A bubble is a type of economic cycle marked by fast increases in market value, notably in the price of assets. An economic bubble, also known as a speculative bubble, a market bubble, a pricing bubble, a financial bubble, a speculative frenzy, or a balloon, is a scenario in which asset values appear to be based on unrealistic or contradictory future expectations. The supported ascent in the cost of a resource over its “typical market esteem” brings about the arrangement of a value bubble. Cost bubbles are supported by assumptions for future expansions in the cost of a resource.

While some economists deny that bubbles exist, those who believe that asset prices frequently vary significantly from underlying values continue to debate the origins of bubbles. Irrational exuberance, a phenomena in which everyone is buying up a specific asset, is the characteristic of a bubble. Regularly, a bubble is made by a flood in resource costs that are driven by abundant market conduct. During a bubble, financial backers keep on offering up the cost of a resource past any genuine, manageable worth.

Assets generally trade at a price, or within a price range, that is significantly higher than the asset’s inherent worth during a bubble (the price does not align with the fundamentals of the asset). Numerous clarifications have been recommended, and research has as of late shown that bubbles might show up even without vulnerability, theory, or limited levelheadedness, in which case they can be called non-theoretical air pockets or sunspot equilibria. At last, the bubble “explodes” when costs crash, the request falls, and the result is regularly decreased business and family spending and an expected decrease in the economy.

Causes of Price Bubbles –

While there are several major drivers of an asset bubble, including low-interest rates, demand-pull inflation, and asset scarcity, one of the important indications to look for is irrational exuberance.

- Low-interest rates: People may easily obtain low-cost credit because of low-interest rates. As a result, they are able to spend more. As a result of the increased spending power, prices rise as a result of the higher demand for commodities.

- Demand-pull inflation: When there is more demand for an asset, the asset’s price rises. The price increase, on the other hand, is regarded as a precursor to future price rises. A speculative bubble forms as a result of this.

- Supply shortage: Increased demand for an item is caused by a drop in supply or the anticipation of a reduction in supply in the future. Investors believe that the market has a finite quantity of assets accessible, therefore they hurry to acquire as much as they can.

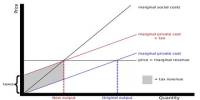

Be that as it may, bubbles are typically just recognized and contemplated everything considered, after a gigantic drop in costs happens. In such cases, the bubbles might be contended to be sane, where financial backers at each point are completely made up for the likelihood that the air pocket may fall by better yields. An unstable equilibrium is shown by a price bubble. An unstable equilibrium is defined as a market in which the forces of supply and demand do not rectify price deviations from the equilibrium price.

A steady harmony portrays a market where the powers of interest and supply right value deviations from the balance cost. Regularly, the cost will continue to increment for quite a long time. The issue is that it is hard to time resource bubbles and their resulting burst. Bubbles are usually ascribed to a shift in investor behavior, however, the exact source of this shift is debatable. Recent asset bubble theories imply that these phenomena are sociologically influenced.

Bubbles in values markets and economies cause assets to be moved to spaces of fast development. Toward the finish of a bubble, assets are moved once more, making costs flatten. Bubbles are typically only definitively detected in retrospect, after a rapid collapse in prices, because inherent values in real-life markets are often difficult to discern. Prices can change wildly in an economic bubble, making supply and demand alone hard to forecast.

The term “bubble” was first used in reference to a financial crisis during the British South Sea Bubble of 1711–1720, and it originally referred to the firms themselves and their inflated stock, rather than the crisis itself. Hyman P. Minsky’s study helps to explain the emergence of financial instability and offers one explanation for the features of financial crises. Minsky defined five stages in a normal credit cycle based on his studies.

Inside standard financial matters, many accept that bubbles can’t be distinguished ahead of time, can’t be kept from shaping, that endeavors to “prick” the air pocket might cause a monetary emergency, and that rather specialists should trust that bubbles will eruption willingly, managing the result through money related strategy and monetary approach. Prices begin to rise, and as additional investors enter the market, they gain even more speed. International trade (current account) imbalances, which result in a surplus of savings over investments, increase capital flow volatility among countries.

Information Sources: