Ratio Analysis of Standard Chartered Bank

SCB has a history of more than 150 years. The name Standard Chartered has came from two distinct original banks. The portions “STANDARD” and “Chartered” stems from the “Chartered Bank” of India, Australia and China; the rest came from the “Standard Bank” of British South Africa.

Chartered bank was established in 1853 by a Royal Charter granted by Queen Victoria of England. The main person behind the Chartered Bank was a Scot, James Wilson. He kind of foresaw the advantages of financing the growing trade links with the areas in the East, where no other financial institution was present that time widely.

VISION OF SCB:

Vision of SCB is to focus on getting the basics of banking right making sure that they’re financially stable with strong governance, so that they can create value for their shareholders and society in the long run. So, their brand promise is to be the right partner.

Mission of SCB is to run the operations well; standing by their clients and investing in local communities by providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver excellence in banking , so they can be a powerful force for good.

MISSION OF SCB

SCB’s objective and brand promise is “Here for good”, and is the essence of who they actually are. It’s about sticking by their clients through good times and bad, and always trying to do the right thing.

OBJECTIVE OF SCB

Standard Chartered Bank’s brand promise is “Here for good”, that underpins everything they do.

BRAN PROMISE OF SCB:

VALUES OF SCB

As SCB strives to be the world’s best international bank, it’s important to them that they conduct their business to the highest standards and are guided by their core values. To do so they act in an open, innovative and collaborative manner to advance the best interests of our clients. SCB has five stated core values:

- Courageous

- Responsive

- International

- Creative

- Trustworthy

PRIORITIES

Standard Chartered Bank uses their business model to make a difference in three ways:

- By contributing to sustainable economic growth; providing finance efficiently and responsibly, they contribute to sustainable economic growth and job creation. They are committed to supporting the clients and customers; helping businesses to set up, expand and trade across borders.

- Being a responsible company they want to deliver long-term value for shareholders and society. This means having the right culture, structures and processes in place to ensure that they practice strong governance, serve the clients and customers well and provide a great workplace for their people.

- Investing in communities; their sustainability as a business is closely intertwined with the health and prosperity of the communities where they operate. Through the employee volunteering and community investment programs they work with partners to deliver programs that promote positive social and economic outcomes for people in their wide markets.

OBJECTIVES OF THE REPORT:

To provide an overview of Standard Chartered Bank

- To focus on the services, products, work environment provided to the employees or customers at SCB

- To understand the functions of SCB

- To determine the profitability, cost ratio, credit performance, liquidity etc.

- To identify the financial performance of SCB

- To determine the market position of SCB

- To identify the competitive market or environment of SCB

DATA COLLECTION METHODOLOGY

As I have been working there for three months, it was some extent to hassle free to collect the financial information from the MIS and Finance department.

There are two types data have been used here to conduct the analysis:

- Primary data:

The primary sources are:

- Interview with the employees of SCB

- Conversations and discussion with the seniors and finance department

- Secondary data:

Secondary sources are:

- Annual report of SCB

- Internet browsing

- Various other reports related to the performance of SCB

FINANCIAL PERFORMANCE MEASURE:

A tool used by individuals to conduct a quantitative analysis of information in a company’s financial statements. Ratios are calculated from current year numbers and are then compared to previous years, other companies, the industry, or even the economy to judge the performance of the company. Ratio analysis is predominately used by proponents of fundamental analysis. (Investopedia)

To do an analysis, the following ratios and values have been calculated:

ROA, ROE, Net Interest Income, cost to income ratio, deposit run off ratio, net interest I\income as a % of TRGA, net non interest income as a % of TRGA net loans to asset ratio, net loans to deposit and borrowings, Earnings per Share, price earnings ratio, interest sensitive gap, relative interest sensitive gap, interest sensitivity ratio, investment maturity strategy, liquidity indicators and Tier 1 or Core Capital.

ANALYSIS:

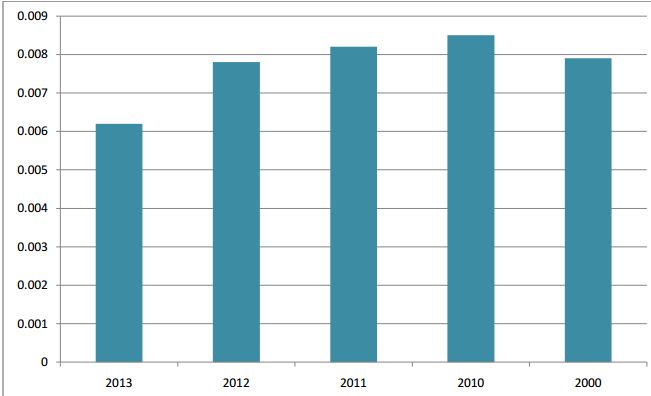

Return on Assets (ROA):

It shows how capable the management of the bank has been in converting the institution’s assets into net earnings, as it calculates how much a bank earns using 1 unit of assets. Here the return on asset has a fluctuating trend. It varies between .0062 to 0.0085 between the years of 2013 to 2009 and being its highest in 2010.

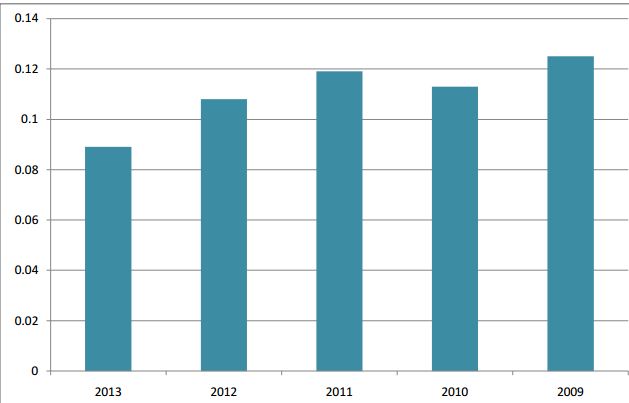

Return on Equity (ROE)

The trend shows that SCB had a fair return on equity ratio in 2009 to 2011 but it was not enough as it started to fall from 2012 and it is least at 2013 with 8.9% where as it was 12.5% in 2009. The reason could be the shortage of profits and as a result net income had gone down. Another reason could be the effect on ROE due to the new instruction of Bangladesh Bank to limit the Credit Deposit Ratio within 85%. So the banks have to take deposit in higher competitive rates.

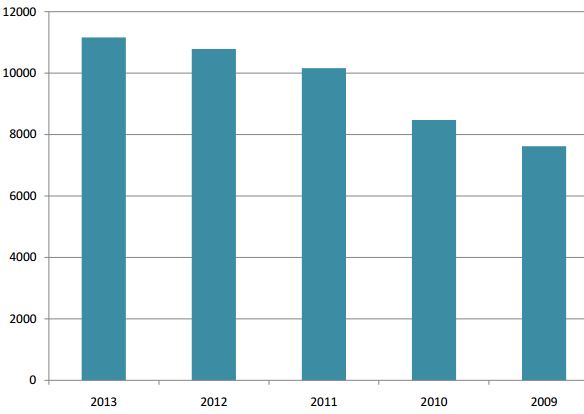

Net Interest income:

When a bank’s assets and liabilities do not re-price at the same time, the result is a change in net interest income. And the net interest income of banks is more sensitive to changes in interest rates than others. Here SCB’s net interest income shows an increasing trend from 2009 to 2013. The higher the ratio is the better for the company because the trend shows a high amount of net interest income which is based on SCB’s smooth operation on the focused investments and service.

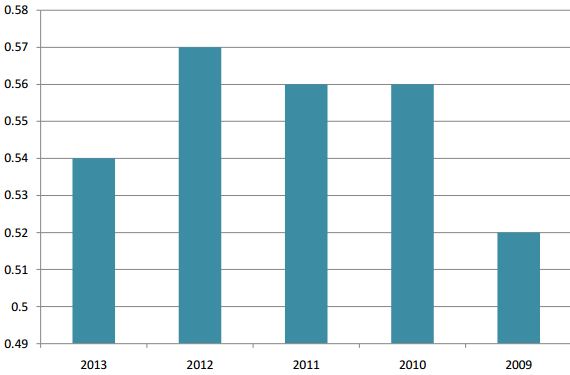

Cost to Income Ratio:

Cost to income ratio is only affected by banks cost but also by the variations in income. For any given level of cost relative to a bank’s assets, a reduction in income will cause cost to ratio to increase. Here we can see that the least cost to ratio of SCB was in 2009 and then it increased during 2010 to 2012 and in 2012 it was highest in last five years then again it reduced to a great extent in 2013. It might be a reason of ineffectuality in generating income by the bank or it could be a reflection of change in the competitive conditions reducing the margins available to banks. But this downturn can also be defined from the insight of economic downturn during 2010-2012 that has reduced the opportunities of banks to undertake profitable business from which to earn interest and fees. But it again started to go downwards in 2013 which is good.

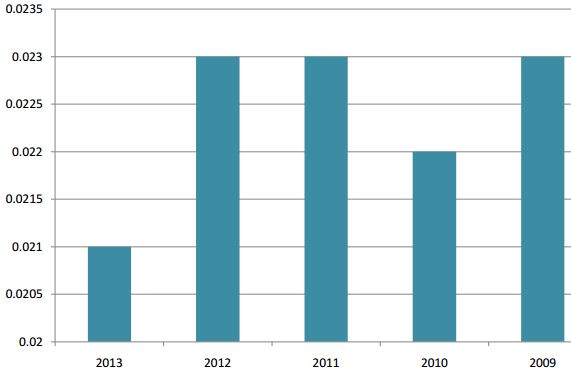

Net interest Margin:

The net interest margin is used to track the profitability of bank’s investing and lending activities over a time period. SCB’s net interest margin declined from 2.30% in 2009 to 2.10% in 2013. Also the yields on its assets that generate interest income declined from 3.9% to 3.4% over this period, it increased its reliance on low-cost deposits and short-term debt, and reduced its use of higher-cost long-term debt, lowering its funding costs more than the interest income on its loans and investments.

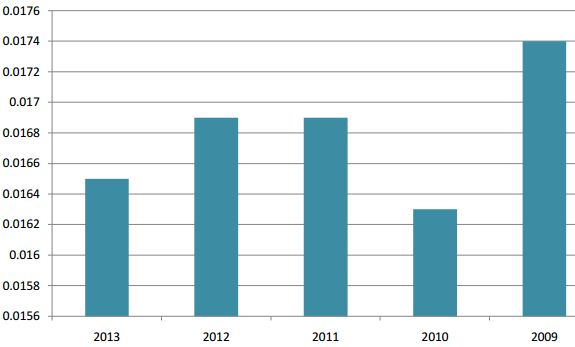

Net Interest Income as % of Total Revenue Generating Assets:

Net interest income as % of TRGA shows how a bank’s net interest income is increasing by utilizing its revenue generating assets. This particular ratio also shows a fall on the 2010 than again it rose in 2011 and became stable in 2012 as well but there is a slight fall in 2013 from 1.69% to 1.65% rate which happened probably because of the slow pace in the economic growth of the year.

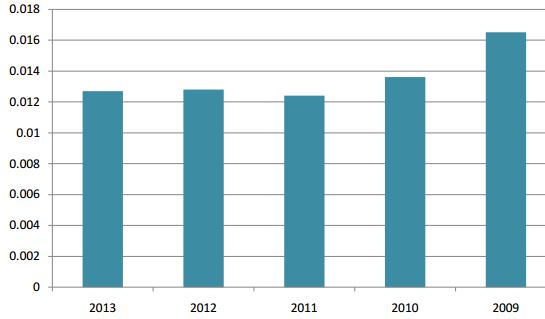

Net Non Interest Income as % of Total Revenue Generating Assets

Net non interest income as % of TRGA shows here the fluctuating trend over 5 years. The highest amount of NNII as % of TRGA is in the year of 2009 which explains that SCB’s main earning revenue sources were non operating income on that particular year, which has both positive and negative sides, because non operating income is not the main source of income of a company. But from the year of 2010 to 2013 the trend has become somewhat stable between 1.36% to 1.27%.

Job Part

In Standard Chartered Bank, my main specific task was related to reporting foreign direct investment (FDI) returns and related rationalized input template (RIT) for Bangladesh Bank. For this task at first I had to check client’s financial statements, relevant encashment papers & documents that have been attached with the company’s FI-1 form (A Foreign Investment related form of client’s financial information). It was also important to check that those papers were signed by any authorized person of the client’s company or not. At the same time my task was to find out the similarities between given financial statements & documents information with the FI-1 form’s information that has been given by the client’s company.

For the purpose of RIT input, after getting proper financial information from the client I had put that information in rationalized input template (which is a standardized non-executable file type used by computer designed file as a pre-formatted example on which to base other files.)

The template of FI-1 form is provided by the Bangladesh Bank. The task is easy to understand but for this it is mandatory to study their circular about FDI returns & related RIT and to follow their guidelines. Being a student of finance it was very easy for me to understand but had to clear and properly understand all the terms and follow as far mentioned in the Bangladesh Bank’s circular and guidelines.

On the other hand, client sometimes provides misleading information so after checking the template report, to ask for clarification and to ask to put down the information in right way even if required I had to contact with the clients.

Another task for me was to make a full copy of client’s submitted papers like FI-1 form, financial statements, company documents, encashment papers etc for both Standard Chartered Bank and Bangladesh Bank. Because for the purpose of the bank, the main copy of the clients papers is required to have in Standard Chartered Bank as a proved file. And the photocopy files are required submitting in Bangladesh Bank for further checking. So I had to make copies of the reports.

Apart from working in Project and MIS division I had also worked with the investigation team; there my tasks was;

- Swift massage sorting and reconciliation

- Delivery of the swifts to the other units

- Manual voucher reconciliation

- NOSTRO recon

- Amendment message releasing and delivery

- Photocopy of other messages and delivery

- Paid ITT finding through system

- Client query handling and visit

CRITICAL OBSERVATIONS AND RECOMMENDATIONS

It was very good experience working in Standard Chartered Bank. The supervisors, seniors and colleagues are very helpful and supportive every time I wanted to learn something new. While working there I have noticed some critical aspects of their work, which are:

- No work has ever left pending for the next working day, unless it is absolutely necessary.

- The work processes could be more prompt and faster if they use upgraded software and operating systems.

- Performances are continuously appreciated by the seniors that eventually motivate the employees to work well further.

- There is always a rush of customer throughout the day so as a result sometimes the sequence of work among the employees varies a lot.

- The supporting staffs should do their own staffs rather taking continuous help from their colleagues because it hampers the work of others.

- They should maintain proper schedule of work and meet the deadlines, for this they should take necessary measures to make the clients understand.

LIMITATIONS OF MY WORK:

- If I go specific then while working on FI-1 reporting, I found out that there are no proper guidelines given from SCB except the guidelines of Bangladesh Bank to their clients about how to fill up the forms

- There is lack of electronic equipment’s like computers

- There is limited scope where you can imply your knowledge, thoughts and

innovations

- It is a chain of work where if one breaks the other eventually collapses

- The customers not that much supportive as they are a little bit of denial to except or understand the importance of FI-1 reporting, as a result they often provide wrong or misleading information

Conclusion and Recommendation:

By observing and analyzing the overall performance and profitability of Standard Chartered Bank Limited, it can be said that net interest income shows an increasing trend over the five years, which is good for the bank and shows smooth operation of the investments and that the expenses are controlled.

A decreasing ROA indicates less profitability. As ROA is derived from net income and assets, so to improve the return on assets, they can increase net Income without acquiring new assets or improve the effectiveness of existing assets. As the more SCB generates in fees, the more it may concentrate on activities that carry high fixed costs. The degree to which SCB is able to leverage its fixed costs also affects its efficiency ratio; that is, the more scalable it would be, the more efficient it would become. .

In year after year they are trying to improve themselves by establishing a sound capital base. They are trying to make their products and services more lucrative to their customers. And they are rewarding their shareholder’s by enhancing their wealth and attracting more investors by their bank performance.

They follow a front-end load maturity strategy where more than 80% of the investments are short and medium term investments which say that SCB prefers higher liquidity to higher profitability. But that is something that they might face trouble with as shown by the analysis of liquidity indicators. The Cash Position Indicator shows fluctuation in the graph and in 2011, 2012 and 2013; it is gradually decreasing which means the liquidity position of the bank is unstable over the years. This problem can be solved by finding out ways to lower the costs of overhead like advertising, professional costs and rent. However, since the bank is well capitalized with sound investments, this after all might not be a major problem for a bank that operates for 150 years with excellence and expertise.