1.1.Introduction

Three month internship program which is a part of MBA program, gave me the opportunity to gather practical knowledge on Banking. This assignment is basically about Corporate Social Responsibility (CSR) and SME financing of Bangladesh. Both of these topics are literature based which I tried to find out what these is all about in the theoretical part and match it with my employer SEBL what are they doing?

As the requirement of the MBA Program a student have to complete an internship under an organization for a period of three months. I am working Southeast Bank at New Elephant Road Branch, Dhaka as a Junior officer. In relation to this requirement I’m doing all sort of work but my concentration is on SME financing.

After the meeting with my supervisor Dr. Laila Arjuman Ara, we both decided to create a report on CSR later I requested to Madam to include SME as it is related to my job. In this report I have collected information from various sources and put my practical job experience.

In my three month of the working career I have tried my level best to prepare a report which can reflect the actual scenario CSR and SME activities of different bank’s of Bangladesh and also try to compare it with the Southeast Bank Limited. This is why my report is titled as —

“CSR & SME – An empirical study on SEBL”

1.2. Objective of the Report

The main objective of the study is to examine the Corporate Social Reporting and SME financing and also find out where SEBL stands in these two issues. To achieve the main objective, the following specific objectives have been covered in this study.

- To identify the nature and extent of CSR practices in the companies, listed on DSE.

- To assess the importance of Corporate Social Reporting.

- To observe the position of social information in the Annual Report.

- To identify the problems regarding Corporate Social Reporting practices.

- To put forward necessary suggestions to overcome the problems.

- To analyze the SME sector in Bangladesh.

- To know the enterprise selection criteria to provide SME loan.

- To know the terms and conditions of SME loans.

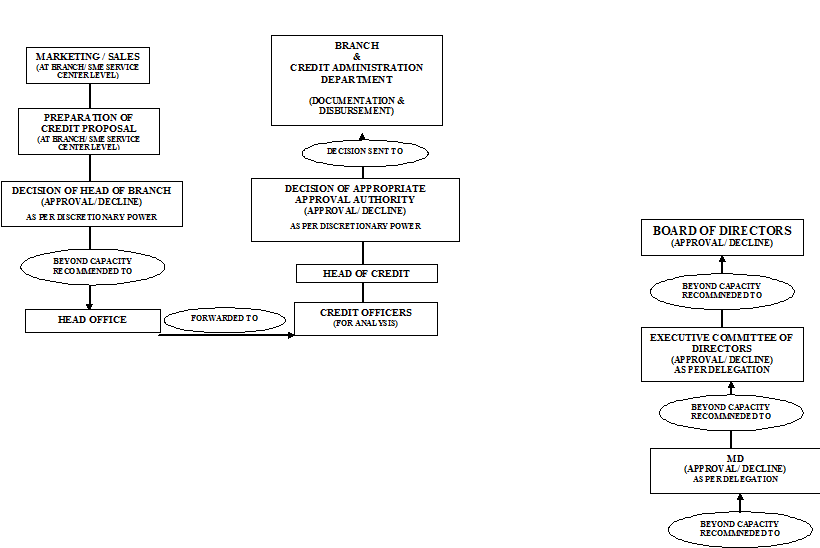

- To know the disbursement and recovery procedures of SME loans.

- To make some recommendations and conclusion to further the development of SME loan products of Southeast Bank Ltd.

- Entry of commercial banks into SME banking industry in Bangladesh.

- Recent performance level of the SEBL on SME loan in the country.

1.3. Research Methodology

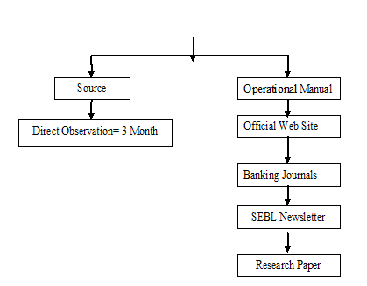

The study uses both primary data and secondary data. The report is divided into two parts. One part is the theoretical part and the other part is the practical part. The information for the theoretical part of the report was collected from secondary sources like books, published reports and web site of the SEBL (www. sebl.com). For general concept development about the bank short interviews and discussion session were taken as primary source. For the practical part of the report general working experience has been utilized.

Information regarding CSR is being collected from Annual Report of Southeast Bank and reports regarding CSR of Bangladesh bank. The information for the Project” Analysis of SME loan in SEBL Bank Limited” both were collected from primary and secondary sources. For gathering concept of SME loan, the Product Program Guideline (PPG) thoroughly analyzed. Beside this observation, discussion with the employee of the SME department and loan administration division they said bank was also conducted. More over a market survey was conducted with a specific questioner. To identify the implementation, supervision, monitoring and repayment practice- interview with the employee and extensive study of the existing file was and practical case observation was done.

|

In recent times a business case has been made for CSR around the world (Pachauri, 2004). A number of academic observers (Belal, 2002; O’Dwyer, 2002; Owen, Swift, & Hunt, 2001; Owen, Swift, Humphrey, & Bowerman, 2000), however, have expressed concern that current CSR practice has failed to achieve the fundamental objective of transparency and accountability (Medawar, 1976). The rapid pace of globalization of markets over the last few decades has added new dimensions to the concept of corporate responsibility in the context of the market economy.

There is a significant and growing interest in the legal academy in exploring new ways to regulate corporations and, in particular, an interest in a shift from regulation to governance. So, Corporate Responsibility has been gaining space in the public policy sphere day by day. It has been increasingly becoming a part of the business practice and has generally been considered as a pragmatic response to consumer and civil society pressures (Bhattacharya, D., 2003). Conventional models, such as command-and-control regulation, operate under a deterrence approach to regulation (Malloy, 2003), which is generally adversarial and punitive (Ruhnka and Boerstler, 1998). Although this traditional approach to regulation has provided many benefits to society (e.g., cleaner air, safer products, and less discrimination), it has its limits and in some cases may have the unintended consequence of actually reducing social welfare (Aalders and Wilthagen, 1997; Sunstein, 1990). For example, some argue that a strict and inflexible regulatory approach may cause some organizations to adopt an adversarial approach to regulators, instead of making good faith attempts to follow the law (Malloy, 2003).

In response to the need for the law to evolve to reflect changes in society and growing complexities, governments have experimented with new approaches to regulation that come closer to self-regulation. Although critics view self-regulation as simply advancing a policy of deregulation (Sinclair, 1997), an increasing number of legal scholars reject a choice between self-regulation and command-and-control and advocate a legal regime based on governance.

Previous studies (Belal, 2001; Imam, 2000) indicated that there is a low level of CSR in Bangladesh and this is the field of study for this research. The main objective of this report is to examine the Corporate Social Responsibility reporting practices in some selected companies listed in Dhaka Stock Exchange. The study identified the companies making disclosure of CSR, its legal status; position of CSR related issues in the Annual Reports. With respect to poor CSR reporting practices, the main problems that have been identified in this study are lack of provision for reporting in the Companies Act, 1994, lack of separate accounting standard, lack of understanding and awareness, lack of qualified and trained personnel and lack of motivation. The study has also put forward suggestions to overcome the problems. The CSR reporting practices need to be improved without any further delay in order to streamline the financial reporting of the selected companies.

1.5. Limitation of the study

In spite of related peoples willingness I could not avail the full concentration as I supposed to have. The officers are extremely busy with their assigned jobs. And even I had to perform the internship while doing the job. On the way of my study, I have faced the following problems that may be termed as the limitations/shortcoming of the study. The main limitations encountered in producing this report are:

I am a full time employee of Southeast Bank Limited. It was difficult for me to allocate enough time to prepare the report. For an analytical purpose adequate time is required. Due to the time limit, the scope and dimension of the study has been curtailed.

At the time of preparing my report I tried to gather every details of process but the major limitation is lack of adequate information.

Due to lack of experience, there may have been faults in the report though maximum labors have been given to avoid any kind of slip-up.

Load at the work place also stood as a barrier to prepare this report.

Poor Library Facility: Most of the commercial bank has its own modern, rich and wealthy collection of huge and various types of banking related books, Journals, Magazines, Papers, Case Studies, Term Papers, Assignments etc. But the library of Southeast Bank Limited is not well ornamented.

1.6. About South East Bank Ltd

Southeast Bank Limited is a scheduled Bank under private sector established under the ambit of bank Company Act, 1991 and incorporated as a Public Limited Company under Companies Act, 1994 on March 12, 1995. The Bank started commercial banking operations effective from May 25, 1995. During this short span of time the Bank had been successful to position itself as a progressive and dynamic financial institution in the country. The Bank had been widely acclaimed by the business community, from small entrepreneur to large traders and industrial conglomerates, including the top rated corporate borrowers for forward-looking business outlook and innovative financing solutions. Thus within this very short period of time it has been able to create an image for itself and has earned significant reputation in the country’s banking sector as a Bank with vision. Presently it has thirty branches in operation.

The emergence of Southeast Bank Limited at the junction of liberation of global economic activities, after the URUGUAY ROUND has been an important event in the financial sector of Bangladesh. The experience of the prosperous economies of Asian countries and in particular of South Asia, has been the driving force and the strategies behind operational policy option of the Bank. The Company Philosophy – “A Bank with Vision” has been preciously the essence of the legend of bank’s success.

Southeast Bank Limited has been awarded license by the Government of Bangladesh as a Scheduled Bank in the private sector in pursuance of the policy of liberalization of banking and financial services and facilities in Bangladesh. In view of the above, the Bank within a period of 10 years of its operation achieved a remarkable success and met up capital adequacy requirement of Bangladesh bank.

Corporate Mission and Vision of Southeast Bank Limited

Mission:

q High quality financial services with the help of latest technology.

q Fast and accurate customer service.

q Balanced growth strategy.

q High standard business ethics.

q Steady return on shareholder’s equity.

q Innovative banking at a competitive price.

q Deep commitment to the society and the growth of national economy.

q Attract and retain quality human resource.

Vision:

To stand out as a pioneer banking institution in Bangladesh and contribute significantly to the national economy.

Core Objectives:

The bank’s overall objective is to have a higher profitability than that of the weighted average of other banks. As such the main focus of the Bank is on highly profitable business with convincing growth potential. Vision for the future is the characteristic that differentiates Southeast Bank from other competitors.

Main Operational Area:

As a commercial bank, Southeast Bank does all traditional banking business including the wide range of savings and credit scheme products, retail banking and ancillary services with the support of modern technology and professional excellence. The bank has launched a number of financial products and services since its inception. Among them different types of monthly savings schemes have achieved wide acceptance among the people.

Comparative financial position of Southeast Bank Ltd

Brief Profile of Southeast Bank Limited:

| 01. |

Date of Incorporation:

12th March, 1995

02.

Date of Commencement of Business:

12th March, 1995

03.Capital Authorized:

Tk. 2500.00 Million

Paid-up:

Tk. 677.16 Million

Reserve Funds:

Tk.622.99 Million

04.

Deposits:

Tk. 20,118.82 Million

05.

Advances:

Tk. 15,548.11 Million

06.

Operating Profits:

Tk. 665.16 Million

07.

Loan as a % of Total Deposits:

77.28%

08.

Global Relations:

350 Correspondents Worldwide

09.

Number of Employees:

2560

10.

Capital Adequacy Ratio:

9.20%

11.

Ratio of Classified Loans to Total Loans:

2.09%

12.

Return on Assets:

1.11%

13.

Name of the Chairman of SEBL:

Mr. Alamgir Kabir, FCA

14.

Number of Branches:

66

15.It is a Publicly Traded Company:

Share quoted daily in DSE & CSE

16.

Credit Card:

Member of Master & VISA Card

17.Banking Operation System:

Both conventional & Islamic Shariah System

18.Technology Used:

Member of SWIF Online Banking Computer System

Chapter-2

Corporate social responsibility (csr) & Southeast bank ltd (Sebl)

2.1. What is Corporate Social Responsibility (CSR)?

Corporate social responsibility (CSR), also called corporate responsibility, corporate citizenship, responsible business and corporate social opportunity is a concept whereby organizations consider the interests of society by taking responsibility for the impact of their activities on customers, suppliers, employees, shareholders, communities and other stakeholders, as well as the environment. This obligation is seen to extend beyond the statutory obligation to comply with legislation and sees organizations voluntarily taking further steps to improve the quality of life for employees and their families as well as for the local community and society at large.

Corporate Social Responsibility (CSR) is a concept whereby organizations consider the interests of society by taking responsibility for the impact of their activities on customers, employees, shareholders, communities and the environment in all aspects of their operations. This obligation is seen to extend beyond the statutory obligation to comply with legislation and sees organizations voluntarily taking further steps to improve the quality of life for employees and their families as well as for the local community and society at large.

The practice of CSR is subject to much debate and criticism. Proponents argue that there is a strong business case for CSR, in that corporations benefit in multiple ways by operating with a perspective broader and longer than their own immediate, short-term profits. Critics argue that CSR distracts from the fundamental economic role of businesses; others argue that it is nothing more than superficial window-dressing; still others argue that it is an attempt to preempt the role of governments as a watchdog over powerful multinational corporations.

The World Business Council for Sustainable Development defines corporate responsibility as the continuing commitment by business to behave ethically and contribute to economic development while improving the quality of life of the workforce, their families and the local community and society at large.

More than goodwill, corporate community involvement or strategic corporate philanthropy, corporate responsibility is a genuine attempt by a company to build meaningful relationships between the corporate sector and the rest of society.

Corporate responsibility is achieved when businesses adapts all of its practices to ensure that it operates in ways that meet, or exceed, the ethical, legal, commercial and public expectations that society has of business.

To be considered effective, corporate responsibility must be an integrated part of day-to-day business, engaging all stakeholders and including strategies to support individual managers to make socially responsible decisions, conform to ethical behavior and obey the law.

2.2. Development of Corporate Social Responsibility (CSR)

In the increasingly conscience-focused marketplaces of the 21st century, the demand for more ethical business processes and actions (known as ethicism) is increasing. Simultaneously, pressure is applied on industry to improve business ethics through new public initiatives and laws (e.g. higher UK road tax for higher-emission vehicles).

Business ethics can be both a normative and a descriptive discipline. As a corporate practice and a career specialization, the field is primarily normative. In academia, descriptive approaches are also taken. The range and quantity of business ethical issues reflects the degree to which business is perceived to be at odds with non-economic social values. Historically, interest in business ethics accelerated dramatically during the 1980s and 1990s, both within major corporations and within academia. For example, today most major corporate websites lay emphasis on commitment to promoting non-economic social values under a variety of headings (e.g. ethics codes, social responsibility charters). In some cases, corporations have re-branded their core values in the light of business ethical considerations (e.g. BP’s “beyond petroleum” environmental tilt).

The term CSR itself came in to common use in the early 1970s although it was seldom abbreviated. The term stakeholder, meaning those impacted by an organization’s activities, was used to describe corporate owners beyond shareholders from around 1989.

2.3. Social Accounting, Auditing and Reporting

Taking responsibility for its impact on society means in the first instance that a company accounts for its actions. Social accounting, a concept describing the communication of social and environmental effects of a company’s economic actions to particular interest groups within society and to society at large, is thus an important element of CSR.

A number of reporting guidelines or standards have been developed to serve as frameworks for social accounting, auditing and reporting:

- Account Ability’s AA1000 standard, based on John Elkington’s triple bottom line (3BL) reporting

- Accounting for Sustainability’s Connected Reporting Framework .

- Global Reporting Initiative’s Sustainability Reporting Guidelines

- Good Corporation’s Standard developed in association with the Institute of Business Ethics

- Green Globe Certification / Standard

- Social Accountability International’s SA8000 standard

- The ISO 14000 environmental management standard

- The United Nations Global Compact promotes companies reporting in the format of a Communication on Progress (COP). A COP report describes the company’s implementation of the Compact’s ten universal principles.

- The United Nations Intergovernmental Working Group of Experts on International Standards of Accounting and Reporting (ISAR) provides voluntary technical guidance on eco-efficiency indicators, corporate responsibility reporting and corporate governance disclosure.

- Verite’s Monitoring Guidelines

The FTSE Group publishes the FTSE4Good Index, an evaluation of CSR performance of companies.

In some nations legal requirements for social accounting, auditing and reporting exist (e.g. in the French bilan social), though agreement on meaningful measurements of social and environmental performance is difficult. Many companies now produce externally audited annual reports that cover Sustainable Development and CSR issues (“Triple Bottom Line Reports”), but the reports vary widely in format, style, and evaluation methodology (even within the same industry). Critics dismiss these reports as lip service, citing examples such as Enron’s yearly “Corporate Responsibility Annual Report” and tobacco corporations’ social reports.

2.4. Potential Business Benefits

The scale and nature of the benefits of CSR for an organization can vary depending on the nature of the enterprise, and are difficult to quantify, though there is a large body of literature exhorting business to adopt measures beyond financial ones (e.g., Deming’s Fourteen Points, balanced scorecards). Orlitzky, Schmidt, and Rynesfound a correlation between social/environmental performance and financial performance. However, businesses may not be looking at short-run financial returns when developing their CSR strategy.

The definition of CSR used within an organization can vary from the strict “stakeholder impacts” definition used by many CSR advocates and will often include charitable efforts and volunteering. CSR may be based within the human resources, business development or public relations departments of an organization, or may be given a separate unit reporting to the CEO or in some cases directly to the board. Some companies may implement CSR-type values without a clearly defined team or programme.

The business case for CSR within a company will likely rest on one or more of these arguments:

2.4.1. Human resources

A CSR programme can be seen as an aid to recruitment and retention, particularly within the competitive graduate student market. Potential recruits often ask about a firm’s CSR policy during an interview, and having a comprehensive policy can give an advantage. CSR can also help to improve the perception of a company among its staff, particularly when staff can become involved through payroll giving, fundraising activities or community volunteering.

2.4.2. Risk management

Managing risk is a central part of many corporate strategies. Reputations that take decades to build up can be ruined in hours through incidents such as corruption scandals or environmental accidents. These events can also draw unwanted attention from regulators, courts, governments and media. Building a genuine culture of ‘doing the right thing’ within a corporation can offset these risks.

2.4.3. Brand differentiation

In crowded marketplaces, companies strive for a unique selling proposition which can separate them from the competition in the minds of consumers. CSR can play a role in building customer loyalty based on distinctive ethical values. Several major brands, such as The Co-operative Group and The Body Shop are built on ethical values. Business service organizations can benefit too from building a reputation for integrity and best practice.

2.4.4. License to operate

Corporations are keen to avoid interference in their business through taxation or regulations. By taking substantive voluntary steps, they can persuade governments and the wider public that they are taking issues such as health and safety, diversity or the environment seriously, and so avoid intervention. This also applies to firms seeking to justify eye-catching profits and high levels of boardroom pay. Those operating away from their home country can make sure they stay welcome by being good corporate citizens with respect to labor standards and impacts on the environment.

2.4.5. Criticisms and concerns

Critics of CSR as well as proponents debate a number of concerns related to it. These include CSR’s relationship to the fundamental purpose and nature of business and questionable motives for engaging in CSR, including concerns about insincerity and hypocrisy.

2.5. CSR and the Nature of Business

Corporations exist to provide products and/or services that produce profits for their shareholders. Milton Friedman and others take this a step further, arguing that a corporation’s purpose is to maximize returns to its shareholders, and that since (in their view), only people can have social responsibilities, corporations are only responsible to their shareholders and not to society as a whole. Although they accept that corporations should obey the laws of the countries within which they work, they assert that corporations have no other obligation to society. Some people perceive CSR as incongruent with the very nature and purpose of business, and indeed a hindrance to free trade. Those who assert that CSR is incongruent with capitalism and are in favor of neo liberalism argue that improvements in health, longevity and/or infant mortality have been created by economic growth attributed to free enterprise.

Critics of this argument perceive neo liberalism as opposed to the well-being of society and a hindrance to human freedom. They claim that the type of capitalism practiced in many developing countries is a form of economic and cultural imperialism, noting that these countries usually have fewer labor protections, and thus their citizens are at a higher risk of exploitation by multinational corporations.

A wide variety of individuals and organizations operate in between these poles. For example, the Leadership Alliance asserts that the business of leadership (be it corporate or otherwise) is to change the world for the better. Many religious and cultural traditions hold that the economy exists to serve human beings, so all economic entities have an obligation to society (e.g., cf. Economic Justice for All). Moreover, as discussed above, many CSR proponents point out that CSR can significantly improve long-term corporate profitability because it reduces risks and inefficiencies while offering a host of potential benefits such as enhanced brand reputation and employee engagement.

2.6. CSR and Questionable Motives

Some critics believe that CSR programs are undertaken by companies such as British American Tobacco (BAT), the petroleum giant BP (well-known for its high-profile advertising campaigns on environmental aspects of its operations), and McDonald’s (see below) to distract the public from ethical questions posed by their core operations. They argue that some corporations start CSR programs for the commercial benefit they enjoy through raising their reputation with the public or with government. They suggest that corporations which exist solely to maximize profits are unable to advance the interests of society as a whole.

Another concern is when companies claim to promote CSR and be committed to Sustainable Development whilst simultaneously engaging in harmful business practices. For example, since the 1970s, the McDonald’s Corporation’s association with Ronald McDonald House has been viewed as CSR and relationship marketing. More recently, as CSR has become main stream, the company has beefed up its CSR programs related to its labor, environmental and other practices. All the same, in McDonald’s Restaurants v Morris & Steel, Lord Justices Pill, May and Keane ruled that it was fair comment to say that McDonald’s employees worldwide ‘do badly in terms of pay and conditions and true that ‘if one eats enough McDonald’s food, one’s diet may well become high in fat etc., with the very real risk of heart disease.

Similarly Shell has a much-publicized CSR policy and was a pioneer in triple bottom line reporting, however, this did not prevent the 2004 scandal concerning its misreporting of oil reserves—an act which seriously damaged its reputation and led to charges of hypocrisy. Since then, the Shell Foundation has become involved in many projects across the world, including a partnership with Marks and Spencer (UK) in three flower and fruit growing communities across Africa.

Critics concerned with corporate hypocrisy and insincerity generally suggest that better governmental and international regulation and enforcement, rather than voluntary measures, are necessary to ensure that companies behave in a socially responsible manner.

2.7. Is CSR Too much of a good thing?

Since there is so much CSR about, you might think big companies would by now be getting rather good at it. A few are, but most are struggling.

CSR is now made up of three broad layers, one on top of the other. The most basic is traditional corporate philanthropy. Companies typically allocate about 1% of pre-tax profits to worthy causes because giving something back to the community seems “the right thing to do”. But many companies now feel that arm’s-length philanthropy—simply writing cheques to charities—is no longer enough. Shareholders want to know that their money is being put to good use, and employees want to be actively involved in good works.

Money alone is not the answer when companies come under attack for their behaviour. Hence the second layer of CSR, which is a branch of risk management. Starting in the 1980s, with environmental disasters such as the explosion at the Bhopal pesticide factory and the Exxon Valdez oil spill, industry after industry has suffered blows to its reputation. Big pharma was hit by its refusal to make antiretroviral drugs available cheaply for HIV/AIDS sufferers in developing countries. In the clothing industry, companies like Nike and Gap came under attack for use of child labour. Food companies face a backlash over growing obesity. And “Don’t be evil” as a corporate motto offers no immunity: Google was one of several American technology titans hauled before Congress to be grilled about their behaviour in China.

So, often belatedly, companies respond by trying to manage the risks. They talk to NGOs and to governments, create codes of conduct and commit themselves to more transparency in their operations. Increasingly, too, they get together with their competitors in the same industry in an effort to set common rules, spread the risk and shape opinion.

All this is largely defensive, but companies like to stress that there are also opportunities to be had for those that get ahead of the game. The emphasis on opportunity is the third and trendiest layer of CSR: the idea that it can help to create value. In December 2006 the Harvard Business Review published a paper by Michael Porter and Mark Kramer on how, if approached in a strategic way, CSR could become part of a company’s competitive advantage.

That is just the sort of thing chief executives like to hear. “Doing well by doing good” has become a fashionable mantra. Businesses have eagerly adopted the jargon of “embedding” CSR in the core of their operations, making it “part of the corporate DNA” so that it influences decisions across the company.

With a few interesting exceptions, the rhetoric falls well short of the reality. “It doesn’t go very deep yet,” says Bradley Googins, executive director of the Boston College Centre for Corporate Citizenship. His centre’s latest survey on the state of play in America is called “Time to Get Real”.

There is, to be fair, some evidence that companies’ efforts are moving in a more strategic direction. The Committee Encouraging Corporate Philanthropy, a New York-based business association, reports that the share of corporate giving with a “strategic” motivation jumped from 38% in 2004 to 48% in 2006. But too often corporate strategy is not properly joined up. In the car industry, Toyota has led the way in championing green, responsible motoring with its Prius hybrid model, but it has lobbied with others in the industry against a tough fuel-economy standard in America. Surveys point to a big gap between companies’ aspirations and their actions (see chart 2). And even corporate aspirations in the rich world lag far behind how much the public expects business to contribute to society.

According to Mr Porter, despite a surge of interest in CSR, in most cases it remains “too unfocused, too shotgun, too many supporting someone’s pet project with no real connection to the business”. Dutch Leonard, like Mr Porter at HarvardBusinessSchool, describes the value-building type of CSR as “an act of faith, almost a fantasy. There are very few examples.”

Perhaps that is not surprising. The business of trying to be good is confronting executives with difficult questions. Can you measure CSR performance? Should you be co-operating with NGOs, and with your competitors? Is there really competitive advantage to be had from a green strategy? How will the rise of companies from China, India and other emerging markets change the game?

This special report will look in detail at how companies are implementing CSR. It will conclude that, done badly, it is often just a fig leaf and can be positively harmful. Done well, though, it is not some separate activity that companies do on the side, a corner of corporate life reserved for virtue: it is just good business.

2.8. CSR Expenditures by Banks

The banking sector of Bangladesh has a long history of involvement in benevolent activities like donations to different charitable organizations, to poor people and religious institutions, city beautification and patronizing art & culture, etc. Recent trends of these engagement indicates that banks are gradually organizing these involvements in more structured CSR initiative format, in line with BB Guidance in DOS circular no. 01 of 2009.

The June 2009 BB Guidance circular suggested that banks could begin reporting their CSR initiatives in a modest way as supplements to usual annual financial reports, eventually to develop into full blown comprehensive reports in GRI format. Information on CSR expenditure available from annual reports of banks, compiled together, bring up the following picture of sectorial patterns:

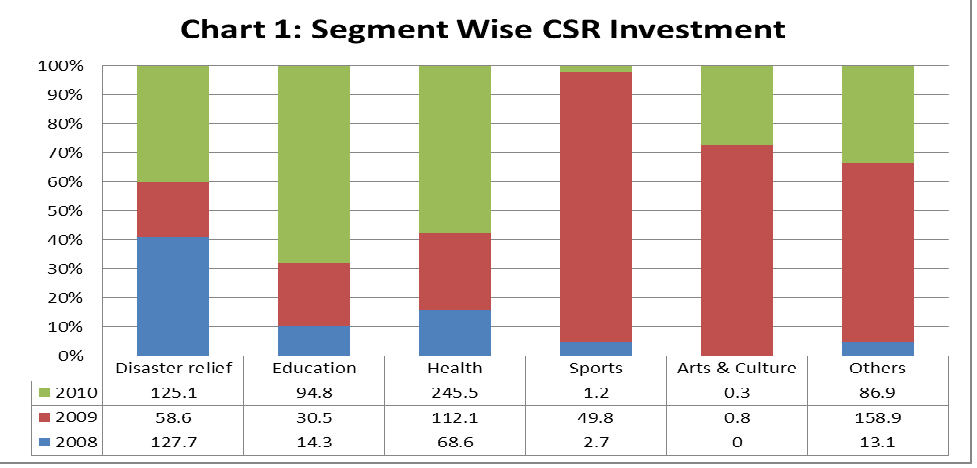

Table-2.1: Sectorial pattern of CSR expenditure reported by banks

(Taka in million)

| Segments | 2008 | 2009 | 2010 |

| Disaster relief | 127.7 | 58.6 | 125.1 |

| Education | 14.3 | 30.5 | 94.8 |

| Health | 68.6 | 112.1 | 245.5 |

| Sports | 02.7 | 49.8 | 1.2 |

| Arts & Culture | 0.0 | 0.8 | 0.3 |

| Others | 13.1 | 158.9 | 86.9 |

| Total | 226.4 | 410.7 | 553.8 |

In the year 2008, large concentration in the field of disaster relief, both in participation and expenditure wise, was observed mainly because of the cyclone ‘Sidr’. Whereas, in the year 2009 & 2010, the ‘Education’ and ‘Health’ sectors were getting more attention and appeared to be the most popular area for CSR activities as huge investments are being made by several banks in these segments. These shifts point to the responsiveness of the banking community to the changing need of the society.

Following are some notable features observed from the CSR activities carried out by the banks:

- In a natural calamity-prone area like Bangladesh, there remains an existing and distinctive CSR agenda focused on the business contribution to tackling social crises in the affected area. Disaster relief and rehabilitation became the segment where the highest number of banks participated to help ease the sufferings of the affected people. In the current context, a desired move from the traditionally popular fields of education or health.

- In the education segment, more and more banks have taken long-term or renewable scholarship programs for under-privileged but meritorious students for the persuasion of their studies instead of providing one time recognition awards to good performers.

- Some banks choose to provide continued financial support for maintaining operating costs of health care organizations. A bank undertook a continuous program called ‘Smile Brighter Program’ to perform as many operations possible per year on cleft-lipped boys and girls to bring back smile on their face.

- Several banks have taken steps and introduced investment schemes to cater the needs of

Self employment and poverty alleviation under which micro-finance is channeled to the

Target groups, such as poor farmers, landless peasants, women entrepreneurs, rootless

slum people, handicapped people, etc.

- A few banks have taken steps to introduce Interest-free Education Loan to poor and meritorious students to help bear monthly educational expenditure including food, accommodation etc. The loan is distributed to the selected students in monthly installments till their completion of studies up to the Masters Degree level.

- A good number of banks have created separate Foundation/Trusts as non-profitable, nongovernmental organization, solely devoted to the cause of charity, social welfare and other benevolent activities towards the promotion CSR objectives. These banks are providing a certain percentage of the pre-tax pro_it/net pro_it each year towards its CSR activities.

2.9. Institutionalizing CSR at Corporate Level

The BB guidance circular suggested embracing of CSR with decisions taken at the highest corporate level (board of directors of the bank), and to choose action programs and performance targets through a consultative processes involving the internal and external stakeholders concerned. As seen in the following table, 12 PCBs and 3 FCBs reported to have embraced CSR with decision at the highest corporate level, none of the SCBs and DFIs reported to have done anything in this regard. A total of 16 out of 30 PCBs and 1 out of 9 FCBs have formed separate Foundations or Trusts as non-profitable, non-governmental organization, solely devoted to the cause of charity, social welfare and other benevolent activities towards the promotion CSR objectives. These banks have also resolved to provide a certain percentage of the pre-tax profit/net profit each year towards its CSR activities. However, none of the banks reported to have adopted action programs and performance targets through consultative processes involving the internal and external stakeholders concerned as suggested in the guideline of June 1, 2008.

Table-2.2: Institutionalizing CSR at corporate level

Compliance issue | SCBs (Nns. 4) | DFIs (Nos. 5) | PCBs (Nos. 30) | FCBs (Nos. 9) |

| Embraced CSR with decision at the highest corporate level | 0 | 0 | 12 | 3 |

| Set up separate body/division/unit in order to mainstreaming CSR activities | 0 | 0 | 16 | 1 |

| Adopted action programs & targets through consultative process involving internal and external stakeholders | 0 | 0 | 0 | 0 |

2.9.1. Ingraining CSR practices within the organization & client businesses

Against the suggestion in the BB guidance circular for ingraining environmentally and socially responsible practices within the organization, only four banks (1 DFI and 3 PCBs) reported having taken steps for adoption of socially and environmentally responsible practices in their own internal operations. The DFI mentioned that they have taken actions towards providing a modern, healthy and safe workplace and creating an environment conducive to learning and development. Regarding reducing the environmental impact as a result of their operation and business activity 1 DFI and 3 PCBs reported to have taken positive actions towards it.

Table-2.3: Ingraining CSR practices in the banks and their client businesses

Compliance issue | SCBs (Nns. 4) | DFIs (Nos. 5) | PCBs (Nos. 30) | FCBs (Nos. 9) |

| Adopted socially and environmentally responsible practices in own internal operations | 0 | 1 | 3 | 0 |

| Providing a modern, healthy and safe workplace and creating a learning and development environment | 0 | 1 | 0 | 0 |

| Reduce the bank’s environmental impact as a result of its operation and business activity | 0 | 1 | 3 | 0 |

| Foster CSR in their client businesses assessing the social and environmental impacts of the projects seeking finance | 1 | 2 | 8 | 0 |

| Ensuring compliance of regulatory environmental and social requirements | 1 | 2 | 8 | 0 |

| Engaging with clients in assessing project’s social and environmental impacts beyond the regulatory requirements | 0 | 0 | 1 | 0 |

As shown in the above table, 1 SCB, 2 DFIs and 8 PCBs have taken steps to foster CSR in their

client businesses in various economic sectors, assessing the social and environmental impacts of the enterprises/projects seeking finance. These banks reported that they try to ensure compliance with environmental standards while financing industrial projects, and that they have formulated environment policies in accordance with guidelines issued by the Government, in terms of which the environmental impacts are considered at the time of conducting Credit and Lending Risks Analysis. Projects likely to have adverse impact on environment are strongly discouraged by them. Some banks have also introduced guidelines requiring assessment of environmental and social impacts of the projects to ensure that operations of the projects would be eco-friendly. It is understood that, banks in Bangladesh in general try to ensure that enterprises projects seeking finance comply with the environmental and social requirements that are compulsorily mandated by laws and regulations. However, most of the banks did not report this in their annual reports.

Financial Inclusion

The CSR guidelines issued by Bangladesh Bank put special emphasis on reaching out with financial services to the less well-off population segments of the community in order to speed up financial inclusion of the large socially disadvantaged rural and urban population segments; drawing them in with appropriate financial service packages and with financing programs innovatively designed to generate new employment, output and income.

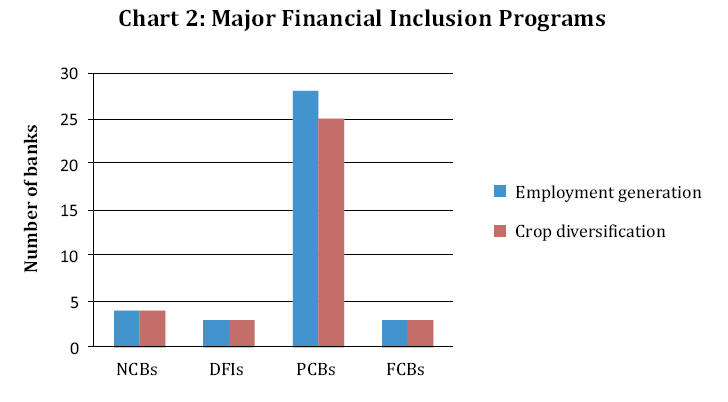

It was observed that 4 SCBs, 3 DFIs, 29 PCBs and 3 FCBs have responded positively to this call and undertaken programs for speeding up financial inclusion of the large socially disadvantaged rural and urban population segments. Out of these programs-

- 4 SCBs, 3 DFIs, 28 PCBs and 3 FCBs were engaged in self-employment credit and Small and Medium Enterprise (SME) lending programs, taken up solo or in association with locally active Micro Finance Institutions (MFIs). These programs were mainly designed to create productive new on-farm/off-farm employment. The banks also formally recognized their philanthropic obligation towards the promotion and development of small and medium industries sector.

- 1 DFI has _inanced programs for installation of biomass processing plants and for Effluent Treatment Plants (ETPs) in manufacturing establishments.

- In order to provide support to small landholder farmers of Bangladesh who play a crucial role in the development of the country, 4 SCBs, 3 DFIs, 25 PCBs and 3 FCBs have disbursed agricultural loans mainly through their rural branches for diversified production of crops, oilseeds, spices, vegetables, fruits etc. by rural households, financing the growers directly or through suitable intermediaries in the value chain, and have provided credit support for combinations of farming activities. Concurrently, credit lines are also extended to different NGOs to support the initiatives for agricultural development and alleviation of poverty in the rural areas.

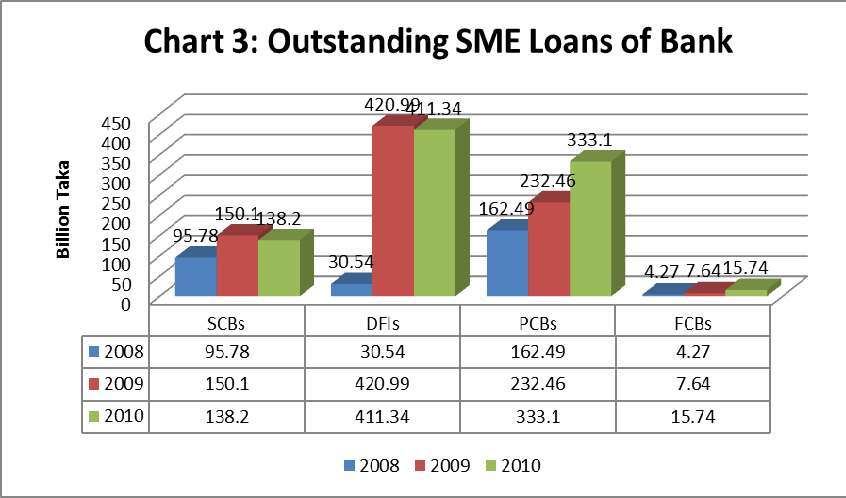

Two banks reported taking up initiatives aimed at prompt delivery of remittances from migrant workers to recipients in remote rural households, or programs for card based mobile phone based delivery of financial services to such households. Among bank financed self-employment & SME projects; dairy, fishery, poultry, goat rearing & cow fattening projects and financing of NGOs for enhancing the flow of micro-credit under NGO Linkage Loan were more prominent. Among the four classes of bank, DFIs were the most important participant in the SME sector. From chart 3 below it can be seen that, during the year 2009, the DFIs had the dominant share of SME credit outstanding during 2009 and 2010. Involvement of SCBs in SME lending does not show signs of stable upward trend. The engagements of PCBs however, have been in significant upward trend. Involvement of FCBs even though small in absolute size, is also showing signs of steady increase.

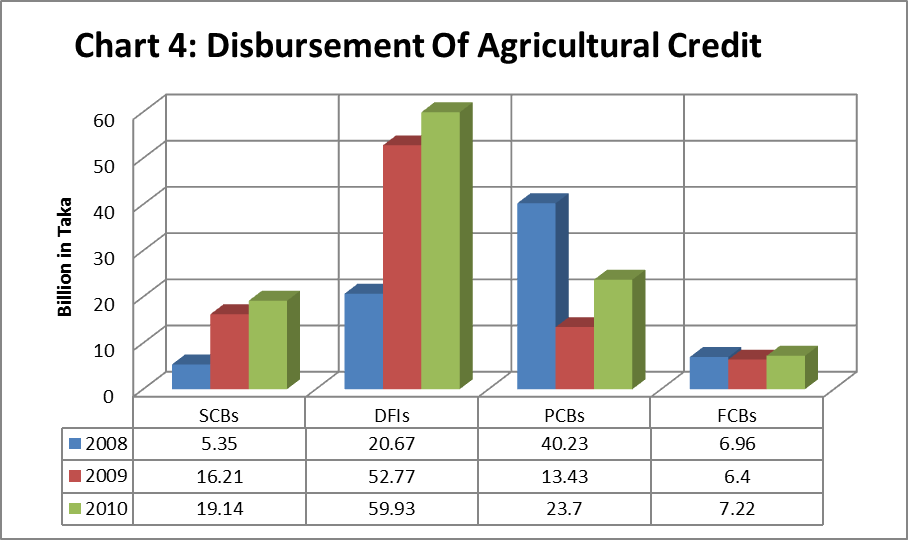

Chart 4 shows the trends of outstanding agricultural credit. Here again, the DFIs have dominant role, because of statutory obligation of two DFIs (BKB, RAKUB).

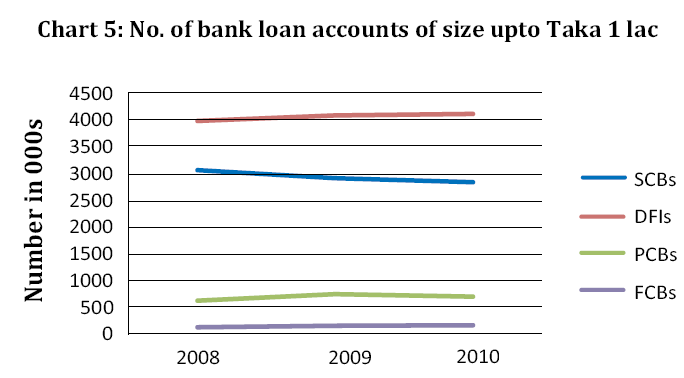

The volume of credit outstanding is no firm evidence of extent of financial inclusion per se however, chart 5 plots the trend of number of small sized bank loan accounts, a plausible proxy for increase in number of agricultural and small enterprise loan accounts and hence for financial inclusion. Trend lines in the chart indicate that the positive results from the CSR and other current initiatives for broadening financial inclusion are yet to show up with prominence

Social and environmental improvement

The banks had significant community investments by way of donations to initiatives of Civil

Society Organizations (CSOs), NGOs and institutions involved in health, education and culture; for social and environmental improvement including nutrition, health and education in the disadvantaged population segments. The following table shows participation of banks in various areas of community development:

Table-2.4: Community investment for social & environmental improvement

| Compliance issue | SCBs (Nns. 4) | DFIs (Nos. 5) | PCBs (Nos. 30) | FCBs (Nos. 9) |

| Banks having community investments by way |

of donations to CSOs, NGOs or others

3

2

30

8

1. Education

3

2

22

5

2. Health

1

3

25

4

3. Disaster relief

3

2

5

8

4. Sports

3

1

14

3

5. Art and Culture

2

1

6

4

6. Environment

0

0

4

1

7. Others

2

1

16

3

It was observed that, Education and Health were the more popular area of participation by the banks in community development. A total of 3 SCBs, 2 DFIs, 22 PCBs and 5 FCBs have made donations to various educational institutions for their cause. In the health sector, 1 SCB, 3 DFIs,

25 PCBs and 4 FCBs patronized a number of health care organizations by way of financial support to them. Disaster Relief also received due attention as 3 SCBs, 2 DFIs, 25 PCBs and 8 FCBs have provided donations to Relief and Rehabilitation Programs for the people affected in different natural calamities.

On the other hand, as shown in the following table, only 12 banks out of 30 PCBs and 3 banks out of 9 FCBs have conducted direct social interventions, both as sustainable/continuous projects or occasional remedial measures. These banks actually tried to enrich economic and social indicators of the society by way of reducing poverty, giving standard health care service, proper nutrition, and ensuring environment friendly society for the present and future generation. However, none of the SCBs or DFIs conducted any direct social interventions. The following areas were covered by the banks that had direct social intervention programs:

- Having considered education as a tool for social change, 8 PCBs and 1 FCB have chalked out programs with a view to remove the access barrier of some of many economic hardship-hit estimable students to their desired level of education by providing scholarship, fellowship, infrastructural development, etc.

- Since a large number of poor people in our country are deprived of the opportunity to cure their health problem, 4 PCBs and 2 FCBs have established permanent health projects to reduce their sufferings.

Table-2.5: Direct social & environmental interventions

| Compliance issue | SCBs |

(4 Nos.)DFIs

(5 Nos.)PCBs

(30 Nos.)FCBs

(9 Nos.)Banks conducting direct social interventions, both as occasional measures or sustainable project001231. Education0 0 812. Health0 0 423. Disaster relief0 0 514. Sports0 0 0 05. Art and Culture0 0 116. Environment0 0 117. Others0 0 01

- Bangladesh lies in a natural calamity-prone area where floods, cyclones and other natural calamities often occur. Some Banks have always been at the service of the people afflicted by the natural calamities. 5 PCBs and 1 FCB have taken direct steps to provide aid and rehabilitation program they considered necessary to the group of people affected in different natural disaster. 1 PCB and 1 FCB have some projects covering Art & culture aspects. 5. 1 PCB and 1 FCB have environmental project to combat the devastating effects of environmental changes for Green House affects due to Global warming.

Reporting CSR initiatives

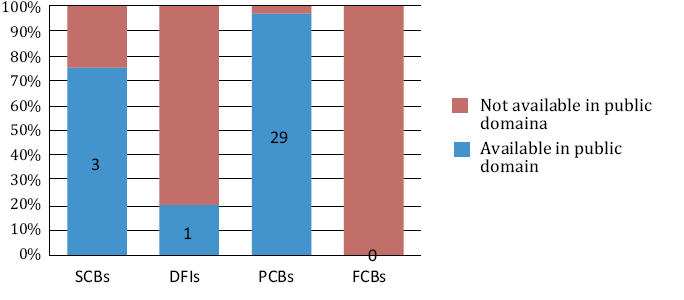

The following figure shows that, 3 SCBs (75%), one DFI (20%) and 29 PCBs (97%) have reported their CSR initiatives as supplements to usual annual financial reports in accordance to the directive of Bangladesh Bank.

(Chart-2.6: Availability of CSR Reports.)

In case of FCBs, only audited financial statements are prepared for the host country, and their annual reports are published from their parent country. As a result, disseminating their CSR activities as supplements to usual annual financial report do not apply. It was also observed that:

- 1 SCB, 1 DFI and 13 PCBs have reported the CSR activities separately as a chapter in the annual report to make it available in the public domain for perusal by stakeholders.

- 1 SCB and 11 PCBs have provided details in those supplements. They have reported the action programs along with amount of investment made in each program.

- 2 SCBs, one DFI and 4 PCBs have included a future plan in the annual financial reports. None of the banks have issued separate reports of their CSR programs and activities in comprehensive standard formats such as the GRI. Additional information had to be asked for in compiling this review, over and above the information provided in annual reports of banks. For convenience of all involved, banks and financial institutions will be well advised to take steps for more elaborate reporting in comprehensive standard formats.

2.10. CSR of Southeast Bank Limited

Southeast Bank is pledge bound to respond to the expectation of the society. By fulfilling their responsibilities, they try to earn the highest trust of the community in which they operate. They act responsibly with regard to their customers, shareholders, employees, business associates, the environment and the society. They contribute to the sustainable development of the society as a whole. They recognize their obligation to the society. The ways they discharge their corporate social responsibility are:

- They contributing to the national economy

- They maintain fair, transparent and sound management based on the principles of self responsibility

- They help the under priviledge section of the society in education

- They create a free and active business environment

- They maintain high compliance standard

- They stand by distressed humanity in national calamities

- They help poor and needy in people in healthcare

- They take care of their employees.

- They help their customers to grow

- They continuously enhance shareholder value and follow stable dividend policy

- They support charitable ventures and environment protection efforts

- They ensure that environment is not harmed as result of their operation

- They contribute to women empowerment and women development

- They observe environment related laws and regulations

- They have scholarship schemes for the poor but meritorious students to change their lots

- They contribute to the development of art, education, culture and sports

- They carry on energy and resources saving activities in the bank

- They foster a relationship of understanding, trust and creditability with the community, in reciprocating, the citizens acknowledge the significance of their existence.

In the financial year of 2009, the bank spent Taka 24,747,500 for CSR activities. Southeast Bank Foundation which is funded by Southeast Bank Limited also carried out CSR activities throughout the year.

Report on Corporate Social Responsibility of SEBL in 2007-2010

2.10.1. CSR of SEBL in 2007

In recent years, there has been growing recognition and acceptance that the behavior of business houses is an important factor in influencing a wide range of social, environmental, community and ethical issues. Their customers want to be treated fairly. Our regulators want to be confident that their operate within the logical and ethical standard with fairness, transparency and honesty. Their staff members want to be paid competitively and treated with respect. Our shareholders want to be assured that we consider the risks and opportunities while taking business decision and pay good dividend every year. The social spectrum under which we operate desires that we carry on our business responsibly and positively contribute to the society and the environment. They are committed to responsible business practices and to a policy of continuous improvement in applying sound environmental and social standards in their dealings with all their stakeholders.

In 2007, they have supported charitable ventures, relief operations, environment protection, education, art, culture, sporting events and have come to the aid of poor people for treatment of serious diseases. They have established Southeast Bank Foundation to do social work for community development. The foundation has provided direct financial support to numerous charities, events and organizations.

Their banking business depends on a network of relationship with their customers, employees, shareholders, suppliers, business associates, and the community. Their corporate social responsibility is about addressing the needs of all the parties in a way that both advances the Bank’s business and makes a positive contribution to the society.

Customers

The main channel we use to discharge our responsibility to the customers is by way of offering financial products and services those truly meet their needs. We strive to maintain the highest standard of ethics in the conduct of our business and feel proud of the trust the customers repose in us. In return, they carry out their every single transaction with them with the highest degree of commitment and transparency without any hidden cost. Our customers are our partners in business and we sincerely Endeavour to improve our relationship with them for our mutual benefit.

Employees

In their business which is dynamic and growing, they depend on their skilled and experienced human resource at every level in the organization. They offer them very competitive pay package and bonus. There are also provisions for handsome retirement benefits by way of Contributory Provident Fund, Gratuity and Superannuation benefits. They provide them with a safe and congenial work environment. Resultantly, the Bank has come out as an employer of choice. Rapid growth of business of the Bank presents opportunities for talented employees to take added responsibilities. Their employees follow the code of conduct as embodied in the Service Rules and Regulations of the Bank. The employees of the Bank are aware of their Responsibilities to the society. They donated total Tk.0.423 million out of their salary for flood and cyclone hit people of the country in 2007.

Shareholders

They are fully committed to the interest of our shareholders. Their constructive suggestions are implemented for the betterment of the company. They release enough disclosures for the information of the shareholders in the Annual Reports, half-yearly financial statements, the print and electronic media and in the Bank’s website. They always try to enhance shareholders value by optimizing financial performance at least cost. They continuously pay good dividends to the shareholders. The number of shareholders of the Bank is increasing which testifies their unshakable trust in the Bank.

Business Associates

They continuously try to create a lasting relationship with our suppliers and business associates for mutual growth. Their relationship with them is based on mutual trust and respect. They deal with them in a fair and transparent way.

Environment

They ensure that their operations are environment-friendly and discourage financing projects contrary to it. They have extended our helping hands to initiatives of community leaders for environment protection and development. They are one of the leading participants in the beautification of DhakaCity. The road-island from Russel Square to Manik Miah Avenue was beautified by our Bank.

Regulators

To be a responsible corporate citizen, we comply with the relevant laws, rules and regulations of all regulatory authorities. Their business practices are transparent and are appreciated by the regulators. They operate cautiously observing the anti-money laundering practices.

Community

They work to promote good community relations to foster a relationship of understanding, trust and credibility. They have a long history of support for charitable causes. In 2007, they have spent Tk.22.56 million as donations for education, sports, art, culture, health-cares, community development, relief operations etc. The major areas of donations are given in the table below:

| Sl. No. | Date |

To whom given Amount in million0113.05.2007Society for Assistance to Hearing Impaired ChildrenTk.1.20

0207.08.2007Chief Advisor’s Relief Fund for flood victims through Islamic Banks’ Consultative ForumTk.1.00

0313.08.2007Chief Advisor’s Relief Fund for country’s flood victimsTk.5.00

0429.11.2007Bangladesh Army Relief Fund for cyclone-SIDR victimsTk.5.00

0503.12.2007Chief Advisor’s Relief Fund for cyclone-SIDR affected peopleTk.5.00

The Bank has also established Southeast Bank Foundation to participate in social work in a more organized way. In 2007, the Foundation donated Tk. 6.33 million for the distressed humanity. It may be cited that the Foundation has donated Tk.2.5 million to the Government of Bangladesh (GOB) for relief operations amongst the hill slide victims of Chittagong. It also donated Tk.0.5 million amongst the tornado affected people of Chhagalnaiya, Feni. To encourage female professionals in the field of accountancy of the country, the Foundation has decided to award 02 (two) scholarships for 02 (two) deserving female articled students of the Institute of Chartered Accountants of Bangladesh (ICAB) on a recurring basis to pursue Chartered Accountancy Course. Each scholarship holder will be paid Tk.3,000.00 per month for 03 (three) years and Tk.10,000.00 for books and other related expenditures.

2.10.2. CSR of SEBL in 2008

Southeast bank’s banking practice is based on a network of relationship with its employees, customers, suppliers, business associates, shareholders, regulatory authorities, and the community. The bank’s corporate social responsibility is about addressing the needs of all the stakeholders in a way that advances its business and makes a positive and meaningful contribution to the society.

Employees

The bank’s business is dynamic and growing. This dynamism and growth comes from its skilled and experienced human resource that can be found at every level of the organization. The bank offers its employees very competitive pay package and bonus that are reviewed on a continuous basis in line with the market forces. It provides the employees a safe and congenial work environment. It also offers its employee’s handsome retirement benefits by way of contributory provident fund, gratuity, and superannuation fund Ltd. As consequences, southeast bank has emerged as a bank with vision. Workplace of choice of many. The bank’s rapid growth in business present opportunities or talented employees to take added responsibilities. The employees follow the ethical and other codes of conduct as embodied in the service rules and regulations of the ban.

Customers

The need to focus on the need to customers is fundamental to banking business. Southeast bank discharges this vital responsibility by offering financial products and services that truly meets their needs. In discharging this vital responsibility, the bank always strives to maintain the highest standard of ethics in the conduct of its business. The bank feels proud that these efforts have earned it the trust of the customers. This trust in turn motivates the bank to carry out every single transaction with the customers with the highest degree of commitment and transparency without any hidden cost. The bank looks upon the customers as its partners in business and sincerely endeavors to improve its relationship with them for mutual benefit.

Shareholders

The southeast bank is fully committed to protect the interest of its shareholders. Their constructive suggestions are implemented for the betterment of the company. It releases enough disclosures for the information of the shareholders in the annual reports, half yearly financial statements, and the print and electronic media and in the bank’s website. It always endeavors to enhance shareholders value by optimizing financial performance at least cost. Since inception, the bank has paid good dividends to the shareholders. The number of shareholders of the bank is increasing that testifies their unshakeable faith in the bank.

The bank’s business associates

The bank continuously endeavors to create a long lasting win relationship with its suppliers and business associates for mutual growth. Its relationship with them is based on mutual trust and respect. It deals with them in a fair and transparent way. Southeast Bank enjoys credit lines from correspondents and foreign banks and special credit line from ADB and IFC.

Environment

The Bank continuously strives to ensure that its operations are environment friendly and discourages financing projects contrary to it. It has extended its helping hands to initiatives of community leaders for environment protections and development. It is one of the leading participants in the beautification of Dhaka city. The beautification of the road island from Russel Square to Manik Miah Avenue has been done by southeast bank.

Regulators

Southeast bank firmly believes that it is imperative to comply with relevant laws, rules and regulations of all regulatory authorities to be a responsible corporate citizen. The bank’s business practices are transparent and are appreciated by the regulators. The bank operates cautiously observing the anti money laundering practices.

Community

Southeast bank works to promote good community relations to foster a relationship of understanding, trust and creditability. It has a strong history of support for charitable causes. In 2008, southeast bank has spent taka 14.82 million as donations for education, sports, art, culture, healthcare, community development, relief operations etc. the major areas of donations are given in the table below —

| SL NO. | Date | To Whom given | Donated Amount |

| 1 | 07/01/2008 | Sub-ordinate employees of the bank affected by cyclone Sidr | Taka 375,000 |

| 2 | 09/02/2008 | Mr. S. Humayan Kabir for medical treatment | Taka 100,000 |

| 3 | 13/02/2008 | Bangladesh amateur boxing federation | Taka 422,500 |

| 4 | 27/03/2008 | Bangladesh amateur boxing federation | Taka 87,500 |

| 5 | 04/05/2008 | Autistic Children’s welfare foundation | Taka 500,000 |

| 6 | 27/05/2008 | Bangladesh amateur boxing federation | Taka 781,500 |

| 7 | 14/06/2008 | Mrs. Sufia Akhter for cancer treatment | Taka 1,000,000 |

| 8 | 16/07/2008 | Mr. Shafayet Hossain for his kidney transplant | Taka 2,500,000 |

| 9 | 03/08/2008 | Bangladesh amateur boxing federation | Taka 262,000 |

| 10 | 29/09/2008 | Ms. Mariam Khanam for medical treatment of her son | Taka 300,000 |

| 11 | 20/11/2008 | Dishari foundation for construction of brick house | Taka 150,000 |

| 12 | 12/11/2008 | Mr. Abu Neser Md. Hasan for medical treatment of his wife. | Taka 50,000 |

| 13 | 24/11/2008 | Mr. Syed Md. Showket Osman for medical treatment | Taka 600,000 |

| 14 | 01/12/2008 | Bangladesh amateur boxing federation | Taka 846,200 |

| 15 | 15/12/2008 | Karmojibi Nari for purchase of a refrigerator for their official use | Taka 30,957 |

| 16 | 28/12/2008 | Bangladesh amateur boxing federation | Taka 100,200 |

Southeast Bank Foundation

The bank has also established the Southeast Bank Foundation to participate in social work in a more organized manner. In 2008, the foundation donated taka 11, 75,000.00 for the distressed humanity. Out of the amount, taka 10.00 lac was given to Mr. Md. Rahimul Islam Majumder for medical treatment of his son’s hearing and speaking disability. Taka 175,000.00 was donated to the society for the welfare of the intellectually disable- Bangladesh.

To encourage female professionals in the field of accountancy of the country, the foundation has awarded scholarships for 02 (two) deserving female article students of the Institute of Chartered Accountants of Bangladesh (ICAB) on a recurring basis to continue annually to pursue chartered Accountancy Course. Each scholarship holder is being given taka 3.000.00 per month for three years. Besides taka 10,000.00 was paid to each of them for books and other related expenditures.

2.10.3. CSR of SEBL in 2009

Southeast Bank’s banking practice is based on a network of relationship with its employees, customers, suppliers, business associates, shareholders, regulatory authorities and the community. The bank’s corporate social responsibility is about addressing the needs of all the stakeholders in a way that advances its business and makes a positive and meaningful contribution to the society.

Employees

The Bank’s business is dynamic and growing. This dynamism and growth comes from its skilled and experienced human resources that can be found at every level of the organization. The bank offers its employees very competitive pay package and bonus that are reviewed on a continuous basis in line with the market dynamics. It provides the employees a safe and congenial work environment. It also offers its employees handsome retirement benefits by way of contributory provident fund, Gratuity, Superannuation benefits, etc. as a consequences, Southeast Bank has emerged as bank with a vision; workplace of choice of many. The Bank’s rapid growth in business presents opportunities for talented employees to take added responsibilities. The employees follow the ethical and other codes of conduct as embodied in the service Rules and Regulations of the Bank.

Customers

The need to focus on the need of customers is fundamental to banking business. Southeast bank discharges these vital responsibilities by offering financial products and services that truly meet their needs. In discharging this vital responsibility, the bank always strives to maintain the highest standard of ethics in the conduct of its business. The bank feels proud that these efforts have earned it the trust of the customers. This trust in turn motivates the bank to carry out every single transaction with the customers with the highest degree of commitment and transparency without any hidden cost. The bank looks upon the customers as its patterns in business and sincerely endeavors to improve its relationship with them for mutual benefits.

Shareholders

The Southeast bank is fully committed to protect the interest of its shareholders. Their constructive suggestions are implemented for the betterment of the company. It releases enough disclosures for the information of the shareholders in the Annual Reports, half-yearly financial statements, the print and electronic media and in the Bank’s website. It always endeavors to enhance shareholders value by optimizing financial performance at least cost. Since inception, the Bank has paid good dividends to the shareholders. The number of shareholders of the Bank is increasing that testifies their unshakable trust in the Bank.

The Bank’s Business Associates

The Bank continuously endeavors to create a long-lasting win-win relationship with its suppliers and business associates for mutual growth. Its relationship with them is based on mutual trust and respect. It deals with them in a fair and transparent way. Southeast Bank enjoys credit lines from Correspondents and Foreign Banks and special credit line from ADB and IFC.

