Reasons for Using Different Types of Securities

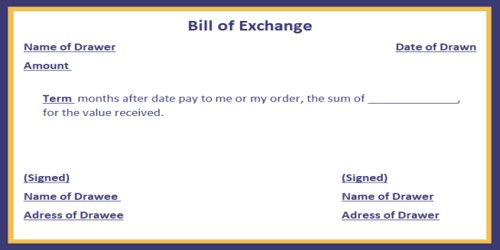

Securities are investments traded on a secondary market. Different types of securities are traded in financial markets. The most well-known examples include stocks and bonds. Some of these securities, which have a maturity period of less than one year are traded in money market such as treasury bill, bill of exchange, commercial paper etc. Some others (long-term security) are purchased and sold in the capital market. Securities allow you to own the underlying asset without taking possession.

Treasury bond, corporate bond, preferred stock, common stock etc are traded in the capital market. A company can issue various types of securities such as commercial papers, bonds, preferred stocks, common stocks etc. For example, Standard Chartered Bank has issued debenture, preferred stock, and common stock to raise capital.

Why did Standard Chartered Band issue different types of securities? The answer lies in the fact that different investors have different risk-return preferences. Therefore, to appeal the broadest possible market, the bank should offer securities that attract as many types of investors as possible. An investor, who takes more risk and wants to get a higher return may purchase common stock. But the investor, who wants to minimize investment risk may prefer bonds or debentures. For this reason, securities are readily traded.

The second reason is the popularity of the security. Different securities are more popular at different points in time. Hence companies tend to issue whatever is popular at the time they need money. Third, the duration of the fund required may lead the company to use a specific source of financing. For example, if the firm needs money for a few months, it may issue short-term securities such as commercial paper. Similarly, a company issues a perpetual bond or preferred stock or common stock when it requires permanent capital.

Information Source;