Credit Risk Management

1.1 Origin of the Report

This report is an internship report prepared as a requirement for the completion of the MBA program. The primary goal of the internship was to provide an ‘on the job’ exposure to the student and an opportunity for translation of theoretical conceptions in real life situation. We, the students, were placed in enterprises, organizations, research institutions as well as development projects. In this connection, after the completions of the MBA program, I was assigned to the Credit Risk Management of the National Bank Limited for practical orientation. I chose the topic “Credit risk Management in National Bank Ltd.” for my internship report under the supervision of Md. Shajul Islam, Lecturer (Accounting), Department of Business Administration, Stamford UniversityBangladesh.

1.2 Background of the report:

Last year Bangladesh Bank undertook a project to review the global best practices in the banking sector and examines in the possibility of introducing these in the banking industry of Bangladesh. Four ‘Focus Groups’ were formed with participation from Nationalized Commercial Banks, Private Commercial Banks & Foreign Banks with representatives from the Bangladesh Bank as team coordinators to look into the practices of the best performing banks both at home and abroad. These focus groups identified and selected five core risk areas and produce a document that would be a basic risk management model for each of the five ‘core’ risk areas of banking. The five core risk areas are as follows-

a) Credit Risks;

b) Asset and Liability/Balance Sheet Risks;

c) Foreign Exchange Risks;

d) Internal Control and Compliance Risks; and

e) Money Laundering Risks.

Bangladesh Bank in one of it’s circular (BRPD Circular no.17) advised the commercial banks of Bangladesh to put in place an effective risk management system by December, 2003 based on the guidelines sent to them.

I am working in the Credit Department of National Bank Limited. In this report, I will try to make a comparative analysis between Bangladesh Bank’ suggested best practices guideline for managing credit risk and National Bank Limited existing credit policy.

1.3 Rationale of the report:

The internship program is very helpful to bridge the gap between the theoretical knowledge and real life experience as the part of the Bachelor of Business Administration (MBA) program. This internship report has been designed to have a practical experience through the theoretical understanding. For the completion of this internship program I have been placed in Bank named “National Bank Limited”. I decided to work on the practices of general banking activities of the bank. The report focuses on the practices of the general banking activities.

1.4 Objective of the study:

The objective of the internship program is to familiarize students with the real business situation, to compare them with the business theories & at last stage make a report on assign task.

Credit Risk Management

The study has been undertaken with the following objectives:

To complete the partial fulfillment of the requirement of MBA Degree

- Ø To know the general banking activities of National Bank Ltd

- Ø To apprise the principal activities and evaluate performance of the National Bank Ltd

- To analysis the pros and cons of the conventional ideas about credit operation of a Bank.

- To have better orientation on credit management activities specially credit policy and practices, credit appraisal, credit-processing steps, credit management, financing in various sector and recovery, loan classification method and practices of National Bank Limited (NBL).

- To compare the existing credit policy of National bank limited with that of best

Practices guideline given by Bangladesh Bank, the central bank of Bangladesh.

- To identify and suggest scopes of improvement in credit management of NBL.

- To get an overall idea about the performance of National Bank Ltd.

- To fulfill the requirement of the internship program under MBA program

1.5 Scope of the Report:

This internship is a part of Business Administration degree that provides an on the job experience to students. I was placed at National Bank Limited as an internee for three months duration. This internship program was my very first on-the-job exposure and provides me with learning experience and knowledge in several areas. During the first few week of my internship period, I was able to get accustomed to the working environment of National Bank Limited. As the internship continued, I not only learned about the activities and operation of correspondent Bank, but I also gathered some

Knowledge about the basic business activities of banking in first one-month of my internship period.

Credit Risk Management

This internship report covers all the trade related products handled by “National Bank Ltd” such as Dispatch, Cash department, Account opening, Cheque clearing, Local remittance, Accounts, Loan division, Credit card division, Foreign exchange, Western Money Union etc.

This has been prepared through extensive discussion with bank employees and with the customer. While preparing this report, I had a great opportunity to have an in depth knowledge of all the banking activities practices by the “National Bank Ltd”. It also helps me to acquire a first hand perspective of a leading private banking in Bangladesh.

Generally, by the word “Bank” we can easily understand that the financial institution deals with money. But there are different types of banks such as; Central Banks, Commercial Banks, Saving Banks, Investment Banks, Industrial Banks, Cooperative Banks etc. But we are used the term “Bank” without any prefix, or qualification, it refer to the “commercial banks”. Commercial banks are the primary contributions to the economy of a country. Therefore we can say commercial banks are profit-making

Institutions that hold the deposit of individuals 7 business in checking & savings accounts and then uses these founds to make loans

Both general public and the government are dependent on the services of banks as the financial intermediary. As, banks are profit earning concern; they collect deposit at the lowest possible cost and provides loans and advances at higher cost. The differences between two are the profit for the bank the bank.

A company can increase efficiency through a number of steps. These include exploiting economies of scale and learning effects, adopting flexible manufacturing technologies,

reducing customer defection rate, getting R&D function to design products that are easily to manufacture, upgrading the skills of employees through training, introducing self-managing team, linking pay to performance building a company wide to efficiency through strong leadership, and designing structures that facilitate cooperation among different functions in pursuit the efficiency goal

Efficiency of customer is related with progression of operation. We can identify the efficiency of customer services by studying the progress of “National Bank Limited” from starting to at present. The progress of “National Bank Limited” is very rapid with concern of its profits making and growth of its operation within the country towards the country’s economy.

National Bank Limited pursues decentralized management policies and gives adequate work freedom to the employees. This results in less pressure for the worker and acts as a motivational tool for them, which gives them, increased encouragement and inspiration to move up the leader of success. Overall I have experienced a very friendly and supporting environment at National Bank Limited which gave me the pleasure and satisfaction to be a part of them for a while.

The study would focus on the following areas of National Bank Limited.

Credit appraisal system of National Bank Limited.

Procedure for different credit facilities.

Portfolio (of Loan or advances) management of National Bank Limited.

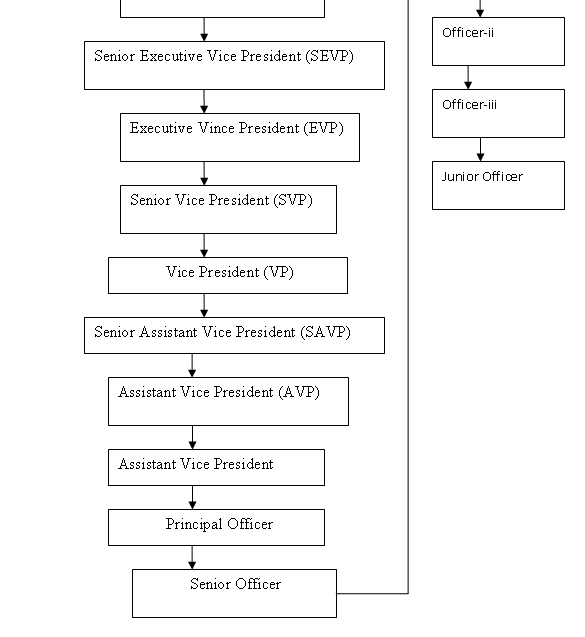

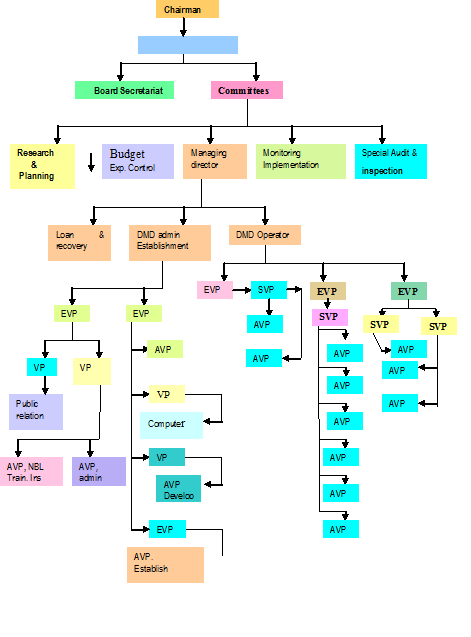

Organization structures and responsibilities of management

1.6 Methodology of the study:

The following methodology will be followed for the study:

Both primary and secondary data sources will be used to generate this report. Primary data sources are scheduled survey, informal discussion with professionals and observation while working in different desks. The secondary data sources are annual reports, manuals, and brochures of National Bank limited and different publications of Bangladesh Bank.

To identify the implementation, supervision, monitoring and repayment practice- interview with the employee and extensive study of the existing file was and practical case observation was done.

1.7 Source of data:

To perform the study data sources are to be identified and collected, the data are to classified, analyzed, interpreted and presented in a systematic.

i) Primary Sources-

- Ø Face to face conversation with the official staff.

- Ø Practical desk work

- ØSimple Depth interview technique was used by asking number open-ended questions to collect the information.

- Ø Relevant file study as provide by the concerned officer.

ii) Secondary Sources:

- Ø Annual Report ( 2005, 2006 and 2008) National Bank Limited

- Ø Credit Risk Manual (2005), National Bank.

1.8 Limitation of the study:

The present study was not out of limitations. But it was a great opportunity for me to know the banking activities of Bangladesh specially National Bank Limited. The study carried on has the following limitations:

- The main constraint of the study is inadequate access to information, which has hampered the scope of the analysis required for the study.

- Some problems create confusions regarding verification of data.

- The time is insufficient to know all activities.

- It was very difficult to collect the information from various personnel for their job constraint.

- As some of the fields of banking are still not covered by our courses, there was difficulty in understanding some activities.

- Because of the limitation of information, some assumption was made. So there may be some personal mistake in the report.

Chapter – 02

Background of banking

2.1 Definition of bank:

The Jews in Jerusalem introduced a kind of banking in the form of money lending before the birth of Christ. The word ‘Bank’ was probably derived from the word ‘bench’ as during ancient time Jews used to do money -lending business sitting on long benches.

First modern banking was introduced in 1668 in Stockholm as ‘Savings Pis Bank’ which opened up a new era of banking activities throughout the European Mainland.

In the South Asian region, early banking system was introduced by the Afghan traders popularly known as Kabuliwallas. Muslim businessmen from Kabul, Afghanistan came to India and started money lending business in exchange of interest sometime in 1312 A.D. They were known as ‘Kabuliwallas

A bank is a financial institution whose primary activity is to act as a payment agent for customers and to borrow and lend money. It is an institution for receiving, keeping, and lending money.

Banks have influenced economies and politics for centuries. Historically, the primary purpose of a bank was to provide loans to trading companies. Banks provided funds to allow businesses to purchase inventory, and collected those funds back with interest when the goods were sold. For centuries, the banking industry only dealt with businesses, not consumers. Banking services have expanded to include services directed at individuals, and risk in these much smaller transactions are pooled.

The name bank derives from the Italian word banco “desk/bench”, used during the Renaissance by Florentines bankers, who used to make their transactions above a desk covered by a green tablecloth.[2] However, there are traces of banking activity even in ancient times.In fact, the word traces its origins back to the Ancient Roman Empire, where moneylenders would set up their stalls in the middle of enclosed courtyards called macella on a long bench called a bancu, from which the words banco and bank are derived. As a moneychanger, the merchant at the bancu did not so much invest money as merely convert the foreign currency into the only legal tender in Rome—that of the Imperial Mint.[3]

2.1.1 Law of banking:

Banking law is based on a contractual analysis of the relationship between the bank and the customer. The definition of bank is given above, and the definition of customer is any person for whom the bank agrees to conduct an account.

The law implies rights and obligations into this relationship as follows:

- The bank account balance is the financial position between the bank and the customer, when the account is in credit, the bank owes the balance to the customer, when the account is overdrawn, the customer owes the balance to the bank.

- The bank engages to pay the customer’s cheques up to the amount standing to the credit of the customer’s account, plus any agreed overdraft limit.

- The bank may not pay from the customer’s account without a mandate from the customer, e.g. a cheque drawn by the customer.

- The bank engages to promptly collect the cheques deposited to the customer’s account as the customer’s agent, and to credit the proceeds to the customer’s account.

- right to combine the customer’s accounts, since each account is just an aspect of the same credit relationship.

- The bank has a lien on cheques deposited to the customer’s account, to the extent that the customer is indebted to the bank.

- The bank must not disclose the details of the transactions going through the customer’s account unless the customer consents, there is a public duty to disclose, the bank’s interests require it, or under compulsion of law.

2.2 Historical background of the banking institution in Bangladesh:

Banks have influenced economies and politics for centuries. Historically, the primary purpose of a bank was to provide loans to trading companies. Banks provided funds to allow businesses to purchase inventory, and collected those funds back with interest when the goods were sold. For centuries, the banking industry only dealt with businesses, not consumers. Banking services have expanded to include services directed at individuals, and risks in these much smaller transactions are pooled.The name bank derives from the Italian word banco “desk/bench”, used during the Renaissance by Florentines bankers, who used to make their transactions above a desk covered by a green tablecloth.[2] However, there are traces of banking activity even in ancient times.

In fact, the word traces its origins back to the Ancient Roman Empire, where moneylenders would set up their stalls in the middle of enclosed courtyards called macella on a long bench called a bancu, from which the words banco and bank are derived. As a moneychanger, the merchant at the bancu did not so much invest money as merely convert the foreign currency into the only legal tender in Rome—that of the Imperial Mint.[3]

2.3 Beginning Banking operation in Bangladesh:

After independence of Bangladesh the government of Bangladesh was formally to change the administration of the territory now constitute Bangladesh. The government promulgated a law called Bangladesh bank order 1971 (acting president order no 2 of 1971). By this order the state bank of Pakistan was declared to be deemed as Bangladesh bank and officers, branches and assets of said state bank was declared to be deemed as officers, branches of Bangladesh bank. On the date there existed 14 scheduled banks with about 3042 branches all over the world.

On the 16th December 1971 there existed the following 12 banks in Bangladesh namely:

| Existing Bank | New Bank |

| Sonali Bank |

| Agrani Bank |

| Janata Bank |

| Rupali Bank |

| Pubali Bank |

| 12. Eastern Banking Corporation Ltd. | Uttara Bank |

2.4 Banking operation of Bangladesh:

The number of banks in all now stands at 49 inBangladesh. Out of the 49 banks, four are Nationalized Commercial Banks (NCBs), 28 local private commercial banks, 12 foreign banks and the rest five are Development Financial Institutions (DFIs).

Sonali Bank is the largest among the NCBs while Pubali is leading in the private ones. Among the 12 foreign banks, Standard Chartered has become the largest in the country. Besides the scheduled banks, Samabai (Cooperative) Bank, Ansar-VDP Bank, Karmasansthan (Employment) Bank and Grameen bank are functioning in the financial sector. The number of total branches of all scheduled banks is 6,038 as of June 2000. Of the branches, 39.95 per cent (2,412) are located in the urban areas and 60.05 per cent (3,626) in the rural areas. Of the branches NCBs hold 3,616, private commercial banks 1,214, foreign banks 31 and specialized banks 1,177.

Bangladesh Bank (BB) regulates and supervises the activities of all banks. The BB is now carrying out a reform program to ensure quality services by the banks.

Chapter – 03

Background of National Bank Ltd.

3.1 Background of National Bank Ltd. (NBL):

National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector Bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain. The member of the board of directors is creative businessman and leading industrialist of the country. To keep pace with time and in harmony with national and international economic activities and for rendering all modern services, NBL, as a financial institution automated all its branches with computer network in accordance with the competitive commercial demand of time. Moreover, considering its forth-coming future the infrastructure of the Bank has been rearranging. The expectation of all class businessman, entrepreneurs and general public is much more to NBL. Keeping the target in mind NBL has taken preparation to open new branches by the year 2008. The expectation of all class businessman, entrepreneurs and general public is much more to NBL. Keeping the target in mind NBL has taken preparation to open new branches by the year 2008.

National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception it is the firm determination of National Bank Limited to play a vital role in the national economy. We are determined to bring back the long forgotten taste of banking services and flavors. We want to serve each one promptly and with a sense of dedication and dignity.

The emergence of National Bank Limited in the private sector is an important event in the Banking arena of Bangladesh. When the nation was in the grip of severe recession, Govt. took the farsighted decision to allow in the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country.

The then President of the People’s Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. The 2nd Branch was opened on 11th May 1983 at Khatungonj, Chittagong.

At present, NBL has been carrying on business through its 101 branches spread all over the country. Besides, the Bank has drawing arrangement with 415 correspondents in 75 countries of the world as well as with 32 overseas Exchange Companies. NBL was the first domestic bank to establish agency arrangement with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. NBL was also the first among domestic banks to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS.NBL has been continuing its small credit programme for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for improving their lot. Alongside banking activities, NBL is actively involved in sports and games as well as in various Socio-Cultural activities. Up to September 2006, the total number of workforce of NBL stood at 2239, which include 1689 officers and executives and 550 staff.

The year 2006 marked the addition of yet another golden stair in the chronicle of NBL’s success story. Compared to 2005, Foreign exchange business of the Bank increased by 34.40% to Tk. 5186 crore, of which export, import and remittance business increased by 34.16%, 31.27% and 56.50% respectively. Total assets of the Bank stood at Tk. 4483 crore on 30.09.2006.

Our Bank invested 25% equity in Gulf Overseas Exchange Company LLC, a joint venture Exchange Company in Oman, operating since November, 1985 under the management of our Bank. The Bank received Riyal Omani 11875 equivalent to Tk.2.10 million as dividend for the year 2006.

Now NBL is on line to establish trade and communication with the Prime International banking companies of the world. As a result NBL will be able to build a strong root in international banking horizon. Bank has been drawing arrangement with well conversant money transfer service agency “Western Union”. It has a full time arrangement for speedy transfer of money all over the world.

Banking is not only a profit-oriented commercial institution but it has a public base and social commitment. Admitting this true NBL is going on with its diversified banking activities. NBL introduced National Bank Monthly Savings Scheme (NMS), Special Deposit Scheme, Consumer’s Credit Scheme and NBL Housing Loan, NBL Small Business Loan, Small House Loan Scheme, Festival Small Business loan etc. to combine the people of lower and middle-income group.

3.2 Corporate information:

3.2.1 Board of Directors:

| MS. PARVEEN HAQUE SIKDER Chairperson |

| MRS HELENA RAHMAN Director |

| MR. A. B. TAJUL ISLAM Director |

| MR. ZAKARIA TAHER Director |

| MR. SHAHADAT HOSSAIN (SALIM) Director |

| MR. M. G. MURTAZA Director |

| MR. LT. COL. (RETD.) MD. AZIZUL ASHRAF, PSC Director |

| MR. A. M. NURUL ISLAM Director |

| MR. SALIM RAHMAN Director |

| MR. S. M. SHAMEEM IQBAL Director |

| PROF. MAHBUB AHMED Director |

| CAPT. ABU SAYEED MONIR Director |

| MR. M. AMINUZZAMAN Managing Director& CEO |

Credit Risk Management

Organ gram of the NBL in Broadly

3.3 Number of branches:

At present, NBL has been carrying on business through its 101 branches spread all over the country. Besides, the Bank has drawing arrangement with 415 correspondents in 75 countries of the world as well as with 32 overseas Exchange Companies. NBL was the first domestic bank to establish agency arrangement with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals.

3.3.1 The list of Branches with opening date of National Bank Limited:

| SL. No | Branch name | Opening Date | SL. No | Branch name | Opening Date |

| Head office | 23.03.83 | 47 | Kawranbazar | 27.08.89 | |

| 01 | Dilkusha | 23.03.83 | 48 | North BK.HI.RD | 15.07.90 |

| 02 | Khatungonj | 11.05.83 | 49 | Paglabazar | 29.08.90 |

| 03 | Imamgonj | 08.06.83 | 50 | Shibganj | 24.12.90 |

| 04 | Agrabad | 16.08.83 | 51 | Saver | 30.01.91 |

| 05 | Rajshahi | 28.08.83 | 52 | Chapaienawabgonj | 10.02.94 |

| 06 | Rangpur | 31.08.83 | 53 | Islampur | 28.02.94 |

| 07 | Khulna | 12.09.83 | 54 | Pahartoli | 13.04.94 |

| 08 | Sylhet | 06.11.83 | 55 | Bhola | 01.06.94 |

| 09 | Comilla | 30.01.84 | 56 | Jhalakathi | 02.06.94 |

| 10 | Narayangonj | 12.03.84 | 57 | Motileel | 26.12.94 |

| 11 | Feni | 09.05.84 | 58 | Subid bazar | 19.06.95 |

| 12 | Bangshal | 31.07.84 | 59 | Sk. Mojib RD | 28.06.95 |

| 13 | Barisal | 10.10.84 | 60 | Ishwardi | 27.08.95 |

| 14 | Bogra | 04.12.84 | 61 | Joypurhat | 14.05.96 |

| 15 | Elephand road | 18.05.85 | 62 | Dhanmondi | 22.06.96 |

| 16 | Jubilee Road | 10.11.85 | 63 | Coxsbazar | 05.02.97 |

| 17 | Chowmohoni | 10.11.85 | 64 | Kishorgonj | 07.06.97 |

| 18 | Moulovibazar | 16.07.86 | 65 | KDA Khulna | 30.09.97 |

| 19 | Sreemongal | 17.07.86 | 66 | Gulshan | 19. 10.99

|

| 20 | F. exchange | 09.10.86 | 67 | Uttara | 29.05.01 |

| 21 | Brahmanbaria | 08.11.86 | 68 | Mirpur | 31.05.01 |

| 22 | Narsindhi | 25.11.86 | 69 | Bishwanath | 12.06.01 |

| 23 | Satkhira | 30.11.86 | 70 | Hobigonj | 14.06.01 |

| 24 | Tongi | 23.02.87 | 71 | Gajipur | 25.10.01 |

| 25 | Mymensing | 24.02.87 | 72 | Z.H.SikdarWomenCollege | 04.11.01 11.08.97 |

| 26 | Faridpur | 26.02.87 | 73 | Thakurgaon | 08.11.01 |

| 27 | Jesshor | 28.02.87 | 74 | Jamalpur | 15.11.01 |

| 28 | Dagondhuiyn | 27.06.87 | 75 | Sherpur | 24.12.01 |

| 29 | chandpur | 17.08.87 | 76 | Chauddagram | 14.02.02 |

| 30 | Babubazar | 31.08.87 | 77 | Gopalgonj | 21.06.06 |

| 31 | Malibagh | 04.11.87 | 78 | Sreenagar | 10.07.06 |

| 32 | Mirpur bazaar | 05.12.87 | 79 | Modupur | 06.07.06 |

| 33 | Tajpur | 28.02.88 | 80 | Godagari | 23.07.06 |

| 34 | Zindabazar | 12.04.88 | 81 | Naria | 11.09.06 |

| 35 | Pabna | 17.04.88 | 82 | Bhanga | 14.09.06 |

| 36 | Dinajpur | 05.06.88 | 83 | Chowgacha | 17.09.06 |

| 37 | Saidpur | 19.06.88 | 84 | Natore | 18.09.06 |

| 38 | Noaogaon | 07.06.88 | 85 | Sunamgonj | 20.90.06 |

| 39 | Sirajgon | 14.08.88 | 86 | Muradpur | 19.11.06 |

| 40 | Kushtia | 16.08.88 | 87 | Bashurhat | 28.11.06 |

| 41 | Patiya | 14.09.88 | 88 | Charfession | 12.12.06 |

| 42 | Mohakhali | 31.10.88 | 89 | Mohammadpur | 20.12.06 |

| 43 | Bebianibazar | 26.12.88 | 90 | LakeCircus | 24.12.06 |

| 44 | Sandwip | 15.03.89 | 91 | Mirsarai | .27.12.06 |

| 45 | Banbura | 04.04.89 | |||

| 46 | Chaktai | 24.06.89 |

3.4 Number of employee:

Up to September 2006, the total number of workforce of NBL stood at 2239, which include 1689 officers and executives and 550 staff.

3.5 Vision statement of the bank:

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

3.6 Mission statement of the bank:

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

3.7 Objective of the Bank:

- Ø Alongside up gradation and diversification of banking service to provide maximum satisfaction to the respected clients, nourishing saving habit among the general people by offering them attractive savings oriented products, thereby assisting economic development.

Ø To build up a deep-rooted and harmonies banker-customer relationship by dispensing prompted improved services to the clients.

- Ø To make best use of the hard-earned investment of our valued shareholders. Simultaneously, play our due part in developing a vibrant capital market by ensuring more effective participation of the Bank in the share market.

- Ø To make best use of latest technologies for giving the clients a taste of modern banking so as to encourage them to continue and feel proud of banking with NBL.

- Ø To respond to the need of the time by participating in syndicated large loans financing, thereby expanding the area of investment of the Bank.

- Ø To gain confidence of all quarters involved in the economic development of the country through pursuance of a policy of continuous adjustment and coordination of the Bank’s external trade programmers with the dynamism inherent in the international trade and payments system.

3.8 Product Scheme

3.8.1Current Deposit:

National Bank Limited offers customers current deposit facility for day-to-day business transaction without any restriction.

Benefits (Condition Apply)

Minimum balance Tk.2000.

Minimum maintenance charge yearly Tk. 800.

No hidden costs.

Standing Instruction Arrangement are available for operating account.

Easy access to our other facilities.

Account Opening

2 copies of recent photograph of account holder.

TIN certificate.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

3.8.2Home Loan:

NBL offers home loan facility for purchasing flats or construction of house .

Benefits (Condition Apply)

Financing amount extends upto 70% or Tk. 75,00,000 which is highest of total construction cost.

Grace period period available upto 9 months in flat purchase or 12 months in construction. Competitive interest rate.

3.8.3 SME Loan:

NBL offers financial support to small businessmen/enterprise with new products named “Festival Small Business Loan” and “NBL Small Business Loan” has been introduced in the Bank.

Benefits (Condition Apply)

Maximum Tk.3.00 lac (Festival Scheme) and Maximum Tk.5.00 lac (Small Business Scheme) .

3 Months (Festival Scheme) and 5 years (including 1 month grace period (Small Business Scheme))

Collateral Free Advance.

Any genuine and small businessmen/ entrepreneurs/enterprise having honesty, sincerity, and integrity.

3.8.4Consumer Loan:

NBL offers consumer credit facility for retail customers.

Financing items

Electronics consumer products.

Computer or Computer accessories.

3.8.5 Trade Finance:

NBL provides comprehensive banking services to all. types of commercial concerns such as in the industrial sector for export-import purpose as working capital, packing credit, trade finance, Issuance of Import L/Cs,Advising and confirming Export L/Cs. – Bonds and Guarantees .

Benefits (Condition Apply)

Low interest rate 13.00%-14.50%.

Minimum processing time.

Low service charges.

3.8.6 Savings Deposit:

National Bank Limited offers customers a basal free and low charges savings account through the branches all over Bangladesh.

Benefits(Condition Apply)

Interest rate of 6.00% on average monthly balance.

Minimum balance Tk.1000.

Maintenance charge yearly Tk. 400.

No hidden costs.

Standing Instruction Arrangement are available for operating account.t Opening

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Valid photocopy of Voter ID Card

3.8.7 Current Deposit:

National Bank Limited offers customers current deposit facility for day-to-day business transaction without any restriction.

Credit Risk Management

Benefits (Condition Apply)

Minimum balance Tk.2000.

Minimum maintenance charge yearly Tk. 800.

No hidden costs.

Standing Instruction Arrangement are available for operating account.

Easy access to our other facilities.

Account Opening

2 copies of recent photograph of account holder.

TIN certificate.

Nominee’s Photograph.

Valid photocopy of Voter ID Card.

3.8.9 RFC Deposit:

National Bank Limited gives opportunity to maintain foreign currency account through it’s Authorized Dealer Branches. Bangladesh nationals residing abroad or Foreign nationals residing abroad or Bangladesh and foreign firms operating in Bangladesh or abroad or Foreign missions and their expatriate employees.

Benefits (Condition Apply)

No initial deposit is required to open the account.

Interest will be offered 1.75% for US Dollar Account , 3.00 % for EURO Account and 3.25% for GBP Account.

They will get interest on daily product basis on the credit balance (minimum balance of US$ 1,000/- or GBP 500/- at least for 30 days) maintaining in the account.

2 copies of recent photograph of account holder.

Nominee’s Photograph.

Passport Copy.

ID of residence in abroad.

3.8.10 NFC Deposit:

National Bank Limited gives opportunity to maintain foreign currency account thorugh it’s Authorized Dealer Branches. All non –resident Bangladeshi nationals and persons of Bangladesh origin including those having dual nationality and ordinarily residing abroad may maintain interest bearing NFCD Account.

Benefits (Condition Apply)

NFCD Account can be opened for One month, Three months, Six months and One Year through US Dollar, Pound Starling, Japanese Yen and Euro.

The initial minimum amount of $1000 or 500 Pound Starling or equivalent other designated currency.

3.8.11 Monthly Savings:

National Bank Limited offers monthly savings scheme for it’s retail customers.

Benefits (Condition Apply)

Monthly amount can be 500 and multiple of it.

Premature encashment is available for urgent need.

Loan facility can be available up to 80% against NMS account balance.

Standing instruction facility can be available to auto transfer installment to NMS account.

1 copy of your recent photograph.

Nominee’s Photograph.

3.8.12 Short Term Deposit:

National Bank Limited offers interest on customer’s short term savings and gives facility to withdraw money any time.

Benefits (Condition Apply)

Minimum balance Tk. 2000.

Minimum maintenance charge yearly Tk. 800.

Standing Instruction Arrangement are available for operating account

3.8.13 Fixed Deposit:

National Bank Limited offers fixed term savings that will scale up your savings amount with the time.

Benefits (Condition Apply)

Any amount can be deposited.

Premature encashment facility is available.

Overdraft facility available against term receipt.

1 copy of recent photograph of account holder.

Nominee’s Photograph.

3.8.14 Overdraft:

NBL offers overdraft facility for corporate customers for day-to day business operations .

Benefits (Condition Apply)

Low charges in overdraft account maintenance.

Facility is available against deposit receipt or mortgage property.

Low interest rate 13-16%.

Opening

Introductory current account .

Others necessary documents as per loan requirement

3.8.15 Western Union:

Joining with the world’s largest money transfer service “Western Union”, NBL has introduced Bangladesh to the faster track of money remittance. Now money transfer between Bangladesh and any other part of the globe is safer and faster than ever before. This simple transfer system ,being on line eliminates the complex process and makes it easy and convenient for both the sender and the receiver. Through NBL – Western Union Money Transfer Service, your money will reach its destination within a few minutes.

Money transfer from anywhere in the World to Bangladesh in minutes.

3.8.16 Credit Card:

Credit card is the newest concept in our country. In our country Credit card was first introduced by the National bank ltd. master card is a name of popular credit card band and it

is world wide accepted credit card. Credit card is safe, instant and universal money. National bank ltd issued two types of credit card, which is as follows:-

- Local credit card: –

Local credit card is two types, such as “gold card” and “silver card”.

Gold card limit is 45000 taka to 100000 taka

Silver card limit is 10000 taka to 45000 taka

Requirement for local credit card:-

ØFDR.STD account Loan

ØTax identification number

Ø Two copy passport size photo

- International credit card:-

It has also two types, such as gold card and silver card.

- Ø For international purpose gold card limit is 2000 us dollar to 4000 us dollar.

- Ø For international purpose silver card limit is 1000us dollar to 2000us dollar.

Requirement for international credit card:-

Ø Pass port photocopy (first five pages)

- Ø Two copy passport size photo.

Ø TIN number

Ø FDR, STD, SB account lien

Through its Credit Card. National Bank Limited has not only initiated a new scheme but also brought a new life style concept in Bangladesh. Now the dangers and the worries of carrying cash money are memories of the past. Credit Card.

3.8.17 NBL ATM Services:

ATM means automated teller machine. NBL ATM card give opportunity to their customer that they can withdraw their money at any time, any days even holidays. By using ATM subscriber can give various utility bill such as telephone, gas, electricity bills etc. actually ATM card is a debit card. National Bank Limited has introduced ATM service to its Customers. The card will enable to save our valued customers from any kind of predicament in emergency situation and time consuming formalities. NBL ATM Card will give our distinguished Clients the opportunity to withdraw cash at any time, even in holidays, 24 hours a day, and 7 days a week.

Charges for ATM card: –

ATM card holders have to pay 1000 taka annually and in the case of card lost subscriber also pay additional 300 taka.

3.8.18 NBL Power Card:

It is a prepaid card. No need of any account of NBL branch. Application form available at any NBL branch and card center. No annual fee for the first year. Renewal fee tk 200.00 only. Local card limit 1000at minimum or its multiple. International card limit-US$ 500.00 at minimum. Refill through any NBL branch. Drawing cash from NBL ATMs free of charge & from ATMs under Q-Cash network-Tk 10.00 per transaction from other ATM-Tk 100.00. Loading fee for international card will be charged @1% of the loaded amount. Cash withdraw fee (abroad) 2% of the cash drawn amount or US $.2.00, whichever is higher. Accepted at all VISA POS merchants. Cash withdrawal at all ATM booths bearing VISA and Q-Cash logo.( Except HSBC Bangladesh). Utility bill payment. It is a prepaid card. No need of any account of NBL branch. Application form available at any NBL branch and card center. No annual fee for the first year. Renewal fee Tk 200.00 only. Local card limit 1000at minimum or its multiple. International card limit-US$ 500.00 at minimum. Refill through any NBL branch.

ATM Location:

| Branch | Location | District |

| Satmasjid Road

| 761 , Satmashjid Road , Dhanmondi

| Dhaka

|

| Uttara

| HossainTower , Next to over Bridge

| Dhaka

|

| Dilkusha

| 48, Dilkusha C/A

| Dhaka

|

| Gulshan

| 97/1 , Gulshan Aenue

| Dhaka

|

| Malibagh

| 474, Malibagh, DIT Road

| Dhaka

|

| Karwan Bazar

| BTMC Bhavan, Karawan Bazar

| Dhaka

|

| Dhaka Varsity

| AdministritiveBuilding

| Dhaka

|

3.9 General banking:

3.9.1 Account Opening Department:

Another function of the banking is A/C opening. The establish a banker and customer relationship account opening is the first step. Opening of account binds the banker and customer into contractual relationship. A bank has to maintain different types of accounts for different purposes. National Bank Limited offers the general deposit products in the form of various accounts.

- Ø Saving Account.

- Ø Current Account.

- Ø Short term deposit Account.

- Ø Fixed deposit Account.

Savings account is that account whose interest rate is higher then current account and saving account holder can withdraw two times in a week. Savings account can be open by individual, joint name or club, society, association etc.

3.9.3 Current account (CD):

Current account is that type’s account where depositor can withdraw his deposited money at any time there is no restriction. Current account can be divided into following such as:-

- Ø Individual current account

- Ø Proprietorship current

- Ø Partnership

- Ø Limited Companies

- Ø Trustees/ clubs/ association/ and different types of institution etc.

3.10 SWOT analysis of the NBL

3.10.1 Strengths:

- Ø NBL provides its customers excellent and consistent quality in every service. It is of highest priority that customer is totally satisfied.

- Ø NBL draws its strength from the adaptabilssity and dynamism it possesses. It has quickly adapted to world class standard in terms banking services. NBL has also adapted state of the art technology to connect with world for better communication to integrate facilities.

- Ø All the level of the management are solely directed to maintain a culture for the betterment of the quality of the service and development a corporate brand image in the market through organization wide team approach and open communication system.

Ø NBL utilizes state of the art technology to ensure consistent quality and operation. The proof of that can be found in one of its branches, Scotia that is equipped with Reuters and SWIFT. All these facilities will be introduced in every branch vary shortly.

- Ø On of the key-contributing factors behind the sources of NBL are its employees who are highly trained and most competent in their own field. NBL provides their employees training both in- house and out side job.

- Ø NBL is free from dependence from the ever-disruptive owner supply of our public sources. The required power is enervated by the company through enervator fed on diesel. Water enervation at present is also done by deep tube wells on site and is abundant in quality.

- Ø NBL provides its workforce an excellent place to work in. total complex has been centrally conditioned. The interior decoration was done exquisitely with the choice of soothing colors and blend of artistic that is comparable to any multinational bank.

- Ø NBL provides the western union money transfer service for these customers are easily getting the foreign money.

- Ø NBL also provide power card service facility. First year Bank is not providing any service charge for the power card.

3.10.2 Weaknesses:

Ø NBL has very limited human resources compared to its financial activities. There are not many people to perform most of the tasks. As a result many of the employees are burdened with extra workloads and works late hours without any overtime facilities. This might cause high employee turnover that will prove to be too costly to avoid.

- Ø Few of the NBL’s products offered to its clients like “Personal credit (PC)” are lying idle due to proper marketing initiative from the management. These products call easily be made available in attractive way to increase its client base as well as its deposit status.

3.10.3 Opportunities:

- Ø Government of Bangladesh has rendered its full support to the banking sector for a sound financial status of the country, as it is becoming one of the vital sources of employment in the country now. Such government concern will facilitate and support the long tern vision for NBL.

- Ø Emergence of e-banking will open more scope for NBL to reach the clients not only in Bangladesh but also in global arena. It is also facilitate wide area network in between the buyer and the population units of NBL to smooth operation to meet the desired need with least deviation.

3.10.4 Threats:

- Ø Government of Bangladesh has rendered its full support to the banking sector for a sound financial status of the country, as it is becoming one of the vital sources of employment in the country now. Such government concern will facilitate and support the long tern vision for NBL.

- Ø Emergence of e-banking will open more scope for NBL to reach the clients not only in Bangladesh but also in global arena. It is also facilitate wide area network in between the buyer and the population units of NBL to smooth operation to meet the desired need with least deviation.

Chapter – 04

Risk Management of National Bank Limited

4.1 Definitions of risk:

Risk is a concept that denotes a potential negative impact to some characteristic of value that may arise from a future event, or we can say that “Risks are events or conditions that may occur, and whose occurrence, if it does take place, has a harmful or negative effect”.

Risk is a commercial strategic board game, produced by Parker Brothers (now a division of Hasbro). It was invented by French movie director Albert Lamorisse, and originally released in 1957, as La Conquête du Monde (The Conquest of the World), in France.

Risk is an album by thrash metal band Megadeth released in 1999. Risk is also notable as the last original Megadeth release to feature long time Megadeth guitarist Marty Friedman. This album is the first Megadeth recording with drummer Jimmy DeGrasso.

The probability of harmful consequences, or expected losses (deaths, injuries, property, livelihoods, economic activity disrupted or environment damaged) resulting from interactions between natural or human-induced hazards and vulnerable conditions

Risk is a science fiction short story by Isaac Asimov, first published in the May 1955 issue of Astounding Science Fiction, and reprinted in the collections The Rest of the Robots (1964) and The Complete Robot (1982).

4.2 Definition of Credit risk:

Risk is inherent in all commercial operations. For banks and financial institutions credit risk is an essential factor, which needs to be managed properly. Credit risk virtually is the possibility that a borrower will fail to repay debt in accordance with the terms of sanction. Credit risk therefore arises from the banks lending operations. In the present days state of deregulation and globalization banks range of activities have increased, so also are the bank. Expansion of bank lending operations covering new products have focused the bank to confront newer risk areas and therefore to work out proper risk addressing devices. Credit risks are so exhaustive that a single device can not encompass all the risk.

As National bank is providing credit facility out of its total available funds, it has to manage these credits very efficiently. An efficient credit management system comprises many things and this cover the pre-sanction activities to post-sanction activities. Credit management is important as it helps the banks and financial institutions to understand various dimensions of risk involved in different credit transactions.

At the pre-sanction stage, credit management helps the sanctioning authority to decide whether to lend or not to lend, what should be the loan price, what should be the extent of exposure, what should be the appropriate credit facility, what are the various facilities, what are the various risk mitigation tools to put a cap on the risk level.

At the post-sanctioning stage, the bank can decide about the depth of the review of renewal, frequency of review, periodicity of the grading, and other precautions to be taken.

4.3 Credit risk and Bangladesh bank:

The Financial Sector Reform Project (FSRP) has designed the LRA package, which provides a systematic procedure for analyzing and quantifying the potential credit risk. Bangladesh Bank has directed all commercial bank to use LRA technique for evaluating credit proposal amounting to Tk. 10 million and above. The objective of LRA is to assess

The credit risk in quantifiable manner and then finds out ways & means to cover the risk. However, some commercial banks employ LRA technique as a credit appraisal tool for evaluating credit proposals amounting to Tk. 5 million and above. Broadly LRA package divides the credit risk into two categories, namely

Business risk & Security risk.

A detail interpretation of these risks and the procedure for evaluating the credit as follows

4.3.1 Business risk:

It refers to the risk that the business falls to generate sufficient cash flow to repay the loan. Business risk is subdivided into two categories.

4.3.2 Industry risk.

The risk that the company fails to repay for the external reason. It is subdivide into supplies risk and sales risk.

4.3.3 Supplies risk:

It indicates that the business suffers from external disruption to the supply of imputes. Components of supplies risk are as raw material, Labor, power, machinery, equipment, factory premises etc.

Credit Risk Management

4.3.4 Sales risk:

This refers to the risk that the business suffers from external disruption of sales. Sales may be disrupted by changes to market size, increasing in competition, change in the regulation or due to the loss of single large customer. Sales risk is determined by analyzing production or marketing system, industry situation, Government policy, and competitor profile and companies strategies.

4.3.5 Company risk:

This refers to the risk that the company fails for internal reasons. Company risk is subdivided into company position risk and Management risks.

4.3.6 Company position risk:

Within an industry each and every company holds a position. This position is very competitive. Due to the weakness in the company’s position in the industry, a company is the risk for failure. That means, company position risk is the risk of failure due to weakness in the companies position in the industry. It is subdivided into performance risk and resilience risk.

4.3.7 Performance risk:

This risk refers to the risk that the company’s position is so weak that it will be unable to repay the loan even under Favor able external condition. Performance risk assessed by SWOT (Strength, Weakness, Opportunity and Threat) analysis, Trend analysis, Cash flow forecast analysis and credit report analysis (i.e. CIB repot from Bangladesh Bank).

Credit Risk Management

4.3.8 Resilience risk:

Resilience means to recover early injury, this refers to risk that the company falls due to resilience to unexpected external conditions. The resilience of a company depends on its leverage, liquidity and strength of connection of its owner or directors. The resilience risk is determined by analyzing different financial ratio, flexibility of production process, shareholders willingness to support the company if need arise and political and private affiliation of owners and key personnel.

4.3.9 Management risk:

The management risk refers to the risk that the company fails due to management not exploiting effectively the company’s position. Management risk is subdivided into management competence risk and integrity risk.

4.3.10 Management competence risk:

This refers to the risk that falls because the management is incompetent. The competence of management depends upon their ability to manage the company’s business efficiently and effectively. The assessment of management competence depends on management ability and management team work. Management ability is determined by analyzing the ability of owner or board of the members first and then key personnel for finance and operation. Management..

4.3.11 Management integrity risk:

This refers to the risk that the company fails to repay the loan amount due to lack of management integrity. Management integrity is a combination of honesty and dependability.

4.3.12 Security risk:

This sort of risk is associated with the realized value of the security, which may not cover the exposure of loan. Exposure means principal plus outstanding interest. The security risk is subdivided into two major heads i.e. security control risk and security cover risk.

4.3.13 Security control risk:

This risk refers to the risk that the bank falls to realize the security because of bank’s control over the security offered by the borrower i.e. incomplete documents. The risk of failure to realize the security depends on the difficulty in obtaining favorable judgment and taking possession of security. For analyzing the security control risk the credit office is required to verify documentation to ensure security protection, documentation completeness, documentation integrity and proper insurance policy. He/she also conducts site visit to verify security existence. Assessment of security control risk requires analyzing the possibility of obtaining favorable judgment and analyzing the case with which the bank could take the possession and liquidate the securities.

4.3.14 Security covers risk:

This refers to the risk that the realized value of security is less than exposure. Security cover risk depends on speed of realization and liquidation value. For analyzing security cover risk, the official requires assessing the power of the customer to prolong the legal process and to analyze the market demand for the security For assessment of security control risk, the officials times the time that would require to liquidate the security and assess the risk and estimates the security value at liquidation and assess the rise

4.4 Process of Credit risk:

Credit Management Policy for any commercial bank must have been prepared in accordance with the Policy Guidelines of Bangladesh Bank’s Focus Group on Credit and Risk Management with some changes to meet particular bank’s internal needs.

Credit management must be organized in such a process that the bank can minimize its losses for payment of expected dividend to the shareholders. The purpose of this process is to provide directional guidelines that will improve the risk management culture, establish minimum standards for segregation of duties and responsibilities, and assist in the ongoing improvement of concerned bank.

The guidelines for credit management may be organized into the following sections:

Policy guidelines

a. Lending guidelines

b. Credit assessment and risk grading

c. Approval authority

d. Segregation of duties

e. Internal control and compliance

Program Guidelines

a. Approval process

b. Credit administration

c. Credit monitoring

d. Credit recovers

Policy guidelines

a. Lending guidelines: The lending guidelines include the following:

- Industry and Business Segment Focus

- Types of loan facilities

- Single borrowers/ group limits/ syndication

- Lending caps

- Discouraged business types

As a minimum, the followings are discouraged:

- Military equipment/ weapons finance

- Highly leveraged transactions

- Finance of speculative investments

- Logging, mineral extraction/ mining, or other activity that is ethically or environmentally sensitive

- Lending to companies listed on CIB black list or known

- Counter parties in countries subject to UN sanctions

- Lending to holding companies.

b. Credit Assessment and Risk Grading:

A thorough credit and risk assessment should be conducted prior to the granting of loans, and at least annually thereafter for all facilities.

Credit Applications should summaries the results of the risk assessment and include, as a minimum, the following details:

- Environment or social risk inputs

- Amount and type of loan (s) proposed

- Purpose of loans

- Loan structure ( tenor, covenants, repayment schedule, interest)

- Security arrangement

- Any other risk or issue

- Risk triggers and action plan-condition prudent, etc.

Risk is graded as per Lending Risk Analysis (LRA), Bangladesh Bank’s Guidelines of classification of loans and advances.

- c. Approval Authority:

Approval authority may be as the following:

- Credit approval authority has been delegated to Branch Manager, Credit Committee by the MD/ Board

- Delegated approval authorities shall be reviewed annually by MD/ Board.

MD/ Board:

- Approvals must be evidenced in writing. Approval records must be kept on file with credit application

- The aggregate exposure to any borrower or borrowing group must be used to determine the approval authority required.

d. Segregation of Duties:

Banks should aim at segregating the following lending function:

- Credit approval/ risk management

- Relationship management/ marketing

- Ø Credit administration

Credit Risk Management

e. Internal Control and Compliance:

Banks must have a segregated internal audit/ control department charged with conducting audits of all branches.

Credit Risk Management

Program Guidelines

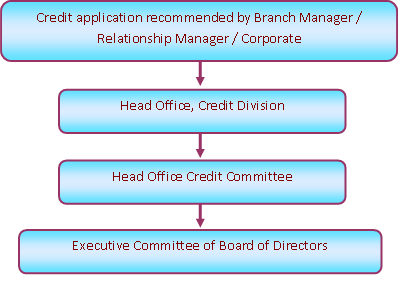

a. Approval process: The following diagram illustrates an example of the approval process:

b. Credit administration: The credit administration function is critical in ensuring that proper documentation and approvals are in place prior to the disbursement of loan facilities.

c. Credit monitoring: To minimized credit losses, monitoring procedures and systems should be in place that provides an early indication of the deteriorating financial health of borrower.

d. Credit recovery: The recovery unit of branch should directly manage accounts with sustained deterioration (a risk rating of sub-standard or worse). The primary functions of recovery unit are:

Credit Risk Management

▪ Determine account action plan/ recovery strategy

▪ Pursue all options to maximize recovery, including placing customers into receivership or liquidation as appropriate.

▪ Ensure adequate and timely loan loss provisions are made based on actual and expected losses.

4.5 Types of credit risk:

- Term financing for new project had BMRE of existing projects (large, medium, SME).

- Working capital for industries, trading services and others (large, medium, SME).

- Trade finance for import and export

- Lease finance

- Small loan for traders, micro enterprise and other productive small venture.

- Consumer finance

- Fee business

4.6 Importance of credit risk:

The importance of credit risk management for banking is tremendous. Banks and other financial institutions are often faced with risks that are mostly of financial nature. These institutions must balance risks as well as returns. For a bank to have a large consumer base, it must offer loan products that are reasonable enough. However, if the interest rates in loan products are too low, the bank will suffer from losses. In terms of equity, a bank must have substantial amount of capital on its reserve, but not too much that it misses the Investment revenue and not too little that it lead itself to financial instability and to the risk of regulatory non-compliance.

Credit risk management, in finance terms, refers to the process of risk assessment that comes in an investment. Risk often comes in investing and in the allocation of capital. The risks must be assessed so as to derive a sound investment decision. Likewise, the assessment of risk is also crucial in coming up with the position to balance risks and returns.

Banks are constantly faced with risks. There are certain risks in the process of granting loans to certain clients. There can be more risks involved if the loan is extended to unworthy debtors. Certain risks may also come when banks offer securities and other forms of investments.

The risk of losses that result in the default of payment of the debtors is a kind of risk that must be expected. Because of the exposure of banks to many risks, it is only reasonable for a bank to keep substantial amount of capital to protect its solvency and to maintain its economic stability. The second Basel Accords provides statements of its rules regarding the regulation of the bank’s capital allocation in connection with the level of risks the bank is exposed to. The greater the bank is exposed to risks, the greater the amount of capital must be when it comes to its reserves, so as to maintain its solvency and stability.

risk management must play its role then to help banks be in compliance with Basel II Accord and other regulatory bodies.

To manage and assess the risks faced by banks, it is important to make certain estimates, conduct monitoring, and perform reviews of the performance of the bank. However, because banks are into lending and investing practices, it is relevant to make reviews on loans and to scrutinize and analyze portfolios. Loan reviews and portfolio analysis are crucial then in determining the credit and investment risks

The complexity and emergence of various securities and derivatives is a factor banks must be active in managing the risks. The credit risk management system used by many banks today has complexity; however, it can help in the assessment of risks by analyzing the credits and determining the probability of defaults and risks of losses.

Credit risk management for banking is a very useful system, especially if the risks are in line with the survival of banks in the business world.

4.7 Credit risk planning:

There are some objectives behind a written credit policy of National Bank that are as follows:

v To provide a guideline for giving loan.

v Prompt response to the customer need.

v Shorten the procedure of giving loan.

v Reduce the volume of work from top level management.

v Delegation of authority of work from top level of management.

v To check and balance the operational activities

4.8 Tools of credit risk:

For credit management, a firm may use tools available to them. Such tools include Credit Risk Grading (CRG) and Financial Spread Sheet (FSS). Credit risk grading is an important for credit risk management as it helps the banks and financial institutions to understand various dimensions of risk involved in different credit transactions. The aggregation of such grading across the borrowers, activities and the lines of business can provide better assessment of the quality of credit portfolio of a bank or branch.

The Lending Risk Analysis (LRA) manual introduced in 1993 by the Bangladesh Bank has been in practice for mandatory use by the banks and financial institutions for loan size of BDT 1.00 crore and above. However, the LRA manual suffers from a lot of subjectivity, sometimes creating confusion to the lending bankers in terms of selection of credit proposals on the basis of risk exposure. Meanwhile in 2003 end, Bangladesh Bank provided guidelines for credit risk management of banks wherein it recommended, interalia, the introduction of Risk Grade Score Card for risk assessment of credit proposals.

Bangladesh Bank expects all commercial banks to have a well defined credit risk management system which delivers accurate and timely grading. In practice, a bank’s credit risk grading system should reflect the complexity of its lending activities and the overall level of risk involved.

4.9 Essential Components of a Sound Credit Policy

There can be some variations based on the needs of a particular organization, but at least the following areas should be covered in any comprehensive statement of credit policy and National Bank’s policy also covers these areas:

1. Legal consideration: The bank’s legal lending limit and other constraints should be set forth to avoid inadvertent violation of banking regulations.

2. Delegation of authority: Each individual authorized to extend credit should know precisely how much and under what conditions he or she may commit the bank’s funds. These authorities should be approved, at least annually, by written resolution of the board of directors and kept current at all times.

3. Types of credit extension: One of the most substances parts of a loan is a delineation of which types of loans are acceptable and which type are not

Credit Risk Management

4. Pricing: In any profit motivated endeavor, the price to be charged for the goods or services rendered is of paramount without it, individuals have few guidelines for quoting retag or fees, and the variations resulting from human nature will be a source of customer dissatisfaction.

5. Market Area: Each bank should establish its proper market area, based upon, among other things, the size and sophistication of its organization its capital standpoint, defining one’s market area is probably more important in the lending function than in any other aspect of banking.

6. Loan Standard: This is a definition of the types of credit to be expended, wherein the qualitative standards for acceptable loans are set forth.

4.10 Focus on Industry and Business Segment

Industry segment focuses on Textile, Pharmaceuticals, Agro-based, Food and allied, Telecommunication, Power generation and distribution, Health care, Entertainment Services, Chemicals, Transport, Infrastructure development, Linkage industry, Information technology, Ceramics, Others as decided from tome to time. And business segment focuses on Distribution, Brick field, Rice mill/ flour mill/ oil mill, Work order, Yarn trading, Cloth merchant, Industrial spares, Hardware, Electronic and electrical goods, Construction materials, Fish trading, Grocery, Wholesale/ retail, Others as dedicated from time to time

Credit Risk Management

4.11 Lending Guidelines

As the bank has a rate of non-performing loans. Banks risk taking applied should be contained and our focus should be to maintain a credit portfolio keeping in mind of bank’s capital adequacy and recovery strength. Thus bank’s strategy will be invigorating loan processing steps including identifying , measuring , containing risks as well as maintaining a balance portfolio through minimizing loan concentration , encouraging loan diversification , expanding product range , streamlining security , insurance etc. as buffer again unexpected.

Chapter – 05

Credit Evaluation Process

5.1 Indebtedness, Rural and Urban:

Indebtedness means the amount borrowed by the people from various sources for investment in the various fields. Rural indebtedness is the amount borrowed by the agriculturists from various sources. This amount is to be used for the improvement in agriculture, for the purchase of improved agricultural implements, better seeds, fertilizers, etc. But the amount, thus borrowed, is not generally used for the purpose for which it is borrowed. The funds are utilized for unproductive purposes such as orthodox, customs heavy expenditure on ceremonial activities, weddings, festivals, etc.

By urban indebtedness is meant the amount borrowed by the industrialists, traders and other business community. Their business needs are met to some extent by the commercial banks and government agencies, but, for incurring non-productive expenditure, they have to resort to borrowing from the money-lenders. Contrary to the indebtedness, the amount borrowed is generally utilized for the use in the respective establishments.

The commercial banks in the district generally charge interest from 7 per cent to 13 per cent, according to the amount advanced and security offered. The banks advance loans on the pledge of goods movable or immovable. The movable goods are kept in the custody of the banks. The average lending rate in the Central Co-operative Financial Institutions ranges in between 6 to 8 per cent, depending upon the nature and purpose of loans. The co-operative societies advance loans at the rate of interest ranging from 2 ½ to 8 ½ percent. Loans advanced, under the State Aid to Industries Act, 1935, carry interest from 2 ½ to 6 ½ percent.

The indebtedness money-lenders charge interest varying from 12 to 25 percent. The loans advanced by the unregistered money-lenders carry much higher rate of interest, usually ranging from 60 to 100 percent, per annum. The indigenous bankers are either going out to the picture or they are trying to fall in line with the modern banking institutions. There is hardly any case where usury is noticed these days.

The interest is sometimes calculated in kind, too, in rural areas. It is done only in case where loan is advance in kind. Such interest varies from 25 to 50 percent on the loan advance in kind, i.e., is one quintal of wheat is advanced as loan, it will fetch one quintal 25 kilos or one quintal fifty kilos to the creditors, as the case may be. Such loans are advanced by landlords, but this practice is by and by disappearing because of the coming up of co-operative institutions which extend financial assistance liberally to the rural areas.

5.2 Role of Private Money-lenders and Financiers

Money-lenders. – Though the institution of private money-lending has lost its importance, yet it has not been completely eliminated. It is regarded as a necessary agency where the modern banking has not developed. The illiterate and conservative people, who have not been fully acquainted with the modern banking practices or have not brought themselves into the co-operative fold, still go to the doors of the private money-lenders.

The money-lenders or the Banian still dominates the rural sector of the district economy. His supremacy in the field of rural finance is still unchallenged. The business of the money-lenders is generally a family concern. His working capital is his own. He grants

He follows indigenous methods of keeping he charges is out of proportion to the rate of interest charged by the other banking institutions.

In the primitive agriculture society, the indigenous money-lender constituted the main and only source of finance to a large section of population. He served in many ways the agriculturist who required money for the purchase of food and other necessaries of life, for social and religious ceremonies and for securing agriculture requisites such as seeds, bullock etc. In times of drought and famine, agriculturists used to borrow heavily from the money-lender against the security of agricultural lands return the debts at harvest time. These debts, not regularly repaid by the farmers, piled up through generation and created in succeeding years the problem of rural indebtedness. In the absence of any adequate protection to the debtor in the form of State regulation the money-lender indulged in a number of malpractices and caused hardships to the debtors. The Government had, therefore, to intervene to prevent money-lenders from indulging in malpractices. The various Acts passed by the Government checked the activities of the money-lenders. The rise and growth of modern banking institutions also affected their business adversely.

Till recently, private money-lending was regarded as a hereditary profession. There was a separate class which was having money-lending as its regular profession. The children of this class generally used to adopt the same profession in turn. The passing of the Punjab Regulation of Accounts Act, 1930, affected the private money-lending business adversely. Though the class of professional money-lending still exists, yet it has either left money-lending as a profession or has refined this profession in line with the modern practice of m0ney0lending. Now the money-lenders are required to get themselves registered with

5.3 Government and Semi-Government Credit Agencies

Till recently, the system of indigenous money-lending as a source of finance, both in rural and urban areas, was common. But the development of Government/Semi Government credit agencies gave a death blow to it. The Government/Semi Government agencies are: (i) The Punjab Financial Corporation. It was established in1953 under the State Financial Corporation Act, 1951, with the object of providing medium and long-term loans to industrial concerns located in the Punjab State to the extent of Rs 20 lakhs in the case of a public limited company or a registered co-operative society and 10 lakhs in other case, at a rate of interest of 3 percent above the bank rate, with a minimum of 9 percent per annum. This amount is repayable in 10 years. The loans are advanced on the security of land, building, plant and machinery, by way of first registered mortgage, with a margin of 40 percent of the net assessed value. In case of Government guarantee, the margin is reduced to 25 percent. ; (ii) The Khadi and Village Industries Commission. It caters to the financial needs of the khadi and village industries for short-term loans. ; (iii) Joint Stock Banks ; and (iv) Co-operative banks.

Financial assistance is also rendered by the State Department of Industries under the State Aid to Industries Act, 1935, for setting up new industrial units and for expansion/modernization of existing units. The Government also advances loans to the agriculturists of agricultural purpose such as purchase of fertilizers, seeds, cattle, tractors, agricultural implements, etc

5.4 Joint-Stock Banks

The banks registered under the Indian Companies Act, 1913, come under this head. Organized on modern lines of joint-stock companies with limited liability, the joint-stock banks are usually referred to as commercial banks.

The modern banking institutions in the country had a very chequered history. The beginning of the 20th century was a turning point in their development. The Swadeshi movement gave a great fillip to the banking industry. A good number of banks were started by enterprising Indian businessmen and capitalists. However, there were several banking failures. The first two decades of the 20th century were characterized by progress of banking as well as bank closures. The World-Wars I (1914-18) and II (1939-45) brought acceleration progress. During the thirties also there was a banking crises. The passage of the Banking Companies Act, 1949, in the banking legislation in India. This Act was amended from time to time.

In the Gurdaspur District, in the beginning, there was at Gurdaspur a branch of the Doaba Bank Ltd., but it had a very short life. Thereafter, a branch of the People’s Bank of Northern India Ltd. was opened. Though fro a sometime it had a good business, yet it also went into liquidation. Batala had a branch of Sahukara Bank Ltd. The Amrit Bank Ltd. with its Head Office at Amritsar, opened a branch at Gurdaspur in 1939 and another one at Batala. The Batala branch was closed after about a year but another was opened at Dinanagar. At that time, the Amrit Bank was the only commercial bank at Gurdaspur. Later on, the Central Bank of India Ltd. And the Imperial Bank of India (now the State Bank of India) also opened their branches there, but these closed soon after. After the lapse of some period, the Bharat Bank Ltd. and the Punjab National Bank Ltd. opened their branches at Gurdaspur (in 1944),

5.5 Leading Guidelines of NBL:

This section details fundamental credit risk management policies that are recommended for adoption by all banks in Bangladesh. The guidelines contained herein outline general principles that are designed to govern the implementation of more detailed lending procedures and risk grading systems within individual banks

5.5.1 Types of loan facilities:

National Bank has been offering wide range of credit facilities as under:

| NAME | PURPOSE |

| Cash credit(Hypo & Pledge) | Business capital / Working capital. |

| SOD ( General) | Against F.O/ Work Order/ supply order. |

| SOD ( Export ) | Payment of accepted bills at maturity before receipt of export proceeds. |

| Loan ( Gen. ) | Acquiring capital assets/ purchasing, constriction finishing, expansion, repair, renovation of house/ flats/ real estate business etc. |

| LCA ( Loans against cash assistance ) | Financing for the period of non- receipt of reimbursement from Bangladesh bank. |

| LC ( Local and foreign) Sight & on deferred payment basis | For import/ local procurement of goods/ service. |

| PAD | For making payment of the L/C obligation against receipt of document. |

| LTR | Retirement of shipping document. |

| LIM | Retirement of shipping document. |

| PC | Meeting financial requirement of the export at pre- shipment stage against export L/C. |

| LDBP/FDBP | As post shipment finances against local/ foreign export bills. |

| BTB L/C | Import of raw/ packing materials against export L/C. |

| Bank guarantee local/ foreign | For submission of tender/ to obtain and offer as security against work order, supply order/ for gas electricity connection against delivery of goods against release of goods without or against partial payment by customer etc. |

5.5.2. Single borrower/ group limits/ syndication:

National bank ltd pursues / will continue to pursue the policy of avoiding too much loan concentration to a single borrower group in order to by pass possible threat in event of such advance turning sticky. In a bid to keep credit risk at the minimum level in respect of larger but prospective advance, National bank will prefer syndicated financing after proper feasibility study.

5.5.3. Leading caps:

National bank ltd is very much aware of over concentration of credit in a particular area, which may under some situation, create disaster for the bank. Keeping this in consideration and also the over all business, trend, prospects/ potentials, problems, risk & mitigates, pricing owner’s stake in business, business competition involvement safety, liquidity, security etc.

Our bank will be guided by the following leading caps generally:

| Sector Caps | % |

| Trade and commerce | 45% |

| SME | 10% |

| Industry- working capital | 10% |

| Project finance- loan term | 10% |

| Retail/ consumer ( CCS ) | 10% |

| Agro credit | 5% |

| Work/ supply order ( contractual finance ) | 5% |

| Others | 5% |

| Total | 100% |

5.5.4.1 Nature of advanced:

Each advanced to be made will be 5.5.4 Loan facilities parameters: