Credit Risk management of Southeast Bank

Credit risk is one of the most vital risks for any commercial bank. Credit risk arises from non performance by a borrower. It may arise from either an inability or an unwillingness to perform in the pre-commitment contracted manner. The real risk from credit is the deviation of portfolio performance from its expected value. The credit risk of a bank is also effect the book value of a bank. The more credit of a particular is in risk, the more probability of a bank to be insolvent.

Therefore, the status of depositor in the bank is at risk and probability of incurring loss from their deposited value. In other way the risk of a commercial bank is calculated through long term and short term rating by the credit rating agencies. Southeast Bank Limited is a scheduled commercial bank in Bangladesh. This is one of the leading private commercial banks which is established under the banking companies Act 1991, the bank began its operation on 1995 with a primary objective of offering all types of commercial banking services mostly emphasizing on promoting small and medium entrepreneurs all over the country. This report is the fulfillment of the requirement for the evaluation process of the internship program. The main purpose of the report is to have an overall idea about function and process of credit risk management, analyzing tools and techniques used to evaluate credit proposal, analyzing steps taken to recover Bank’s bad portfolio of Southeast Bank Limited. Lending is one of the main functions of a bank. The objective of Credit Risk management of Southeast Bank Limited is to minimize the risk and maximize banks risk adjusted rate of return by assuming and maintaining credit exposure within the acceptable parameters. The Credit Risk Management department is responsible for upholding the integrity of the Bank’s risk/return profile. Credit Risk Management Department of Southeast Bank Limited conducted their functions by six wings. Central Collection Unit collects the credit.

Special Asset Management wings help the bank to recover Banks bad portfolio. For credit approval, the Bank has a team who approve the credit. Different tools and techniques are being used to evaluate a credit proposal. Retail Credit, Cards Credit, Authorization and Fraud Control, Central Verification Unit (CVU) are related with retail underwriting. Credit Collection Unit of Southeast Bank Limited collects credit based on the level of delinquencies of credit. Special Asset Management wings help the Bank to recover bad portfolio by taking different types of steps. To understand the performance of the present credit risk management process, the year by year ratio of loans which are grouped on basis of classification rules in the total loan and advances has analyzed. From the performance analysis, it is found that the collection of Standard Loan decline in year 2009 because of the national and global economic situation which reflects a low ratio of Standard Loan to total loans and advances. As a result, the balance of SMA, Sub standard, Doubtful and Bad/Loss loan increases in year 2009. Since 2009, national as well as global economy started to fallen in a dangerous phase of slowing growth and rising risk. But with the right initiatives taken by the top management of Southeast Bank Limited i.e. establishment of regional Credit Risk Management Centers, introduction of new wing called Special Asset Management & Credit Inspection, since the following year 2010 the situation has become normal which reflects the economy Bangladesh where economy starts back to upward growth phase from the impact of global recession. Although Southeast Bank Limited is successfully operating credit risk management, the Bank should improve in some areas which will take help the Bank to become the leader of banking sector.

OBJECTIVES OF THE STUDY

The main objectives of the study are follows:

Broad Objectives

- To observe& learn the Credit process &Risk Management of SEBL and its services.

Specific Objectives

The objective of the internship program is to familiarize students with the real business situation, to compare them with the business theories & at the last stage make a report on assigned task.

Specific objectives are as follow:

- To have exposure to the functions of foreign exchange section.

- To understand procedures of foreign exchange management of commercial banks in Bangladesh.

- To observe the working environment in commercial banks.

- To identify a link between practical operational aspects of the Bank to complementary the theoretical lessons

- To get an overview of the private Banking in our country.

- To identify the main factors of the credit risk and computation of credit risk grading of Southeast Bank Limited.

- To have an overall idea regarding the banking system of commercial Bank.

- To know the Credit risk management system of SEBL.

- To know about the different products offered by the bank.

- Identify products and service quality level.

- To know about the rate and charges.

- To evaluate the customer service of the Southeast Bank Limited.

- To know about the client pattern.

- To study the risk involved during the banking operations.

- To find out how the reasons behind the risks are resolved by the management.

BANKING SYSTEM IN BANGLADESH

The Nation can look back with certain justifiable pride at the achievements of the banking sector of Bangladesh. In the wake of liberation struggle, the banking structures of Bangladesh were in shambles in the war ravaged economy of the country. The banking business in the country was performed entirely by the nationalized banks till 1981/82. Thereafter, some banks were allowed to function as private sector banks for the purpose of widening the area of private sector operation. Two nationalized banks, the Uttara Bank and the Pubali Bank Were denationalized, and they started operation as private commercial bank. The banking system of Bangladesh has undoubtedly made significant strides during the last years. Banking network now covers the entire country. Commercial banks play a very important role in our economy; in fact, it is difficult to imagine how our economic system could function efficiently without many of their services. They are the heart of our financial structure since they have the ability, in co-operation with Bangladesh bank to add to the money supply of the nation and thus create additional purchasing power. This characteristic sets commercial Banks apart from other financial institutions. In addition to issuing deposits payable in demands, they accept time deposits. By Lending and investing these resources, and by transferring funds throughout the nation and even between countries, they make possible a more complete utilization of the resources of the nation.

Although banks create no new wealth, their lending, investing and related activities facilitate the economic processes of production, distribution and consumption. Human resource development through training is most crucial for organization growth. Training is a means to reduce obsolesce among the people in organization in the face of relentless innovation. Training is the process of increasing the skills and knowledge of personnel for the purpose of improving individual and organizational performance. Training is essential for the continued growth and development of both individual employee and the organization.

BACKGROUND OF SOUTHEAST BANK LIMITED

Southeast Bank Ltd is a fast growing private bank. It focuses on providing high quality customer service at a very competitive price. Bank’s efforts are directed at diversification of product and service. Offering customers a wide variety of choices and options have remained cornerstone of their business strategy. Southeast Bank Limited (SBL), “A Bank with Vision”, emerged in the Commercial Banking Industry of Bangladesh in 1995. It was incorporated on March 12, 1995 as a public limited organization according to the Companies Act 1994. The commencement of its banking operations occurred on May 25, 1995 by the Principal Branch located at 1, Dilkusha Commercial Area, Dhaka. The inception of SEBL is the outcome of a successful group of prominent and non-resident Bangladeshi investors whose vision was to contribute to the country’s economy through commercial banking. Southeast Bank Limited began its services with the inaugural Chairman Mr. Mohammad AbulKashem, Vice Chairman Mr. Ragib Ali and the former President and Managing Director Mr. Shah Mohammad Nurul Alam. In 1995, the Bank used to provide services to its clients through only five branches situated in different strategic locations and has increased its total number of branches to 19 by 2002. The number of employees in 2003 stood over 600. Bangladesh Institute of Bank Management (BIBM) and other training institutes are providing regular training and orientation courses to update the skills and knowledge of the officers and staffs of the Bank. Although the Bank is considered as the 2nd generation bank and has been in operation for only 8 years, it has begun fierce competition with its other contemporary banks. Southeast Bank Limited was licensed as a scheduled bank. It is engaged in pure commercial banking and providing services to all types of customers ranging from small entrepreneurs to the large business organizations. It is working for the economic welfare by transferring funds from the surplus economic unit to the deficit economic unit.

CREDIT ACTIVITIES OF SOUTHEAST BANK LTD.

Almost in every bank, there are 4 basic departments. They are:

- General Banking ( Including account opening, issuance of cheque book, FDR, Clearing, Cash, Pay order, etc)

- Credit

- Foreign exchange

- Accounts and Logistics

Account Opening Section

To establish a banker and customer relationship account opening is the first step. Opening of an account binds the Banker and customer into contractual relationship. But selection of customer for opening an account is very crucial for a Bank. Indeed, fraud and forgery of all kinds start by opening account. So, the Bank takes extremely cautious measure in its selection of customers. The following works are done by this section-

- Accepting of deposit

- Opening of account

- Check book issue

- Closing of account

Accepting Of Deposit

Accepting deposits is one of the main classic functions of banks. The relationship between a banker and his customer begins with the opening of an account by the former in the name of the latter. Initially all the accounts are opened with a deposit of money by the customer and hence these accounts are called deposits accounts. There is two officers performing various functions in this department. The deposits those are accepted by SEBL may be classified in to:

- Demand deposit

- Time deposit

Demand Deposit

There are mainly two types of demand deposit accounts, this are:

Savings A/C

To encourage savings habit amongst the general public, bank allows depositors to open savings account. As the name indicates, these accounts are opened for the purpose of savings. Interest is awarded on the balance of the account.

- The minimum balance requires to be maintained at all times is Tk. 1,000.00. And the bank reserves the right to change the minimum balance requirement and/or to close such accounts without prior notice if the balance falls below this amount.

- The maximum interest bearing amount allowed on any Saving Bank account Tk.50, 00,000.00 interest is payable on collected funds.

- The Bank reserves to itself the right not to pay any Cheque presented that contravenes the rules. In the event of a Cheque being returned for want of funds a penalty change of Tk.50.00 for each presentation will be made.

Current A/C

Current account is an account where the account holder within the funds can make numerous transactions available in its credits. No interest is paid on those deposits. Requirements to open an account are almost same to that of savings account except the initial deposit and the introducer must be the current account holder. Requirement for different types of current account holder are given below:

Limited Company: A separate account opening form is used for Limited company. The bank should be cautious about opening account for this type of customer. Requirements to open an account are as follows:

- Articles of association

- Two copies of attested photograph

- Letter of commencement

- Letter of incorporation

- List of directors, their number of shares and status

- Memorandum of Association

- Registration-which the company is registered and certificate relating to this issue, is obtained from the registration office of Joint Stock Company.

Partnership Firm: Same account opening form for partnership firm is used. Instruction of account is given in this form. Documents required to open this type of account are as follows:

- Two copies attested photograph of those who will operate the account.

- Partnership deed

- Resolution of the firm regarding account opening should be given

- Trade license

Personal Current A/c: Same account opening form for partnership firm is used. Instruction of account is given in this form. Document required to open personal current account are given below:

- Two copies photograph of who will operate the account

- The guarantor who is already maintaining an account introduces personal.

- One copy photograph of nominee

- One photocopy of national ID of both , Account holder and nominee.

Proprietorship A/c: Requirements for opening this type of account are as follows:

- The guarantor attests two copies photograph of who will operate the account.

- Photocopy of trade license.

Co-operative Society: Following documents have to be obtained in case of the account of

Co-operative Society: i) Copy of Bye-Law duly certified by the Co-operative Officer. ii) Up to date list of office bearers. iii) Resolution of the Executive Committee as regard of the account. iv) Certified copy of Certificate of Registration issued by the registrar, Co-operative societies

Minor Account: Following documents have to be obtained in case of the account of minor:

- Putting the word “MINOR” after the title of the account.

- Recording of the special instruction of operation of the account. The AOF is to be filled in and signed by either the parents or the legal guardian appointed by the court of law and not by the minor. Banks are maintained a signature card and different types of register to open every types of accounts. An account number is given for each account and the description of the account entered in the computer. According to rules of the bank a letter of thank should be given to the account holder and to the introducer but in practice it is not done

Monthly Schemes

- Mudaraba Monthly Savings Scheme (MMSS): Duration: 3 (three) Years & 5 (Five) Years Amount of Monthly Installment: TK.500 or Multiple amount up to TK.50, 000 (Fifty Thousand).

- A Person of 18 years of age and above having a sound mind can open the account

- A Person can open more than one MMSS account at any branch of the Bank and in such case separate form should be filled

- A passport size Photograph is required to open the account

- MMSS account can be opened at any working day of the month.

- Account opened within first 10th of any month will be treated as account of that particular month. If the account is opened after 10th of any month in that case 1st installment will be due and realized from the next month.

- MMSS account cannot be opened in the name of any minor, in joint names, or I n the name of institution.

- An account can be transferred from one Islamic Branch to another Islamic Branch of the Bank by a written application of the account holder. In such case a fee of TK. 500 is payable as banks service charge. 8. Installments can be deposited in advance.

Pensions Savings Scheme (PSS): Duration:4,6 and 8 Years Terms Amount of Monthly Installment’s 500 or multiple up to TK.25, 000 (i.e. Tk.500 or 1000 or 1500)

- A Person of 18 years of age and above having a sound mind can open the account

- A person can open more than one PSS account for different amount at any branch of the Bank and in such case separate form should be filled in.

- A passport size photograph of the account holder and each nominee (attested by the account holder) are required to open the account

- The account can be opened at any working day of the month.

- Account opened within 10th of any month will be treated as account opened on the particular month. If the account is opened after 10th of any month in that case 1st installment will be due from the following month and will be realized in the following month.

- PSS account can be opened in the name of minor .In that case minor’s legal guardian can operate the account.

- Account cannot be opened in joint names, or in the name of any institution.

- Double Benefit Scheme (DBS) Double Benefit Scheme is a time specified deposit scheme for clients where the deposited money will be doubled on maturity.

Features and Benefits:

- Amount to be deposited TK 10,000 or its multiple; No fees and charges.

- Deposited amount will be doubled in 7.5 years;

- Account can be opened at any working day of the month;

- Allowed to open more than one DBS Account at any branch of the Bank;

- Loan facility against lien of DBS Account;

- The Scheme is covered by Insurance and Insurance Premium is borne by the bank;

- Premature closure facility.

- Eligibility

- DBS Account can be opened for Individual, joint account and corporate bodies.

- Only Resident Bangladeshi National is allowed to open Personal DBS Account

- Age bar for opening of Personal DBS Account: 18 years or above.

- Minor account can be opened under the supervision of his / her / their guardian.

- Millionaire Deposit Scheme (MDS) Millionaire Deposit Scheme is a time specified monthly deposit scheme for clients where the deposited money will become millions on maturity.

Features and Benefits

- Tenor: 4,5,6,7,8,9 and 10 years term;

- Deposit on monthly installment basis;

- Attractive rate of interest;

- Account can be opened at any working day of the month;

- Monthly installment can be deposited through a standing debit instruction from the designated CD/SB Account;

- Monthly installment can be deposited in advance;

- An account can be transferred from one branch to another branch of the bank;

- Credit facility for maximum of 2 years can be availed at any time during the period of the scheme;

- Allowed to open more than one MDS Account for different amount at any branch of the Bank

Eligibility

- MDS Account can be opened for Individual, joint account and Corporate bodies.

- Only Resident Bangladeshi National is allowed to open Personal MDS Account.

- Age bar for opening of Personal MDS Account: 18 years or above. However, Minor account can be opened under the supervision of his / her / their guardian.

Fees & Charges

- Account transfer fee is Taka 500/-;

- Account closure fee is Taka 500/-;

- Penalty of Taka 200/- for failure to pay monthly installment within the stipulated time;

- VAT applicable for all fees & charges @15%.

Multimillionaire Gold Deposit Scheme (MGDS): A person of 18 years of age and above can open the account. MDGS account can be opened in joint names and in the name of any institution. Monthly installment can be deposited by cash/cheque or can be deposited through a standing debit instruction from the designated SB or CD account of every month. Monthly installment can be deposited in advance. In that case no interest for the advanced installment will be paid.

Time Deposit

There are mainly two types of time deposit:

Short Term Deposit (STD): In short term deposit, the deposit should be kept for at least seven days to get interest. The interest offered for STD is less than that of savings deposit. In PBL, various big companies, organization, Government Departments keep money in STD account. Frequent withdrawal is discouraged and requires prior notice.

Fixed Deposit Receipt (FDR): Fixed Deposit Receipt offers the customers the opportunity to invest a fixed amount for a fixed period at a fixed rate of interest. The customers have the option to re – invest their funds both principal amount and interest amount on maturity or principal amount and the interest amount being paid into their SB or CD accounts. In FDR: Money can grow with attractive interest rate with flexible tenure.

- Automatic renewal facility at maturity.

- Loan facility against FDR to meet urgent financial needs.

- Premature closure facility at savings rate

- Eligibility

- FDR Account can be opened for Individual, joint account and corporate bodies.

- Only Resident Bangladeshi National is allowed to open Personal FDR Account.

Clearing

Generally speaking, clearing means settlement but from Banker’s point of view it refers to the procedure of receipts & payments of proceeds of cheques and other instruments through banks. Clearing House is a place where the representatives of all member banks meet together and settle mutual obligations of banks arising out of cheques & other instruments drawn on one bank and deposited with another bank for collection, under a special arrangement. The characteristic of the clearing house is that at the time of coming to this place the representative of every bank brings with him all cheques etc drawn on other banks along with schedules and delivers the cheques to the clearing house and receives cheques etc drawn on his bank and on the basis of cheques etc. delivered & received the mutual obligations between banks is ascertained and settled through their respective bank accounts maintained with the Central Bank or any other bank which conducts the clearing house.

Types of Clearing

There are two types of Clearing. Such as

- Internal or Inter-branch Clearing,

- Inter-Bank Clearing.

Under the 1st type all branches of the same bank situated in a particular city settle their mutual obligations through the main branch of the bank. On the other Hand, in one city the obligations between all banks are settled. In this case Bangladesh Bank or Sonali Bank performs the function of the Clearing House in Bangladesh.

Kinds of Clearing

The Clearing House activities may be grouped into two types,

- Outward clearing,

- Inward Clearing.

Outward Clearing Procedure:

- Receipt of instrument with paying in slip.

- Checking of instrument & paying in slip.

- Affixing of seal

- Special Crossing seal.

- Clearing Seal (Instrument & Paying in slip)

- Signing of counterfoil and returning it with seal to the depositor.

- Separation of instrument from paying in slip.

- Sorting of instrument bank wise and branch wise.

- Preparation of schedule- branch wise

- Preparation Bank wise schedule.

- Tallying of totals of paying in slips with the totals of Clearing House sheet.

- Making of entries in Clearing Register (Outward)

- Preparation of vouchers.

- Sending of instruments to main branch with schedule.

- Collection of credit advice from Main Branch.

Inward Clearing Procedure:

- Receipt of instruments with schedule

- Checking of instruments.

- Sending of instruments to different Departments/Sections for posting.

- Preparation of Vouchers and sending of credit advice to main branch.

Clearing Return Procedure:

- Outward clearing Return

- Preparation of return memo.

- Making of entry in clearing return Register.

- Preparation of schedule.

- Sending of instruments to main branch before second clear.

- Inward Clearing Return

- Receipt of instrument with return memo.

- Preparation of Party debit Voucher.

- Making of entry in cheque return Register.

- Sending of instrument with return memo and party debit advice to party by post or through peon.

Cash

In cash department, Trainee cash officers receive cash and pay cash to the customers.

Procedure of Cash Receipts:

- While receiving cash the receiving cashier should see that the paying in slip has peen properly filled in.

- The paying in slip does not bear the name of another branch or the customer has not mentioned the name of another branch.

- The title and number of account have been mentioned on the paying in slip and the counterfoil.

- The amount in words and figures are the same.

- The particulars and amount on the pay-in slip and the counterfoil are same.

- The Cashier should receive money, count it and mention the denomination of notes on the back of the paying in slip and see that the total tallies with the amount of the paying in slip.

- He should count the notes again and verify the amount from that mentioned on the paying in slip.

- He should enter the particulars as to the name of the party, account number and amount in the Receipt Register.

- He should sign on both the parts of the paying in slip i.e. voucher and the counterfoil.

- He should then hand over the paying in slip and the Receipt Register to the authorized person, Officer in Charge/Head Cashier.

- For the amount received on account of commission, Telegram and postal charges where no separate voucher is passed he should maintain record in a separate book or enter the same in Receipt Register immediately. He should prepare relevant vouchers and hand over the same to the authorized person for affixing the “CASH RECEIVED” stamp and obtain counter signature from the officer.

- After the close of business hours, he should balance the cash receipts from the register, and should keep the cash ready for checking by the authorized person

Procedure of Cash Payment:

For Payment of Cheques:

- Payment Cashier should see that the cheque is in order i.e. the amount in words and figures is same. The cheque is neither post dated nor state.

- He should then request the presenter of the cheque to sign on the back of the cheque.

- The paying cashier sees that the signature of the ledger keeper and in case of big amount cheques, the signature of the officer and the Manager are there on the cheque as a token of having posted and supervised the cheque.

- If the cheque is payable to the order of payee, the payee or the endorsee (if endorsed) has been properly identified.

- Then he should take out cash and call out the name of the party and ask him about the amount of the cheque and his token number. If the amount stated by the party differs from the amount of the cheque, he should tally the token number, if the token number is the same and the amount differs, he should report the matter to the Officer in charge/ Manager.

- He should obtain another signature of the party on the back of the cheque. He should now see that the second signature tallies with the first one already on it.

- In case the signatures do not tally, he should not make the payment and report to the Officer in charge.

- Before making the payment he should obtain the token from the party and see that the amount and token number are the same.

- He should, once again, ask the party about the amount of his cheque and count the cash for the second time before making payment. When satisfied in all respects he should make payment.

- He should affix the “CASH PAID” stamp bearing the date of payment.

- He should put his full signature under the cash paid stamp.

- He should enter the particulars of the cash payment in his payment Register.

- He should keep the cheques so paid in his safe custody till the Officer in charge/Manager checks his payment register.

Cash Payment of other instrument:

- In case of cash payment of Drafts, Pay Orders and Pay Slips, he should see that the payee has been properly identified, and in case of Pay Slips, the beneficiary has signed on proper revenue stamp.

- The Officer/ Officers has/ have signed under the stamp “PAY CASH”

- In other respects, so far as applicable, the same procedure is to be followed as in payment of cheques.

Procedure of Cash Handling: The Cashier should know to differentiate defective, Mutilated, Burnt, Torn etc. notes from good notes. As a matter of rule such notes should not be accepted over the counter as deposits or in exchange of good notes. These notes, under special circumstances, may be accepted only on “collection basis”. These notes should immediately be sent to Bangladesh Bank/ Sonali Bank for receiving payment of exchange value.

Others products:

ATM / Debit Card: ATM card of Southeast Bank ltd is known as “SEBL My Card”. Features of this card, are:

- 24/7 accessibility across the country

- Accessibility through DBBL ATM Network

- Free for year one

- Renewal fee is taka 500 ( five hundred ) only

- PIN reissuance is taka 200 (two Hundred) only.

Virtual Card : Virtual Card will only be used for online payment on internet against the fees as under:

- Membership Fees of Foreign Professional and Scientific Institutions

- Fees for Application, Registration, Admission, Examination (TOEFL, SAT etc.) in connection with admission into foreign educational institutions.

Product Pricing :

- Card Fee : USD 10.00 as Card Fee + USD 1.50 Vat on Card Fee

- Loading Fee : 1 % of the remittance amount

Remittance Business

Our eight million expatriates are a source of pride for Bangladesh. They represent us abroad by building our image. Their contribution is equally important, if not more, in the contribution they make to the economy of the country. The foreign exchange they send home is the second largest source of much needed foreign exchange for our economic development.

Although Southeast Bank Limited (SEBL) has entered into remittance late compared to the other private banks, it has continuously strived to build its remittance business around quality service by making it easy for remitters to remit money through a network under agreements with reputed banks and exchange houses abroad and an extensive network in the country to deliver the money to the beneficiaries at their door in the quickest possible time in safe and without hassle.

Features of our one – stop remittance delivery service are:

- No service Charge

- Confidentiality in Transaction

- Instant Account credit

- 24/7 cash payment facilities from nationwide 1000 Grameen Phone (GP) outlets

- Direct communication with both Sender and Receiver for solving cash payment / account deposit problem.

South east Bank Ltd has adequate Foreign Remittance sending arrangements in the major Bangladeshis Expatriates concentrated countries and territories over the globe through which any Bangladeshi expatriates can easily remit their money .

Global Partners :

- Western Union Money Transfer Services

- Ria Financial Services

- Xpress Money Services

- MoneyGram International

- Aftab Currency Exchange

- SWIFT Services

Internet Banking

SEBL’s aim is to provide every customer easy access to his/her account from any branch. Recognizing the need of customers SEBL has networked all of its branches all over the country to permit its valued customers to carry out transactions from any branch. Cash withdrawal or deposit or any type of personal banking transactions can be performed using the any Branch office.

- Bill Collection Service SEBL Provides following Bill collection service:

- Dhaka WASA Bill

- Western Union Money Transfer Services

With the signing of the Representation Agreement between Western Union Financial Services, Inc., U.S.A. and Southeast Bank Ltd., Bangladeshi Wage Earners abroad can send their money through Western Union and their families and friends can receive the money in minutes by visiting any of the branches of Southeast Bank Ltd. all over Bangladesh. There is a 3 step process to send money through Western Union Money transfer Service, which are given below:

- First, the sender has to receive a money receipt with a Money Transfer Control Number (MTCN) from any of the Western Union agent location outside Bangladesh after depositing money.

- Then, the sender will inform the money transfer detail (amount of money sent, sender’s name, receiver’s name, destination country, and MTCN) to the receiver.

- The receiver will receive the money from any of the branches of Southeast Bank Ltd. By showing a valid Identification and filling a form.

BANK PERFORMANCE AND EVALUATIONS

For bank performance and evaluation of Southeast bank limited we will analyze the ratio analysis. The ratio analysis will consist of

- Return on Equity (ROE)

- Return on Asset (ROA)

- Net Interest Margin (NIM)

- Net Bank Operating Margin (NBOM)

- Earning Per Share (EPS)

- Net Profit Margin (NPM)

- Asset Utilization Ratio (AUR)

- Operating Efficiency Ratio (OER)

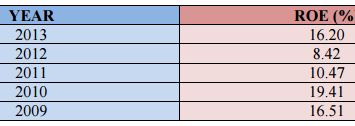

RETURN ON EQUITY (ROE)

The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

ROE is expressed as a percentage and calculated as:

Return on Equity = Net Income/Shareholder’s Equity

Returns on equities of SEBL from Year 2013 to Year 2009 are given below:

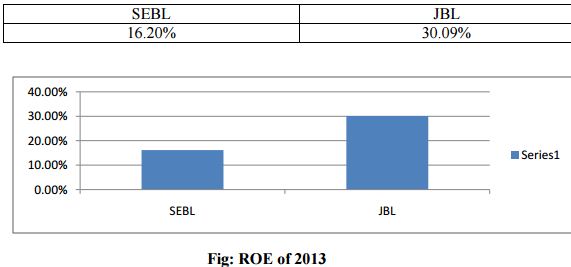

Comparison between ROE of year 2013 of SEBL and JBL

Janata bank limited had higher ROE than Southeast bank limited in 2013.

RETURN ON ASSET (ROA)

An indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. Calculated by dividing a company’s annual earnings by its total assets, ROA is displayed as a percentage. Sometimes this is referred to as “return on investment”.

FINDINGS

Risk areas in Account opening

- Account holder’s identification: If account holders provide fake national identification number (NID) or fake passport. It might be risk for bank.

- Source of income: Legal income source must. If account holder’s source of income illegal then money laundering must. Verification of source of fund is required.

- Ensuring proper introduction before opening any account which will help to trace out the customer for any kind of mishaps due to his conducts.

- Verifying the documents provided by the client such as NID, Passport, Driving license, Trade license, Certificate of Incorporation, Board Regulation which will protect the fraudulent activities of the client.

- Compliance of Bangladesh Bank guideline money laundering. Proper KYC (know your customer) should be done at the time of opening of the account and subsequent follow up is required.

Risk areas in Clearing

- To ensure that the cheque has been received for clearing in the proper beneficiaries account.

- Proper endorsement on cheque must be ensured.

- To verify Fake/False/Post dated cheque.

Risk areas in Remittance

- To ensure that actual beneficiary receives the remitted amount.

- In case of remittance through TT, TT controlling number & test code must match.

- Verity the genuineness of remittance.

Others

- Lack of effective advertising and promotion: Advertising and promotion is one of the weak point of Southeast Bank Limited, Southeast Bank Limited does not have any effective. Promotional activities through advertisement, but other banks have better promotional strategy. Therefore most customers are not known about their Islamic banking branch.

- Lack of Computer Knowledge: All the organizations including banks are now mostly depends on computer but employees do not have much knowledge on computer.

- Unsatisfactory software performance: Southeast bank use Ultimus software for performing their banking activities. But the software often hanged as because of slower upgrade of data by vender. Therefore it delays to performing banking activities at time.

CONCLUTION

Banking is the backbone of national economy. Banking sector no more depends on only on a traditional method of banking. Banking industry has been treated as a prospective financial sector in Bangladesh. Bangladesh’s banking system is heavily affected by bad loans. This is not only makes conservative, contracts the lending system, it discourages investment. As a result the growth of the economy is impeded. One major reason for default loan is banks ineffectiveness of assessing credit risk of a proposed investment. With time Bangladesh bank has set rules and general guidelines to help banks asses risk and mitigate their credit risk. In spite of that many banks fail to attract good credit and run profitably. Thus it is not only the guidance provided by the Bangladesh bank that a commercial lending institution need to follow own lending policies should be in place to ensure maximum effectiveness of credit assessment.

Credit risk management is becoming more and more important in today’s competitive business world. It is all the more important in the context of Bangladesh. The tools for improving management of consumer credit risk have advanced considerably in recent years. Therefore, as a responsible and reputed commercial bank, SEBL has instituted a contemporary credit risk management system. From the study, it is evident that the bank is quite sincere in their approach to managing the consumer credit risk though there are rooms for improvement. They have to be more cautious in the recovery sector and preferential treatments to some big clients should also be stopped. However, they follow an in-depth procedure in assessing the credit risk by using the credit risk grading techniques which provides them a solid ground in the time of any settlement. From the discussion in this report, it has become clear that credit risk management is a complex and ongoing process and therefore financial institutions must take a serious approach in addressing these issues. They have to be up to date in complying with all the required procedures and must employ competent people who have the ability to deal with these complex matters.

Utmost importance should be given to the improvement of the networking system which is essential for modern banking environment and obviously for efficient and effective credit risk management process.

SEBL is well prepared to and capable of meeting the demand for a broad range of banking services. It has got adequate resources, both human and physical, to provide the customers with the best possible services. SEBL has already developed goodwill among its client by offering its excellent services. This success has resulted from the dedication, commitment and dynamic leadership of its management over the periods. But they must concentrate more on customer oriented services and provide better technological advancement relating to banking activities.

RECOMMENDATIONS

Southeast Bank Ltd. is one of the potential banks in the banking sector in Bangladesh. The Rupnagar branch of SEBL is a small branch. It was a wonderful experience working at Southeast Bank Limited. The employees of the bank were very helpful and nice to me. In spite it was not an easy job to find so many things during the very short period of practical orientation program.

The recommendations given below are not decisions; rather they are only suggestions to improve the customer’s service in order to fulfill the customer’s satisfaction so that customers give more preference to SEBL. The recommendations are given below:

- Develop more customized parameters for credit approval process under the general guideline of BB to increase its market.

- ATM booths should be increased

- More research and innovative ideas should be made.

- SEBL should give more emphasize on liquidity management in a balanced way.

- Emphasize on more advertisements should be made.

- Website of SEBL Bangladesh need to be enriched.

- Continuous improvement should be made in the lending procedure which would reduce the default risk of the bank and increase profitability.

- All the branches should be computerized.

- Employees should be given training for better customer service.

- More Gifts, Discounts as well as differentiated interest rates on several loan and deposit schemes for the Premium Customers.