Reflexivity in Economics

In Economics reflexivity refers to the self-reinforcing effect of market sentiment, whereby rising prices attract buyers whose actions drive prices higher still until the process becomes unsustainable and the same process operates in reverse leading to a catastrophic collapse in prices.

It actually focuses on the mechanisms through which bounded rational actors perceive the self-referential nature of economic theories and might absorb their prescriptions. As individuals think and are conscious of their thought, reflexivity is potentially involved in all human acts of cognition and in all conceptualizations. Further, the individuals can make use of social theories which can, therefore, yield recursive effects and interfere with the phenomena they aim to depict.

The theory of reflexivity has its roots in social science, but in the world of economics and finance, its primary proponent is George Soros.

Grammatically, a reflexive verb is defined as a verb that has a similar subject and object.

“Reflective” is a general word that describes the action taken by the verb form “to reflect.” It denotes the process of reflection in physics, as in the light reflects into a mirror. It also indicates a surface that is reflective; for example, polished wood. Reflexive is seen more frequently in the grammatical sense. The definition of reflexive includes the instance where two phrases or words denote the same thing or person, but the grammatical function differs. In the phrase “she sees herself,” “she” and “herself” denote the same person, but one is the subject while the other is the object.

Economic philosopher George Soros, influenced by ideas put forward by his tutor, Karl Popper (1957), has been an active promoter of the relevance of reflexivity to economics, first propounding it publicly in his 1987 book The Alchemy of Finance. He regards his insights into market behavior by applying the principle as a major factor in the success of his financial career.

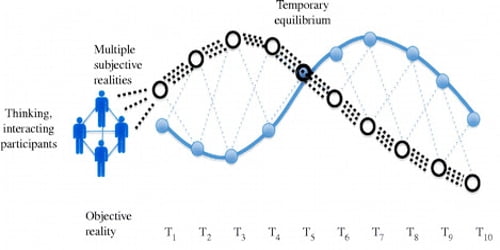

Reflexivity theory states that investors don’t base their decisions on reality but their perceptions of reality. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors’ perceptions and thus prices. The process is self-reinforcing and tends toward disequilibrium, causing prices to become increasingly detached from reality.

Soros has often claimed that his grasp of the principle of reflexivity is what has given him his “edge” and that it is the major factor contributing to his successes as a trader. For several decades there was little sign of the principle being accepted in mainstream economic circles, but there has been an increase of interest following the crash of 2008, with academic journals, economists, and investors discussing his theories.

Economist and former columnist of the Financial Times, Anatole Kaletsky, argued that Soros’ concept of reflexivity is useful in understanding the way in which Western analysts believe that China’s “economy is not only slowing, but falling off a cliff.”

The reflexivity theory runs counter to mainstream economic theory. This theory states that economic participants are on the whole rational and that they make decisions that in the aggregate amount to good choices. It also holds that free markets are effective at balancing supply and demand, at pricing assets correctly and that they are self-correcting, resulting in equilibrium. And at equilibrium, market prices reflect fundamentals but do not change fundamentals.

Information Source: