Introduction

Aaaah comes up with a new refreshing and strong tea. It creates a new invention in the taste of its tea as it offers orange flavor and color. It has influenced greatly on the tea lovers as it is a new invention for them. In currently there are many tea company exist in the market but not with an innovative idea of different flavor and color like Aaaah. The business idea will be implemented into action plan in 2010. The company will be located at Aminbazar, Savar. The legal form of the business will be on partnership basis as it requires a huge amount of fund as well as a great deal of effort for planning, organizing, managing and promoting the product in the competitive market.

1.2 Mission Statement

Aaaah focuses on fruits flavor distinctive taste tea for tea lovers who want to enliven themselves.

1.3 Description of the Industry

Among many industries “Aaaah!!” firm will regulate under the Tea industry of Bangladesh. To offer the people tea the market growth of tea industries are increasing. The major competitors of “Aaaah!!” tea are; Lipton Taza, Finlay Tea, Nescafe and Ispahani Mirzapur Tea.

Strengths of Competitors: All of the Companies are renowned and all of them kept a good position in the market.

Weakness of Competitors: No distinction in their products tastes.

1.4 Company strengths and core competences:

Though “Aaaah!!” will be a new Company in tea industries of Bangladesh but we hope that the Company will gain success in future for some of its unique features-

“Aaaah!!” come with an orange flavor tea in the market for those customers who want something new in their tea.

It gives most emphasis on the distinctive taste.

It operates on minimum cost without compromising the quality.

The Company also uses some innovative ideas in the process of product marketing.

2.0 Products /Service Overview

“Aaaah!!” Single Tea Bags

Cone Shape Tea Bag Heart Shape Tea Bag Bird Shape Tea Bag

“Aaaah!!” Tea Packets

Full Tea Bag Packet Single Tea Packet Holiday Tea Packet

2.1 Description of the Product:

“Aaaah!!” offer its customer orange tea. The product named “Aaaah!!” is the liquor tea with orange flavor and color. The orange flavor, color and different shape packaging make the product unique than other products exist in the market.

It packages the product in different shape such as cone shape, heart shape and bird shape. These different shape packaging differentiate the product from the competitors and also attract the attention of its customers.

“Aaaah!!” will open its own stall in different places and will also implement mobile distribution strategy for distribution process to its customers. It will offer the product to its customers in many packets-single mini tea bags, full tea bags, Holiday tea packets, single tea packets etc. Customers can instantly drink tea by setting in our stalls.

For setting the price of our product we follow the cost plus strategy. Through which we try to minimize our cost as well as keep a reasonable price of our product without minimizing our quality. There is also a huge market opportunity for “Aaaah!!” as most of the people in Bangladesh love drinking tea and as we include some innovative idea in our flavor, color, shape, marketing and distribution so it become for us to attract customers attention.

2.2 Features and Benefits Table

Features Benefits

The Total weight of “Aaaah!!” tea are –

Single tea bag : 3gm

Other tea packets:50 gm, 100 gm, 200 gm, 400 gm Our product can be carried easily.

“Aaaah!!” tea has orange color and flavor. Customer can enjoy a new flavor and color.

Different shape packaging. Customer can experience the new shape packet tea.

We offer product at a reasonable price. Customers get a new product at a reasonable price.

3.0 Industry and Market Analysis

3.1 Opportunity Analysis

3.1.1 Strength and Opportunity

Strength:

• “Aaaah!!” will stand for premium quality, will emphasis on distinctive taste and flavor as it will focus on customer satisfaction.

• “Aaaah!!” is promising with its customers that its distinctive orange color and flavor tea will give daylong freshness.

• “Aaaah!!” will offer its customers with different packages of tea. Consumers will have the option to customize their own cup of tea by “Aaaah!!”’s tea bag.

• “Aaaah!!” has a skilled and efficient management team.

• The suppliers are well committed with “Aaaah!!” to deliver raw materials more efficiently within time.

• It will provide nutrition that will meet the need of health conscious people.

• It can expand its operation.

• It can experiment with different shapes of packaging.

• It can try to minimize its cost without comparing with their quality.

• It will try to reduce its price.

Opportunity:

• “Aaaah!!” will produce consuming products that raw materials are available in the market.

• ”Aaaah!!” will get a good number of existing customers of tea as their market in Dhaka city.

• High probability of increasing market size and growth.

• As recent research has indicated that tea can offer some protection against heart disease and even some cancers. “Aaaah!!” can use this research result in their promotional activities to attract the consumers.

3.1.2 Weakness and threat

Weakness:

• “Aaaah!!” has to depend on its strategic partners for tea grain and orange colours and flavored .

• Profit have to be share with its strategic partners.

• It has no control over the production.

• Completely depends on suppliers.

• Can not provide variety in its product line.

• Because of late delivery from its suppliers, it may happen that sometimes it can not deliver the final products to its venders timely. That may create a negative impact.

Threat:

• As there are many competitors in the market, they can also launch the same distinctive orange taste and flavored tea.

• Competitors can duplicate its strategies, such as marketing, pricing, promotional etc.

• Skilled employees can switch to another tea company if they will get better facilities .

3.2 Industry analysis

‘“Aaaah!!”’ will operate in the tea industry of Bangladesh, as the country has a large prospectus in that industry and the demand for tea to all classes’ people is growing continuously. We are highly expecting that we will able to gain success and will be a part of that industry as if the domestic consumption of tea has been rising 3.5 percent annually against 1.5 percent increase in production.

Now-a days tea export declines in Bangladesh as tea industry face multifarious problems

It is being hampered due to lack of adequate competency to cope in the global market.

It is very difficult to sustain in global market without having core competency that is distinctive and unique and our tea industry is facing problem and lagging behind for not having unique attractions to compete in the global market. While foreign countries

have successfully adopt to it.

3.3 Competitive environment

3.3.1 Competitors

Finlay

Finlay is a global integrated tea company focusing on the manufacture and sale of black tea, green tea, instant tea and decaffeinated tea. It also has other significant interests including coffee trading and packing as well as flower growing.

Finlay’s tea trading offices in Kenya, Sri Lanka, USA, UK, Bangladesh and Pakistan combine to service practically everywhere in the world where tea is grown, traded or consumed. Substantial volumes of Finlay’s own label tea and branded tea are packed at facilities in the UK and Sri Lanka.

Finlay’s tea plantations in Kenya, Uganda, Bangladesh and Sri Lanka are regarded as being amongst the best in the world, producing around 55million kilos of tea each year.

Finlays is able to supply an entire range of leaf teas specially formulated for particular customers’ requirements and able to manufacture tea with certain taste, colour and leaf characteristics.

Finlays operates a factory at Hull in the North East of England which has the capability of extracting caffeine from black and green leaf tea using either methylene chloride or ethyl acetate. The facility currently supplies a sizeable share of the US and European markets.

Finlay is a manufacturer of decaffeinated instant teas.

Lipton

Brooke Bond’s presence in India dates back to 1900. By 1903, the company had launched Red Label tea in the country. In 1912, Brooke Bond & Co. India Limited was formed. Brooke Bond joined the Unilever fold in 1984 through an international acquisition. The erstwhile Lipton’s links with India were forged in 1898. Unilever acquired Lipton in 1972, and in 1977 Lipton Tea (India) Limited was incorporated.

Ispahani Mirzapore

Blessed with a 184-year-old heritage, the House of Ispahani is one of the most respected business concerns in the entire subcontinent today. The company’s historical roots can be traced way back to 1820 when its founder Haji Mohammed Hashem moved from Isfahan, Persia to Bombay and started a business that soon expanded phenomenally in both scale and coverage. In Bangladesh, the first branch office was opened in Dhaka in 1888; after 1947, the corporate headquarters of M. M. Ispahani Ltd. was shifted from Calcutta to Chittagong. Today, the company — still continuing in its private limited structure — is involved in numerous sectors as diversified as textiles and tea, real estate and poultry, shipping and internet services. It has corporate offices in Chittagong, Dhaka and Khulna employing more than 20,000 people in its various concerns. The founding family is still very much hands-on involved in existing and new businesses. Three brothers — Ali Behrouze, Salman, and Shakir — are now at the helm, but over time, the owners have also been able to instill professional and structured management across the businesses at different levels so that processes are self-sustaining.

The Ispahani group has been the forerunner in numerous fields and has achieved noteworthy success in its many endeavours. Ispahani Tea is a household name and is the largest tea trading company in the country. It dominates the domestic tea market by capturing about 50 percent of the national branded tea market and 80 percent of the branded tea-bag segment. Particularly, the Mirzapore brand is a widely popular name distribution partners often identify the entire company as the “Mirzapore Tea” company.

Nescafe

Nescafe products are produced by Nestle. The beginnings of NESCAFÉ can be traced all the way back to 1930, when Nestlé was approached by the Brazilian Coffee Institute to seek a way to preserve the huge coffee surpluses. Nestlé took up the challenges , coffee specialist, Max Morgenthaler, and his team set out to find a way of producing a quality cup of coffee that could be made simply by adding water, yet would retain the coffee’s natural flavour. After seven long years of research in Swiss laboratories, they succeeded in producing the world’s first fully soluble coffee extract and quickly gained popularity around the world. Today NESCAFÉ is the world’s leading coffee brand with more than 4,000 cups of NESCAFÉ enjoyed every second throughout the world.

The new product was named NESCAFÉ – a combination of the Nes-root of Nestlé and the word café. NESCAFÉ was first introduced in Switzerland, on April 1st, 1938. For the first half of the next decade, however, World War II hindered its success in Europe. NESCAFÉ was soon exported to France, Great Britain and the USA. American forces played a key role in re-launching NESCAFÉ in Europe by virtue of the fact that it was included in their food rations. Its popularity grew rapidly through the rest of the decade. By the 1950s, coffee had become the beverage of choice for teenagers, who were flocking to coffee-houses to hear the new rock ’n’ roll music. In 1965 NESCAFÉ continued to bring the world’s best cup of coffee by introducing freeze-dried soluble coffee with the launch of Gold Blend. A few years later, a new technology was invented to capture more aroma and flavor from every single coffee bean. In 1994 the ‘full aroma’ process was invented to make the unique quality and character of NESCAFÉ even better.

3.3.2 Competitive matrix

Competitors Product Quality Unique features Geographic location strength

Nescafe

Coffee High Market leader of coffee industry U.S.A Highly recognized product with a great deal of brand loyalty

Lipton

Tea High Long year of experience India Country’s largest branded tea manufacturer

Ispahani Mirzapore

Tea Medium Exposure to international benchmarks Bangladesh Largest tea trading company in the country

Finlay Tea Medium Operates a factory at Hull in the North East of England, which has the capability of extracting caffeine from black and green leaf tea using either methylene chloride or ethyl acetate UK One of the industry’s prominent processor of decaffeinated tea

3.4 Market size & Growth

3.4.1 Market size

Total number of people in Dhaka city = 1,28,00,000

Percentage of adult tea lover people = 20%

So, the target market size will be 1,28,00,000 × 20% = 25,60,000 people of Dhaka city.

3.4.2 Market Growth

There is a high probability of increasing market size. Because “Aaaah!!”’s tea will provide a distinctive taste and flavored with nutrition that will attract the health conscious people, students and potential customers of tea industry as well as the tea lovers.

3.5 Target Market

Tea lovers of Dhaka city are the target customers of “Aaaah!!”. As it is going to introduce a distinctive orange color and flavored tea, tea lovers will eager to justify its distinction in quality and taste. Generally peoples who love tea are executives, business peoples, students, Writers etc. Monotony seized such types of people and they always look for something different. For this reason “Aaaah!!” likes to introduce such type of distinctive tea for the tea lovers.

3.5.1 Customer description

“Aaaah!!” will serve a specific market segment that loves tea. “Aaaah!!” selected its market through demographical as well as psycho graphical segmentation. “Aaaah!!” focuses on age, profession, income level for demographical segmentation. Who are higher class people or executives or business people like to have a different touch within or after their work. So they will show eagerness to drink distinctive orange color and flavored tea that also provide nutrition. “Aaaah!!” consider customer interest and opinion that comprises psycho graphical segmentation. People who are tea lovers they never bother about the price of tea, they will look for the quality and taste that “Aaaah!!” will Provide.

3.5.1 Sales Analysis

As there are a lot of competitors in tea industry, so we tried to survey the daily sales and other operations of some companies. Among them Rangdhunu Tea is one of a new entranced company helped us very cordially and provide us all of their information.

As they are new entrant, for this reason we can calculate our sales according to their daily sales.

Rangdhunu’s daily sales in one outlet are Tk. 4000.

As we will have four distribution and sales outlet around Dhaka city, so total sales of “Aaaah!!” per day will = 4000×4 = Tk. 16000

Sales revenue for the first year will be (16000×365) = Tk.58, 40,000

4.0 Marketing plan

4.1 Target market strategy

At the initial stage tea lovers of Dhaka city are the target market of “Aaaah!!” tea company. Tea lovers are only the group that will meet the company’s values, goals and objectives. Besides it is easy to concentrate for a new company on a single market segment rather than various. When the company will be able to gain the success and will be able to fulfill their target objective then it will think to expand its product line by some product variations to capture the potential customers of tea industry.

4.2 Product strategy

“Aaaah!!” is going to introduce to its customers only a distinctive orange color and flavored tea at the initial stage. If the target customers will receive the distinctive tea then “Aaaah!!” will go for variations.

We are trying to provide to our customers something different than the existing competitor’s product of tea industry.

We will try to launch some different shapes of packaging, such as bird, cow etc. By our promotional planning we will try to ensure our customers about the taste and quality of our product.

The promises of “Aaaah!!” to its customers that, “Aaaah!!” will give daylong freshness will be a major strategy to differentiate it from its competitors. According to the result of market research “Aaaah!!” will expand its operations.

4.3 Pricing Strategy

As “Aaaah!!” will introduce a distinctive tea with orange color and flavored so it will set the price according to cost, that means “Aaaah!!” will price at a desired margin over cost. That is leading “Aaaah!!” to cost plus strategy.

The company is thinking that this pricing strategy will be effective with its target consumers because the tea lovers of Dhaka city are use to pay a traditional amount of money for tea, for this reason it will be difficult to charge too more than the existing companies prices.

A list of approximate price of “Aaaah!!” tea is given below:

Types Price

““Aaaah!!”” tea bag 3 Tk

50 gm pack 25 Tk

100 gm pack 40 Tk

200 gm pack 75 Tk

400 gm pack 140 Tk

4.4 Promotional Strategy

As “Aaaah!!” is introducing a distinctive tea with orange color and flavor, so it should provide its information about the distinctive product to consumers, as well as to influence consumers. To perform these activities “Aaaah!!” will apply some promotional strategy. To affiliate its target customers most of the promotional strategy will be informative, attention gaining and awareness creating. Our strategy is to reach to maximum customers at minimum cost. To fulfill our strategy we will use the following promotional tools.

Place advertising: We will go for some place advertisement around Dhaka city which will contain information about “Aaaah!!” and will influence customers to take. The location that we select for our place ad are such as, in front of tea stalls that are situated in foot path, in front of colleges and universities, in front of banks and offices.

Contractual advertising: As Kraft Food Holdings is our strategic partner so we will go for contractual advertising with them. In which in the packet of

“ Tang” , they will place a comment that “ “Aaaah!!” a distinctive tea is using our ingredient”.

Leaflet : We will distribute leaflet to our potential customers.

Personal selling : As the executives and business professionals comprise a mentionable percentage of tea lovers so to reach that group we will go for personal selling. We will set automatic tea maker machine in various banks and offices.

4.4.1 Slogan

The proposed slogan for Aaaah is-

“Aaaah!!” will give daylong freshness”

4.4.2 Logo

4.5 Distribution strategy

“Aaaah!!” will go for direct distribution method and for this it will establish two distribution outlets, situated respectively in Motijheel and Mirpur-1. It will also establish 4 mobile stores to distribute its product to the consumers around Dhaka city.

Aaaah will follow administered distribution system. All functions of distribution strategy will managed by “Aaaah!!”’s key personnel. Aaaahs mobile store will go to a location at specific time twice in a day. Aaaahs mobile stores will take position to sel their product in front of various fair, markets and stations.

5.0 Operations Plan

5.1 Stake holders

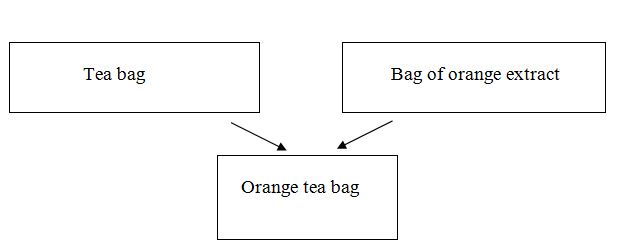

For doing the business Aaaah will link up with several stake holders. They need two strategic partner who will supply them the raw materials needed to produce the product.

As the raw material and technology that is needed to produce the tea is very sophisticated so the Company who manufacture the product need a huge fund for covering the cost. That’s why it will be a better decision for Aaaah to go for contract manufacturing. The Company will make contract with different Companies for the raw material. It will collect tea directly from tea garden at Shylet, and for orange ingredient it will contract with ‘Kraft Food Holdings”, a leader in our powdered soft drink portfolio and TANG is trademark of Kraft Food Holdings. Then, the Company will package product in their own factory. For delivering the products they will depend on their own delivery system.

Aaaah will make a contract manufacturing agreement with all their strategic partners as well as suppliers.

5.2 Location

The Head office of Aaaah will locate at Mirpur-1 and factory will locate at Amin bazaar, Savar.

5.2.1 Facility

The company chooses the location for the convenience of both target group and owners.

One of the owners possesses a land at savar, so, it will be used as factory. The head office will also be located at 1st floor of owner’s house in Mirpur-1.

5.2.3 Business hours

The estimated business hours for Aaaah will differ for management and employees.

For the management people, the business hour is 9.00 AM to 5.00 PM and for the factory workers business hour is 8.00 AM to 5.00 PM and sometimes they would do overtime.

Both management and employees will have Friday as holiday.

5.3 Inventory

The inventory of “Aaaah!!” will be both raw materials and finished goods. “Aaaah!!” will bring raw materials from their strategic partners and a contract will be made at the beginning of the year. 15% of projected sales revenue will be used to purchase raw materials.

5.4 Machinery

Technology that is needed to produce the tea and orange powder is very expensive. So, the cwho manufacture the product need a huge fund for covering the cost. That’s why it will be a better decision for “Aaaah!!” in its primary stage to engage in repacking the tea. For repacking they need the automatic packaging machine, which will be imported from Guangdong China (Mainland) from Guangzhou Mingke Packaging Machine Co., Ltd.

The machine is capable to pack 40-60bag/min

Machine’s detail

Place of Origin: Guangdong China (Mainland)

Automatic Grade: Automatic Capacity: 40-60bag/min

Type: General Usage: Outer Brand Name: Mingke

Model Number: MK-T80 Processing: Packing Machine

Inner and Outer Tea Bag Packing Machine(Packaging Machine/Machinery)

Supplier Details

Guangzhou Mingke Packaging Machine Co., Ltd.

[Guangdong China (Mainland)]

Figure: Tea Bag Packing Machine

“Aaaah!!” will run production in its own plant and it will deliver the products in its own van. So, they don,t have to purchase/lease land and to buy delivery van.

“Aaaah!!” need skilled technical, manual and supervisory people. Now, owner of “Aaaah!!” will be responsible in managing the firm. Technical peoples are needed to handle the tea packaging machine, manual people are needed to operate the machine and supervisory people will supervise all the activities.

• The salary of supervisory people will be 5,000 Tk

• The salary of technical peoples will be 3,000 Tk

• The wage of daily labor will be 2,000 Tk

5.5 Operations strategy

“Aaaah!!” will do most of the operations in house and for some operation they will go for subcontracting .A chart of their in house and subcontracting operation is given below-

Production Subcontracting

Product development Subcontracting

Order fulfillment In-house

Customer service In-house

Warehouse and shipping In-house

Technical support In-house

Warranty service In-house

6.0 Management plan

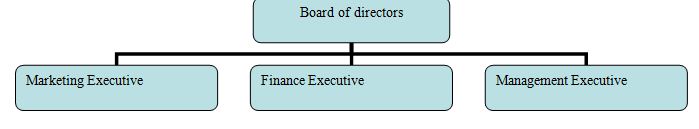

Designation of owner’s in organizational chart

Marketing Executive : Sahidur Rahaman Chowdhury

Finance Executive:

Cashier: Kazi Tripti Hasan

Accountant: Shahnaz Pervin Bably

Management Executive: Muttakin Bakhs

7.0 Financial Plan

7.1 Capitalization plan

We use capitalization plan to summarize all of your capital requirements and financial needs, whether we need loans, investment capital etc

7.1.1 Capital required- start up requirement and operating cost

Estimated Cost of Capital

Amount In Taka

| Particulars | Amount (Tk.) |

| INITIAL START UP COST | |

| Equipment and Machinery | 14,56,000 |

| Legal, professional & licenses fees | 10,000 |

| Opening Inventory | 20,000 |

| Repairs, remodeling and decoration of the business site | 10,000 |

| Other costs & services | 5,000 |

| TOTAL INITIAL START UP COST | 15,01,000 |

| OPERATING COSTS | |

| FIXED OPERATING COSTS | |

| Operating loan payments | 20,000 |

| Phone ( 5*5000) | 25,000 |

| Building rent | 10,000 |

| Owners remuneration | 0 |

| VARIABLE OPERATING COST | |

| Advertising | 5,000 |

| Auto & Travel | 3,000 |

| Building & Equipment maintenance | 3,000 |

| Delivery & Shipping costs | 3,000 |

| Employee wages and salaries (81,224*3) | 2,43,672 |

| Utilities (23,506*3) | 70,518 |

| Other supplies and purchases | 5,000 |

| Total Operating cost for 3 month | 3,88,190 |

| TOTAL START UP COST | 18,89,190 |

7.1.2 Capital sources

Owner’s equity

Amount In Taka

| Year | 2011 |

| Beginning balance | 0 |

| Investment in cash by owner’s | 5,00,000 |

| 2 computers, 2 laptop | 1,50,000 |

| Owner’s house to be used as factory and office | 1,00,000 |

| Owner’s shop to be used as distribution channel | 1,50,000 |

| Owner’s equity ending balance | 10,00,000 |

7.1.3 Loans required

As we require about 20,00,000 Tk as capital to start-up our business and we have an owner’s equity of 10,00,00 Tk. So to finance required capital, we need a loan of 10,00,00 Tk from bank.

Sources of Funds

Means Of Finance

Amount In Taka

| Financial plan | Principal |

| Long-term loan from Bank | 10,00,000 |

| Owner’s equity | 10,00,000 |

| Total | 20,00,000 |

Collateral offered

As a supporting of loan, we want to offer an agricultural land at savar that has market value of 15,00,000 Tk.

If the loan from the bank will be sanctioned of those 10,00,000 Tk for 5 years at the rate of 15%, as per current interest for SME loan. Then we will repay it as per mentioned repayment schedule

Repayment schedule in reducing balance method

Amount in taka

| principal | Interest rate | At 60 equal payments | Total payment at maturity |

10,00,000 | 15% | 24,000 per installment | 14,21,473.33 |

7.2 Uses of fund statement

We need loan to make a purchase of a tea bag packaging machine, some other supporting machines etc.

