The marginal propensity to save (MPS) is the percentage of additional income that customers save. It’s the slope of the line that connects saving and profits. If a household gains an extra dollar and the marginal tendency to save is 0.35, the household can spend 65 cents of that dollar and save 35 cents. In Keynesian economic theory, the marginal propensity to save (MPS) alludes to the extent of a total raise in pay that a buyer saves as opposed to spends on the utilization of labor and products. For each additional dollar of revenue, an individual’s MPS represents how much they are able to save, normally a percentage.

To put it another way, the marginal tendency to save is the percentage of extra money that is invested rather than expended. Similarly, a reduction in revenue results in a fractional decrease in savings. MPS is a segment of Keynesian macroeconomic theory and is determined as the adjustment of reserve funds isolated by the adjustment of pay, or as the supplement of the marginal propensity to consume (MPC). If national income rises £2 billion and national savings rise £0.1 billion, the marginal tendency to invest can apply to the entire economy. The marginal saving propensity is 0.05.

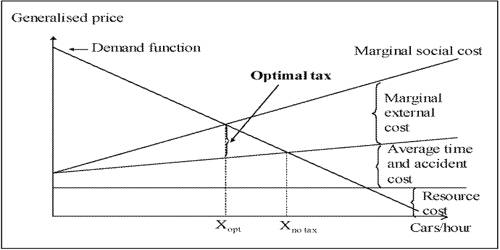

The MPS is important in Keynesian economics because it quantifies the saving-income relationship, which is the inverse of the consumption-income relationship, and it represents the fundamental psychological rule, according to Keynes. The term can likewise allude to the entire economy to show how the whole family area manages the percent of extra pay that is saved. The incline of the saving line can be introduced on a diagram to examine MPS. A savings line is a slanted line formed by plotting change in savings on the vertical y-axis and change in income on the horizontal x-axis to reflect MPS.

The marginal propensity to save and the marginal propensity to spend are intertwined. Since saving and consumption go hand in hand, the MPS represents important aspects of a household’s spending habits. It also depicts the amount of money saved by a country’s economy. Given information on family pay and family saving, business analysts can ascertain families’ MPS by pay level. This estimation is significant on the grounds that MPS isn’t consistent; it changes by pay level. The MPS is additionally a critical variable in deciding the worth of the multiplier.

The higher the salary, the higher the MPS, and as money grows, so does the opportunity to meet needs and desires, and each extra dollar is less likely to be spent on more things. A saving number, also known as leakage, is the portion of income that is not reinvested in the economy by consumption. The sum is communicated as a rate, and a higher extent shows that an individual gets a higher pay and subsequently exhibits a more noteworthy capacity to fulfill their requirements. Nonetheless, the chance remaining parts that a customer may modify investment funds and utilization propensities with a salary raise.

The MPS can be calculated as the change in savings divided by the change in income.

MPS = Change in Savings / Change in Income

Or the derivative of the savings (S) function with respect to disposable income (Y) is expressed mathematically as the marginal propensity to save (MPS) function.

MPS = dS / dY

Where,

dS = Change in Savings

dY = Change in income

Normally, a higher pay means a higher MPS. As individuals become more affluent, it gets simpler to fulfill their necessities, and the extra pay procured is bound to go into investment funds as opposed to meet family consumptions. Normally, with a pay raise comes the capacity to cover family expenses all the more effectively, considering more slack to save. A higher wage gives you access to more goods and services, which means you’ll have to spend more money. This may involve purchasing higher-end or luxury cars or relocating to a new, more expensive home.

At low-pay levels, buyers will purchase every one of the necessities of life. An increment in pay, will likely all be spent. At higher pay levels, with all necessities purchased, saving turns into a moderate extra. Even so, a higher income can change a person’s consumption habits and lead to a greater desire for luxury goods and services, such as high-end automobiles, better neighborhoods, and lavish vacations. Since MPS is defined as the ratio of change in savings to change in income, it has a range of 0 to 1. Furthermore, the marginal propensity to save is the polar opposite of the marginal propensity to spend.

Marginal propensity to save likewise assumes a critical part in deciding the multiplier impact. A multiplier estimates an adjustment of the market worth of all items delivered inside a nation’s lines, like the Gross Domestic Product (GDP). It results from a change in the self-ruling variable, like government consumption. Extra income has decreasing utility as income levels increase, so customers do not know what to do with it and therefore spend a greater percentage of it. The Keynesian consumption function shows that as income grows, the marginal propensity to spend decreases, while the marginal propensity to save increases.

For the most part, it is accepted that worth of minor penchant to put something aside for the more extravagant is more than the negligible affinity to put something aside for the less fortunate. Assuming pay increments for the two players by $1, the affinity to put something aside for a more extravagant individual would be more than that for the more unfortunate individual. A multiplier effect occurs when a shift in the manufacturing process results in extra disposable income that is spent on consumption. The new consumption generates revenue for another segment of the economy, resulting in increased consumption and a shift in the manufacturing process.

The calculation of the multiplier is a significant consequence of marginal tendency to save. A multiplier is a metric that calculates the magnified change in aggregate product, or gross domestic product, as a result of a change in an independent variable (for example, government expenditure, investment expenditures, etc.). On the off chance that financial analysts understand what shoppers’ MPS is, they can decide how increments in government spending or speculation spending will impact saving. Financial analysts use MPS in estimating the relationship between such patterns to give the overall monetary image of the populace.

The extra income that is removed from the circular flow is known as the marginal tendency to withdraw MPW. The MPS is included in this method because it shows how extra income is divided between spending and saving. It decides how much saving is initiated with each adjustment of creation and pay, and in this way how much utilization is prompted. The multiplier increases as the MPS decreases, indicating that a change in government spending or expenditure would have a greater economic effect.

Information Sources: