Registration rights are control arrangements that permit a speculator to constrain the business to record an enlistment explanation with the Securities and Exchange Commission (SEC) and state controllers. It is correct which entitles a financial specialist who possesses confined stock the capacity to require an organization to list the offers freely with the goal that the speculator can sell them. The document, consistent with the Securities Act of 1933, must be filed with the Securities and Exchange Commission (SEC). Under this rule, before a sale or other sort of trade, all securities need to be registered. In order to raise capital, these rights are usually assigned when a private corporation issues shares. Specifically, before sale or trade, it demands that securities be registered. The method of registration can be expensive and burdensome.

By and by, registration rights held by a gathering of minority financial specialists rarely become an integral factor. The greater part square of investors normally chooses if or when the organization opens up to the world. When a business registers protection, they become more fluid, which empowers speculators to sell the offers all the more without any problem. The registration rights are considered a possible exit strategy with the ability to sell the stock, especially for those investors who hold a negative view of how the stock price is going to change. Thusly, new companies depend vigorously on exclusions for the protection’s enlistment necessities. Large numbers of these exceptions confine the offer of protections to certain outsiders, consequently lessening the liquidity of the protections.

Registration rights can help speculators holding private offers access the more extensive market to sell their offers. Early financial specialists may have more limited time skylines than organization authors for a liquidity occasion and subsequently may wish to practice these enrollment rights. These rights are regularly characterized to an explicit class of offers (by and large normal stock). And these rights are normally divided into registration rights for piggyback and demand. Exercised rights, however, may potentially have important effects on the business. The privately-owned business would need to experience the initial public offering (IPO) documenting measure, which is probably going to be costly, maybe untimely for the administrators of the firm and its investors, or excessively dilutive.

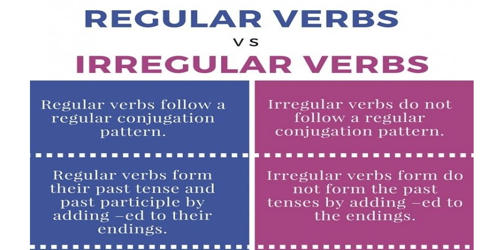

Registration rights can be classified into two main categories: demand rights and piggyback rights.

- Demand Registration Rights: Demand registration rights, as the name suggests, are rights that warrant investors to force the company’s hand into registering common stock shares, enabling them to sell them to the public. This means that if it isn’t already one, the company in question must become a publicly traded firm.

- Piggyback Registration Rights: Piggyback registration rights are rights which entitle investors to register their unregistered stock at the time when an IPO is carried out by the company or the registration process has begun. Since shareholders need to wait for the company to initiate the registration, piggyback rights are considered inferior to demand rights.

Rights are normally arranged when secretly held offers are bought. The average exchange focuses incorporate the quantity of rights distributed to the financial specialist, with the executives probably favoring less rights because of IPO costs. With request enlistment rights, speculators reserve a privilege to compel an organization to enlist imparts to the SEC. The shareholders may then, once licensed, sell their shares to outside investors and leave the company. The company can prevent the enactment of registration rights for several years, especially if the company is in the early stages of fund-raising. This keeps the organization from being pushed to open up to the world before it has worked long enough to be steady. It is to the organization’s advantage to restrict the impact of the enrollment right.

When the entrepreneur has majority ownership and full decision-making authority over the company, allowing investors to control the decision to make a public offering of business shares protects the investor. As a means of leaving the company, the shareholder may either sell her stock in any public offering or compel a public offering. Alternately, piggyback rights permit financial specialists to enroll any unregistered offers they own, however just when the organization or another investor starts the cycle. In such a case, the financial specialists don’t have as much force as those with request enlistment rights.

Specifically, to seek an exit that does not favor the entrepreneur or the company, an investor may require registration. When the investor seeks an escape to encourage personal interests rather than those of the company, this unique circumstance is known as grandstanding. Usually, registration rights include clauses that set out the registration terms. Among these details is the “lock-up” period during which speculators are disallowed from selling their offers in an organization after it has opened up to the world. Ordinarily, this is restricted to 180 days. Termination of the lock-up period is frequently brings about the selloff of an organization’s stock and a fall in its cost.

Information Sources: