Objectives

Contribute to the socio-economic development of Bangladesh.

To promote the underserved, who can’t go a long way due to lack of financial support.

Create employment opportunity.

Increase contribution of SME sector to GDP.

WHAT IS SME?

The definition of Small and Middle Enterprises (SME) varies according to context. The way SME is defined in the UK or the US is hardly the way to define it in the context of the developing countries. However, there are some general criteria on the basis of which SMEs are defined in both the developed and developing countries. These criteria are-

- Number of employees in the firm.

- Assets employed.

- Sales turnover

- Employee turnover

- Asset and turnover ratio

Since a universally accepted definition of SMEs is yet to appear, it is better to conceptualize them through their characteristics. The these characteristics again can be viewed from two contexts-

General characteristics:

The characteristics that SMEs generally exhibit are as follow-

- These are managed in a personalized way by their owners or partners.

- SMEs have small share of market and usually do not have access to the stock market for raising capital.

- SMEs have limited access to formal channels of finance and depend on the savings of owner(s), family and friends.

- Most SMEs are sole proprietorship and partnership.

- Most of the SMEs in APEC countries consist of less than 100 employees. However, variations may be found in this figure in case of some countries; for example, China employs less than 500 people in a SME, Korea, Japan employ less than 300, Thailand, Vietnam and Philippine employ less than 200 and Malaysia employs less than 150 people.

The asset base of SMEs is also an important characteristic but it is more particular rather than a general characteristic. The small-scale enterprises in Srilanka have assets equivalent to Rs.1 to 20 million while in India these enterprises possess assets of Rs.1 to 10 million. So, we will find varying pictures in different countries with regard to the asset base of SMEs

Particular characteristics in Bangladesh context:

In the context of Bangladesh, most SMEs exhibit the following, if not all characteristics-

- They are sector and location neutral.

- They employ a mix of family and hired workers.

- They usually use no division of labour.

- They hardly follow any modern and/or accounting system.

- They usually exhibit low to medium level work skill.

- They are usually local raw material based.

- They usually apply personal marketing endeavors.

This paper focuses on the SMEs in Bangladesh. Therefore it is important to define these enterprises in the context of this country. The “East Pakistan Small Industry Act XVII” of 1957 for the first time provided a definition of SME and still today this is the only official definition existing in Bangladesh. The Act says-

“Small industry means an industrial establishment or unit which is run mainly by hired labour and not using mechanical motive power but does not employ more than 50 workmen and whose land, building and machinery do not exceed tk 250,000 in value either case.”

The definition is quite old and hardly fits in today’s context. Nowadays, firms employing more than 50 employees and using machine power are also classified as SMEs. So, we see that the definition of SME is ever changing and based on situational parameters. In the New Industrial Policy of 2003 Enterprises employing less than 50 workers have been identified as SMEs. The following table summarizes the industry classification by the government of Bangladesh.

Table : Industry Classification

| Type of industry | Investment (tk) |

| Medium industry | Tk 250 to Tk 500 million |

| Small industry | Tk 100 to Tk 250 million |

An overview of Existing SME Credit Program

Although the effort started with the help of some donor agencies since 2001 Uttara Bank Limited has been actively involved with financing SMEs since early 2003. The SME Credit Program for Uttara Bank Limited has been designed in the light of the terms & conditions by USAID, as it was the first advising agent for SME Credit Program. A brief description of UBL SME Credit Program has been given below before going to the Five Years Plan for SME Credit Program:

Product Feature under SME:

As Uttara Bank Limited has launched products under the umbrella of Loan Portfolio Guarantee of USAID, the products has been designed for Micro Enterprise & Small Business rather than Medium Enterprises. It is mentionable that in future we will go for further new products depending on the response & success of the products launched recently.

The products for Micro Enterprise & Small Business are as follows:

i) Micro Enterprise Promotional Credit (MPC)

ii) Small Business Promotional Credit (SPC)

Product Size:

| Product | Minimum Amount | Maximum Amount |

| MPC | Tk.50,000.00 | 2,75,000.00 |

| SPC | Tk.3,00,000.00 | 80,00,000.00 |

Purpose of Loan: Loans may be given to any of the following purposes:

i) Working Capital

ii) Fixed Asset

Nature of Facility:

i) Overdraft (OD) – In case of Working Capital financing

ii) Term Loan – In case of Fixed Asset financing

Recent Initiatives

Dealer Finance – Under this program Uttara Bank Limited facilitates the dealer of the Large Corporate unit by financing them for procurement of goods.

Receivable Finance – Under this program the bank facilitates the suppliers of the large corporate against the purchase order/ work order.

No-Funded facilitates – The bank now a dys provide and approve various no funded facilities like LC and Bank Guarantee in order to fill the vertical gap in need of the customer. The bank allows to open LC and then retire it by creating LTR which is a funded facility in order to import various machinery for the company itself or raw material or other spares to supply them to the large corporate against supply order.

On the other hand it provides Bank guarantee in order to facilitate the customer to submit bid-bon or performance-bond against the work order.

Product Price

Interest & charges will apply for both MPC & SPC as follows:

Interest Rate : 15.00% p.a.

Utilization Fee : 1.50% p.a.

Supervision fee : 1% p.a. to be realized upfront.

Loan Processing Fee : In addition to the above, a Loan Processing Fee of 0.50% will be charged once on the total amount before disbursement of the loan.

Facility Period & Repayment:

(Max) 33 equal monthly installments

commencing from the 4th month

Nature of Borrower:

Borrowers of the following natures will be eligible for SME credit:

i) Proprietorship concern

ii) Partnership concern

iii) Limited Company

iv) Group of enterprises

Nature of Business:

Enterprises of each of the following natures will be eligible for availing SME credit:

i) Manufacturing Enterprises

ii) Trading Enterprises

iii) General Service Rendering Enterprises

iv) Professional Service Rendering Units i.e. medical, engineering, agricultural, architectural etc. services units. In this case, loans may be considered in the name of individuals i.e. doctors, engineers, agriculturists, architects etc.

Area of Business:

Enterprises doing business in the following area will be entitled for the UBL MPC & SPC:

i) Small & Cottage industry

ii) Agro-processing industry

iii) Information Technology and Software Development

iv) Garments Industry

v) Light Engineering

vi) Any Export oriented business

vii) Any Import substitute business

viii) Capital Machinery/equipment for professional services i.e. Medical, Engineering, Architectural, Agricultural services etc.

ix) Garments backward linkage industry

x) Printing industry

ix) Packaging industry

x) Decoration products industry

xi) Food & Beverage industry

xi) Laundry, Tele-network, Power etc. services

SEDF has chosen 4 industries as priority industries. These are:

i) Agro-processing industry

ii) Information Technology & Software Development,

iii) Garments Industry and

iv) Light Engineering

Marketing Force

Branch Manager

- Branch Credit In-charge

- Branch Credit officers

- SME Unit of Head Office

Client Selection Authority

Branch Manager

- SME Unit of Head Office

Geographical Segmentation

- Urban Area

- Semi-Urban Area

- Rural Area

Semi-urban and rural area are the most focus point for the SME fiance of Uttara Bank Limited.

Clients Selection Process:

The Credit managers of the branches will be responsible for appraising, scrutinizing & processing of loan applications under SME credit program. Micro Enterprise & Small Business generally do not maintain any proper financials. So, it is difficult to justify creditworthiness and appraise & select clients for Micro & Small Credits. In this regard, the borrowers to be selected in a very careful manner applying branch/credit manager’s own prudence & subjective judgment. Some points are mentioned bellow to help the managers in selecting clients for SME products:

i) The borrower must be well known to the bank

ii) The owner(s) of the enterprise must be energetic and innovative;

iii) The owner(s) must have entrepreneurship quality;

iv) The owner(s) must have good command over the business & be well conversant in technical know how;

vi) The owner(s) must be of integrity;

vii) The owner(s) must be competent in management;

According to USAID, each loan must be a “Qualifying Loan” to be considered under Loan Portfolio Guarantee. A loan will be considered as “Qualifying Loan” which is a new or net additional Local Currency credit including commercial loan, overdraft, letter of credit, guarantee to qualifying micro or small enterprise for any productive or commercial activity qualifying the following criteria:

i) If the borrower is an individual, the borrower must be a national or permanent resident of the country;

ii) If the borrower is a business entity, it must be majority-owned by nationals or permanent residents of the country and/or business entities that are owned by such nationals or residents;

iii) The borrower must be 100% privately owned, controlled and operated;

iv) The borrower’s principal place of business must be in the country;

v) The borrower must be a “micro enterprise” for that portion of the Guarantee Portfolio allocated to loans to micro enterprises, or a “small business enterprise” for that portion of the Guarantee Portfolio allocated to loans to small business enterprises;

Restricted Area:pective client engaged in any of the following activities can not be selected for SME lending under Loan Portfolio Guarantee:

(i) production, processing or marketing of sugar, palm oil, cotton or citrus for export;

(ii) purchase, manufacture, importation, distribution or application of pesticides;

(iii) production, processing or marketing of luxury goods including such items as gambling equipment, alcoholic beverages, jewelry and furs;

(iv) activities related to abortion or involuntary sterilization;

(v) police, other law enforcement or military activities;

(vi) production, processing or marketing of materials for explosives, surveillance equipment or weather modification equipment;

(vii) any activity which would result in any significant loss of tropical forests or involve the extraction of commercial timber in primary tropical forests;

(viii) purchase of goods or services which are shipped from or produced in Brazil, Cuba, Iraq, Iran, Liberia, Libya, Nigeria, Serbia, Somalia, Sudan, The Gambia, and North Korea or are produced by corporations or other entities that are more than fifty percent (50%) owned by nationals or permanent residents or Governmental Authorities of those countries;

(x) any activity the purpose of which is the establishment or development of any export processing zone or designated area where the labor, environmental, tax, tariff and safety laws of the country would not apply,

(xi) purchase or lease of motor vehicles manufactured outside the United States.

Moreover, Branches should ensure that the borrower is not engaged in any activity which is not permitted under the regulation of Bangladesh Government & Bangladesh Bank.

Other Conditions:

i) If the Borrower is an existing customer of the Bank, the Loan must be additional to the credit already being provided by the Bank and must not be a renewal or extension of a pre-existing Loan.

ii) The Loan must be made at the market rate of interest and no portion of the Loan may be financed directly or indirectly with subsidized funds.

iii) At least 50% of the commercial risk of the Loan must be retained by the Bank at all time and no portion of the Loan may be guaranteed by a Governmental Authority or a donor organization (other than USAID).

iv) The Loan must be placed under Guarantee coverage within 10 business days after the Loan has bee disbursement (for term loans) or approved (for lines of credit and all other credit facilities).

v) No Loan once removed from Guarantee coverage may thereafter be placed again under Guarantee coverage without written consent of USAID

Primary Security:

The following securities may be taken as primary security for the credit facilities of i) Overdraft & ii) Term Loan:

i) Hypothecation over Stocks-in-trade, raw materials, work-in-process and finished goods of the enterprise both present & future

ii) Hypothecation of Book Debts/Trade Receivables not older than 60 days

iii) Hypothecation over Fixed Assets

iv) Personal Guarantee of the Proprietor/Partners/Directors in case of proprietorship concern/partnership concern/limited company

v) Group/Joint & Several Guarantee from all the members of the borrowing group in case of group financing and form the directors in case of limited company.

vi) Letter of Undertaking from the borrower

Collateral Security:

One or more of the following collateral securities may be obtained as collateral security depending on the facility(ies), client & its nature of business:

i) Lien on Fixed Deposit Receipts (FDR) and/or Fixed Deposit Accounts (FDA)

ii) Lien on Shanchaya Patras

iii) Bank Guarantee from other bank

iv) Registered Mortgage of landed property

v) Equitable Mortgage of landed property

vi) Assignment of possession right

vii) Assignment of security money & advance rent

viii) Personal/Corporate Guarantee form third party acceptable to the bank

Documentation:

Standard charge documents to be obtained and all other necessary documentation formalities relating to the securities to be obtained to be duly completed before disbursement of loan .Special feature Collateral free lending up to Tk.5,00,000.00 for eligible client.

COLLABORATION AND NETWORKS

Uttara Bank Limited has started its journey for SME operation after receiving the Loan Portfolio Guarantee from U. S. Agency for International Development (USAID) on 31.08.2001 under the direct supervision of the Head of Credit Division. It had to make a substantial effort to be qualified for the Guarantee program. Now, it has been enjoying a guarantee limit for USD1,000,000.00 (BDT5,89,50,000.00; approx.) for the total portfolio of USD2,000,000.00 (BDT11,79,00,000.00; approx). The Guarantee portion is 50% of the total limit of the portfolio.

Subsequently, it came under a Training & Technical Assistant program by SouthAsia Enterprise Development Facility (SEDF) through signing a Memorandum of Understanding (MOU) on 25.11.2002. SEDF is a multi donor organization with its head office in Dhaka, Bangladesh, promoted by the International Finance Corporation (IFC) and managed by the SME Department of the World Bank Group. Under this program, UBL has been enjoying different training facilities at cost sharing basis. To come under this program, it had to work with SEDF for a long time since September 30, 2001 in different ways including a long Diagnostics & Skill Gap Analysis.

Loan Portfolio Guarantee:

Guarantee Portfolio Size: Maximum Portfolio for the Guarantee is US$2,000,000.00 i.e. the total loan size under LPG might go upto equivalent Taka of US$2,000,000.00 i.e. BDT11,79,00,000.00 (approx.).

Guarantee Coverage: 50% of the total portfolio under the Guarantee i.e. USD1,000,000.00 eqvt. to BDT 5,89,50,000.00 (Approx.).

The actual guarantee will cover 50% of net principal loss amount of the loan for each client

Guarantee Period:

a) First Guarantee Period ends on September 30, 2001. Each subsequent Guarantee Period is a 6 (six) months period commencing on the date following the expiration of the immediately preceding period. The expiry date of the last period will coincide with that of the Guarantee. The Guarantee Periods are October 1 to March 31 and April 1 to September 30.

b) Unless the Guarantee is earlier terminated, the last Guarantee Period will expire at the end of 5 (five) years term of this Guarantee i.e. March 31, 2006.

Facility Fees: A facility fee of US$5,000.00 eqvt. to Tk.2,82,350.00 has been paid to USAID to come under this guarantee for a period of five years.

Utilization Fees: A Utilization Fee will also be charged by USAID for the Guarantee. A separate notice of payment due for such fee after the expiration of each Guarantee Period will be received. The Utilization Fee is equal to 1.50% of the guaranteed portion of the average U.S. dollar value of outstanding Qualifying Loans placed under Guarantee coverage during a six-month Guarantee Period.

Claim Requirements for Guarantee amount:

No claim on a Qualifying Loan may be submitted to USAID unless all of the following requirements are met:

- As a consequence of the Borrower’s Default, the total outstanding principal of the Qualifying Loan has become immediately due and payable and the Bank has made a demand upon the defaulting Borrower for full payment of all amounts due.

- The Bank has pursued all reasonable and diligent collection efforts against the Borrower (and any other person that may be liable on the Qualifying Loan) to make full payment of all amounts due.

- After such collection activities, the Bank has either (1) certified to USAID that it has written off the entire outstanding balance (including principal and interest) of the Qualifying Loan as a Bad Debt Expense, or (2) certified to USAID that it (A) is unable, because of a legal impediment or significant impracticality, to take the action described in (1) above and (B) has established a specific provision for possible Loan Losses.

- The Claim has bee submitted to USAID no earlier than three (3) months after the Bank demanded for full payment, as required by subsection A above and no later than six (6) moths after the expiration of earlier termination of the Guarantee, provided, however, that no claim may be submitted to USAID if the dated of the Bank’s demand for full payment under subsection A above occurs after the expiration or earlier termination of the Guarantee.

Refinance from Bangladesh Bank

Beside all these Uttara Bank limited as a Private sector commercial Bank operating Bangladesh, enjoys the refinancing facility from Bangladesh Bank. Any loan properly disbursed the SME sector can be refinanced from Bangladesh Bank and the rate of interest is 5% P.A. only.

Business Environment and Private Sector Development

Despite higher economic growth during the 1990s, Bangladesh still lagged behind other countries in the region such as India, Pakistan, and Sri Lanka. Various studies carried out under Asian Development Bank (ADB) TA in 20027 and 2003,8 an investment climate assessment by the WB,9 the 2003 National Private Sector Survey of Enterprises in Bangladesh (the 2003 Private Sector Survey),10 and surveys by the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI) have identified major impediments to the country’s competitiveness and economic growth, including inadequacies in infrastructure facilities (particularly power, gas, and port facilities), corruption and “invisible” costs, deficiencies in the legal and regulatory framework, and lack of access to finance by businesses.

Nevertheless, the Government has taken several policy initiatives to improve the investment climate. The I-PRSP recognizes the private sector as the engine of economic

growth. The 1999 Industrial Policy eliminated restrictions on private sector participation in all sectors except defense, nuclear energy, forest plantation, and mechanized extraction of reserved forests. The foreign direct investment regime is also liberal, although the bulk of direct investment from abroad has been in the gas and power subsectors. With regard to trade reform, the Government has introduced a three-tier tariff structure with the maximum rate having been reduced from 30% to 25%. The average tariff and the number of products subject to quantitative restrictions have also been reduced. Import-licensing requirements have been streamlined. The Government has introduced export promotion measures and at the same time developed a comprehensive plan to cope with the phaseout of the Multi-Fibre Arrangement (MFA) at end- 2004, which will adversely affect textiles and garments, the strategic exports of Bangladesh.

Reforms are also under way to create an enabling environment for private sector development and development partners, including ADB, are providing continuing support for infrastructure development. To tackle the issue of corruption and rent-seeking behavior of public officials, the Government set up the Anti-Corruption Commission (ACC) under the ACC Act passed in February 2004. The WB’s Development Support Credit I and II projects as well as the ADB’s ongoing TA provide support for the establishment of the ACC. In addition, the Government is promoting e-governance and introducing the use of computers and web sites in all ministries and sector corporations to enhance transparency and expedite administrative processes

Banking Sector

The banking sector, specially the private sector banks, made significant progress and growth in terms of significant market share of deposits and advances through improved customer service, introduction of new products and switching over to on line banking, keeping pace with the globalization process. The 30 banks in the private sector posted a 29% growth in the operating profit in 2005 over the previous year.

The amount of loan default was 16.34 per cent of the bank’s total outstanding loans in September, 2005 that shows a 1.29 percentage point decline over a nine-moth period, thanks to the effort of the private banks and development financial institutions.

Bangladesh Bank has been playing an important role for bringing out discipline and dynamism in the banking sector of the country. Due to stringent supervision and control exercised by the central bank, there had been a continuous progress in the reduction of percentage of classified loans in the banking sector.

Why SME Banking?

A bank must have a corporate strategy for selecting business and other operations. We can draw a frame work for formulating a corporate strategy –

The bank must make balance between the profit opportunity and relative growth prospects.

Among a lot alternatives a Bank can choose product through considering the following factors –

| Parameters | Corporate Banking | SME Banking | Retail Banking | Rural Banking |

| Attractiveness |

MediumCompetitive PositionVulnerableStrongWeakMedium

SME banking is a specific sector of bank’s business. A bank mainly deals with the following things –

Information

- Risk

- Liquidity

Risk is the major element that any bank tries to mitigate. The major risk of the bank comes from the following sources –

Portfolio Risk

Operational Risk

Portfolio Risk

The components of portfolio risks in corporate and SME sector can be pointed as follows

Corporate Portfolio

•Large size of each loan

•Small number

•High Risk

SME Portfolio

•Small size of each loan

•Large number

•Low Risk

Considering the above points we can assume risk is well diversified in SME Banking than Corporate

Operational Risk

The major source of operational risk comes from the Transaction risk. The major component of transactional risk in Corporate and SME are as follows –

Transactional Risk

Corporate – Big transaction size

Single error makes a big loss

SME – Small transaction size

Single error makes small loss

SME is much less risky than Corporate

Moreover in case of corporate loan more prudence required for financial analysis and knowledge in technology, Product variety, local & foreign market and foreign exchange.

Market

Some of the notable components in terms of corporate and SME market for banks can be pointed as follows –

Corporate

- Increasing competition among banks for corporate client

- Declining earnings from fees and interest

- A single corporate client is enjoying credit facilies from different banks

- More companies considering going directly to market with IPOs and bonds

- High bargaining power

- High switching frequency

- Increase searching cost

SME

- Less competition among banks

- Few Market players

- Huge opportunity

- Mostly enjoys credit facility from a single bank

- Less bargaining power

- Loyal to the bank

- Low switching frequency

The present scenario of the market can be sketched by the following graph –

Why is the SME sector under served

Promoters have limited financial and managerial resources

- The ability of the promoters to make the project/loan application is also limited

- In general financial statements do not reflect the true financial position of the SME

- The quality of collateral(s) offered is low in quality

- Sustenance power is low. A business recession or even a delay in credit sanction has far reaching implication in its performance.

Key Issues in SME Financing

What does a Bank gain by financing in SME sector ?

Growth and profit consideration

- Diversification of risks

- Socio-economic consideration

Possible Reasons for higher Interest Spread

The ability of the SMEs to directly approach the capital market is limited.since a large number of SMEs operate in urban and semi-urban areas, the alternative funding sources are limited

SME finance is not generally focus are of the foreign banks. The large volume of SME sector and the high cost structure of the foreign banks make lending to SMEs a difficult value proposition

Other Benefits

Besides higher interest rate bank gains other befit from SME banking like as follows –

Government and Central Banks encourage SME finance to facilitate some socio-economic benefits as follows –

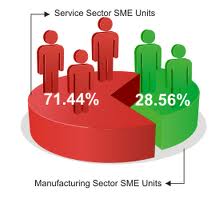

In developing economy SME form a significant part in the national economy. It is generally recognized that SMEs have a significant role in generating growth and employment. SMEs account for about 40% of gross manufacturing output, about 80% of

industrial employment, and about 25% of the total labor force in Bangladesh. Preliminary figures based on the 2001–2003 Census of Non-Farm Economic Activities (Urban and Rural) [the Economic Census], which excludes agriculture, fisheries, and forestry, estimate the number of persons employed by SMEs at 1.72 million, which is about 45% of the total number employed in nonfarm small, medium, and large establishments.

The 2003 Private Sector Survey estimated that micro, small, and medium enterprises contributed around 20–25% of GDP. Given the critical role of SMEs in economic growth and poverty reduction, it is imperative that the Government develop and implement targeted policy measures to address specific constraints to SMEs to enable them to realize their full potential and contribute more effectively to economic growth and employment generation.

In the year 2005 the GDP growth in our country was registered at 6.9 per cent. The largest growth came from industrial sector which is 8.5 per cent. The large-medium and small scale industry grew by 8.7 per cent and 7.9 percent respectively.

There are varying estimates of the SME population in line with different definitions of SMEs. Based on the Economic Census, the total number of SMEs13 is estimated at 79,754 establishments, of which 93.6% are small and 6.4% are medium. The 2003 Private Sector Survey estimated about 6 million micro, small, and medium enterprises defined as enterprises with fewer than 100 employees.

Development of SME also results in the following –

- Attainment of self-employment and satisfaction; stimulates entrepreneurship.

- Reduces regional imbalances, as all regions are not equally endowed with resources for large industries.

- Plays effective role in reducing the economic backwardness and help improves infrastructures.

- Reduces disparities in income and wealth distribution.

UNDERSTANDING SMALL AND MEDIUM ENTERPRISES

TYPICALRACTERISTICS OF SMEs CHA

Owner-managed

One-man management (lack of balanced managerial skills)

Multi-tasked employees

Verbal instructions widely relied upon

Quick response to identified opportunities

Close contact with workers, suppliers, customer

Fast decision making and implementation

Co-mingling of personal and business funds

Minimal recording and records-keeping

Key functions held by family members

Low capital base (Often inadequate capital)

Major funds sources are relatives, friends, informal sources

Flexible production process

Low level of technology

Limited product lines (and limited marketing know-how)

COMMON PITFALLS OF SMEs

Some of the common pitfalls of SMEs in respect of – i. Management ii. Market iii. Technical iv. Financial and v. Others – are portrayed as follows –

COMMON PITFALLS OF SMEs – MANAGEMENT ASPECTS –

Project cost overruns

Change in project concept

Absence of full-time manager

Presence of dishonest manager

Overexpansion / overdiversification

Diversion / Misuse of Resources

COMMON PITFALLS OF SMEs – MARKET ASPECTS –

Dependence on a single market

Lack of familiarity with the market

Entry of competition

Adverse changes in market conditions

COMMON PITFALLS OF SMEs – TECHNICAL ASPECTS –

Inadequate project planning

Erroneous choice of project location

Raw materials shortage/overstocking

Unreliable power/water supply

Ineffective quality control

COMMON PITFALLS OF SMEs – FINANCIAL ASPECTS –

Working capital shortage

Mismanagement of receivables

Improper debt management

Inadequate accounting system

Ineffective cash management

COMMON PITFALLS OF SMEs – OTHERS –

Mismanagement of receivables and payables

Failure to exert diligence in assessing the paying habits and capability of buyers

Failure to properly match sales collections with payables

Failure to monitor maturing obligations

Failure to understand certain loan covenants

Failure to segregate business from personal funds

Involvement of business in family problems

WAYS TO AVOID PITFALLS IN STARTING AND MANAGING SMALL BUSINESS

Studies at the UP-ISSI have shown that one out of four small businesses close shop in the first three years of operations. Knowing the reasons of small business failures can guide you, as an existing or prospective entrepreneur, in avoiding these pitfalls.Lack of balanced managerial skills.

This is the principal reason and the root cause for most small business failures. This is not surprising because the managerial job requires many skills especially in the small firm which cannot afford to hire specialists. The success of the small firm largely depends on the owner-manager who usually lacks the necessary skills to perform or supervise all the tasks of marketing, production, accounting, finance and personnel management. For example, a super salesman starting his own business may not have the ability to plan and coordinate production to meet commitments and customers’ expectations. Or an accountant may not have the ability to understand his market or the personality to push his products successfully. The lack of managerial skills may not be too much of a problem for the small firm with less than 5 employees or for the self-employed person. But the problem becomes more acute as the firm grows.

The problem can be avoided or minimized in the following ways:

The prospective small business owner can postpone his decision to start his business until he has acquired sufficient experience on the general management level and in the particular business he intends to enter.

- The skills that the small business owner lacks can be provided by qualified employees, business partners or consultants. Everyone has his limitations, but the wise manager can bring to his firm the talents of many people. He need not fight the battle alone.

- The small business owner can acquire the necessary skills through training given by universities and other training institutions or on-the-job training in a similar business.

Inadequate capital

Starting a business involves many risks and hard work. It is not surprising then that the would-be entrepreneur must be an optimist. Optimists tend to underestimate the time and money required to start a new business — the time needed to develop a new product, organize the firm’s resources and develop market acceptance. Schedules slip, expenses exceed expectations and sales stagnate. The starting capital is depleted and operations slow down and perhaps grind to a halt.

- Prevention is better than cure and planning can avoid this problem of inadequate capital. Plan so that you can accurately estimate how much starting capital you need for land, buildings, machinery and equipment, materials and working capital, providing for safety margins to absorb cost overruns. It is advisable to have your plan checked or prepared by a knowledgeable person — an accountant, a consultant or the banker, if you intend to borrow.

Borrowing can solve your financing problems but it can also worsen your financial situation in some cases. For instance, if you are going to borrow at an effective interest rate of 18% per year and your net profit before interest is only 15%, you end up with a loss.

If you are going to borrow a substantial amount, be reasonably sure that your business will earn enough profits to cover interest charges and generate enough cash to meet amortization payments and sustain operations. A good project study will show if your plan to borrow is viable.

Poor accounting records

The study found out that successful small business firms kept more complete accounting records than did the unsuccessful small businesses. The reason seems obvious. A manager can seldom make sound decisions without adequate information. Without accounting records you cannot know what is your break-even selling price or sales volume, how much you should price your product, how much profit, if any, you are making, how safe is the cash position.

The small entrepreneur should hire a knowledgeable accountant on a part-time or full-time basis to set up a simple recording system to give accurate information on sales, costs, gross margin, profit and loss, and cash situation.

Too much capital in fixed assets

One advantage of the small firm is its low overhead. But if it invests too much of its capital on fixed assets — land, building, machinery — the small firm loses this advantage. Moreover, the working capital available is lessened impairing your flexibility to overcome a crisis or take advantage of an opportunity.

You can avoid investing too much capital in fixed assets by:

- Leasing instead of buying land, building, machinery and equipment.

- Buying on installment

- Purchasing second-hand machinery and equipment if operations and the marketability of your product are not seriously affected.

- Using labor instead of machinery for some operations.

- Subcontracting part or all of the production requirements so that you will not need additional machinery and equipment.

- Acquiring fixed assets that are adequate to meet the requirements of the business, e.g. do not buy a 1000 sq. m. lot if a 500 sq. m. lot will do; do not purchase machinery and equipment that can produce 10,000 units a year if your expected sales is only 5,000 units a year; and

- Make, instead of buying, equipment, furniture and fixtures.

Poor Credit Practices

In your desire to generate more sales, you may be liberal in granting credit. In turn, some of your customers, taking you for granted, delay payment and you find yourself having a hard time paying your own obligations to your employees, suppliers and creditors.

- It is easier said than done but the solution is proper credit control. You should prefer cash paying customers and be more selective in granting credit. Business is business and you should collect even from friends and relatives. Monitor closely your customers whose accounts are due and promptly follow up these accounts. In granting credit, the rule of thumb is to have additional capital equal to 45 days credit sales if you are giving customers 30 days to pay.

- Before granting credit, you must have a positive answer to these two questions: Do I have enough capital? Can I collect?

Poor Cash Management

Related to the previous two issues is poor cash management. Any accountant will tell you that your business may show profit on paper but may have little cash to sustain its operations. You may have attained your sales targets but if most of the sales are on credit, you do not have additional capital and payments are delayed, then you have a cash crisis. Sales may be picking up but you lack cash to purchase additional inventory. You look for additional credit, but, as many businessmen have found out, when you do not need credit, credit is available; when you desperately need credit, no one is willing to lend to you. The mark of a good manager is his ability to prevent a problem from becoming a crisis and this requires planning and foresight.

- The technique to use here is cash flow analysis with which you project your cash flow for the coming months — where the cash will come from, where the cash will be used, how much will be the cash balance, how much additional cash will be needed.

- If you anticipate a need to conserve cash you may decide to keep inventories to a minimum,. seek suppliers who can provide credit, reduce credit sales, seek cash paying customers, get purchases discount or limit investments in fixed assets (see pitfall No. 4).

- Your cash flow projections will become more accurate as you compare projected and actual cash flow and study the differences. A knowledgeable accountant can prepare a cash flow form suitable to your needs.

Limited Marketing Know-how

Your success as a small businessman will ultimately depend on your ability to market your product or service at a profit. Marketing is so basic that it is practically the business itself. Many small business management problems are related to marketing: wrong price, wrong location, poor quality products, inappropriate products, and so forth.

To operate a more competitive and successful business, your way of thinking about marketing should have these characteristics:

- Customer orientation. Although you may be managing your own business, you still have a boss, and that is your customer. Your success as a small business manager depends greatly on how well you can satisfy your customers’ needs. In effect, you are not really selling a product or service but satisfaction of a need. Focus your attention on what your customers need, not on what you can make or provide.

- Integrated activity. Marketing is not an isolated function. Any activity or decision regarding marketing is influenced by or has an effect on other areas and functions within and outside the enterprise. For instance, a plan to develop other products would greatly depend on the firm’s financial resources; or the objective to attain a greater sales volume has to be balanced with the concern to reduce losses from bad debts. If your marketing is customer-oriented and is conducted in an integrated manner, you will have a better chance of attaining in the long run your company’s profit and growth objectives.

Taking too much out of the business

You are earning a living by managing your own business but resist the temptation to withdraw too much from the business for personal expenses. Exercise fiscal discipline especially in the first years and in difficult times.

Few small firms can recover from a major setback. Your firm will have a better chance of weathering a crisis if you conserve your capital “for a rainy day”.ss

Yes, too much success can create trouble for the small firm. The sales of your products have exceeded your expectations and you decide to expand or diversify into other businesses. You later find out that you cannot duplicate your earlier successes.

Before deciding whether or not to expand your business, first analyze the reasons why you were successful in the past. You may have succeeded because you or your men had the special knowledge and skills for your particular business. But you may not have the competence to expand into a new business or run a bigger scale operation.

- Or you may have succeeded not because of your expertise but simply because you were lucky. The timing was right or there was no competition.

- Simply stated, grow according to your ability, your resources and external conditions affecting your firm.

Too much success, instead of generating overconfidence, may encourage complacency. After years of struggle your business becomes established and you may tend to relax. You continue to depend on the same management skills, the same products and processes for future growth and profits. Before long you become uncompetitive and other firms encroach on your market share. If you want to stay in business, you must realize that market conditions change very fast — new firms are coming in and new products, materials, processes and machinery are being developed. From biology, we learn that the organism that can adjust to changes in its environment is the organism that will survive and grow. This also holds true for business organizations.

Failure to delegate

Many firms remain small because their growth depends on what the owner can do himself. At the start when the business is very small, it is appropriate that the owner takes charge of all the operations. The need to delegate occurs when the firm is too large for one man to run but too small to afford a full team of managers. The failure to delegate is apparent when the owner-manager is bogged down in details; when he starts making costly mistakes he normally would not commit if he were not too busy. This inability to delegate is difficult to overcome because of the nature of the entrepreneur himself; the business is his “baby”; he would not like to share control over it with anybody else. But if the entrepreneur wants his business to survive, he simply must change his management s style when the situation requires it.

Why should you delegate? Delegating multiplies your power — you can do more things. It is a form of insurance — business can run smoothly even when you have to be absent. Some employees become more motivated when they are given more responsibility.

One way of avoiding this pitfall is to develop a strong second man, a top assistant. These guidelines can help you develop a good second man:

- Recruit one who has the qualifications and the potential to be your top assistant. You may need one who is strong where you are weak. Since hiring a top assistant is a key decision, consulting other people can help you make a good choice.

- Define clearly what your top assistant can do, share relevant information and skills, and get the other employees’ cooperation.

- Give a trial period during which you delegate responsibility gradually and the top assistant can prove his ability to help you and the firm.

- Reward your top assistant adequately, perhaps, even to the extent of sharing the profits or the business with him.

You can best avoid the pitfalls described above if you are both an entrepreneur and a manager. That is, if you know not only how to do things but also know how to get things done through other people; if you can reduce risks as well as take risks.

There are indeed many pitfalls besetting the entrepreneur’s way to profits, growth and self-fulfillment. But these pitfalls are in a sense an advantage to the true entrepreneur because these pitfalls will select and limit the number of entries into small-scale entrepreneurship.

CHARACTERISTICS OF GOOD ENTREPRENEURS

Respected in their community

Knowledgeable of various aspects of their operations (and strives to know even more)

Prudent in asset acquisitions

Good track record of borrowing experience

Sensitive to opportunities and problems

Live simple lifestyles

Grow by manageable levels

CHARACTERISTICS OF BAD PROJECTS

Technically unsound

Poorly planned

Very risky

Weak financing package

Poor management

Wrong market mix

Inadequate inputs

Lack of competitive advantage

Overambitious forecasts

Disregard for real level of needs

Dependence on subsidies/incentives

REASONS FOR BAD PROJECT DECISIONS

Personal/emotional attachment to the project

Involvement with prevalent political waves

Pressure for quick results

Ulterior motive of parties

Disregard of local situation vs. “standards”

Conflict between project interest and national programs

Influence of inappropriate incentives or financial package

Macroeconomic Performance

Bangladesh achieved a steady 5% growth rate of real gross domestic product (GDP) during the 1990s, as compared with 4% in the 1980s. In terms of US dollars, the value of GDP in current prices increased by 6.9 percent to US$60407 million in FY05 from US$56493 million in the previous year. The growth of per capita real GDP accelerated from 1.7% per annum in the 1980s to 3.1% in the 1990s. Per capita GDP stood at US$445 in FY05 against US$418 in the previous year. The growth in the 1990s was attributable to the reforms to move Bangladesh toward an open economy, such as making the currency convertible on the current account, reducing import duties, removing controls on the movements of foreign private capital, and introducing value-added tax. The Bangladesh economy became more closely integrated with the global economy, with its trade doubling over the 1990s to reach 31% of GDP by 2001. The industry and services sectors each contributed about 41%, and agriculture about 18%, to incremental GDP growth in the 1990s compared with the 1980s. Unlike the 1980s, when the rapid shift of labor into the rural nonfarm sector was largely in the form of self-employment, the 1990s witnessed the absorption of wage labor in greater numbers by relatively larger-scale enterprises. These enterprises were at the higher end of the productivity scale compared with the self-employed form of enterprises in the earlier years.1 Reflecting higher economic growth and increased employment generation, the poverty rate declined from 59% to 50% between 1991 and 2000.

The Government has progressively moved away from administered interest rates toward market-based rates. The disproportionately high interest rates offered by the National Savings Certificates2 that crowded out long-term borrowing by financial institutions (FIs) and private sector borrowers have been reduced toward closer alignment with comparable market rates. Despite these efforts, spreads between lending and deposit rates remain high due to the nonperforming loan (NPL) problem in the banking system, which is being addressed by the Government. The Government is also developing a market for government securities and significantly reduced the withholding tax on income from securities and bonds.3 On the foreign exchange market, the taka was floated in May 2003 and the exchange rate is managed flexibly, with interventions confined to countering disorderly conditions.

To maintain macroeconomic stability and implement structural reforms that will contribute to improving the investment climate, promoting economic growth, and reducing poverty, the Government has prepared the National Strategy for Economic Growth, Poverty Reduction, and Social Development, the Government’s interim poverty reduction strategy paper (I-PRSP), dated March 2003,4 which forms the basis for a 3-year arrangement with the International Monetary Fund (IMF) under the Poverty Reduction and Growth Facility (PRGF) originally approved for SDR347 million (about $505 million). The Government will have to accelerate economic growth to about 7% per year over the next decade to reduce poverty in half by 2015 in accordance with the Millennium Development Goals.5 In comparison, annual GDP growth was 5.3% in FY2003, 5.5% in FY 2004, and is projected at 5% for FY2005. The IMF PRGF target is 6% for FY2006–FY2008. The IMF PRGF together with the Development Support Credit I and II projects of the World Bank (WB) also provide policy support in the financial sector, including preparation for privatization of and management support for the nationalized commercial banks (NCBs) and issuance of prudential regulations. In July 2004, IMF completed the second review of Bangladesh’s economic performance under PRGF and approved a release of SDR49.5 million (about $72 million) as well as an augmentation of the PRGF, amounting to SDR53.33 million (about $78 million), for the Trade Integration Mechanism.

Recommendations:

Uttara Bank Limited tries to give the best customer support, the have some lake and linkage compare to other bank of the same generation such as the way……..

- Employee may need advance training

- Policy may be revised from time to time

- Customized software may be implemented

The bank has to increase their advertisement and also increase their social activity

The interest rate in Uttara Bank Limited is now 18%, which is very high for the customers. Interest rate should be reduced to attract more customers and raise the satisfaction level significantly.

A new internal division can be opened for information deliver in RFC.

HR should be more concerned about to train the sales team.

The disburse time in the Uttara Bank Limited is very lengthy. It should be reduced and the customers should get their service at a shortest possible time.

The application process time is very lengthy. The time required for the applications should be reduced as well.

Debt burden ratio should be relaxed especially in case of highly potential and successful business personnel.

The specific and board recommendations of the study are as follows:

The authority should recruit more employees to serve the customers. The can recruit experienced employee as well as fresh graduate.

The bank should introduce more products based on the market demand.

The bank should reduce their minimum balance to attract more customers.

The salary of the worker need to be rise, as a result experienced people from other bank will be attract to join Uttara Bank Limited Limited.

The bank can open more branches to reach to more customers.

The bank can open branches or foreign booth because many people send money from abroad every year to Bangladesh.

The bank should finance to the consumer goods, because many people in the country wants to buy consumer goods from bank loan.

The marketing department of the bank should more efficient to reach at the hart of the customer.

For the success of any organization, employee satisfaction is one of he most important factor and DBBL authority have to look about it.

The bank should be more profit concern as well as took part to the economics development of the country.

The departments of the bank should more efficient to make profit by satisfying customers.

The bank should use printed instruments like cheque, pay orders etc.

Being a clear transparent the bank can provide the best support to the customer as earn profit.

Conclusion:

It is revealed from the above presentation that in 2010, the bank has achieved remarkable success in various financial activities as well as in bank’s business. During the year under report the bank has earned commendable operating profit and also attained capital adequacy. Substantial amount has been recovered from classified loan because of appropriate action in this regard.

UBL Bank contains an important part in overall operation of the Bank. Our industrial sector that are operating their business in different countries getting a good benefit from this department. Although there have some limitation in total operation process including online disturbance, management process, code fore, d authorization, technical problem etc. Bank now trying their best to improve such problem and to enhance their operation and customer services. For more facilities UBL bank have a good step to serve in rural areas. They made a deal with an ego, which facilitates them for more service in this sector. Moreover they have taken steps to open more branches in different area for wide operation. Due to clear and transparent operation bank have introduces Corporate Governance where board reviews and approves various policies for compliance by the management. The Board/ Executive committee reviews the polices / guidelines issued by the Central Bank regarding operation of the Industry. The Board / executive committee of the board approves the credit proposal as per approved policy and Bangladesh Bank guidelines/regulations. Due to maintaining different level of transparency bank are now receiving more profit in every year.

Needless to mention that continuous support and extended by our valued clients, shareholders, sponsors, business associates and well wishes played a vital role behind these operating results and the Board of Directors express felicitation to them in this regard. New CEO has joined to existing team and in 25th silver jubilee celebration a new logo with utterly new concept is introduced. Consequently, the directors acknowledge with gratitude the valuable guidance and co-operation received from the Ministry of Finance, Bangladesh Bank and Securities and Exchanges Commissions. The directors place on record their depreciation for the dedicated services rendered by the executives, officers and staff members of the bank.

As borrower selection is the key to successful retail lending, Uttara Bank Limited should focus on the selection of true borrower. At the same time it must be taken into account that right borrower selection does not mean that Uttara Bank Limited has to adopt conservative lending policy but rather it means that compliance with the KYC or Know Your Customer to ascertain the true purpose of the loan.

Uttara Bank Limited is bank of new generation. Though I tried to include at my report about deposit, customer service and general banking, I followed their rules and regulation and tried to use them in my report to prepare this report with my best effort.

Though all departments and sections are covered in the internship program, it is not possible to go to depth of each activities of branch because of time limitation. Bank is an institution, which acts as a financial intermediary. Since bank collect deposit from various source by paying interest to them and grant loan to some other parties at high rate to interest then the interest paid to the depositor, the differences between the two interests is termed as the profit.

Since Uttara Bank Ltd. Credit limit increased by taka 9907 core or 18.10% to tk. 64553.10 core during 2008-2009 as compared to increase of 10.30% in the preceding year, Uttara bank Ltd. Should pay more attention to loan and advance which not only increase it’s profit position but also alleviate poverty level of Bangladesh by providing loan to the capital seeker, increase standards of living.