Revenue-based finance (RBF) is a type of business financing in which a firm obtains cash in exchange for a percentage of its future revenues. It is a sort of financial capital supplied to small or growing firms in which investors pump capital into a business in exchange for a fixed proportion of ongoing gross revenues, with payment increments and decreases based on business revenues, commonly defined as monthly revenue. This model is an alternative to typical financing strategies such as equity or debt finance.

It is a non-dilutive kind of financing, which implies that the company’s management keeps total independence and control because there is no equity investment or influence on the company’s shareholding. Typically, the investor’s returns continue until the initial capital amount plus a multiple (sometimes known as a cap) is repaid. RBF investors often expect the loan to be repaid within 1 to 5 years of the initial investment, depending on the model and the financed companies.

Here are some key features of revenue-based financing:

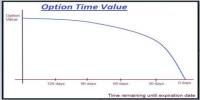

- Repayment Structure: Instead of making fixed monthly payments, a business that receives revenue-based financing agrees to share a percentage of its future revenues with the investor. Payments are directly tied to the company’s income.

- Flexible Repayment: The amount repaid each month is proportionate to the company’s revenue. When the business performs well, the investor receives higher payments, and during slower periods, payments decrease, providing some flexibility for the business.

- Duration: The repayment period is not fixed like a traditional loan; instead, it continues until a predetermined repayment cap is reached. The total amount repaid is usually capped at a certain multiple of the initial investment, providing an upper limit on the investor’s return.

- No Equity Dilution: Unlike equity financing, revenue-based financing does not need the sale of stock in the company. The proprietor of the company retains complete ownership and control.

- Risk Sharing: Investors in revenue-based financing share in the business’s risks and profits. Higher repayments reward the investor if the company does well. If the business fails, the investor takes some of the financial consequences.

While revenue-based financing provides flexibility and prevents equity dilution, both the business and the investor must carefully negotiate terms to achieve a fair arrangement. Entrepreneurs should think about things like the proportion of revenue split, the repayment cap, and the term of the arrangement. Investors, on the other hand, must evaluate the company’s revenue potential as well as the accompanying dangers.