6. Financial Performance Analysis

With the help of 5 years balance sheet and income statement managed from the Annual Reports of Standard Bank Limited I have done the following ratio analysis.

Financial indicators in the last six years

| Item | Ratio | 2007 | 2006 | 2005 | 2004 | 2003 |

| Earning Ability | Return on Equity | 20.59% | 16.71% | 23.16% | 16.05% | 10.94% |

| Return on Assets | 2.19% | 2.11% | 1.25% | 087% | 0.99% | |

| Net Interest Margin | 3.89% | 3.74% | 2.86% | 2.30% | 3.93% | |

| Earning Base in Assets | 95.21% | 99.42% | 93.94% | 95.70% | 87.49% | |

| Productivity | Deposit Per Branch | 485.00 | 374.16 | 315.50 | 274.91 | 228.23 |

| Deposit Per Employee | 21.56 | 17.32 | 15.65 | 16.82 | 8.41 | |

| Advance Per Branch | 433.38 | 330.14 | 268.90 | 236.52 | 83.53 | |

| Advance Per Employee | 19.26 | 15.28 | 13.34 | 9.85 | 3.08 | |

| Net Profit Per Branch | 13.59 | 10.12 | 5.08 | 3.53 | 2.59 | |

| Net Profit Per Employee | 0.604 | 0.469 | 0.248 | 0.131 | 0.095 | |

| Cost – Efficiency | Manpower Expense to Total Expense | 13.35% | 11.96% | 16.71% | 18.37% | 9.28% |

| Total Interest Expense to Earning Assets | 5.35% | 6.53% | 6.44% | 6.40% | 22.02% | |

| Total Non-Interest Expense to Earning Assets | 2.13% | 2.50% | 2.81% | 2.91% | 7.52% |

| 6.1 Comments on Different Ratios: Return on equity: Net Profit After Tax/Total Equity CapitalEquity Capital = Paid-up Capital + Reserve & Surplus + Undistributed Net Profit Note: ROE is a measure of the rate of return flowing to the bank’s shareholders. Though it could not make any profit in the first year, it started improving gradually. The highest ROE achieved in 2004.

|

| Return on assets: Net Profit After Tax/Total AssetsNote: ROA is primarily an indicator of managerial efficiency. It indicates how capably the management of the bank has been utilizing the institution assets to generate net earnings.After the initial loss started improving, but the rate is too low. The highest ROA achieved in 2006. |

| Net interest margin: (Interest Income – Interest Expense)/Total AssetsNote: The net interest margin measures how large a spread between interest revenues and interest cost management has been able to achieve by close control over the earning assets and pursuit of the cheapest sources of funding.Increasing over the years except in the year 2002 & 2003. |

| Earning base in assets: Total Earning Assets/Total Assets = (Total Assets – Non Earning Assets)/Total Assets.Note: Non-Earning Assets = Cash + Fixed Assets + IntangiblesAlmost increasing and shows good indicators. |

| Deposit per branch: Total Deposits/No. of Branches.It is increasing every year. |

| Deposit per employee: Total Deposits/ No. of Employee.Consistently increasing over the years. |

| Advance per branch: Total Amount of Advances/Total No. of Branches.Good performance. Consistently increasing over the years. Highest was in 1999 |

| Advance per employee: Total Advances/Total No. of Employee.Very good. Consistently increased over the years. |

| Profit per employee: Net Profit After Tax/No. of Employee.Gradually increasing every year. |

| Profit per branch: Net Profit After Tax/No. of Branch.After initial loss start earning profit and it increases every year. Highest was in 2004. |

| Manpower expense to total expense: Manpower Expense/Total ExpenseThis ration is not in a good shape. One year it is decreasing, another year it is increasing over the years. |

| Total interest expense to earning assets: Total Interest Expense/Earning AssetsIt is in good shape. It is decreasing every year. |

| Total non-interest expense to earning assets: Total Non-Interest Expense/Earning AssetsIt is decreasing over the years. Good sign for the bank. |

CAMEL Rating

CAMEL rating has some formula and Standard level of values for each measure for rating the bank’s performance as strong, satisfactory, fair, marginal and unsatisfactory.

The rating formulas with its Standards are given below:

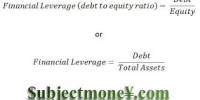

►Capital Adequacy Ratio:

It is the ratio of capital and reserve (adjusted) to the risk weighted assets. The main objective of this ratio is to find out the proportion of reserve to the risky assets that mean the capacity to cover the risk with reserve. Incase of capital banks (Tier-1 and Tier-2) have to maintain not less than 9% of total risk weighted assets with at least 4.50 % in Tier-1 capital. [BRPD Circular No.10 issued by Bangladesh Bank on 25th November 2002]

Capital and Reserves (Adjusted)

Capital Adequacy = __________________________ X 100

Total Risk Weighted Assets.

6.2 Constituents of Capital:

Core Capital (Tier-I)

- Paid up Capital

- Non-repayable share premium account

- Statutory Reserve

- General Reserve

- Retained Earnings

- Minority interest in Subsidiaries

- Non-Cumulative irredeemable Preference Shares

Supplementary Capital (Tier II)

- General provision (1% of Unclassified loans)

- Assets Revaluation Reserves

- All other Preference Shares

- Perpetual Subordinated debt

* If there is any shortfall in required provision and if there is any loss then it shall have to be adjusted and after such adjustment, the capital & reserve of the bank is determined.

Risk-weighted Assets:

Balance sheet assets and off-balance sheet exposures are to be weighted according to broad categories of relative risk. There are five categories of risk weight-0, 10, 20, 50 and 100 percent.

A brief explanation of the components of risk category may help to understand the basic approach given to risk-based plan.

The first category zero percent is given to items like cash in hand and in banks indicating that the banking company holds no risk in retaining the assets.

The last category of maximum 100 percent is given to items private business and consumer loans indicating highest risky assets. The items like export and other foreign bills, private sector loans etc.

Risks are assigned according to nature and anticipated risks associated with the Balance Sheet assets.

Off-balance sheet transactions are to be converted to balance sheet equivalents before being allocated a risk weight. Four categories of credit equivalents-100, 50, 20 and 0 percent will apply.

| Particulars | 2007 | 2006 | 2005 | 2004 | 2003 |

| Capital Adequacy Ratio | 15.63% | 21.00% | 10.07% | 11.27% | 27.05% |

Capital Adequacy Ratio Rating Scale

| Rating | Description | Percentage |

| 1 | Strong | 10.00% and above |

| 2 | Satisfactory | 9.00% – 9.99% |

| 3 | Fair | 8.00% – 8.99% |

| 4 | Marginal | 7.00% – 7.99% |

| 5 | Unsatisfactory | 6.99% and below |

►Asset Quality Ratio:

This ratio is between classified loans to total loans. Loans and advances are the assets of a bank. If can is made without prudential judgment that involves project appraisal, proper repayment schedule, industry conditions and so many others the loans and advances have every possibility to be classified. A higher amount of classified loans indicate the inefficiency in management.

Asset Quality = Classified Loans/Total Loans. * 100

Asset Quality Rating

| Rating | Percentage Scale | Description |

| 1 | Up to 5.00% | Strong |

| 2 | 5.01% – 10.00% | Satisfactory |

| 3 | 10.01% – 15.00% | Fair |

| 4 | 15.01% – 20.00% | Marginal |

| 5 | Above 20.00% | Unsatisfactory |

►Earning Ratio (E):

Earning ratio is the ratio between net income and total assets. It measures that how much the bank earns utilizing its total assets. If earning is higher, the bank is certainly in good position.

Earning Ratio = Net Income/Total Assets. *100

Earning Rating

| Particulars | 2006 | 2005 | 2004 | 2003 | 2002 |

| Return on Assets (ROA) | 4.44 | 4.06 | 2.31 | 2.19 | 2.12 |

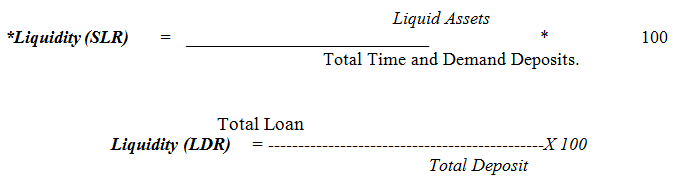

►Liquidity (L):

Liquidity is one of the most important decision on the part of a bank. Because if a bank has not enough liquid money, it will not be able to meet up the public demand which in result deposit position may be deemed. So banks have to maintain a good amount of liquid money to meet up the public demand.

| Particulars | 2006 | 2005 | 2004 | 2003 | 2002 |

| Liquid Assets | 2721.14 | 2018.43 | 1685.76 | 1505.24 | 1439.13 |

| Total Time & Demand Deposits | 8731.00 | 5612.42 | 4101.56 | 2749.07 | 2054.12 |

| Total Loan | 7801.00 | 4952.24 | 3495.71 | 2365.18 | 751.78 |

| SLR | 31.16% | 35.96% | 41.10% | 54.75% | 70.06% |

| LDR (Loan Deposit Ratio) | 89.34% | 88.23% | 85.22% | 86.03% | 36.60% |

6.3 Liquidity Rating

| Rating | Rating Scale | Remarks | |

| Statutory Liquidity Reserve (SLR) | Loan Deposit Ratio (LDR) | ||

| 1 | 30% and above | Less than 60% | Strong |

| 2 | 20.00%-29.99% | 60% to 80% | Satisfactory |

| 3 | 19.00%-19.99% | 81% to 85% | Fair |

| 4 | 10.00%-18.99% | 86% to 90% | Marginal |

| 5 | Below 10% | 91% and above | Unsatisfactory |

*In accordance with the Section 33 of Bank Companies Act 1991 and subsequent BCD Circular No.13 dated May 24, 1992; BRPD Circular No.12, dated 20.09.1999 and BRPD Circular No.22, dated 06.11.2003 the bank has to maintain Statutory Liquidity Reserve (SLR) at least 12%.

Comments:

It has been observed from the above that from 2004 to 2007 the Bank possessed strong position in the CAMEL rating.

The overall performance of Standard Bank on the basis of composite rating 1 (strong) is defined as follows:

Basically sound in every respect.

Resistant to external economic and financial disturbance.

No cause for supervisory concern.

7. SWOT Analysis

SWOT Analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help the organization to navigate in the turbulent ocean of competition.

7.1 STRENGTHS

Company Reputation

SBL has already established a favorable reputation in the banking industry of the country particularly among the new comers. With in a period of six years, SBL has already established a firm footing in the banking sector having tremendous growth in the profits and deposits. All these have leaded it to earn a reputation in the banking field.

Sponsors

SBL has been founded by a group of eminent entrepreneurs of the country having adequate financial strength. The sponsor directors belong to large industrial conglomerates of the country. The Board of Directors headed by its Chairman Mr. Kazi Akram Uddin has earned the reputation of being a successful businessman. Other directors are also eminent in their respective business area. Therefore, SBL has a strong financial strength and is built upon a strong foundation.

Leadership

At SBL, eminent banker Mr. Mosharaf Hossain as the CEO of the Bank head of the management team. His years of banking experience at Pubali Bank Limited and others have enable him to navigate the organization in the turbulent ocean of fierce competition and taking SBL to a new millenium. Mr. S. A, Farooqui, currently the DMD of the Bank, supports the CEO. The bold leadership of Mr. Shahajadaa Syed M. Nizamuddinthe, Chief Banking Consultant (CBC) who was the former CEO of the Bank has been guiding the CEO according to his Ex-experience.

Top management

Like the CEO and DMD the top management of the bank is also a major strength for the SBL and has contributed heavily towards the growth and development of the bank. The top management officials have all worked in reputed banks and their years of banking experience, skill, expertise will continue to contribute towards further expansion of the bank. At SBL, the top management is the driving force and the think tank of the organization where policies are crafted and often cascaded down.

Market share profitability

As already mentioned earlier, SBL has established a fin-n footing among the new comers in the banking industry of Bangladesh. They have already achieved a high growth rate accompanied by an impressive profit growth rate in 2004. The number of deposits and the loans and advances are also increasing rapidly.

- Strong financial resources

Standard Bank Limited has strong financial resources to run the banking business. In the year 2004 the capital fund of the bank including paid up capital, reserves, retained earnings stood at around Tk 759.00 million. It is expected that in the near future the banks financial resources will get much more stronger.

Facilities and Equipment

SBL has adequate physical facilities and equipment’s to provide better service to the customers. The bank has computerized banking operations under the software called Bexi Bank. Counting machines in the teller counters have been installed for speedy service at the cash counters. Computerized statements for the customers as well as for the internal use of the banks are also available. All the branches of SBL are equipped with telex, SWIFT and fax facilities.

Impressive Branches

SBL has earned a reputation in the banking sector for establishing impressive branches. The Gulshan Branch, Dhanmondi Branch, Uttara Branch , Agrabad Branch and the Jubilee Road Branch are the most lavish and impressive branches of SBL. This creates a positive image in the minds of the potential customers and many people get attracted to the bank. This is also an indirect marketing campaign for the bank for attracting customers. The other branches of the bank are also impressive and are compatible to foreign banks.

Interactive Corporate Culture

SBL has an interactive corporate culture. Unlike other local organization, SBL’s working environment is very friendly, interactive and informal. There are no hidden barriers or boundaries while interactive among the superior or the subordinate. The environment is also lively and since the nature of the banking job itself is monotonous and routine, SBL’s lively work environment boosts up the sprit and motivation of the employees. At the same time.

Team work at mid level and lower level

At SBL mid level and lower level management, there are often team works. Many jobs are performed in-groups of two or three in order to reduce the burden of the workload and enhance the process of completion of the job. People are eager to help each other and people in general are devoted to work.

7.2 WEAKNESSES

No Vision

The greatest irony is that despite claiming to be “Setting a new Standard in Bankin” which is used as its advertising platform and mission statement, the bank as of today has failed to develop a prescribed set of vision as it embarks in to the cyber age of twenty first century. The bank still could not identify the core area of business and where it should concentrate in its business, as the new millenium is already started. The bank does not have any long-term strategies of whether it wants to focus on retail banking or become a corporate bank. till now, the bank is in a nowhere situation. Unofficially, retail banking is discouraged but at the same time the bank is not being able to pull itself away from retail banking. At the same time SBL has failed to be a full-fledged corporate bank. The path for the future should be determined right now.

Advertising and Promotion

This is a major set back for SBL and one of its weakest areas. SBL does not pursue an aggressive marketing campaign. It does not expose itself to the general public and are not in the lime light unlike other banks. As a result people are not aware of the existence of this bank. Moreover there make ambiguity in most of the people between the existence of Standard Bank and Standard Chartered Bank.

Poor Recruitment

During its inception, SBL has not recruited competent people in filling up its lower and some mid level positions. Other than the recruitment of the Probationary Officers people who were recruited from banks for the lower management are not competent enough to provide the best output. As a result the services of the bank are being jeopardized. The external search of the bank in attracting people from other banks had flaws in it and the right people were not taken from the right bank.

Reference appointment

This is one of the set backs of SBL and will have a long-term repercussion on the quality of Human Resource. Many people have been recruited under the reference of the recommendation of the Board of Directors, which has become a chronic disease in the PCB’s. as a result, people having inadequate qualifications and experience have been recruited only because of their ties with the sponsors. The practice must be stopped considering the future of the bank and it is very important to have a component workforce.

Low remuneration package

The remuneration package for the entry and the mid-level management is considerably low. The compensation package for SBL entry level positions is even lower than the contemporary banks. Under the existing low pay structure, it will be very difficult to attract and retain MBA’s at SBL. Since foreign banks pay double then that of SBL, it will be very difficult to attract competent MBA’s in future for SBL. Therefore SBL will fall to attract competent MBA’s and retain them if they do not revise their pay structure.

Human Resources Department

The HR department is another weak area of SBL. The HR department is very small relative to the size of the bank and other than the Head of HR wing, the staffs in this wing are incompetent to be an official in the HR department. Most of the HR practices and policies are not being followed or implemented here. The annual performance appraisal report of the employees are not evaluated properly and employees are not getting the required feedback. There is also no prescribed set of promotion policies. The bank is still practicing the traditional method where solely the experience or length of service is considered as the criteria for promotion. On the other hand, criteria for work output or productivity is not considered. Moreover, the HR department is only confined in the Head Office and does not have any role in the branch level activities.

Centralized Decision-Making

At SBL, corporate decisions, the CEO. DMD and other top management officials craft policies and strategies and then they are cascaded down. At times the Board of Directors is also engaged in making corporate decisions. As a result of this practice there is only a top down flow of communication at SBL. The scope for bottom up communication is very limited and many bright ideas or opinions are not being able to climb up the ladder to the top management. Ideas remain their forever.

Noise Pollution

This has become another major problem SBL. Since there are no cubical shaped offices, there is a tremendous noise in each department of the Bank. The noise greatly hampers the work activity and the level of concentration. This is the problem of having an open space office where everyone is communicating with each other and creates noise.

Lack of qualified system operators and computer operators

Currently at SBL’s Head office and in the Branches, there are computer operators who do not have any background academic knowledge on computer applications.

Few staff meetings

It has been observed that there are very few staff meetings and departmental meetings at the branch level. This is not a good management practice.

- Small Market Share

It is revealed from the industry analysis that market share of Southeast Bank in terms of deposits and advances are relatively low.

- High Concentration on Fixed Deposits

High concentration on fixed deposits has negative effect on Bank’s profitability. From our analysis it is found that during the period under review fixed deposit of the Bank was around 80% to 85% of total deposit.

OPPORTUNITIES

Diversification

SBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking of diversify in to leasing and insurance. By expanding their business portfolio, SBL can reduce their business risk.

Product line proliferation

There are several opportunities for SBL to expand its product line. In this competitive environment SBL must expand its product line to enhance its Sustainable Competitive Advantage (SCA). As a part of its product line proliferation, SBL can introduce the following products.

ATM

This is the fastest growing modern banking concept. SBL should grab this opportunity and take preparations for launching ATM. Since SBL is a local bank, they can form an alliance with other contemporary banks in launching the ATM. Few local private commercial Banks have already successfully launched the ATM.

Credit Cards and Tele banking

These are the new retail banking services provided by the foreign banks. SBL can evaluate the option of launching credit cards and Telebanking system. There are the recent developments in the banking sector and SBL should also evaluate the option of doing it.

On-line banking

SBL should move towards the on line banking operations. It is high time that they should go for this because the foreign banks as well as some local banks are already in to the on line banking operations.

Introduction of SBL’s own savings scheme

This can be another new retail product for SBL. They can start introducing their own savings scheme or pension scheme for different professions. For example, Standard Chartered Grindlays has SYFANZ and PLANZ and Standard Chartered also has similar offers. Therefore for attracting more depositors, the management should consider the option of its own savings scheme.

- Introduction of corporate scheme

This is an innovative way of attracting corporate clients to the bank. In stead of providing CCS to executives of various companies, SBL can introduce a special scheme for corporate officers for the purchase of consumer durable at an attractive interest rate. In this way, the bank will be able to attract a lot of corporate clients and in the long run the bank would be benefited by getting business for the bank from the corporate clients in

terms of L/C, Loans and advances etc. for example, officers of BTC, Lever Brothers, Square, BStandardco can be entered in to the corporate scheme.

Separate schemes for service holders

The bank as a part of expanding its loan portfolio can assistance in terms of giving loans to service holders under various professions under a separate scheme. The bank can provide assistance to Engineers, Doctors, Lawyers and other professions under a separate scheme. Standard Chartered Grindlays has already introduced such a scheme for different professions.

7.4 THREATS

Multinational Banks

The emergence of the multinational banks and their rapid expansion poses a potential threat to the new PCB’s. due to the booming energy sector, more foreign banks are

expected to arrive in Bangladesh. Moreover, the already existing foreign banks such as Standard Chartered, CITI N.A are now pursuing an aggressive branch expansion strategy. This bank is establishing more branches countrywide and are expected to get into for operation soon. Since the foreign banks have tremendous financial strength, it will pose a threat to local banks to a certain extent in terms of grabbing the lucrative clients.

Upcoming Banks

The upcoming private local banks can also pose a threat to the existing PCB’S. it is expected that in the next few years more local private banks may emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to complete against an on slaughter of foreign banks.

Contemporary Banks

The contemporary banks of SBL such as Standard Bank, Premier Bank, Bank Asia, and Mercantile Bank are its major rivals. Mercantile Bank and others are carrying out aggressive campaign to attract lucrative corporate clients as well as big time depositors. SBL should remain vigilant about the steps take by these banks as these will in turn affect SBL strategies.

No new deposit creation

This is a problem and a threat faced by the whole banking sector of Bangladesh. Due to the current economic slowdown, there is hardly any new deposit creation as there few investments and savings accompanied by a galloping inflation. As a result the new banks are not being able to attract absolutely new depositors but rather they have to hunt or snatch away depositors from other banks.

Default culture

This is a major problem in Bangladesh. As SBL is a very new organization the problem of non-performing loans is very minimum or insignificant. However, as the bank becomes older this problem arises and the whole community suffers from this chronic disease. SBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem if not elimination.

8.1 Findings

Analyzing the loan policies described on the earlier pages, some weaknesses are found which are mentioned below-

- Small Enterprise Loan:

Consumer Loan: Standard Bank Limited offers this type of loan for the individuals or business enterprises other than public limited companies to meet their business expenses requirement; but in their loan policies the purpose for which the loan will be provided is not specified. Again they charges additional 2% penal charges per annum on the over due amount which may be considered as an extra burden on the part of the borrowers.

Retailers Loan: The bank provides this loan to both the individuals & proprietorship firms. But getting this loan, the borrowers need to have personal security of either the spouse or parents which in many cases impose difficulties to them. The rate of interest & penal interest is also very high that is 15% & 2.5% respectively. In addition, here the bank also charges 1% service charge on the loan amount, which costs a notable amount for the borrower.

Transport Loan: This loan is especially for the people engaged in transport business. But here the prospective borrower required to have 2 years experience in the relevant field of business, which can be considered as an impediment on the part of the borrower. The interest rate is also high here that is 14.5%. In this case, the bank charges 1% loan processing fee in addition with the 0.50% service charges, which may deter the borrowers.

Commercial House Building Loan: This loan is provided to meet the construction cost of commercial buildings. This loan is considered as very tough to be sanctioned for its complex policy. This policy ask for the sufficiency of average monthly income of the borrower to pay the liability but the amount which will be considered as sufficient is not mentioned specifically. It also requires personal guarantee of either spouse or parents, interest rate is charged as 14.5%, penal interest is 2%, loan processing fee is 1%.

Possession Right Loan: This loan is provided to meet the working capital need. Here both the interest rate & penal interest rate is high that is 15% & 2% respectively. Another notable thing is the maximum term of loan which is only 36 months.

Contractor Loan: Here again the interest rate 15% & penal interest rate 2% are very high.

Working Capital Loan: In this case maximum term of loan is low that is 12 months, interest rate is high that is 14.5% & penal interest is also high as 2%.

Loan against Imported Merchandise: Here the maximum term of the loan is fixed by considering the nature of the imported items, but surprisingly no category of the items on the basis of its nature is provided on the policy.

B. Consumer Financing:

Easy loan: This loan is provided to individuals to meet personal financial requirements. Here the interest rate (11%) is considered as high for any individual; & the penal interest 2% is also a burden on the part of the borrower.

Consumer Durable Loan: This loan is provided to the individuals to buy their personal family use items. But it has few loads on its back, such as high interest rate of 16.5%, service charge 1% on the loan amount, 2% penal interest on overdue amount.

Thikana Loan: Here the maximum loan amount (Tk.5, 00,000) is very thin compared to its purpose; in addition it charges higher interest of 15%, service charge of 2%, & also penal interest of 2%.

Flexi Loan & Peshajeebi Loan: Both of the type of loans poses some burden on the borrowers, such as: both the loan charge 16.5% interest, 1% service charge & 2% penal interest.

To get most of the category of loans, the prospective borrower required to be the client of the same branch of the bank from which s/he want to get the loan, but it may pose some difficulties to the borrower.

8.2 Recommendations

Based on the findings mentioned above, some recommendations are suggested below-

- Standard Bank Limited should lower its loan interest rate, which is seemed to be very high in most of the cases.

- Penal interest is burden for the borrowers & it depends on loan category. The bank should reduce the rate.

- 1% service charge on Retailers loan, 0.5% on Transport loan, 2% on Thikana loan & 1% on Flexi & Peshajeebi loan should be reduced.

- The bank also charges loan processing fee on various types of loans such as, commercial house building loan, transport loan etc. It is an extra burden for the borrowers, so bank should reduce the rate & if possible should eliminate it.

- The maximum loan amount of “Thikana Loan” that is currently Tk. 5,00,000 only should be increased.

- The provision of personal security of parents or spouse should be exempted, because in many cases the kinsfolk’s are reluctant to keep themselves involved in business dealings, especially where it is with any loan processing.

- For “Imported Merchandise Loan” the bank should categorize imported items on the basis of their nature which will facilitate both the borrower & banker to determine the maximum term of the loan.

- The provision that the borrower need to be the client of the same branch from where s/he want to get the loan, should be exempted because s/he might have an account in different branch of the same bank, distant from his business location. So to get the loan, s/he will have to carry out the formalities of opening a new account or transfer the account to that branch, which is expensive side by side time consuming.

- The bank should introduce new loan packages such as, car loan, festival loan etc.

- The bank can build up a separate, adept “Credit Management Team” to handle the loan sanction functions & procedures which will simplify & quicker the overall process for both the bank & borrowers.

8.3 Conclusion

Standard Bank Limited which had been started its journey first on 11th of May, 1999 with the slogan “Setting a new standard in Banking” still now is trying to fulfill its commitment to customers. By providing maximum services to its customers it has been regarded a profitable business organization now. Now a day it has thirty branches in various places of the country.

All the branches of Standard Bank are providing the Small Enterprises Loan & Consumer Financing. Under Small Enterprise Loan the Bank is providing thirteen types of credit facilities like Easy Commercial Loan, Retailer’s Loan, Transport Loan, Commercial House Building Loan, Possession Right Loan, Contractor’s Loan, Letter of Guarantee, Working Capital Loan, Letter of Credit, Loan against Imported Merchandize (LIM), Loan against Trust Receipt, Bidder’s Loan, Project Loan. And under Consumer Financing it is providing six types of credit facilities like: Easy Loan (Secured Personal Loan), Consumer Durable Loan, ‘Parua’ (Education Loan), Thikana (House Building Loan), Flexi Loan (Personal Loan), Peshajeebi Loan (Loan for Professional). By providing several types of credit facilities the bank is playing vital role for the development of the economy of Bangladesh. Standard Bank Limited is committed to expand its area & scope of credit facilities as well as other services. That is why there seems to be great potential for the bank to reach its mission in near future and to set a new standard in banking.

Some more parts of this post-

Report On Loan Policies Of Standard Bank Limited (Part-1)