Uses of loan funds

Purchasing tea bag packaging machine and other supporting Equipment – 10,00,000 Tk

7.3 Pro-forma statement

Pro- forma Income Statement

Amount In Taka

At the growth rate of 6%

| ||

| Particulars | 2011 | 2012 |

| Revenue | ||

| Sales 100% | 58,40,000 | 61,90,400 |

| Expenses | ||

| Raw materials 28.64% | 16,72,576 | 17,72,930 |

| Power & fuel cost 4.83% | 2,82072 | 2,98,996 |

| Salaries and wages 16.69% | 9,74,696 | 10,33,177 |

| Other manufacturing expenses10.12% | 5,91,008 | 6,26,468 |

| Selling and advertising expenses 6.6% | 3,85,440 | 4,08,566 |

| Administrative Expenses 6.6% | 3,85,440 | 4,08,566 |

| Miscellaneous Expenses 3.75% | 2,19,000 | 23,2140 |

| Total Expenses 77.23% | 45,10,232 | 47,80,845 |

| PBDIT | 13,29,768 | 14,09,554 |

| Interest 4.93% | 2,88,000 | 3,05,280 |

| PBDT | 10,41,768 | 11,04,274 |

| Depreciation 2.24% | 1,30,816 | 1,38,664 |

| PBT | 9,10,952 | 9,65,610 |

| Tax 2.57% | 1,50,088 | 1,59,093 |

| Net Income | 7,60,864 | 8,06,516 |

Pro- forma Income Statement

For the month ended

Amount In Taka

| Peak sales | Peak sales | |||||

| Particulars | Jan | Feb | March | April | May | June |

| Revenue | ||||||

| Sales | 5,83,999 | 4,86,666 | 4,86,666 | 4,86,666 | 4,86,666 | 5,59,665 |

| Expenses | ||||||

| Raw materials | 1,67,257 | 1,39,381 | 1,39,381 | 1,39,381 | 1,39,381 | 1,60,288 |

| Power & fuel cost | 28,207 | 23,506 | 23,506 | 23,506 | 23,506 | 27,031 |

| Salaries and wages | 97,468 | 81,224 | 81,224 | 81,224 | 81,224 | 93,407 |

| Other manufacturing expenses | 59,100 | 49,250 | 49,250 | 49,250 | 49,250 | 56,637 |

| Selling and advertising expenses | 38,544 | 32,120 | 32,120 | 32,120 | 32,120 | 36,938 |

| Administrative Expenses | 38,544 | 32,120 | 32,120 | 32,120 | 32,120 | 36,938 |

| Miscellaneous Expenses | 21,990 | 18,250 | 18,250 | 18,250 | 18,250 | 20,987 |

| Total Expenses | 4,51,022 | 3,75,852 | 3,75,852 | 3,75,852 | 3,75,852 | 4,32,229 |

| PBDIT | 1,32,977 | 1,10,814 | 1,10,814 | 1,10,814 | 1,10,814 | 1,27,436 |

| Interest | 24,024 | 24,024 | 24,024 | 24,024 | 24,024 | 24,024 |

| PBDT | 1,08,953 | 86,814 | 86,814 | 86,814 | 86,814 | 1,03,412 |

| Depreciation | 13,081 | 10,901 | 10,901 | 10,901 | 10,901 | 12,536 |

| PBT | 95,872 | 75,912 | 75,912 | 75,912 | 75,912 | 90,875 |

| Tax | 15,008 | 12,507 | 12,507 | 12,507 | 12,507 | 14,383 |

| Net Income | 80,864 | 63,405 | 63,405 | 63,405 | 63,405 | 76,491 |

Notes

- During rainy season, june-july sales will be increased by 15% for the increasing demand of tea.

- During winter season, December-january sales will be increased by 15% for the increasing demand of tea.

- As sales will be increased so all the expenses as well as profit will also be increased in peak sales season.

- Interest rate will remain unchanged because whatever profit rises or decline, interest rate will have to pay in fixed amount.

For the month ended

Amount In Taka

| Peak sales | Peak sales | |||||

| Particulars | July | August | Sept | Oct | Nov | Dec |

| Revenue | ||||||

| Sales | 5,59,665 | 4,86,666 | 4,86,666 | 4,86,666 | 4,86,666 | 5,83,999 |

| Expenses | ||||||

| Raw materials | 1,60,288 | 1,39,381 | 1,39,381 | 1,39,381 | 1,39,381 | 1,67,257 |

| Power & fuel cost | 27,031 | 23,506 | 23,506 | 23,506 | 23,506 | 28,207 |

| Salaries and wages | 93,407 | 81,224 | 81,224 | 81,224 | 81,224 | 97,468 |

| Other manufacturing expenses | 56,637 | 49,250 | 49,250 | 49,250 | 49,250 | 59,100 |

| Selling and advertising expenses | 36,938 | 32,120 | 32,120 | 32,120 | 32,120 | 38,544 |

| Administrative Expenses | 36,9383 | 32,120 | 32,120 | 32,120 | 32,120 | 38,544 |

| Miscellaneous Expenses | 20,987 | 18,250 | 18,250 | 18,250 | 18,250 | 21,990 |

| Total Expenses | 4,32,229 | 3,75,852 | 3,75,852 | 3,75,852 | 3,75,852 | 4,51,022 |

| PBDIT | 1,27,436 | 1,10,814 | 1,10,814 | 1,10,814 | 1,10,814 | 1,32,977 |

| Interest | 24,024 | 24,024 | 24,024 | 24,024 | 24,024 | 24,024 |

| PBDT | 1,03,412 | 86,814 | 86,814 | 86,814 | 86,814 | 1,08,953 |

| Depreciation | 12,536 | 10,901 | 10,901 | 10,901 | 10,901 | 13,081 |

| PBT | 90,875 | 75,912 | 75,912 | 75,912 | 75,912 | 95,872 |

| Tax | 14,383 | 12,507 | 12,507 | 12,507 | 12,507 | 15,008 |

| Net Income | 76,491 | 63,405 | 63,405 | 63,405 | 63,405 | 80,864 |

Notes

- During rainy season, June-July sales will be increased by 15% for the increasing demand of tea.

- During winter season, December-January sales will be increased by 15% for the increasing demand of tea.

- As sales will be increased so all the expenses as well as profit will also be increased in peak sales season.

- Interest rate will remain unchanged because whatever profit rises or decline, interest rate will have to pay in fixed amount.

Pro- forma Balance sheet

Amount In Taka

| Year | 2011 |

| Properties & Asset |

|

| Current Assets |

|

| Cash and bank balance (.40%) | 8,000 |

| Fixed deposits ( 3.35%) | 67,000 |

| Accounts receivable ( 2.37%) | 47,400 |

| Inventories ( 13.35%) | 2,67,000 |

| Loans and advances (7.73% ) | 1,54,600 |

| Total Current Assets (27.2%) | 5,44,000 |

| Fixed Assets | |

| Equipment 72.80% | 14,56,000 |

| Total Assets (100%) | 20,00,000 |

| Owners equity & Liabilities | |

| Owners equity | |

| Owner’s capital | 10,00,000 |

| Liabilities | |

| Long-term loan from Bank | 10,00,000 |

| Total Owners equity & Liabilities | 20,00,000 |

Pro- forma Cash flow statement

Amount In Taka

| Particulars | Jan | Feb | March |

| Cash Flow from operating activities | |||

| From sale of goods and services | 5,83,999 | 4,86,666 | 4,86,666 |

| To suppliers for inventory | (1,67,257) | (1,39,381) | (1,39,381) |

| To employees for services | (97,468) | (81,224) | (81,224) |

| To lenders for interest | (24,024) | (24,024) | (24,024) |

| To others for manufacturing expenses | (59,100) | (49,250) | (49,250) |

| To government for taxes | (15,008) | (12,507) | (12,507) |

| Utilities expenses | (28,207) | (23,506) | (23,506) |

| Depreciation expenses | (13,081) | (10,901) | (10,901) |

| Selling expenses | (38,544) | (32,120) | (32,120) |

| Administrative expenses | (38,544) | (32,120) | (32,120) |

| Miscellaneous expenses | (21,990) | (18,250) | (18,250) |

| Legal, professional & licenses fees | (10,000) | 0 | 0 |

| Net Cash (used in)/from operating activities | 70,864 | 63,405 | 63,405 |

| Cash Flow from investing activities | |||

| To purchase plant and equipment | (14,56,000) | 0 | 0 |

| Net Cash (used in)/from investing activities | (14,56,000) | 0 | 0 |

| Cash Flow from financing activities | |||

| Owner’s equity | 10,00,000 | 0 | 0 |

| Long-term loan | 10,00,000 | 0 | 0 |

| Net Cash (used in)/from financing activities | 20,00,000 | 0 | 0 |

| Net(decrease)/increasein cash and cash equivalents | 6,14,864 | 0 | 0 |

| Opening Cash & Cash Equivalents at the beginning of the year | 8,000 | 0 | 0 |

| Closing Cash & Cash Equivalents | 6,22,865

| 63,405 | 63,405 |

Pro- forma Cash flow statement

| Particulars | April | May | June |

| Cash Flow from operating activities | |||

| From sale of goods and services | 4,86,666 | 4,86,666 | 5,59,665 |

| To suppliers for inventory | (1,39,381) | (1,39,381) | (1,60,288) |

| To employees for services | (81,224) | (81,224) | (93,407) |

| To lenders for interest | (24,024) | (24,024) | (24,024) |

| To others for manufacturing expenses | (49,250) | (49,250) | (56,637) |

| To government for taxes | (12,507) | (12,507) | (14,383) |

| Utilities expenses | (23,506) | (23,506) | (27,031)

|

| Depreciation expenses | (10,901) | (10,901) | (13,081) |

| Selling expenses | (32,120) | (32,120) | (36,938) |

| Administrative expenses | (32,120) | (32,120) | (36,938) |

| Miscellaneous expenses | (18,250) | (18,250) | (20,987) |

| Legal, professional & licenses fees | 0 | 0 | 0 |

| Net Cash (used in)/from operating activities | 63,405 | 63,405 | 76,491 |

| Cash Flow from investing activities | |||

| To purchase plant and equipment | 0 | 0 | 0 |

| Net Cash (used in)/from investing activities | 0 | 0 | 0 |

| Cash Flow from financing activities | |||

| Owner’s equity | 0 | 0 | 0 |

| Long-term loan | 0 | 0 | 0 |

| Net Cash (used in)/from financing activities | 0 | 0 | 0 |

| Net(decrease)/increasein cash and cash equivalents | 63,405

| 63,405 | 76,491 |

| Opening Cash & Cash Equivalents at the beginning of the year | 0 | 0 | 0 |

| Closing Cash & Cash Equivalents | 63,405 | 63,405 | 76,491 |

Pro- forma Cash flow statement

| Particulars | July | April | May |

| Cash Flow from operating activities | |||

| From sale of goods and services | 5,59,665 | 4,86,666 | 4,86,666 |

| To suppliers for inventory | (1,60,288) | (1,39,381) | (1,39,381) |

| To employees for services | (93,407) | (81,224) | (81,224) |

| To lenders for interest | (24,024) | (24,024) | (24,024) |

| To others for manufacturing expenses | (56,637) | (49,250) | (49,250) |

| To government for taxes | (14,383) | (12,507) | (12,507) |

| Utilities expenses | (27,031)

| (23,506) | (23,506) |

| Depreciation expenses | (13,081) | (10,901) | (10,901) |

| Selling expenses | (36,938) | (32,120) | (32,120) |

| Administrative expenses | (36,938) | (32,120) | (32,120) |

| Miscellaneous expenses | (20,987) | (18,250) | (18,250) |

| Legal, professional & licenses fees | 0 | 0 | 0 |

| Net Cash (used in)/from operating activities | 76,491 | 63,405 | 63,405 |

| Cash Flow from investing activities | |||

| To purchase plant and equipment | 0 | 0 | 0 |

| Net Cash (used in)/from investing activities | 0 | 0 | 0 |

| Cash Flow from financing activities | |||

| Owner’s equity | 0 | 0 | 0 |

| Long-term loan | 0 | 0 | 0 |

| Net Cash (used in)/from financing activities | 0 | 0 | 0 |

| Net(decrease)/increasein cash and cash equivalents | 76,491 | 63,405

| 63,405 |

| Opening Cash & Cash Equivalents at the beginning of the year | 0 | 0 | 0 |

| Closing Cash & Cash Equivalents | 76,491 | 63,405 | 63,405 |

Pro- forma Cash flow statement

| Particulars | October | November | December |

| Cash Flow from operating activities | |||

| From sale of goods and services | 4,86,666 | 4,86,666 | 5,83,999 |

| To suppliers for inventory | (1,39,381) | (1,39,381) | (1,67,257) |

| To employees for services | (81,224) | (81,224) | (97,468) |

| To lenders for interest | (24,024) | (24,024) | (24,024) |

| To others for manufacturing expenses | (49,250) | (49,250) | (59,100) |

| To government for taxes | (12,507) | (12,507) | (15,008) |

| Utilities expenses | (23,506) | (23,506) | (28,207) |

| Depreciation expenses | (10,901) | (10,901) | (13,081) |

| Selling expenses | (32,120) | (32,120) | (38,544) |

| Administrative expenses | (32,120) | (32,120) | (38,544) |

| Miscellaneous expenses | (18,250) | (18,250) | (21,990) |

| Legal, professional & licenses fees | 0 | 0 | |

| Net Cash (used in)/from operating activities | 63,405 | 63,405 | 80,864 |

| Cash Flow from investing activities | |||

| To purchase plant and equipment | 0 | 0 | 0 |

| Net Cash (used in)/from investing activities | 0 | 0 | 0 |

| Cash Flow from financing activities | 0 | ||

| Owner’s equity | 0 | 0 | 0 |

| Long-term loan | 0 | 0 | 0 |

| Net Cash (used in)/from financing activities | 0 | 0 | 0 |

| Net(decrease)/increasein cash and cash equivalents | 0 | 0 | 0 |

| Opening Cash & Cash Equivalents at the beginning of the year | 0 | 0 | 0 |

| Closing Cash & Cash Equivalents | 63,405 | 63,405 | 80,864 |

Net present valu

NPV

For the month ended

Amount In Taka

| Particulars | Jan | Feb | March | April | May | June |

| Total cash inflow from all activities | 20,80,864 | 4,86,666 | 4,86,666 | 4,86,666 | 4,86,666 | 5,59,665 |

| Total cash outflow from all activities | 14,56,000 | 3,75,852 | 3,75,852 | 3,75,852 | 3,75,852 | 4,32,229 |

| Total | 6,22,865 | 63,405 | 63,405 | 63,405 | 63,405 | 76,491 |

NPV

For the month ended

Amount In Taka

| Particulars | July | August | Sept | Oct | Nov | Dec |

| Total cash inflow from all activities | 5,59,665 | 4,86,666 | 4,86,666 | 4,86,666 | 4,86,666 | 5,83,999 |

| Total cash outflow from all activities | 4,32,229 | 3,75,852 | 3,75,852 | 3,75,852 | 3,75,852 | 4,51,022 |

| Total | 76,491 | 63,405 | 63,405 | 63,405 | 63,405 | 80,864 |

Deviation analysis

Revenue increase by 10%

| Year | Y1 | Y2 | Y3 | Y4 | Y5 |

| Revenue | 64,24,000 | 64,24,000 | 64,24,000 | 64,24,000 | 64,24,000 |

| Total expenses | 45,10,232 | 45,10,232 | 45,10,232 | 45,10,232 | 45,10,232 |

| PBDIT | 19,13,768 | 19,13,768 | 19,13,768 | 19,13,768 | 19,13,768 |

Expenses decrease by 10%

| Year | Y1 | Y2 | Y3 | Y4 | Y5 |

| Revenue | 58,40,000 | 58,40,000 | 58,40,000 | 58,40,000 | 58,40,000 |

| Total expenses | 40,59,208 | 40,59,208 | 40,59,208 | 40,59,208 | 40,59,208 |

| PBDIT | 17,80,791 | 17,80,791 | 17,80,791 | 17,80,791 | 17,80,791 |

Revenue increase and expenses decrease by 10%

| Year | Y1 | Y2 | Y3 | Y4 | Y5 |

| Revenue | 64,24,000 | 64,24,000 | 64,24,000 | 64,24,000 | 64,24,000 |

| Total expenses | 40,59,208 | 40,59,208 | 40,59,208 | 40,59,208 | 40,59,208 |

| PBDIT | 23,64,792 | 23,64,792 | 23,64,792 | 23,64,792 | 23,64,792 |

7.4 Loan Application

Dear Sir,

Subject : Request for credit

“Aaaah!!” will enter in tea industry of Bangladesh in 2011 with a distinctive tea. As “Aaaah!!” is a new firm and will go for introducing a new product so, it needs to finance about 20,00,000 Tk to purchase tea bag packaging machine, raw materials and to perform other necessary activities. Aaaah’s owner’s equity will finance 10,00,000 Tk and for financing another 10,00,000 Tk, it need to go for a loan.

Please, let assist us in implementing our objective to introduce a distinctive product in the market of Bangladesh.

Please, reply us as early as possible.

Your faithfully.

8.0 Appendices

Balance Sheet of Tata Tea | ——————- in Rs. Cr. ——————- |

Mar ’05 | Mar ’06 | Mar ’07 | Mar ’08 | Mar ’09 | ||||||||

12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||||||||

| Sources Of Funds | ||||||||||||

| Total Share Capital | 56.22 | 56.22 | 59.03 | 61.84 | 61.84 | |||||||

| Equity Share Capital | 56.22 | 56.22 | 59.03 | 61.84 | 61.84 | |||||||

| Share Application Money | 0.00 | 0.00 | 21.83 | 0.00 | 0.00 | |||||||

| Preference Share Capital | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Reserves | 970.89 | 1,083.18 | 1,462.83 | 1,720.35 | 1,715.61 | |||||||

| Revaluation Reserves | 21.86 | 21.86 | 21.86 | 21.86 | 21.86 | |||||||

| Networth | 1,048.97 | 1,161.26 | 1,565.55 | 1,804.05 | 1,799.31 | |||||||

| Secured Loans | 179.38 | 234.51 | 247.00 | 542.51 | 445.36 | |||||||

| Unsecured Loans | 11.99 | 6.84 | 550.00 | 215.00 | 309.64 | |||||||

| Total Debt | 191.37 | 241.35 | 797.00 | 757.51 | 755.00 | |||||||

| Total Liabilities | 1,240.34 | 1,402.61 | 2,362.55 | 2,561.56 | 2,554.31 | |||||||

Mar ’05 | Mar ’06 | Mar ’07 | Mar ’08 | Mar ’09 | ||||||||

12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||||||||

| Application Of Funds | ||||||||||||

| Gross Block | 521.73 | 423.68 | 439.09 | 180.76 | 192.37 | |||||||

| Less: Accum. Depreciation | 225.47 | 178.59 | 194.52 | 87.24 | 95.32 | |||||||

| Net Block | 296.26 | 245.09 | 244.57 | 93.52 | 97.05 | |||||||

| Capital Work in Progress | 6.42 | 5.22 | 2.02 | 4.57 | 6.90 | |||||||

| Investments | 865.86 | 1,106.83 | 2,045.92 | 2,193.77 | 2,073.67 | |||||||

| Inventories | 165.53 | 139.57 | 180.01 | 195.83 | 291.10 | |||||||

| Sundry Debtors | 29.39 | 48.20 | 64.86 | 63.50 | 91.84 | |||||||

| Cash and Bank Balance | 4.84 | 6.19 | 6.53 | 14.04 | 5.65 | |||||||

| Total Current Assets | 199.76 | 193.96 | 251.40 | 273.37 | 388.59 | |||||||

| Loans and Advances | 95.88 | 118.35 | 139.41 | 523.20 | 424.74 | |||||||

| Fixed Deposits | 41.50 | 0.43 | 15.00 | 0.00 | 40.00 | |||||||

| Total CA, Loans & Advances | 337.14 | 312.74 | 405.81 | 796.57 | 853.33 | |||||||

| Deffered Credit | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||||

| Current Liabilities | 214.06 | 203.39 | 234.21 | 265.06 | 334.93 | |||||||

| Provisions | 85.80 | 97.54 | 126.70 | 278.19 | 149.31 | |||||||

| Total CL & Provisions | 299.86 | 300.93 | 360.91 | 543.25 | 484.24 | |||||||

| Net Current Assets | 37.28 | 11.81 | 44.90 | 253.32 | 369.09 | |||||||

| Miscellaneous Expenses | 34.52 | 33.66 | 25.16 | 16.38 | 7.60 | |||||||

| Total Assets | 1,240.34 | 1,402.61 | 2,362.57 | 2,561.56 | 2,554.31 | |||||||

| Contingent Liabilities | 38.49 | 24.30 | 12.83 | 19.19 | 26.74 | |||||||

| Book Value (Rs) | 182.70 | 202.67 | 257.81 | 288.19 | 287.43 | |||||||

Profit & Loss account of Tata Tea | ——————- in Rs. Cr. ——————- | |||||||||||

Mar ’05 | Mar ’06 | Mar ’07 | Mar ’08 | Mar ’09 | ||||||

12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||||||

| Income | ||||||||||

| Sales Turnover | 893.02 | 970.89 | 1,056.06 | 1,134.87 | 1,361.72 | |||||

| Excise Duty | 5.45 | 0.14 | 0.09 | 0.17 | 0.19 | |||||

| Net Sales | 887.57 | 970.75 | 1,055.97 | 1,134.70 | 1,361.53 | |||||

| Other Income | 64.40 | 98.98 | 225.31 | 299.61 | 159.90 | |||||

| Stock Adjustments | 29.33 | -11.60 | 15.59 | -18.39 | 18.67 | |||||

| Total Income | 981.30 | 1,058.13 | 1,296.87 | 1,415.92 | 1,540.10 | |||||

| Expenditure | ||||||||||

| Raw Materials | 281.00 | 350.86 | 435.33 | 660.21 | 885.23 | |||||

| Power & Fuel Cost | 47.42 | 43.57 | 39.72 | 12.19 | 15.86 | |||||

| Employee Cost | 163.74 | 121.57 | 126.94 | 68.25 | 87.83 | |||||

| Other Manufacturing Expenses | 125.73 | 85.75 | 79.50 | 15.60 | 26.39 | |||||

| Selling and Admin Expenses | 129.50 | 146.44 | 155.35 | 156.33 | 161.73 | |||||

| Miscellaneous Expenses | 36.77 | 44.76 | 49.46 | 45.60 | 50.02 | |||||

| Preoperative Exp Capitalised | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Total Expenses | 784.16 | 792.95 | 886.30 | 958.18 | 1,227.06 | |||||

Mar ’05 | Mar ’06 | Mar ’07 | Mar ’08 | Mar ’09 | ||||||

12 mths | 12 mths | 12 mths | 12 mths | 12 mths | ||||||

| PBDIT | 197.14 | 265.18 | 410.57 | 457.74 | 313.04 | |||||

| Interest | 14.04 | 17.57 | 47.09 | 65.68 | 83.56 | |||||

| PBDT | 183.10 | 247.61 | 363.48 | 392.06 | 229.48 | |||||

| Depreciation | 21.99 | 19.43 | 18.54 | 10.17 | 10.65 | |||||

| Other Written Off | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Profit Before Tax | 161.11 | 228.18 | 344.94 | 381.89 | 218.83 | |||||

| Extra-ordinary items | 1.02 | 2.34 | 4.84 | 3.94 | 8.95 | |||||

| PBT (Post Extra-ord Items) | 162.13 | 230.52 | 349.78 | 385.83 | 227.78 | |||||

| Tax | 33.23 | 43.59 | 43.20 | 73.00 | 70.00 | |||||

| Reported Net Profit | 128.93 | 186.93 | 306.57 | 312.86 | 159.06 | |||||

| Total Value Addition | 503.16 | 442.09 | 450.97 | 297.97 | 341.83 | |||||

| Preference Dividend | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Equity Dividend | 56.22 | 67.46 | 92.76 | 216.44 | 108.22 | |||||

| Corporate Dividend Tax | 8.01 | 9.46 | 15.76 | 36.78 | 15.84 | |||||

| Per share data (annualised) | ||||||||||

| Shares in issue (lakhs) | 562.20 | 562.20 | 590.30 | 618.40 | 618.40 | |||||

| Earning Per Share (Rs) | 22.93 | 33.25 | 51.93 | 50.59 | 25.72 | |||||

| Equity Dividend (%) | 100.00 | 120.00 | 150.00 | 350.00 | 175.00 | |||||

| Book Value (Rs) | 182.70 | 202.67 | 257.81 | 288.19 | 287.43 | |||||