Executive Summary

Nestlé Bangladesh Limited is a leading food company with lots of global strategic brands operating in Bangladesh. NIDO is one of the strategic brands of Nestlé Bangladesh Limited. In Bangladesh, NIDO is one of the largest profit-making categories of Nestlé Bangladesh Ltd. To reach to more consumers and to better satisfy the needs, NIDO is trying to implement some of the exceptional promotional programs such as ‘Ashun NIDO Pushti Jagate’ and ‘NIDO Growth Program’. This research is being carried out with an intention to evaluate the effectiveness of these programs into two different regions of Bangladesh. By talking with the mothers before and after attending the programs and also by interviewing them personally whenever it was convenient, it was being tried to find out whether there is any differences between the pattern of choices between this two region.

1.2 Origin of the Report

This OCP report has been prepared as the fulfillment of the partial requirement of M.B.A Program as authorized by the Director; OCP Committee of the School of Business. This report is based on an OCP program. Department of Business. Administration, IIUC (DC), arranges OCP program in attachment with its students after the completion of theoretical. In this particular report, the author is an intern of the previously mentioned program and the concerned organization is NIDO Milk Limited, one of the leading Milks in Bangladesh. Hence I was placed in NIDO Milk Limited Main Branch from February 17, in way of delegation; responsibility of carrying out the study has conferred upon the concerned intern.

1.3 Objective if the study

This report has been prepared considering a number of objectives. The objectives are:

- To present an overview of NIDO full cream milk powder.

- To observe on current market position of NIDO full cream milk powder in two different parts of Bangladesh.

- To observe the choice patterns of two different parts of Bangladesh.

- To compare between NIDO full cream milk powder and other brand of full cream milk powder regarding brand awareness, Quality of the product, price of the product, communication and promotional choice.

- To demonstrate different aspects of marketing plan for NIDO full cream milk powder in Bangladesh.

1.4 Methodology:

For the organization part, much information has been collected from different published articles, journals, brochures and web sites. All the information incorporated in this report has been collected both from the primary sources as well as from the secondary sources. I have presented my experience and finding by using different charts and table, which are presented in the analysis part.

Research method: This was totally a Descriptive Research. The following technique of Descriptive Research was followed:

Questionnaire Interview: The research was totally based upon the questionnaire. The selected participants were been interviewed by a group of pre-selected questionnaire. There were both Close-Ended as well as Open-Ended question’s to conduct the depth interview; I always tried to maintain the 7 c’s (Communication, Cooperation, Confidence, Candor, Closeness, Continuity, Creativity)

1.5 Data Collection Method:

Relevant data for this report has been collected primarily by direct investigations of several consumers and different personnel. The interviews were administered by formal and informal discussion

- Personal observation

- Face-to-face conversation with the consumers and distributor of two different areas.

- Practical work experience in the different locality and supper shop.

1.6 Scope of the study:

The key focus of the report is the company’s strategic brand NIDO. It covers the following aspects:

- Analyzing only the FCMP (Full Cream Milk Powder) market of Bangladesh.

- To have a view of the whole market, particularly the participants of Dhaka and Narayangong were being selected.

1.7 Limitation:

It is the reality that it is not humanly possible to attain one hundred percent perfection, to reach the acme of excellence, or to ensure one hundred percent quality. However, although there has been no dearth of sincerity, devotion, and seriousness on my part, but at the outset it is to be declared that the study as well as the resulting research paper is not entirely flawless.

The chief limitation of this paper includes the collection of primary data. As I was working alone it was difficult to reach all the targeted houses and interview the mothers.

Secondly, time constraint is another limitation restricting this report from being more detailed or analytical as most of the time had to spent in work place.

Company & Brand Orientation

|

2.1 Company Background

Nestle is the world’s largest food company involved in nearly every field of nutrition, with a turnover of 88 billion Swiss Francs. It is largest not only in terms of its sales but also in terms of its product range and its geographical presence. Its field of nutrition includes infant formula, milk products, chocolate and confectionery, instant coffee, ice-cream, culinary products, frozen ready-made meals, mineral water etc. Nestle is also major producer of pet food. In most of these product groups and in most markets, Nestle is the leader or at least a strong number two. Nestle is focused company with more than 94 percent of the sales coming from the food and beverage sector. Nestle is present around the globe, on all continents, with around 230,000 people working in more than 84 countries with 468 factories and with sales representatives in at least another 70 countries. Most popular brands of Nestle are Nescafe, NIDO, Maggi, Polo, Smarties, Milo, Perrier, Friskies, Kit Kat, and Crunch. Some of their products have broken records: 3,000 cups of Nescafe are consumed every second, and Kit Kat merited an entry in the Guinness Book of World Records as the world’s best selling chocolate bar, with 418 Kit Kat fingers eaten every second around the world.

Nestlé Bangladesh Limited is a wholly owned subsidiary of Nestlé S.A. Switzerland. In Bangladesh, Nestlé imports pure coffee, confectionery; repacks infant nutrition, full cream milk powder and manufactures culinary products. The popular brands in Bangladesh are Nescafé, Kit Kat, Polo, Cerelac, Lactogen, Maggi and NIDO in these categories. The factory of Nestlé is located in Sripur, about 55 kilometers from capital city Dhaka. Nestlé Bangladesh Ltd. has a vision of becoming the number one Food and Beverage Company in the country.

2.2 History of Nestle

Nestlé is an international company with its headquarters in Vevey, Switzerland. In 1867 Henri Nestlé, a chemist from Frankfurt who had settled in Vevey, became interested in infant feeding. To satisfy a clear need, he developed and produced a milk-based food for babies whose mothers could not nurse them. The new product soon became well- known worldwide under the name of “Farine Lactee Nestlé “ (Nestlé Milk Food).

In order to expand into a broader product category and meet more people’s needs, the Nestlé Company’s first diversification occurred in 1905 when it merged with the Anglo- Swiss Condensed Milk Company (est.1866). Today, processing milk food is still the company’s chief activity together with the other products of Nestlé family such as chocolates, instant milk-based drinks, culinary products, frozen foods, ice cream, dairy products and infant foods.

Nestlé is still primarily concerned with the field of nutrition, but it has also acquired interests in pharmaceuticals and cosmetics industries.

As a result of the company’s initiative and bold activity, it has grown into a large organization, employing almost 230,000 people in nearly 500 factories worldwide. Nestlé products are now widely distributed on all continents and sold in more than 100 countries.

2.3 About the founder of Nestle

Henri Nestle (1814-1890) is the founder of world’s largest food company. Henri Nestle was 53 by the time he developed the infant cereal that was to make his name a household word. The Nestle family originally came from Sulz on the Neckar in Wurttemberg Germany. Most of Heinrich forebears were glaziers. In the local parish registers the name is written in a variety of ways – Nastlin, Nastlen, Nestlin, and Nestlen. It was not until Heinrich’s grandfather Johann Ulrich (1728-1816) moved to Frankfurt am Main in 1755 that “Nestle” (“little nest”) became the accepted family spelling. After settling in Switzerland, Heinrich gave the name a French accent. Writing it as Nestle, the form henceforth used in used in Switzerland and changed Heinrich into Henri.

By the time Henri was born, five of his brothers and sisters were already in their graves. As a result Nestle made it his life’s work to fight with the high infant mortality of the times leading to his invention of infant cereal. Nestlé’s interest in baby food was decades away. The children did not actually die in infancy. They were victims less of malnutrition or gastrointestinal infections than of contagious diseases such as diphtheria, scarlet fever, measles, and whooping cough. Moreover, when he made his invention Nestle was not looking for a cure but trying to improve the state of infant nutrition.

2.4 Nestle in Bangladesh

Nestle Bangladesh Limited started its first commercial production in Bangladesh in 1994. In 1998, Nestle S.A. took over the remaining 40% share from the local partner and Nestle Bangladesh became a fully owned subsidiary of Nestle S.A.

Nestle Bangladesh’s vision is to be recognized as the most successful food and drink company in Bangladesh, by generating sustainable, profitable growth and continuously improving results to the benefit of shareholders and employees.

The world-class factory is situated at Sripur, 55 km north of Dhaka. The factory produces instant noodles, cereals and repacks milks, soups, beverages and infant nutrition products.

2.5 History of Nestle Bangladesh Ltd

Popular Nestlé brands entered this part of the sub-continent during British rule and the trend continued during the pre-independence days of Bangladesh.

After independence in 1971, Nestlé World Trade Corporation, the trading wing of Nestlé S.A., sent regular dispatches of Nestlé brands to Bangladesh through an array of indentures and agents, and some of the brands such as Nespray, Cerelac, Lactogen, and Blue Cross etc. became household names.

In the early eighties Transcom Ltd. was appointed the sole agent of Nestlé products in Bangladesh.

In 1992 Nestlé S.A. and Transcom Ltd. acquired the entire share capital of Vita Rich Foods Ltd. Nestlé S. A. took 60 percent while Transcom Ltd. acquired 40 percent.

The name of the company was also changed at this time to Nestlé Bangladesh Limited. In 1998 Nestlé S.A. took over the remaining 40 percent share from Transcom Limited.

Today Nestlé Bangladesh Ltd. is a strongly positioned organization. We will continue to grow through our policy of constant innovation and renovation, concentrating on our core competencies, with the aim of providing the best quality food to the people of Bangladesh

2.6 Mission of the Company

Good Food for Good Life is the main theme of Nestlé’s business. Their mission statement is:

“Nestle is dedicated to providing the best foods to people throughout their day, throughout their lives, throughout the world. With our unique experience of anticipating consumers’ needs and creating solutions, Nestle contributes to your well-being and enhances your quality of life.”

Research is a key part of our heritage at Nestlé and an essential element our future. We know there is still much to discover about health, wellness and the role of food in our lives, and we continue to search for answers to bring consumers Good Food for Good Life.

Vision of Nestle in Bangladesh

Vision—what we want to be “To be the very best Food, Beverage and Nutrition Company in Bangladesh”

We will not rest until our consumers, our customers, our suppliers, our shareholders and our employees judge our company to be the very best. Nestle Bangladesh’s vision is to be recognized as the most successful food and drink Company in Bangladesh, generating sustainable, profitable growth and continuously improving results to the benefit of shareholders and employees. Today Nestlé Bangladesh Ltd. is a strongly positioned organization. The Company will continue to grow through our policy of constant innovation and renovation, concentrating on our core competencies and our commitment to high quality, with the aim of providing the best quality food to the people of Bangladesh.

2.8 Objectives of Nestle

- Nestlé does not favor short-term profit at the expense of successful long-term business development.

- Nestlé recognizes that its consumers have a sincere and legitimate interest in the behavior, beliefs and actions of the Company behind brands in which they place their trust and that without its consumers the Company would not exist.

- Nestlé believes that, as a general rule, legislation is the most effective safeguard of responsible conduct, although in certain areas, additional guidance to staff in the form of voluntary business principles is beneficial in order to ensure that the highest standards are met throughout the organization.

- Nestlé is conscious of the fact that the success of a corporation is a reflection of the professionalism, conduct and the responsible attitude of its management and employees. Therefore recruitment of the right people and ongoing training and development are crucial.

- Nestlé continues to maintain its commitment to follow and respect all applicable local laws in each of its markets.

Nestle brand

Quality is an essential ingredient in all the Nestlé brands and also Nestlé brands maintain

nutritional balance in a fast pace world, that is why people around the globe choose. The detail of the

Nestlé brand is as follows:

- Baby foods (Nestlé Cerelac, NAN)

- Breakfast cereals (Nestlé Cereals)

- Dairy products (Milkpak, NIDO, Nespray, Nestlé Yogurts, Everyday)

- Ice-creams (Movenpick, Dreyer’s)

- Chocolate confectionary (Kit Kat, Smarties, Toffo)

- Beverages (Nescafe, Milo, Nestlé juices)

- Food service (Nestlé Jumbo Bottle)

- Prepared foods (Maggi, Powered Soups)

- Bottled water ( Nestlé Pure Life, Nestlé Aquarral)

- Pet care (Pro Plan, Purine, ONE, Fancy feast, Dog Chow, Cat Chow, Felix, Alpo)

- Pharmaceuticals (Ophthalmic drugs, lens-care solutions & optical surgical Instruments

Current status

The first, Nestlé, holds the financial shares in the allied companies. It also check the

profitability of these companies and to ensure the profitability of the group as whole

The second, Nestlé, has two areas of activities that are as follows:

- Research and technological development

- Technical assistance

Beside this, it provides know-how in engineering, marketing, production, organization, management and personnel training on a continuous basis.

The third company is Nestlé World Trade Corporation that oversees the import and export of merchandise worldwide.

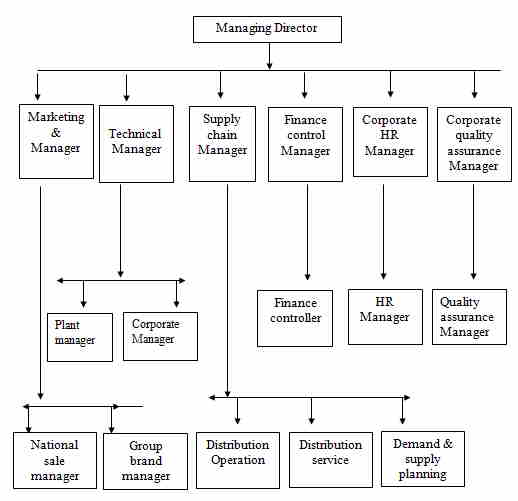

ORGANOGRAM:

2.7 Brand Background

The brand NIDO was first launched as a whole milk powder in Switzerland in 1944, and was progressively introduced in other countries thereafter Czechoslovakia 1947, Panama 1948, Egypt 1951, Mexico 1951, Morocco 1953, and Lebanon 1959 etc. Other brands of similar milk powders were introduced in some markets at around the same time-like Nespray (Great Britain 1948, Malaysia 1950, South Africa 1958), NINHO (Brazil 1965), NEST (Germany 1948) and SUNSHINE (Australia 1939).

In terms of usage and positioning, these products have followed an evolution path from all purpose whole milk powders to nutritious full cream milk powders for all family consumption to the current positioning of NIDO as a milk brand for nutrition of pre-school and school-age children. The introduction of age segmented growing Up Milks under the NIDO/NESPRAY/NINHO range of brands has further strengthened this evolution of brand positioning and usage, and should ensure its future evolution as a milk brand for the nutrition of children.

2.8 Product Attributes

NIDO milk products should meet the nutritional, organoleptic and convenience requirements of children 1-12 years of age. In addition, specific products are designed for the three life stages of the target: the toddler years (1 to 2 years); the pre-school years (3-5 years); and the school years (6 to 11 years).

Core Values of NIDO

NIDO Means:

- Holistic Development-NIDO has the nutritional goodness that helps the child grow up healthy to face the challenges of life. It is specially formulated for complete development of children.

- Experience & trust-NIDO benefits from Nestlé’s nutrition and milk products know how. It has been in the family for generations and has always symbolized the guarantee of constant premium quality.

- Maternal Love & Wisdom- NIDO is an intelligent and loving choice by the mother to give her child the best. It is motivated by an ongoing and deeply felt love between mother and child.

- Brand Personality:

NIDO is:

- Warm & caring- NIDO understands that bringing up a child is a mother’s main concern and it acts as a close companion to help her accomplish this aspiration task. It is not elitist. It has deep human feeling.

- Dependable-NIDO is reliable and will always find ways to satisfy the nutritional needs of growing children.

- Experience-NIDO is knowledge and is a recognized authority around the world on child feeding and well being.

- Positive-NIDO shares the positive outlook on the world and aspiration that come from the joys and hopes of parenthood.

- Specialized & Evolving- NIDO understands that children have special nutritional needs that change, as they grow older.

- Universally liked-Both children and mothers like NIDO.

2.9 Marketing strategy of NIDO full cream Milk powder

Every organization has forms some strategy to follow. Nido is generally targeted at the growing, specially school going, children. Because children are fond of playing and as they done in growing age so they need of vitamins and calcium for the growth of strong bones and teeth.

Therefore, strategies adopted by NIDO that have proved fruitful are as follows:

- Consumer communication

- Product development

Company strategy to get mission

Innovation and renovation: Continuously revitalize their brands and products. Prioritize and launch successful new products that drive consumer needs. Achieve a 60/40+ quality advantage while making their products affordable to as many consumers as possible. Base all their marketing decisions on superior and actionable consumer insights.

Consumer communication: Improve the quality and quantity of our consumer communication investments to drive consumer demand and to increase awareness of our brands in the most cost effective way.

Product availability: Whenever, Wherever, However. Ensure that their brands and products have the widest and cost effective distribution possible.

Low cost, highly efficient operations: Follow a disciplined continuous improvement process that facilitates their ability to promote growth while reducing their delivered product cost and eliminating non value added activities

2.10 IMC planning and execution

The most flexible element of the marketing mix, Marketing Communications is the means by which companies attempt to inform, persuade, and remind consumers directly or indirectly about the brands. Below is the outline of all the commonly used marketing communication options:

Media Advertising:

- TV

- Newspaper

- Magazines

Place Advertising:

- Billboards

- Outdoor Posters

- Shop Signs

Point-of Purchase Advertising:

- Trade posters

- Shelf-talkers & Shelf-stickers

- Danglers

- Buntings

- Product Display Units

Trade Promotions:

- Trade Contests

- Push Money

- Incentives and complementary gifts

- Consumer Promotions:

- Premiums

Event Marketing & Sponsorships:

- Art & Talent programs

- Fairs

Publicity:

- Educational Program

Now let us discuss all the activities in detail that are applied for the Brand NIDO.

2.11 Media Advertising

TVC:

When it comes to TVC advertising, certain advertising tools such as TRP and GRP are use to select specific programs. For example, since the GRP is high for TV programs such as popular drama, and evening news, NIDO ads are aired during these programs. In terms of frequency, NIDO ads will be aired in all 12 months in 2006 and were aired in 9 months in the previous air.

Newspaper:

Two things are considered in selecting specific newspapers for NIDO ad-circulation and a subjective evaluation of which type of newspapers, specific NIDO target audience might read. In the last couple of year’s newspapers like “Prothom Alo”, “The Daily Star”, “Jonokontho” and “Jugantor” have received the most NIDO ads. In the case of magazines, the most widely ones used for NIDO ads include “Shaptahik 2000” and “Annodin”. However, in terms of frequency, print ads are used less frequently than compared to that of TVC’s. The reason is that print ads have less reach and ad/message recall among target audience. So print ads have only been used when there has been a requirement to communicate detail nutritional information and facts on NIDO and how it scientifically helps children grow.

2.12 Place Advertising

Place advertising has the objectives of increasing brand visibility and TOM awareness. However, less focus is given on this aspect since NIDO awareness among potential target market is quite high. Therefore, little is invested in this area. As of now, there is only one NIDO billboard, which located in the capital city. In total, there are 28 NIDO shop signs located around the country.

2.13 Point-of-sales Advertising:

POP advertising campaigns are carried out on numerous occasions through out the year. POP campaign acts as supporting advertisement when there is any new product launched and when there are any trade promotions. During trade promotions, retailers tend to stock up more than usual quantity of products and hence the POP materials are used to assist the product off-take from the retail shelves. POP materials are also used during trade display contests. The contents invites retailers to accumulate points on the number of product purchase, placement on shelf and proper and creative use of POP materials such as trade posters, shelf-talkers, buntings and danglers. In addition, product display units are given out to large and potential outlets through the year in order to create distinct and greater product visibility in trade.

2.14 Trade Promotions

Trade Contests

An annual Trade contest has been held for the last two years running in the form of a Display Contest. The contest is very simple. Retailers are given points based on product purchase, shelf display, POP advertisement maintenance and additional creativity in display. The program obviously runs for a specific duration of time, usually 2 months. At the end of the promotion period, retailers with most number of points within their stipulated territory are given cash prizes.

Push Money

During this trade promotion, cash discounts are given to traders when they purchase a specified minimum number of products within a given time. In the case of NIDO, discounts are given when traders purchase certain number of cartoons of NIDO. (Ex: a carton of NIDO 350g contains 24 packs).

Complementary Gifts

In order to build better relationships with the trader’s gift items such NIDO branded clocks, caps and t-shirts, bags etc. are given out.

2.13 Consumer Promotions

The specific objectives of consumer promotions for NIDO include increasing short-term sales, creating hype among consumers and build brand equity through association of brand positioning and promotion theme. In the case of NIDO, usually premium based consumer promotions have been used. In 2005, only one consumer promotion was run with title “Growth Kit”. The concept of this CP was very simple. Consumer got a free Growth Kit set, which included a height sticker, NIDO mug and nutritional booklet for mothers with purchase of one NIDO 350g pack. The promotion also helped build NIDO associations with the concept “growth of children” because the gifts were directly related with the concept. Similarly, in the previous year similar consumer promotion was run with free gifts of “Stationery set for children” and “Faber castle crayon set” for children.

Sales Promotion

Sales promotion, offers and extra incentive for the ultimate consumer, distributors, or the sales force. Here we are only concerned with consumer-oriented sales promotion. Sales promotional techniques used by nestle Pvt. Ltd.

2.14 Event Marketing & Sponsorships

From time to time, NIDO does engage in event marketing and sponsorships. However, they do have to be related to the brand’s positioning and targets consumers. For example, in 2006 NIDO sponsored a children’s art exhibition, science fair for young children in schools. NIDO also co-organizes an annual story writing competition for children with the title “NIDO Shaptahik 2000-Golpo Lekho Golpo Jeto”. This competition is conducted through out the country in almost 10,000 schools.

Publicity

NIDO organizes nutrition based educational programs in schools for mothers with the aim of providing information and knowledge to mothers on how best to take care of the nutritional needs of children and what role milk plays in respect of their nutritional needs. The programs titled, “NIDO Growth Program” was conducted in over 150 schools last year and will be conducted in more schools this ye

Consumer Confidence

The Consumer Confidence department is the scientific heart of the Nestlé Quality System. Consumer confidence and trust has been fundamental to Nestlé’s success for over 135 years. Our wide range of expertise is made available to R&D scientists, operational and technical units and businesses. We cover five main areas.

- Consumer safety that guarantees the delivery of safe products.

- Product compliance that combines all aspects related to the legal compliance of Nestlé products.

- Consistent quality that involves all measures for the delivery of Nestlé products with a consistent level of quality.

- Consumer preference that ensures our products demonstrates superior organoleptic and nutritional quality.

- Occupational and environmental safety that combines all aspects related to the safety of workers and the environment

Safety evaluation requires extensive scientific skills in the two areas of food safety: analytical method development and science-based risk assessment. Ingredients also need to be analyzed for authenticity and allergens. Leading edge packaging expertise also has a role to play in ensuring both quality and safety of Nestlé food products.

Anticipation of food safety issues is guaranteed through a systematic screening of scientific and technical literature and evaluation by our network of experts for case-adapted responses.

Market Position of NIDO (Dhaka)

3.1 Analysis

One of the prime targets of this research was to find out the NIDO information. As the market is so much competitive and some of the companies are so much concentrated about Niche marketing, they always need to know who are their customers, what they are wanting from a particular brand, what are their likings and disliking etc. This is truer in case of NIDO as it is always focused on the demands of its consumers. So at the beginning of the survey, I wanted some of the NIDO information such as their occupation, age, education level, gross family income etc.

3.1.1 Occupation:

Frequency | Valid Percent | Cumulative Percent | ||

| Service | 27 | 54.0 | 54.0 | |

| Housewife | 16 | 32.0 | 86.0 | |

| Part-time works | 2 | 4.0 | 90.0 | |

| business | 5 | 10 | 100.0 | |

| Total | 50 | 100.0 | ||

Among the NIDO mothers, more than 50% (Actual percentage is 52.4%) are housewives. 64% mothers are engaged in services and the rest 20% are engaged in part-time works such as handicrafts, clothing etc. One significant point in this case is that the company should develop their marketing strategies according to the necessity of these various types of mothers.

3.1.2 Age

Frequency | Valid Percent | Cumulative Percent | ||

| 22 to 25 | 8 | 16.0 | 16.0 | |

| 26 to 29 | 25 | 50 | 66.0 | |

| 30 to 33 | 8 | 16.0 | 82.0 | |

| 34 to 38 | 5 | 10.0 | 92 | |

| Above 38 | 4 | 8.0 | 100.0 | |

| Total | 50 | 100.0 | ||

Most of the mothers are between the age ranges of 26 years to 29 years. Most of them have more than one kid. Another significant group of mothers are between the age ranges of 30 years to 33 years.

3.1.3 Education

Frequency | Valid Percent | Cumulative Percent | ||

| Below SSC | 4 | 8.0 | 8.0 | |

| HSC | 6 | 10.0 | 18.0 | |

| Graduation | 25 | 50 | 68.0 | |

| Above Graduation | 15 | 30 | 100.0 | |

| Total | 50 | 100 | ||

Most of the NIDO mothers I have found are highly educated form the context of our country. Of the50 NIDO mothers, 50% have completed their graduation and another 30% have the degree above graduation. So more than 75% of the mothers are either graduate or more than that. This should be a considering point for the marketers.

3.1.4 Gross family income

Frequency | Valid Percent | Cumulative Percent | ||

| Below 15000 | 5 | 10.0 | 1.0 | |

| 15000-20000 | 5 | 10.0 | 20.0 | |

| 20000-25000 | 18 | 36.0 | 56.0 | |

| 25000 to Above | 22 | 44.0 | 100.0 | |

| Total | 50 | 100.0 | ||

It was found from my survey that comparatively higher income families are giving their child NIDO. Of the NIDO mothers, 44% has income of 25,000 or above. Another 18% has an income range of 20,000 to 25,000. So targeting them would be a good idea.

3.2 Brand Awareness

Next few queries to them were dedicated to discover the brand awareness among the NIDO mothers about their brand. In this case, questions were asked like ‘why they are currently using NIDO’, ‘has she taken the advice of someone else before choosing a particular brand’, ‘what does she know about NIDO FCMP, NIDO GUM, Prebio 1, perfect growth formula’ etc.

3.2.1 Why currently using NIDO

Frequency | Valid Percent | Cumulative Percent | ||

| It provides the best quality | 12 | 24.0 | 24.0 | |

| This is the best in the market | 10 | 20.0 | 44.0 | |

| This can give my child a balanced diet | 7 | 14.0 | 58.0 | |

| This has the balanced nutritional facts | 13 | 26.0 | 84.0 | |

| My kid like the test of it | 4 | 8.0 | 92.0 | |

| This is the product of world renowned Nestlé | 2 | 4.0 | 96.0 | |

| It helps to protect my child from various diseases | 2 | 4.0 | 100.0 | |

| Total | 50 | 100.0 | ||

When I asked the question ‘why they are currently using NIDO’ they showed some positive feelings about NIDO. The majority percentage (26%) told that it has the balanced nutritional facts. The second best respondent group (24%) told that they use this brand, as it is the best in the market. Some of the other comments regarding the same query are as like – ‘It provides the best quality’, ‘it can give my child a balanced diet’, ‘my kid like the test of it’, ‘this is the product of world renowned Nestlé’ and ‘It helps to protect my child from various diseases’. So we can find from this statistics that all these comments are positive feelings about NIDO in the mind of its users. In this regard, the communication form the brand is successful, I think.

3.2.2 Has consumer taken the advice of other?

Now, this is a vital question whether they take the advice of someone before choosing this particular brand. The majority percentage (52.0%) told that they have taken the advice of their doctor before choosing this brand. The second largest portion (30.0%) told that they have chosen it on the basis of their own judgment. This is the influence of the brand promotions, I believe.

3.2.3 What does a consumer know about of NIDO FCMP

In this regard, 48% respondents told that this is the category of milk for a bit age Childs 48.0% couldn’t respond except to tell that it is the product of world renowned Nestlé. 8.0% has the wrong perception as they told that this is as like as other categories of NIDO. So strong communication should be there to improve this situation.

3.3 Consumption Habit

The next few questions to them were to identify their consumption habits.

3.3.1 Use of NIDO

Frequency | Valid Percent | Cumulative Percent | ||

| For baby food only | 40 | 80.0 | 80.0 | |

| For both purposes | 10 | 20.0 | 100.0 | |

| Total | 50 | 100.0 | ||

From my survey, it was found that the NIDO mothers are using it for only baby foods, whereas the non-NIDO mothers are using it for other purposes also. The above table shows the right percentage

3.3.2 Age of the kid who is actually consuming the milk

Frequency | Valid Percent | Cumulative Percent | ||

| 4 Yrs | 13 | 26.0 | 26.0 | |

| 5 Yrs | 17 | 34.0 | 60.0 | |

| 6 Yrs | 10 | 20.0 | 80.0 | |

| Above 6 Yrs | 10 | 20.0 | 100.0 | |

| Total | 50 | 100.0 | ||

My next question to them was to find out the age of the kids who is actually consuming the milk. The above table states the percentage detailed. Most of the kids are between the age ranges of 5 yrs to 7 yrs.

3.3.3 How many times the kid is consuming milk

Most of the mothers feed their child 3 to 4 times a day. The above table is showing the detailed percentage of how many times they are giving their child milk.

3.4 Product related attitude

To know the product related attitudes, I asked several questions such as ‘what are the considering factors behind purchasing NIDO’, ‘what extra benefits she wants from NIDO’ etc.

3.4.1 Considering factor behind purchasing NIDO

As mentioned earlier, NIDO users have strong feelings about their brand, it also reflecting in this question. The portion (34%) told that they are giving their kid NIDO as this is better than any other brands in the market. This is a good sign for the brand. The largest portion (22.0%) told that they are using this as their doctors have suggested them to use that.

3.4.2 What extra benefits consumer wants from NIDO

Frequency | Valid Percent | Cumulative Percent | ||

| The price should be less | 29 | 56.0 | 56.0 | |

| It should be more available | 4 | 8.0 | 64.0 | |

| I am satisfied with what I am getting from NIDO | 17 | 34.0 | 100.0 | |

| Total | 50 | 100.0 | ||

One common argument against NIDO (Whether or not they are NIDO user or from other brands) is that, NIDO charges a comparatively higher price. More than 50% (The actual percentage is 56.0%) of the NIDO users told that the price of NIDO should be less. One positive sign in this case is that, 34.0% of the respondents told that they are satisfied with what they are getting from NIDO right now.

3.5 Buying pattern

to know the buying patterns, I tried to discover their buying frequency, which makes the purchasing decisions, who is actually making the purchase etc. to them.

3.5.1 Who is making the purchasing decision

Frequency | Valid Percent | Cumulative Percent | ||

| She herself | 32 | 64.0 | 64.0 | |

| Her husband | 15 | 30.0 | 94.0 | |

| All the family members together | 3 | 6.0 | 100.0 | |

| Total | 50 | 100.0 | ||

In this part, we can see that most of the mothers are making the purchasing decision by their own. So this is the point that should be kept in mind by the marketers.

3.5.2 From where consumers purchasing it

70.0% of the respondents are purchasing NIDO from the modern trades (Super shops). Other 24.0% are purchasing from confectionary/ stationary and the rest 6.0% are purchasing from nearby grocery shops.

3.5.3 Is NIDO is available in the market?

Frequency | Valid Percent | |

Yes | 19.0 | 38.0 |

no | 31.0 | 62.0 |

total | 50 | 100.0 |

About 31% of consumer of Dhaka told that NIDO is not available in the market and also claimed that company sometimes decreases supply of milk in the market to increase price.

3.6 Communication and promotion:

To discover their frequently used communication channels, I asked the following questions to them:

3.6.1 The Communicationmedia consumers watches frequently

Frequency | Valid Percent | Cumulative Percent | ||

| Television | 24 | 48.0 | 48.0 | |

| Newspaper | 11 | 22.0 | 70.0 | |

| Magazine | 15 | 30.0 | 100.0 | |

| Total | 50 | 100.0 | ||

As expected, Most of the respondents (48%) choose television as their number one preferred communication channel.

3.6.2 Has consumer ever watched a NIDO advertisement?

Frequency | Valid Percent | Cumulative Percent | |||||

| Yes | 24 | 48.0 | 48.0 | ||||

| No | 26 | 52.0 | 100.0 | ||||

| Total | 50 | 100.0 | |||||

Only one respondent told that she hasn’t ever seen a NIDO advertisement in any of the communication channels that NIDO is currently using. Except that, all other told that they have seen the NIDO advertisement in any of the communication channels.

The above table will show the details of the communication channels where the NIDO mothers have seen the NIDO advertisement. Most of them told that they have seen it in the televisions.

3.6.3 Where a consumer has watched the NIDO advertisement?

Frequency | Valid Percent | Cumulative Percent | ||||||

| Television | 27 | 54.0 | 54.0 | |||||

| Newspaper | 12 | 24.0 | 78.0 | |||||

| Magazine | 11 | 22.0 | 100.0 | |||||

| Total | 50 | 100.0 | ||||||

The above table will show the details of the communication channels where the NIDO mothers have seen the NIDO advertisement. Most of them told that they have seen it in the televisions.

3.6.4 Better than any other brand in the market according to Quality

Chapter- Four

Market Position of NIDO (Narayangong)

This is the part where I will try to elaborate and explain the details that I have got during my survey about the NIDO full cream powder in Narayangong

4.1 Analysis

The following are the necessary information of the NIDO mothers Narayangong

4.1.1 Occupation:

Like the NIDO mothers of Dhaka, most of the NIDO mothers of Narayangong are also housewives. The number of them is 50.0%. Another major portion of them are service holders. The percentage of service holder is 38.0% in this regard.

4.1.2 Age

Not only the NIDO mothers of Dhaka, the NIDO mothers of Narayangong are also educated. Of the NIDO mothers of Narayangong 38% have completed graduation and 20.0% have a degree of over graduation. As the choice patterns of the educated mothers will be different from that of the less educated mothers, NIDO should communicate in such a way so that it matches with the likings of them to convert them as NIDO mother.

In compare to the NIDO mothers of Dhaka, the NIDO mothers of Narayangong are of less income groups. As from the statistics given above, most of them range the income group of 15000 to 20000.

4.2 Brand Awareness

Next few queries to them were dedicated to discover the brand awareness among the NIDO mothers of Narayangong about their brand. In this case, questions were asked like ‘why they are currently using NIDO’, ‘has she taken the advice of someone else before choosing a particular brand’, ‘what does she know about NIDO FCMP, NIDO GUM, Prebio 1, perfect growth formula’ etc.

4.2.1 Why currently using NIDO

Frequency | Valid Percent | ||

| It provides the best quality | 14 | 28.0 | |

| This is the best in the market | 8 | 16.0 | |

| This can give my child a balanced diet | 6 | 12.0 | |

| This has the balanced nutritional facts | 10 | 20.0 | |

| My kid like the test of it | 6 | 12.0 | |

| This is the product of world renowned Nestlé | 3 | 6.0 | |

| It helps to protect my child from various diseases | 3 | 6.0 | |

| Total | 50 | 100.0 | |

When I asked the question ‘why they are currently using NIDO’ they showed some positive feelings about NIDO. Majority of them had the best feelings that a FCMP may have in the market. They showed some positive feelings as they told that ‘It is the best in the market’, ‘This has the balanced nutritional facts’, ‘It provides the best quality’ etc. likewise the mothers of Dhaka, the mothers of Narayangong possess the same mentality and idea about NIDO.

4.2.2 Has consumers taken the advice of other?

Most of the mother from Narayangong also relies upon the advices of the doctors and on their own judgment for choosing a particular brand for their child. As Most of the mothers rely upon their own judgment, it is easy to convince them. This should be kept in mind by the marketing department of Nestlé

4.2.2 What does a consumer know about of NIDO FCMP

In this regard, the mothers of Narayangong showed that they at least keep some information about the outside world. Majority of the mothers know that this is the product from the world class brand Nestlé. Some handsome number of the mothers (19.0%) knows the fact that this is the milk for the grown-up child

4.3 Consumption Habit

The next few questions to them were to identify their consumption habits.

4.3.1 Use of NIDO

Frequency | Valid Percent | ||

| For baby food only | 38 | 76.0 | |

| For both purposes | 12 | 24.0 | |

| Total | 50 | 100.0 | |

As NIDO has been developed for baby food only, it has been found from the survey that most of the mothers of Narayangong also are using the brand as only baby food. The percentage is 76.0%. But there are also some of the mothers who are using the milk as for other purposes also.

4.3.2Age of the kid who is actually consuming the milk

The above are the distribution of the child who is actually consuming the milk, that is – the kids. Majority portion lies from the range of 4 to 6 yrs.

Most of the mothers are giving milk to their child between 3 to 5 times a days. The above table shows the exact percentage distribution

4.4 Product related attitude

To know the product related attitudes, I asked several questions such as ‘what are the considering factors behind purchasing NIDO’, ‘what extra benefits she wants from NIDO’ etc.

4.4.1 Considering factor behind purchasing NIDO

Frequency | Valid Percent | Cumulative Percent | ||

Quality is a concern for the mothers all the times, but price of the product also plays a vital role in this regard.

4.4.2 Which sort of benefits will motivate consumers to change his existing brand

Frequency | Valid Percent | Cumulative Percent | ||

The benefits that will motivate themselves to change their existing brand are ‘the likings of the kids’, ‘quality’, ‘doctor’s advice’ and obviously ‘price of the product’.

4.5 Buying frequency

To know the buying patterns, I tried to discover their buying frequency, who makes the purchasing decisions, who is actually making the purchase etc. to them.

4.5.1 Who is making the purchasing decision

Frequency | Valid Percent | Cumulative Percent | ||

| She herself | 35 | 70.0 | 70.0 | |

| Her husband | 13 | 26.0 | 96.0 | |

| All the family members together | 2 | 4.0 | 100.0 | |

| Total | 50 | 100.0 | ||

It has been found from the survey that most of the mothers are choosing their brand for the kid on their own judgments. In this case also, it is true. 70.0% of the mothers are making the purchasing decision by their own.

4.5.2.From where consumers purchasing it

Frequency | Valid Percent | Cumulative Percent | ||

As modern trades (Super shops) are flourishing more in our country, the mothers are becoming habituated with shopping from there. The above statistic also says in favor of the statement.

4.6 Communication and promotion:

Frequency | Valid Percent | Cumulative Percent | ||

Of the 50 NIDO mothers of Narayangong, only 2, I have found that they enjoy radio frequently. But in case of the rest other respondents, most of them prefer TV (52.0%) as their number one entertainment, as expected.

Has consumer ever watched a NIDO advertisement?

Frequency | Valid Percent | Cumulative Percent | |

| Yes | 50 | 100.0 | 100.0 |

All the 50NIDO mothers from Narayangong have watched a NIDO advertisement in any of the communication channels. All of them have at least seen the advertisement.

4.6.2 Where a consumer has watched the NIDO advertisement?

Frequency | Valid Percent | Cumulative Percent | ||

Television | 25 | 50.0 | 50.0 | |

Newspaper | 12 | 24.0 | 74.0 | |

Magazine | 13 | 26.0 | 100.0 | |

Total | 50 | 100.0 | ||

As most of the respondents prefer television as their communication channel, it is quite normal that they have watched a NIDO advertisement in the television. The number is 50.0%. The others have seen the advertisement in newspaper and magazines.

4.7 Better than any other brand in the market according to Quality

Chapter -Five

Comparison between two cities

5.1 SEC Information

SEC Information | Dhaka (%) | Narayangong(%) | |

Occupation | Service | 54.0 | 42.0 |

| Housewife | 32.0 | 50.0 | |

| Business/Part-time workers | 14 | 12.0 | |

Age | 22 to 25 | 16.0 | 20 |

| 26 to 29 | 50.0 | 46 | |

| 30 to 33 | 16.0 | 18 | |

| 34 to 38 | 10.0 | 12 | |

| Above 38 | 8.0 | 8 | |

Education | Below SSC | 8.0 | 16 |

| HSC | 10.0 | 26 | |

| Graduate | 50 | 38 | |

| Above Graduation | 30 | 20 | |

Gross Family Income | Below 15000 | 10.0 | 24 |

| 15000-20000 | 10.0 | 40 | |

| 20000-25000 | 36.0 | 20 | |

| Above 25000 | 44.0 | 16 | |

In comparing the SEC information of Dhaka and Narayangong, I considered four variables: Occupation, Age, Education and Gross family income. So basing upon these variables, we can see the following picture:

In case of occupation, the NIDO mothers from Dhaka city are more self-dependable than that of Narayangong38.1% of the NIDO mothers from Dhaka city are engaged in service, while the percentage is only 22.4 in case of the Narayangong mothers. The mothers from Narayangong remain more in the house than that of Dhaka mothers. 62.9% of the mothers from Narayangong are housewife while this percentage is only 52.4% for Dhaka. But one interesting thing in this case is that more mothers from Narayangong are engaged in business or part-time works than that of Dhaka city.

In case of age, the distributions among the mothers are almost same in both cases. Most of the mothers from both the locality are between the age ranges of 26 to 29. The next largest segment is the age range from 30 to 33.

Next comes the variable education. In this regard, it has been seen that the mothers from Dhaka are more educated than that of Narayangong50% of the total mothers of Dhaka are graduate whereas the number is only 39.7% in case of Narayangong. The number of mothers who has the degree of over graduation is also higher than that of Narayangong

It was obvious that the gross family income of the mothers from Dhaka would be higher than that of Narayangong The statistics also shows the same scenario. 61.9% of the mothers from Dhaka said that they have a gross family income of over 25000 Tk.

5.2 Brand Awareness:

Brand Awareness | Dhaka (%) | Narayangong(%) | |

Why currently using NIDO | Best quality | 24.0 | 28.0 |

| Best in the market | 20.0 | 16.0 | |

| Balanced diet for my kids | 14.0 | 12.0 | |

| Balanced nutritional facts | 26.0 | 20.0 | |

| My kid like the test of it | 8.0 | 12.0 | |

| Product of world renowned Nestlé | 4.0 | 6.0 | |

| Helps to protect my kid from various diseases | 4.0 | 6.0 | |

Knowledge about NIDO FCMP

The next comparison was based on brand awareness.

The first query to them was to find out the fact that why they are currently using NIDO. The responses were a bit same for both the mothers. The maximum number of the consumers from Dhaka said that they are using it for their kids, as it will give them the right nutrition. In case of the other responses, the ratios were a bit similar for both the mothers.

My next query to them was to find out whether they have taken the advice of others in case of choosing this brand for their kids. In this regard, we can see that the mothers from Dhaka were much dependent on the advices of doctors and they also depended upon their own judgment. In case of the consumers from Narayangong, they were self-reliable in case of this decision-making.

Reliable in case of this decision-making.

In case of the knowledge about various things of full crème milk powder, the consumers from Dhaka were more knowledgeable than the Narayangong mothers as they were a bit more correct in picking up the right answers.

5.3 Consumption Habits:

Consumption Habits | Dhaka (%) | Narayangong(%) | |

Use of NIDO | For baby food only | 80.0 | 76.0 |

| For both purposes | 20.0 | 24.0 | |

Age of the kid who is consuming | 4 Yrs | 26.0 | 28.0 |

| 5 yrs | 34.0 | 26.0 | |

| 6 yrs | 20.0 | 24.0 | |

| Above 6 yrs | 20.0 | 22.0 | |

The consumption habits for both the mothers were a bit similar in this regard. Most of the mothers are using NIDO only for baby consumption. The average age of the consumers who are actually consuming the milk is 5 yrs in both cases. Most of the mothers are giving milk to their child 3-4 times a day.

5.4 Product related attitude:

Product related attitude | Dhaka (%) | Narayangong(%) | |

Considering factors behind choosing the brand | Quality | 28.0 | 36.0 |

| Price | 10.0 | 16.0 | |

| Better than any other brand | 34.0 | 16.0 | |

| Doctor’s suggestion | 22.0 | 28.0 | |

| Buying Pattern | |||

Who is making the purchasing decision | She herself | 64.0 | 70.0 |

| Her husband | 30.0 | 26.0 | |

| All the family members together | 6.0 | 4.0 | |

From where they are purchasing | From nearby grocery shops | 6.0 | 8.0 |

| From stationary/Confectionary | 24.0 | 28.0 | |

| From super shops | 70.0 | 64.0 | |

The next section of query was to find out the product related attitudes. This is the most vital part of the research and the marketing department and the brands are more keen to have this sort of information as they analyze with these sorts of data. brand.

The first criterion in this regard was the cause behind choosing this particular brand. Most of the mothers from both the locality told that they have chosen this particular brand as they think that this is the best FCMP in the market. A handsome portion of the mothers from Dhaka told that they have chosen this brand as their kids like the test of it. But the mothers from Narayangong were a bit different in their opinion. They said that they have chosen this brand as it has the highest quality and they are also able to afford the price of it. Again the mothers from these two localities were different in their opinion about the factors that will motivate them to change their existing brands. Most of the mothers from Dhaka said that they would change their existing brand if the quality deteriorates. But the mothers from Narayangong were not that much concerned about the quality. They were a bit different in their opinion.

In case of the other criteria, the opinions were a bit similar for both the mothers.

5.5 Communication and promotion:

Communication and Promotion | Dhaka (%) | Narayangong(%) | ||

| Communication media she uses frequently | Television | 48.0 | 52.0 | |

| Radio | 22.0 | 24.0 | ||

| Newspaper | 30.0 | 24.0 | ||

| Magazine | 48.0 | 52.0 | ||

| Where she has watched a NIDO Advertisement | Television | 54.0 | 50.0 | |

| Newspaper | 24.0 | 24.0 | ||

| Magazine | 22.0 | 26.0 | ||

This is another vital part for the marketers. These sections were to find out the communication channels they are using. In this regard also, we have found that mothers from both the localities rely upon television more than any other medias. As a result, the marketers should communicate through this channel, as it will cover most people.

Chapter -Six

- NIDO is reliable and will always find ways to satisfy the nutritional needs of growing children. It has been in the family for generations and has always symbolized the guarantee of constant premium quality.

- Most of the Consumers from both the locality told that they have chosen this particular brand as they think that this is the best FCMP in the market. A handsome portion of the consumers from Dhaka told that they have chosen this brand as their kids like other brand of milk powder. But the consumers from Narayangong said that they have chosen this brand as it has the highest quality and they are also able to afford the price of it.

- Nido faces direct competition with the ordinary milk and milk based beverages like Complan, Bournvita and the like. NIDO takes the differentiation from other milk brands by essential nutrients that growing children needs (comparison with nutrients of Complan).

- Marketing Strategy for NIDO is good for different segments of marketing areas mainly due to price stability, aggressive media and non-media activities.

- NIDO is trying to grab the full cream powder market of Bangladesh in both cities and rural areas.

- In case of the knowledge about various things of full cream milk powder, the consumers from Dhaka were more knowledgeable than the Narayangong consumers as they were a bit more correct in picking up the right answers.

- Sometimes Nestle create artificial shortage of supply of NIDO to increase the price of milk for that customers sometimes deprive NIDO and switch to others brand which results fall down their market position.

6.2RECOMMENDATIONS

Basing upon the survey result, here are some of the recommendations for Nestlé Bangladesh:

*As the portfolio of the consumers varies from locality to locality, the company should develop customized marketing plan for different areas.

*A great number of the customers fix the milk for their kids in accordance with the advices of the doctors. This section should be explored in order to get the maximum market share. They should fix up a marketing budget for this section also.

*Nestle should improve its promotional activities on television regarding NIDO full cream milk powder.

*Company should conduct survey from time to time to according to which changes can be introduced in the organization to stay updated in the market.

*To ensured sufficient supply of NIDO milk powder in the market.

*The FCMP (Full cream milk powder) companies should try to educate the customers not to use the FCMP for other purposes, rather to use it only as baby food.

*It has been found from the study that customers are not that much loyal to a specific TV channel, rather they enjoy to move in different channels. So the marketing department should cut the budget from there, and invest more in the BTL (Below the Trade Line) activities as these seems to be more effective in new consumer recruitment.

6.3 Conclusion

The objective of this research was to study market position of NIDO full cream milk powder. From my report it is concluded that NIDO has a good reputation as a strong consumer brand. Most of the consumers use Nestlé’s products regularly. This is also proved by the statistical and graphical analysis of the data obtained from consumers that they are quite satisfied from nestle NIDO full cream milk powder. Nestle formulating a good strategy and they are trying to go for mass-marketing. NIDO benefits from Nestlé’s nutrition and milk products know how. It has been in the family for generations and has always symbolized the guarantee of constant premium quality. NIDO is knowledge and is a recognized authority around the world on child feeding and well being NIDO is reliable and will always find ways to satisfy the nutritional needs of growing childre.