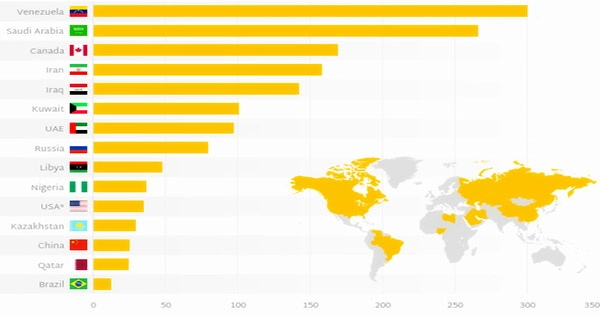

The quantity of natural resources that a firm reasonably expects to obtain from a certain deposit is referred to as proven reserves, or “proved reserves.” It is described as the amount of energy sources that may be recovered with reasonable confidence from well-established or known reservoirs using current equipment and operating circumstances, as determined by a review of geology and engineering data. Geological and engineering data acquired through seismic testing and exploratory drilling are used to establish proven reserves.

A save is considered demonstrated in case it is plausible that essentially 90% of the asset is recoverable by monetarily productive means. In oil and gas extraction, when the actual state of development is perceived, the repository is assessed by liquid contacts. Liquid contacts allude to the regular layering of gas, oil, and water in an arrangement. Multiplying the quantity of contained metal (content) by the intended metallurgical recovery percentage yields an estimate of the amount of valuable product that can be physically recovered by the metallurgical extraction process.

A precise image of the arrangement shape and known degrees of liquid contact give the information to a volume gauge with a serious level of certainty. Working conditions are considered while deciding whether a save is named demonstrated. It includes the operational break-even price, as well as regulatory and contractual permissions, all of which are required for the resource to be certified as proved. Proven reserves are those that have a 90% or higher chance of being extant and economically feasible for extraction under current conditions.

Value changes along these lines can generally affect the arrangement of demonstrated stores. Administrative and authoritative conditions might change and furthermore influence the measure of demonstrated stores. Firms utilize the findings of a seismic survey of a piece of land to assess the quantity of oil accessible beneath that area as part of the exploration and production process. The firms then classify the amount of oil-based on how easy or difficult it will be to extract the oil or gas from the earth.

In case a hold’s assets can be recuperated utilizing current innovation however isn’t financially productive it is thought of as “technically recoverable” yet can’t be viewed as a demonstrated save. As part of the estimation process, proven reserves take into consideration current extraction technologies, area legislation, and market circumstances. Reserves that are less than 90% recoverable but more than 50% recoverable are referred to as “likely reserves,” whereas reserves that are less than 50% recoverable are referred to as “possible reserves.”

Contingent upon the provincial divulgence guidelines, extraction organizations may just reveal demonstrated holds despite the fact that they will have gauges for likely and potential stores. As a result, it differs from the business term, which considers current break-even profitability as well as regulatory and contractual permission, but is regarded a rough equivalent. Possible reserves are oil deposits for which the probability of effective extraction is assessed to be between 10% and 50% if existing equipment is employed and extraction is carried out under usual conditions.

Ignoring financial matters, the appropriate designing term for the all-out innovatively extractable sum is the Producible part, which is effortlessly mistaken for the business term demonstrated stores. Proven reserves sit at the highest point of the scale, at 90% or above the probability of business extraction. Most people believe that known gas and oil reserves will increase only when new exploratory wells are dug, leading in the discovery of new reservoirs. In practice, alterations in classifications frequently result in more significant gains and losses than increases in proved reserves from really new discoveries.

The term demonstrated stores is additionally partitioned into demonstrated created holds and demonstrated lacking stores. Note that it does exclude doubtful stores, which is separated into likely saves as well as could be expected stores. On the off chance that a financial backer doesn’t have the information on plausible stores, demonstrated stores can abruptly change in various circumstances. Furthermore, if the price of oil rises, oil and gas firms may use a wider range of more expensive extraction technologies while still making a profit, converting probable reserves to proved reserves.

New proven reserves are usually added by new field revelations. Obviously, demonstrated stores can likewise decay. They do as such normally as supplies are exhausted through creation, yet they can likewise see sharp drops when guidelines take a specific extraction or functional technique off the table. Reserves expansion is also typical in previously existing fields, when reservoir features are better understood, fields are stretched laterally, or new oil and gas reservoirs are discovered in existing fields.

Although the mining industry prefers the phrases inferred, indicated, and measured to describe the increasing knowledge and confidence in a formation, analysts still use the terms likely and proved. Technological and economic advancements may also result in reserve growth. The economically feasible and mineable component of a measured mineral resource is known as proven reserves in mining. In a broad sense, the mining industry’s concept of proved reserves is based on and corresponds to that of the oil and gas industry.

Information Sources: