Introduction:

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. BRAC Bank will be a unique organization in Bangladesh. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh 8. Organizational Structure

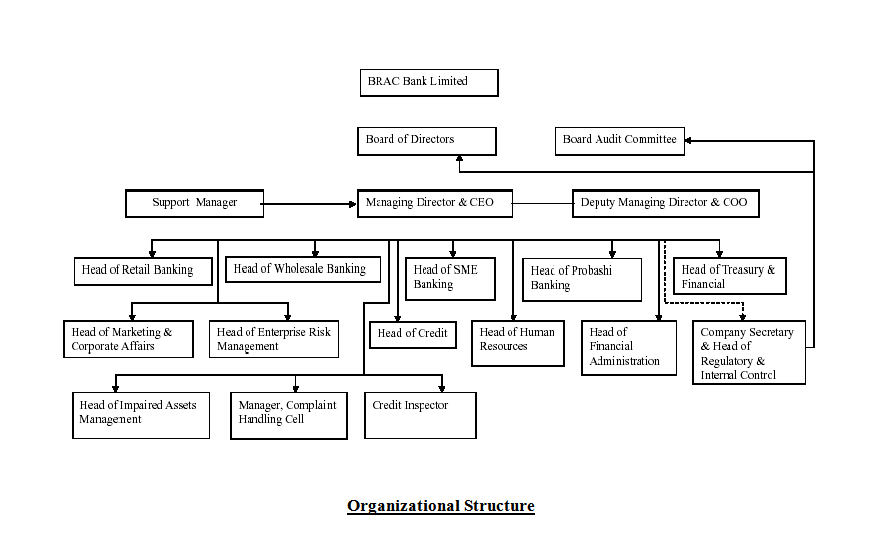

BRAC Bank Limited has two sets of reporting lines, one that reports directly to the MD and another that reports to the DMD. MD is the representative of the Board of Directors as well as responsible for all the business decisions taken by the bank. The Support Manager assists him. Under him work the Heads of the Business and some of the Support Units. They are: Head of SME Banking, Head of Retail Banking, Head of Corporate Banking, Head of Probashi Banking, Head of Treasury & Financial Institutions, Head of Marketing & Corporate Affairs, Head of Enterprise Risk Management, Head of Human Resources, Head of Financial Administration,

Company Secretary & Head of Regulatory & Internal Control, Head of Impaired Assets Management, Manager-Complaint Handling Cell & Credit Inspector. There is another part of the Organogram, which deals with the reporting line of Deputy Managing Director & COO. This line constitutes of the Heads of the Support Units. The Units are: Head of Retail Banking Operation, Head of Corporate Banking Operations, Head of SME Banking Operations, Head of Probashi Banking Operations, Senior Manager-Card Operations, Head of Business Solutions, Head of Technology, Head of General Infrastructure Services, Head of Central Operations, Senior Manager-Call Centre, Senior Manager, Project Admin, Service Quality, Operations Risk Mgt. & Operations MIS.

Functional Units:

BRAC Bank has a centralized banking structure through online banking system that resembles the ABN.AMRO Model. Overall, BRAC Bank is divided into three major units – business unit, operations unit and support unit. All the functional divisions are discussed below. Besides these divisions, there is another support division for infrastructural support of BBL – Channel Infrastructure Development and one more operations divisions – General Infrastructure Services. Among the functional units only five are business units and the rest work as support units. They are:

1. Small and Medium Enterprise

2. Retail Banking

3. Corporate Banking

4. Probashi Banking

5. Cards

Small and Medium Enterprise:

The biggest operational division of BRAC bank is the SME (Small & Medium Enterprise) Division. SME is directly related to business of the bank. BRAC Bank extends loans to potential small and medium trading, manufacturing and service enterprises. This loan is able to provide quick and quality banking services to targeted business at any places of the country. Potential women entrepreneurs will also get the facilities of SME loan; this initiation is to play a role in the socioeconomic development of the country by expansion of business as well as creation of employment. BRAC Bank was titled to be the fastest growing bank in 2004 & 2005, and it had a profit of 14 crore taka. The profitability of the bank came mostly from the SME sector. SME division is enriched with more than 700 staffs and it has 367 unit offices all over the country.

Retail Banking:

Retail Banking is known as general banking where the individual customers get services time to time from the local branches of the larger commercial banks. In BRAC Bank Retail section has been divided into four parts –

Distribution – Serve the acquired customers

Sales – Business acquisition.

Non Funded Business, Alternate Delivery Channels, Priority Banking

Phone Banking

They are interdependent and work closely with each other. Retail offers different types of competitive banking products to the customers. The retail division of the BRAC Bank also offers some special types of deposits and loan scheme for the customer attention.

Corporate:

Corporate department has also two different wings – Corporate Banking division & Cash Management. Corporate Banking is a specialized area of BRAC Bank, which addresses the diverse financial needs of Corporate Clients. This division exists to provide banking services and financial partnership with local and foreign business houses (Public and Private Limited Companies), NGO’s, trading houses, joint ventures and various government bodies/corporations etc. As the financial partner of choice for the corporate sector, BRAC Bank wants to be distinguished by its:

Quality of service

Value of innovative solutions

Level of trust with clients

Customer knowledge

Probashi Banking:

This offers an array of products and services that are targeted towards the nonresident Bangladeshis living in different parts of the world, a milestone for BRAC bank as to becoming the pioneer in such operation. The official launching of Probashi Subidha Account took place on 16 January 2007 with a prospective to catering the beneficiaries of NRB customers with their different banking needs.

With a goal to provide fast and expeditious services to deliver remittances even in the most remote corner of Bangladesh, the network of electronically connected field offices have been expanded more than 1200 BDP outlets across the country for remittance payment. In 2007 the remittance services has turned out to be one of the core business areas of the Bank. The year remained as a rewarding and successful one in terms of new tie-ups and partnerships with a focus on pursuing unexplored and niche markets around the world.

Cards:

February 6th 2007 marks the beginning of BRAC Bank’s Credit Cards business. Being the latest entrant into the cards market, the card division’s greatest challenge was to establish itself in an already demanding marketplace and create its own niche. In a space of one year, BRAC Bank’s today has become the fastest growing issuers of credit cards in Bangladesh. Staying true to its motto of being the banks of the masses BRAC Banks has successfully managed to penetrate and enlist a large segment of the middle class society who has adopted the plastic card as part of their everyday life. With an aim to becoming the Credit Card of choice, regular product innovations and value added services round the year ensured acquisition of new users and also aided in retention of existing clients. Aggressive promotional and brand building campaigns have created a niche that serves to distinguish BRAC Bank Credit Card from the competition. Apart from these five business units, BBL has other support units, which provide the functional assistance to smoothly run the business.

These are:

1. Treasury & Financial Institutions

2. Central Operations

3. Enterprise Risk Management

4. Financial Administration

5. General Infrastructure Services

6. Credit

7. Consumer Service Delivery (CSD)

8. Impaired Assets Management

9. Information Technology

10. PSRM

11. Human Resources

12. Marketing & Corporate Affairs

13. Company Secretariat

Financial Performance Review:

Interest income for the period has increased by 71% because of increase of loan by 61% and investment income by 93% over previous year; because of change in investment mix and inclusion of long term nature BGTB at higher interest rates. These factors cause the significant increase in operating margin over previous year.

Economic profit:

Economic profit is a residual measurement, which subtracts the cost of capital from the net operating profits after tax generated in the business. The Bank’s internal performance measures include economic profit, a calculation that compares the return on the financial capital invested in the Bank by its immediate sponsors of the Bank with the cost of that capital. The Bank prices it’s cost of capital internally and the difference between that cost and post-tax profit attribute to the ordinary shareholders represents the amount of economic profit generated. The management as one of the measures to decide where to allocate resources so that they will be most productive uses economic profit.

Total Assets:

Total asset of the bank rose to BDT 46,382.59 million in 2007 from BDT 30,011.82 million in 2006 registering a growth of 54.55%. Significant increases in assets documented in loans and advances investments, fixed assets and cash assets maintained by the bank.

Earnings Per Share (EPS):

Earnings per share stood at Tk. 54.95 as on December 31, 2007 compared to Tk. 29.38 at the end of previous year, which is restated because of issuance of bonus shares during the year.

Premium Banking:

Premium Banking is new service that provides customer with a comprehensive range of products and services, developed specially with customer’s superior needs in mind. Premium Banking is a personalized and privileged service that aims to provide customized banking solutions to simplify a customer’s life. High-net-worth customers and other VIPs comprise the target market.

Premium Banking setup commenced in March 2006, and the design and approval of the various aspects of this new department and service were undertaken over the next six months. It was officially launched on 24th September 2006 and within a small period of time this service became very popular among a particular segment of customers.

Premium Banking highlights the importance of a small customer segment, which holds a major stake of BRAC Bank’s retail portfolio. By providing relationship –based services to this customer segment, Premium Banking safeguards Bank’s Retail and SME portfolios and add to an increase in the Bank’s liability base.

Eligibility Criteria (Regular):

Maintenance of a minimum balance of deposits or cumulative credit exposure, or a combination of both (i.e. funds under management), is the basic eligibility criteria. The minimum fund under management for an individual/joint accountholders is currently BDT 2,000,000. This minimum balance is subject to change from time to time at the Bank’s discretion.

Family Premium Banking:

Up to 4 family members may combine their deposits or cumulative credit exposure (as above) to attain a specified minimum balance. For purposes of this system of eligibility, “family members” are defined as: father, mother, brother, sister, son, daughter and spouse. The minimum fund under management for Family Premium Banking is currently BDT 3,000,000. This minimum balance is subject to from time to time at the Bank’s decision.

Other Eligibility Criteria:

Premium Banking may also be offered to very important or socially influential persons in lieu of the minimum balance. Head of Retail Banking retains the authority to approve applications for this service to any such persons, on a case-by-case basis. This will help to safeguard and maintain relationships with key persons who may directly or indirectly affect the bank’s reputation in the industry.

Basic Features:

Dedicated Relationship Manager

Preferential Rates and Charges

Free auxiliary Services (SMS/Internet/Phone Banking)

Special Debit Cards and Cheque books

Pre-approved VISA Gold Card

Privileged Arrangements and Discounts

Review of Related Literature:

Customer satisfaction and retention are critical for retail banks, as they have an impact on profit (Levesque and McDougall, 1996). However, as business leaders try to implement the concept of customer satisfaction and/or retention in their companies, employees working with customers may come to regard customer retention (Levesque and McDougall, 1996) or satisfaction (Stauss et al., 2001) as in themselves the goal of business. Regardless as to what business leaders may be trying to implement in their companies, any employee interacting with customers is in a position either to increase customer satisfaction, or put it at risk. Employees in such positions should therefore have the skills to respond effectively and efficiently to customer needs (Potter-Brotman, 1994).

Satisfaction is an “overall customer attitude towards a service provider” (Levesque and McDougall, 1996, p.14), or an emotional reaction to the differences between what customers anticipate and what they receive ( Zineldin, 2000), regarding the fulfillment of some need, goal or desire (Oliver, 1999)

A similar definition is provided by Gerpott et al. (2001) who propose that satisfaction is based on a customer’s estimated experience of the extent to which a provider’s services fulfill his or her expatiations.

Customer satisfaction brings many benefits. Satisfied customers are less price sensitive, buy additional products, are less influnced by competitors and stay loyal longer (Zineldin, 2000). Ovenden (1995) argues that organizations must be aware of how well or badly its customers are treated. Customers rarely complain, and when someone does, it might be too late to retain that that customer.

Satisfaction increases customer retention, and customer retention depends on the substance of the relationship between parties (Eriksson and Lofmarck Vaghult, 2000). Spreng et al. (1995) examine the importance of service recovery in determining overall satisfaction, arguing that a company is more likely to retain a customer encouraging complaints and then address them, then by assuming that the customer is satisfied.

Satisfied and properly served customers are more likely to return to an organization than are dissatisfied customers who could choose simply to go elsewhere (Ovenden, 1995).

In today’s business environment companies cannot afford to lose a single profitable customer. By effectively leveraging results from a customer satisfaction survey an organization can respond to their customer’s needs in ways that increase revenue as well as improve customer and employee, satisfaction and loyalty. Many companies perform customer satisfaction surveys, but don’t receive full value from their investments to administer the program. (Customer Centricity, Craig Bailly 2002)

Findings and Analysis

As the sample size of 25 was set from the concerned population for the research, survey was taken on 25 customers. The Premium Banking customers were selected by random sampling and the survey was conducted. After finishing the survey all the questionnaires were gathered and all the data from the questionnaires were put in to Microsoft Excel. Then by using the software the analysis were mainly done through graphical presentation, frequency, and percentage. Finally the implications of the analyzed data have been discussed in the result section.

Findings and analysis of the individual questions:

Gender:

This is the very first question where the main purpose to find out the percentage of male clients to female clients among the respondents. Customer’s responses regarding this question are given below:

Table 1: Customers’ responses regarding question 1.

Gender Frequency Percent

Male 21 84

Female 4 16

Total 25 100

Figure-1: Customers’ responses regarding question 1.

From the frequency table and bar chat it can be said that the number of male clients is more than the female clients among the respondents. There were 21 males and only 4 females among the respondents, which means 84% of the respondent is male and 24 % are the female.

Age

Table-2: Customers’ responses regarding question 2.

Age group Frequency Percent

Below 30 4 16

30 to 40 10 40

40 to 60 9 36

Above 60 2 8

Total 25 100

Figure-2: Customers’ responses regarding question 2.

It can be said from the frequency chart that highest number of respondents are between the age group 30 to 40, which is 40%. The second highest is age group 40 to 60which is 36%. Age below 30 is 16% and the rest are from the oldest group of people ageing above 60 who are very few in numbers.

Educational Qualification

In question number 3 respondents were asked about their educational qualification. Their responses are given below:

Table-3: Customers’ responses regarding question 3.

Educational Qualification Frequency Percent

Masters Degree 5 20

BachelorDegree 18 72

H.S.C 2 8

S.S.C 0 0

Total 25 100

Figure-3: Customers’ responses regarding question 3.

From the findings it can be said that most of the respondents have completed their Bachelor degree, which is 72%. Among the other respondents, 20% have completed Masters degree and the rest 8 % of the respondents have completed only H.S.C. None of the respondents were just S.S.C passed.

Family Income

In question no. 4 an income range was given to know Premium Banking customer’s income level. Their responses are as follows:

Table-4: Customers’ responses regarding question 4.

Family Income Frequency Percent

20,000- 30,000 2 8

30,000 –50,000 3 12

50,000-100,000 6 24

More than 100,000 14 56

Total 25 100

Figure-4: Customers’ responses regarding question 4.

Among the 25 respondents 56% came from high-income level. 24% come from middle-income level (taka 50,000-100,000) and 12% come from high-mid income family (taka 30,000-50,000). The rest of the 8% are customers with low family income. This finding indicates most of the respondents are from high family income.

Period of taking the service

Table-5: Customers’ responses regarding question 5.

Period of taking the service Frequency Percent

Less than 1 month 1 4

1 to 6 month 4 16

6 month to 1 year 6 24

More than 1 year 14 56

Total 25 100%

Figure-5: Customers’ responses regarding question 5.

Respondents were asked about how long they are using this Premium Banking services of BRAC Bank Ltd. Result shows that highest number of respondents are using it for more than one year and the second highest is users ranging form 6 months to 1 year. 16% of the respondents are with the service for 1 to 6 months. Only 4% are new as the PB service holder.

Source of Information about Premium Banking

The result about how the respondents got informed about the PB service of BRAC Bank is given in the following frequency table:

Table-6: Customers’ responses regarding question 6.

Source of Information Frequency Percent

From RMs of the bank 17 68

From friend 3 12

Bank’s brochure 2 8

Company website 3 12

Total 25 100

Figure-6: Customers’ responses regarding question 6.

Here, it shows that most of the respondents (68%) have come to know about the product and got encouraged by their relationship managers who work in the bank. Few numbers of respondents learned about this service from the bank’s brochure and company website. The least number of customers have found it from the website.

Service Quality of PB

Respondents were asked about the quality of service that PB of BRAC Bank is providing. Their responses to the answer are given in the following frequency table.

Table-7: Customers’ responses regarding question 7

Service Quality of PB Frequency Percent

Yes, absolutely 5 20

Sometimes 9 36

Neutral 4 16

Never 6 24

Total 25 100

Figure-7: Customers’ responses regarding question 7.

36% respondents agree that sometimes PB provides quality service. 20% of the respondents strongly agree with the statement and 16% were neutral about it. There was 24% negative attitude or disagreement about the statement among the respondents.

Relationship Manager’s Knowledge and Attitude towards customers

Respondents were asked about that if they think the Relationship Managers were knowledgeable about their customers and if they were helpful enough, their responses are given the following frequency table:

RM’s Knowledge and Attitude towards customers Frequency Percent

Yes, absolutely 19 76

Sometimes 3 12

Neutral 2 8

Never 1 4

Total 25 100

Table-8: Customers’ responses regarding question 8.

Figure-8: Customers’ responses regarding question 8.

As we can see that 76% of the respondents have supported the statement, which can be taken as a positive side of the service. 12% of the respondents think relationship mangers are sometimes helpful. 2% of the respondents were neutral about the question and only 4% customers think that they are never getting the service.

Credit Card Facility

Question no. 9 in the questionnaire tries to find out the credit card facility provided for PB clients. This was an unstructured question that asked the respondents about dissatisfactions (if any) faced by credit card facility. It was an open ended question where the customer can write their problems.

Table-9: Customers’ responses regarding question 9

Credit Card Facility Frequency Percent

Very satisfactory 4 16

Neutral 1 4

Not that much satisfactory 3 12

Dissatisfied 17 68

Total 25 100

Figure-9: Customers’ responses regarding question 9.

16 % of the respondents were very satisfied with the credit card facility. Only one respondent were neural about the question, which is 20%. Most of the respondents said that they are not that much satisfied which is 12%. And 68% of the customers were dissatisfied with the credit card facility. Reason they mentioned is that bank often deducts credit card charges and sends them credit card bills though as a PB client they are supposed to get 50% waver from these charges. Customers consider this as a big hassle for them as it is sometimes time consuming, as they need to wait for banks verification and other procedures.

Reason for signing up for PB service

In question number 10 customers were asked about the reason for signing up for Premium Banking of BRAC Bank Limited. The results of their responses are given below:

Table-10: Customers’ responses regarding question 10.

Reason for signing up Frequency Percent

PB provides quality services 3 12

It is very much secured 2 8

Relationship Managers are very helpful 2 8

All of the above 18 72

Total 25 100

Figure-10: Customers’ responses regarding question 10.

From the frequency table and the bar chart we can say most of the respondents went with the option “all of the above” which is 72%. Among the other respondents, 12% agrees that they have signed up for Premium Banking because it provides quality service, 8% says it is very much secured and another 8% says because relationship managers are very helpful. So we can conclude with saying that respondents signed up for this service because of all the services Premium Banking provides to its clients, which means the respondent’s perception regarding this statement is good.

Recommendation for PB service to others

In question no.9 customers were asked whether they would recommend this service to others. Their responses are given below:

Table-11: Customers’ responses regarding question 11.

Recommendation Frequency Percent

Yes, absolutely 15 60

Maybe 5 20

No, not at all 3 12

Never 2 8

Total 25 100

Figure-11: Customers’ responses regarding question 11.

Most of the respondents agree that they would recommend this service to others, which is 60%. 20% said they might recommend this service to others. 12% said not at all and only 8% said never. From this response it can be determined that most of the respondents are more or less happy with the existing service, that’s why we can see that most of the people agrees with the statement and only a few number of respondents disagree.

Satisfaction Level

This is the main question where the main purpose of the research lies. It is about the overall satisfaction level of customers regarding the service. Respondent’s responses regarding this question are given below:

Table-12: Customers’ responses regarding question12

Satisfaction Level Frequency Percent

Completely satisfied 8 32

Somewhat satisfied 8 32

Neither satisfied nor satisfied 3 12

Completely dissatisfied 6 24

Total 25 100

Figure-12: Customers’ responses regarding question12.

From the above frequency table and the bar chart it can be determined that the 32% of the respondents are completely satisfied with the BRAC Bank’s Premium Banking service. About 32% agrees with the option somewhat satisfied. 12% of the respondents were neither satisfied nor dissatisfied and 24% of the respondents were completely dissatisfied. This is a positive aspect, as the percentage of dissatisfied customers seemed to be lower then percentage of satisfied customers among the respondents.

Findings and Analysis:

In this part of findings and analysis were made by gathering all the data from the questionnaire survey to find out the answer of the research question. The above-mentioned questions were prepared to evaluate customer satisfaction level of BRAC Bank’s Premium Banking department of Motijheel branch. One can get mixed feeling if he or she look into the out comes. At the conclusion of this findings and analysis it can be said that the customers’ overall perception about the service of Premium Banking Department of BRAC Bank is moderately good although they have different perceptions regarding the individual items or questions. (For example in question number nine it can be seen that customers are dissatisfied about the credit card facility. As a premium-banking client they are not supposed to pay any charge for their credit card or ATM card, but still bank is deducting the charge by mistake. BRAC Bank should put serious effort to make sure that this sort of mistakes doesn’t happen again.)

• In case of educational qualification most of the customers are from Bachelor Degree and they are between age group 30 to 40. This shows that most of the Premium Banking clients are educated and aged. These types of customers are more concern about the service they are paying because this is the time when most of the people actually start depositing money for their future.

• The using period of the service may indicate another aspect of the product. As most of the Premium Banking clients are more or less with the service for a long time contrast to the very few new account holders, it shows that there might be less popularity of this service in the recent trend.

• It seems that BRAC Bank is promoting their Premium Banking service through their relationship managers. This is maybe because they are not promoting their product accordingly. Company website and brochure is the only source where people can know about this service but it seems like people can learn only a little from this sources. So most of the clients came to know about this service from their relationship managers and from their friends, which indicates the reference tendency instead of using specific marketing or promotion strategy.

• Motijheel Branch has only one computer for Premium Banking clients for their account processing activities. But there suppose to be minimum two computers for the services of Premium banking clients.( One computer does all the tasks of two desks. As a result, customers need to wait for the service or they have to go the customer service officer for their account verification and other services. So it sometimes bothers the customers as a priory client they are not suppose to go through this trouble. It would be better if there were one more computer in the account-opening desk.

• Sometimes ATM goes out of service, which is a problem for customer.

• Customers seem to be very much disappointed regarding the credit card service charge.

• Lack of sitting arrangement in the branch is a trouble for the customer. (As the clients of Premium Banking are the most prioritized clients there should be a separate lounge dedicated just for these clients)

• Branch premises is not large enough for the customer

• There is no additional customer service officer for Premium Banking.

• As the clients of Premium Banking are the most prioritized clients they are supposed get all the services from one desk though they are not getting any.

• There suppose to be a separate lounge for premium banking. As Motijheel branch is always overcrowded with customers it is very difficult to pay special attention to these clients.

Recommendations:

In order to remain competitive in the industry and become profitable by improving business performance, BRAC Bank Ltd. can think about the following recommendations:

Bank is a financial service-oriented organization. Its business profit depends much on its customer’s satisfaction level. That’s why the authority always should be concern about their customers and the quality of service they are providing to them.

Credit card charges should be immediately reversed because customers seem to be very much disappointed regarding the credit card service charge. As a premium Banking client they are not supposed to pay any charge for their credit card or ATM card, but still bank is deducting the charge by mistake. BRAC Bank should put serious effort to make sure that this sort of mistakes doesn’t happen again and reverse the charges immediately.

BRAC Bank Motijheel should have bigger branch premises for increased number of customer and more sitting arrangement should be made for Premium clients.

Premium Banking lounge should setup in the branch to provide quick and better service to valued and important customers

Bank should offer more facilities to the Premium Banking customers such as travel facilities, medical facilities, send flowers and cakes to customer’s birthday or any other anniversary etc.

The using period of the service indicates there is only a few number of clients have signed up for this service recently. BRAC Bank should promote their product accordingly so that they can draw in new clients as well as provide quality service to existing clients.

BRAC Bank should use specific marketing or promotion strategy rather then just promoting their services through relationship managers

There suppose to be one relationship manager and two associate relationship managers and minimum two computers dedicated to Premium client for each branch. Though there is only one computer and one relationship manager for Premium Banking in motijheel branch. BRAC Bank authority should assign at least one associate relationship manager and one computer for Motijheel branch.

When a customer will go to the Premium Banking for a particular service or problem BRAC Bank authority should make sure that he or she gets all the services from one booth rather moving from one desk to another desk for service

There should be at least one customer service officer assigned only for Premium Banking clients to each branch, though currently there is none for PB.

Conclusion:

Consumer banking is quite a new concept in banking history, especially in Bangladesh. With the growing number of local private banks competing for customers, BRAC Bank Limited cannot hold on to their expected customer base only with their earlier reputation. It also has to ensure it’s customer satisfaction, maintain service quality and have to keep upgrading their service as well. Since the banking industry of our country is very competitive, one might want to add and innovate newer product and service to their line. Premium Banking for priority clients is a unique product of the bank that can bring more loyal customers if promoted in a planned way. It will help the bank in two ways, firstly they can keep their existing customer feel interested about bank’s product and services and secondly this strategy will help them to add more and more new customer to their portfolio.

Finally, it can be said that though the results achieved so for are moderately satisfactory, Premium Banking of BRAC Bank Ltd. still possesses great potentiality. They have wonderful opportunities in the market to utilize and they can easily survive in the industry with full profitability by adopting some current relevant tactics. To keep up the expectations of their customers BRAC Bank Ltd. have to take all the necessary measures to satisfy their customers, because if the customers once realize that they are not getting proper treatment, they might switch to other bank.

ABBREVIATED TERMS:

BBL = BRAC Bank Limited

PB = Premium Banking

SRM = Senior Relationship Manager

RM = Relationship Manager

ARM = Associate Relationship Manager

Appendix

References

Anderson, E.W. (1996), “Customer satisfaction and price tolerance”, Marketing Letters, Vol. 7 No.3, pp.265-74.

Babakus, E., Boller, G. (1992), “An empirical assessment of the SERVQUAL scale”, Journal of Business Research, Vol. 24 pp.253-68.

David Martı´n-Consuegra (1997), “An integrated model of price, satisfaction and loyalty: an empirical analysis in the service sector” Journal of Product & Brand Management, Volume 16, No.7 pp 469-468

Mittal, V., Kamakura, W. (2001), “Satisfaction, repurchase intent, and repurchase behavior: investigating the moderating effect of customer characteristics”, Journal of Marketing Research, Vol. 38 pp.131-42

Ove C. Hansmark and Marie Alinsson (2004), “Customer satisfaction and retention” Managing Service Quality, Volume 14, No. 1, pp40-57

BRAC Bank Limited (2007) Annual Report

http://www.bracbank.com

QUESTIONNAIRE

Dear Sir/Madam,

I am a student of AIUB is currently conducting my intern report on ‘The satisfaction level of BRAC Bank’s Premium Banking Service among the premium client segment’. It would be highly appreciated if you provide us information in this regard and we assure you that all the data will be kept confidential and will be used only for academic purpose.

1. Gender: Male Female

2. Age:

3. Educational qualification:

a. Master degree b. Bachelor degree c. Higher secondary certificate

d. Secondary school certificate

4. Please mention your family income from the options given below?

a. 20,000- 30,000 b. 30,000 – 50,000 c. 50,000-100,000 d. more than 100,000

5. For how long you are using the Premium Banking services of BRAC Bank Ltd?

a. Less than 1-month b. 1 to 6 month c. 6 month to 1 year

d. More than 1 year

6. How did you find out about this PB service at first?

a. From Relationship Managers of the bank b. from my friend c .Bank’s Brochure d. Company website Other______________________

7. Do BRAC Bank Premium Banking provides quality services?

a. Yes, absolutely b. Sometimes c. neutral d. Never

8. Do you think All Relationship managers are knowledgeable of their customers and they are very helpful?

a. Yes, absolutely b. Sometimes c. neutral d. Never

9. Do you think the credit card facility provided for Premium Banking clients is satisfactory? If not then please specify the problem in the blank space.

a. Very satisfactory b. Neutral c. Not that much satisfactory d. Dissatisfied

__________________________________________________________________________________________________________________________________________

10. I have signed up for PB services because:

a. PB provides quality services b. it is very much secured

c. Relationship Managers are very helpful d. All of the above

Other______________________

11. Would you recommend PB service to other people?

a. Yes, absolutely b. Maybe c. No, not at all d. Never

12. Please state your satisfaction level regarding the Premium Banking service of BRAC Bank.

a. Very satisfied b.Neutral d. Dissatisfied

e. Very dissatisfied

suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 04 June 2001 and the Bank has started its operations from July 04, 2001.

Bank goal is to provide mass financing to enable mass production and mass consumption, and thereby contribute to the development of Bangladesh. BRAC Bank intends to set standard as the market leader in Bangladesh by providing efficient, friendly and modern fully automated online service on a profitable basis aiming at offering commercial banking service to the customers’ door around the country, BRAC Bank limited established 36 branches up-to this year.

This organization achieved customers’ confidence immediately after its establishment. Within this short time the bank has been successful in positioning itself as progressive and dynamic financial institution in the country. It is now widely acclaimed by the business community, from small entrepreneur to big merchant and conglomerates, including top rated corporate and foreign investors, for modern and innovative ideas and financial solution. Thus within this short time it has created a unique image for itself and innovated significant solutions to contribute in the banking sector of the country.

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shore cap International, has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “Double Bottom Line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last six years of operation, the Bank has disbursed over BDT 11,158.15 million in loans to nearly 60,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 36 branches, 413 SME unit offices and 48 ATM sites across the country, and the customer base has expanded to 2,58,601 deposits around 2007. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches and ATMBRAC Bank, for the first time among local commercial banks, starts providing loan facilities to small and medium trading, manufacturing and service oriented enterprises all over the country.

Statement of the Problem:

BRAC bank is serving its customers for more than five years. At present there are numbers of national and international banks coming up with new services. Hence, the competition has increased to a great extent. The services provided by the banks needs to be satisfactory to its users. The study has tried to explore the potential opportunities and threats regarding the Premium Banking Service provided by BRAC Bank. Hopefully, the results of this perception survey will assist the company (BRAC Bank) in identifying the strengths and weaknesses of its service and also to identify potential opportunities and threats. It is also hoped that the results from this study will help management in taking decisions regarding its service features. The Premium Banking Service has been chosen because they are the potential and the prospective clients for the banks. If they are aware and satisfied about it now, they can be the part of this exclusive service for a long time. Finally this study will provide a better understanding of the premium client in general so that the product can be positioned more effectively

Purpose of the Study:

The study is mainly a descriptive study. The main purposes of this study are as follows:

- Identifying the consumers’ satisfaction level about the service of Premium Banking of BRAC Bank LTD.

- Finding out the weaknesses of their service.

- Making the solutions that can remove those weaknesses.

Methodology:

The data generated is primary in nature. Data has been collected through survey questionnaires containing both structured and unstructured questions. One set of questionnaires has been prepared. It was given to clients who are main service holder of Premium Banking Service in order to identify their satisfaction level.

Sampling Method:

Convenient sampling method was adopted whereby most of the respondents available at Motijheeil Branch.

Research Design:

A descriptive research under conclusive research was used to conduct this research because according to N.K. Malhotra (2003) a descriptive research is a type of conclusive research and it can e conducted to determine the perception of product or service characteristics.

Target Respondents:

For the sake of simplicity and the reason of easy availability the study concentrated on existing Premium Banking clients only.

Sample Size:

The selection of the sample was random and size is 25. One set of questionnaire has been used to conduct an investigative research. Data analysis was mainly done through graphical presentation, frequency and percentage. Finally the implications of the analyzed data have been discussed in the result section.

Data Collection Procedure:

The gathered data was collected from the customers when they came for service at the Motijheeil branch of BRAC Bank and the questionnaire was provided to those customers who were interested in participating in the survey.

Data Analysis Procedure:

After completing the survey the data was analyzed by Microsoft Excel. Then the findings were made. Based on the findings the present situation was explained and recommendation was made.

Limitations of the study:

- BRAC Bank authority did not want to disclose all the information needed.

- Load at the work place was also a barrier to prepare this report.

- Although the officers of the BRAC Bank Ltd. have been very helpful, they didn’t have enough time to provide, as they are very busy with their assigned works. So, in some cases, observation was needed.

- The sample size was small.

- The survey was based on Premium Banking customers of Motijheel Branch only.

- Finally, the length of this internship program is not sufficient conduct a detailed study on the subject of research

Organizational overview:

Background:

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shorecap International, has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a povertyfree, enlightened Bangladesh.

A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 1500 crore in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh.

BBL started off in July 2001, and has now grown to 26 branches, 368 SME unit offices and 54 ATM sites across the country, and the customer base has expanded to 200,000 deposit and 45,000 advance accounts through 2006. In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of SME unit offices, Retail Branches, POS and ATMs across the country.

BBL Achievements till date:

- BRAC Bank Limited, the fastest growing bank in Bangladesh has recently received ICMAB National Best Corporate Award 2007 for the criteria of its Capital Adequacy, Asset Quality, Profitability, Liquidity, Corporate Governance, Market Share, Contribution to National Economy, Risk Management, Regulatory Compliance, Disclosure, CSR in the category of “Financial Institutions”.

- One of the four sustainable SME banks in the world.

- Leader in SME financing through 368 offices.

- Biggest suit of personal banking & SME products.

- Large ATMs (Automated Teller Machine) & POS (Point of Sales) network.

Corporate Vision:

Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a just, enlightened, healthy, democratic and poverty free Bangladesh.

Corporate Mission:

- Sustained growth in ‘Small & Medium Enterprise’ sector.

- Continuous low cost deposit growth with controlled growth in Retained Assets.

- Corporate Assets to be funded through self-liability mobilization.

- Growth in Assets through Syndications and Investment in faster growing sectors.

- Continuous endeavor to increase fee-based income Keep our Debt Charges at 2% to maintain a steady profitable growth.

- Achieve efficient synergies between the bank’s Branches, SME Unit Offices and BRAC field offices for delivery of Remittance and Bank’s other products and services.

- Manage various lines of business in a fully controlled environment with no compromise on service quality.

- Keep a diverse, far flung team fully motivated and driven towards materializing the bank’s vision into reality

Corporate Values:

Our Strength emanates from our owner – BRAC. This means, we will hold the following values and will be guided by them as we do our jobs.

- Value the fact that we are member of the BRAC family.

- Creating an honest, open and enabling environment.

- Have a strong customer focus and build relationships based on integrity, superior service and mutual benefit.

- Strive for profit & sound growth.

- Work as a team to serve the best interest of our owners.

- Relentless in pursuit of business innovation and improvement.

- Value and respect people and make decisions based on merit.

- Base recognition and reward on performance.

- Responsible, trustworthy and law-abiding in all that we do.

Objectives:

The objective of BRAC Bank Limited is specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objective of BRAC Bank Limited is as follows:

Building a strong customer focus and relationship based on integrity, superior service.

►To finance the industry, trade and commerce in both the conventional way and by offering customer friendly credit service.

►To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development.

►To work as a team to serve the best interest of our owners

►To develop the standard of living of the limited income group by providing Consumer Credit.

►To base recognition and reward on performance

►To responsible, trustworthy and law-abiding in all that we do

►To mobilize the savings and channeling it out as loan or advance as the company approve.

►To establish, maintain, carry on, transact and undertake all kinds of investment and financial business including underwriting, managing and distributing the issue of stocks, debentures, and other securities.

STRUCTURE

Capital Structure

BRAC Bank has started with an initial capital of amount BDT 250 million, while the authorized capital is BDT 1,000 million. Over time the bank has increased it capital base because of its steady growth and within three years of operations, it has doubled its capital base to BDT 500 million. The Bank has planned to go public by the last quarter of this year (2006) and raise it’s paid up capital to BDT 1000 million. BRAC Bank originated with Local and International Institutional shareholding including BRAC as promoter with IFC and ShoreCap International, UK. Here is the break-up of BRAC Bank’s shareholdings positions.

BRAC:

BRAC, a national, private organization, started as an almost entirely donor funded, small-scale relief and rehabilitation project initiated by Fazle Hasan Abed to help the country overcome the devastation and trauma of the Liberation War and focused on resettling refugees returning from India. Today, BRAC has emerged as an independent, virtually self-financed paradigm in sustainable human development. It is one of the largest Southern development organizations employing 97,192 people, with 61% women, and working with the twin objectives of poverty alleviation and empowerment of the poor.

International Finance Corporation:

The International Finance Corporation (IFC) is the private sector arm and the commercial wing of the World Bank Group. IFC promotes sustainable private sector development in developing countries. Using certain channels and overseas representatives, IFC helps local financial institutions find profitable ways to target small and medium sized companies. Funding comes from the Asian Development Bank, Canada, the European Commission, the Netherlands, Norway, the United Kingdom and IFC itself. IFC is a 19% shareholder in BRAC Bank. A new assistance program signed in August 2005 aims to double the bank’s number of small and medium enterprise clients in 18 months through campaigns to target women entrepreneurs and rural clients, introduce new products and train branch managers.

ShoreCap International:

ShoreCap International Ltd. (SIL) is an international private non-profit, equity company seeking to invest in small business banks and regulated micro finance institutions in countries with developing and transitional economies. ShoreBank Corporation, America’s first and leading community development and environmental Banking Corporation launched SIL. ShoreBank’s international work began in 1983 advising Muhammad Yunus and for 10 years doing the financial feasibility work for the major institutional donors to the Grameen Bank in Bangladesh.

Founded in mid 2003, ShoreCap has a current base of $28.3 million in capital commitments and seeks to support the growth of development finance institutions in Africa, Asia and Eastern Europe. The institution has made investments totaling $7 million in Bangladesh, India, Cambodia, Armenia, Mongolia and Kenya. ShoreBank is a 9% investor of ShoreCap and runs the management company, which oversees investment activities.

ShoreCap typically invests between $500,000 and $2 million for an ownership position of 10-25% of a company. As a minority shareholder, ShoreCap seeks financial institutions with a strong, experienced management team and a committed set of local development-minded investors. ShoreCap currently owns 18% of BRAC Bank Limited.

Organizational Structure:

BRAC Bank Limited has two sets of reporting lines, one that reports directly to the MD and another that reports to the DMD. MD is the representative of the Board of Directors as well as responsible for all the business decisions taken by the bank. The Support Manager assists him. Under him work the Heads of the Business and some of the Support Units. They are: Head of SME Banking, Head of Retail Banking, Head of Corporate Banking, Head of Probashi Banking, Head of Treasury & Financial Institutions, Head of Marketing & Corporate Affairs, Head of Enterprise Risk Management, Head of Human Resources, Head of Financial Administration,

Company Secretary & Head of Regulatory & Internal Control, Head of Impaired Assets Management, Manager-Complaint Handling Cell & Credit Inspector. There is another part of the Organogram, which deals with the reporting line of Deputy Managing Director & COO. This line constitutes of the Heads of the Support Units. The Units are: Head of Retail Banking Operation, Head of Corporate Banking Operations, Head of SME Banking Operations, Head of Probashi Banking Operations, Senior Manager-Card Operations, Head of Business Solutions, Head of Technology, Head of General Infrastructure Services, Head of Central Operations, Senior Manager-Call Centre, Senior Manager, Project Admin, Service Quality, Operations Risk Mgt. & Operations MIS.

Functional Units:

BRAC Bank has a centralized banking structure through online banking system that resembles the ABN.AMRO Model. Overall, BRAC Bank is divided into three major units – business unit, operations unit and support unit. All the functional divisions are discussed below. Besides these divisions, there is another support division for infrastructural support of BBL – Channel Infrastructure Development and one more operations divisions – General Infrastructure Services. Among the functional units only five are business units and the rest work as support units. They are:

- Small and Medium Enterprise

- Retail Banking

- Corporate Banking

- Probashi Banking

- Cards

Small and Medium Enterprise:

The biggest operational division of BRAC bank is the SME (Small & Medium Enterprise) Division. SME is directly related to business of the bank. BRAC Bank extends loans to potential small and medium trading, manufacturing and service enterprises. This loan is able to provide quick and quality banking services to targeted business at any places of the country. Potential women entrepreneurs will also get the facilities of SME loan; this initiation is to play a role in the socioeconomic development of the country by expansion of business as well as creation of employment. BRAC Bank was titled to be the fastest growing bank in 2004 & 2005, and it had a profit of 14 crore taka. The profitability of the bank came mostly from the SME sector. SME division is enriched with more than 700 staffs and it has 367 unit offices all over the country.

Retail Banking is known as general banking where the individual customers get services time to time from the local branches of the larger commercial banks. In BRAC Bank Retail section has been divided into four parts –

- Distribution – Serve the acquired customers

- Sales – Business acquisition.

- Non Funded Business, Alternate Delivery Channels, Priority Banking

- Phone Banking

They are interdependent and work closely with each other. Retail offers different types of competitive banking products to the customers. The retail division of the BRAC Bank also offers some special types of deposits and loan scheme for the customer attention.

Corporate:

Corporate department has also two different wings – Corporate Banking division & Cash Management. Corporate Banking is a specialized area of BRAC Bank, which addresses the diverse financial needs of Corporate Clients. This division exists to provide banking services and financial partnership with local and foreign business houses (Public and Private Limited Companies), NGO’s, trading houses, joint ventures and various government bodies/corporations etc. As the financial partner of choice for the corporate sector, BRAC Bank wants to be distinguished by its:

- Quality of service

- Value of innovative solutions

- Level of trust with clients

- Customer knowledge

Probashi Banking:

This offers an array of products and services that are targeted towards the nonresident Bangladeshis living in different parts of the world, a milestone for BRAC bank as to becoming the pioneer in such operation. The official launching of Probashi Subidha Account took place on 16 January 2007 with a prospective to catering the beneficiaries of NRB customers with their different banking needs.

With a goal to provide fast and expeditious services to deliver remittances even in the most remote corner of Bangladesh, the network of electronically connected field offices have been expanded more than 1200 BDP outlets across the country for remittance payment. In 2007 the remittance services has turned out to be one of the core business areas of the Bank. The year remained as a rewarding and successful one in terms of new tie-ups and partnerships with a focus on pursuing unexplored and niche markets around the world.

Cards:

February 6th 2007 marks the beginning of BRAC Bank’s Credit Cards business. Being the latest entrant into the cards market, the card division’s greatest challenge was to establish itself in an already demanding marketplace and create its own niche. In a space of one year, BRAC Bank’s today has become the fastest growing issuers of credit cards in Bangladesh. Staying true to its motto of being the banks of the masses BRAC Banks has successfully managed to penetrate and enlist a large segment of the middle class society who has adopted the plastic card as part of their everyday life. With an aim to becoming the Credit Card of choice, regular product innovations and value added services round the year ensured acquisition of new users and also aided in retention of existing clients. Aggressive promotional and brand building campaigns have created a niche that serves to distinguish BRAC Bank Credit Card from the competition. Apart from these five business units, BBL has other support units, which provide the functional assistance to smoothly run the business.

These are:

- Treasury & Financial Institutions

- Central Operations

- Enterprise Risk Management

- Financial Administration

- General Infrastructure Services

- Credit

- Consumer Service Delivery (CSD)

- Impaired Assets Management

- Information Technology

- PSRM

- Human Resources

- Marketing & Corporate Affairs

- Company Secretariat

Financial Performance Review:

Interest income for the period has increased by 71% because of increase of loan by 61% and investment income by 93% over previous year; because of change in investment mix and inclusion of long term nature BGTB at higher interest rates. These factors cause the significant increase in operating margin over previous year.

Economic profit:

Economic profit is a residual measurement, which subtracts the cost of capital from the net operating profits after tax generated in the business. The Bank’s internal performance measures include economic profit, a calculation that compares the return on the financial capital invested in the Bank by its immediate sponsors of the Bank with the cost of that capital. The Bank prices it’s cost of capital internally and the difference between that cost and post-tax profit attribute to the ordinary shareholders represents the amount of economic profit generated. The management as one of the measures to decide where to allocate resources so that they will be most productive uses economic profit.

Total Assets:

Total asset of the bank rose to BDT 46,382.59 million in 2007 from BDT 30,011.82 million in 2006 registering a growth of 54.55%. Significant increases in assets documented in loans and advances investments, fixed assets and cash assets maintained by the bank.

Earnings Per Share (EPS):

Earnings per share stood at Tk. 54.95 as on December 31, 2007 compared to Tk. 29.38 at the end of previous year, which is restated because of issuance of bonus shares during the year.

Premium Banking:

Premium Banking is new service that provides customer with a comprehensive range of products and services, developed specially with customer’s superior needs in mind. Premium Banking is a personalized and privileged service that aims to provide customized banking solutions to simplify a customer’s life. High-net-worth customers and other VIPs comprise the target market.

Premium Banking setup commenced in March 2006, and the design and approval of the various aspects of this new department and service were undertaken over the next six months. It was officially launched on 24th September 2006 and within a small period of time this service became very popular among a particular segment of customers.

Premium Banking highlights the importance of a small customer segment, which holds a major stake of BRAC Bank’s retail portfolio. By providing relationship –based services to this customer segment, Premium Banking safeguards Bank’s Retail and SME portfolios and add to an increase in the Bank’s liability base.

Eligibility Criteria (Regular):

Maintenance of a minimum balance of deposits or cumulative credit exposure, or a combination of both (i.e. funds under management), is the basic eligibility criteria. The minimum fund under management for an individual/joint accountholders is currently BDT 2,000,000. This minimum balance is subject to change from time to time at the Bank’s discretion.

Family Premium Banking:

Up to 4 family members may combine their deposits or cumulative credit exposure (as above) to attain a specified minimum balance. For purposes of this system of eligibility, “family members” are defined as: father, mother, brother, sister, son, daughter and spouse. The minimum fund under management for Family Premium Banking is currently BDT 3,000,000. This minimum balance is subject to from time to time at the Bank’s decision.

Other Eligibility Criteria:

Premium Banking may also be offered to very important or socially influential persons in lieu of the minimum balance. Head of Retail Banking retains the authority to approve applications for this service to any such persons, on a case-by-case basis. This will help to safeguard and maintain relationships with key persons who may directly or indirectly affect the bank’s reputation in the industry.

Basic Features:

- Dedicated Relationship Manager

- Preferential Rates and Charges

- Free auxiliary Services (SMS/Internet/Phone Banking)

- Special Debit Cards and Cheque books

- Pre-approved VISA Gold Card

- Privileged Arrangements and Discounts

Review of Related Literature:

Customer satisfaction and retention are critical for retail banks, as they have an impact on profit (Levesque and McDougall, 1996). However, as business leaders try to implement the concept of customer satisfaction and/or retention in their companies, employees working with customers may come to regard customer retention (Levesque and McDougall, 1996) or satisfaction (Stauss et al., 2001) as in themselves the goal of business. Regardless as to what business leaders may be trying to implement in their companies, any employee interacting with customers is in a position either to increase customer satisfaction, or put it at risk. Employees in such positions should therefore have the skills to respond effectively and efficiently to customer needs (Potter-Brotman, 1994).

Satisfaction is an “overall customer attitude towards a service provider” (Levesque and McDougall, 1996, p.14), or an emotional reaction to the differences between what customers anticipate and what they receive ( Zineldin, 2000), regarding the fulfillment of some need, goal or desire (Oliver, 1999)

A similar definition is provided by Gerpott et al. (2001) who propose that satisfaction is based on a customer’s estimated experience of the extent to which a provider’s services fulfill his or her expatiations.

Customer satisfaction brings many benefits. Satisfied customers are less price sensitive, buy additional products, are less influnced by competitors and stay loyal longer (Zineldin, 2000). Ovenden (1995) argues that organizations must be aware of how well or badly its customers are treated. Customers rarely complain, and when someone does, it might be too late to retain that that customer.

Satisfaction increases customer retention, and customer retention depends on the substance of the relationship between parties (Eriksson and Lofmarck Vaghult, 2000). Spreng et al. (1995) examine the importance of service recovery in determining overall satisfaction, arguing that a company is more likely to retain a customer encouraging complaints and then address them, then by assuming that the customer is satisfied.

Satisfied and properly served customers are more likely to return to an organization than are dissatisfied customers who could choose simply to go elsewhere (Ovenden, 1995).

In today’s business environment companies cannot afford to lose a single profitable customer. By effectively leveraging results from a customer satisfaction survey an organization can respond to their customer’s needs in ways that increase revenue as well as improve customer and employee, satisfaction and loyalty. Many companies perform customer satisfaction surveys, but don’t receive full value from their investments to administer the program. (Customer Centricity, Craig Bailly 2002)

12. Findings and Analysis

As the sample size of 25 was set from the concerned population for the research, survey was taken on 25 customers. The Premium Banking customers were selected by random sampling and the survey was conducted. After finishing the survey all the questionnaires were gathered and all the data from the questionnaires were put in to Microsoft Excel. Then by using the software the analysis were mainly done through graphical presentation, frequency, and percentage. Finally the implications of the analyzed data have been discussed in the result section.

Findings and analysis of the individual questions:

Gender:

This is the very first question where the main purpose to find out the percentage of male clients to female clients among the respondents. Customer’s responses regarding this question are given below:

Table 1: Customers’ responses regarding question 1.

Gender | Frequency | Percent |

Male | 21 | 84 |

Female | 4 | 16 |

Total | 25 | 100 |

Figure-1: Customers’ responses regarding question 1.

From the frequency table and bar chat it can be said that the number of male clients is more than the female clients among the respondents. There were 21 males and only 4 females among the respondents, which means 84% of the respondent is male and 24 % are the female.

Age

Table-2: Customers’ responses regarding question 2.

Age group | Frequency | Percent | |

Below 30 | 4 | 16 | |

30 to 40 | 10 | 40 | |

40 to 60 | 9 | 36 | |

Above 60 | 2 | 8 | |

Total | 25 | 100 | |

Figure-2: Customers’ responses regarding question 2.

It can be said from the frequency chart that highest number of respondents are between the age group 30 to 40, which is 40%. The second highest is age group 40 to 60which is 36%. Age below 30 is 16% and the rest are from the oldest group of people ageing above 60 who are very few in numbers.

Educational Qualification:

In question number 3 respondents were asked about their educational qualification. Their responses are given below:

Table-3: Customers’ responses regarding question 3.

Educational Qualification | Frequency | Percent | |

Masters Degree | 5 | 20 | |

BachelorDegree | 18 | 72 | |

H.S.C | 2 | 8 | |

S.S.C | 0 | 0 | |

Total | 25 | 100 | |

Figure-3: Customers’ responses regarding question 3.

From the findings it can be said that most of the respondents have completed their Bachelor degree, which is 72%. Among the other respondents, 20% have completed Masters degree and the rest 8 % of the respondents have completed only H.S.C. None of the respondents were just S.S.C passed.

Family Income:

In question no. 4 an income range was given to know Premium Banking customer’s income level. Their responses are as follows:

Table-4: Customers’ responses regarding question 4.

Family Income | Frequency | Percent |

20,000- 30,000 | 2 | 8 |

30,000 –50,000 | 3 | 12 |

50,000-100,000 | 6 | 24 |

More than 100,000 | 14 | 56 |

Total | 25 | 100 |

Figure-4: Customers’ responses regarding question 4.

Among the 25 respondents 56% came from high-income level. 24% come from middle-income level (taka 50,000-100,000) and 12% come from high-mid income family (taka 30,000-50,000). The rest of the 8% are customers with low family income. This finding indicates most of the respondents are from high family income.

Period of taking the service

Table-5: Customers’ responses regarding question 5.

Period of taking the service | Frequency | Percent |

Less than 1 month | 1 | 4 |

1 to 6 month | 4 | 16 |

6 month to 1 year | 6 | 24 |

More than 1 year | 14 | 56 |

Total | 25 | 100% |

Figure-5: Customers’ responses regarding question 5.

Respondents were asked about how long they are using this Premium Banking services of BRAC Bank Ltd. Result shows that highest number of respondents are using it for more than one year and the second highest is users ranging form 6 months to 1 year. 16% of the respondents are with the service for 1 to 6 months. Only 4% are new as the PB service holder.

Source of Information about Premium Banking

The result about how the respondents got informed about the PB service of BRAC Bank is given in the following frequency table:

Table-6: Customers’ responses regarding question 6.

Source of Information | Frequency | Percent |

From RMs of the bank | 17 | 68 |

From friend | 3 | 12 |

Bank’s brochure | 2 | 8 |

Company website | 3 | 12 |

Total | 25 | 100 |

Figure-6: Customers’ responses regarding question 6.

Here, it shows that most of the respondents (68%) have come to know about the product and got encouraged by their relationship managers who work in the bank. Few numbers of respondents learned about this service from the bank’s brochure and company website. The least number of customers have found it from the website.

Service Quality of PB:

Respondents were asked about the quality of service that PB of BRAC Bank is providing. Their responses to the answer are given in the following frequency table.

Table-7: Customers’ responses regarding question 7

Service Quality of PB | Frequency | Percent |

Yes, absolutely | 5 | 20 |

Sometimes | 9 | 36 |

Neutral | 4 | 16 |

Never | 6 | 24 |

Total | 25 | 100 |

Figure-7: Customers’ responses regarding question 7.

36% respondents agree that sometimes PB provides quality service. 20% of the respondents strongly agree with the statement and 16% were neutral about it. There was 24% negative attitude or disagreement about the statement among the respondents.

Relationship Manager’s Knowledge and Attitude towards customers

Respondents were asked about that if they think the Relationship Managers were knowledgeable about their customers and if they were helpful enough, their responses are given the following frequency table:

RM’s Knowledge and Attitude towards customers | Frequency | Percent |

Yes, absolutely | 19 | 76 |

Sometimes | 3 | 12 |

Neutral | 2 | 8 |

Never | 1 | 4 |

Total | 25 | 100 |

Table-8: Customers’ responses regarding question 8.

Figure-8: Customers’ responses regarding question 8.

As we can see that 76% of the respondents have supported the statement, which can be taken as a positive side of the service. 12% of the respondents think relationship mangers are sometimes helpful. 2% of the respondents were neutral about the question and only 4% customers think that they are never getting the service.

Credit Card Facility:

Question no. 9 in the questionnaire tries to find out the credit card facility provided for PB clients. This was an unstructured question that asked the respondents about dissatisfactions (if any) faced by credit card facility. It was an open ended question where the customer can write their problems.

Table-9: Customers’ responses regarding question 9

Credit Card Facility | Frequency | Percent |

Very satisfactory | 4 | 16 |

Neutral | 1 | 4 |

Not that much satisfactory | 3 | 12 |

Dissatisfied | 17 | 68 |

Total | 25 | 100 |

Figure-9: Customers’ responses regarding question 9.

16 % of the respondents were very satisfied with the credit card facility. Only one respondent were neural about the question, which is 20%. Most of the respondents said that they are not that much satisfied which is 12%. And 68% of the customers were dissatisfied with the credit card facility. Reason they mentioned is that bank often deducts credit card charges and sends them credit card bills though as a PB client they are supposed to get 50% waver from these charges. Customers consider this as a big hassle for them as it is sometimes time consuming, as they need to wait for banks verification and other procedures.

Reason for signing up for PB service:

In question number 10 customers were asked about the reason for signing up for Premium Banking of BRAC Bank Limited. The results of their responses are given below:

Table-10: Customers’ responses regarding question 10.

Reason for signing up | Frequency | Percent |

PB provides quality services | 3 | 12 |

It is very much secured | 2 | 8 |

Relationship Managers are very helpful | 2 | 8 |

All of the above | 18 | 72 |

Total | 25 | 100 |

Figure-10: Customers’ responses regarding question 10.

From the frequency table and the bar chart we can say most of the respondents went with the option “all of the above” which is 72%. Among the other respondents, 12% agrees that they have signed up for Premium Banking because it provides quality service, 8% says it is very much secured and another 8% says because relationship managers are very helpful. So we can conclude with saying that respondents signed up for this service because of all the services Premium Banking provides to its clients, which means the respondent’s perception regarding this statement is good.

Recommendation for PB service to others

In question no.9 customers were asked whether they would recommend this service to others. Their responses are given below:

Table-11: Customers’ responses regarding question 11.

Recommendation | Frequency | Percent |

Yes, absolutely | 15 | 60 |

Maybe | 5 | 20 |

No, not at all | 3 | 12 |

Never | 2 | 8 |

Total | 25 | 100 |

Figure-11: Customers’ responses regarding question 11.

Most of the respondents agree that they would recommend this service to others, which is 60%. 20% said they might recommend this service to others. 12% said not at all and only 8% said never. From this response it can be determined that most of the respondents are more or less happy with the existing service, that’s why we can see that most of the people agrees with the statement and only a few number of respondents disagree.

Satisfaction Level

This is the main question where the main purpose of the research lies. It is about the overall satisfaction level of customers regarding the service. Respondent’s responses regarding this question are given below:

Table-12: Customers’ responses regarding question12

Satisfaction Level | Frequency | Percent |

Completely satisfied | 8 | 32 |

Somewhat satisfied | 8 | 32 |

Neither satisfied nor satisfied | 3 | 12 |

Completely dissatisfied | 6 | 24 |

Total | 25 | 100 |

Figure-12: Customers’ responses regarding question12.

From the above frequency table and the bar chart it can be determined that the 32% of the respondents are completely satisfied with the BRAC Bank’s Premium Banking service. About 32% agrees with the option somewhat satisfied. 12% of the respondents were neither satisfied nor dissatisfied and 24% of the respondents were completely dissatisfied. This is a positive aspect, as the percentage of dissatisfied customers seemed to be lower then percentage of satisfied customers among the respondents.

Findings and Analysis:

In this part of findings and analysis were made by gathering all the data from the questionnaire survey to find out the answer of the research question. The above-mentioned questions were prepared to evaluate customer satisfaction level of BRAC Bank’s Premium Banking department of Motijheel branch. One can get mixed feeling if he or she look into the out comes. At the conclusion of this findings and analysis it can be said that the customers’ overall perception about the service of Premium Banking Department of BRAC Bank is moderately good although they have different perceptions regarding the individual items or questions. (For example in question number nine it can be seen that customers are dissatisfied about the credit card facility. As a premium-banking client they are not supposed to pay any charge for their credit card or ATM card, but still bank is deducting the charge by mistake. BRAC Bank should put serious effort to make sure that this sort of mistakes doesn’t happen again.)

- In case of educational qualification most of the customers are from Bachelor Degree and they are between age group 30 to 40. This shows that most of the Premium Banking clients are educated and aged. These types of customers are more concern about the service they are paying because this is the time when most of the people actually start depositing money for their future.

- The using period of the service may indicate another aspect of the product. As most of the Premium Banking clients are more or less with the service for a long time contrast to the very few new account holders, it shows that there might be less popularity of this service in the recent trend.

- It seems that BRAC Bank is promoting their Premium Banking service through their relationship managers. This is maybe because they are not promoting their product accordingly. Company website and brochure is the only source where people can know about this service but it seems like people can learn only a little from this sources. So most of the clients came to know about this service from their relationship managers and from their friends, which indicates the reference tendency instead of using specific marketing or promotion strategy.

- Motijheel Branch has only one computer for Premium Banking clients for their account processing activities. But there suppose to be minimum two computers for the services of Premium banking clients.( One computer does all the tasks of two desks. As a result, customers need to wait for the service or they have to go the customer service officer for their account verification and other services. So it sometimes bothers the customers as a priory client they are not suppose to go through this trouble. It would be better if there were one more computer in the account-opening desk.

- Sometimes ATM goes out of service, which is a problem for customer.

- Customers seem to be very much disappointed regarding the credit card service charge.