Executive summary

The report has been prepared on the basis of the four annual report of a reputed company, “Techno Drugs Pharmaceutical” in respect to my partial BBA program. I have chosen four consecutive years 2005, 2006, 2007 and 2008 to analyze the ratios, and conduct a DuPont analysis to find the competitive position and the level of performance of both the organizations in respect to the calculated ratios. In addition I have done index analysis of both balance sheet and income statement to find the position of the organizations in respect of profitability.

The organizations are pharmaceutical companies. The reason behind calculating the ratios of different years of a company gives us a complete view about company’s gradual improvement or decline. The chosen company has gained significant popularity in the market of Bangladesh and has been running the business for a considerable period.

The report consists of five types of ratio analysis which are as follows:

1. Liquidity Ratio

2. Financial Leverage Ratios

3. Interest Coverage Ratio

4. Activity ratios

5. Profitability Ratios

Under these primary categories there are several other sub categories. I calculated those ratios and provided interpretation of the results and also evaluated the company’s position in terms of their results.

Last but not the least we did the index analysis of the balance sheet and income statement. We found some problems in the financial activities of the company and provided recommendations based on that.

2. Introduction

Ratio analysis is a numerical attempt to analyze the performance and financial position of a business. By converting absolute numbers into ratios, we can compare between one firm and another, or between several periods of one company. Indeed, ratio analysis, which is the interpretation of ratios, cannot be meaningfully achieved without some form of comparison. Ratio analysis expresses the relationship among selected items of financial statement of data. A ratio expresses the mathematical relationship between one quantity and another. The relationship is expressed in terms of a percentage, a rate or a simple proportion. For analysis of the primary financial statements, ratio can be used to evaluate liquidity, profitability and solvency.

Ratio Analysis enables the business owner/manager to spot trends in a business and to compare its performance and condition with the average performance of similar businesses in the same industry. In order to do this, a firm can compare its ratios with those of businesses similar to the company as well as compare its own ratios for several successive years, watching especially for any unfavorable trends that may be alarming. Ratio analysis may provide the all-important early warning indications that allow the firm to solve its business problems before there is any sort of destruction. Ratio can provide clues to underlying conditions that may not be apparent from individual financial statement component.

2.1 Origin of the Report

Reporting means the written presentation of the evidence and findings of a research. After completion of the internship program report submission is essential. This report is prepared for satisfying both the organization and my academic institution. And it is based on the annual reports of the Techno Drugs Pharmaceuticals Ltd.

2.2 Purpose of the Report

The main purposes of the report are as follows:

To apply theoretical knowledge with practical situation.

To understand the real management and to gather practical knowledge.

To familiar with the pharmaceutical industry.

To gain some clear ideas about the ratio analysis

To know about the financial condition of selected company

To know the day to day activities of Techno Drugs pharmaceutical company.

To examine the balance sheet of the company.

To understand the different operation of techno drugs pharmaceutical company.

2.3 Scope of the Report

Techno Drugs Pharmaceuticals Limited is one of leading pharmaceuticals companies in Bangladesh. They export their products in different countries of the world. The report covers the ratio analysis as well as index analysis of income statement and balance sheet of these companies. After calculation, interpretation and evaluation have also been provided based on their financial condition.

2.4 Limitations of the Report

The limitations of the report are as follows:

Sometimes it is difficult to understand a few accounting and financial terms which could otherwise be incorporated sufficiently in preparing the report.

I have to be aware that ratio analysis is widely used as a performance indicator, but it does have its limitations too. For instance, accounts show only the monetary aspects of the business. They do not show management or staff strengths or weaknesses. So ratio analysis ignores this aspect of the performance as well.

The Techno Drugs pharmaceutical company allowed me to their head office situated in Shegun bagicha. So, I did not study their factory activities.

Frequent failure of electricity creates a great disturbance in making this report.

Disturbance of computer creates lots of problem and even for this computer problem some important data of my collection for this report is lost.

.

2.5 Methodology of data Collection

For making any report or statistical survey most of the data should be taken in such a way that reflect actual situation. For my report I have collected various types of primary and secondary data while I was performing my job. I have collected various data from various sources, by interviewing the respected officers’ and from the journal published by the authority i.e. annual reports, prospectus, Brochures and different policies and so on. After that I made some calculations to get necessary data to make comparison.

In a disciplined way I can say that the study input are collected from two sources-

Primary Sources:

(1) Practical desk work

(2) Face to face conversation with officers.

(3) Face to face conversation with other employees.

Secondary Sources:

(1) Annual report of techno drugs Pharmaceutical Company

(2) Prospectus of Techno Drugs Company

(3) Policies of Techno Drugs

(4) Published or unpublished or personally collected data from officers and employees.

3. Company Profile

Techno Drugs Pharmaceuticals

Corporate Office : 31, SHEGUN BAGICHA,

DHAKA-1000,

Operational Office : 31, SHEGUN BAGICHA,

DHAKA-1000,

Factory : Narshingdi

Year of Establishment : 1996

Status : Privately Owner Company.

Business Lines : Manufacturing and Marketing of Pharmaceutical finished Products, Basic chemicals, and Pesticide Products.

Export Market : Srilanka, Kingdom of Saudi Arab.

Authorized Capital (taka) : 5 million.

Paid – up Capital (taka) : 3 corers

Net Turnover 2005 (taka) : 4million.

Number of Employee : 1100

Number of workers : 300

At A glance: Techno Drugs pharmaceutical company

* Techno Drugs Pharmaceutical Company is a well known and reputed company working in Bangladesh. They are serving for the well being of human for several years. They mainly prepare two types of medicine:

(1) Health care division

(2) Animal health division

• They have 10 DEPOT ‘S throughout the country. They operated their activities through this DEPO’S.

• There are seven departments active in the corporate office of Techno Drugs pharmaceutical. These are-

(1) Finance department

(2) Accounts department

(3) Human Resource development department & Admin (HRD).

(4) Commercial and procurement department.

(5) Product management department (PMD).

(6) Market Survey department (MSD)

(7) Training Department.

(8) Sales and marketing department.

Organ gram of Techno Drugs Pharmaceutical co:

The Organ gram is enclosed with this report.

4. Ratio Analysis

Ratio analysis was developed to determine the stability of various financial aspects of a business. It shows the relationship between two figure and two aspects of the business. It helps us work out our business’ financial weaknesses and strengths, so that we can take appropriate action.

Ratio analysis also offers a view of business’ competitive performance in relation to similar businesses in the industry. We will only discuss a few ratios here, as some can become very complicated. Essentially, we will group the ratios into the following types and discuss them in depth:

1. Liquidity ratio

2. Asset Management ratio

3. Debt ratio

4. Profitability ratio

5. Market ratio.

4.1 Liquidity Ratio

These ratios indicate the ease of firm’s ability to meet short term debts. They include the Current Ratio and Quick Ratio. These ratios analyze the available liquid assets the business has at any given time to meet current liabilities. In other words, it tells us how much cash-on-hand we have, as well as assets that can readily be turned into cash. This lets us know how much money is accessible if needed to pay for the liabilities and debts. The higher the liquidity ratio, the greater the proportion of resources tied up in relatively non-productive assets.

4.1.1 Current Ratios:

The Current Ratio is one of the best-known measures of financial strength. It is a measure of firm’s short-term solvency and indicates how much money a firm has for every one Tk. of current liability. However, this ratio is a crude measure because it does not take into account the liquidity of the individual components of current assets. It is figured as shown below:

Note: We have taken the values of current assets and current liabilities of 2005 and 2006 from the annual report of 2006. To calculate the ratios of 2007 and 2008 we have used the report of the year 2008 and 2006 accordingly.

Interpretation: From the above ratio we can say that the current ratio of techno drugs pharmaceuticals is increasing year by year. In the year 2005 the current ratio was 1.155 which increased to 1.61 in 2006. In 2007 the ratio increased to 1.66 and in the latest year 2006 the ratio finally increased to 1.78 times. This means that in the last four years techno drugs had sufficient current asset to cover short term obligations. For 1 TK of debt, Techno drugs had 1.155, 1.61, 1.66 and 1.78 TK increasing from the year 2005 to 2008 accordingly.

Evaluation: Thus the statistics indicates a good liquidity position of the company. They have enough cash in hand to meet the short term liabilities. The main cause behind it is that the current asset has increased to a greater extent up to 2007 compared to the increase in the current liabilities of that year. But in the year 2008 both the amount of current assets and liabilities has increased a great extent.

4.1.2. Acid test (Quick) Ratio

Liquid assets are those which are in the form of cash and those which can readily be converted into cash. The least form of current asset is inventory whether of materials, work in progress or finished goods. The quick ratio tests the ability of the current assets other than stock to meet the current liabilities.

We calculate Acid test ratio with the following formula:

For techno Drugs pharmaceuticals the Acid test ratios of four consecutive years 2005 to 2008 are given below:

1,441,552,30- 739,835,42

Acid Test ratio (2005) =

1,247,966,32

= 0.5662 Times

2,016,06,187- 75,856,209

Acid Test ratio (2006) =

1,250,75,506

= 0.98 Times

3, 242, 52,312- 1,144,912,356

Acid Test ratio (2007) =

1,94, 949, 426

= 1.08 Times

4,031,64,955- 1,342,364,478

Acid Test ratio (2008) =

2, 260, 75, 481

= 1.189 Times

Note: For 2005 we have taken stocks as inventories to calculate the ratio.

