Role of Banks in the modern Economy

The prosperity of a country depends upon its economic activities. Like any other sphere of modern socio-economic activities, banking is a powerful medium of bringing about socio-economic changes of a developing country. Agriculture, Commerce and Industry provide the bulk of a country’s wealth. Without adequate banking facility these three cannot flourish. For a rapid economic growth a fully developed banking system can provide the necessary boost. The whole economy of a country is linked up with its baking system.

Functions of a bank

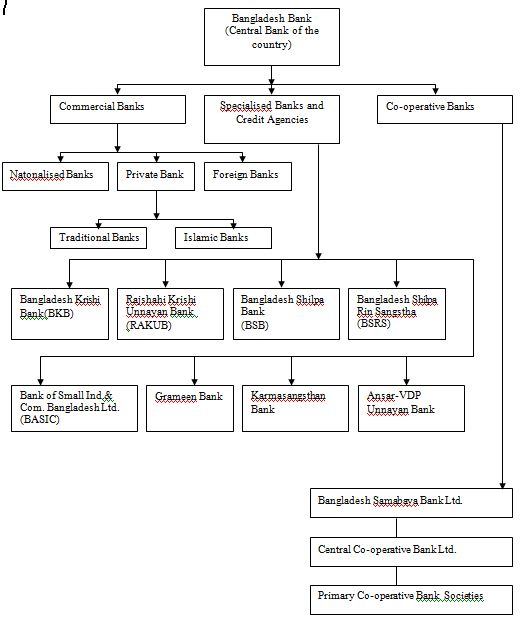

The functions of the bank are now wide and diverse. Of all the functions of modern bank, lending is by far the most important. They provide both short-term and long-term credits. The customers come from all walks of life, from a small business to a multi-national corporation having its business activities all around the world. The banks have to satisfy requirements of different customers belonging to different social groups. The banking business has, therefore, become complex and requires specialized skills. They function as a catalytic agent for bringing about economic, industrial and agricultural growth and prosperity of the country. The banking can, therefore, be convinced “a sector of economy on the one hand and as a lubricant for the whole economy on the other”. As a result different types of banks have come into existence to suit spec National requirements.(L.R. Chowdhury,2004)

Figure Types of Banks

Source: A Textbook on banker’s loans and advances, L.R.Chowdhury

Company Profile of National Bank Ltd.

The Bank was initially emerged in the Banking scenario of the then East Pakistan as Eastern Mercantile Bank Limited at the initiative of some Bangalee enterpreneurs in the year 1959 under Bank Companies Act 1913 . After independence of Bangladesh in 1972 this Bank was nationalised as per policy of the Government and renamed as National Bank . Subsequently due to changed circumstances this Bank was denationalised in the year 1983 as a private bank and renamed as National Bank Ltd.. The Government of the People’s Republic of Bangladesh handed over all assets and liabilities of the then National Bank to the National Bank Ltd.. Since then National Bank Ltd. has been rendering all sorts of Commercial Banking services as the largest bank in private sector through its branch network all over the country.

Corporate Vision and Mission

Vision Statement

Economic Advancement in Traditional Way.

Mission Statement

- To constantly seek to better serve our Customers.

- Be pro-active in fulfilling our Social Responsibilities

- To review all business lines regularly and develop the Best Practices in the industry

- Working environment to be supportive of Teamwork, enabling the Employees to perform to the very best of their abilities.

Products & Services

Service of the Professional Personal

The officers of National Bank Ltd. have to their credit, decades of banking experience with national / interNational Bank s at home and abroad. They are suitably equipped to meet customer expectations and are available at all times to provide a single-window customized and confidential service.

A State-Of-The-Art Technology Banking

The Bank will provide a state-of-the-art technology banking such as Any Branch Banking, ATM Services, Home-Banking, Tele-Banking, Mobile-Banking etc.

Retail Banking

Bank limited offers individuals the best services, including the following, to provide complete customer satisfaction:

- Deposit services.

- Current Account in both Taka and major foreign currencies.

- Convertible Taka Accounts.

- Local and foreign currency remittances.

- Various types of financing to cater to the banking requirements of multinational clients.

Institutional Banking

National Bank Ltd. will offer various services to foreign missions, NGOs and voluntary organizations, consultants, airlines, shipping lines, contractors, schools, colleges and universities. The services include mainly the following:

- Deposit services.

- Current Account in both Taka and major foreign currencies.

- Convertible Taka Accounts.

- Local and foreign currency remittances.

- Various types of financing to cater to the banking requirements of multinational clients.

Corporate Banking

National Bank Ltd. caters to the needs of the corporate clients and provides a comprehensive range of financial services, which include:

- Corporate Deposit Accounts.

- Project & Infrastructure Development Finance, Syndicated Finance, Linkage Finance, Investment Business Counseling, Working Capital and other finances.

- Bonds and Guarantees.

Commercial Banking

Being a commercial bank, National Bank Ltd. provides comprehensive banking services to all types of commercial concerns. Some of the services are:

- Trade Finance.

- Commodity Finance.

- Issuance of Import L/Cs.

- Advising and confirming Export L/Cs. – Bonds and Guarantees.

- Investment advice.

Online Banking

National Bank Ltd. offers ‘Any branch’ banking service (to limited scale) that facilitates its customers to deposit, withdraw and transfer funds through the counters of any of its branches within the country.

Merchant Banking Advisory Services

The Bank will provide Merchant Bank advisory services, offer complete packages in areas of promotion of new companies, evaluation of projects, mergers, take-over and acquisitions, liaise with the Government with regard to rules and regulations, management of new issues including underwriting support etc.

Capital Market Operation

The Bank will also introduce capital market operation which will include Portfolio Management, Investors Account, Underwriting, Mutual Fund Management, Trust Fund Management etc.

Islamic Banking Services

National Bank Ltd. will open Islamic Banking Window as first initiation to serve the customers who are interested in banking based on Islamic Shariah.

Farm and Off-Farm Credits (Rural)

Out of Bank’s social commitment towards the population at the grass-root level, it will participate in farm and off-farm credit programmers in rural Bangladesh to bring in economic buoyancy in the periphery.

Seed Money for Self-Employment

The educated young people with an aptitude for organizing enterprises will be provided with the seed money primarily for self-employment and subsequently will be given advisory services as well as required fund for expansion into a fast growing productive and employment generating venture.

Credit To Women Entrepreneurs

The Bank believes in ‘Equal Opportunity Policy’ and as such has been contemplating to introduce credit programmers for willing and talented women entrepreneurs.

Consumer Credit Facility

The Bank offers a Consumer Credit Scheme, facilitating financial ease in acquiring various day to day consumer products such as usable appliances and other items.

Counter For Payment of Bills

Dedicated counters are available at National Bank Ltd.’s branches to receive the payment of various utility bills.

Other Services

- Remit funds from one place to another through DD, TT and MT etc.

- Conduct all kinds of foreign exchange business including issance of L/C, Traveller’s Cheque etc

- Collect Cheques, Bills, Dividends, Interest on Securities and issue Pay Orders, etc.

- Act as referee for customers.

- Locker facility for safe keeping of valuables and documents.

Resources & Facilities

Total full time regular employee strength had increased to 300 by the year-end. Excepting for the new inductees, the remaining employees are all skilled banking professionals with varying degrees of experience and exposure, recruited from the leading local and foreign banks.

The Bank has a strong focus on imparting training towards enhancement of the skills and competencies of the employees. In the year-2007 the bank had 5,270 officers and employees. Both the Board and Management stress on developing human resources. 57 (fifty seven) courses covering different subjects were organized at the Bank’s Training Institute where 1,357 officials of different levels participated in Human Resources Development Programs. Besides these, the bank utilized the training services rendered by other training institutions like BIBM, BBTA and other national institute.

Deposits and advances

Deposits Schemes

Deposit of the Bank showed a continuous increase during the year and in 2007 stood at TK.10.16 billion. The growth over previous year was 19.15 percent. The growing customers’ confidence in National Bank helped the necessary broadening of customer range that spanned private individuals, corporate bodies, multinational concerns and financial institutions. The Bank introduced various products/ schemes to attract the depositors. In addition to the conventional deposit forms like Current, Savings, Short-Term Deposits and Term Deposits, the Bank introduced savings schemes to attract small savers belonging to fixed low-income group. Due to affordable installment sizes and customer driven service, products are widely welcomed by small depositors.

Online banking service has been extending to cover almost the entire network of branches to enhance delivery system and provide the necessary competitive edge. The Bank continued to provide its service arms to facilitate the collection of various utility bills, which earned customer appreciation. The Bank also provides Locker Services for its depositors.

Mix of deposits improved during the year. The cost of deposit declined but was within the range of 8.50 percent. The cost of scheme deposits was higher than the conventional deposits and had reduced the net interest income during the year. However, the rate of interest on various deposits was lowered during the last quarter of the year under review.

Cash and Balances with Banks and Financial Institutions

Cash and Balances with Bangladesh Bank was TK. 6843.52 million as against Tk. 4652.40 million in 2006. The funds are maintained to meet Cash Reserve Requirement (CRR) and Statutory Liquidity Requirement (SLR) of the Bank. Due to increase in Deposits, the CRR and SLR of the bank have correspondingly increased and such requirement was properly and adequately maintained. Surplus funds after meeting the SLR and CRR were placed on short –term deposits with several commercial banks. Outstanding in such accounts in Bangladesh was TK. 1101.57 million as at 31 December 2007. The Bank maintained sufficient balances with correspondents outside Bangladesh to facilitate prompt settlement of payments under Letter of Credits commitments.

Investments

Investments of the Bank were TK. 5556.58 million showing an increase of 11.53 percent during the year under review. Investment activities centered around meeting the Bank’s SLR and were mostly in the form of Government Treasury Bills having varying dates of maturity. The average yield on the bills was 7.00% per annum.

Loans and Advances

The Bank’s total Loans and Advances stood at TK. 50,549.17 million as at December 31, 2007 showing a growth of 25.16 percent over the previous year. The portfolio was further diversified to avoid any risk of industry concentration and remained in line with the Bank’s credit norms to risk quality, yield, exposure, tenor and collateral arrangements. Bank’s clientele comprised of corporate bodies engaged in such vital economic sectors as Trade Finance, Steel-Re-Rolling, Ready Made Garments, Textiles, Ship Scrapping, Edible Oil, Cement, Transport, Construction etc. Small Business Loan Scheme was developed for providing financial assistance to small business units at urban and rural areas who cannot offer tangible securities.

Consumer Banking

The Bank continued to offer loans under Consumer Credit Scheme to the fixed income group to enable borrowers to acquire consumer products such as household appliances, office equipment, motor vehicles, mobile phone etc. With the expansion of the branch network, both in Urban and Rural areas, the Bank is now better positioned to create and deliver new services and products to its retail customers.

Foreign Exchange and Foreign Trade

Total import business handled during the year was Tk. 48.35 billion as against Tk. 37.32 billion of the previous year. The growth was 29.55 percent. Main import items were industrial raw materials, cement clinkers, yarn & fabrics for the RMG industry, vessels for scrapping, CPO & CDSO for edible oil processing and consumer items.

On the other hand, total export business handled was Tk. 19.91 billion indicating a growth of 12.46 percent. Planned and calculated thrust to finance the leading RMG units helped improve the Bank’s performance in the export sector. The satisfactory performances in Foreign Trade and Foreign Exchange sector helped the Bank to increases its fee-based income.

Treasury

The Bank’s Treasury function continued to concentrate on local money market operations which primarily include term placement of surplus fund and inter bank lending and borrowing at call. Investments for SLR purposes and participation in tenders for purchase of government treasury bills were also performed by Treasury Department. The Bank’s foreign currency dealings were supported by customer driven transactions, mainly LC payment sand negotiation of Export Bills. Special attention was given so that the Bank always remained within the open Position Limit prescribed by the Bangladesh Bank. Prudent dealing in foreign currency could improve the earnings of the Treasury Department. Hence, the Bank intends to start proper dealing operation in foreign currency as soon as possible. As a first step towards setting up a dedicated dealing room, the Treasury Department is already connected to Reuters.

Merchant Banking

Merchant Banking activity has lately gained popularity in our country. The Bank has applied for Merchant Banking License to the Securities and Exchange Commission and Intends to introduce Merchant Banking functions in 2009. At the initial stage the activities would center around issue Management, Portfolio Management and Underwriting.

Branch Network

The Bank has established a wide network of branches in urban and rural areas totaling 356. National Bank Ltd. is the largest Commercial Bank in Private Sector in Bangladesh. It provides mass banking services to the customers through its branch network all over the country.

Divisional Operations in National Bank Ltd.

The operations in National Bank Ltd. are carried out through 5 separate departments:

General Banking (GB)

Cash

Accounts

Trade Finance

Credit

General Banking

The General Banking division, in National Bank Ltd., generally performs the following functions:

a) Account opening

b) Cheque book issue

c) FDR issue

d) FDR encashment

e) Product issue and encashment

f) Account transfer from one branch to another branch

g) Pay order issue and encashment

h) Fund transfer from one account to other account

i) Inward Remittance

j) Outward Remittance

k) Demand Draft (DD) issue

l) Stop payment order

m) Issue of solvency cert National ate

n) Inward and outward clearing through the software ‘PIBS’

For every job, necessary postings are made in MicroBank software.

Cash

Cash division is the center point of any bank. In National Bank Ltd., the cash division performs an integral part of its banking operations.

The tellers in the cash division receive cash from the clients and gives necessary postings in the PIBS (National Bank Integrated Banking Software). At the time of receipt, ‘cash received’ and ‘posted’ seal is attached to the deposit slip. At the time of payment, the tellers first verify the signatures and then make payment. If the check is for a big amount, then it has to be authorized by the cash in charge and branch in charge. The seals used here are ‘cash paid’, ‘posted’ and ‘signature verified’.

The cash division of a branch is connected to other branches through internet and thus it can receive and pay any cheque drawn by or drawn on any other branches. In this regard, the cash division gives credit advice to other branches using Inter Branch Credit Advice (IBCA) and debit advice through Inter Branch Debit Advice (IBDA). When payment is made from other branch accounts, the payer branch issues IBCA. When payment is received for other branch, the receiver branch issues IBDA. IBDA and IBCA are treated as instruments. Related postings are made by the cash division in the MicroBank software. All the activities are also recorded in different registers.

The cash division also receives the outward clearing checks. ‘Clearing’ seal is attached for cheques inside Dhaka and ‘Collection’ seal is attached for cheques outside Dhaka. ‘Crossing’ seal is given for account pay cheques.

At the end of the day, the cash position has to be matched with the cash in hand balances. A ‘Cash Position Reserve Sheet’ is prepared and maintained by the cash in charge.

Accounts

In Punali Bank Limited, the accounts related information is fully computer generated. The central IT department generates several important statements such as the General Ledger, profit and Loss Account, Transaction journal, Overdraft and Advances Position, Full Balance position etc. These statements are disseminated in the network so that every branch can have access to its accounting information at the beginning of each working day.

The accounts division prepares the daily and weekly position of the branch in triplicate using the General Ledger. One copy is sent to the Branch Manager, one copy to the Treasury and one copy is preserved in the office record. Weekly positions of all the branches are consolidated by the central accounts department and then sent to the Bangladesh Bank. At the month end, accounts division prepares Profit Result Sheet for the month ended and Salary Sheet, charges for depreciation on fixed assets and accrued interest. It has to prepare SBS-1 (monthly) and SBS-2 (quarterly) and these statements have to be sent to Bangladesh Bank.

The accounts division performs other jobs also. It has to tally the transaction journal with each voucher. Online accounts are tallied by checking the IBDA and IBCA. Petty cash transactions and bills are also prepared and posted by the accounts division. Branch Level establishment, requisition and other personnel related activities are the responsibilities of the accounts division.

Trade Finance

Trade Finance division operates independently in the branches and it generally deals with the followings:

a) Import L/C

b) Export L/C

c) Local & foreign Bills Purchased

d) Remittance

a) Import L/C

When a client comes to open an L/C, basic queries about the IRC, VAT registration number, TIN etc, are made. Then the client presents such necessary documents as Pro-forma Invoice, Request letter to open an L/C, Application Form, IMP form for Bangladesh Bank reporting, Insurance cover note, L/C authorization form (Commercial or industrial) etc. If the bank is satisfied with all the documents, an L/C is opened and an operational entry for L/C opening is passed in Micro Bank.

Customer’s Liability A/c Dr.

Bank’s Liability A/c Cr.

At this time, the bank charges for commission and other related things and pass an operational entry.

Client C/D A/c Dr.

Margin A/c Cr.

Commission A/c Cr.

SWIFT charges A/c Cr.

VAT Cr.

Stamp Charges Cr.

After shipment, the exporter submits the document to the negotiating bank. The negotiating bank sends the documents to the issuing bank. The authenticity and the content of the documents are checked and if the authority is satisfied, payment is made. At the same time, a PAD (Payment Against Document) loan is crested in the name of individual client and an operating entry is passed.

PAD Dr.

Interbranch Tk. A/c Cr.

Profit on exchange trading Cr.

Here, interbranch A/c is credited because nostro accounts are maintained by the Head Office. Another entry is passed here for reversal of liability.

Bank’s Liability Dr. Margin A/c Dr.

Customer’s Liability Cr. PAD Cr.

It is to be noted that PAD is created for only one month and if it is not adjusted within this period, a forced loan or a Loan Against Trust Receipt (LTR) is created. When the client makes payment, the bank adjusts the PAD or LTR against the client’s CD account and releases the documents. Then the bill of entry must be obtained from the client and the amount of payment must be reported to the Bangladesh Bank.

b) Export L/C

National Bank Ltd. provides money to the borrowers in terms of Packing Credit and Back to Back L/C.

Packing credit is essentially a short term advance with a fixed repayment date granted by the bank to an eligible exporter for the purpose of buying, processing, manufacturing, packing and shipping of the goods meant to be exported (L.R.Chowdhury 2004). It is allowed to an exporter only when he has obtained a foreign buyer’s order. It has a certain limit and generally issued for not more than 180 days. This facility my be extended in the form of Hypothecation of goods, Pledge or Export Trust Receipt.

A Back to Back L/C is essentially a secondary credit opened by a bank on behalf of the beneficiary of the original credit, in favor of a supplier inside or outside the original beneficiary’s country.

Credit

The credit division is also an independent division in National Bank Ltd.. This division basically deals with the extension of credit to the worthy clients and thus to make a profit from the interest charges. The bank invests the money of the depositors and thus the credit division has to be very cautious in terms of credit extension.

There are Relationship Managers (RM) in the branches who have the responsibility to gather valued client where the bank can invest. When a client applies for certain amount of credit, the credit officers first assess the financial and operational viability of the client and prepare a call report. A call report includes basic information about the client as well as the financial and operational position and market reputation. The credit officers often visit the business premises of the client to have an idea about his/ her business conditions. The report of these inspection visits are also enclosed in the call report. It is then sent to the Head of Credit (HOC) and Head of Marketing (HOM). If the call report passes their initial scrutiny, the branch is ordered to prepare a full fledged proposal. It is also sent to the HOC HOM and Managing Director (MD). If satisfied, they enclose their recommendations and give positive nod to the branch to prepare a credit memorandum. At this time, client is requested to present different legal documents to the loan administration division. If the board approves of disbursement and the client fulfills all the necessary legal and procedural requirements, then only the loan is sanctioned. A sanction advice is prepared and provided to the client.

The loan administration department ensures that all the guarantee and security arrangements are properly done and maintained. It keeps record of the obtained documents using security document software. After disbursement, the credit division continuously monitors the client’s business and loan repayment performance and takes necessary actions in case of non-repayment.

The credit division arranges for different types of loans and high emphasis is given on Small and Medium Enterprises (SMEs). It also issues bank guarantee in favor of the clients. Necessary postings are made through MicroBank software.