurs to set up new ventures and BMRE of industrial units.

Now JBL is on line to establish trade and columniation with the Prime Imitational banking companies of the world. As a result JBL will be able to build a strong root in international ‘banking horizon. Bank has been drawing arrangement with well conversant money transfer serve agency Gram”. It has a full time arrangement for speedy transfer of money all over the world.

Banking is not only a profit-oriented commercial institution but it has a public base and social commitment. Admitting this true JBL is going on with its diversified banking activities. JBL offers different types of Corporate and Personal Banking Services involving all segments of the society within the purview of rules and regulations laid down by the Central Bank and other regulatory authorities. JBL introduce^ different types of Savings Schemes, Consumer’s Credit Scheme, Housing Loan, different types of SME Loan facilities to combine the people of lower and middle-income group.

As regards mobilization of the Bank’s deposit, utmost importance is attached for mobilization of stable, low and no-cost deposit so that proper liquidity could be maintained and maximum deployment of fund could be made avoiding mismatching of fund.

Corporate Vision:

To become a leading banking institution and to play a pivotal role in the development of the country through best application of modem information technology in business activities, offering high standard clientele services and proper coordination of high quality assets is the core of the vision.

Corporate Mission:

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so sustainable growth, reasonable return and contribution to die development of the country ensured with a motivated and professional work-force potential. With a view to achieving commercial objectives of the Bank, the sincere and all out efforts stay put unabated. Respected clients and shareholders are attracted to it for its transparency, accountability, social commitments and high quality of clientele services.

Objectives of JBL:

The following objectives are set for JBL:

• To earn and maintain CAMEL Raring “Strong’.

• To establish relationship banking and improve service quality through development of Strategic Marketing Plans.

• To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

• To introduce fully automated systems through integration of information technology.

• To ensure an adequate rate of return on investment.

• To keep risk position at an acceptable rarer (including any off balance sheet risk).

• To maintain adequate liquidity to meet maturing obligations and commitment.

• To maintain a healthy growth of business with desired image.

• To maintain adequate control systems and transparency in procedures.

• To develop and retain a quality work-force through an effective human Management System.

• To ensure optimum utilization of all available resources. ;

• To pursue an effective system of management by ensuring compliance to ethical norms, transparency and accountability at all levels sources

Strategies of JBL:

The strategies of JBL are as follows:

• To raise the Paid-up Capital and Statutory Reserve Fund i.e. Regulator Capital up to Tk.2000.00 million by June, 2010

• To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund.

• To strive for customer satisfaction through quality control and delivery of timely services.

• To identify customers’ credit and other banking needs and monitor their perception towards our performance in meeting those requirements.

• To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

• To train and develop all employees and provide them adequate resources so that customers’ needs can be reasonably addressed.

. • To cultivate a working environment that fosters positive motivation for improved performance.

• To diversify portfolio bum in the retail and wholesale market.

• To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

Risk Assessment & Risk Management:

Risk assessment is the process of analyzing potential-losses from a given hazard using a combination of known information about the situation, knowledge about the underlyirlg process, and judgment about the information that is not known or well understood.

The process of combining a risk assessment with decisions on how to address that called risk management. Risk Management part of a larger decision process that co insiders lent in the technical and social aspects of the risk situation. Risk assessments are per primarily for the purpose of providing information and insight to those who make d about how mat risk should be managed. Judgment and values enter to risk assessor the context of what techniques ore should use to objectively describe and evaluate risk, Judgment and values enter into risk management in the context of what is the most effective and socially acceptable solution.

Overview of credit Risk Management:

As Bank deals with the money collected from the depositors repayable on demand. So, it can not afford to lock up it fund for long or uncertain periods. Consequently, Bank must safeguards its deposits through effective management of all possible risks associated with its credits.

One of the most significant risks of a bank is exposed to is, what is generally termed as “Credit Risk”, which is the primary risk in the baking system. Since the largest slice of income generated by a bank and a major percentage of asset; is subject to this risk, it is obvious that prudent management of this risk is fundamental to the sustainability of a bank. Management Risks needs to be a robust process that enables the Banks to proactivel1/ manage he credit portfolio in order to minimize losses and earns an acceptable level of return for the Shareholders.

Risk is inherent in all aspects of commercial operation. However for Banks Credit risk is the fundamental to the sustainability of a bank. Thus Credit Risk is an essential factor that needs to be managed.

Credit Risk:

Credit risk is the possibility that a borrower will fail to meet its obligation in accordance with agreed terms. Credit risk, therefore, arises from the Bank’s dealings with or lending to corporate, individual and other Banks or financial institutions.

To prevent excessive flow of credit and proper use of it, banks require taking on the appropriate credit appraisal procedure to impose financial discipline on borrowers. The procedure that organize, control and motivate the borrowers will tailed credit management.

Risk is defined as the product of a hazard (such as damage costs) and the probability that this hazard occurs. In other words, (probability) x (hazard) = risk. The first two values must be known or at least estimated in order to define risk.

Credit Risk Management:

the value of credit transactions, and proactively implements risk mitigation strategies. Major Credit risk mitigates are:

• Improved collection rates.

• Increased product and customer profitability

• Reduced net bad debt and operating costs

• Enhanced customer ma anemone processes

• Decreased receivables carrying costs

• Improved bottom lines

Credit constitutes the major part of the Bank’s asset portfolio and managing credit risk is by far the most important concern of the Bank. The failure of a commercial Bank is usually associated with the problems in Credit portfolio and is less often the result of shrinkage in the value of other assets. As such, Credit portfolio not only features dominates in the assets structure of the Bank, it is critically important to the success of the Bank as well.

Management of Credit Risks needs to be robust process that enables Banks to proactively manage credit portfolio in order to minimize losses and earns an acceptable level of return. Given the fast changing glob cockney and the increasing pressure of jubilation, liberalization, consolidation and disintermediation, it is essential that Banks have robust Credit risk management polices and procedures their are sensitive and response c to these changes.

Since exposure to credit risk continues lo be the leading source of problems in banks world-wide, banks should be able to draw useful lessons from past experiences. Banks should now have a keen awareness of the need to identify/ measure, monitor and control credit risk.

To provide a board guideline for the Management of Credit Risk towards achieving the objectives of the Bank, for efficient and profitable deployment of its mobilized resources and to administer the Credit portfolio in die most efficient wavy, a clearly defined, well planned, comprehensive and appropriate Credit policy and Control Guidelines of the Bank is a pre-requisite

On the other hand, JBL is a new generation 3unk. It is committed to provide high quality financial services/products to contribute to the growth of G.D.P. of the country through stimulating trade & commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the educated youth, proverb alleviation, raising standard of living of limited income group and over all sustainable socio-economic development of the country.

In achieving the aforesaid objective of the Rink, Credit Operation of the Bank is of paramount importance. Hence, JBL has changed about as credit culture has been shifting towards a more professional and standardized Credit Risk Management approach.

Core Risks of Banking:

The risks of banking are complex and multi-dimensional. Banks are exposed to a number of risks of different types. Resultantly, managing risk is an art of identifying, measuring and irrigating the risks.

In view of the above, Bangladesh Bank as identified 05(five) core risk area relating to banking business which are as follows :

The Management of above Core Risks of Banking are described below:

* Credit Risk Management – It has already been stated in this report that Management of Credit Risk is the most significant and key task of the bank. Credit Risk refers the probability of loss arising from the failure of a counterparty/ customer to perform as per agreement with the Bank.* Financial Spread Sheet (FSS):

A Financial Spread Sheet (FSS) has been developed by Bangladesh Hank which main- be used by the Banks while analyzing the credit risk elements of a credit proposal from financial point-of view.

The FSS is well designed and programmed software having two parts. Input and Output Sheets. The financial numbers of borrowers need to be inputted in the Input Sheets which will then automatically generate die Output Sheets.

Classification & Provisioning of loans & Advances.

In order to strengthen credit discipline and improve the recovery positions of Loans and Advances by the Banks, Bangladesh Bank vide BCD Circular No.34/ 1989 introduced a new system covering loans and advance: classification, the suspension of interest due and the making of provisions against potential loan loss.

With a view to further strengthening credit discipline and bring classification and provisioning regulation in line with international standard, a phase wise program for loan classification and provisioning was undertaken by Bangladesh Bank through BCD Circular Mo. 120/1994. Afterwards, a comprehensive circular, BRPD Circular No. 16/1998 was issued with major amendments in previous circulars with a view to achieving a more specified and simplified system of loan classification and provisioning.

Later on, as part of the process i.e. regarding ‘die changes meanwhile Bangladesh Bank hap already introduced “Special Mention Account” vide BRPD Circular No. 02/2005 and 09/2005 for the banks and raise early warning signals for accounts showing first signs of weakness an|. making appropriate provisioning therein. As a farther move towards this end, changes in the formats for classification and provisioning have been made vide BRPD Circular No. 08/2005. Moreover, some changes have been made in the provisioning requirement for Consumer Financing and Small Enterprise Financing.

Meanwhile, in order enable the banks to have all existing instructions on the subject at one place a Master Circular has been issued by Bangladesh Bank vide BRPD Circular No. 05/2006 by incorporating all instructions issued from time to time, which includes: a few new instructions as well.

Categories of Loans and Advances:

Any Continuous Loan will be classified as:

• “Sub Standard (SS)” if it is past due/ overdue for 06(six) months but less than 09 (nine) months.

• “Doubtful (DF)” if is past due/ overdue for 09(nine) months but less than 12 (twelve) months.

- “Bad & Loss (SI,)” if t is past /overdue for 12(twelve) months or beyond

Any Demand Loan will be classified as

• “Sub Standard (SS)” if it remains past due/ overdue for 06(six) months our beyond but not over 9 (nine) months from the date of claim by the bank or from creation of the loan.

• “Doubted (DF)” if it remains -past due/ overdue for 09 (nine) months or beyond but not over 12 (twenty) month, from the date of claim by the bank or from the date of creation of -the loan.

• “Bad & Loss (BL)” it remains past due/ overdue for 12 (twelve) months or beyond from the date of claim by the bank or from the date of creation of the loan.

• In case of any installments’ or part of installment(s) of Fixed Term Loan is not repaid within the due date, the amount of the unpaid installment-is) will be termed as “Defaulted Installment“.

• In case of Fixed Term which are repayable within maximum 05(five) years

If the amount of “Defaulted Installment” is equal to or more than the mount of installment (s) due within 12 (twelve) months, the entire loan will be classified as “Sub Standard.”

• If the amount of ”Defaulted Installment” is equal to or more thenn the mount of installment (s) within 18(eighteen) months, the entire loan classified as “Doubtful (DF)”‘.

• If the amount of “Defaulted Installment” is equal to or more than the amount of installment (s) due within 24 (twenty four) months, the entire loan will be classified as “Bad & loss (BL)”.

In case of fixed loans, which are repayable more than 05 (five) years of time:

• If the amount of “Defaulted installment” is equal to or more then the amount of installments due within 6 (six) months, the entire loan will be classified as “Sub Standard (SS)”.

• If the amount of “Defaulted Installment” is equal to or more than the amount of installment due within 12( twelve) months, the entire loan will be classified as “ Doubtful (DF).”

• If the amount of “Defaulted Installment” is equal to or more than the; amount of installment (s) due within 18 (eighteen) months, the entire loan will be classified as “Bad & Loss”

Explanation:

If any Fixed Term Loan is repayable on monthly installment basis, the amount of installments due within 06 (six) month will be equal to the sum of 06 (six) monthly installments. Similarly, if the loan is repayable on quarterly installment basis, the amount of installments due within 06(six) month will be equal to the sum of 02(two) quarterly installments.

The Structure of Basel II.

The First Pillar

The first pillar deals with maintenance of regulatory capital calculated for three major components of risk that a bank faces: credit risk, operational risk and market risk. Other fit are not considered fully quantifiable at this stage.

The credit risk component can be calculated in three different ways of varying degree of sophistication, namely standardized approach, Foundation 1RB and Advanced 1RB, stands for Internal Rating-Based Approach, for operational risk, there are tree different approaches – basic indicator approach or BIA,, standardized approach or TSA, and advanced measurement approach or AMA for market risk the preferred approach is VaR (value at risk)

The Second Pillar

The second pillar deals with the regulatory response to the first pillar, giving regulators much improved ‘tools’ over those available to them under Basel. It also provides a framework for dealing with all the other risks a bank may face, such as systemic risk, pension risk, concentration risk, strategic risk, reputation. risk, liquidity risk and legal risk, which the accord combines under the title of residual riskily gives bank a power to review their risk management system.

The third Pillar

The third pillar greatly increases the disclosures mat the bank must make. This is designed to allow the market to have a bettor picture of the overall risk position of the bank and to allow the counterparties of the bank to price and deal appropriately.

The Basel II Accord focuses on the following three areas :

• Minimum Capita! Requirement :

The committee recognizes that to have a sound bank it is necessary to have a minimum volume of capital matching the risk profile of the bank. The capital provides the bank with safety cushion to absorb losses without compromising on its obligations. The minimum ratio of regulatory capital with risk-weighted asset; should not be less than 8%.

The committee recognize that beaks face three major kinds of risks :

O Credit Risk

O Operational Risk & Market Risk.

Total risk-weighted assets are determined by multiplying the capital requirements for market risk and operational risk by 12.50 and adding the resulting figures to the sum of risk-weighted assets for credit risk.

Supervisory Review:

The committee has laid out key principles of supervisory review, risk management guidance, supervisory transparency and accountability with respect to banking risks. It also includes guidance relating to treatment of interest rate risk in the banking book, credit risk, enhanced cross-border communication are cooperation and securitization

Public Discloser:

The committee stresses on public disclosure as a means to improve on the market discipline, The disclosure will be in the area of Capital Structure, Capital Adequacy, Risk Exposure and assessment in the areas of Credit Risk, Market Risk, Operational Risk, Interest Rate Risk, etc.

Basel II Accord & Credit Risks:

The committee permits of bank a choice- between two broad methodologies for calculating their capital requirements for Credit Risk.

One alternative will be to measure Credit Risk in a standardized manner as provided committee, supported by external credit assessments.

The alternative methodology allows banks to use their internal rating systems for credit risk subject to the explicit approval of the suspension bank.

Principles for the Assessment of Bank. Management of Credit Risk:

- Establishing an appropriate credit risk environment:

Principle1: The board of directors should have responsibility for approving and periodically reviewing the credit risk strategy and significant credit risk policies of the bank. The strategy should reflect the bank’s tolerance for risk and the level of profitability the bank expects to achieve for incurring various credit risks.

•Principle 2: Senior management should have responsibility for implementing the credit risk strategy approved by the board of directors and for developing for and procedures for identifying, measuring, monitoring and controlling credit such policies and procedures should address credit risk in all of tire bank’s act and at both the individual credit and portfolio levels.

Principle 3: Banks should identify and manage credit risk inherent in all products activities. Banks should ensure that the risks of products and activities new to them are subject to adequate procedures and controls before being introduced or undertaken, and approved in advance by the board of directors or its appropriate committee.

- Operating under a sound credit granting process:

• Principle 4: Banks must opera’s under sound, well-defined credit-granting criteria. These criteria should include a thorough understanding of the borrower or counterparty, as well as the purpose and structure of the credit, and its source of repayment.

• Principle 5: Banks should establish, overall credit limits at the level of individual borrowers and counterparties, and groups of connected counterparties that aggregate in a comparable and meaningful manner different types of exposures, both in the banking and trading book and on and off the balance sheet.

• Principle 6: Banks should have a clearly-established process in place for approving new credits as well as the extension of existing credits.

• Principle 7: All extensions of credit must be made on an arm’s-length basis. In particular, credits to related companies “and individuals must be monitored with particular care are other appropriate steps taken to control or mitigate the risks of connected lending.

Credit Operations in Jamuna Bank Ltd:

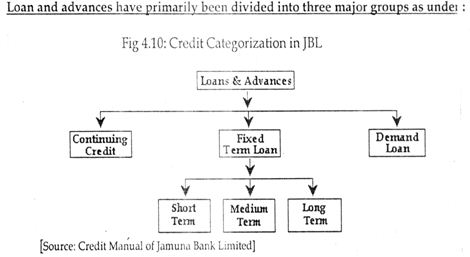

Credit operation is the vital part of a Bank. At first the customer approach to Branch accordingly branch sends proposal to Mead Office and by analyzing the proposal makes the decision. Jamuna Bank Limited has a sound credit operation system, detail of which described as under:

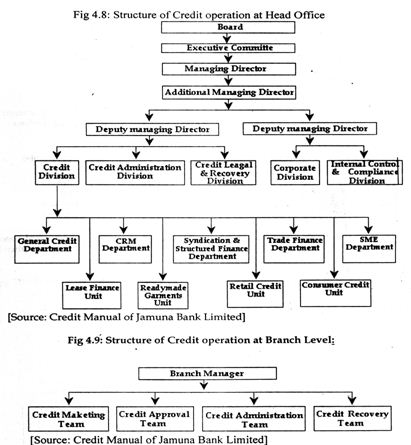

Organizational Structure for Credit Operations:

JBL has a suitable organizational structure for credit operations. The credit organogram of the bank has been structured in the following manner:

In case of L/C proposal:

• Performance of L/C during the last year i.e. No. & Date of L/C

opened:

• Commodity;

• L/C value;

• Date of creation of PAD;

• Date of retirement;

• Mode of retirement etc.

In case of BTB L/C proposal:

• Detailed list of machinery;

• Production capacity;

• Working Capital (BTB L/C) Assessment; j

• Existing Export L/C in hand mentioning date of shipment; j

• Detailed position of outstanding BTB L/C/Accepted Bills; j

• Progress of production and expected date of shipment;

• Statement of Outstanding FDBP/IDBP, if any.

• Quota Position;

• Inspection Report;

• Copy of Valid Bonded Ware House License;

• Customs Clearance of dispute, if any

• Whether the applicant is Director of JBL as per definition of Banking Company Act.

Financial Analysis to be prepared by the Branch Manager based on the financial statement with trends etc. It should ago contain an assessment of the competence and quality of he business management, the general economic and competitive environment of the borrowers industry and any other pertinent factors relevant for credit decision.

Credit Principal of JBL

The Bank shall provide suitable credit services mid products for the market in which it operates. Product innovation shall be a continuous process. BL mile’s the understated credit principle for considering potential credit proposal

• Loans and advances shall normally be financed from customers deposit and not out of temporary fund or borrowing from money market.

• Credit facilities shall be allowed in a manner so that credit expansion goes on ensuring quality i.e. no compromise with the Bank s standard of excellence. Credit is extend to customers who will complement such standards.

• All credit extension must comply with the requirements of Bank’s Memorandum and Articles of Association, Bank companies Act as amended from time to time, Bangladesh Bank’s instructions Circulars, Guidelines and other applicable laws, rules and regulations.

• The conduct of the credit portfolio should contribute, within defined risk. Limitation, to the achievement of profitable growth and superior return on the Bank’s capital.

• Credit advancement shall focus on tine development and enhancement of customer’s relationship and shall be measured on the basis of the total yield for each relationship with a customer (on the global basis), though individual transactions should also be profitable.

• Credit facilities will be extended to those compares/persons, which can make best use of the facility thus helping maximize our profit as well is economic growth of the country. To ensure achievement of this objective lending decision shall be based mainly on the borrower’s ability to repay.

The portfolio shall be well diversified sector wise, Industry wise, geographical area wise, maturity wise, size wise, mode wise, purpose wise. Concentration of credit shall be carefully avoided to minim risk.

If Credit facilities are granted on a trisection one-off basis, the yield from the facility should be commensurate with the ( risk Pricing of Credits shall depend on the level of risk and type of securities offered. Rate of interest is the reflection of risk in the Transaction. The higher the risk, the higher is pricing. Interest rate may be revised from time at time in view of the change it; the cost of Fund and market condition. Effective yield can be enhanced by requiring the customer to maintain deposit to support borrowing flutings. Yield may be further improved by realizing Management fee, Commitment fee service charge etc where possible.

* Proper staffing: Proper analysis of Credit proposal is complex and required high level of numerical as well as analytical ability and common sense. To ensure effective understanding of the concept and thus to make the overall credit port-folio of the Bank healthy, proper staffing shall be made through placement of qualified officials having appropriate background, who have got the right aptitude, formal training in Credit Risk Analysis, Bank’s credit procedures as well as required experience

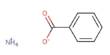

Credit Categories in Jamuna Bank Ltd:

Jamuna Bank Limited has broadly three categories of loan facilities, these are Continuous credit, Fixed term loan and Demand loan. Fixed term loan are divided into three parts based on loan tenor. The; categorization is shown below:

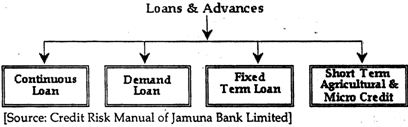

Loan and advances have primarily been divided into three major groups as under:

Term Loans for Large & Medium Scale Industries:

“Large Industry” is defined to include all industrial enterprises whose total fixed cost\ replacement cost excluding land an factor building is over Tk.100 million. Med Industry is defined to include all industrial enterprises whose total fixed cost replacement cost excluding value of land and facto: y building is between Tk.15 million of Tk.100 million.

This category of advances accommodate the medium and long term financing for acquiring capital machinery of new Industries or for BM ?E of the existing units who are engaged in manufacturing goods and services.

Term financing to tea gardens may included in this category depending on the nature and size.

As the financing under this category have fixed repayment schedule it under the head “Loan (Gen)/Hire-Purchase/Lease.

Term Loans to Small & Cottage Industries:

“Small Industry” will mean enterpriser whose total fixed cost/ replacement cost excluding land and factory building is not more than Tk.15 million.

No short term or continuing credits are to by included in this category. Medium & term credits arc also included under the category.

Like the Large & Medium Scale Industry it is also allowed in the form of “Loan (Gen)\Hire Purchase/ Lease Financing”.

Working Capital:

Loans & Advances are allowed to the manufacturing units to meet their working capital requirements, irrespective of their size – big, medium or small, fall under the category. These are usually continuing credits are as such fall under the head “Cash Credit”.

Export credit :

Credit facilities allowed to facilitate export of ill items against Letter of Credit and/or confirmed export orders fall under this category. It is accommodated under the heads “Export Cash Credit (ECC)”, Packing Credit (PC), Foreign Documentary Bills Purchased (FDBP), Local Export Bills Purchased etc. However, bills discounted/ purchased against supply of goods and services to companies/ industries which are located in the country and not involved in export/ deemed export shall not fill under export credit.

Short term loans and continuing creeps inflows for commercial purposes other that exports fall under this category. It incipit Limner financing, financing for internal trade.

Service establishment, etc. No medium and long term loans are accommodated here. This category of advances are allowed in the for of (Gen), etc. for commercial purposes.

Any loan that does net fall in any of the above categories is considered under the category “Others”. It includes loan to JBL has separate SME Financing Scheme duly approved by tic Hoard. There are several products, modalities and loan ceiling for SME financing. SME CeH witling Corporate Division handles SME loans.

Analysis

Deposits & Deposit: Mix:

In commercial Bank operation starts with mobilization of resources i.e. tapping of deposits and then the same are deployed as loans, advances&. investment for the purpose of maximizing wealth. Thus, cenobite is the lifeblood of a bank.

In keeping with this axiom JBL attaches utmost importance to the deposit mobilization campaign and to the optimal dine-sit rid for minimum cost of fund as far as practicable.

The comparative position of Deposits & Deposit Mix of the Bank for the last two years are depicted below:

TOTAL DEPOSITS ‘ [Source: Annual Report, Jamuna Bank Ltd.

Under the prevailing stiffly competitive market JBL has been able to install confidence customers as to its commitment to depositorde could mobilize a total deposit of Tk Tk.20924.02 million showing an increase of TK.6383.92 million being 3G.55 percent.

Cost of Funds (Deposit Cost & Overhead Cost:

The Cost of Funds of JBL in 2007 was 12.49%, which was 20078was 12.26%, 12.18% in 2006. So, it is noted that in 2009 the cost of funds was big higher than that of 20067& 2008.

Loans & Advances:

Under favorable business environment due to political turmoil throughout the JBL was in constant efforts to explore different areas of credit operation and could raise the loans and advances portfolios to Tk. 21036.86 million in 20089with an increase Tk.4419.41 million being 26.59%, over that of the preceding year.

Classified Loans & Advance:

Over the last couple of years the Ratio of Classified Loans & Advances out of Total Loans & Advances has been increased alarmingly year 2006 and year 2007 with respect to than that of the previous years, but in 2008 it declined substantially.

Investment:

JBL’s investment portfolio as on 31/,2/2009was Tk.4238.63 million from which Tk.5390.03 million as on 31/12/2008 registering a decrease of Tk. 1151.40 million i.e. 21.36 percent.

The investment portfolio was blended with Govt. investment of Tk.4185.46 million, Treasury Bonds of Tk.2935.54 million, investment in Primary Shares and Zero Coupon Bonds of Tk.43.61 million. Its investment was made in acquisition of Preference Silages of Tk.2.50 (5.00-2.50) million of After Automobiles Ltd. Besides, Tk.2.00 million has been invested in acquisition of two shares of Central Deponent/ Bangladesh Ltd. (CDBL). The Bank s major portion of investment in Govt. Treasury Bills and Bonds for the purpose of fulfilling Statutory Liquidity Requirement (SLR). ”

SWOT Analysis:

SWOT is for an organization’s strength, weakness, opportunities and threats. The underlying assumption of a SWOT analysis that managers can better formulate successful strategy after they have carefully reviewed the organization strengths and weakness in the light of threats and opportunities presented by the environments. A right strategy can turn fledging organization ink successful one, whereas a wrong strategy could lead to a disaster. SWOT analysis emphasizes that organizational strategies must result a good fit between the organization and external environments. Some significant factors of Jamuna Bank Limited presented below for SWOT Analysis:

Strengths

* As a third generation bank, Jamuna Bank Limited has a very rood credit comparison of other third generator, banks and also first and second Aeration banks.

* Robust Banking software that helps to cope with modem techniques and facilities the real-time online banking, sirs banking, debit card & credit t card booth facilities

* More efficient human resources competitive remuneration packages.

* All the branches of Jamuna Bank Limited situated in commercially through out Bangladesh.

* Jamuna Bank is the only bank in Bangladesh that has agreement with Bangladesh Services regards to inflow rerun trance quickly to all over Bangladesh.

* Jamuna Bank Limited is Authorized Primary Dealer of Government Treason Bonds & Bills, approved by Bangladesh Bank.

Weakness

- Weak marketing strategies.

- Jamuna Bank Limited has loan portfolio very few sectors.

- Traditional banking approach.

- Lack of managerial activities in branch level,

- Jamuna Bank Limited has not created market impression on customer service such as other third generation private banks.

Opportunities

Branches are opening in prime location different parts of Bangladesh each year. Jamuna Bank Limited has given emphasis on SME segment and going to own SME center all over the Bangladesh.

To expand business and capture the market share and lead the banking sector. Jamuna Bank Foundation can play a vital role in corporate social activities that increase the image of the bank.

Threats

* Jamuna Bank Limited looses Customer due to customer service.

* In a market oriented industry, it’s very to sustain without marketing.

* Job oriented training is less in Jamuna Bank Limited

* Global market recession Political instability.

Effects of Management of Credit Risks in Jamuna Bank Ltd.: Identifying and assessing credit risk essentially a first step in managing it effect -ivery. As per Financial performance JBL it is observed that the after Tax Earnings’ per Share (EPS), Net Assets per Shan (NAV) turned improved significantly over the last year in compare to last yea and also the Deposit and Credits Portfolio, Total Income, Operating Profit, ‘Number of Branched increased during the said period.

The reasons behind the fact were doing the period under reference a sizeable amount of Bank’s credits recovered the classified amount. Meanwhile recently the Bank has been able to improve the quality assets significantly through efficient Management of Credit Risks, which are mentioned below:

• The Bank has been about to recover around Tk.212.50 million in cash out of its adversely .classified loans and advances during 2008 to 31st instance of December. Consequent the percentage of Classified and Non performing loans and advances of Total Loans & Advances has gone down to 2.84% as on 31st December, 2008 from 5.06% as on 31st December, 2007, which can be termed as remarkable progress.

The Bank has successfully developed an integrated and well-coordinated system Analysis, Appraisal and Sanction of Credits through its Credit Operation Div followed be proper and strict Control and Disbursement process through its C Administration Division backed by fully automated structure.

Notable that almost entire classic loans and advances were extended at die ii stage of the Bank i.e. from 2001 to 2005, which became classified during the couple of years and Dan suffered adversely in 2006 and 2007. While, thee of edit tibiae last ilk of the recently sanctioned credit sound good. Consequently, the Bank has been able to mark an upward -rend lies operational and financial performance.

The bank is a way of establishing proper governance structure risk and returns are evaluated with a view o producing sustainable revenues, reducing volatility- in earnings and enhancing value to shareholders.

The Bank also pursues an effective internal control system by establishing systems and procedures for scrutinizing the transactions periodically encompassing key back-up supports and cornice regular contingency plan.

Conclusion

Jamuna Bank Limited celebrates its 9th anniversary on 3rd June2010 started its operation from in 2001. Within this tangible period, the Bank has been recognized by the Bangladesh Bank through improvement of overall asset quality and establishment of well-organized credit risk management. Credit Management System of JBL is successful (classified loan is only 2.84% whereas the market average is more that 20%). This success lies on its selection of good borrower and close credit monitoring system, which reflects on its profitability.

Credit is utmost important factor for a Bank and core income generating source as well as it is involved with risk. So, decision regarding credit is very important in all respect of the Bank. JBL has proper credit management policies that describes what type of loans piloted the Bank’s soundness and also help to meet the need of the communities the Bank serves.

JBL should capitalize its present successful credit management system and try to give better service to its stakeholders in days to come which can ensure its sustainable growth and development

Recommendations

A banker cannot sleep well with bad debts in his portfolio. The failure of commendable banks occurs mainly due to bad loans, which occurs due to inefficient management of the loans and advances portfolio. Therefore any banks must be extremely cautious about its lending portfolio and credit policy. So far Jamuna Bank Limited has been able to manage its credit portfolio skillfully and kept the classified loan at a very lower rate….. thanks goes to the standard and stringent credit appraisal policy and practices of the bank. Considering the findings and inlay is in the earlier chapters, JBL can do the following for further sustainable growth and development.

* The bank should emphasize reducing the classified and non-performing credits by concerted efforts.

* Central monitoring system should be more active to maintain classified loan to a minimum level.

* The Bank should develop the detail outlines and courses of actions to be taken for recovery of classified loans and advances so as to the classified barometer would not rise again.

* The bank should focus on procedural guidelines that have been devised for meticulous compliance by the branches for effective Management of Credit Risk

* Interest expenses on Deposits of the Rank may be tried to keep low with due regard to balances Deposit Mix for the cost and maximizing the profit.

* The research cell of this Bank should be strengthening with the efficient manpower by studying turn feasibility of introduction of new products, analysis of manpower productivity end similar other which works and eventually the efficient Management of Credit Risks.

* JBL has to arrange to train up its personnel through adequate training programs and workshops so as to they can carry out their jobs properly and up to the mark.

* The Bank should strengthen the promotional activities and marketing of different products for catering its services of the potential customers.

* The Bank should support its corporate culture in order to ensure proper Management of Credit Risk.

* JBL should establish more own ATM machine all over the country, to overcome dependency on other Bank.