Interpretation: We know this ratio show’s a firm’s ability to cover its current liabilities with its most liquid asset. This ratio concentrates on more liquid assets like cash and marketable securities. After the calculation of Acid test ratio, we see that for the year of 2005 and 2006 Techno Drugs Pharmaceuticals did not have sufficient cash and other liquid assets to meet the short term obligations, but it had managed to overcome that by the year 2007 when it had tk 1.08 worth of liquid assets to meet every tk. 1 worth of the short-Term obligation. Later on in 2008 they managed to increase this ratio to 1.189 times which ensured more liquidity of assets to cover current liabilities.

Evaluation: Therefore, we can say that although Techno Drug’s ability to meet the current liabilities was below the standard level, they successfully managed to overcome their shortcoming and the statistics suggest that they are now in a good position to cover current liabilities with their current assets.

4.2 Financial leverage (Debt) Ratio:

Financial Leverage Ratio indicates the extent to which firm has financed its investments by borrowing. These ratios focus on the firm’s financial structure. The issue here is to calculate the amount of the debt the firm is using and the firm’s ability to serve the debt. Debt financing increases the risk of liquidation, so the more extensive the use of debt, the larger the firm’s debt management ratios the more risk present in the firm.

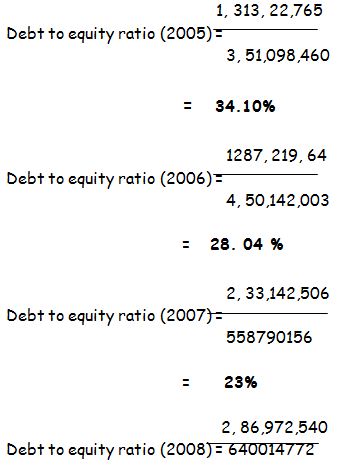

4.2.1. Debt to Equity Ratio:

This ratio is the indicator of the extent to which the company is using borrowed money. Creditors would prefer a low percentage of this ratio. The lower the ratio the higher the level of the firm’s financing that is being provided by shareholders and the larger the credit cushion. The ratio of debt to equity will vary according to the nature of the business and variability of cash flow. This ratio gives a general indication of the credit worthiness.

We know Total debt

Debt to equity ratio =

Shareholders’ Equity

Where, Total Debt = Current liabilities + Long term liabilities

For Square pharmaceuticals the debt to equity ratios of the last four years are as follows:

Interpretation: In 2007 their ratio was 34.10% and decreased to 27.17% in the next year. Again in 2007 and 2008 it increased to 23% and 45.3% correspondingly. This indicates that in the year of 2005, 2006, 2007 and 2008 out of 100 taka equity they took 34.10, 27.17, 36.53 and 45.30 taka debt.

Evaluation: This increasing trend indicates that Techno drugs are taking more loan from year to year so debt financing is increasing. This allows credit cushion to be low for the company. Moreover it can be said that credit worthiness is decreasing and the financial risk of the company is increasing. So this increasing trend of debt to equity ratio is not good for the company.

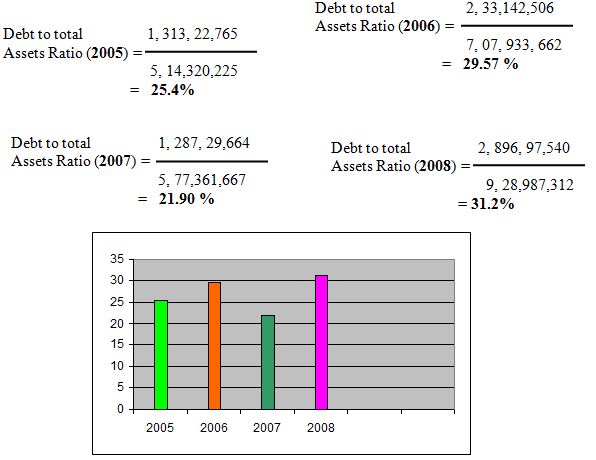

4.2.2 Debt to Assets Ratio:

Debt ratio measures the percentage of assets provided by creditors, regardless of whether short term or long term. The debt to asset ratio reflects the financial structure of the firm by showing the firm’s financial risk posture, which is of primary interest to investors. Creditors prefer low debt to assets ratios because the lower the ratio, the greater the cushion against creditors’ losses in the event of liquidation. Stockholders, on the other hand, may want more leverage (use of debt financing) because it magnifies expected earnings.

We know,

For our selected company techno drugs Pharmaceuticals we see the following scenario:

Interpretation: From the above ratio, we see that the debt to total asset ratio of Techno Drugs Pharmaceuticals decreased from 25.4% in 2005 to 21.90% in 2006. However, in the year 2007 it increased to 29.57% and continued to increase up to 31.20% in the year 2008. These figures suggest that, of the total asset of 100 Tk of the company Tk 25.4, 29.57, 21.90 and 31.2 was supported by the debt financing in the year of 2005, 2006, 2007 and 2008 accordingly.

Evaluation: We can see that the debt to total asset ratio is increasing year to year. It seems they are expanding their asset and these asset expansions are supported by the debt financing. So this increasing trend is not good for the company.

4.3. Interest Coverage Ratio:

Interest Coverage ratio or times interest earned serves as a measure of the firm’s ability to meet its interest payments and thus avoid bankruptcy. The higher the ratio, the greater the likelihood that the company can cover its interest payments without difficulty. It also helps to understand the firm’s capacity to take on new debt.

The ratio of Earnings before interest & taxes (EBIT) divided by Interest Expense is called the interest coverage ratio.

Earnings before interest & taxes (EBIT)

Interest Coverage Ratio

Interest Expense

Now the interest coverage ratio of Techno Drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

Interpretation: From the above ratio, we see that the interest coverage ratio of Techno Drugs Pharmaceuticals has an increasing trend. It increased gradually from 8.47 times in 2005 to 11.60 times in 2006 and to 15.21 times in the year 2007. In the year 2008 it decreased to 11.96 times. However, the ratio is still above 1 and that suggests that the company is well equipped to pay their interests.

Evaluation: we know that the higher the ratio, the greater the likelihood that the company can cover its interest payments without difficulty. The increasing trend of this ratio shows good indication for the company. The increasing trend also serves as a measure of the firm’s ability to meet its interest payments more efficiently year from year. Though it has reduced in the year 2008, it is higher than that of 2005 and 2006. So the company’s position is satisfactory in terms of covering the interest expenses.

4.4. Activity Ratios:

Activity ratios also known as efficiency or turnover ratios measures how effectively the firm is using its assets. It measures the speed at which the firm is turning over accounts receivable, inventory, and long term assets. In other words, activity ratios measure how many times per year a company sells its inventory or collects its accounts receivable. For long term assets, the ratio tells us how productive the fixed assets are in terms of generating sales.

4.4.1. Receivables turnover ratio:

Receivable turnover ratio provides insight into the quality of the firm’s receivables and how successful the firm is in its collection. This ratio shows the number of times accounts receivables have been turned into cash during the year. The higher the turnover, the shorter the time between the typical sale and cash collection. If receivables are far from being current the firm’s liquidity should be reassessed. Receivables are liquid as long as they are collected within a reasonable time. The ratio that we get by dividing Net Credit sales by receivables is known as Receivable turnover Ratio.

Now the receivable turnover ratios of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

4,05,850,882

Receivables Turnover Ratio (2005) =

10, 536, 470

= 28.93 times

4,21,551,742

Receivables Turnover Ratio (2006) =

22,115,010

= 20.97 times

5,32,046,635

Receivables Turnover Ratio(2007) =

26,527,741

= 19.93 times

6,08,905,396

Receivables Turnover Ratio (2008) =

28,732,137

= 21.09 times

Interpretation: In 2005, 2006, 2007 and 2008 the ratio was 28.93 times, 20.97 times, 19.93 times, and 21.09 times. This means for example in the year of 2008 their receivables are turning into cash by 21.09 times. For the other years these turning numbers are the specified amount of times in the respective years.

Evaluation: This ratio shows the number of times accounts receivables have been turned into cash during the year. In 2005 the ratio was good. But in the next year it decreased and for the last three years it fluctuated around the number 20. We think the range is satisfactory for the company. However, the calculation shows that along with the increase of sales the amount of receivables has also increased and a bigger amount is pending by the end of each year and that is why the company can not return to its previous position of the year 2005. So the company should give effort to hold the last amount of ratio as a standard and strive to return to its previous outstanding position.

4.4.2. Receivables Turnover in Days:

This ratio shows the average number of days that receivables are outstanding before being collected. Interpretation of the ratio depends on the credit terms offered by the firm to its customers. Although too high an average collection period is usually bad, a very low average collection period may not necessarily be good. Collection period should be an ideal one. The ratio that we get by dividing the days in the year by the receivable turnover is called the receivable turnover in days.

Days in the year

Receivables Turnover in Days =

Receivable turnover

Now the receivable turnover in days of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

365

Receivables Turnover in Days (2005) =

28.93

= 12.62 days

365

Receivables Turnover in Days (2006) =

20.97

= 17.41 days

365

Receivables Turnover in Days (2007) =

19.93

= 18.31 days

365

Receivables Turnover in Days (2008) =

21.09

= 17.31 days

Interpretation: From the above ratio, we see that the receivable turnover in days of Techno drugs Pharmaceuticals increased from 10.73 days in 2005 to 17.41 days in 2006 and to 18.31 days in the year 2007. But it decreased to 17.31 days in the year 2008. In 2005 the receivable turned within 1 month which is to be specified by .95 month. For the second year the term was even better than that as the receivable turned in each .68 month. For 2007 and 2008 the terms are .65 and .69 accordingly.

Evaluation: This ratio suggests that the receivable turnover in days has increased from 2005 to 2007, but the ratio in the year 2008 it is quite similar to that of 2006. This ratio also suggests that the average cash collection period is changing within a range. The Company’s credit term is three months that is 90 days and the receivables are turning in before that. So this ratio is good for the company.

4.4.3. Payable turnover Ratio:

This ratio shows the promptness of a firm’s own payment to its suppliers. This ratio is also useful for analyzing the promptness of payments of a potential credit customer. This ratio shows the number of times accounts payables have been turned into cash during the year. When information on purchases is not available, one can use cost of goods sold plus change in inventory.

The ratio of Annual credit purchases divided by accounts payable is called payable turnover ratio.

Annual Credit Purchases

Payables Turnover Ratio=

Accounts Payable

Now the payable turnover ratios of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

2,59,568,438

Payable Turnover ratio (2005) =

3445046

= 75.03 times

2,14,959,729

Payable Turnover ratio (2006) =

5264198

= 53.47 times

3,59,453,706

Payable Turnover ratio (2007) =

83,84,465

= 37.68 times

3,52,402,669

Payable Turnover ratio (2008) =

79,390166

= 44.41 times

Interpretation: From the above ratio, we see that the payable turnover ratio of Techno drugs Pharmaceuticals decreased from 75.03 times in 2005 to 53.47 times in 2006 and to 37.68 times in the year 2007. But it increased to 44.41 times in the year 2008.

Evaluation: we know that this ratio shows the number of times accounts payables have been turned into cash during the year. The ratios show that the company is having a trend of getting low payable ratio from 2003 to 2005. But in the year 2006 it increased. From the company’s perspective it can be said that as the ratio is decreasing which is good for the company. More over the notes of the company suggest that the dues of the company were paid in regular basis. So it can be said that paying the credits with in the credit term and in regular basis is both good for the operation and image of the company.

4.4.4. Payable Turnover in Days:

This ratio shows the average number of days that payables are outstanding before payment is made to suppliers. It also helps in evaluating the probability that a credit applicant will pay on time.

The ratio of days in the year divided by payable turnover is called the payable turnover in days.

Days in the year

Payable Turnover in Days =

Payable Turnover

Now the payable turnover in days of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

365

Payable Turnover in Days (2005) =

75.03

= 4.86 days

365

Payable Turnover in Days (2006) =

53.47

= 6.82 days

365

Payable Turnover in Days (2007) =

37.68

= 9.68 days

365

Payable Turnover in Days (2008) =

44.41

= 8.22 days

Interpretation: Interpretation: From the above ratio, we see that the payable turnover ratio of Techno drugs Pharmaceuticals increased from 4.86 days in 2005 to 6.82 days in 2006 and to 9.68 days in the year 2007. But it decreased to 8.22 days in the year 2008.

Evaluation: we know that his ratio shows the average number of days that payables are outstanding before payment is made to suppliers. From the ratios it is clear that the average number of payment is increasing year to year. As a matter of fact it can be said that to the supplier the image of the company would get worse. But as the ratio has been decreased in the year 2008 we hope that the company will make the ratio better in the upcoming years.

4.4.5. Inventory Turnover Ratio:

It shows how effectively the firm’s inventory is being managed. Generally, higher average inventory turnovers are suggestive of good inventory management. As a result, the profits are earned sooner on it and the more the times the profit can be earned. Lower turnover may result from excessive inventory levels, the present of expired inventory or unexpectedly low sales levels. On the other hand, abnormally high inventory turnover may indicate inventory levels so low that stock outs will occur and future sales will be impaired.

Cost of goods sold

Inventory Turnover Ratio =

Inventory

2,599,568,438

Inventory Turnover Ratio (2005) =

739,835,432

= 3.51 times

2,814,959,729

Inventory Turnover Ratio (2006) =

795,856,209

= 3.54 times

3,159,453,706

Inventory Turnover Ratio (2007) =

1,144,912,356

= 2.76 times

3,525,402,669

Inventory Turnover Ratio (2008) =

1,342,364,478

= 2.63 times

Interpretation: As this ratio indicates the effectiveness of the inventory so in 2005, 2006, 2007 and 2008 their inventory was turned into receivable by 3.51, 3.54, 2.76 and 2.63 times. This means in 2005 and 2006 only three times the inventory turned into sales and for 2007 and 2008 this was only for two times.

Evaluation: From the above ratio we can state that the Inventory Turnover Ratio of Techno drugs Pharmaceuticals has decreased in 2007 and 2008 in comparison to 2006. In 2007 and 2008 it has become 2.76 and 2.63 times, which is not a good sign and it indicates that the company is holding larger inventory in these years. Such piling up of inventory has resulted due to a decline in the sales figure of the company too. Excess inventory is, of course, unproductive, and it represents an investment with a low or zero rate of return.

4.4.6. Inventory Turnover in Days:

Inventory turnover in days indicates how many days in average it takes before inventory is turned into accounts receivable through sales.

Days in year

Inventory turnover in day =

Inventory turnover

We will now look into the inventory accounts of Techno drugs pharmaceuticals and find out about the days within which the inventories are turned in to cash in the year of 2005, 2006, 2007, and 2008.

365

Inventory Turnover in Days (2005) =

3.51

= 103.99 days

365

Inventory Turnover in Days (2006) =

3.54

= 103.11 days

365

Inventory Turnover in Days (2007) =

2.76

= 132.25 days

365

Inventory Turnover in Days (2008) =

2.63

= 138.78 days

Interpretation: From the above ratio, we see that the inventory turnover in days of techno drugs Pharmaceuticals decreased from 103.98 days in 2005 to 103.11 days in 2006 and then increased to 132.25 days in the year 2007and also increased to 138.78 days in the year 2008. This indicates during the year of 2005 and 2006 they had sale after each 3.4 months and in the year 2007 and 2008 this duration was 4 months.

Evaluation: We know that the ratio tells how many days, on average, before inventory is turned into accounts receivables through sales. We know that the lower this ratio the better for the company. The ratio is quite similar in the year 2005 and 2006 but in the year 2007 and 2008 it is increasing in large scale. As a matter of fact it is a threat to the company because the large the ratio is there is chance of pilling up of inventories.

4.4.7. Total Assets Turnover Ratio:

The total asset turnover ratio measures the turnover of all the firm’s assets. We know,

Net sales

Total Assets Turnover Ratio =

Total assets

4,065,80,882

Total Assets Turnover Ratio (2005) =

514320225

= 0.787296431 Times

4,71,551,742

Total Assets Turnover Ratio (2006)=

577361667

= 0.803345448 Times

5,33,046,635

Total Assets Turnover Ratio (2007) =

7,90,932,662

= 0.674265559 times

6,08,905,396

Total Assets Turnover Ratio (2008) =

9,28,987,312

= 0.65489985 times

Interpretation: From the above calculations, we see that the total Assets turnover ratio of Techno drugs Pharmaceuticals increased from 0.79 Times in 2005 to 0.80 times in 2006 and then decreased to 0.57 times in the year 2007and then increased to 0.65 times in the year 2008. So in every year for 1 Tk of Asset the company had .79, .80, .57 and .65 Tk of sales in those four years.

Evaluation: We know that the ratio shows the relative efficiency with which a firm utilizes its total assets to generate sales. It tells us how much revenue is generated per dollar of assets. Higher the ratio, better for the company. We can see that the ratio increased in 2006. But it decreased in the year 2007 and again increased in 2008. So the relative efficiency of the asset utilization is decreasing. It also indicates that the revenue per dollar of assets is decreasing. So this is not a good situation for the company.

4.5. Profitability Ratios:

It measures the ability of the firm to earn an adequate return on sales, total assets, and invested capital. The profitability ratios show the combined effects of liquidity, asset management, and debt on operating results.

4.5.1. Gross Profit Margin:

The ratio of the profit of the firm relative to sales, after the cost of producing the goods is deducted is called the gross profit margin.

Gross Profit (Net Sales – Cost of Goods Sold)

Gross Profit Margin =

Net Sales

This ratio is a measure of the efficiency of the firm’s operations, as well as an indication of how products are priced.

Now the Gross profit margin of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

163780346

Gross Profit Margin (2005) =

405850882

= 40.33%

190659013

Gross Profit Margin (2006) =

421551742

= 40.38%

2,17,592,929

Gross Profit Margin (2007)

5,32,046,635

= 40.74%

254502727

Gross Profit Margin (2008) =

609905396

= 42.11%

Interpretation: From the above ratio, we see that the gross profit margin of Techno drugs Pharmaceuticals fluctuated around 40% in 2005, 2006, and 2007. It increased to 42.11% in the year 2008. This ratio tales in each year about 40 to 42% of the sales return as gross profit. So the remaining 60% is my cost of goods sold.

Evaluation: the higher the ratio of gross profit margin the better for the company. As the ratios are increasing year to year, it indicates that the profit for the company is increasing yet at a slower pace. It also means that the efficiency is increasing year to year. The products are priced properly for the company. So according to this ratio the company is in a pretty good position.

4.5.2. Net Profit Margin:

The ratio of net profit after tax divided by net sales is called the net profit margin.

Net Profit after Taxes

Net Profit Margin =

Net Sales

This ratio is a measure of a firm’s profitability of sales after taking account of all expenses and income taxes. It shows a firm’s net income per dollar of sales.

Now the Gross profit margin of Techno drugs pharmaceuticals in the year 2005, 2006, 2007, and 2008 are given below:

764884,789

Net Profit Margin (2005) =

406550882

= = 0.188124162

18.81%

970,03,543

Net Profit Margin (2006) =

472151742

= = 0.205450156

20.54%

1,25,848,153

Net Profit Margin (2007) =

5,32,046,635

= = 0.235528351

23.55%

1,16864,616

Net Profit Margin (2008) =

608905396

= = 0.191442156

19.14%

Interpretation: From the above ratio, we see that the net profit margin of Techno drugs Pharmaceuticals increased from 18.81% in 2005 to 20.54% in 2006 and then increased to 23.55% in the year 2007and decreased to 19.14% in the year 2008. These ratios show that the income per taka of sales is first increasing then it is decreasing.

Evaluation: From the ratios we can see that there is an increasing trend from year to year. It indicates that company’s net income per dollar is increasing year to year, which is fine for the company. Though in the year 2008 the ratio is slightly low but we hope that the company will look into it and take appropriate measures.

4.5.3. Return on Investment:

This ratio shows how efficiently the assets are managed and how much profit is generated per taka of investment. Shows how efficiently the assets are managed and how much profit is being generated by per dollar of asset.

Net profit after tax

Return on investment (ROI =

Total Assets

We will see the return on investment ratio of our selected company in the last four years.

764,84,789

Return on investment (2005) =

516320225

= 0.148109481

= 14.81%

970,03,543

Return on investment (2007) =

587361667

= 0.165047448

= 16.50%

1,255,48,153

Return on investment (2007) =

7,907,32,662

= 0.158808655

= 15.88%

Return on investment (2008) = 1,165,864,616

9,298,987,312

= 0.125375439

= 12.54%

Interpretation: From the above ratio, we see that return on investment of techno drugs Pharmaceuticals increased from 14.81% in 2005 to 16.50%in 2006 and then decreased to 15.88% in the year 2007 and to 12.54% in the year 2008. There is a clear indication that the profit generated per taka of asset is decreasing.

Evaluation: We know that the higher the ratio the better for the company. So, here we can see from the ratio that it is increasing in the year 2005 to 2006. But in 2007 it decreased and in 2008 it also decreased. As a matter of fact it is bad for the company to have a lower return on investment which will affect the investment in the company.

4.5.4. Return on Equity:

Return on equity shows the earning power of the shareholder’s investments. A high return on equity reflects the firm’s acceptance of strong investment opportunities and effective expense management. We can find return on equity by the following formula:

Net profit After Tax

Return on Equity =

Shareholder’s Equity

Let us look into the return on equity ratios of Techno drugs pharmaceuticals for the year of 2005, 2006, 2007, and 2008.

764,84,789

Return on Equity (2005) =

3,851,08,460

= 0.198614706

= 19.86%

970,03,543

Return on Equity (2006) =

4,590,12,003

= 0.211331924

= 21.13%

1,255,48,153

Return on Equity (2007) =

5,58,790,156

= 0.225515438

= 22.55%

1,165,64,616

Return on Equity (2008) =

6,402,04,772

0.182109017

18.21%

Interpretation: From the above ratio, we see that return on equity of Techno drugs Pharmaceuticals increased from 18.21% in 2005 to 22.55% in 2006 and then decreased to 21.13% in the year 2007 and decreased to 19.86% in the year 2008. From the ratios above we can see the earning power of the stockholders investment of per 100 taka in the respective year.

Evaluation: We know that the higher the ratio the better for the company. So, here we can see from the ratio that it is increasing in the year 2005 to 2006. But in 2007 and it decreased. As a matter of fact, it is bad for the company to have a lower return on equity. This indicates that the earning power of the shareholders equity is decreasing. Moreover, may be they are not have been able to hold on strong investment projects.

5. “DU PONT” Analysis with Calculation and Evolution

A formula which shows that the rate of return on assets can be found as the Product of the profit margin times the total assets turnover. DU Pont Equation has two parts:-

1. Return on total assets (ROI)

2. Return on equity (ROE)

1. Return on Investment (ROI)

ROI = Net Profit Margin × Total Assets Turnover

Net Profit after Tax Net Sales

= X

Net Sales Total Assets

For Techno drugs Pharmaceuticals the Return on total Assets for the four years are as follows:

ROI (2005) =0.188124162 X 0.787296431

= 0.1481094

=14.81%

ROI (2006) = 0.205450156 X 0.803345448

= 0.165047448

= 16.50%

ROI(2007) = 0.235528351 X 0.674265559

= 0.158808655

= 15.88%

ROI(2008) = 0.191442156 X 0.65489985

= 0.125375439

= 12.54%

After doing the Du Pont approach for return on investment we see total asset turnover contributed more to the return in all the four years. Although in 2008 the return was not satisfactory compared to other years, asset turnover played its role there too. In all the four years net profit margin is responsible for the low return to investment.

2. Return on Equity:

ROE = Total Asset Turnover X Net Profit Margin X Equity Multiplier

5164320225

ROE (2005) = 0.787296431 X 0.188124162 X

3,851,098,460

= 0.148109481 X 1.34099927

= 0.198614706

= 19.86%

5877361667

ROE (2006)= 0.803345448 X 0.205450156 X

4,590,142,003

= 0.165047448 X 1.280431338

= 0.211331924

= 21.13%

7,907,932,662

ROE (2007)= 0.674265559 X 0.235528351 X

5,568,790,156

= 0.158808655 X 1.420045008

= 0.225515438

= 22.55%

9,298,987,312

ROE (2008)= 0.65489985 X 0.191442156 X

6,402,014,772

= 0.125375439 X 1.452509506

= 0.182109017

= 18.21%

In 2005 we see the equity multiplier is the component resulting in a high ROE but here the net profit margin is the lowest. In all the other years same picture is visible. Here we see the equity multiplier has been consistently increasing up to 4.5 in 2008 but the other ratios like asset turnover and net profit margin has not increased that much. So here it can be said that behind this moderate performance of the company equity multiplier has played the major role and the company could not efficiently manage its assets to generate sales which ultimately failed to generate much profit.

6. Index Analysis

6.1. Income Statement

As we know income statement shows the income after tax of the company. Here we include all the sales revenues and then deduct the cost of goods sold which is the gross profit for the company. From the gross profit we deduct operating expenses to get the net income.

So income statement is a statement where we include all the revenues and expenses. To do the index analysis of the income statement we assume 2005 as the base year. The comparison is shown in the next page:

From the index analysis of the income statement of Techno drugs pharmaceuticals of the last four years 2005, 2006, 2007and 2008 we see that the net turnover consistently increased from 2005 to 2008 and after deducting the cost of goods sold it resulted in increasing gross profit in the last four years. However, operating and financial expenses also increased a great deal which resulted in small increase in the net profit before tax. After paying the tax the ultimate profit remained for the company. But it is clearly visible that although sales has increased a lot net profit did not increase that much, even in 2008 the profit was lower than that of 2007. May be it was like it because they introduced a new account of provision for deferred income tax in 2008.

6.2. Balance Sheet

In the Balance Sheet we include all assets account and liabilities accounts. Balance Sheet indicates the total picture of the company. To analyze the balance sheet we also assume 2003 as abase year. On the basis of that we compare all the components of assets and liabilities of the company. The index analysis of the four years balance sheets are shown below:

From the analysis we can see that fixed asset of the company does not increase that much. But their capital work in progress is increasing significantly. They also reduced the long term investment year to year. They are actually investing more for production of the product.

As business is expanding so the stocks and trade debtors are also increasing. We think this is very common phenomenon for the business. Under the current asset they emphasize on short term loan and cash and bank balances. From 2003 to 2006 these two components increased significantly.

On the liabilities section short and long term loan are in a reasonable range. But the trade creditors and expense liabilities are increased. As they are operating huge production, so the long term secured loan is also increased considerably.