Return on total assets (ROTA) is a profitability ratio, also known as the return on assets ratio, which calculates the net income created by total assets over the period by comparing the net income to the average total assets. In using company assets to produce revenues, ROTA provides analysts with an example of management effectiveness. It is a profitability ratio that interests both creditors and equity owners since it encompasses total assets (assets financed by debt and equity). The ratio is viewed as a pointer of how viably an organization is utilizing its resources for produce income. EBIT is utilized rather than a net benefit to keep the measurement zeroed in on working income without the impact of duty or financing contrasts when contrasted with comparable organizations.

In other words, the ratio of return on assets or ROA calculates how effectively a business can leverage its assets over a period to generate income. When investors don’t buy quality, when their price gets close to its real value, they need to sell their investment. This technique does not have anything wrong with it. Some concern exists about ROTA depending on the book estimation of complete resources instead of their reasonable worth, giving a return that looks higher than it should be in actuality. Once in a while, the cost of a stock is low to such an extent that, despite the fact that it might come up short on the attributes of a quality venture, it is as yet a deal worth purchasing.

The higher the profits of a company in proportion to its assets (and the higher the coefficient of this calculation), the more efficiently the assets are said to be used by that company. The ROTA expressed as a percentage or decimal, gives insight into how much money is generated in the company from each dollar invested. Since organization resources’ sole reason for existing is to create incomes and produce benefits, this proportion helps both administration and speculators perceive how well the organization can change over its interests in resources into benefits. To put it plainly, this proportion quantifies how beneficial an organization’s resources are.

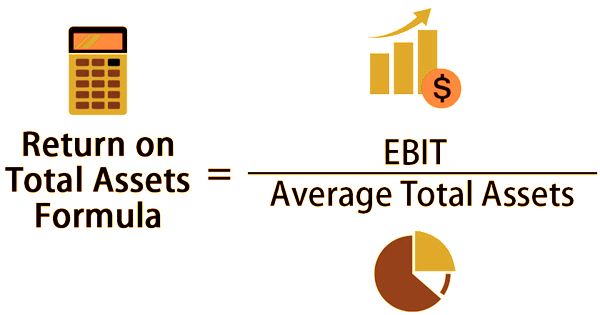

The formula for the return on assets ratio is determined by dividing the net profits by the average total assets:

Return on assets ratio = Net Income/ Average Total Assets

This ratio can also be interpreted as a gross margin commodity and as the overall turnover of the asset.

The Formula for Return on Total Assets (ROTA) Is:

Return on Total Assets = Average Total Assets/EBIT

where:

EBIT = Earnings before interest and taxes

Return on Total Assets (ROTA) calculates how effectively a corporation produces income before paying interest and taxes. This suggests that comparisons between different firms will not be influenced by the capital structure and different tax rates. To calculate the ROTA, divide the net income by the average total assets in a given year or if the data is available, by the trailing twelve-month span. A similar proportion can likewise be spoken to as the result of overall revenue and all-out resource turnover. Since all resources are either financed by value or obligation, a few speculators attempt to ignore the expenses of obtaining the resources in the return computation by adding back interest cost in the recipe.

Obtain the net income statistic from the income statement of a corporation to calculate ROTA, and then add back interest and/or taxes that were charged during the year. The resulting number is the EBIT of the company. To display the profits that the company has generated with each dollar of assets on its books, the EBIT number should then be divided by the company’s total net assets. All out resources incorporate contra represents this proportion; implying that stipend for dicey records and gathered deterioration are both deducted from the absolute resource balance prior to figuring the proportion.

Typically, a positive ROA ratio also suggests an upward trend in earnings. As different industries use assets differently, it is most useful for comparing businesses in the same sector. Since the ROTA calculation uses the book values of the balance sheet assets, the real market value of the fixed assets could be substantially understated. This prompts a higher proportion result that shows a profit for absolute resources that is higher than it should be on the grounds that the denominator (all-out resources) is excessively low. Since many new ventures have higher levels of debt associated with their properties, these changes will make the company appear less appealing in the eyes of investors. The ROTA will start to increase accordingly as these debts begin to clear.

Information Sources: