Retail and Corporate Credit Scheme of Prime Bank Limited

The bank plays an important role in the economy of any country. The banking system of Bangladesh is composed of variety of banks working as nationalized commercial banks, private banks, foreign banks, specialized banks and development banks. However there are many private banks in Bangladesh. At present, among other banks Prime Bank Limited plays as a leading bank to provide efficient banking service with a view to accelerating socio-economic development of the country. Day by day, new competitors appear with better ideas and product as well as service. “Consumer Credit scheme” one of the new innovative idea which is provided to the credit needs to various income group for different purpose. In a present time few banks operate this scheme with short volume than Prime Bank Limited. To make its position more strong, PBL wants to make their credit scheme more attractive to the customer. For various purpose PBL provide their credit scheme at various level. For individual purpose, for investing purpose, for exporting-importing purpose they have different kind of loan facilities.

In retail credit the loan has to repay within a specific period. The person within the age of 25 to 6o having a permanent job can apply for the CCS loan for Prime Bank Limited. They can borrow a limited amount of money within a specific range. The interest rate is 15% for all the products.

Prime Bank Limited has some problem with their CCS customer. Sometimes the down payment paid by CCS Customers is very high with the PBL. Many of the customers are not satisfied with the interest rate and loan payment period. They should include more differentiate product in their scheme. In corporate credit the organization or companies mainly deal with PBL. The SOD, BG, Commercial House Building Loan are provided in corporate credit. In this department customers are much satisfied than retail credit department. The individual person also takes loan against their SOD, PMS, FDR account etc. To gain competitive advantage and to reach the 1st position in the banking sector they need to overcome their barriers.

As Prime Bank Ltd. is one of the leading banks in Bangladesh it is providing a good service to the customers and contributing in the economic growth of our country. It’s different kind of product and services helping people to overcome their financial problem. The corporate banking and retail banking services providing a good effort in the progressing of the economy and the growth of organizations.

Introduction:

Banking system occupies an important place in a nation’s economy. A banking institution is indispensable in a modern society. Banks safeguard money and valuables and provide loans, credit and payment services such as checking accounts, money orders and cashier checks. Banks also may offer investments and insurance products. As a variety of models for cooperation and integration among finance industries have emerged, some of the traditional distinctions between banks, insurance companies and securities firms have diminished. In spite of these changes, banks continue to maintain and perform their primary role accepting deposits and lending funds from these deposits.

Objective of the study:

Specific objectives are:

- To know the overall performance of credit scheme of Prime Bank Limited through different aspects of banking sector.

- To trace the origin of the credit scheme of PBL.

- To understand the need and objective of credit management.

- To acquire in depth knowledge on about PBL credit function

- To find out the competitive position of the retail credit and corporate credit of Prime Bank Limited.

- To identify the weaknesses and problems in credit scheme.

Background of Prime Bank Limited:

Prime Bank Limited was created and commencement of business started on 17th April 1995. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc. Now it has 117 branches all over the country.

As a fully licensed commercial bank, Prime Bank Ltd. is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes so is the bank and it repositions itself in the changed market condition.

Prime Bank Ltd. offers all kinds of Commercial corporate and personal banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by the central bank. Diversification of products and services include corporate banking, retail banking and consumer banking right from industry to agriculture and real state to software.

Prime Bank Ltd., since its beginning has attached more importance in technology integration. In order to retain competitive edge, investment in technology is always a top agenda and under constant focus. Keeping the network with a reasonable limit, the strategy is to serve the customers through capacity building across multi-delivery channels. The past performance gives an indication of strength.

Commencement of Prime Bank Limited:

Prime Bank Ltd. started its operation on 17th April 1995 with an authorized capital of Tk. 1000 million and paid up capital of Tk. 100 million by a group of highly successful entrepreneurs who are established in various fields of economic and business activities. PBL is a fully licensed scheduled commercial bank set up in private sector in pursuance of the Government of Bangladesh to liberalize banking and financial services

Currently, there are some proposed branches. The commercial and investment services of PBL range from small enterprises to big business loans to all type of customers. Besides this, the bank actively participates in socio-economic development of priority sectors like agriculture, industry, housing, self-employment, etc. PBL is also a pioneer in providing consumer loans as well as financing the industries and transport sector through attractive leasing and higher purchase scheme.

SWOT Analysis of Prime Bank Limited

SWOT Analysis is an organization’s strength, weaknesses, opportunity and threat analysis. It helps an organization to stay in line of performance and also inspire to improve in future.

Strengths:

PBL had been gaining market share quickly in all of the existing banking markets of the country. PBL made partner with reputable suppliers and it helped them to overcome any kind of barriers and gave them the opportunity to provide the better service to their customers. Prime Bank Limited is committed to provide timely service to their customer. Employee motivation is also strength of PBL. The employees are also stockholders and they are committed to take care of the health of Prime Bank Limited. It has recognized that if they concentrate to the quick pace of the service then it will help to serve more and quickly. So they turn their product business into a service business. Prime Bank Limited developed their metrics of performance by which they can share the responsibilities to the managers and it energized the employees significantly. It follows cost leadership for positioning in the industry. By reducing cost and process improvement it is providing uncompromised quality of service.

Weaknesses:

Decline in garments export and fall in inward remittance continued pressure on interest margin, fee and exchange earnings will be challenge to PBL. The political situation will have a significant effect throughout the year on PBL. Sometimes recruitment is done by director’s influence or other way which ends of recruiting not very efficient workers.

Opportunities:

Government investment is friendly attitude. If government focus on banking sector and its investment than it will have more opportunity to growth and expand all over the country. New monetary policy targeting easy credit terms makes it possible to expand in the market. Government should allocate fund for Readymade Garments. Export sector such as leather and jute be taken special care so that the new entrepreneurs can be encouraged. Foreign missions should take steps for creating new markets of products in the respective countries. The non Bangladeshis should be encouraged to direct invest their fund in Bangladesh.

Threats:

Competitive interest rate is a threat for PBL. Customers are very much pricing sensitive. Garments sector threat such as Labor unrest. In our country since the large portion is in garments sector, any turmoil in this sector may affect the finance sector of the country. Negative motivation among workforce created from various internal and external factors.

Description of retail credit and corporate credit

Retail credit:

- The customer profile:

Any person within the range of 25 to 60 years and if he/she has a permanent job or the permanent employee of any organization can apply for the loan of Prime Bank Limited. The job sectors are:

- Government sector

- Semi Government sector

- Banks, Insurance companies and any kind of financial institute

- Armed forces, BDR, Police and Ansar

- Teachers of universities, colleges and schools

- Permanent employees of public Limited companies, multinational companies and Bank acceptable companies

- Other professionals such as: Self-employed person, Doctors, Engineers, Lawyers, Architects, Accountants, Journalists etc.

Loan products of Prime Bank Limited:

Prime Bank Limited has different kind of loan services. They are given below:

- Household durable loan: Motor cycle, furniture, personal computer, Fax machine, Small PABX System, Television, Mobile Phone set, Refrigerator, Auto-video equipments, home electric appliances and any other house hold items.

- Car loan: Car, jeep, station jeep, pick up van, cover van, bus, truck, ambulance and any vehicles for own use.

- Doctors loan: For the doctors only or their medical equipment buying purpose.

- Education loan: For education purpose. Inside or outside of the country.

- Travel loan : For travelling purpose

- Wedding loan: For wedding purpose only

- CNG Conversion loan : Only for CNG conversion purpose

- Any purpose loan: For emergency need

- Hospitalization loan: For treatment in hospital.

- Home loan (Swapna Neer): for buying, renovation and reconstruction of home.

Documentation:

For implementation of customers loan Bank usually uses two types of documents. One is application form and another one is charge documents.

Details of these are given below:

Application form:

The contents of application form for loan are:

- Personal details of applicant: The applicant’s personal information is written down in this segment.

- Employment details: In this section applicant has to specify the details about his/her employment (name of the company, designation, years of service, salary etc.)

- Loan details: Amount of loan, Period, Interest, Equity, Mode of Repayment, Security and other charges are to be mentioned.

- Financial details: total assets, total liabilities, monthly income, monthly expenses and all other financial details of the applicant have to be mentioned.

- Particular of guarantors: details of guarantors with their job details are to be stated here.

- Quotation: quotation contains the details descriptions of the goods, brand, model, size, manufacturer, price and details of supplier.

- Letter of assurance: this is the assurance of the working organization of the client to pay the installment in case of client fails to repay to the Bank.

- Declaration: this is the declaration of the borrower which means all the information about the quotation of the goods is correct and the applicant agrees with all terms and conditions of the Bank.

- Certification of the organization: here the working organization will certify that the borrower is the employee of the organization.

- Photograph: two copies of photograph is needed for each client

Charge documents:

Charge documents are set for documents that contain different e rules, terms and condition. Borrower needs to follow the rules otherwise the documents will be exercised to suit against the borrower. Before the disbursement of loan the following document must be signed by the client/borrower:

- The stamps must be needed for these documents are paid by the clients.

- Letter of guarantee: the letter of guarantee is two sided. One is borrower sided guarantee and another one is guarantor side guarantee. Borrower side guarantee consists or agreement of all terms and conditions of Bank as well as assurance of proper repayment of installment. Guarantor side guarantee is the undertaking by the guarantor to pay the installments in case of failure of the client.

- Letter of hypothecation: it signifies that the goods/items are hypothecated to the Bank.

- Demand promissory note: it is the promise of borrower to pay on demand to the

Bank the overdue or total outstanding if necessary.

- Letter of installment: in this document borrower promise to pay all regular and irregular installments in due time.

- Letter of disbursement: this is the declaration of disbursement of loan to the borrower.

- Letter of agreement: this is the agreement where borrower is bound to pay all dues together with all other charges and the borrower gives the Bank the authority to discharge the agreements any time due to the fault in the borrower side

- Letter of authority: this is the letter the borrower gives the Bank the authority to debit the account if necessary.

Mode of repayment:

The repayments of loans including interest will be made by equal monthly installments which will start from the following month of the disbursement of loan. Before disbursement of loan the customer will deposit crossed cheque covering the total number of monthly installments in favor of Bank which will have to be presented for collection on the due date. Installment will be paid within 7th day of each month or prepayment is also allowed.

Other conditions:

- Customer will bear the license fee, registration fee, insurance charge etc. if any, in respect of the articles

- Customers will bear the expenses for necessary repair and maintenance of the articles during the period loan.

After delivery of the articles, the respective customer shall remain responsible if the articles are broken, stolen or damaged. The articles shall be used by the customer with optimum care, caution and prudence and he will be liable for

- Compensation or replacement etc. for any damaged caused due to this negligence, carelessness and inefficient handling. In the event of the articles being lost or totally damaged and become irreparable due to his negligence, carelessness and inefficient handling, he will be liable to adjust Bank’s due such as outstanding principal, interest and other charges on demand

- Customer will inform the bank of any change of his address immediately after the change

- Customer will keep available all the articles supplied to him for inspection by the bank officials or supervising agency as and when required

- Default in payment of three consecutive installments shall render the customer liable to handover the articles of the bank

- In case of loan for purchase of car loan, the registration of the vehicle loan shall be made in the sole name of the bank/joint name of the bank and the customer until full adjustment of the loan

- The registration, Blue book, Tax token, Fitness certificate etc. for vehicles must always be kept up to date at the cost of the customer

Judgment process of credit proposal the consumer credit scheme:

Loan and advances are the main assets of a bank. It is very crucial for any bank because it is generates the greatest part of revenue of bank. Within the total credit portfolio consumer credit is the most popular form of credit because it is easily recoverable. To disburse the loan, the credit officer has to verify the potential borrower’s income, expenditure pattern, type of service etc to select the appropriate borrower. The factors which are considered in this process are started below:

(a) Borrower’s income: It is the vital factor for selecting a borrower. To gather required information in his regard, the borrower is requested to allow the credit officer to verify the following subject matters:

- Place of employment

- The stated salary

- The continuity of existing job

- Income from part time employment

- Spouses income

- Income from rentalss

- Dividend or interest

- Children’s support

Besides these the credit officer also verifies borrower’s income from the TIN certificate, tax return and salary statement etc.

(b) Estimated housing expenses: The credit officer tries to evaluate the expenditure pattern as well as monthly living expenditure with the help of the following information:

- Children’s educational expenses

- House rent

- Interest payment on previous borrowing

- Interest payment for the loan which is under consideration.

(c) Location: The location of the borrower is an important factor for selecting any borrower. If the location of the borrower is far from the bank, the physical communication becomes tough for the bank. So bank likes to provide loan to those who stay near to the bank’s branch.

(d) Assessment of credit history: The credit officer evaluates the credit history of a potential borrower with the help of the CIB report and with the inquiry of his or her business community subsequently verified by five outsourcing CPV (Contact Point Verification) agents namely Credit Ben balance Consultancy, Snipers Secures Limited, Beacon Consultancy Services, Management Consultancy Limited and Prime Asset and Insight Management. Quality of a loan is heavily dependent on the reports provided by the low salaried employees of the outsource agents.

(e) Social status: Social status of a borrower is to be verified from the following information:

- Ownership of a car

- Ownership of a house in the metropolitan area

- Holding a land phone in residence

- Holding a passport, TIN certificate

- Membership of a first club

- Marital status

- Guarantors status

Under the credit scheme, credit is offered by taking personal guarantors from a third party. The guarantor will be liable for the default of loan. So guarantor’s designation, type of job, monthly salary, period of service, office address and the consent of the guarantors regarding the matters are evaluated.

(f) Loan sectioning process:

- The officer of retail credit unit pursue the prospective customer to take the retail asset product

- The customer may submit the loan application directly to the retail credit or to any nearest branches of Prime Bank as convenience

- After receiving the credit application from the customer the branch forward it to retail credit unit immediately

- Then the retail credit unit inspect and verify the information provided by the customer in the credit application and apply all due diligences for approval or declining the loan

- If the retail credit committee approves the proposal, section advice is issued to the customer and asked to finish all other documentation and to give the required number of post date cheques

- Both the retail credit unit and branches keep the record of approved and declined loan proposals.

Monitoring and Recovery:

The credit under this scheme is fully supervised and as such, the success of the schemes depends on proper and persistent supervision, follow up, persuasion and monitoring of the credits by the branches. Branches shall maintain proper records of the applicants received, loan sanctioned, disbursement and recovery made. It is worthwhile to mention here that optimum recovery can be ensured by developing relationship with the customers and the beneficiaries and maintaining supervision thereon without filling any suit/case. The mechanism of supervision and monitoring are as follows:

- Regular checking of the balance of the clients account

- Regular communication with the defaulting customer and guarantors physically/over telephone

- Issuance of letter to customers immediately after dishonor of cheque

- Issuance of letter to defaulting customers and respective guarantors

- Contacting the employers of the defaulting customers (after their overdue

installments)

- Issuance of legal notice to the customers and guarantors prior classification of loans

- Periodical visit to the customer to maintain relationship and supervision of supplied goods/items

- Call Center of Head Office Recovery Unit of Retail Banking Division is currently handling only overdue (Standard) and SMA (Special Mention Account) files with the help of 79 Collection Executives. There are also six outsourcing agents such as Standard Credit Collection Agency, Smart way, Quorum Financial Services Limited, Intelligent Credit Care Advance Business Snipers Secures Limited and Legal Care Services Limited also involved in recovery of overdue and all types of classified loans as referred to them by the management.

- Legal actions to be taken after all possible efforts to recover the Bank’s dues have in vain

Steps against defaulters:

If a borrower fails to pay 3 (three) installments consecutively he/she consider as a defaulter. Prime Bank Limited usually follows the following guidelines for treatment of its overdue installments:

- Telephone contact

- Cheque bounce letter

- Overdue recover letter

- Letter of guarantors

- Letter to authority

- Legal notice to borrower and guarantor

- Suit notice

Prepayment:

Customers can repay the loan before maturity of the loan. In case of early payment bank has to face reinvestment risk. That is from the early payment of a loan bank gets an unanticipated fund that may not be invested at the previous rate, because interest tends to decline over time because of the growing competition among banks. But Prime Bank usually welcomes the early repayment of loan and offers a rebate of interest amount as well as no prepayment penalty is to be charged like other banks. The reason behind this is that Prime Bank tries to avoid classified loan even at the cost of losing some profit and receiving risk just to maintain its credit history and good rating.

Present position of Prime Bank Loan and advances:

- Position of loan and advances of 2013 as follows:

- Total loans and advances 153,588.76 (taka in millions)

- Credit deposit ratio is 76.07%

- Percentage of classified loans 5.09%

- Amount of classified loans 7,814.50 (taka in millions)

- Provision kept against classified loans 3,342.05% (taka in millions)

- Interest income on house building loan is 586,329,448 tk.

- Particularly in retail loan the interest income was 1,915,282,906

Products of Corporate Credit in PBL:

Corporate credit department in Prime Bank Limited:

- Lending sector: In this sector loans and advances have been divided into three major groups:

- Term loan: These loans were made by the bank with fixed repayment schedules. The term loans are Short term, Medium term and Long term with a different time period.

- Continuous loan: It has no fixed repayment schedule but it has limit and expiry date which can be renewable according to customers demand.

- Demand loan: In this kind of loan which is repayable on demand by the bank and no fixed installment or repayment schedule are laid down. Forced loan are also treated as demand loan.

- Agricultural sector: This facility is given to the customers who are doing agro business. It is also divided into two sectors. They are:

- Loans to primary producers and

- Loans to dealers/distributors

- Term loan to large and medium scale industry: For long term financing and capital formation of new industries who manufacture goods and services, the term loan is provided to them. For example: Tea gardens, leather industries, plastic industries etc.

- Term loan to small and cottage industries: For small and cottage industries they allow the industries which do not exceed 30 million tk. and equipment do not exceed 10 million tk.

- Working capital: Here the purpose of providing loan is to meet their working capital requirements according to their business size.

- Export credit: In this sector loan facilities are given to export all items against letter of credit. It is accommodated under the heads of Export Cash Credit, Packing Credit, and Foreign Documentary Bill Purchased etc.

- Commercial lending: This credit is allowed for commercial purpose businesses such as local trade, import business, service establishment etc. Medium and long term loans are not allowed here. They can get loan in the form of Loan against Imported Merchandise (LIM), Loan against Trust Receipt (LTR), Secured Overdraft (SOD), and Cash Credit etc.

Types of corporate credit facilities: All the credit facilities have been brought under two major groups: 1) Funded Credit and 2) Non-funded Credit.

- Funded credit facilities: It is a kind of facility which involves direct outflow of bank’s fund on account of borrower refers to funded credit facility. The facilities are:

- PAD (Payment Against Documents): It is a short term advance connected with import through L/C. The L/C issuing bank is compelled to pay for the import bills when these are presented for payment. By creating PAD the issuing bank will lodge the in-order shipping documents in their book.

- LTR (Loan against Trust Receipt): This facility allowed for retirement of shipping documents so that the importer can release the imported goods through Letter of Credit. Then it needs to be adjusted with PAD liability and it’s known as LTR.

- SOD (EM) (Secured Over Draft (Earnest Money)): This facility is allowed by issuing payment order/demand draft/ special deposit receipt in favor of bid security.

- PC (Packing Credit): It is a short term facility allowed to customers against export L/C and firm contract for processing/packing/shipping of goods to be exported. It must be adjusted from proceeds of the relevant exports.

- FBP (Foreign Bill Purchase): Payment made to a customer through purchase of Foreign Currency Cheques/Drafts.

- Over Draft (Export): This facility is allowed for making import payments including L/C liability in foreign currency against export L/C.

- Loan (General): This is mainly allowed to accommodate term financing, when the other term financing modes are not applicable. Loan facility may be allowed to meet short, medium and long term requirement for the customer.

- House Building Loan (commercial): Term loans allowed for purchase of commercial space or construction of house for commercial purpose.

- ECC (Export Cash Credit): This facility is allowed to a customer for processing of export of goods. It must be adjusted from proceeds of the relevant exports.

- SOD (FO): It stands for Secured Over Draft (Financial Obligation). This continuous credit limit is allowed against financial obligations such as FDR, MBDR, Scheme Deposit of bank.

There are more Funded Credit Facilities, they are OD General, Cash Credit (against Hypothecation), SOD (Work Order), Hire Purchase, Lease Finance, OD (Export) etc.

- Non-Funded Credit Facility: It is a kind of credit facility which involves direct commitment of bank on behalf of customer for payment to third party in case of under some conditions refers to non-funded credit facility. The facilities are:

- Letter of Credit: This is an obligation undertaken by the Bank to import any allowed items on behalf of the customer from both local and foreign sources. There are some kinds of L/Cs which are practicing in PBL. They are: Sight L/C, Deferred Payment L/C, Back to Back L/C.

- ABP (Accepted Bills for Payment): It is an acceptance which is made by the bank for payment. After a certain period through DP L/C against shipping documents for import the payment can be done.

- Bank Guarantee: BG is an unconditional responsibility given by the bank. The task is for the beneficiary on behalf of their customer to pay a specific amount of money if beneficiary claims that the customer is failed to complete the task and as a guarantor bank should pay that amount. There are many kinds of bank guarantee that PBL follows:

Bid bond, Performance Guarantee, Advance Payment Guarantee, Retention Money Guarantee, Payment Guarantee, customs guarantee etc.

Differences between retail and corporate credit in Prime Bank Limited:

In terms of defaulters:

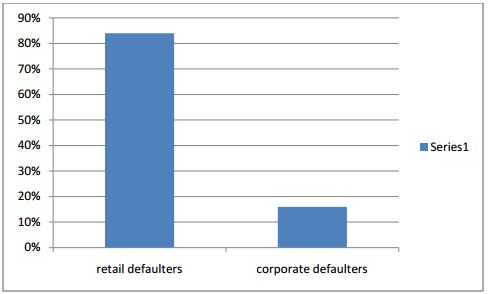

The numbers of defaulters are more in retail credit than corporate credit. In 2014 the percentages of defaulters in retail credit were 84 % which is larger than corporate credit. And the rest (16%) defaulter was in corporate credit. The reason behind the many defaulters in retail credit is mainly the interest percent of the loan. Somehow it is difficult to borrower to carry this high interest rate so they skip their repayment and outstanding increase day by day. In corporate credit that has loan account, they take loan against their SOD, FDR, PMS etc. account. If they are failed to repay their terms then outstanding will increase day by day. As the limit in corporate credit much higher than retail credit so people try to repay the loan on time so that they do not fall in any problem. In retail credit people mainly default in home loan. They buy their home by taking loan but they got upset because of their service and because of this the numbers of defaulter increase.

The defaulter’s percentage in retail credit and corporate credit (retail 84% and Corporate 16%)

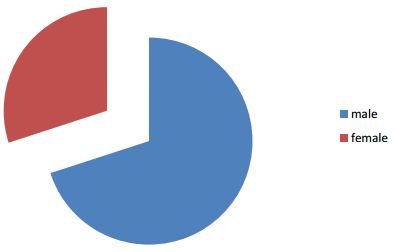

In terms of male/female: In Prime Bank Limited the number of male borrower is more than female borrower. If we consider the percentage then it is 70% of male borrower and 30% is female borrower.

Male borrower is 70% and female borrower is 30%

The pie chart is showing the percentage of male and female borrower in Prime Bank Limited. As in our country most of the male are the only income person in family so they took loan in their name so that he can easily get the loan from the bank.

In corporate credit the customers are mainly the organizations, companies and NGOs but they have also individual customer. In corporate credit the percentage of male and female borrower is same. Both of the borrowers (male and female) mainly take home loan, car loan and any purpose loan. In terms of home loan the percentage of male borrower is 77.3% and female borrower is 22.7%. In terms of car loan the male borrower is 85% and female borrower is 15%. In terms of any purpose loan the male borrowers are 60% and female borrowers are 40%.

Findings:

- The information about customer is not taken properly like valid address and live contact numbers. That is why the chance of default loan accounts increase.

- The server they use “Globus Temenos” for daily transaction is not developed enough.

- They give too much attention to car loan and home loan, which is good but on the other hand it is risky only concentrate in few products. • The activities of some of the branches are slow

- Some customers complain to the employee that they are not satisfied with their service like money transfer from one branch to another branch or account.

- The formalities to open a bank account or loan account is very much hectic because of formalities, sometimes it takes time to finish the process.

- Some employees are given too much pressure work

- To call the defaulters they have no extra rooms, so the work environment spoils when they communicate with the defaulters.

- The number of ATM booths is less than other bank’s ATM booths.

- Software system and hardware should be more up to date. Their IT team needs to provide more flexible and efficient service.

- Sometimes the credit term and conditions seems more critical for the customer.

They should concentrate more in retail credit defaulters.

Recommendations:

Since its beginning Prime bank Ltd. Has been performing impressively with their well defined organizational structure, management system, business model supported by clear and smart strategies and their timely execution. Still there are some challenges that Prime Bank Ltd. Is going to face in near future for further expansion.

Following are some recommendation that will help Prime Bank Ltd. to hold leading position among the private commercial banks in Bangladesh:

- The interest amount should be reduced by the bank like Dhaka bank it is 13%, MTBL it is 10%.

- The information about customer should be taken more properly.

- They should concentrate equally all kind of products.

- The server and hardware or computers they use should be more developed.

- The banking sector in Bangladesh is undergoing significant changes. For those sudden changes and future risks bank should take steps to recover them.

- Continue to do the business that they do well. Their exposure in corporate business will be better managed.

- Expand into areas of potentialities such as retail and SME business

- Enter new sectors like micro finance in collaboration with NGOs

- Explore innovative ideas

- Continued focus on IT development for efficient customer service and expand to larger customer base

The Prime Bank Limited is one of the largest local banks in our country. For any kind of loan and advances PBL is always preferred by people who preferred local banks. The banking sector plays an important role in the success of economic development of the country. But this sector has been suffering from so many problems like corruptions, unsatisfactory performance level or overdue loan, poor recovery rate and unethical and illegal influences in decision-making process etc. These problems can be overcome through increasing employees’ efficiency by training & motivating, enhance recovery rate, strictly prohibiting unethical & illegal influences in decision making process etc.

There is no alternative of skilled, trained and professional manpower. So, continuous training, learning and development are essential for Prime Bank Ltd. to enrich knowledge and develop skills and competences to succeed in today’s dynamic banking world and to compete with multinational banks. To reach its expected goals, Prime Bank Limited has to compete with multinational and foreign banks along with local bank. After all, PBL must put special attention to its employees, customer segmentation, service quality and IT and R&D sector. Corporate banking is a useful scheme for the organizations to reduce the risk. Organizations are growing gradually and taking financial risks, Prime Bank is giving them an opportunity to growth and step ahead through providing money and guarantee. Retail credit scheme also contributing the value to the people’s life. The demand of various kinds of product or in emergency people needs money to overcome their problems. Retail loan is solving their problems by providing money for their needs.

To run the economy of a country people need money and the security of collecting money and PBL is helping them through loan and advances. The customers of Prime Bank are taking advantage of different scheme and they are fulfilling their needs by money. To gain the highest peak of success PBL should spread their service to the people and organization and they should be more flexible dealing with the customers and give them their best services.