Main objective of this report is to analysis Credit Rating, Factors Affecting the Bank Rating. Other objectives are to analyze and identify the qualitative factors which are considered at the time of credit rating of the bank. Here also find out those key ratios significantly contributing differences in credit rating and identify the deposit growth of rated commercial banks. Finally making some recommendations to improve the activities of the bank and credit rating practices of the country to better coup with the international practices.

Introduction

The term “Credit Rating” can be analyzed by dividing it in two parts – credit and rating. Credit is taking money or some benefits from a lender for generating some benefits with a promise to pay back the principle and the interest after a specific time period. Rating usually denotes to a symbol or on a relative judgment of something on a scale. So the entire term ‘credit rating’ can defined as a judgment or an opinion on the quality of a credit, whether the creditor or the borrower is financially capable to meet the obligations i.e., principle and interest.

A credit rating assesses the credit worthiness of an individual, corporation, or even a country. It is an evaluation made by credit bureaus of a borrower’s overall credit history. Credit ratings are calculated from financial history and current assets and liabilities. Typically, a credit rating tells a lender or investor the probability of the subject being able to pay back a loan. However, in recent years, credit ratings have also been used to adjust insurance premiums, determine employment eligibility, and establish the amount of a utility or leasing deposit.

Credit ratings are used by investors, issuers, investment banks, broker-dealers, and governments. For investors, credit rating agencies increase the range of investment alternatives and provide independent, easy-to-use measurements of relative credit risk; this generally increases the efficiency of the market, lowering costs for both borrowers and lenders. This in turn increases the total supply of risk capital in the economy, leading to stronger growth. It also opens the capital markets to categories of borrower who might otherwise be shut out altogether: small governments, startup companies, hospitals, and universities.

Background of the Study

Rating agencies has existed for over a century. Their prominence has grown enormously as bond markets have started to expand in recent decades. Previously, bank loans used to be the main form of debt financing for companies and governments, and banks used their own credit risk measurements to determine client creditworthiness. With bonds, however, all potential bond buyers must assess the credit risks involved, and often they lack the capacity to properly do so. Therefore, rating agencies have become increasingly important in providing this information. Investors often will not even consider purchasing bonds from borrowers that don’t have a rating from one of the major agencies. Companies and government that wish to borrow on capital markers thus are completely dependent on credit raters, and are willing to pay substantive amounts of money to be rated.

In this era of globalization, the concept of credit rating spread all over the world. With the advancement of finance, credit rating also changes its definition. Apart from rating of a security, an entity and even a sovereign state is now rated by the credit rating agencies. Rating of a sovereign state explains the risk exposure associated with the economic, social and political condition of that country. International investment funds are now crossing the boarders towards a good rated country from a poor rated country. A strong credit rating plays a major role in determining the cost and availability of credit flows, and the failure to maintain a strong rating possibly leads to a reversal of capital flows, a disruption of the financial system and an overall economic downturn.

The concept of credit rating emerged in early 1900s in the financial market of USA but still the concept is to be familiar in the financial market of Bangladesh. Rules to regulate the credit rating agencies of Bangladesh came into force in 1996. After six years of those rules, the first ever entity was rated in 2002 by the premier credit rating firm CRISL. Now-a-days, about hundreds of rating report is published each year by two rating agencies of the country – CRISL and CRAB. These rating reports are affecting our capital market, money market and the economy as well.

Objectives of the Report

Primary Objective

To correlate theoretical learning acquired through classroom study with the real life business situation faced as an internee during the Internship period.

Secondary Objectives

The secondary objectives regarding this study are as follows:

- Depicting the current dynamics of our rated banks

- To analyze and identify the quantitative factors of rating methodology of bank.

- To analyze and identify the qualitative factors which are considered at the time of credit rating of the bank.

- Find out those key ratios significantly contributing differences in credit rating.

- To identify the deposit growth of rated commercial banks

- Predicting the potential impacts of CRAs on our financial market.

- Finally making some recommendations to improve the activities of the bank and credit rating practices of the country to better coup with the international practices.

CRAB Profile

CRAB has a technical collaboration Agreement with ICRA Ltd. of India, one of the leading credit rating agencies of the region. This collaboration has provided CRAB with facility for development of rating methodologies, for performing rating assignments and for training of its professionals. ICRA-CRAB collaboration facilities sharing of resources and information base and professional expertise between the two organizations, much to the advantage of CRAB.

CRAB is a member of Credit Rating Agencies in Asia (ACRAA). ACRAA was organized on 2001, is a federation of domestic rating agencies of the Asian Continent- including those of Japan, Philippine, Malaysia, Indonesia, Korea, India, Pakistan, Taiwan, China, Thailand and Bangladesh, established with support and cooperation of the Asian Development Bank (ADB). As a member, CRAB participates in all the activities of this Association.

Mission & Objectives

Mission:

Effect significant contribution towards qualitative development of the money and capital markets and enhancement of transparency of financial information and credibility of the corporate sector in Bangladesh.

Objectives:

The objectives of Credit Rating Agencies are:

- To perform the credit rating of various debt instruments as Commercial papers, Bonds and Debentures, Islamic bonds, Preference shares, Equity instruments, Rights issue, Mutual fund units etc.

- To perform grading of various institutions as banks, non banking financial institutions, insurance companies, corporations, non-corporations, societies, trusts or individuals or their clients for purposes requested clients or required by authorities.

- To accumulate, process and offer information services in broad areas for the use of organization and clients at different levels.

- To provide consultancy and advisory services in broad areas to clients at different levels.

- To act as trustees of any debentures, bonds, securities, commercial papers or any other obligations and to exercise the powers of executor, administrator, receiver, treasurer, custodian in respect of such debts and securities.

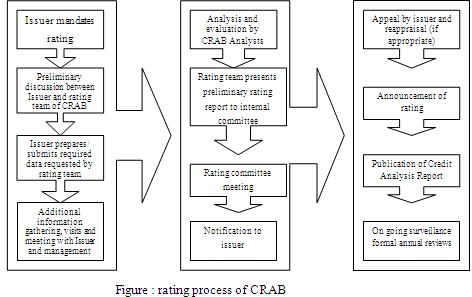

Rating Process

CRAB’s Rating process initiated on receipt of a formal request (or mandate) from the prospective issuer. A rating term, which usually consists of two analysts with the expertise and skills required to evaluate the business of the issuer, is involved with the Rating assignment. An issuer is provided a list of information requirements and the broad framework for discussions. These requirements are derived from CRAB’s experience of the issuer’s business and broadly cover all aspects that may have a bearing on the rating.

CRAB also draws on secondary sources of information, including its own research division. The Rating involves assessment of a number of qualitative factors with a view to estimating the future earnings of the issuer. This requires extensive interactions with the issuer’s management specifically relating to plans, outlook, and competitive position and funding policies. Plant visits are made to gain a better understanding of the issuer’s production process, make an assessment of the state of equipment and main facilities, evaluate the quality of technical personnel and form an opinion on the key variables that influence the level, quality and cost of production. These visits also help in assessing the progress of projects under implementation.

After completing the analysis, a Rating Report is prepared, which is presented to the CRAB Rating Committee. The Rating Team also makes a presentation on the issuer’s business and management. The Rating Committee is the final authority for assigning Ratings.

Rating Service Provided by CEAB

CRAB is a full service credit rating agency offering ratings of all kinds of financial instruments and entities including those required by regulatory authorities. Our services cover ratings of securities issued by manufacturing companies, corporate bodies, commercial banks, non-bank financial institutions, investment banks and mutual funds, among others. The obligations include long term instruments such as bonds and debentures, medium term instruments such as fixed deposit programmes, and short term instruments such as commercial papers.

CRAB also offers ratings of structured obligations and sector specific debt obligations such as instruments issued by Power, telecom and Infrastructure companies. The other services offered include Credit Assessment of large, medium and small scale units for obtaining specific lines of credit from commercial banks, financial institutions and financial services companies.

CRAB offers the following Rating Services:

- Entity Ratings:

Entity ratings are a measure of a company’s intrinsic ability and overall capacity for timely repayment of its financial obligations. They are mandatory ratings required for any regulatory compliance or voluntary ratings that may be sought by companies to enhance corporate governance and transparency. These ratings are useful for benchmarking a company against its peers, enhancing investors’ confidence, market profiling, reducing time for future debt ratings.

- Financial Institution Ratings:

These ratings will assess the creditworthiness of financial institutions, i.e. commercial and merchant banks, non-banking finance companies, housing finance companies etc. While each of these entities has the same function, i.e. leverage on own funds and lend to others on a cost plus basis, there are significant differences in terms of scale of operations, and their internal control systems. Ratings of financial institutions focus on the risks that can possibly affect the operations of a finance company – operating risks, financial risks and management risks.

- Corporate Debt Ratings:

Such ratings specifically assess the likelihood of timely repayment of principal and payment of interest over the term to maturity of such debts as per terms of the contract with specific reference to the instrument being rated. A missed or delayed payment by an issuer in breach of the agreed terms of the issue is considered as default.

- Equity Ratings (Initial public Offerings and Right Offerings):

Equity rating makes assessment of the relative inherent quality of equity reflected by the earnings prospects, risk and financial strength associated with the specific company. The rating is not intended to predict the future market price of the stock of a company.

- Structured Finance Ratings:

Structured Finance Ratings are opinion on the likelihood of the rated structured instrument servicing its debt obligations in accordance with the terms. An SFR is generally different from the corporate Credit Rating of the originator

- Insurance Companies Rating/Claims Paying Ability Rating:

Such ratings assess the ability of the insurers concerned to honor policy-holder claims and obligations on time. Rating provides an opinion on the financial strength of the insurer, from a policyholder’s perspective, which may act as an important input influencing the consumer’s choice of insurance companies and products.

- Mutual Funds Schemes Rating:

Mutual Funds Schemes rating is designed to provide Investors, Intermediaries and Fund Sponsors/Asset Management Companies with an independent opinion on the performance and risks associated with various Mutual Fund Schemes. Funds ratings incorporate various qualitative and quantitative factors affecting a fund’s portfolio

Other Rating Services

CRAB performs other rating assignments as requested by clients or required by regulatory authorities. The other service provided by CRAB is-

- Grading Service

- Advisory & Consulting Service

- Information Service

Grading Service

CRAB is equipped to offer specialized evaluation methodologies addressing exclusive and area specific requirements under the umbrella of Grading services. CRAB’s grading service is designed to provide an objective, credible and independent opinion on the quality of entities being examined with specific reference to parameters and issues unique to the sector/sub-sector.

Advisory & Consulting Service

The Advisory & Consultancy Services will offer wide ranging management advisory services which include strategic counseling, restructuring solutions, financial feasibility, financial structuring/modeling, client specific need-based studies in the banking and financial services, corporate and other core sectors.CRAB is ready to offer advisory/consulting services to clients who are seeking to be more competitive in their operating spheres. Such advisory services will be useful for a variety of clients – corporate entities, regulatory authorities, banks/financial service organisations, industry associations, local governments, government organizations.

Information Service

CRAB provides information service in the form of database, financial analysis, market analysis, market survey etc. The service is customized to specific need of the clients. For further information please contact through email or telephone.

Rating Methodology

CRAB has developed a highly standardized rating methodology for different instruments and entities. The methodologies have been developed considering all the relevant factors impacting on the future cash generation capacity of the issuers. These factors include: industry characteristics, competitive position of the issuer, operational efficiency, management quality, commitment to new projects and other associate companies, and future funding policies of the issuer.

A detailed analysis of the past financial statements is made to assess the actual business performance. Analysis considers the estimated future earnings under various sensitivity scenarios are drawn up and evaluated against the future obligations that require servicing over the tenure of the instrument being rated. CRAB rating methodology intends to assess the relative comfort level of the issuers to service the obligations and this is reflected in the rating of a debt instrument. In case of equity instruments the rating reflects the future earning capabilities with reference to the resilience to perform in adverse situations.

Definition of Credit Rating

A credit rating is an opinion of the credit agency on the future ability and willingness of the borrowing entity/ Issuer of debt instruments/ obligations to make payment of principal and interest as per the terms of the underlying contract. It measures the relative probability of borrowing defaulting on its obligations over its life and also an assessment of the severity of monetary loss of the lender should such default occur.

The primary objective of Credit Rating is to provide guidance to the investors in determining credit risk associated with a debt instrument/ credit obligation. The Credit Rating is neither a general-purpose evaluation of the issuer/ entity nor an opinion on all the debt contracted/ to be contracted by such an entity. Credit Rating is not a recommendation to buy or sell or hold securities / debt obligations. It is only an opinion of the Credit Rating Agency on the relative capacity of the issuer to service its debt obligation as per terms of the contract with particular reference to the instrument being rated.

Origin of Credit Rating

The credit rating system emerged as a private sector institution in the middle of the 19th century. The precursors of bond rating agencies were the mercantile credit agencies, which rated merchants’ ability to pay their financial obligations. In 1841, in the wake of the financial crisis of 1837, Louis Tappan established the first mercantile credit agency in New York. Robert Dun subsequently acquired the agency and published its first ratings guide in 1859. A similar mercantile rating agency was formed in 1849 by John Bradstreet, who published a ratings book in 1857.

In 1941 Poor Publishing merged with Standard Statistics to form the S&P. In 1960 S&P acquired a stake in Fitch Investors Service rating agency operations. The ratings symbols that are today used worldwide that were developed by Fitch were incorporated into the S&P ratings. In 1966 McGraw Hill an American publishing house bought out S&P and still today they own the company.

The ratings developed by Moody in early 1900s, were later applied to industrial companies and in the 1970s they began rating commercial paper and euro bonds. Since 1962 Moody’s has been a subsidiary of the Dun and Bradstreet Corporation (D&B). The most significant new entry in the United States since that time has been the Chicago-based Duff and Phelps, which began to provide bond ratings for a wide range of companies in 1982. Another major ratings provider–McCarthy, Crisanti, and Maffei–was founded in 1975 and acquired by Xerox Financial Services before its fixed income rating and research service was merged into Duff and Phelps in 1991.

In the beginning the CRAs sold their information to investors, rather than charging issuers as is the case today. Some issuers were skeptical in the beginning and regarded the CRAs as intruding, but in the end they were forced to provide the agencies with information because absence of information would affect their rating. In these initial stages the ratings provided by CRAs were financed through the sale of publications. Following the invention of the photocopier however and ease at which these publications were copied, CRAs started to charge the issuers. Since the beginning of the 1980s, the role and importance of rating agencies has increased. As it stands today they hold a central role in the international system of capital allocation.

Definition of Credit Rating Agencies

A credit rating agency (CRA) is a company that assigns credit ratings for issuers of certain types of debt obligations as well as the debt instruments themselves. In some cases, the servicers of the underlying debt are also given ratings. In most cases, the issuers of securities are companies, special purpose entities, state and local governments, non-profit organizations, or national governments issuing debt-like securities (i.e., bonds) that can be traded on a secondary market. A credit rating for an issuer takes into consideration the issuer’s credit worthiness (i.e., its ability to pay back a loan), and affects the interest rate applied to the particular security being issued.

The Rating Agency does not guarantee the completeness or accuracy of the information on which the rating is based. The Rating, usually expressed by way if an alphabetical or alphanumeric symbol, is an easily understood tool enabling the investors to differentiate between credit instruments on the bases of underlying credit quality. A Rating dose not gives any direct or indirect assurance or guarantee against the probability of default. It enables lenders/ investors to take an informed decision based on their individual risk return preferences. It also enables the lender to assess the risk underlying a debt offering and factor the same in his lending/ pricing decision. A Rating tries to establish a linkage between risk and return. The Rating being an opinion, subjective and judgemental in nature, there can not be a precise correct or incorrect Rating, the endeavour always at a “fair” Rating.

When there is a chance of default in repayment, the borrower is assigned a low grade and when the borrower has the sound financial health to meet its obligations it is awarded a high grade. The grades or rates assigned to the borrower are called rating symbols or rating notch. Rating notches range from “AAA” to “D”. “AAA” is the highest safety grade in the rating scale for an entity that indicates a safe and timely repayment of borrowed money whereas “D” signals a current or future default in repayment of the borrower. The table in the next page summarizes the rating scales used by premier rating agencies:

Generally, international rating agencies assign short-term and long-term credit ratings.

- Short-term rating gives the benchmark of the likelihood of borrower’s default within one year.

- Long-term rating evaluates the likelihood of default over longer time (up to the lifetime of the securities issued).

| Rating Grade | Rating Symbol / Rating Notch | Definitions |

| Investment Grade | AAA | Highest Safety |

| AA+, AA, AA- | High Safety | |

| A+, A, A- | Adequate Safety | |

| BBB+, BBB, BBB- | Moderate Safety | |

| Speculative Grade | BB+, BB, BB- | Inadequate Safety |

| B+, B, B- | Risky | |

| C | Vulnerable | |

| Default Grade | D | Default |

It is important to note that ratings are not equal to or the same as buy, sell or hold recommendations, it is an opinion on the creditworthiness of a person or an entity or even of a country. Ratings are rather a measure of the borrower’s ability and willingness to repay borrowed money.

There is a wide disparity among CRAs. They may differ in size and scope (geographical and sectoral) of coverage. There are also wide differences in their methodologies and definitions of the default risk, which renders comparison between them difficult.

Role of Credit Rating Agencies

Rating merely provides a relative ranking of issuers with regard to the risk of default. CRAs publish historical data on the default rates associated with rating. These data provide important information and give an idea of how the agencies’ rating have performed in past. The rating agencies are an integral component of the financial market. Done properly, their evaluations of credit risk are essential to many market participants who lack the resources or skill to make an independent evaluation. In recent years credit rating agencies (CRA) have become increasingly important in the management of financial market risk. CRA are commercial firms that receive payment for publishing an evaluation of the creditworthiness of their clients. This information is especially useful when borrowing takes place through the issue of securities, rather than by bank loans, since buyers of securities do not know the issuers as well as banks usually know their customers. CRA now define a truly global benchmark for credit risk. Published ratings are not only closely observed in the market place. They are significant for regulation as well. The major roles played by Credit Rating Agencies are given below:

- Investor protection via independent, 3rd party opinion on the credit risk or default risk of issuers/issues

- Provide a common yardstick to evaluate default risk for investment decision making

- Monitor and disseminate credit opinions on rated issuers/issues in a timely and efficient manner

- Bridge the information gap between issuers and investors and a source of credit surveillance for investors

- Assist regulatory authorities in developing and facilitate implementation of prudential guidelines requirements e.g. BASLE II

- Tracks and monitor performance of economy/industries, as well as default statistics.

Overview on International Credit Rating Agencies

Credit scores for individuals are assigned by credit bureaus (US; UK: credit reference agencies). Credit ratings for corporations and sovereign debt are assigned by credit rating agencies.

In the United States, the main credit bureaus are Experian, Equifax, and TransUnion. A relatively new credit bureau in the US is Innovis. In the United Kingdom, the main credit reference agencies for individuals are Experian, Equifax, and Callcredit In Canada, the main credit bureaus for individuals are Equifax, TransUnion and Northern Credit Bureaus/ Experian. In India, the main credit bureaus are CRISIL, ICRA and Credit Registration Office (CRO).The credit rating agency for individuals in India is CIBIL(Credit Information Bureau (India) Limited).

The largest credit rating agencies (which tend to operate worldwide) are Moody’s, Standard and Poor’s and Fitch Ratings.

Moody’s

Moody’s is the oldest agency in the credit rating industry and published the first rating in the history. Moody’s history dates back to 1900 when John Moody founded the company. In 1909 Moody’s published their first ratings when they rated loans and American railway companies. These were classified according to the same rating scale still in use today. Since 1962 Moody’s has been a subsidiary of the Dun and Bradstreet Corporation (D&B). Moody’s Investors Service is among the world’s most respected and widely utilized sources for credit ratings, research and risk analysis. The Investors Services subsidiary provides ratings, research and risk analysis for a broad scope of debt securities. It has 17 offices worldwide and provides ratings on a 100 sovereign nations’ debt.

Standard & Poor’s

Standard & Poor’s (S&P) is a company with a history that dates back to 1860 when Henry Varnum Poor opened a publishing house that produced manuals of railway companies. It was not until 1923 that S&P started to publish ratings and these were limited to loans of industrial companies. In 1941 Poor Publishing merged with Standard Statistics to form the S&P. In 1960 S&P acquired a stake in Fitch Investors Service rating agency operations. In 1966 McGraw Hill an American publishing house bought out S&P and still today they own the company. Standard & Poor is not a public company.

Standard & Poor’s is a leading provider of financial market intelligence. The world’s foremost source of credit ratings, indices, investment research, risk evaluation and data, Standard & Poor’s provides financial decision-makers with the intelligence they need to feel confident about their decisions.

Fitch:

The third major rating agency, Fitch Ratings provides ratings and research to almost 100 countries. Similar to the other agencies, Fitch Ratings covers a wide range of debt securities offered by corporations, financial institutions, municipal government, insurance companies and sovereign nations. At present they have ratings on 100 sovereign nations. It has further been expanding by opening offices in Central Europe and by joint ventures and equity stakes in Asian rating agencies.

Fitch Ratings was founded as the Fitch Publishing Company on December 24, 1913 by John Knowles Fitch. Located in the heart of the Financial District in New York City, the Fitch Publishing Company began as a publisher of financial statistics. In 1924, the Fitch Publishing Company introduced the now familiar “AAA” to “D” ratings scale to meet the growing demand for independent analysis of financial securities. Fitch Ratings was one of the three ratings agencies first recognized as a nationally recognized statistical rating organization (NRSRO) by the Securities and Exchanges Commission in 1975. In 1997, Fitch Ratings merged with IBCA Limited, headquartered in London, significantly increasing Fitch Ratings’ worldwide presence and coverage. Fitch is dual-headquartered in New York and London, operating offices and joint ventures in more than 50 locations and covering entities in over 100 countries.

Background of Credit Rating Agencies in Bangladesh

Although the concept of credit rating emerged in early twentieth century in the financial market of USA, it is still new in the developing countries like Bangladesh. Long after a century of its emergence, Securities and Exchange Commission (SEC) of Bangladesh promulgated rules regarding the operation of rating agencies in 1996. No rating agency was licensed in the country till 2002, hence no rating was published. It was the South-east Bank Limited to be rated for the first time in Bangladesh by premier credit rating agency CRISL, in November 2002. After that delayed initiation, hundreds of institutions and few bonds are rated each year. CRISL and CRAB are the two licensed credit rating agency of the country permitted to rate the entity and debt instruments under the Credit Rating Companies Rules 1996. CRISL and CRAB earned their certificate of registration in August 2002 and February 2004 respectively. Here is an overview of both the CRAs:

Credit Rating Agency of Bangladesh (CRAB):

Credit Rating Agency of Bangladesh Ltd. (CRAB) was incorporated as a public limited company under the Registrar of Joint Stock Companies in August 2003 and received its certificate for commencement of business in November 2003. It has been granted license by the Securities & Exchange Commission (SEC) of Bangladesh for operating as a credit rating company in February 2004. The formal launching of the company was held on 5 April 2004.

The details about Credit Rating Agency of Bangladesh are given in the organizational part.

Credit Rating Information & Service Limited (CRISL):

Credit Rating Information and Services Limited is a company that started its journey to implement a Concept in Bangladesh – “Credit Rating”. Before CRISL, “Credit Rating” was text paper words for the teachers and students of Bangladesh. The voyage of how CRISL conceptualized this idea in 1995 and implemented it in Bangladesh and finally achieved its operating license in 2002 – after almost eight years of struggle. CRISL is leading the rating industry holding about 60% of market share. CRISL rated about 30 banks out of 48 in 2007.

CRISL is the first ever joint venture rating agency operating in Bangladesh since 1995. It is a joint venture of Malaysia Berhad (RAM), JCR-VIS Credit Rating Company of Pakistan, few financial institutions and a host of celebrated professionals of Bangladesh. With a license from the Securities Exchange Commission (SEC) under Credit Rating Companies Rules 1996, CRISL now appears as the flagship organization of Bangladesh. CRISL is a founder member of the Association of Credit Rating Agencies in Asia (ACRAA) which is sponsored by the Asian Development Bank, where CRISL has significant contribution towards the development of the profession of rating agency in the Asian region. CRISL is a public limited company dedicated for credit rating and related services and is being recognized by Bangladesh Bank as the External Credit Assessment Institution (ECAI) to offer its services to the banking community for banking client rating. CRISL provides its services with high business and ethical code as approved by the International Organization of Securities Commission (IOSCO), Securities and Exchange Commission of Bangladesh and Bangladesh Bank ECAI recognition Criteria.

Necessity of Credit Rating

The motives act behind the entities’ paying fees to secure a credit rating depends on the surrounding regulatory environment and form of financial market. There are several reasons of getting a rating. The reasons are different in different markets and economies. The motives of getting a rating in Bangladesh are not identical as USA or UK. As same, the motives of American entities are not same as those of European or Australian entities. However, there are some common reasons for which the entities all over the world are spending money to get rating from the rating agencies. The identical reasons are enumerated here with in the context of Bangladesh:

Market access:

Any company that wishes to enter capital markets and issue debt in capital market is obliged to obtain a credit rating. Rating conveys the entity’s ability and willingness to the market participants regarding repayment of its borrowed money or equity capital. In Bangladesh, as per Credit Rating Companies Rules 1996, all the companies are required to be rated before issuing its debt or floating its equity share at premium in the market.

Build up market reputation:

New companies that seek to build a reputation in the international financial markets demand credit ratings to increase the exposure of their brand name. This brand exposure is important when companies for example initiate foreign direct investments. An entity with a higher rating is considered as a reputable organization. Recently, Delta Brac Housing – DBH has been awarded as an “AAA” rated company of the country, that excels the company’s reputation that was reflected through the share price the company at DSE and CSE.

Lower cost of funding:

A less known company can lower their cost of borrowing if they obtain a higher investment grade rating. Banks or financial institutions consider rating as an indication of an entity’s performance measurement yardstick. Entities with a higher rating are sanctioned loan at a lower interest rate whereas a lower graded entity is charged at a higher interest rate. So, it is going to be a common practice of the country to require an entity to be rated itself before applying for a loan to the banks or financial institutions.

Distinguish oneself from the competition:

In sectors that are characterized by a limited number of competing companies such as the banking or insurance industry, a credit rating is a tool to distinguish them from the competition. Our banking sector is an example of this practice. In 2006, only Standard Chartered Bank was rated “AAA” by CRISL that makes the bank unique. But in 2007, both Standard Chartered Band and HSBC operation of Bangladesh has been awarded the highest rating “AAA” by CRISL and CRAB respectively that creates some competitive advantage for both the banks.

Regulatory Requirement:

All over the world entities are rated for the regulatory bindings by the securities commissions and other authorities. In Bangladesh, SEC, Bangladesh Bank and Department of Insurance are the three regulators who issued regulations, circulars and notifications for the entities for rating. Our banks and insurances are now rated once in a year for these requirements of the regulatory authorities.

THEORITICAL REVIEW

Current Position of Banking Sector In Bangladesh

Bangladesh banking sector has 48 banks consisting of 4 Government owned PLCs (former NCBs), 5 specialized banks, 9 foreign banks, 30 private sector commercial banks including 6 private sector banks operating on Islami Shariah principles. The four PLCs occupy 31.34% and 24.26% of market share of deposits and loans & advances and others share the balance indicating strong dominance of the PLCs still existing in the sector. However, the market share of private sector banks is in increasing trend. Bangladesh Bank has already initiated Basel-II implementation ground work, formed high powered national Implementation Committee, carrying out quantitative study in order to finalize the road map of Basel-II implementation. In the meantime, Bangladesh Bank has increased the minimum requirement of capital adequacy to 10% of risk-weighted assets from 9%. It may even be raised up to 12% to create caution for the supervisors’ discretionary capital under Pillar –II of the Basel. Under the Standardized Approach, the banks will be required to determine capital adequacy on the basis of the rating of the counter parties which may also ask for additional capital. This may be more important for the NCBs as the credit portfolio of the banks are wide and diversified covering many sectors and counter parties that may not carry good credit rating. In addition, 15% of the gross income of the banks will be applied in determining the capital base for operational risk. The above would warrant the financial institution to invest more in IT infrastructure systems and Human Resources. The business operation will be more sensitive to risk and capital and in this connection; the supervisory oversight will be stronger. To arrange for additional capital that would be needed under BASEL Accord, Bangladesh Bank has already advised the bank to raise the capital from 1000 million to 2000 million, if there is shortfall. If there is shortfall 50% of the same has to be raised by June 2008 and remaining 50% by the end of June 2009.

The economy of Bangladesh rebounded in the 1st quarter of 2008 after having a shock in Preliminary estimates indicate that the overall growth of the manufacturing sector during Q1 of2008 continued to be moderate relative to the growth in the same quarter of 2007. The interest rate spread declined from 5.92% in June 2007 to 5.74% in March 2008. Average lending rate of all banks reduced to 12.65% in the first quarter of 2008 from 12.75% in last quarter of 2007. On the other hand, in the first quarter of 2008 average deposit rate in the banking sector increased to 6.91%.

Gross non performing loan (NPL) to total ratio of the banking sector declined from 13.23% during end- December 2007 to 13.15% in end-March 2008. Gross NPL ratio for the state owned commercial banks (SCBs) increased marginally to 30.0% during Q1 of 2008 from 29.9% at the end of Q4 of 2007. For the specialized banks (SBs) the ratio declined from 28.6% to 27.9% while, for the private commercial banks (PCBs) and the foreign commercial banks (FCBs), the change was from 5.0% to 5.4% and 1.4% to 1.5% respectively during the same period.

Circulation for Commercial Bank by Bangladesh Bank

To comply with international best practices and to make the bank’s capital more risk-sensitive as well as to build the banking industry more shock absorbent and stable, all the scheduled banks will start implementing revised regulatory capital framework “Risk Based Capital Adequacy for Banks” from January 2009. This guideline is structured around the following three aspects:

- Minimum capital requirements to be maintained by a bank against credit, market and operational risk.

- Process for assessing overall capital adequacy in relation to a bank’s risk profile and a strategy for maintaining its capital at an adequate level.

- To make public disclosure of information on the bank’s risk profiles, capital adequacy and risk management.

This Risk Based Capital Adequacy framework applies to all Banks on ‘Solo’ as well as on ‘Consolidated’ basis where–

-‘Solo Basis’ refers to all position of the bank and its local and overseas branches/offices.

-‘Consolidated Basis’ refers to all position of the bank (including its local and overseas branches/offices) and its subsidiary company(s) like brokerage firms, discount houses, etc (if any).

Capital Base:

Regulatory capital: For the purpose of calculating regulatory capital requirement, capital is categorized into the following three tiers;

- Tier 1 Capital:

Tier 1 capital, also called ‘Core Capital’, comprises of highest quality capital elements and shall include: Paid up capital, non-payable share premium account, Statutory Reserve, General Reserve, Retained Earnings, Minority Interest in subsidiaries, Non-Cumulative irredeemable Preference Shares, Dividend Equalization Account.

- Tier 2 Capital:

Tier 2 capital, also called ‘Supplementary Capital’, represents other elements which fall short of some of the characteristics of the Core capital but contribute to the overall strength of a bank and shall include: General Provision 2, Asset Revaluation Reserve3, All other Preference Shares, Perpetual Subordinated Debt, Exchange Equalization Account, Revaluation Reserves for Securities.

- Tier 3 Capital

Tier 3 capital, also called ‘Additional Supplementary Capital’, consisting of short-term subordinated debt (original/residual maturity less than or equal to five years but greater than or equal to two years) is meant solely for the purpose of meeting a proportion of the

capital requirements for market risk.

- Conditions for maintaining Regulatory Capital

The computation of the amount of Core (Tier 1) and Supplementary (Tier 2 and Tier 3) Capitals shall be subject to the following conditions: –

1) Eligible Tier 2 plus Tier 3 capital shall not exceed total Tier 1 capital.

2) Fifty percent (50%) of Asset Revaluation Reserves shall be eligible for Tier 2 i.e. Supplementary Capital.

3) A minimum of about 20% of market risk needs to be supported by Tier 1 capital. Supporting of Market Risk from Tier 3 capital shall be limited up to a maximum of 250% of a bank’s Tier 1 capital that is available after meeting credit risk capital requirement4.

4) Up to 50% of Revaluation Reserves for Securities shall be eligible for Supplementary Capital.

5) Subordinated debt (definition & qualification is stated in appendix-1) shall be limited to a maximum of 30% of the amount of Tier 1 capital and shall also include rated and listed subordinated debt instruments/bonds raised in the capital market.

Minimum Capital Requirements (MCR)

a) No Scheduled Bank in Bangladesh shall commence and carry on its business unless it has a minimum Paid up Capital/Capital deposited with BB (applicable or foreign bank branches) as fixed by BB5 from time to time.

b) Banks shall also maintain a minimum Capital Adequacy Ratio (CAR) of at least 10% of Risk Weighted Assets (RWA) with core capital (Tier-1) not less than 5% of RWA. CAR would be derived dividing total Eligible Regulatory Capital by RWA and multiplied by 100.

c) Total Risk weighted Assets (RWA): Total Risk Weighted Assets (RWA) will be determined by multiplying capital charge for market risk and operational risk by a factor of 10 (i.e., the reciprocal of the minimum capital adequacy ratio of 10%) and adding the resulting figures to the sum of risk weighted assets for credit risk i.e., Total RWA = RWA for Credit Risk + 10 × (Capital Charge for Market Risk + Capital Charge for Operational Risk)

Measurement Methodology of RWA for Credit Risk

According to the standardized approach of Basel II framework, the risk weight will be based on the risk assessment (hereinafter called credit rating) made by External Credit Assessment Institutions (ECAIs) duly recognized by BB. Risk weights are based on external rating or a fixed weight that is broadly aligned with the likelihood of counterparty default.

Why Bank Need Credit Rating

Bank rating is arising from the fact that the banks and financial institutions are highly leveraged. A bank in Bangladesh with an average owner’s equity of 5% are undertaking a liability of 95% with 100% guarantee to repay in timely manner. The fund collected through the above guarantees are invested with 100% risk to earn a net interest margin of 2% to 4% through undertaking high Credit Risk, Operational Risk and Market Risk. The above situation puts the banks and financial institutions in such a vulnerable position that any mistake in the process may put the bank in a distress situation. Keeping in view the above globally banks are managed through a very cautious Asset Liability Management System (ALM).

The objective of Commercial Bank Rating is to provide an opinion on the relative inherent quality of the Equity Instrument contemplated to be issued at Public Offer. The rating opinion is reflected by the earnings prospects, risk and financial strength, associated with the specific bank. Rating of Commercial Bank for the purpose of Public Offer does not predict the future market price of the share; rather it rates the fundamentals of a bank, which ultimately act as important inputs in the price behavior of the share of the bank over the medium and long term perspectives. In the short term, Commercial Bank Rating facilitates the reconciliation of the market attitude with respect to the share of company to the long-term fundamentals as reflected by the equity rating.

The benefits of Credit Rating to Issuers/Companies are:

- Rating of a Public Offer issued by Commercial Bank would ensure due compliance with the relevant legal regulatory provision of the Securities & Exchange Commission (SEC) of Bangladesh.

- Rating would facilitate the issuer bank to effect of credibility among potential investors.

- CRA opinion would help the issuer company to broaden the market for their equity. As ‘name recognition’ is replaced by objective opinions, the issuer company may access the equity market more comfortably.

- Equity Instrument Rating may help in establishing issuer’ access to the equity market even when the market price of listed equities is relatively unfavorable in the prevailing market conditions.

- Rating would facilitate a bank with fundamental strength an extended level of confidence from the depositors.

- CRA rating would provide the Commercial Bank with an in depth analysis of the overall position and performance of the bank in comparison with its competitors in the peer group and give a guideline for areas of improvement.

- Commercial Bank Rating would give market participants timely access to unbiased, objective, independent, expert, professional opinion on the equity quality in a user friendly manner that may be relied upon for investment decisions.

Methodologies for Rating of Commercial Bank

In Bangladesh CRISL & CRAB has developed a comprehensive methodology for credit rating of commercial banks. These factors ate divided in two categories:

i) Quantitative Factors

ii) Qualitative Factors

Qualitative Factors:

The starting point in reaching a rating decision is a detailed review of key measured of financial performance and stability. The point consider under quantitative factors are-Capital Adequacy, Asset quality, Earning Prospects, Liquidity and Funding, Capacity of external fund mobilization.

Capital Adequacy:

Capital provides a cushion against losses arising from Credit Risk, Operational Risk and Market Risk. Therefore the size and composition of capital both in Tier-I and Tier-II, internal capital generation, minimum capital adequacy requirement (CAR) set by Bangladesh Bank, business growth and business plan to judge the prospective capital adequacy, sustainability of Capital adequacy rations, presence of hidden reserve etc.

Asset Quality:

Asset quality is the measure of Banks/FIs ability of managing credit risk. In reviewing the asset quality, CRA places due importance to the Banks/FIs credit appraisal mechanism, portfolio management system, problem asset resolution strategy, repayment rescheduling philosophy etc. In addition to the above CRA emphasis covers the areas such as portfolio diversity and sectoral concentration, large credits covering at least 70% of the total portfolio, quality of non-industrial lending, level of non-performing loans etc.

Earning Prospects:

Earning is the gateway to increase shareholders value of any organization. While reviewing the earnings and its prospects, CRA reviews the level of earning, its diversity, basic earning before provisioning and tax, sustainability of the earnings. Earnings are compared in terms of Return of Assets(ROA), Return on Equity(ROE), earnings as the percentage of net loan, interest rate management and Banks/ FIs policy in this regard, non-funded business prospects and its contribution towards earnings etc. In this process CRA also reviews the interest rate policy, product mix management, risk vs return policy, risk appetite to increase earning etc. In the cost efficiency side CRA focus covers a wide range of measurements such as cost efficiency in terms of cost to income ratio, NIIM trend, yield per taka staff cost, personnel expenses as percentage of total assets.

Liquidity and Funding:

Liquidity and funding is the vulnerable area, which may be a cause of bank failure even having strong other fundamentals. The banks are required to maintain high liquidity against demand and time liabilities. The central bank also requires the bank to maintain SLR and CRR at certain percentage, depending on monetary policy. CRA evaluates the asset-liability maturity structure, deposit renewal ratios, proportion of liquid assets to total assets and the extent to which core assets are funded by core liabilities.

Capacity of External Fund Mobilization:

CRA evaluates the Bank/FIs in terms of its ability to raise fund through stable sources in cost effective manner. The banks normally rely on its deposit base while the FIs are dependent mostly on wholesale fund. CRA analysis covers wide range of areas such as size of deposit base and its diversity, deposit mix, growth potential cost of deposit etc. while evaluating the funding base of FIs. CRA takes into account the regulatory restrictions on money market borrowing, funding lines availed and available vis a vis the credibility of such funding sources to allow the Banks to avail of fund in distress situation.

ii) Qualitative Factors:

Some of the qualitative factors that are deemed critical in the rating process are-management quality, size of the bank, ownership, risk management, corporate governance, application of information technology, regulatory environment and compliances and BASEL-II compliance.

Management Quality:

The management in banking sector goes with the basic philosophy of Assets and Liability Management (ALM). Banks are human resource based institutions. CRA places strong emphasis on the quality management, experience and educational background of the senior, mid level and junior management goals and strategies, management appetite towards risk taking. Human resource management operating efficiency calculated on the basis of earning by spending one taka staff cost etc are assessed. Due emphasis is placed on system based banking, staff motivation plans, staff turnover organization only dealing with deposits and granting loan on demand.

Branch Network:

The funding base and branch network plays an important role in assessing the competitive position of the Bank/FI. The number of branch network plays an important role in having low cost and diversified deposits. In Bangladesh economy both small and large banks are coexisting with different market niche which are given due importance in the CRA rating process.

Ownership:

An assessment of ownership pattern and shareholder support in a crisis is significant. In case of public sector banks, the willingness of the government to support the bank is an important consideration.

Risk management:

Credit risk management is evaluated through the appraisal, monitoring and recovery systems and the internal prudential lending norms of the bank; the bank’s balance sheet is examined from the perspective of interest rate sensitivity and foreign exchange rate risk. Interest rate risk arises due to differing maturity of assets and liabilities and mismatch between the floating and fixed rate assets and liabilities. CRA also assesses the extent to which the bank has assets denominated in one currency with liabilities denominated in another currency. The derivatives and other risk management products used in the past and implication of these deals is also analyzed.

Corporate governance:

Corporate governance in the financial sector is being viewed by the regulators of the country seriously in view of the absence of many common fundamentals of the governance norms in the sector. CRA analysis covers a wide range of factors such as composition of board and its committees, delegation of power at required level of management, operational independence, interruption in system by external interference, conflict of interest issues in the operational management, personnel policy and employee satisfaction, recruitment and training, application of informational technology in the system etc.

Application of information technology:

Bank management today is almost impossible with out appropriate application of Information Technology. CRA reviews the IT infrastructure, its application in business operation especially in risk management, database management, credit risk analysis, data transfer mechanism, data disaster management system etc in order to assess the strength of the system.

BASEL-II Compliances:

International Convergence of Capital Management and Capital Standard, popularly known as BASEL-II is being implemented globally. The Bangladesh Bank has also the plan to implement the same within a given the frame. Under BASLE-II banks will be required to comply with a new set of risk management system covering its credit risk, operational risk and disclosure management. All these warrant to bank to bring the existing system as close to BASEL requirement as possible so that the bank do not face any major change in the system in the system abruptly. CRA examines the current status and management policy to bring the bank to a position within a time horizon. BASEL-II emphasized on the adequate disclosure of banks risk management system, which is also considered by CRA in the evaluation process.

Quantitative Factors Analysis

Profitability Ratio:

- Return on Average Asset:

Return on average assets (ROAA) is a measure of profits relative to size that is most commonly used in analyzing banks and finance companies. Return on average assets is a financial measurement of the efficiency with which a business uses its assets. Return on average assets is the ratio of net income divided by average total assets.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 8.75% | 5.58% | 5.90% | 6.63% | 6.64% |

| AA | 2.27% | 2.96% | 2.73% | 3.30% | 3.64% |

| A | 1.35% | 1.58% | 1.87% | 1.82% | 3.98% |

| BBB | 1.39% | 1.54% | 1.01% | 0.64% | 1.29% |

Table: 1

Form the table we see that the return on average asset of AAA rated bank is very high from the BBB rated bank .AAA’s return on average asset is 5.58& and BBB’s is .98%. In 2007 the ratio of A that is 3.98% is greater than the AA that is 3.64%.

- Return to average equity:

The amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. The formula of calculating return on average equity is-Net profit before tax/ Avg. shareholders equity.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 69.21% | 64.43% | 53.99% | 54.36% | 56.38% |

| AA | 35.10% | 43.54% | 46.78% | 51.82% | 54.56% |

| A | 26.31% | 31.43% | 35.43% | 32.71% | 66.69% |

| BBB | 36.28% | 40.44% | 23.02% | 14.76% | 27.94% |

Table: 2

Here graph shows that in 2007 return on average equity, A graded banks had highest ROE and it’s growth rate is 66.69 % over the year that is very good symbol for the bank. But in average of the bank the percentage is near. AAA banks have 49.72% which is greater than others. This ratio also clearly states the differentiation among the differently rated banks. Though 2007 A rated banks have enjoyed higher ROE than AAA and AA rated banks. But the trend of five years shows otherwise. Historically AAA rated banks have higher return on asset though it is dropped slightly from 2005. AA rated banks have steady rate of ROE and BBB rated banks have the least rate compared to other ratings.

- Efficiency Ratio:

The efficiency ratio compares operating expenses with operating revenue. It measures how effectively or efficiently operating expenses are used to generate loans, deposits and fee income. The formula is- Total operating expenditure / Total operating Income

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 34.02% | 30.13% | 28.76% | 24.54% | 24.89% |

| AA | 56.88% | 41.69% | 40.79% | 40.97% | 37.64% |

| A | 66.67% | 58.27% | 46.03% | 58.09% | 32.58% |

| BBB | 45.88% | 41.85% | 51.82% | 52.06% | 61.18% |

From the table and chart, it is evident that AAA rated banks are spending least percentage of their income as operating expense. From five years data it is found that the AA rated bank improve their efficiency in 2007. Their efficiency ratio considerably increases from 66.67% in 2003 to 32.58% in 2007.

- Net Interest Margin:

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 5.10% | 6.12% | 7.33% | 8.29% | 8.46% |

| AA | 3.26% | 5.18% | 4.47% | 4.99% | 5.44% |

| A | 2.55% | 2.98% | 3.30% | 2.66% | 3.82% |

| BBB | 2.42% | 2.19% | 1.62% | 2.42% | 2.14% |

Net Interest Margin (NIM) is a measurement of the difference between the interest income generated by banks or other financial institutions and the amount of interest paid out to their lenders. Formula is-Net Interest Income / Interest earning assets (Avg.)

This ratio is also a differentiating factor for differently rated banks. AAA rated banks are charging highest rate and it is increasing year by year, but other rated bank face a fluctuation.

- Capital Adequacy Ratio:

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 8.37% | 8.93% | 12.54% | 11.96% | 11.68% |

| AA | 7.89% | 6.27% | 5.67% | 6.73% | 6.66% |

| A | 4.63% | 4.55% | 5.66% | 5.37% | 6.27% |

| BBB | 3.79% | 3.84% | 4.73% | 4.76% | 4.43% |

- Shareholders’ Fund to Total Assets:

Shareholders fund to total asset refers strength of capital base of a particular bank. That means they will have more credit repaying ability. Formula is-Stock holder’s equity / Total assets.

Table: 5

From the graphs and charts we see that AAA rated banks are ahead of other banks. AAA rated banks have better repaying capability than other banks. In other ratings, there are slight differences, but all of them are have difference according to their rating. So Shareholders fund to total asset is also a differentiating factor for differently rated banks.

- Shareholders’ fund to Deposits and Borrowing:

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 10.06% | 10.86% | 15.84% | 14.73% | 14.35% |

| AA | 9.38% | 7.39% | 6.60% | 8.17% | 7.96% |

| A | 5.36% | 5.07% | 6.49% | 6.00% | 7.26% |

| BBB | 5.01% | 4.82% | 5.45% | 5.50% | 5.05% |

Shareholders fund to deposit and borrowings (Stockholder’s equity / Deposit and borrowing) indicates the repaying ability of credit of a bank. The high of this ratio will mean, the banks will be safer for the customers (depositors).

Table: 6

As AAA banks have strong capital position, they are also ahead in this ratio. There are a huge difference between AAA and other banks. They are maintaining nearly 2 time strong capital base compare to other banks. Among other rated banks there are also slight differences.

- Shareholders’ Fund to Net Loans & Advances:

Shareholders fund to net loans and Advances = (total shareholders fund or total equity)/ Total loans and advance. Here net loans = Net L&A= Total L&A – Specific provision for L&A – Interest Suspense Account. No standard for that, the more % of shareholders fund the more is better. Means that the bank has own fund to meet the liabilities.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 12.70% | 14.20% | 20.86% | 20.02% | 19.45% |

| AA | 12.36% | 10.29% | 7.91% | 9.98% | 9.47% |

| A | 7.91% | 8.31% | 8.44% | 7.99% | 9.62% |

| BBB | 8.32% | 8.27% | 8.51% | 8.23% | 7.64% |

AAA rated bank have higher ratio all year than others. The ratio of A rated bank fluctuate over the years.

- Tier 1 Risk Weighted Capital Adequacy Ratio:

The formula is Tier 1 capital (As per FS) / Risk Weighted Assets. Tier 1 capital refers to core capital of the banks. According to BRPD circulation the core capital is not less than 5%. From the comparison we see AAA rated banks are maintaining high core capital compared other banks, which led them to strongest position in Bangladesh banking industry.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 15.84% | 15.16% | 19.17% | 18.99% | 18.71% |

| AA | 12.75% | 9.69% | 7.95% | 10.25% | 8.95% |

| A | 8.71% | 8.50% | 8.69% | 7.48% | 8.71% |

| BBB | 6.91% | 7.21% | 7.82% | 7.92% | 7.71% |

Even all foreign companies are maintaining strong capital position in Bangladesh. There is not much difference in other banks core capital. But there are well enough to differentiate among them.

Tier 2 Risk Weighted Capital Adequacy Ratio:

Tier 2 capital known as supplementary capital. The formula of Tire 2 Risk Weighted Capital Adequacy ratio is -Tier 2 Capital (as per FS) / Risk Weighted Assets . Here we see all banks raise their supplementary capital from 2003 to 2007. AA rated banks are ahead of other banks in recent two years. But there are no trend that differentiates banks in rating basis.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 1.32% | 1.07% | 1.28% | 1.93% | 2.29% |

| AA | 1.05% | 0.97% | 1.50% | 2.12% | 2.71% |

| A | 1.32% | 1.30% | 1.40% | 1.85% | 1.84% |

| BBB | 1.56% | 1.62% | 1.81% | 1.89% | 1.94% |

Risk Weighted Capital Adequacy Ratio:

Capital adequacy ratio (CAR), also called Capital to Risk (Weighted) Assets Ratio (CRAR) is a ratio of a bank’s capital to its risk. Capital adequacy ratios (“CAR”) are a measure of the amount of a bank’s capital expressed as a percentage of its risk weighted credit exposures.

Total Risk Weighted Asset is the summation of two types of capital. So Total Risk Weighted Capital Adequacy Ratio = Tier 1 capital adequacy ratio + Tier 2 capital adequacy ratio.

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| AAA | 17.16% | 16.23% | 20.45% | 20.93% | 21.00% |

| AA | 13.80% | 10.67% | 9.46% | 12.38% | 11.66% |

| A | 10.03% | 9.80% | 10.09% | 9.33% | 10.55% |

| BBB | 8.47% | 8.83% | 9.63% | 9.81% | 9.65% |

According to Bangladesh Bank circulation the ratio is 10%. From the chart and graph we see that except BBB bank other bank fulfill the requirement. The ratio AAA rated bank is two times greater than others.

Specific Findings

At the time of credit rating of banks CRA take 40% information from the qualitative factors of the bank. Maximum banks have similar information that means there are less variation among the banks performance. From the above information I find out the following things:

- Most of the banks have two committee i.e. MANCOM, ALCO. Some bank have Anti money laundering committee, BASEL II committee. The function of SCB is observed by the global SCB board.

- Strong branch network signifies the strength of the bank. From the above information we see that two banks who score AAA are foreign banks and they have limited branch.

- All banks are aware about the BASEL II and some banks already fulfill some requirement of this.

- Most of the bank has been functioning as per Bangladesh Bank guidelines and Stock Exchange Listing requirements in corporate governance.

- Bank has been introducing Bangladesh Bank’s guidelines on Credit Risk Grading. Most of the banks covers 5 (five) core risk areas of banking i.e. Internal Control Compliances, Credit Risk Management, Foreign Exchange Risk Management, Asset Liability Management and Prevention of Money Laundering as circulated by Bangladesh Bank.

- Today is the day of technology. Banks are given special attention on their management information systems and use several sophisticated software. Those software make them different from each other.

Recommendation

Analysis all the dynamics of credit rating of banks, some shortcomings have been detected. To have full-fledged recommendations for the credit rating, I want to make my recommendation in two parts. One part is for Banks, another one for Credit Rating Agencies.

Recommendation for Banks

Following recommendations are made for the banks:

- With a view to strengthening the capital base of banks and make them prepare for implementation of Basel II Accord, Bangladesh Bank under BRPD circular No.5, May 14,2007, decided all bank will required to maintain Capital to Risk Weighted Asset ratio 10% at the minimum with core capital not less than 5%. All bank should take necessary steps to fulfill this requirement.

- It is the high time for the bank to review its capital adequacy position that may stand under Basel-II. It should be needed the banks capital requirement of the bank will increase on implementation of Basel-II and the bank should take risk preparation to face the challenge as and when it is due.

- In our country maximum bank have high risky NPL ratio. All-out effort of the Bank management which included timely identification of overdue assets, initiating incentive schemes, building up task forces for recovery along with write off and rescheduling of loan which is long overdue etc will reduced the NPL ratio.

- Bangladesh Bank has already advised the bank to raise the capital and reserve from Tk 1000 million to Tk 2000 million by June 30, 2009. Bank having capital shortfall will have to meet 50% by June 30, 2008 and remaining 50% by the end of June 2009. Most of the banks already fulfill the requirement; those banks who do not meet the requirement yet should take immediate step for this.

- In order to reduce the high and dishonest competition, the central bank can limit the lending and deposit rate of commercial bank to be offered to the client. Through this regulation, a bank can maximize utilization of their fund

Recommendation for Credit Rating agency

- Restrictions on rating:

Not all the entities or securities should be rated by credit rating agencies. To ensure independence and objectivity in rating process, some restrictions should be imposed on rating of securities or entities related to the CRA.

- Disclosure of rating and rationale by the entity:

Respective circulars for banks and insurances guide the entities to publish the rating in any two national daily within one month of completion of the rating. But no guideline was prescribed thereby. Exploiting this opportunity, the entities are publishing their respective rating and only the strengths of its analysis, keeping weaknesses and lacking out of investors’ sight.

- Regulatory Framework for CRA:

It is about 12 years to promulgate the Credit Rating Companies Rules 1996 and about 6 years to the issuance of BRPD Circulars. But it is a matter of great regret that Bangladesh Bank is yet to set up a different wing to monitor the rating status of scheduled banks. To strengthen the regulatory framework of our money market it is proposed here that Bangladesh Bank should set up a monitoring cell for the rated banking companies to supervise, review and to advice on the rating results of each bank.

- Range of Rating Grade:

The Credit Rating Companies Rules 1996 instructs the companies to be rated before floating shares to the market through IPO or right issue but didn’t mention any range of rating to qualify itself for issuance. In 2002, Oriental Bank was rated “D” and floated shares through right issue. Eventually, the bank defaulted in 2007. Securities and Exchange Commission should specify a rating range for the entity to be qualified for issuance so that any such “D” rated entity could not issue public shares. It is proposed here that the rating range primarily could be from “AAA” to “B-” for floating of shares and the rule could be stiffed with the advancement of our capital market.

- Steps against Biasness:

Since source of income of a rating agency is from the client whom they are rating. So there might be a chance to be biased to the client and may have chance to rate artificially higher in order to get more money. Central bank should have a monitoring cell to control this face.

Conclusion

The financial sector of Bangladesh is now considered to be the most regulated sector compared to other sectors. As many as 48 banks are now in operation in a small economy like Bangladesh. Consequently, the financial institutions have been facing tough competition in grabbing market share. Bank for International Settlement (BIS) has issued Basel-II Capital Accord, which is in the process of implementation globally. Under this framework, capital adequacy will be determined in either in Standardized Approach or Internal Rating Based Approach. Most of the developed and developing countries even our neighboring countries have already taken initiatives to implement Basel-II since the beginning of 2007. Realizing the importance, Bangladesh Bank has already declared time frame for the parallel run of Basel-II exercise along with BASEL I from the beginning of the year 2009. CRAs’ role has expanded with financial globalization and has received an additional boost from Basel II which incorporates the ratings of CRAs into the rules for setting weights for credit risk.

At national level, there is a lack of initiatives to let the CRAs play their natural role. The credit rating industry of our country is yet to be matured. Government and regulatory authorities are taking initiatives to establish a platform for them. Recently, Bangladesh Bank has set up a committee to evaluate the rating process and methodologies followed by the CRAs. The committee is expected to report the central bank to recognize the activities of rating agencies.