A redemption mechanism is a tool used by exchange-traded fund (ETFs) market managers to resolve the gaps between net asset values (NAV) and market prices. This process allows ETFs to differ as they move more fluidly from mutual funds or investment trusts by the unit. The redemption process occurs between ETF issuers and huge institutional investors called “authorized participants,” or APs.

A redemption mechanism, not the foremost widely used term within the financial world, people may hear investors speak about redemption mechanisms when they’re weighing up the advantages of various exchange-traded funds. It helps to prevent shares of an ETF trading at a reduction or premium, keeping it in line with its underlying NAV, the fair value of one share of the fund.

ETFs provide a special process for creation and redemption. APs directly create or redeem ETF shares in development units with the ETF provider, which are usually exchanged in-kind for baskets of the underlying securities and/or cash. APs make the most of ETF shares trading at a premium or discount, arbitraging price differences until the fund is restored back to its fair value. Adding or subtracting ETF shares from the market to match demand boosts efficiency, tighter tracking of indexes, and ensures that ETFs are priced fairly.

Redemption mechanisms set exchange-traded funds except for mutual funds and unit trusts. It’s utilized by APs: the broker-dealers answerable for acquiring the securities that the ETF wants to carry. So as to make sure an ETF doesn’t stray too removed from its net asset value, a dealer can arbitrage its shares with the shares that form its underlying portfolio. Alternatively, they will like better to purchase or redeem an oversized number of the fund’s shares.

There are two key reasons why creations and redemptions are crucial to an ETF’s day-to-day effectiveness. First, because APs do most of the buying and selling of the securities held by the ETF, the trading costs and costs are off from the fund, allowing tighter tracking to its underlying index. Second, because an ETF is sort of a stock, its share price will fluctuate throughout the trading day because of supply and demand. APs monitor this demand and buy or sell the underlying shares.

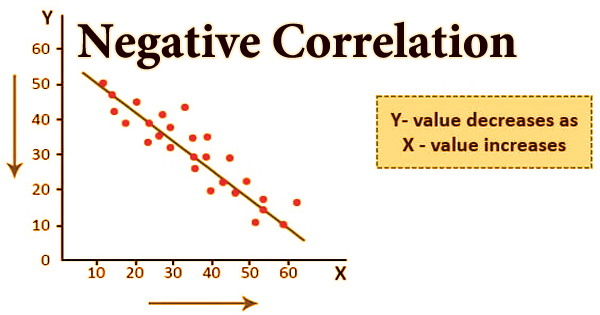

ETFs trade like standard stocks, meaning their prices fluctuate all day long. Unless the ETF experiences a sudden burst in popularity, the share price would rise above the value of its underlying securities. Conversely, market prices could fall below fair value if the fund falls out of favor with investors and a sell-off occurs. The ETF’s share price is kept closely aligned with the worth of the assets held within the portfolio, while the APs benefits from an arbitrage profit.

The redemption mechanism process is that the thrust behind many of the benefits related to ETFs, helping to stay them cheap, transparent, and tax-efficient among other things. A redemption mechanism may be a key component of how an ETF functions. The power of APs to feature or subtract ETF shares from the market to match demand can deliver efficiencies and tighter tracking typically not seen in a very traditional open-end investment company.

Most of an ETF’s possible advantages may be extracted from the method of redemption schemes. APs are instrumental in ensuring that the ETF is priced fairly and in line with its NAV. Competing products like closed-end mutual funds or unit investment trusts (UITs) don’t enjoy this luxury. Not having anyone behind them to make or redeem shares and manage the market value ends up in them imposing higher charges and often trading at notable premiums or discounts to their NAVs.

Information Sources: