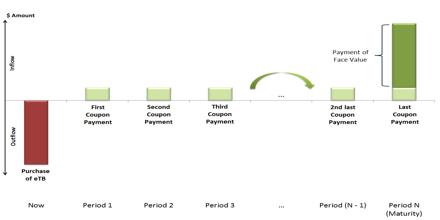

Coupon payments are expressed as a percentage of the face value (par) of a bond. It received by a bondholder are an example of an ordinary annuity because the amount of the payments is fixed, and the payments occur at the same time every period. In fixed coupon payments, the coupon rate is fixed and stays the same throughout the life of the bond. In variable coupon payments, the coupon rate varies directly or indirectly with another variable.

Coupon Payment