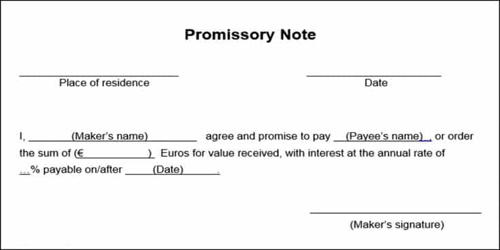

Promissory Note

A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money, either on-demand or at a specified future date. It is an unconditional promise in writing made by one person to another to pay a stated amount of money to a specified person or to the order of a certain person to the earner at a fixed date or on-demand. It contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer’s signature. They are debt instruments. They can be issued by financial institutions.

A promissory note is a legal, financial tool declared by a party, promising another party to pay the debt on a particular day. It is a legally binding promise of payment. Occasionally referred to as a note payable, they are used to document and legally formalize the terms of a loan. It is a written agreement signed by a drawer with a promise to pay the money on a specific date or whenever demanded. It should include all terms that relate to the indebtedness, including when and where the note was issued, the principal amount the issuer owes, what the interest rate on the note is, and when the note reaches maturity (becomes due). This type of document is common in financial services and is something you’ve likely signed in the past if you’ve taken out any kind of loan

Types – Depending upon the kind of promissory loan, notes are of different types. Few are mentioned below.

- Personal Promissory Notes – This is a particular loan taken from family or friends.

- Commercial – Here, the note is made when dealing with commercial lenders such as banks.

- Real Estate – This is similar to commercial notes in terms of nonpayment consequences. If the borrower becomes a defaulter, then the party has the right to keep the property until the debt is cleared.

- Investments – The promissory note is occasionally used to raise funds for the business. It is used as a security purpose and managed by securities laws.

Features

- Printed/Written Agreement – A promissory should be in writing, and an oral promise to pay money is not accepted.

- Pay Defined Amount – It is a promise to pay the money at a particular time or when demanded.

- Signed Documents – The document is duly signed and drawn by the drawer and stamped.

- Unconditional Promise – The promise to pay a certain amount of money must be absolute in all cases.

- Legal Composition – All the payments should be made in the nation’s legal currency.

- Detailed Information – The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.