Environment

The Bank continuously strives to ensure that its operations are environment-friendly and discourages financing projects contrary to it. It has extended its helping hands to initiatives of community leaders for environment protection and development. It is one of the leading participants in the beautification of DhakaCity. The beautification of the road island from Russell Square to Manik Miah Avenue was done by the Southeast Bank. Regulators

Southeast bank firmly believes that it is imperative to comply with the relevant laws, rules and regulations of all regulatory authorities to be a responsible corporate citizen. The Bank’s business practices are transparent and are appreciated by the regulators. The Bank operates cautiously observing the anti-money laundering practices. Community Southeast Bank works to promote good community relations to foster a relationship of understanding, trust and credibility. It has a long history of support for charitable causes. In 2009, Southeast Bank has spent Tk.24.75 million as donations for education, sports, art, culture, health-care, community development, relief operations etc.

Their credit policy has been redesigned to avoid concentration of Bank’s credit in major cities and to encourage distribution of credit in priority sectors particularly in Agriculture and SMEs.

A senseless killing of valiant army officers was committed by the misguided BDR personnel at BDR Headquarters, Peelkhana, Dhaka on February 25, 2009. It widowed and orphaned innocent people and catapulted the affected families in distress and uncertainty. Southeast Bank pioneered and propagated an idea to stand by the affected families which won it wide appreciation at different levels.

In accordance with our devised formula, the Bank, in collaboration with the Government of Bangladesh, selected the following 7 (seven) bereaved families of the Shaheed Army Officers who embraced martyrdom at the carnage at BDR Headquarters to stand by them. Each family is being given Tk.40,000.00 (Forty Thousand) only per month totaling Tk.4,80,000.00 (Four Lac Eighty Thousand) only in a year and the contribution will continue for 10 (ten) years.

| Sl no. | Name of Shaheed Army Official | Monthly Contribution | Yearly Contribution | Widow Shaheed Army Official |

| 01 | Brig. General Md. Abdul Bari | 40,000.00 | 480,000.00 | Ms. Farhana Bari |

| 02 | Col. Md. Mojibul Huq | 40,000.00 | 480,000.00 | Ms. Nehrin Ferdousi |

| 03 | Col. Mohammad Mashiur Rahman | 40,000.00 | 480,000.00 | Ms. Zobaida Begum |

| 04 | Col. Kudrat Elahi Rahman Shafiq | 40,000.00 | 480,000.00 | Ms. Loby Rahman |

| 05 | Maj.Md. Abdus Salam Khan | 40,000.00 | 480,000.00 | Ms. Mahbuba Begum |

| 06 | Lt. Col.Md. Lutfur Rahman | 40,000.00 | 480,000.00 | Ms. Munmun Rahman |

| 07 | Maj.Md. Mahbubur Rahman | 40,000.00 | 480,000.00 | Ms. Rita Rahman |

First year’s contribution for Tk.33,60,000.00 (Thirty Three Lac Sixty Thousand) only was paid to the widows of the Shaheed Army Officers at the Prime Minister’s Office (PMO) on April 01, 2009. Apart from the above, Southeast Bank also donated Tk.25,00,000.00 (Twenty Five Lac) only to the Prime Minister’s Relief Fund on 15 June, 2009 for relief operations amongst Cyclone Aila and other natural calamity victims.

National Economy

Southeast Bank has directly employed 1402 people in the service of the Bank. We have also generated employments for thousands of men and women in the projects and industrial ventures established with our finance. The credit policy of the Bank has also been so designed as to promote trade, commerce and industry which will ultimately contribute to the growth of national economy. It will also help creation of employment opportunities. By mobilizing deposits for the Bank, we have contributed to the formation of capital of the country. We have collected tax on

Interest/profit earning of the depositors for the public exchequer. Our Bank has been a conduit for bringing foreign remittance from Bangladeshi expatriates living abroad and thereby contributed to the overall foreign exchange reserve of the country. We contributed handsome amounts to the national exchequer in the preceding years as corporate tax.

Southeast Bank Foundation

The Bank has also established the Southeast Bank Foundation to participate in social work in a more organized manner. To meet corporate social responsibility, Southeast Bank Foundation has designed an educational program to support meritorious students in the secondary education level of poor and low income families. To begin with, a stipend program has been initiated for meritorious students who passed SSC examination in 2009. Applications have been invited through newspaper announcement. A number of 2746 students from all the Boards applied and only 230 of them have been qualified for stipend this year. They will receive Tk.1500 per month for the academic session (2009-2011) along with a lump sum of Tk.4000 to purchase books and accessories. The Foundation has also started a stipend program for the schools near and around the Southeast Bank Branches of rural and semi urban areas. The concerned branches will act as the focal points. The selected students will receive stipends while schools will receive necessary support to impart quality education. As many as 260 students have been selected from the schools around 19 branches of the Bank. For students of class VII and VIII, the stipend is Tk.600 per month along with a lump sum of Tk.1500, while Tk.1000 per month is the amount of stipend for students of class IX and class X; the lump sum for these classes is Tk-2500 only. The branch executives will liaise with the schools and students regarding the stipend program. Minor revision in the in- built infrastructure will be made to make environment of schools more student friendly. Gradually competent teachers of English and Mathematics will be provided to respective schools to ensure quality education.

2.10.4. CSR of SEBL in 2010

Southeast Bank works to promote good community relations to foster a relationship of understanding, trust and credibility. It has a long history of support for charitable causes. We help achieve lasting changes in the lives of people who are disadvantaged or vulnerable. In 2010, Southeast Bank has spent Tk.2.37 million as donations for education, sports, art, culture, health-care, community development, relief operations etc.

SEBL’s credit policy has been redesigned to avoid concentration of Bank’s credit in major cities and to encourage distribution of credit in priority sectors particularly in Agriculture and SMEs.

a) A senseless killings of valiant army occurs was committed by the misguided BDR personnel at BDR Headquarters, Peelkhana, Dhaka on February 25, 2009. It widowed and orphaned innocent people and catapulted the elected families in distress and uncertainty. Southeast Bank pioneered and propagated an idea to stand by the elected families which won wide appreciation at deferent levels.

b) In accordance with our devised formula, the Bank, in collaboration with the Government of Bangladesh, selected the following 7 (seven) bereaved families of the Shaheed Army Officers who embraced martyrdom at the carnage at BDR (now BGB) Headquarters to stand by them. Each family is being given Tk.40,000.00 (Forty thousand) only per month totaling Tk.4,80,000.00 (Four Lac Eighty thousand) only in a year and the contribution will continue for 10 (ten) years.

c) First year’s contribution for Tk.3.36 million only was paid to the widows of the Shaheed Army Officers at the Prime Minister’s Office (PMO) on April 01, 2009. _e second year’s contribution of Tk.3.36 million was paid to the widows of the Shaheed Army Officers at the PMO vide pay orders dated February 02, 2010.

d) Apart from the above, Southeast Bank also donated Tk.2.50 million only to the Prime Minister’s Relief Fund on 16 June, 2010 for relief operations amongst victims of _re incident at Neemtali and building collapse of Begunbari of Dhaka City.

e) Southeast Bank also donated Tk.5.00 million on 26.07.2010 towards establishment of Muktijuddha Jadughar to uphold national heritage for posterity.

f) Boxing is a neglected sport areas, Southeast Bank came forward for improvement of boxing in the country. Bank donated total Tk.2.26 million to Bangladesh Amateur Boxing Federation for the purpose.

g) Southeast Bank donated Tk.5.00 million on 11.01.2010 to Bangladesh Olympic Association in co-sponsoring the 11th SA Games Dhaka-2010. Southeast Bank donated Tk.0.50 million on 05.04.2010 to Bangladesh Hand Ball Federation in sponsoring the IHF Challenge Trophy, Bangladesh – 2010.

National Economy

Southeast Bank has directly employed people in the service of the Bank. We have also generated employments for thousands of men and women in the projects and industrial ventures established with our finance. Credit policy of the Bank has also been so designed as to promote trade, commerce and industry which will ultimately contribute to the growth of national economy. It will also help creation of employment opportunities. By mobilizing deposits for the Bank, we have contributed to the formation of capital of the country. We have collected tax on interest/profit earning of the depositors for the public exchequer. Our Bank has been a conduit for bringing foreign remittance from Bangladeshi expatriates living abroad and thereby contributed to the overall foreign exchange reserve of the country. We contributed handsome amounts to the national exchequer in the preceding years as corporate tax.

Southeast Bank Foundation

The Bank has also established the Southeast Bank Foundation to participate in social work in a more organized manner. In 2009 the Bank has sufficiently manned the Foundation to carry out activities towards the promotion of high order CSR i.e. activities over and beyond simple donation.

Under the Corporate Social Responsibilities (CSR), the Foundation has identified education as the main field of responsibility and has initiated a Scholarship Project in the Secondary Level to support meritorious students of poor and low income families in the year 2009. It has begun with two layers one for school students and the other for HSC Level College students.

A huge number of Secondary Schools established in the rural areas of Bangladesh within last two decades are yet to create conducive teaching environments mainly due to poorly trained underpaid teachers. Though government has taken a number of projects to address issues like training of teachers and stipend for girl students, the overall gain regarding quality education is not noteworthy.