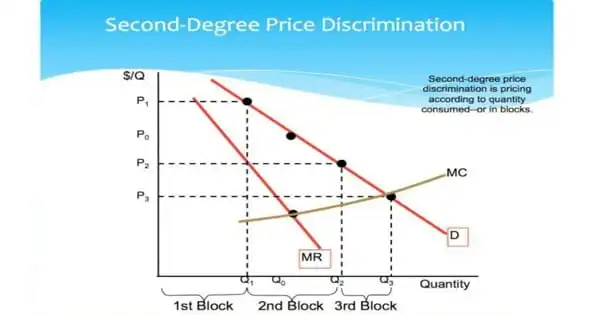

Second-degree price discrimination is the practice of charging different prices for different quantities, such as quantity discounts for bulk purchases. When a corporation charges a variable price for different quantities consumed, such as quantity discounts on bulk purchases, this occurs. It does not eradicate all consumer surplus, but it does allow a corporation to boost its profit margin on a subset of its customer base.

The opportunity to acquire information on every potential buyer is not present in second-degree pricing discrimination. It entails charging customers a varied fee depending on the amount or quantity consumed. Instead, corporations charge varied prices for their products or services according on the interests of diverse consumer groups. Examples include:

- A phone plan that charges a higher rate after a certain number of minutes have been utilized.

- Reward cards that give repeat buyers a discount on future purchases

- Quantity discounts for customers who buy a certain quantity of more of a particular item.

Second-degree price discrimination occurs when a company sells at varying rates depending on quantity. Second-degree pricing discrimination is most commonly used by businesses through quantity discounts; clients who buy in bulk receive unique offers not available to those who buy a single product. This might include deals like buy two, get one free or 20% discount when you buy six. It is a frequent pricing technique employed by warehouse sellers who can take advantage of economies of scale to make large purchases and then pass the savings on to the customer.

Costco and Sam’s Club are two examples of companies that charge a minor membership fee of $50 to $60 each year. This gives members an incentive to buy in bulk in order to justify their membership cost. However, because such businesses already buy in bulk, they profit from lower prices, which are then passed on to the consumer.

Warehouse stores, such as Costco or Sam’s Club, employ this price strategy. Due to economies of scale, firms can engage in this sort of price discrimination. Profit margins for a single unit sold are typically relatively substantial, which means they can cut these margins for future units in order to stimulate more use. It can also be found in businesses that provide loyalty or rewards cards to frequent customers, as well as in phone plans that charge more for additional minutes above a certain limit. So, while the profit margin for the second unit may not be as great as the first, the overall profit is higher than if only one unit was sold.