Introduction

The purpose of this study is focuses on the products and services . Dhaka Bank offers to its respective corporate & normal clients under transactional banking facilities . It will also include or mantion of corporate baning, retail banking like liability products, assete products & services ..

Objectives

The objectives of this report are:

- To present the DBL products & services.

- To provide an overview of the existing corporate products and services offered by Dhaka Bank Limited

- To present the product & service.facilities.

- To present the deposits of new rates.

Scope

The scope of this report is the Head office and Uttara Branch of DBL and their operations throughout the country. The report also touches the banking industry and its trends and competitors of DBL.

Methodology

I have used mainly secondary data sources for this report. But primary data has been collected in the form of interviews with various employees.The interviews were based on informal discussion. I asked questions based on the discussion and he/she shared relevant information.

He discussed different strategies relating to strengths, weaknesses, opportunities and threats. He also talked about the banking sector in Bangladesh and the banking policies set forth by Bangladesh Bank. But mostly he shared information about credit appraisal at DBL.

I used the following sources for information:

• Dhaka Bank Annual Report 2011

• Dhaka Bank website

• General Banking regular circular

• Office inword paper

• www.dhakabankltd.com

Limitations

Some limitations of the report are:

• Time span – 3 months was not very sufficient for a report of this magnitude

• Less time to work on as I came back from office at 8 pm.

• Hesitance to share all types of information on the part of the Bank

• Lack of availability of sufficient data

Part 1

Organization Overview

Overview of Dhaka Bank Limited

Bangladesh economy has been experiencing a rapid growth since the ’90s. Industrial and agricultural development, international trade, inflow of expatriate Bangladeshi workers’ remittance, local and foreign investments in construction, communication, power, food processing and service enterprises ushered in an era of economic activities. Urbanization and lifestyle changes concurrent with the economic development created a demand for banking products and services to support the new initiatives as well as to channelize consumer investments in a profitable manner. A group of highly acclaimed businessmen of the country grouped together to responded to this need and established Dhaka Bank Limited in the year 1995.

The Bank was incorporated as a public limited company under the Companies Act. 1994. The Bank started its commercial operation on July 05, 1995 with an authorized capital of Tk. 1,000 million and paid up capital of Tk. 100 million. The paid up capital of the Bank stood at Tk 1,547,402,300 as on December 31, 2007. The total equity (capital and reserves) of the Bank as on December 31, 2007 stood at Tk 3,125,688,713.The Bank has 41 branches and 1 Business Center including 2 Offshore Banking Units across the country and a wide network of correspondents all over the world. The Bank has plans to open more branches in the current fiscal year to expand the network.

The Bank has a total number of 71 branches and 2 Off Shore Banking Unit at DEPZ Savar Dhaka and CEPZ Chittagong., 7 SME Service Centers, 1 Klosk (Business Center) and 1 Central Processing Centre . and plans to open more more branches in the current fiscal year to expand its network.

The Bank offers the full range of banking and investment services for personal and corporate customers, backed by the latest technology and a team of highly motivated officers and staff. The Bank has launched Online Banking services (i-Banking), joined a countrywide shared ATM network and has introduced a co-branded credit card. A process is also underway to provide e-business facility to the bank’s clientele through Online and Home banking solutions.

Organizational Overview of Dhaka Bank Limited, Uttara Branch

Dhaka Bank Limited Uttara Branch started on 31st Decenmber, 1999. The First Branch Manager Back the was Kazi Mamun-or Rashid. It was originally situated in Sector 4 of Uttara but later moved to a more strategic location in Sector 1 in Jashimuddin Road which was very visible to people entering Uttara and also it had a lot of potential customers surrounding that area. Any other information about history was unobtainable as all the employees has changed since then.

Dhaka Bank Ltd. is the preferred choice in banking for friendly and personalized services, cutting edge technology, tailored solutions for business needs, global reach in trade and commerce and high yield on investments.

Mission of the Dhaka Bank Limited

“To be the premier financial institution in the country providing high quality products and services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.”

Vision of the Dhaka Bank Limited

“At Dhaka Bank, we draw our inspiration from the distant stars. Our team is committed to assure a standard that makes every banking transaction a pleasurable experience. Our endeavor is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investments.”

“Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries in the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision – Excellence in Banking.”

Values of the Dhaka Bank Limited:

• Customer Focus.

• Integrity and Honesty

• Quality

• Teamwork.

• Respect for the Individual

• Responsible Citizenship

• Transparency and Accountability

• Environmentally Conscious

• High Morale

Visions for 2010

They expect higher groth of business in 2010. The growth will presumably generate from the diversified corporate sector, personal banking, money market operations, structured financing, Visa debit and pre paid card, ATM network and Export oriented initiatives. New innovative products like Capital Market, Bundled Savings Account, Refurbished Home Loan etc has been introduced to increase profitability.

Strategies Objectives of DBL:

Their objectives are to conduct transparent and high quality business operation based on market mechanism within the legal and social framewaork.

Their greatest concerns are to provide their customers continually efficient, innovative and high quality products with excellent delivery system.

Their motto is to generate profit with qualitative business as a sustainable ever-growing organization and enhance fair returns to the shareholders.

Establish DBL as one of the top five successful Private Commercial Banks by 2010

Be committed to the community as a corporate citizen and contribute towards the progress of the nation

Build a strong deposit base

Introduce new products & services and upgrade existing products & services at comparatively low cost in order to assure quick respond to the changing demands in the market

Promote the well being of the employees and raise their morale

Strengthen corporate identity and values

Fullfill of their responsibility to the government by paying taxes and abiding by other rules

Bring the entire system under a very advanced IT platform

Socialize and present the bank to the community as a corporate partner

Encouraging and motivating the new entrepreneurs to establish industries and business in line with development of national economy.

Enhancing savings tendency of the people by offering attractive and lucrative new savings scheme.

Financing the foreign trade of the country both Export and Import.

Enhancing the mobilization of savings both from urban and rural area.

The prime objective of DBL is to deliver a quality that demonstrates a true reflection of their vision-Excellence in Banking. Improve the quality of lone and services, and diversify the sources of revenue.

Focus on Current, Savings & Short Term Deposit Accounts to reverse the ratio (26:74) with Fixed Deposit Receipt.

Take immediate action required to reverse the rise of Cost of Fund.

Increase fee based income: increase volume & fee of Letter of Credit & Guarantee, increase export and exchange earnings.

Reduce operating cost by at least 20%.

Corporate Social Responsibility

Dhaka Bank is committed to their corporate responsibility toward the community. They allocate 2% of their tax profit for CSR practices each year. They have also taken numerous initiatives towards social welfare and community development. They also donated-

Anti-Drug Campaign in Chittagong

Donation to Prime Minister’s Relief Fund for bereaved family members of the Army Officers during the recent carnage at BDR Head Quarter, Peelkhana, Dhaka on March 10, 2009 of taka 25 Lac.

Donaton to Prime Minister’s Relief Fund for bereaved family members of the Army Officers during the recent carnage at BDR Head Quarter, Peelkhana, Dhaka on April 1, 2009 of taka 9.60 Lac.

Donation to BIRDEM Hospital in 2009 of taka 24 Lac.

Donation to Center for Women &Child Health Hospital in 2009 of taka 24 Lac. Contribution to Bangladesh Tennis Federation (BTF) as sponsorship of 23rd Bangladesh International Junior Tennis Championships 2009 of taka 5 Lac.

Financial assistance for Shahidbagh Jame Mosque, Dhaka of taka 50 Lac.

Financial assistance for Kapasatia Jame Mosque, Hossainpur, Kishoreganj of taka 20 Lac.

Donation to Bangladesh Hockey Federation for sponsorship of Jawharlal Nehru Cup Hockey Tournament of taka 10 Lac.

Donation for the Aila Cyclone Victims of taka 10 Lac.

Donate 2 unit of Ambulances to be used by the Highway Police of taka 48.86 Lac.

Donation to the Players and Officials of National Hockey Team for winning 3rd AHP Cup Tournament held in Singapore of taka 2 Lac.

Donation to Bangladesh Athletic Federation Sponsorship of 25th National Junior Athletic Championships 2009 of taka 8 Lac.

Sponsorship of Air Ticket an international player to participate in International Chess Tournament to be held in Hungary of taka 0.80 Lac.

Donation to Bangladesh Olympic Association for sponsorshipof BOA Sports Development Lottery 2009 of taka 10 Lac.

Corporate Information:

Name of the Company: Dhaka Bank Limited

Legal Form: A public limited company incorporated in Bangladesh on April 06, 1995 under the Companies Act 1994 and listed in Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited

Date of Commencement: July 05, 1995

Registered Office: Biman Bhaban (1st Floor) 100 Motijheel C/A

Dhaka – 1000, Bangladesh

Telephone: +880 2 9554514

Telefax: +880 2 9556584, 9571013, 9565011

SWIFT Code: DHBLBDDH

E-Mail: info@dhakabank.com.bd

Web Page: www.dhakabankltd.com

Auditors: ACNABIN

Chartered Accountant

Tax Consultant: Howlader, Yunus & Co.

Chartered Accountant

Managing Director: Khondker Fazle Rashid

From February 24, 2009

Company Secretary: Arham Masudul Huq

Departments of DBL

Dhaka Bank maintains the jobs in a proper and organized considering their interrelationship that are allocated in a particular department to control the system effectively. Different departments of DBL are as follows:

Human Resources Division

Dhaka Bank Limited recognizes that a productive and motivated work force is a prerequisite to leadership with its customers, its shareholders and in the market it serves. Dhaka bank treats every employee with dignity and respect in a supportive environment of trust and openness where people of different backgrounds can reach their full potential.

The bank’s human resources policy emphasize on providing job satisfaction, growth opportunities, and due recognition of superior performance. A good working environment reflects and promotes a high level of loyalty and commitment from the employees. Realizing this Dhaka Bank limited has placed the utmost importance on continuous development of its human resources, identify the strength and weakness of the employee to assess the individual training needs, they are sent for training for self-development. To orient, enhance the banking knowledge of the employees Dhaka Bank Training Institute (DBTI) organizes both in-house and external training.

The major responsibilities of HR are as follows:

• Employee recruitment

• Posting

• Transfer

• Increment

• Established yearly performance bonus

• Provident fund

• Confirmation

• Training

• Telephone policy

• Travel policy

Personal banking Division

The personal banking department deals with the consumer credit schemes such as the personal loan, car loan, education loan, tax loan, personal secured loan that are tailored to meet the demand of individual customers. The manager of DBL credit who approves and administers all the activities heads this department. The approval officer mainly rejects or approves the credit requests. After being checked by the approval officer, the credit requests go to the processing officer for further processing of the application.

Treasury Division

Their main job is to take decisions regarding purchase and sell of foreign Currency. The purpose of Treasury’s operations is to utilize the funds effectively and arrange funds at a lowest possible rate of interest, through maintaining effective relationship with other banks and following the Government rules and foreign exchange regulations.

Computer and Information Technology Division

This department gives the software and hardware supports to different departments of the bank. As Dhaka Bank is engaged in online banking, the role of IT is very crucial for the bank. This department is the most active department of DBL where employees always stand by to solve any problems in the system. The managers and executives of IT division work continuously to develop the total IT system of DBL so that it can be operated with ease, accuracy, and speed. Since its journey as commercial Bank in 1995 Dhaka Bank Limited has been laying great emphasis on the use of improved technology. It has gone to online operation system since 2003. The main softwares that DBL uses are:

• Flexcube

• DBCube

• SWIFT Manager

• Excel

• El Dorado

• Dhaka Bank Server

• Nikash

• UNIX

• Western Union

• Dhaka Bank Foreign Trade

- Word

Credit Division

The borrowing capacity provided to an individual by the banking system, in the form of credit or a loan. The total bank credit the individual has is the sum of the borrowing capacity each lender bank provides to the individual. Credit Policy Committee is composed of the managing director, the general manager, the Chief Risk Officer and the assistant general manager responsible for credits. Committee meets every other week, evaluates the banks overall lending portfolio and determines principles and policies regarding portfolio management.

Operation Division

This is an integral and vital part of the bank. The services department ensures smooth operation and functioning within and between all the departments of DBL. It also provides continuous support to the core banking activities of DBL. The Manager of Services heads the department who formulates and manages various critical issues of the services function of DBL. He is followed by a group of executives who are the heads of various subsidiary divisions that operate within the services department. The Services Department is considered as the backbone of all other departments.

Card Division

DBL is the first domestic commercial bank in Bangladesh to introduce Visa Electronic and Visa Credit Card at the same time. DBL is also the only bank in Bangladesh to introduce Visa ATM Acquirer along with POS Acquire, which opened the opportunity for all the Visa Cardholders (domestic and international) to use the ATMs.

Finance & Accounts Division

This is considered as the most powerful department of DBL. It keeps tracks of each and every transaction made within DBL Bangladesh. It is headed by Manager of FCD who ensures that all the transactions are made according to rules and regulation of DBL group. Violation of such rules can bring serious consequences for the lawbreaker. The functions of FCD are briefly discussed below along with an organ gram of the department.

Audit & Risk Management Division

The Risk Management Division is responsible for measuring risks that the Bank might face in the course of its operations, developing corporate risk management policies and ensuring that risks remain within the limits in which the Bank prefers to bear such risks in line with its own strategic targets and risk appetite. The primary goal of risk management is to provide capital to businesses in line with their risks (economic capital), maximize risk-adjusted return and increase the added value.

The risk management function consists of Market Risk, Credit Risk and Operational Risk Management Units. Bank Risk Committee, Asset-Liability Committee (ALCO), Credit Policy Committee, and Operational Risk Management Committee are the other risk management bodies.

Risk Management Unit

During the 3rd quarter of the year 2009 the Management of the Bank has set up a Separate Risk Management Unit (RMU) in line with Bangladeshi Bank directives. The RMU functions under direct supervision of the Managing Director, who is assigned by the Deputy Managing Director ( Risk Management). The Risk Management Unit supervises and monitors independently and consistently the management of following Main Risks:

1. Credit Risk

2. Asset- Liability Risk

3. Foreign Exchange Risk

4. Internal Control & Compliance

5. Anti Money Laundering

6. Information and Communication Technology

7. Balance Sheet Risk

8. Operational Risk

9. Market Risk

10. Liquidity Risk

11. Reputational Risk

12. Insurance Risk

13. Sustainability Risk

The main purpose for establishing the RMU is to prevent the Bank from taking too much risk and build up a Capital Adequacy, which is more risk sensitive. The RMU tends to take necessary measures and find out strategy against financial crisis, unusual market condition, and different investment vulnerabilities.

Organizational Structure of Dhaka Bank Ltd

There are four different wings to consist the organizational structure of DBL. They are:

• Board Directors

• Executive Committee

• Audit Committee

• Management Committee

Organizational Hierarchy

| Managing Director |

Deputy Managing Director |

Senior Executive Vice President |

Executive Vice President |

Senior Vice President |

Vice President |

Senior Asst. Vice President |

First Assistant Vice President |

Assistant Vice President |

Senior Principal Officer |

Principal Officer |

Senior Officer |

Officer |

Probationary Officer |

Junior Officer |

Asst. Officer/Asst. Cash Officer |

Trainee Asst. Officer/Trainee Asst. Cash Officer |

Telephone Operator |

Trainee Telephone Operator |

Part-2

DBL Products& Services

Products of DBL

Different banking products and services are being offered exclusively to the Non Government Organizations and international projects in Bangladesh and its staff, both local and expatriate, based in Bangladesh. With the assistance of the Marketing Team, who have prior experience of serving diplomatic missions with other multinational banks, the Bank has tailored a list of products to address the NGO / International Organization’s unique banking requirements in Bangladesh. Dhaka Bank Limited is committed to developing and delivering to the corporate relationships total banking solutions while ensuring a level of service that exceeds customer expectations.

1) Retail Banking:-

In 2001 DBL. introduced its personal banking program responding to the market demand for a complete range of modern banking products & services. Last year they introduced a new product called Savings bundles Product. Designed exclusively for the salaried executives, Excel Account offers a packaged solution to companies and organizations in processing their employees’ salaries and funding employees’ loans.

Retail Banking consists of the following products:

Liability Products-

• Savings bundled Products

• Deposit Pension Scheme

• Special Deposit Scheme

• Deposit Double Scheme

• Gift Cheque

Asset Products-

• Home Loan

• Personal Loan

• Vacation Loan

• Car Loan

• Any Purpose Loan

Services-

• Internet Banking

• SMS Banking

• Locker

• ATM Card

• VISA Credit Card

• Utility Bill/Tuition Fee Collection

• Letter of Credit

• Western Union and other money transfers like Placid, Rupali etc (Note: they do not provideMoneyGram Services)

Savings Bundle Product

Dhaka Bank Saving Bundle Product is the first of its kind in Bangladesh. A unique blend of all flexibilities of a current account and provision high interest on daily balance and monthly interest paid savings account in three schemes, namely-

• Dhaka Bank Silver Account

• Dhaka Bank Gold Account

• Dhaka Bank Platinum Account

| Feature | Dhaka Bank Silver Account | Dhaka Bank Gold Account | Dhaka Bank Platinum Account |

| Minimum Balance Deposit | Tk.30,000 | Tk.50,000 | Tk, 1,00,000 |

| Interest | 7% P.A.(Paid monthly) | 7.5%P.A.(Paid monthly) | 8.5%P.A.(Paid monthly) |

| Creadit Card | Free Limit upto Tk.50,000 | Free Limit upto Tk.90,000 | Free Limit upto Tk.500,000 |

| SMS Banking | Free | Free | Free |

| Atm Card | Free | Free | Free |

| Yearly fee | Tk.2500 | Tk.3500 | Tk.5000 |

| Maximum Mounthly Withdrawals | 04 | 08 | 12 |

| Cheque Book | 1 Cheque Books of 50 leaves free per year | 2 Cheque Books of 100 leaves free per year

| 1 Cheque Books of 150 leaves free per year |

Dhaka Bank Savings Bundle product is another landmark to our commitment – Excellence in Banking

Customer will get the following benefits for opening any of the above account

• 0.5% less interest on Retail Loan

• Minimum Income Tk.30,000/- in Silver Account,Tk.75000/- in Gold account & Tk.150000/ in Platinum Account.

- Last 6 month’s bank statement

- TIN Certificate, National ID/Passport

- Post facto CIB etc.

Deposit Pension Scheme

Dhaka Bank is well poised to be the leading Personal Banking business amongst the local private banks. Bank’s conscious efforts in brand building, introducing and supporting new packaged products, developing PB organization along with non-traditional delivery channels have resulted in good brand awareness amongst its chosen target markets.

Installment based savings schemes are a major category of saving instruments amongst mid to upper middle-income urban population. DPS is an installment based savings scheme (Deposit Pension Scheme) of Dhaka Bank for individual clients. The key differentiators of the product will be –

Amount of monthly deposit – The scheme offers the clients the flexibility of tailoring the amount of monthly deposit based on his monthly cash flow position. The minimum monthly deposit will be BDT 500.00 The client will have the option of depositing any amount in multiples of BDT 500.00 subject to a maximum of Tk 20,000.

Flexible tenor of the scheme– The client has flexibility of deciding on the tenor of the scheme in-terms of number of months. However, the minimum tenor would be 48 months and the maximum would be 144 months.

Flexibility to open any number of DPS Account– A client can open maximum five DPS accounts in client’s name, in his/her spouse’s name or in the name of his/her children or in joint names with any of his/her family members.

Bonus point – if the client continues the scheme up-to maturity then at maturity, the client will be awarded a bonus 1% on the total deposit amount. However, to qualify for the bonus point, client may default in paying maximum 2 installments within the tenure of the DPS.

Premature encashment – if any client closes the deposit account before one year, s/he will not be entitled to any interest. Account running more than a year will be eligible for the prevailing interest offered in the savings account.

Late payment fee – Clients failing to deposit any installment will pay 5% late payment fee on the deposit installment amount as late payment fee, which will be realized at the time of depositing the next deposit Installment.

Payment through Account – Clients will have to open an Account with Dhaka Bank Limited and a standing instruction will be executed for auto-debit to effect the monthly installment.

OD Facility against DPS – Clients will have the option of taking advance upto 90% of the deposited amount at the time of application. However, to be eligible for the OD facility, the account must be at least 2 years old or the minimum ticket size of the advance will be Tk 20,000.00

Interest– the bank wiii be give 11.50% interest on his/her deposit.

Deposit Double

Deposit Double is a time specified deposit scheme for individual clients where the deposited money will be doubled in 5 years 4 month. The key differentiators of the product will be:

Amount of deposit – The minimum deposit will be BDT 50,000.00 (either singly or jointly). The client will have the option of depositing any amount in multiples of BDT 10,000 subject to a maximum of Tk 20, 00,000 in a single name and Tk 35, 00,000 in joint name.

Tenure of the scheme – The tenure of the scheme will be 5 years. 4 month & normal 6 year.

Premature encashment – If any client chooses to withdraw the deposit before the tenure, then she/he will only be entitled to prevailing interest rate on savings account in addition to the initial deposit. However, withdrawal of the deposited amount before one year will not earn any interest to the depositor(s).

OD Facility against Deposit – Clients will have the option of taking advance upto 90% of the initial deposited amount. The lending rate will be tied up with the interest rate offered on the deposit.

| Product Features | |

| Deposited Amount | Min Tk 50,000 (singly or jointly) with multiples of Tk 10,000 Max Tk 20,00,000 (in single name) Tk 35,00,000 (in joint name) |

| Lone facility | 90% |

| Tenure | 5 years. 4 month |

Govt. Charges – The matured value is subject to taxes and other Govt. levies during the tenure of the deposit.

Income Unlimited

The management of Dhaka Bank Limited is pleased to launch Special Deposit Scheme, a new liability product on May 04, 2005.

Product Name– Special Deposit Scheme

Products Features

| Deposit Amount | In multiples of Tk 50,000 However the minimum deposit will be Tk 1,00,000 (singly or jointly) and the maximum Tk 50,00,000 (singly/Jointly). |

| Interest Due | One month after the initial deposit date the interest will be credited to the savings/current account. |

| Tenure | 1,2&3 Years |

| Monthly income on Tk 100,000 | Tk 1,000 subject to 10% Income Tax(if he/she have a TIN certificate) |

| Rate of Interest | 12.00% |

Excel Account

Excel Account has been tailored in the manner of having both asset and liability characteristics blended into a single product for salaried individuals employed in any institution. On virtue of this product, prospective clients receive a credit interest based on the credit balance available in the account. The clients will also be required to pay the bank OD interest if the balance of the account becomes overdraft.

The tenure of the account will be for 3 years maximum, having renewal facility for every year until the client resigns from the institution. OD facility is a pre-embedded feature of the Excel Account. An OD limit is given to the account up to the amount of the salary of the individual employed at the institution. For a credit balance this facility provides an interest rate of 4.5% p.a. based on the daily balance of the account. If in the case, the account is utilized for an OD limit, the debit balance will be subject to a debit interest rate of 16% p.a.

Salary Account

Dhaka Bank has launched a special package of savings account for employees belonging to institutions with which Dhaka Bank has a corporate agreement. With this package salaried employees of these institutions enjoy interest on a daily balance. The key features of the Salary Account are:

• Interest to be calculated on a daily balance basis

• No Periodic Service Charge

• ATM Card Facility

• Credit Card Facility

• On-line Banking Facility

• Internet & SMS Banking Facility

Smart Plant : Smart Plant offers the opportunity to multiply initial cash to 10 times in 6 years. The customer deposits at least Taka 10,000 or multiple of it to avail the opportunity. In single name one can deposit maximum Taka 50, 00,000. Dhaka Bank shall contribute 4 times of your deposited amount to build up a fund for issuance of Smart Plant. Maturity period of the Smart Plant is 6 years.

The total Smart Plant amount (customer’s deposit + Bank Contribution) will double in 6 years. For example; if you deposit Taka 10,000, bank shall contribute Taka 40,000, altogether the Smart Plant amount will be Taka 50,000. On maturity (after 6 years) the Smart Plant amount will be Taka 1, 00,000. You will repay the bank contribution amount in 72 equal installments. After repayment of all installments the matured value will be credited in your savings account

Shopno Jatra Student Services

Shopno Jatra Student Services [SJSS] of Dhaka Bank Limited is destined to provide “One Stop Solution” for Bangladeshi students going overseas for study purpose. Understanding the need, this exclusive service is tailored to provide same day banking solution at lowest charge/fees.

Shopno Jatra Student Service offers

1. Transfer of Student Application Charges to foreign educational institute

2. Opening/ processing of student file

3. Issuance of Foreign Currency for Tuition Fees & Living Expenses

4. Issuance of Student International VISA Card

5. Special Study loan

Dhaka Bank, has a dedicated student service wing is pioneer to launched Student International VISA Card for the first time in Bangladesh, which allows the students of flexibility & safety of plastic money, which they can avail for living expenses. Card is affordable & easy to re-charge is the fastest solution to remit living expenses to the students

Gift Cheque

Dhaka Bank has recently refurbished its Gift Cheque. The features of the gift cheque are as follows:

- Can be encashed at any branch even if the encashing branch is not the issuing branch of the instrument.

- Interest will be applicable only if the instrument is encashed after three months from the date of issue in the following manner:

- No Interest if encashed before three months from the date of issue.

- 6% if encashed after three months and before twelve months from the date of issue.

- 7.25% if encashed after twelve months from the date of issue.

- The gift cheque may be encashed using either of the two modes, (a) cash or (b) Fund Transfer. Encashment of gift cheque is not allowed over clearing.

- Dhaka Bank Limited issues gift cheques in three denominations of Tk.100, Tk.500 and Tk.1000

Loan

As part of establishing a personal banking franchise of Dhaka Bank Limited, the bank has successfully launched Personal Loan. The product is a term financing facility to individuals to aid them in their purchases of consumer durables or services. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months.

Target Market-

a. Salaried employees of institutions in the Dhaka, Chittagong and Sylhet markets.

b. Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

c. Businessmen who are permanent residents of Dhaka, Chittagong and Sylhet metropolis with at least 3 years of continued operation in the line of business.

Restrictions and client eligibility

- Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 25 years and the maximum age 52 years with a minimum verified Gross Family Monthly Income of BDT 10,000.

| TLoan amount limits under the program | ype of Loan | Minimum loan amount | Maximum loan amount | |||

| Personal | BDT 25,000 | BDT 500,000 | ||||

Car Loan

As part of establishing a personal banking franchise of Dhaka Bank Limited, the bank has successfully launched Car Loan. The product is a term financing facility to individuals to 40

them in their pursuit of has a car of their dream. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 60 months. In case of brand new cars the loan tenure will be maximum 72 months.

Target Market

a. Salaried employees of institutions in the Dhaka, Chittagong and Sylhet markets.

b. Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

c. Businessmen who are permanent residents of Dhaka, Chittagong and Sylhet metropolis with at least 3 years of continued operation in the line of business.

Restrictions and client eligibility

Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 25 years and the maximum age 52 years with a minimum verified Gross Family Monthly Income of BDT 45,000.

| TLoan amount limits under the program | ype of Loan | Minimum loan amount | Maximum loan amount | |

| Car | Not specified | Tk 20,00,000 | ||

Vacation Loan

As part of establishing a personal banking franchise of Dhaka Bank Limited, the bank has successfully launched Vacation Loan. The product is a term financing facility to individuals to aid them in their pursuit of spending a vacation in the country or abroad. The facility becomes affordable to the clients as the repayment is done through fixed installment s commonly known as EMI (equal monthly installment) across the facility period. Depending on the size and purpose of the loan, the number of installment varies from 12 to 48 months..

Target Market

a. Salaried employees of institutions in the Dhaka, Chittagong and Sylhet markets.

b. Professionals who are self employed and have at-least 3 years of independent practice in the area of profession.

c. Businessmen who are permanent residents of Dhaka, Chittagong and Sylhet metropolis with at least 3 years of continued operation in the line of business.

Restrictions and client eligibility

Loans are restricted to Bangladeshi nationals falling in the categories mentioned below The minimum age for any borrower will be 25 years and the maximum age 52 years with a minimum verified Gross Family Monthly Income of BDT 10,000.

| Loan amount limits under the program | Type of Loan | Minimum loan amount | Maximum loan amount | |||

| Vacation | BDT 25,000 | BDT 500,000 | ||||

Home Loan

The product is a term financing facility to individuals to aid them in their purchases of apartment or house or construction of house. The facility will become affordable to the clients as the repayment is done through fixed installment as commonly known as EMI (equal monthly installment) across the facility period. Depending on the size of the loan, the maximum period of the loan would be 180 months (15 years).

Target Market

The target market for Home Loan will be mainly focused in Dhaka and Chittagong . However, strong recommendation from branches operating in other areas will also be facilitated with the major concentration on the fo

- Salaried employees of institutions with minimum 3 years continuous service

- Self-employed Professionals who are self employed and have at-least 5 years of independent practice in the area of profession. (Example: Doctors, Dentists, Engineers, Chartered Accountants, Architects who are members of their professional institutes.)

- Businessmen who are permanent residents of Dhaka, Narayangonj, Chittagong and Sylhet with at least 5 years of continued operation in the line of business.

Restrictions and client eligibility

1. Loans are restricted to Bangladeshi nationals falling in the categories mentioned below: The minimum age for any borrower will be 21 years with a maximum age 50 years (at the time of application). The minimum verified Gross Family Monthly Income of the applicant should be BDT40,000.The family income will include only the income of the applicant and spouse.

2. The maximum permitted Equal Monthly Installment (EMI) paid by the borrower should be no more than the 33% of the Family Monthly Disposable Income (FMDI) of the borrower per month.

3. In calculating FMDI, we propose to use the following industry standard formula: Proven income of obligor PLUS proven income of spouse (if the spouse is working) LESS current monthly loan obligations (if any), other monthly fixed obligations (rent, children’s education, monthly food expenses, etc).

| Loan amount limits under the program | Minimum loan amount | Maximum loan amount | |

| BDT 500,000 | BDT 3,500,000 | ||

4. * The tenor will be decided at the discretion of the management.

Any Purpose Loan

Any Purpose Loan is a term financing facility to individuals to meet their immediate requirements. The facility becomes affordable to the clients as the repayment is done through fixed installments commonly known as EMI (Equal Monthly Installment) across the facility period. Depending on the size and purpose of the loan, the number of installments varies from 12 to 48 months. This facility is available for Salaried Employees, Self Employed / Professionals or Businessmen. Loans are restricted to Bangladeshi Nationals within 21 years to 57 years age limit with a minimum verified Gross Family Monthly Income of BDT 10,000. The amount of loan may vary from BDT 25,000 to 5,00,000 depending on the applicants requirement and repayment capability.

2) Corporate Banking

Corporate Banking business was performed fairly well in 2002 despite a sluggish credit demand in the market. This year priority has been given to expand business in low risk sectors. Besides we have designed a comprehensive risk management system to monitor and control our asset quality. Letter of Credit, Guarantee, Import & Export Finance, Syndicate Loan, Project Financing, Leasing, Working Capital Financing etc. all are Corporate Banking Products.

Securitization of Assets

Securitization of Assets is still in its infancy in The need however for such a service is great and there is a lot of support from multilateral financial institutions, such as the World Bank A powerful and effective means of generating funds for a certain category of institutions, and the Asian Development Bank, for such activities to be developed further in this country.

Dhaka Bank intends to take up this challenge and play a significant role in ensuring that Securitization of Assets becomes a normal part of the range of financial instruments available for organizations who can count on a steady, but piecemeal, flow of revenue and want to translate this stream into cash resources with which to carry out further lending activities to new customers. Some practical issues still need to be settled such as those concerning pricing, or the legal framework, but it is expected that, as Dhaka Bank and other institutions pursue more such securitization activities these will be resolved.

Finance & Advisory Services

Given the needs of its large and varied base of corporate clients Dhaka Bank will be positioning itself to provide investment banking advisory services. These could cover a whole spectrum of activities such as Guidance on means of raising finance from the local Stock markets, Mergers and Acquisitions, Valuations, Reconstructions of Distressed companies and other expert knowledge based advice. By this means Dhaka Bank hopes to play the role of strategic counselor to blue-chip Bangladesh companies and then move from the level of advice to possible implementation of solutions to complex financing problems that may arise from time to time.

Syndication of Fund

There has been a surge in the number of syndication deals closed in the last few years. 2004 was an exceptionally good year for syndicated deals for the local commercial banks also for the foreign banks. The total number of syndications in 2004 exceeded 10 totaling over Tk. 10 billion. This rise in the number of syndications can be primarily attributed to the prudential lending guidelines of the Bangladesh Bank. A commercial bank may provide funded facilities up to a maximum of 25% of its equity. Due to this reason, projects with sizeable costs need to approach more than one bank for their debt requirements and therefore the demand for syndications exist. Credit risk diversification has led many international companies to introduce credit derivatives that are activel being traded. Securitization of assets is one such credit risk derivative that allows financial institutions to diversify their portfolios.

At Dhaka Bank Limited, the Syndications and Structured Finance unit was setup on October 30, 2004. This unit successfully closed two syndicated deals in the first and second quarters of 2004. The Syndications and Structured Finance team as a business unit soon followed up by closing another deal totaling Tk 2.10 billion for a large local corporate. The year (2004) being the first full year of operation for the team ended on a high note as we were able to close three syndicated deals as the Lead Bank, two deals as the Co-Arranger and several other deals as a participant.

Services of DBL

The Bank offers the full range of banking and investment services for personal and corporate customers, backed by the latest technology and a team of highly motivated officers and staff.

The Bank has launched Online Banking service, joined a countrywide shared ATM network and has introduced a co-branded credit card.

Dhaka Bank Limited offers various types service. Those are:

Corporate Banking

Personal Banking

Islamic Banking

Capital Market Services

SME

ATM Card Services

Credit Card Services

Locker Services

Corporate Banking

Providing a tailored solution is the essence of our Corporate Banking services. Dhaka Bank recognizes that corporate customers’ needs variation from one to another and a customized solution is critical for the success of their business.

Dhaka Bank offers a full range of tailored advisory, financing and operational services to its corporate client groups combining trade, treasury, investment and transactional banking activities in one package.

Whether it is project finance, term loan, import or export deal, a working capital requirement or a forward cover for a foreign currency transaction, our Corporate Banking Managers will offer you the right solution. You will find top-class skills and in-depth knowledge of market trends in our corporate Banking specialists, speedy approvals and efficient processing fully satisfying your requirements – altogether a rewarding experience.

Loan Syndication

DBL participates in a number of loan syndication arrangements involving foreign investment has been highly acclaimed. The projects that they have handled as the lead arranger or co-arranger with other banks and financial institutions include production and export oriented ventures in power generation, cement production, food processing and a large undertaking in leisure and amusement

Floating of Public Issues

The Bank assists companies to underwrite public issues. Dhaka Bank has successfully participated in a number of issues

Personal Banking

Amongst Private Sector bank’s, Dhaka Bank has already made its mark in the personal banking segment. The promotions like “Baishakhi Offer”, a strategic tie up with Electra International Limited, distributor of Samsung brand products, and “Freeze the Summer Campaign” a strategic tie-up with Esquire Electronics Limited, distributor of Sharp/General Brand electrical appliances saw Dhaka Bank to experience more than a reasonable growth on the personal banking business in 2008.

Islamic Banking

Dhaka Bank Limited offers Shariah based Islamic Banking Services to its clients. The bank opened its First Islamic Banking Branch on July 02, 2003 at Motijheel Commercial Area, Dhaka. The second Islamic Banking branch of the bank commenced its operation at Agrabad Commercial Area, Chittagong on May 22, 2004. Dhaka Bank Limited is a provider of on line banking services and any of its clients may avail Islamic Banking services through any of the branches of the bank across the country.

Dhaka Bank Islamic Banking Branches offer fully Shariah based, Interest free, Profit-Loss Sharing Banking Services. Dhaka Bank Shariah Council is closely monitoring its activities. Besides, Dhaka Bank is an active member of Islamic Banking Consultative Forum, Dhaka and Central Shariah Board of Bangladesh.

Capital Market Services

Capital Market Operation besides investment in Treasury Bills, Prize Bonds and other Government Securities constitute the investment basket of Dhaka Bank Limited. Interest rate cut on bank deposits and government savings instruments has contributed to significant surge on the stock markets in the second half of 2004, which creates opportunities for the Bank in terms of capital market operations. The Bank is a member of Dhaka Stock Exchange Limited and Chittagong Stock Exchange Limited.

ATM Card Services

Cash Withdrawals – up to Tk.1 Lac per day

Utility payments – T&T, Mobile phones, DESA, etc.

Multi-account access

Fund Transfers

Mini Statements

PIN change

Low cost,

Time saving,

East to monitor a/c position,

Easy to reach within every Residential & Commercial Location.

Credit Card Services

Dhaka Bank Limited brings you Your Everyday Credit Card in the shortest possible time. We recognize that you need your card every day. That is why we have developed processes to guarantee delivery of your card in just 7 days when you apply for a fully sec ured card; for an unsecured card it will be ready in just 10 days.

Locker Services

A client could use the locker facility of Dhaka Bank Limited and thus have the option of covering your valuables against any unfortunate incident. DBL offer security to our locker service as afforded to the Bank’s own property at a very competitive price.

Online Banking Services

Dhaka Bank Limited introduces Net Banking and intends to maintain the lead with enhanced facilities through this media. Client can get access to real time account information through the Internet. Transfer money from his/her account, utility bill payment and more. Through on–Line Banking Services, clients can deposit to and 49

withdraw from his/her account held with a particular branch up to a limit of Tk: 10,000.00 through any branch of Dhaka Bank Limited.

Internet Banking Services

Through Internet banking the client can access the account to view and print the balance account statement for last 20 (twenty) transactions.

Other Products and Service

Global Trade Services (GTS)

Global Trade Services (GTS), Head Office consists of two units- Financial Institutions or FI and Remittance Unit. FI arranges correspondent banking network, credit lines and other facilities required for 15 Authorized Dealer (AD) branches and one Offshore Banking unit of DBL. With a vast network (320+) of correspondents throughout the globe, Dhaka Bank Limited is one of the banks in Bangladesh enjoying credit line facility from International Finance Corporation (IFC) under it’s Global Trade Finance Facilitation Program (GTFP) for conformation of the L/Cs issued by itself. Dhaka Bank Ltd. provides the following services:

• Import Letter of credits

• Export Letter of credits, negotiation & documentary collection

• Local guarantees against counter guarantees

Small and Medium Enterprises

Dhaka Bank has come forward to extend its services towards Micro and Small & Medium Enterprises. Since inception, the Dhaka Bank has held socio-economic development in high esteem and was among the first to recognize the potentials of SMEs. Recognizing the SME segment’s value additions and employment generation capabilities quite early, the Bank has pioneered SME financing in Bangladesh in 2003, focusing on stimulating the manufacturing sector and actively promoting trading and service businesses.

It should be noted that there are products not mentioned here like special service, different types of the same product. I learned that during my internship there,

How will the customer know about these products? They would have to discuss with the CSO or the Branch Manage.

Part 3

Focuse on General Banking

My Performance at general banking

The first I was assigned to GB (General Banking). I spent the 3 month here. It was very arduous, but very fruitful. I was under Mohammad Zakir Hossain (SAVP & GB Incharge), who was very intellectually intriguing.

I had a wide variety of responsibilities at GB:

Writing a inword &.giving them .

Bringing out the cheque books for the customers, verifying them, receiving them from the courier.

Writing and later on printing pay orders

Sometimes I did the FD (Fixed Deposits), SDS ( Special Deposits Scheme) and DPS(Deposit Pension Scheme), but it was under strict supervision.

Finding the FDR,DD,SDS,& DPS forms

Fill up FD SDS and DPS for new customer.

Checking and filling up CIB forms

Checking and filling up SBS forms

Taking signatures

Typing other documents given by my incharge

Sometimes I did the account opening forms

Keeping things in order and at arm’s length

Printing,The statement other paper etc

Picking up the phone, calling up customers for missing information.

Taking necessary papers from customers such as taking photocopy of National ID card, Passport, Trade License etc

Photocopying was a major activity in this departments

Learned how to receive mail and send out mail via courier

Sometimes I checke the customers account balance& transaction profile.

The work was really hard at GB. I also had to hear a lot of complaints from the customers. At first I was demoralized. But later on I learned how to deal with it.

Observation

It was very interesting working at Dhaka Bank. The people there are really nice and talented. The things that I have noticed and observed are:

- Work is never left pending for the next day unless it is absolutely necessary

- The work process could be made faster with better computers and operating systems.

- A good job performance is rarely praised, hence lacking motivation of the employees

- There is always a rush of customers so there is no standard on what the employees do throughout the day. The work activities of an employee is set, but what to do when varies along the day

- The work activities are always set and divided for each of the employees. This is the way it should be, but when I saw it first hand it was remarkable. Each and every employee has a certain set of responsibilities. He/she carries out those responsibilities throughout the day. It is also easy to assign duties that way. Even though this is the case, I often saw other staff members helping each other out.

In my observation I have also noticed some problem about the bank. This are-

Incomplete information: To open an account sometimes people have given incomplete information which will become a very acute when any dispute arises. I find out these and called them to submit the necessary document.

Introducer problem: When a client tries to open an account he must have to need an introducer, sometime it may create problem for the new clients. I referred them old clients to introduce.

Requisition for check book: For getting a new check book in case of opening a new account or a new book for old account holder he/she have to wait 3 or 4 working days after submit the requisition form. I provided the form and filed it

Lowest no of employee: On the counter service is sometimes unsatisfactory because of not having enough employees for the counter sector at that time I gave them basic information and provided them different forms. And helped them to fill it up.

High interest rate: In case of advances in different project, the interest rate is too high.

High maintenance cost: Though it is a private bank its maintenance cost is higher then any other Government bank.

Pressure for loan: Most of the time parties are creating some sort of pressure to get the loan.

Mortgage problem: There are some mortgage problem such as, acquisition & proprietorship, problem of asset.

Security against loan: In case of method of granting security against loan, hypothecation is much risky as compared with other charging security, but it is being used massively in DBL.

Part 4

Analysis and Findings

Findings

Fixed dposit Rates:

I found a new fixed deposite rates. Like this….

| Tenure | Any Amount |

| 1 month | 11.50% |

| 2 month | 12.50% |

| 3 month | 12.50% |

| 6 month | 12.50% |

| 12 month | 12.50% |

Above rates will be also applicable for Islami banking branches

Specile Notice Deposit as under :

| Amount below Tk.1Cr. | Amount Tk.1Cr. and below Tk. 25 Cr. | Amount Tk.25Cr. and below Tk. 50 Cr.. | Amount Tk.50Cr. and below Tk. 100 Cr. | Amount Tk.100Cr. and below |

| 5% | 5.50% | 6% | 9% | 10% |

Above rates will be also applicable for Islami banking branches

Savings rates : Savings rate is 7.50%(conventional)

Mudaroba Savings rates 6.00% (Islam)

Edu Savings Plan:

Dhaka Bank resently re-disigened Edu Savings Plan ensuring best return with Accidental Insurance protection underwritten by MetLife Alico.

Protection Feature : Dhaka Bank offers Edu Savings Plan, which guarantees coverge equivalent to full maturity value of the respective plan in case of parent’s Accidental Death or Accidenal Permanent Total Disability( Maximum pay out will be Tk. 64,54,000/- inclusive of VAT & GOVT. charges)

Additional Featirs :

Free Debit Card.

Free cheque book (25 leaves.)

Minimum deposit Tk. 500 & Maximum deposit Tk. 20,000/.

Tenure of the valu is 4 year to 12 year.

MICR:

MICR (magnetic ink character recognition) is a technology used to verify the legitimacy or originality of paper documents, especially checks. Special ink, which is sensitive to magnetic fields, is used in the printing of certain characters on the original documents. Information can be encoded in the magnetic characters.

The use of MICR can enhance security and minimize the losses caused by some types of crime. If a document has been forged – for example, a counterfeit check produced using a color photocopying machine, the magnetic-ink line will either not respond to magnetic fields, or will produce an incorrect code when scanned using a device designed to recover the information in the magnetic characters. Even a legitimate check can be rejected if the MICR reader indicates that the owner of the account has a history of writing bad checks.Retailers commonly use MICR readers to minimize their exposure to check fraud. Corporations and government agencies also use the technology to speed up the sorting of documents.

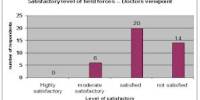

SWOT Analysis

Strengths

Strong corporate identity

According to the customers, DBL is the leading provider of financial services identity worldwide. With its strong corporate image and identity, it has better positioned itself in the minds of the customers. This image has helped DBL grab the personal banking sector of Bangladesh very rapidly.

Strong employee bonding and belongings

DBL employees are one of the major assets of the company. The employees of DBL have a strong sense of commitment towards organization and also feel proud and a sense of belonging towards DBL. The strong organizational culture of DBL is the main reason behind its strength.

Efficient Performance

It has been seen from customers’ opinion that DBL provides hassle-free customer services to its client comparing to other financial institutions of Bangladesh. Personalized approach to the needs of customers is its motto.

Young enthusiastic workforce

The selection & recruitment of DBL emphasizes on having the skilled graduates & postgraduates who have little or no previous work experience. The logic behind is that DBL wants to avoid the problem of ‘garbage in & garbage out’. And this type of young & fresh workforce stimulates the whole working environment of DBL.

Empowered Work force

The human resource of DBL is extremely well thought & perfectly managed. As from the very first, the top management believed in empowering employees, where they refused to put their finger in every part of the pie. This empowered environment makes DBL a better place for the employees. The employees are not suffocated with authority but are able to grow as the organization matures.

Hospitable Working Environment

All office walls in DBL are only shoulder high partitions & there is no executive dining room. Any of the executives is likely to plop down at a table in its cafeteria & join in a lunch, chat with whoever is there. One of the employees has said

Strong Financial Position

It has been seen that the net profit has been gradually rising over the years. Furthermore, DBL is not just sitting on its previous year’s success, but also taking initiatives to improve.

Weaknesses

High charges of L/C

Presently DBL charges same rates for all types of import L/C. But for import L/C of exports-oriented industry, DBL should reduce the charge of L/C. As a result, exporter will be benefited and the country will earn more foreign exchange. The commission often even rises up to 30%

Discouraging small entrepreneurs

DBL provides clean Import Loan to most of its solvent clients. But they usually do not want to finance small entrepreneurs whose financial standing is not clean to them.

Not enough innovative products

In order to be more competitive in the market, DBL should come up with more new attractive and innovative products. This is one of the weaknesses that DBL is currently passing through but plans to get rid of by 2011.

Diversification

DBL can pursue a diversification strategy in expanding its current line of business. The management can consider options of starting merchant banking or diversify it to leasing and insurance. As DBL is one of the leading providers of all financial services, in Bangladesh it can also offer these services.

Lack of Proper Motivation

The salary at DBL is very decent, but it lacks other sorts of motivation. Incentives such as bonuses are given for acquiring a particular figure, but all in all these are the only motivational factors.

High Cost for maintaining account

The account maintenance cost for DBL is comparatively high. Other banks very often highlight this. In the long run, this might turn out to be a negative issue for DBL.

Outdated Software and Hardware at DBL Uttara

Some of the PCs in this branch have very outdated hardware which is very slow and affects the customers and hence the performance of the bank as a whole. The softwares themselves are pretty old – Flexcube is from 2003, Microsoft Office XP is used. All of these prevent smooth operations.

Opportunities

Distinct operating procedures

Repayment capacity as assessed by DBL of individual client helps to decide how much one can borrow. As the whole lending process is based on a client’s repayment capacity, the recovery rate of DBL is close to 100%. This provides DBL financial stability & gears up DBL to be remaining in the business for the long run.

Country wide network

The ultimate goal of DBL is to expand its operations to whole Bangladesh. Nurturing this type of vision & mission & to act as required, will not only increase DBL’s profitability but also will secure its existence in the log run.

Experienced Managers

One of the key opportunities for DBL is its efficient managers. DBL has employed experienced managers to facilitate its operation. These managers have already triggered the business for DBL as being new in the market.

Huge Population

Bangladesh is a developing country to satisfy the needs of the huge population, a large amount of investment is required. On the other hand, building EPZ areas and some Govt. policies easing foreign investment in our country made it attractive to the foreigners to invest in our country. So, DBL has a large opportunity here.

El Dorado Program

It is software which enables customers to deposit and withdraw money from any bank with the cheque or deposit of any other bank. Although a select few has implemented this program, this poses as an opportunity for DBL as the number of transactions would drastically increase.

Threats

Upcoming Banks/Branches

The upcoming private, local, & multinational banks posse’s serious threats to the existing banking network of DBL: it is expected that in the next few years more commercial banks will emerge. If that happens the intensity of competition will rise further and banks will have to develop strategies to compete against and win the battle of banks.

Similar products are offered by other banks

Now-a-days different foreign and private banks are also offering similar type of products with an almost similar profit margin. So, if all competitors fight with the same weapon, the natural result is declining profit.

Default Loans

The problem of non-performing loans or default loans is very minimum or insignificant. However, this problem may rise in the future thus; DBL has to remain vigilant about this problem so that proactive strategies are taken to minimize this problem.

Industrial Downturn

Bangladesh is economically and political unstable country. Flood, draught, cyclone, and newly added terrorism have become an identity of our country. Along with inflation, unemployment also creates industry wide recession. These caused downward pressure on the capital demand for investment.

Part 5

Recommendations and Conclusions

Recommendation

If DBL increases number of employee they can provide more satisfactory service to the customers.

If DBL increase the number of enovativeor new product they can get more client.

If the bank create a better client, the bank should increase the amount of consumer loans in a short-term basis.

If The bank can provide a product services & facilities, in this time they can get mome coustomer to use this DBL product services & facilities.

If The bank can provide a loan, which may be student loan. Though in other countries many bank provide this facility. This may encourage the students to come forward do something for the economy.

DBL should fix their margin of decrease their margin; if they fix their margin into35% to 45% then their import business can be increase.

If anybody wants to import then he must have an account. But in DBL if any body wants to open an account in DBL that time he must have an introducers which was doing anything in the DBL or employee of DBL. For that reason they lost many client or deposit.

Improve and maintain a consistent relationship with customers, expecially at retailing

DBL has 71 branches all over the country. It is very hard to provide full range services with those branches. They already are but they need pay more attention toward the expansion the branch network

Dhaka Bank has no separate department or division to entertain corporate clients alone. Currently the General Bank Management department services both corporate and retail clients under transactional banking. Hence the service quality varies greatly. Since its inception the number of corporate clients are growing at a fast rate, it is time that Dhaka Bank introduces a separate priority division for its corporate clients.

Many clients are found to be dissatisfied on the services provided by Dhaka Bank like lack of proper communication, information etc. To solve these problems, proper integration of the departments is essential to provide the on time services to the corporate clients.

Customized training should be provided to employees dealing with clients.

Because of loosing their jobs some employees of corporate clients close their accounts as they will not receive the same privilege such as waivers on certain services. In this case the waiver system can still be applied to these employees and reinstate them.

By introducing the correspondent banking and widening the branch area coverage Dhaka Bank can reinstate those clients who expand business outside Dhaka.

Conclusion

The last 3 months was quite intriguing to do my internship at Dhaka Bank Limited, Uttara Branch. I found out about the Dhaka Bank has earned a remarkable market share in terms of providing quality service in Bangladesh. There are many other reasons why corporate customers chose Dhaka bank for their banking needs. They are the followings:

- One stop service using latest technology

- Can operate their accounts from any branch (online banking)

- Low charge or no charge on company accounts

- Wide range of banking network (correspondence banking)

- Crediting thousands of salary accounts in a minute using GEFU software

- In this bank ,every employees are very good person& well behaveor. That why many coustoer interested to be a better client in this bank.

In the recent years some other banks are also offering corporate products and services in the market. They are offering new services. They are not only targeting the new users but also trying to get the clients of Dhaka Bank and some of the clients are found to switch.

In this situation Dhaka Bank really got to know the real scenario. Several steps has already been taken by Dhaka Bank to reinstate the corporate clients, some are in the pipeline but still some new initiatives has to be taken for getting the in-depth solution.

The following strategies are taken by Dhaka Bank till now:

- . Providing service to corporate and retail clients under one roof

- Providing general banking service at low cost to corporate clients & other client

- Introduced salary accounts for corporate clients

- To influence a client for opening a FDR, SDS,DD, DPS& Account Opening Form.

- To influence a client for a Home Loan ,Car Loan & Personal Loan.

- To influence a client for opening a new LC account.

- Giving a better service & facilities for the client as soon as possible.

- On the counter service is sometimes unsatisfactory because of not having enough employees for the counter sector. So they should need a more employee to set the counter part.

But yet some other things must be done not only to reinstate the existing clients but also to attract new customers.

Bibliography

Dhaka Bank Annual Report 2011

Dhaka Bank website

General Banking regular circulars

Office inword paper

www.dhakabankltd.com